Key Insights

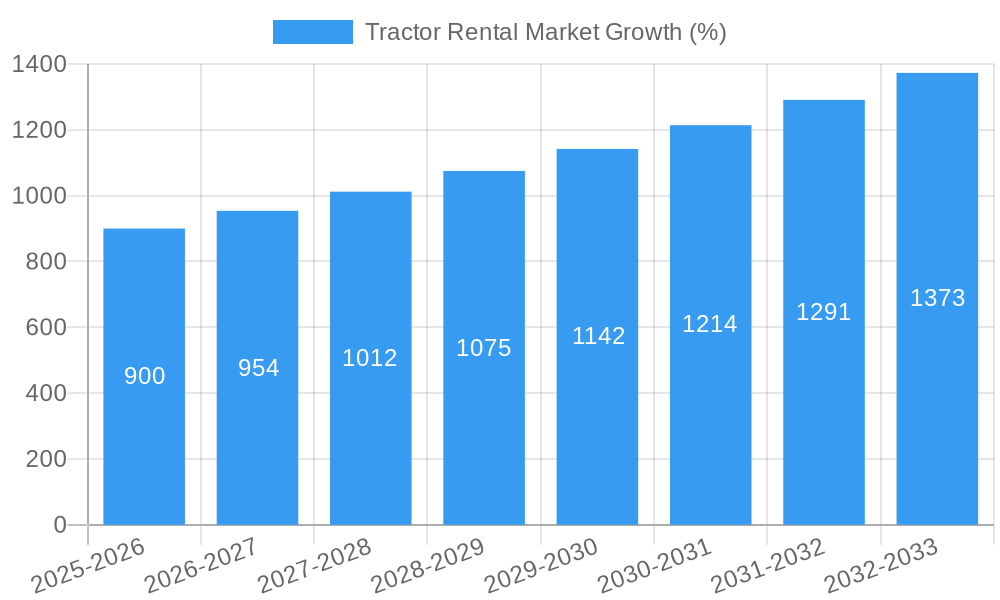

The global tractor rental market is experiencing robust growth, fueled by several key factors. The rising demand for agricultural mechanization, particularly in developing economies, is a primary driver. Farmers, especially smaller operations, increasingly prefer renting tractors over purchasing them due to lower upfront costs, reduced maintenance burdens, and access to advanced technology without significant capital investment. This trend is particularly pronounced in regions with seasonal agricultural practices, where owning a tractor year-round might be economically unfeasible. Furthermore, the expanding construction and infrastructure sectors contribute to market growth, as tractors are utilized in land clearing, excavation, and other related activities. Technological advancements, such as the introduction of GPS-guided tractors and automated systems, further enhance efficiency and appeal, attracting more renters. However, market growth is not without constraints. Economic downturns can significantly impact rental demand, while fluctuating fuel prices and maintenance costs also pose challenges. Competition among rental providers is intensifying, necessitating efficient operations and competitive pricing strategies. The market is segmented by equipment type (tractors, harvesters, haying equipment, and others), reflecting diverse applications and customer needs.

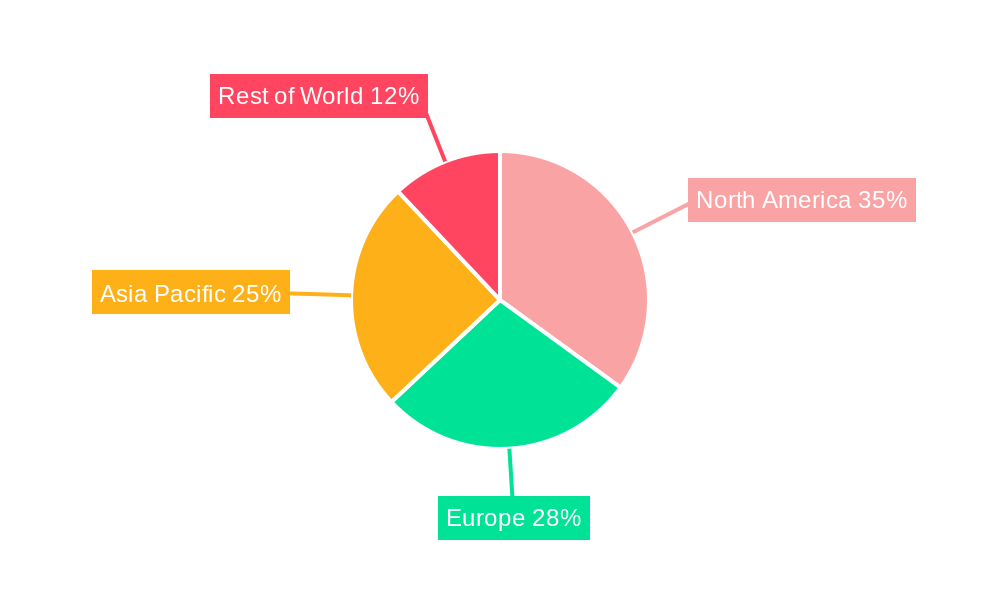

Looking forward, the market's positive trajectory is expected to continue. The increasing adoption of precision farming techniques and the growing awareness of sustainable agricultural practices are likely to boost rental demand for modern, efficient tractors. Government initiatives promoting agricultural modernization and infrastructure development in various regions will also play a crucial role in market expansion. Companies operating in this sector are focusing on enhancing their service offerings, expanding their fleet, and investing in technology to gain a competitive edge. The North American and European markets currently hold significant market share, but the Asia-Pacific region, driven by rapid agricultural development in countries like India and China, is poised for substantial growth in the coming years. Strategic partnerships, acquisitions, and technological innovations will continue shaping the competitive landscape, ensuring the tractor rental market remains a dynamic and evolving sector.

This comprehensive report provides an in-depth analysis of the global Tractor Rental Market, covering the period 2019-2033. With a base year of 2025 and a forecast period of 2025-2033, this study offers invaluable insights into market size, segmentation, growth drivers, challenges, and competitive dynamics. The report is essential for industry stakeholders, investors, and anyone seeking to understand this rapidly evolving market. The global Tractor Rental Market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

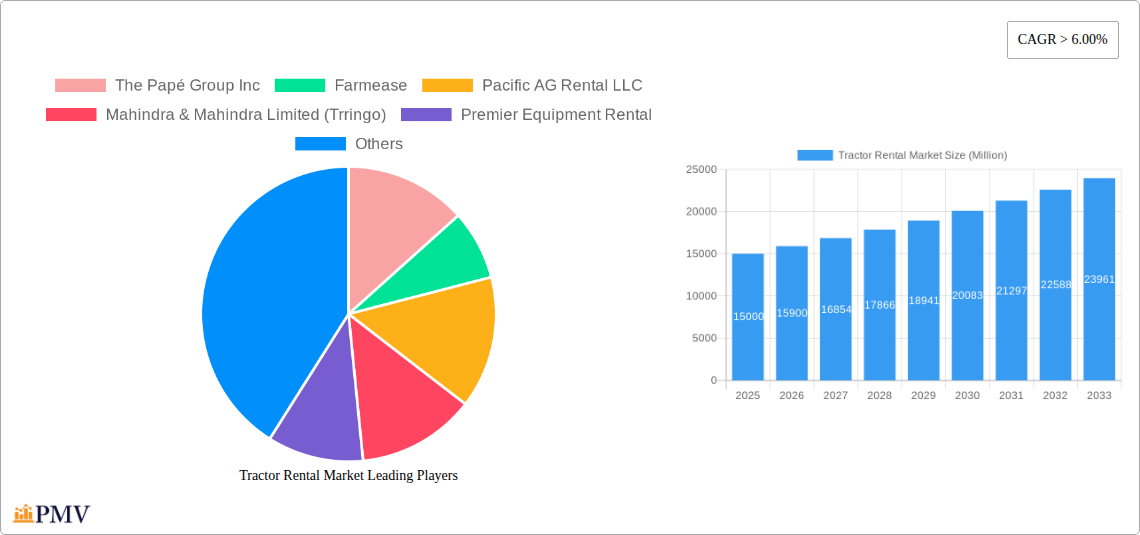

Tractor Rental Market Market Structure & Competitive Dynamics

The Tractor Rental Market is characterized by a moderately fragmented structure, with a mix of large multinational corporations and smaller regional players. Market concentration is relatively low, with no single dominant player commanding a significant majority of the market share. However, key players like The Papé Group Inc, Mahindra & Mahindra Limited (Trringo), and KUBOTA Corporation hold substantial market share due to their extensive product portfolios and strong brand recognition. Innovation is driven by advancements in technology, particularly in areas such as precision agriculture and autonomous systems. Regulatory frameworks vary across regions, impacting market access and operational costs. Product substitutes, such as hiring manual labor or contracting out farming activities, exert competitive pressure, particularly in regions with low mechanization rates. End-user trends, including increasing demand for efficiency and reduced operational costs, are fueling market growth. M&A activities are relatively frequent, with deal values ranging from xx Million to xx Million, primarily focused on expanding market reach, gaining access to new technologies, and enhancing service offerings. For instance, Deere & Company's investment in Hello Tractor signifies the growing interest in leveraging technology for rental services.

Tractor Rental Market Industry Trends & Insights

The Tractor Rental Market is experiencing robust growth driven by several factors. Rising labor costs, coupled with the increasing adoption of precision agriculture techniques, is compelling farmers to adopt rental models as a cost-effective alternative to outright ownership. Technological advancements, such as the integration of GPS and other sensor-based technologies, are enhancing the efficiency and productivity of rented tractors. Consumer preferences are shifting towards flexible rental agreements and value-added services, including maintenance and repair. The market is also witnessing a rise in the adoption of mobile app-based platforms that facilitate convenient equipment booking and management. The competitive landscape is dynamic, with both established players and new entrants vying for market share. Market penetration is growing rapidly, particularly in developing economies where access to agricultural mechanization is limited. The overall market size is estimated at xx Million in 2025, projected to reach xx Million by 2033, demonstrating a significant growth trajectory. This expansion is primarily driven by the increasing demand for rental services in both developed and developing economies.

Dominant Markets & Segments in Tractor Rental Market

The Tractor Rental Market exhibits considerable regional variations in terms of adoption and growth. North America and Europe currently hold dominant positions due to high agricultural mechanization levels and established rental infrastructure. However, developing economies, particularly in Asia and Africa, are showing significant growth potential, fueled by government initiatives promoting agricultural modernization and increasing farmer awareness of rental services.

- Key Drivers in North America: High farm sizes, advanced agricultural practices, established rental networks, and readily available financing options.

- Key Drivers in Asia: Growing agricultural land under cultivation, government support for mechanization, and increasing disposable income of farmers.

- Key Drivers in Africa: Government initiatives to boost agricultural productivity, expanding access to credit, and growing awareness of the benefits of farm mechanization.

By equipment type, the Tractors segment dominates the market due to its extensive applications across various farming operations. The Harvestors and Haying Equipment segments are also experiencing substantial growth, driven by the increasing demand for efficient harvesting and hay management solutions. The Others segment encompasses a wide range of equipment, including tillers, planters, and sprayers, showcasing moderate growth based on specific agricultural needs.

Tractor Rental Market Product Innovations

Recent innovations in the Tractor Rental Market are largely focused on enhancing efficiency, precision, and user experience. This includes the integration of advanced GPS and sensor technologies into rental equipment, the development of mobile apps for streamlined booking and management, and the introduction of telematics systems for remote monitoring and diagnostics. These innovations aim to improve operational efficiency and minimize downtime, ultimately providing increased value to customers. The focus remains on creating rental solutions that are not just cost-effective but also user-friendly and aligned with the evolving demands of modern farming.

Report Segmentation & Scope

This report segments the Tractor Rental Market based on equipment type:

- Tractors: This segment comprises a wide range of tractors, from small to large, encompassing various horsepower levels and configurations, catering to diverse farming needs. The growth trajectory is expected to be driven by continued demand for efficient tillage, planting, and hauling.

- Harvestors: This segment covers a variety of harvesters, tailored for various crops, and growth will depend on increasing crop production and the need for efficient harvesting.

- Haying Equipment: This segment includes balers, rakes, and other equipment used in hay production, with growth tied to livestock farming and the demand for efficient hay management.

- Others: This includes a broad range of agricultural equipment used for various farming tasks, exhibiting growth in line with the overall mechanization of agricultural practices.

Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail.

Key Drivers of Tractor Rental Market Growth

The Tractor Rental Market is driven by several key factors: rising labor costs, the increasing need for efficient farming practices, technological advancements leading to improved equipment, government initiatives supporting agricultural modernization, and the growing awareness among farmers of the cost-effectiveness of renting compared to owning. The increasing adoption of precision agriculture, leading to improved yield and efficiency, is also significantly contributing to market growth. Furthermore, favorable economic conditions in several key regions are promoting investments in farm equipment.

Challenges in the Tractor Rental Market Sector

The Tractor Rental Market faces certain challenges, including seasonal demand fluctuations, managing equipment maintenance and repairs, ensuring timely equipment availability, and navigating varying regulatory frameworks across different regions. Competition from established players and new entrants can also exert pressure on pricing and profitability. Supply chain disruptions, particularly related to parts and components, can impact the availability of equipment and result in increased operating costs.

Leading Players in the Tractor Rental Market Market

- The Papé Group Inc

- Farmease

- Pacific AG Rental LLC

- Mahindra & Mahindra Limited (Trringo)

- Premier Equipment Rental

- KUBOTA Corporation

- Friesen Sales & Rentals

- CNH Industrial

- AGCO Corporation

- Messick's

- Flaman Group of Companies

- Titan Machinery

- JFarm Services

Key Developments in Tractor Rental Market Sector

- September 2021: Sonalika Group launched its Sonalika Agro Solutions App to offer high-tech agro machinery on rent to farmers in India.

- March 2022: eThekwini Municipality in South Africa acquired tractors to rent for free to the farmers.

- May 2022: India-based agriculture equipment rental and agro e-commerce startup KhetiGaadi launched its agro advisory services for farmers in Pune.

- July 2022: The state government of Bihar in India announced the launch of mobile app-based farm equipment rental services.

- August 2022: Deere & Co. invested in Hello Tractor, a Nigerian startup offering marketplace and fleet management technology.

These developments highlight the ongoing innovation and expansion within the Tractor Rental Market, particularly in leveraging technology to enhance accessibility and efficiency.

Strategic Tractor Rental Market Market Outlook

The Tractor Rental Market is poised for continued growth, driven by ongoing technological advancements, increasing demand for efficient and cost-effective farming solutions, and supportive government policies promoting agricultural modernization. Strategic opportunities exist for companies to expand their service offerings, leverage technology for improved operational efficiency, and cater to the evolving needs of farmers in both developed and developing economies. The market presents significant potential for companies that can adapt to changing market dynamics and effectively address the challenges and opportunities within this sector.

Tractor Rental Market Segmentation

-

1. Equipment Type

- 1.1. Tractors

- 1.2. Harvestors

- 1.3. Haying Equipment

- 1.4. Others

Tractor Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Tractor Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Metals and Minerals to Fuel the Market

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations and Community Concerns may Hinder the Market

- 3.4. Market Trends

- 3.4.1. Rising Developments in Tractor Rental Service Likely to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Tractors

- 5.1.2. Harvestors

- 5.1.3. Haying Equipment

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. North America Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Tractors

- 6.1.2. Harvestors

- 6.1.3. Haying Equipment

- 6.1.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. Europe Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Tractors

- 7.1.2. Harvestors

- 7.1.3. Haying Equipment

- 7.1.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Asia Pacific Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Tractors

- 8.1.2. Harvestors

- 8.1.3. Haying Equipment

- 8.1.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. Rest of the World Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9.1.1. Tractors

- 9.1.2. Harvestors

- 9.1.3. Haying Equipment

- 9.1.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10. North America Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Rest of Europe

- 12. Asia Pacific Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 The Papé Group Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Farmease

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Pacific AG Rental LLC

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Mahindra & Mahindra Limited (Trringo)

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Premier Equipment Rental

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 KUBOTA Corporation

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Friesen Sales & Rentals*List Not Exhaustive

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 CNH Industrial

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 AGCO Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Messick's

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Flaman Group of Companies

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Titan Machinery

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 JFarm Services

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.1 The Papé Group Inc

List of Figures

- Figure 1: Global Tractor Rental Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Tractor Rental Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 11: North America Tractor Rental Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 12: North America Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Tractor Rental Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 15: Europe Tractor Rental Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 16: Europe Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Tractor Rental Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 19: Asia Pacific Tractor Rental Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 20: Asia Pacific Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Tractor Rental Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 23: Rest of the World Tractor Rental Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 24: Rest of the World Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tractor Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Tractor Rental Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 3: Global Tractor Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Rest of North America Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: India Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: South America Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Middle East and Africa Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Tractor Rental Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 24: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of North America Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Tractor Rental Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 29: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Germany Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: United Kingdom Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Tractor Rental Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 36: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: India Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: China Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Japan Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Korea Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Tractor Rental Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 43: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: South America Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Middle East and Africa Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tractor Rental Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Tractor Rental Market?

Key companies in the market include The Papé Group Inc, Farmease, Pacific AG Rental LLC, Mahindra & Mahindra Limited (Trringo), Premier Equipment Rental, KUBOTA Corporation, Friesen Sales & Rentals*List Not Exhaustive, CNH Industrial, AGCO Corporation, Messick's, Flaman Group of Companies, Titan Machinery, JFarm Services.

3. What are the main segments of the Tractor Rental Market?

The market segments include Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Metals and Minerals to Fuel the Market.

6. What are the notable trends driving market growth?

Rising Developments in Tractor Rental Service Likely to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations and Community Concerns may Hinder the Market.

8. Can you provide examples of recent developments in the market?

August 2022- Deere and Co. invested in Hello Tractor, a Nigerian startup that offers marketplace and fleet management technology for African farmers to rent tractors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tractor Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tractor Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tractor Rental Market?

To stay informed about further developments, trends, and reports in the Tractor Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence