Key Insights

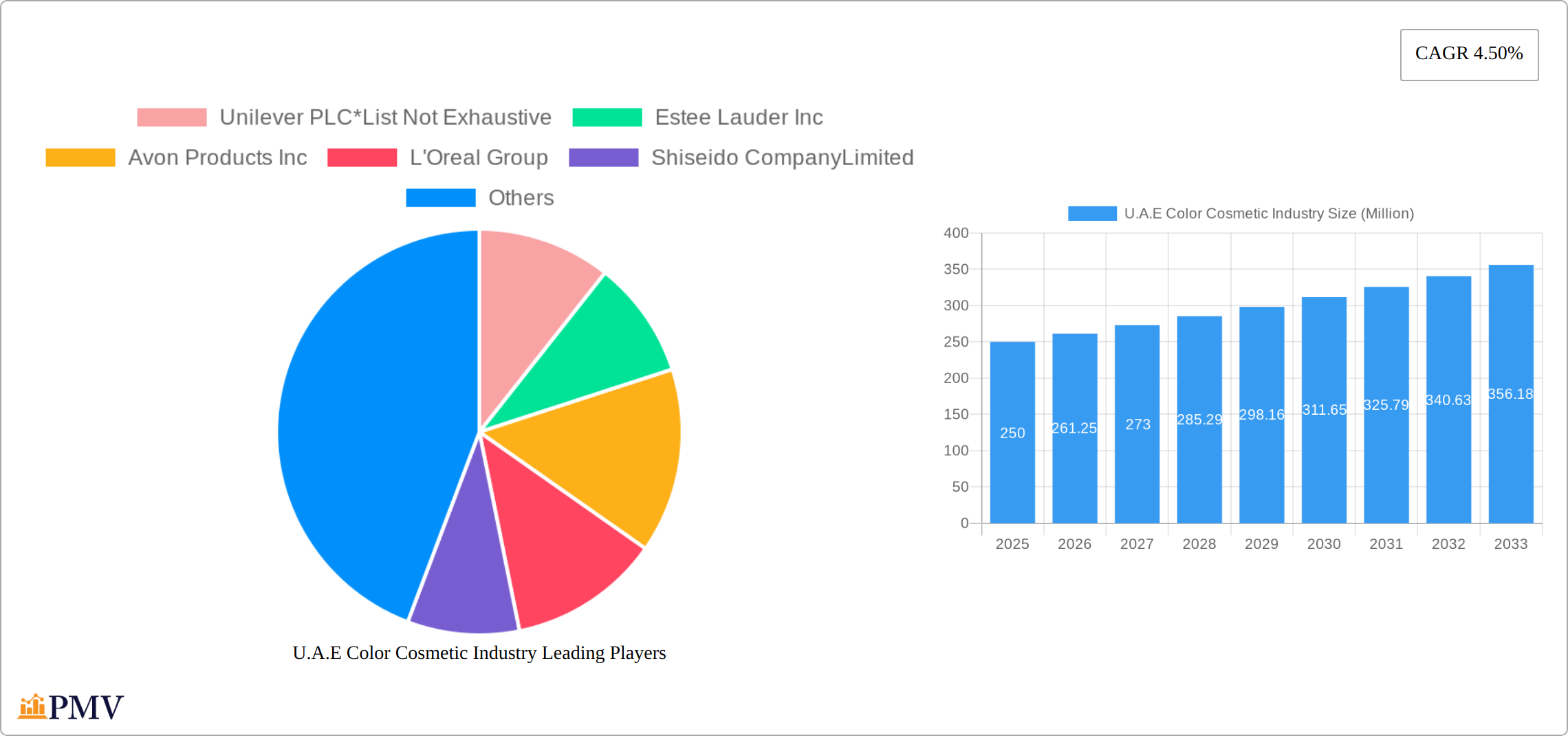

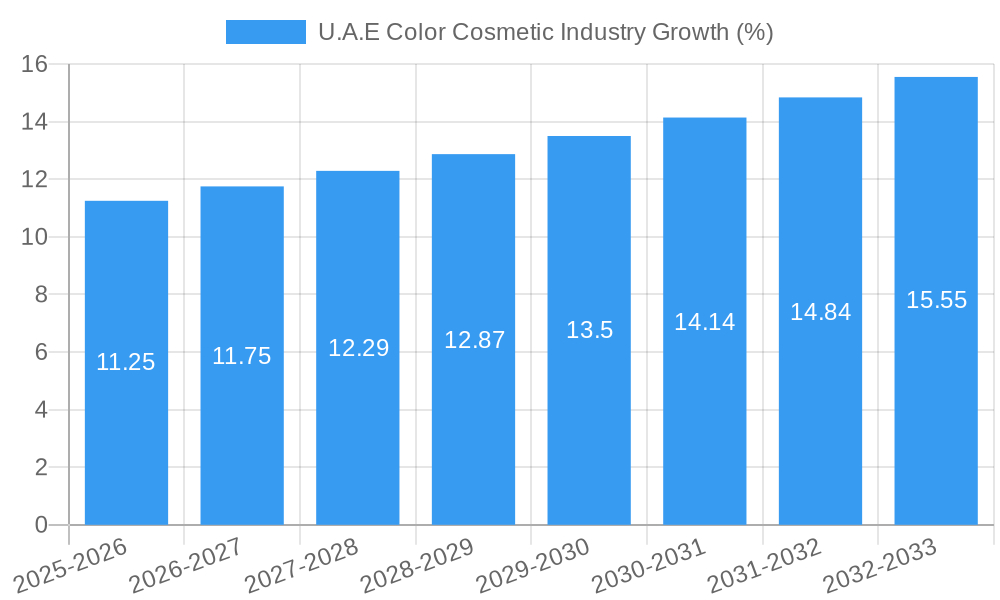

The UAE color cosmetics market, valued at approximately $X million in 2025 (estimated based on provided CAGR and market trends), is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.50% from 2025 to 2033. This expansion is fueled by several key drivers. The rising disposable incomes of the UAE's population, particularly among young adults and working women, coupled with a strong fashion-conscious culture, are significantly boosting demand for a diverse range of color cosmetics. Furthermore, the increasing popularity of social media influencers and beauty bloggers, along with the proliferation of online retail channels offering convenient access to international and local brands, are driving market growth. The market segmentation reveals significant demand across various product categories, including facial makeup (foundations, concealers, powders), eye makeup (eyeliners, eyeshadows, mascaras), lip makeup (lipsticks, lip glosses), and nail makeup, with facial and eye makeup likely holding the largest market shares. Distribution channels are diversified, spanning supermarkets/hypermarkets, specialty stores, and increasingly, online retail platforms, reflecting evolving consumer preferences.

The UAE's thriving tourism sector further contributes to market expansion by attracting a substantial number of international visitors who contribute to the cosmetics sales volume. However, the market faces certain restraints. Fluctuations in oil prices can impact consumer spending, potentially slowing down market growth. Furthermore, intense competition amongst established international brands and emerging local players necessitates continuous innovation and effective marketing strategies for sustained success. The growing awareness of natural and organic cosmetics also presents both an opportunity and a challenge, requiring companies to adapt their product offerings and marketing messages to cater to these evolving consumer preferences. The market's future growth trajectory will depend on maintaining a balance between catering to established trends, embracing innovative products, and addressing potential macroeconomic influences.

U.A.E Color Cosmetic Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the United Arab Emirates (UAE) color cosmetic industry, offering invaluable insights for businesses, investors, and stakeholders seeking to understand this dynamic market. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The study encompasses key segments, competitive dynamics, and future growth prospects, leveraging data from the historical period (2019-2024) and projecting future trends. The UAE color cosmetics market, valued at xx Million in 2025, is poised for significant expansion, driven by factors such as rising disposable incomes, increasing urbanization, and a young, fashion-conscious population.

U.A.E Color Cosmetic Industry Market Structure & Competitive Dynamics

The UAE color cosmetic market exhibits a moderately concentrated structure, with several multinational corporations and regional players vying for market share. Key players include Unilever PLC, Estée Lauder Inc, Avon Products Inc, L'Oréal Group, Shiseido Company Limited, Revlon Inc, Maybelline New York, and Oriflame Cosmetics SA. However, the market also features a significant number of smaller, niche brands, reflecting the growing demand for diverse and specialized products.

The competitive landscape is characterized by intense rivalry, fueled by product innovation, aggressive marketing campaigns, and strategic partnerships. Recent years have witnessed several mergers and acquisitions (M&A) activities, with deal values reaching xx Million in 2024. These transactions reflect the consolidation trend within the industry and the strategic pursuit of market expansion. The regulatory framework in the UAE is generally supportive of business growth, fostering a conducive environment for foreign investment and innovation. The market also sees the emergence of new distribution channels, particularly online retail, disrupting traditional retail models and increasing consumer reach. Consumer preferences are evolving rapidly, driven by trends such as natural and organic cosmetics, personalized beauty solutions, and the increasing influence of social media. Substitute products, like homemade cosmetics or skincare routines, exert some competitive pressure, but the overall market remains vibrant and dynamic.

U.A.E Color Cosmetic Industry Industry Trends & Insights

The UAE color cosmetic industry is experiencing robust growth, driven primarily by a young and expanding population, rising disposable incomes, and increasing awareness of beauty and personal care. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was xx%, and is projected to reach xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Rising Disposable Incomes: Increased purchasing power among UAE consumers drives demand for premium and luxury cosmetic products.

- Growing Urbanization: Urban centers are hubs for beauty trends and offer greater access to retail outlets and online platforms.

- Social Media Influence: Social media platforms significantly influence consumer preferences and purchasing decisions.

- Tourism: The UAE's thriving tourism sector contributes to the market's growth by attracting visitors who purchase cosmetics.

- E-commerce Boom: The rapid growth of e-commerce platforms expands market reach and provides convenience to consumers.

Technological disruptions, such as AI-powered personalized beauty recommendations and virtual try-on tools, are also impacting the industry's trajectory. Market penetration of online retail channels is increasing rapidly, with projections indicating that online sales will account for xx% of the total market by 2033. Competitive dynamics are intense, with both established brands and emerging players vying for market share through innovation, pricing strategies, and targeted marketing campaigns.

Dominant Markets & Segments in U.A.E Color Cosmetic Industry

Within the UAE color cosmetic market, several segments display particularly strong growth potential:

Distribution Channel:

- Online Retail Stores: This segment is experiencing the fastest growth, driven by convenience, wider product selection, and targeted advertising. Key drivers include widespread internet access and a young, tech-savvy population.

- Specialty Stores: Specialty stores offering high-end cosmetics and personalized services maintain strong market share, catering to discerning consumers willing to pay a premium for quality and expertise.

- Supermarkets/Hypermarkets: While not the fastest-growing segment, supermarkets/hypermarkets provide mass-market accessibility and contribute significantly to overall sales volume.

Product Type:

- Facial Makeup: This segment commands the largest share of the market, driven by diverse product offerings and evolving beauty trends.

- Lip Makeup: This segment exhibits strong growth due to the increasing popularity of diverse lip colors and textures.

- Eye Makeup: This segment, while smaller, is gaining traction due to the rising demand for sophisticated eye makeup looks.

U.A.E Color Cosmetic Industry Product Innovations

Recent innovations in the UAE color cosmetics market include the rise of customizable makeup palettes, the integration of skincare benefits into makeup products, and the development of environmentally friendly and sustainable formulations. Technological advancements, such as augmented reality (AR) and virtual reality (VR) tools for virtual try-ons, are enhancing the consumer experience and driving sales. This focus on personalization, sustainability, and technological integration positions the market for future growth.

Report Segmentation & Scope

This report segments the UAE color cosmetic industry by distribution channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, Other Distribution Channels) and product type (Facial Makeup, Eye Makeup, Nail Makeup, Lip Makeup, Hair Color Products). Each segment is analyzed in detail, providing market size estimates, growth projections, and competitive dynamics. The report also includes an assessment of each segment's current market share, growth trajectory, and key players. Growth projections are based on various macroeconomic factors, evolving consumer trends, and expected industry innovations.

Key Drivers of U.A.E Color Cosmetic Industry Growth

Several key factors are driving the growth of the UAE color cosmetic industry:

- Rising Disposable Incomes: Increased spending power allows consumers to invest more in personal care and beauty products.

- Young & Growing Population: A large young population, particularly those under 30, fuels demand for new trends and innovative products.

- Tourism: The tourism sector adds to the demand and provides a diverse consumer base.

- Social Media Influence: Social media significantly impacts the industry by setting trends and influencing purchasing behavior.

- E-commerce Expansion: The significant rise of online shopping provides accessibility and convenience, driving significant growth.

Challenges in the U.A.E Color Cosmetic Industry Sector

The UAE color cosmetic industry faces several challenges:

- Intense Competition: A large number of both established international and local brands leads to competitive pressure on pricing and marketing.

- Counterfeit Products: The prevalence of counterfeit cosmetics negatively affects both consumer safety and the reputation of legitimate businesses.

- Economic Fluctuations: Global economic uncertainty may influence consumer spending on non-essential goods like cosmetics.

- Regulatory Changes: Any changes in regulations related to labeling, ingredients, or safety standards could disrupt the market.

Leading Players in the U.A.E Color Cosmetic Industry Market

- Unilever PLC

- Estée Lauder Inc

- Avon Products Inc

- L'Oréal Group

- Shiseido Company Limited

- Revlon Inc

- Maybelline New York

- Oriflame Cosmetics SA

Key Developments in U.A.E Color Cosmetic Industry Sector

- March 2023: Olive Young, a K-beauty retailer, launched its own color cosmetics line in the UAE, targeting a young demographic.

- September 2022: Nykaa, an Indian e-commerce company, expanded its brand range into the UAE, introducing its house of brands.

- May 2021: Selena Gomez's beauty line debuted in the UAE, expanding the availability of international brands.

Strategic U.A.E Color Cosmetic Industry Market Outlook

The UAE color cosmetic market exhibits significant growth potential, fueled by continued economic development, a young population, and evolving consumer preferences. Opportunities exist for brands that leverage technology, personalization, and sustainability. Strategic partnerships, innovative product development, and targeted marketing campaigns are crucial for success in this competitive landscape. The market is poised for further expansion, driven by increasing digital adoption, the rise of social commerce, and the growing preference for natural and sustainable cosmetics.

U.A.E Color Cosmetic Industry Segmentation

-

1. Type

- 1.1. Facial Makeup

- 1.2. Eye Makeup

- 1.3. Nail Makeup

- 1.4. Lip Makeup

- 1.5. Hair Color Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

U.A.E Color Cosmetic Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

U.A.E Color Cosmetic Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Per Capita Expenditure on Cosmetic Products especially K-beauty cosmetic products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global U.A.E Color Cosmetic Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Facial Makeup

- 5.1.2. Eye Makeup

- 5.1.3. Nail Makeup

- 5.1.4. Lip Makeup

- 5.1.5. Hair Color Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America U.A.E Color Cosmetic Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Facial Makeup

- 6.1.2. Eye Makeup

- 6.1.3. Nail Makeup

- 6.1.4. Lip Makeup

- 6.1.5. Hair Color Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America U.A.E Color Cosmetic Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Facial Makeup

- 7.1.2. Eye Makeup

- 7.1.3. Nail Makeup

- 7.1.4. Lip Makeup

- 7.1.5. Hair Color Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe U.A.E Color Cosmetic Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Facial Makeup

- 8.1.2. Eye Makeup

- 8.1.3. Nail Makeup

- 8.1.4. Lip Makeup

- 8.1.5. Hair Color Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa U.A.E Color Cosmetic Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Facial Makeup

- 9.1.2. Eye Makeup

- 9.1.3. Nail Makeup

- 9.1.4. Lip Makeup

- 9.1.5. Hair Color Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific U.A.E Color Cosmetic Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Facial Makeup

- 10.1.2. Eye Makeup

- 10.1.3. Nail Makeup

- 10.1.4. Lip Makeup

- 10.1.5. Hair Color Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Unilever PLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Estee Lauder Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Avon Products Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L'Oreal Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shiseido CompanyLimited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Revlon Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Maybelline New York

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oriflame Cosmetics SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Unilever PLC*List Not Exhaustive

List of Figures

- Figure 1: Global U.A.E Color Cosmetic Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: U.A.E U.A.E Color Cosmetic Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: U.A.E U.A.E Color Cosmetic Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America U.A.E Color Cosmetic Industry Revenue (Million), by Type 2024 & 2032

- Figure 5: North America U.A.E Color Cosmetic Industry Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America U.A.E Color Cosmetic Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America U.A.E Color Cosmetic Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America U.A.E Color Cosmetic Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America U.A.E Color Cosmetic Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America U.A.E Color Cosmetic Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: South America U.A.E Color Cosmetic Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America U.A.E Color Cosmetic Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America U.A.E Color Cosmetic Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America U.A.E Color Cosmetic Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: South America U.A.E Color Cosmetic Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe U.A.E Color Cosmetic Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe U.A.E Color Cosmetic Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe U.A.E Color Cosmetic Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe U.A.E Color Cosmetic Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe U.A.E Color Cosmetic Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe U.A.E Color Cosmetic Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa U.A.E Color Cosmetic Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa U.A.E Color Cosmetic Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa U.A.E Color Cosmetic Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa U.A.E Color Cosmetic Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa U.A.E Color Cosmetic Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa U.A.E Color Cosmetic Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific U.A.E Color Cosmetic Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific U.A.E Color Cosmetic Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific U.A.E Color Cosmetic Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific U.A.E Color Cosmetic Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific U.A.E Color Cosmetic Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific U.A.E Color Cosmetic Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global U.A.E Color Cosmetic Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific U.A.E Color Cosmetic Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.A.E Color Cosmetic Industry?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the U.A.E Color Cosmetic Industry?

Key companies in the market include Unilever PLC*List Not Exhaustive, Estee Lauder Inc, Avon Products Inc, L'Oreal Group, Shiseido CompanyLimited, Revlon Inc, Maybelline New York, Oriflame Cosmetics SA.

3. What are the main segments of the U.A.E Color Cosmetic Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force.

6. What are the notable trends driving market growth?

Increasing Per Capita Expenditure on Cosmetic Products especially K-beauty cosmetic products.

7. Are there any restraints impacting market growth?

Growing Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

March 2023: With its own color cosmetics line, K-beauty shops Olive Young is expanding into the Middle East market. It plans to introduce more of its own brands. The United Arab Emirates (UAE), chosen for its sizable population of people under 30, served as the launch point for the pilot expansion. The retailer's regional headquarters would also be in the United Arab Emirates. It decided to enter the market with Wakemake, a makeup line that may be well-liked by domestic customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.A.E Color Cosmetic Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.A.E Color Cosmetic Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.A.E Color Cosmetic Industry?

To stay informed about further developments, trends, and reports in the U.A.E Color Cosmetic Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence