Key Insights

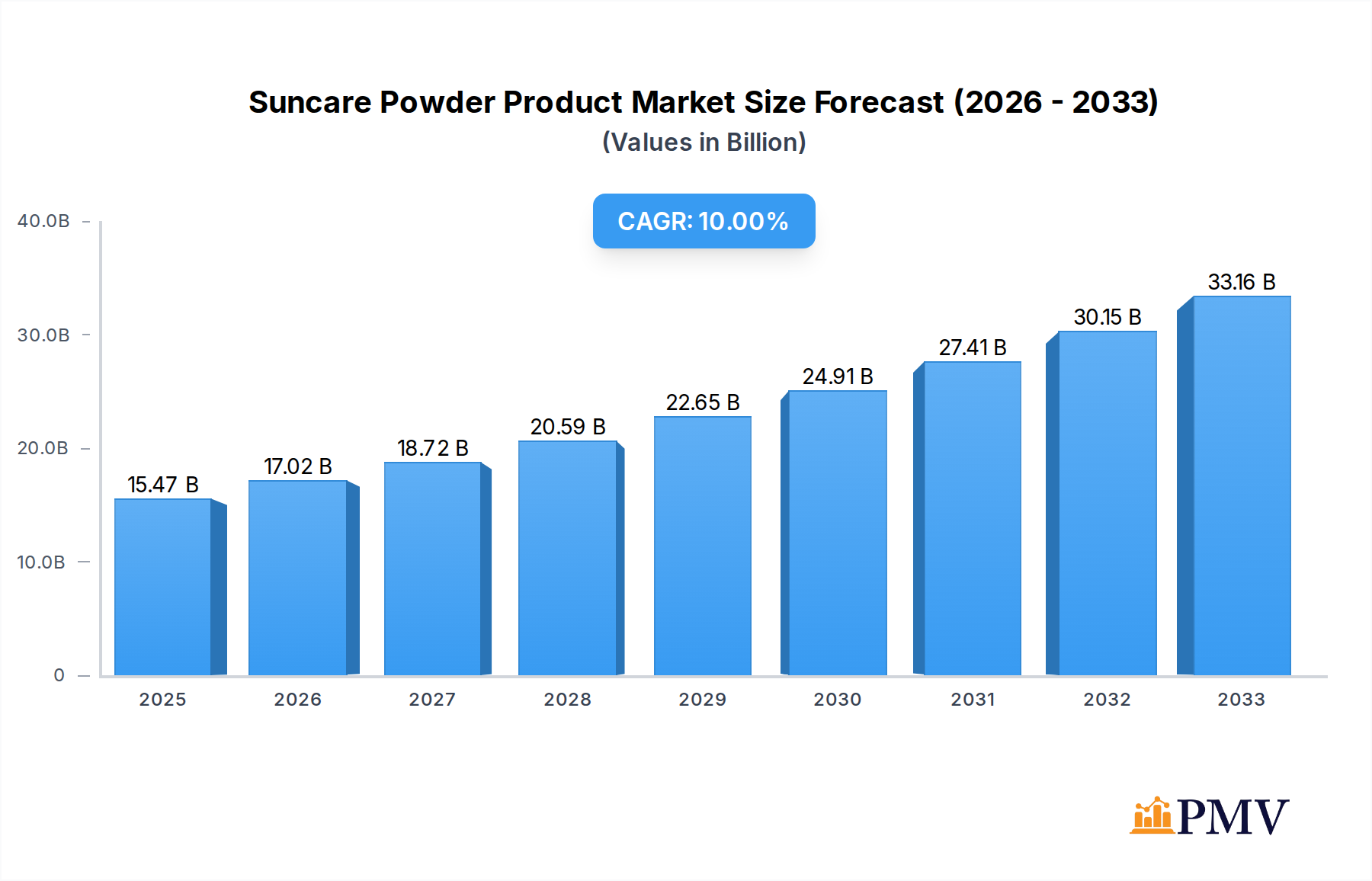

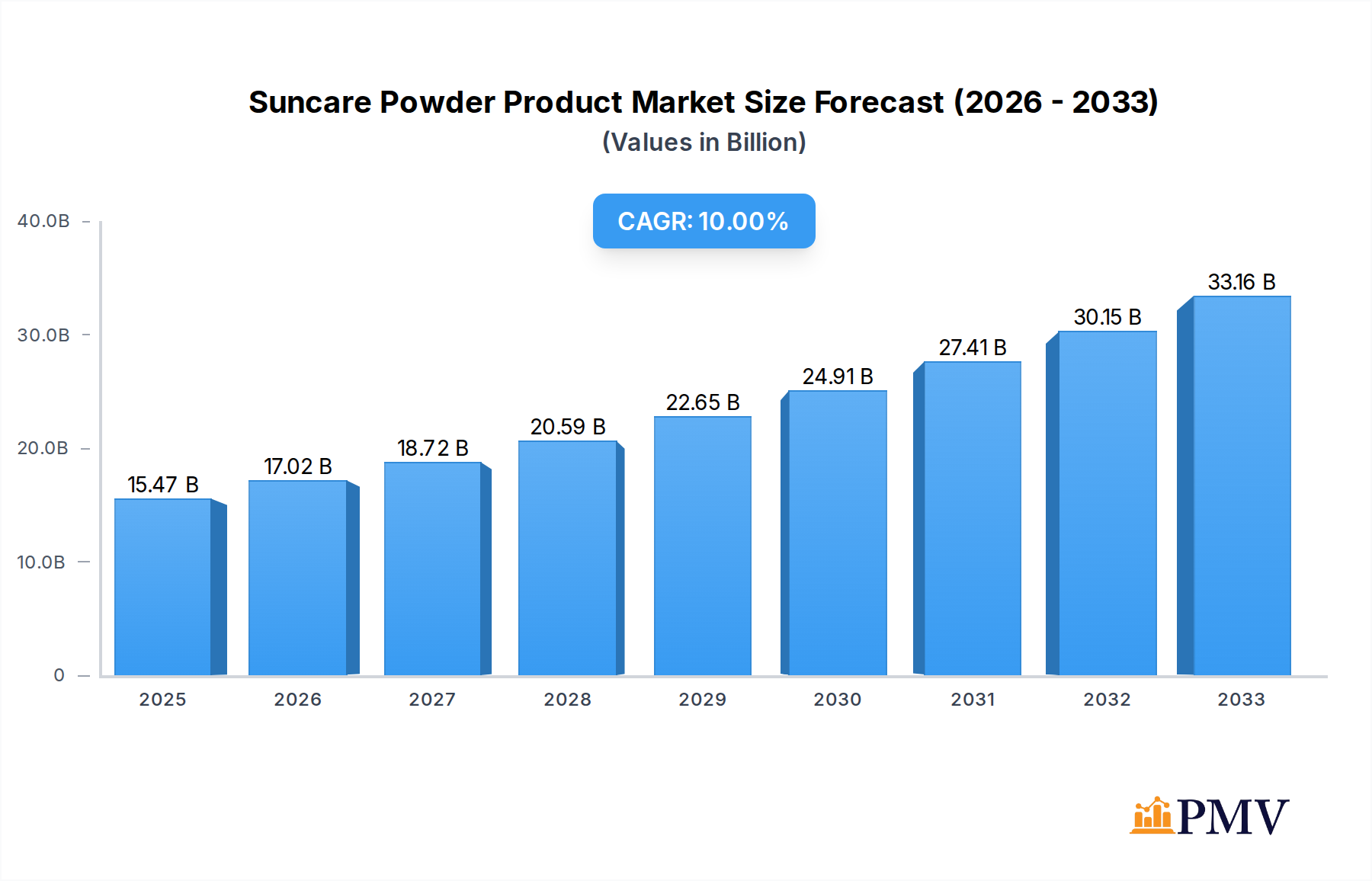

The global Suncare Powder Product market is poised for significant expansion, estimated at USD 15.47 billion in 2025, and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 10% through 2033. This impressive growth is fueled by a confluence of evolving consumer preferences and technological advancements within the beauty and personal care industry. Key drivers include the increasing awareness of sun protection benefits, the rising demand for convenient and portable beauty solutions, and the continuous innovation in formulating powders with enhanced UV protection, skin-caring ingredients, and aesthetic appeal. The trend towards "clean beauty" and mineral-based sunscreens further bolsters the market, aligning with consumer demand for safer and more sustainable products. As a result, manufacturers are investing in research and development to create advanced formulations that offer broad-spectrum protection, a lightweight feel, and a natural finish, catering to a diverse range of skin types and concerns.

Suncare Powder Product Market Size (In Billion)

The market's dynamism is also shaped by distinct application segments and product types. Online sales channels are emerging as a dominant force, driven by e-commerce penetration and the convenience of at-home shopping, alongside traditional supermarket and specialty store distribution. Supermarkets and specialty stores will continue to be crucial for impulse buys and expert advice, while online platforms offer broader accessibility and competitive pricing. In terms of product types, the demand for both normal and dry formulations is expected to be strong, catering to varied skin needs. However, the increasing prevalence of oily skin types in certain demographics may also spur growth in specialized formulations. While the market is largely driven by positive consumer trends and product innovation, potential restraints could include stringent regulatory landscapes in certain regions and the high cost associated with developing and manufacturing advanced suncare formulations.

Suncare Powder Product Company Market Share

Suncare Powder Product Market Research Report: Comprehensive Analysis and Strategic Insights (2019–2033)

This in-depth market research report offers a detailed examination of the global Suncare Powder Product market, providing critical insights for stakeholders navigating this dynamic sector. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this report delivers actionable intelligence. Our analysis encompasses market structure, competitive dynamics, key industry trends, dominant markets and segments, product innovations, growth drivers, challenges, leading players, and strategic outlooks. The market is valued in billions, offering a significant financial perspective.

Suncare Powder Product Market Structure & Competitive Dynamics

The Suncare Powder Product market exhibits a moderately concentrated structure, with a handful of key players holding substantial market share, estimated to be around 65 billion. However, the presence of numerous niche manufacturers and emerging brands contributes to a vibrant competitive landscape. Innovation ecosystems are driven by ongoing research and development in advanced formulations, including mineral-based powders, micronized particles, and hybrid formulations offering both sun protection and cosmetic benefits. Regulatory frameworks, primarily focused on SPF efficacy, ingredient safety, and labeling standards, play a crucial role in shaping product development and market entry. Product substitutes include traditional sunscreens, sun sprays, and tinted moisturizers, but the convenience and unique texture of suncare powders offer distinct advantages, driving an estimated 70 billion in market penetration. End-user trends highlight a growing demand for lightweight, non-greasy formulations that are easy to apply and integrate into makeup routines. Mergers and acquisition (M&A) activities have been a significant factor in market consolidation, with estimated M&A deal values reaching 15 billion over the historical period, fostering synergies and expanding product portfolios.

- Market Concentration: Moderate, with key players holding approximately 65 billion in market share.

- Innovation Ecosystems: Driven by R&D in advanced formulations and ingredient technologies.

- Regulatory Frameworks: Emphasis on SPF efficacy, ingredient safety, and clear labeling.

- Product Substitutes: Traditional sunscreens, sprays, and tinted moisturizers.

- End-User Trends: Demand for lightweight, non-greasy, and convenient application methods.

- M&A Activities: Significant consolidation, with estimated M&A deal values of 15 billion.

Suncare Powder Product Industry Trends & Insights

The Suncare Powder Product industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8.5 billion over the forecast period. This expansion is propelled by a confluence of factors including rising consumer awareness regarding the detrimental effects of UV radiation, an increasing preference for multi-functional beauty products that offer both skincare benefits and cosmetic enhancement, and a surge in demand for natural and organic ingredients. Technological advancements in particle size reduction and formulation stability have enabled the development of more efficacious and aesthetically pleasing suncare powders. The market penetration of suncare powders is steadily increasing, estimated to reach 55 billion by 2025, as consumers embrace their ease of use and seamless integration into existing beauty regimes. The growing influence of social media and beauty influencers further amplifies product awareness and adoption. Furthermore, a significant trend is the customization of formulations to cater to specific skin types (Normal, Dry, Oily) and concerns, offering tailored protection and coverage. The demand for sustainable and eco-friendly packaging solutions is also gaining traction, influencing product development and brand positioning. The competitive landscape is characterized by continuous product innovation, strategic partnerships, and targeted marketing campaigns aimed at educating consumers about the benefits of daily sun protection. The global market size is projected to reach an impressive 120 billion by the end of the forecast period.

- Market Growth Drivers: Increased UV awareness, demand for multi-functional products, natural/organic ingredient preference, technological advancements in formulations.

- Technological Disruptions: Innovations in micronization, UV filter encapsulation, and texture enhancement.

- Consumer Preferences: Growing demand for lightweight, non-greasy, easy-to-apply, and aesthetically pleasing suncare options.

- Competitive Dynamics: Focus on product innovation, strategic alliances, and influencer marketing.

- CAGR: Estimated at 8.5 billion over the forecast period.

- Market Penetration: Projected to reach 55 billion by 2025.

- Global Market Size (Forecast): Expected to reach 120 billion by 2033.

Dominant Markets & Segments in Suncare Powder Product

North America currently dominates the Suncare Powder Product market, holding an estimated 30% of the global market share, valued at approximately 36 billion. This dominance is attributed to high consumer disposable incomes, a well-established beauty and personal care industry, and a strong emphasis on skincare and sun protection. The United States, in particular, represents a significant market due to widespread consumer awareness of sun damage and a robust retail infrastructure. Economic policies supporting the beauty and wellness sectors, coupled with advanced distribution networks, further bolster North America's leading position. Within this region, the Supermarket segment accounts for the largest share, driven by convenience and accessibility, estimated at 15 billion in sales. Specialty Stores follow, catering to consumers seeking premium and curated beauty products, contributing approximately 12 billion. Online Sales are rapidly growing, projected to reach 10 billion, propelled by e-commerce convenience and a wider product selection.

In terms of product types, powders formulated for Normal skin types are the most popular, representing a market value of 20 billion, due to their broad appeal. However, the demand for suncare powders specifically designed for Dry skin, offering moisturizing benefits, and Oily skin, providing mattifying effects, is steadily increasing, each segment estimated at 8 billion and 8 billion respectively. Key drivers for this regional dominance include effective marketing campaigns that emphasize the benefits of suncare powders in preventing premature aging and skin cancer, coupled with the availability of diverse product offerings from global brands. Furthermore, an aging population in many developed economies contributes to a higher demand for anti-aging and protective skincare solutions.

- Leading Region: North America (30% market share, approx. 36 billion).

- Key Country: United States.

- Dominant Segments:

- Application:

- Supermarket (15 billion)

- Specialty Store (12 billion)

- Online Sales (projected 10 billion)

- Other

- Types:

- Normal Skin (20 billion)

- Dry Skin (8 billion)

- Oily Skin (8 billion)

- Application:

- Key Drivers: High disposable income, established beauty industry, strong skincare awareness, advanced retail infrastructure, effective marketing, aging population.

Suncare Powder Product Product Innovations

Product innovation in the Suncare Powder Product sector is focused on enhancing efficacy, user experience, and formulation sustainability. Key developments include the incorporation of advanced UV filters, such as micronized zinc oxide and titanium dioxide, for broad-spectrum protection with minimal white cast. Innovations also extend to synergistic ingredient blends that combine sun protection with antioxidant properties, hydration boosters, and skin-conditioning agents, creating multi-functional cosmetic powders. The development of oil-controlling formulations and those designed for sensitive skin are gaining traction. Competitive advantages are derived from superior texture, long-lasting wear, and the integration of skincare benefits into makeup, leading to a market fit that appeals to modern consumers seeking convenience and efficacy.

Report Segmentation & Scope

This report segments the Suncare Powder Product market based on key application channels and skin types. The application segments analyzed include Supermarket, where accessibility and convenience drive sales, Specialty Store, catering to a discerning customer base seeking premium products, and Online Sales, which is experiencing rapid expansion due to e-commerce convenience and a vast product selection. The Other application segment encompasses channels like pharmacies and direct-to-consumer sales. In terms of product types, the market is segmented by Normal skin, Dry skin, and Oily skin, with each segment offering tailored benefits. Growth projections and market sizes for each segment are meticulously detailed within the report, alongside an analysis of the competitive dynamics influencing their performance.

- Application Segments: Supermarket, Specialty Store, Online Sales, Other.

- Types Segments: Normal, Dry, Oily.

Key Drivers of Suncare Powder Product Growth

The Suncare Powder Product market's growth is fueled by several interconnected factors. Rising global temperatures and increasing awareness of the detrimental effects of UV radiation on skin health, including premature aging and skin cancer, are primary drivers. Technological advancements in cosmetic science have enabled the development of lightweight, non-comedogenic, and aesthetically pleasing suncare powders that seamlessly integrate into daily routines. Economic prosperity in emerging markets translates to increased disposable income, allowing consumers to invest more in premium skincare products. Furthermore, supportive government initiatives promoting public health awareness and stricter regulations on sun protection product efficacy contribute to market expansion. The growing popularity of "clean beauty" and demand for natural ingredients are also significant accelerators.

- Consumer Awareness: Rising understanding of UV damage and skin cancer prevention.

- Technological Advancements: Development of improved formulations, textures, and efficacy.

- Economic Growth: Increased disposable income in key regions.

- Regulatory Support: Public health campaigns and efficacy standards.

- Clean Beauty Movement: Demand for natural and sustainable ingredients.

Challenges in the Suncare Powder Product Sector

Despite its strong growth trajectory, the Suncare Powder Product sector faces several challenges. Intense competition from established sunscreen brands and the broader cosmetics industry can lead to price pressures and require significant marketing investment to achieve differentiation. Evolving regulatory landscapes regarding ingredient safety and labeling can necessitate costly product reformulations. Supply chain disruptions, particularly for specialized ingredients and packaging materials, can impact production timelines and costs. Furthermore, consumer education remains a challenge, as some consumers may perceive powders as less effective than traditional sunscreens. The high cost of research and development for innovative formulations can also be a barrier for smaller players.

- Intense Competition: Pressure from established brands and the wider cosmetics market.

- Regulatory Hurdles: Evolving ingredient safety and labeling requirements.

- Supply Chain Issues: Disruptions in ingredient sourcing and production.

- Consumer Education: Perceptions regarding efficacy compared to traditional sunscreens.

- R&D Costs: Investment required for advanced formulation development.

Leading Players in the Suncare Powder Product Market

- Blackstone Group Inc

- Crescita Skin Sciences

- Edgewell Personal Care Company

- Jane Iredale Cosmetics, Inc

- LG H&H Co. Ltd

- Pep Technologies Pvt. Ltd

- Pierre Fabre USA, Inc

- SPF Ventures

Key Developments in Suncare Powder Product Sector

- 2023/08: Jane Iredale Cosmetics, Inc. launched a new mineral-based suncare powder with enhanced SPF protection and added antioxidant benefits, targeting the premium beauty market.

- 2023/11: Pierre Fabre USA, Inc. announced a strategic partnership with a biotechnology firm to develop novel UV-filtering ingredients for cosmetic applications.

- 2024/01: Edgewell Personal Care Company expanded its suncare portfolio with a new line of multi-functional powders designed for on-the-go application.

- 2024/04: LG H&H Co. Ltd invested in a startup specializing in sustainable packaging solutions for beauty products, aiming to reduce its environmental footprint.

- 2024/07: Crescita Skin Sciences introduced a dermatologist-recommended suncare powder formulated for acne-prone and oily skin types.

Strategic Suncare Powder Product Market Outlook

The strategic outlook for the Suncare Powder Product market remains highly optimistic. Growth accelerators include the increasing adoption of hybrid beauty products that offer both skincare and makeup benefits, the expanding e-commerce channel, and a persistent consumer demand for convenient, effective, and aesthetically pleasing sun protection solutions. Opportunities lie in developing innovative formulations with advanced ingredients, catering to niche skin concerns, and expanding into emerging markets with growing beauty and wellness consciousness. Strategic collaborations, mergers, and acquisitions will continue to shape the competitive landscape, allowing companies to leverage synergies and broaden their market reach. The focus on sustainability and clean beauty will also be a critical differentiator, presenting a significant avenue for market leadership and long-term growth.

Suncare Powder Product Segmentation

-

1. Application

- 1.1. Supermarket

- 1.2. Specialty Store

- 1.3. Online Sales

- 1.4. Other

-

2. Types

- 2.1. Normal

- 2.2. Dry

- 2.3. Oily

Suncare Powder Product Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Suncare Powder Product Regional Market Share

Geographic Coverage of Suncare Powder Product

Suncare Powder Product REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Suncare Powder Product Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Supermarket

- 5.1.2. Specialty Store

- 5.1.3. Online Sales

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Normal

- 5.2.2. Dry

- 5.2.3. Oily

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Suncare Powder Product Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Supermarket

- 6.1.2. Specialty Store

- 6.1.3. Online Sales

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Normal

- 6.2.2. Dry

- 6.2.3. Oily

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Suncare Powder Product Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Supermarket

- 7.1.2. Specialty Store

- 7.1.3. Online Sales

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Normal

- 7.2.2. Dry

- 7.2.3. Oily

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Suncare Powder Product Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Supermarket

- 8.1.2. Specialty Store

- 8.1.3. Online Sales

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Normal

- 8.2.2. Dry

- 8.2.3. Oily

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Suncare Powder Product Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Supermarket

- 9.1.2. Specialty Store

- 9.1.3. Online Sales

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Normal

- 9.2.2. Dry

- 9.2.3. Oily

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Suncare Powder Product Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Supermarket

- 10.1.2. Specialty Store

- 10.1.3. Online Sales

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Normal

- 10.2.2. Dry

- 10.2.3. Oily

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Blackstone Group Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Crescita Skin Sciences

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Edgewell Personal Care Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jane Iredale Cosmetics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LG H&H Co. Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pep Technologies Pvt. Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pierre Fabre USA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SPF Ventures

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Blackstone Group Inc

List of Figures

- Figure 1: Global Suncare Powder Product Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Suncare Powder Product Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America Suncare Powder Product Revenue (billion), by Application 2025 & 2033

- Figure 4: North America Suncare Powder Product Volume (K), by Application 2025 & 2033

- Figure 5: North America Suncare Powder Product Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Suncare Powder Product Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Suncare Powder Product Revenue (billion), by Types 2025 & 2033

- Figure 8: North America Suncare Powder Product Volume (K), by Types 2025 & 2033

- Figure 9: North America Suncare Powder Product Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America Suncare Powder Product Volume Share (%), by Types 2025 & 2033

- Figure 11: North America Suncare Powder Product Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Suncare Powder Product Volume (K), by Country 2025 & 2033

- Figure 13: North America Suncare Powder Product Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Suncare Powder Product Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Suncare Powder Product Revenue (billion), by Application 2025 & 2033

- Figure 16: South America Suncare Powder Product Volume (K), by Application 2025 & 2033

- Figure 17: South America Suncare Powder Product Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America Suncare Powder Product Volume Share (%), by Application 2025 & 2033

- Figure 19: South America Suncare Powder Product Revenue (billion), by Types 2025 & 2033

- Figure 20: South America Suncare Powder Product Volume (K), by Types 2025 & 2033

- Figure 21: South America Suncare Powder Product Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America Suncare Powder Product Volume Share (%), by Types 2025 & 2033

- Figure 23: South America Suncare Powder Product Revenue (billion), by Country 2025 & 2033

- Figure 24: South America Suncare Powder Product Volume (K), by Country 2025 & 2033

- Figure 25: South America Suncare Powder Product Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Suncare Powder Product Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Suncare Powder Product Revenue (billion), by Application 2025 & 2033

- Figure 28: Europe Suncare Powder Product Volume (K), by Application 2025 & 2033

- Figure 29: Europe Suncare Powder Product Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Suncare Powder Product Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Suncare Powder Product Revenue (billion), by Types 2025 & 2033

- Figure 32: Europe Suncare Powder Product Volume (K), by Types 2025 & 2033

- Figure 33: Europe Suncare Powder Product Revenue Share (%), by Types 2025 & 2033

- Figure 34: Europe Suncare Powder Product Volume Share (%), by Types 2025 & 2033

- Figure 35: Europe Suncare Powder Product Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe Suncare Powder Product Volume (K), by Country 2025 & 2033

- Figure 37: Europe Suncare Powder Product Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Suncare Powder Product Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Suncare Powder Product Revenue (billion), by Application 2025 & 2033

- Figure 40: Middle East & Africa Suncare Powder Product Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa Suncare Powder Product Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa Suncare Powder Product Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa Suncare Powder Product Revenue (billion), by Types 2025 & 2033

- Figure 44: Middle East & Africa Suncare Powder Product Volume (K), by Types 2025 & 2033

- Figure 45: Middle East & Africa Suncare Powder Product Revenue Share (%), by Types 2025 & 2033

- Figure 46: Middle East & Africa Suncare Powder Product Volume Share (%), by Types 2025 & 2033

- Figure 47: Middle East & Africa Suncare Powder Product Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East & Africa Suncare Powder Product Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa Suncare Powder Product Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Suncare Powder Product Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Suncare Powder Product Revenue (billion), by Application 2025 & 2033

- Figure 52: Asia Pacific Suncare Powder Product Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific Suncare Powder Product Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Suncare Powder Product Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Suncare Powder Product Revenue (billion), by Types 2025 & 2033

- Figure 56: Asia Pacific Suncare Powder Product Volume (K), by Types 2025 & 2033

- Figure 57: Asia Pacific Suncare Powder Product Revenue Share (%), by Types 2025 & 2033

- Figure 58: Asia Pacific Suncare Powder Product Volume Share (%), by Types 2025 & 2033

- Figure 59: Asia Pacific Suncare Powder Product Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific Suncare Powder Product Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific Suncare Powder Product Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Suncare Powder Product Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Suncare Powder Product Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Suncare Powder Product Volume K Forecast, by Application 2020 & 2033

- Table 3: Global Suncare Powder Product Revenue billion Forecast, by Types 2020 & 2033

- Table 4: Global Suncare Powder Product Volume K Forecast, by Types 2020 & 2033

- Table 5: Global Suncare Powder Product Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Suncare Powder Product Volume K Forecast, by Region 2020 & 2033

- Table 7: Global Suncare Powder Product Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Suncare Powder Product Volume K Forecast, by Application 2020 & 2033

- Table 9: Global Suncare Powder Product Revenue billion Forecast, by Types 2020 & 2033

- Table 10: Global Suncare Powder Product Volume K Forecast, by Types 2020 & 2033

- Table 11: Global Suncare Powder Product Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Suncare Powder Product Volume K Forecast, by Country 2020 & 2033

- Table 13: United States Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global Suncare Powder Product Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Suncare Powder Product Volume K Forecast, by Application 2020 & 2033

- Table 21: Global Suncare Powder Product Revenue billion Forecast, by Types 2020 & 2033

- Table 22: Global Suncare Powder Product Volume K Forecast, by Types 2020 & 2033

- Table 23: Global Suncare Powder Product Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Suncare Powder Product Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Brazil Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global Suncare Powder Product Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Global Suncare Powder Product Volume K Forecast, by Application 2020 & 2033

- Table 33: Global Suncare Powder Product Revenue billion Forecast, by Types 2020 & 2033

- Table 34: Global Suncare Powder Product Volume K Forecast, by Types 2020 & 2033

- Table 35: Global Suncare Powder Product Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Suncare Powder Product Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Benelux Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Nordics Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global Suncare Powder Product Revenue billion Forecast, by Application 2020 & 2033

- Table 56: Global Suncare Powder Product Volume K Forecast, by Application 2020 & 2033

- Table 57: Global Suncare Powder Product Revenue billion Forecast, by Types 2020 & 2033

- Table 58: Global Suncare Powder Product Volume K Forecast, by Types 2020 & 2033

- Table 59: Global Suncare Powder Product Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Suncare Powder Product Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Israel Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: GCC Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: North Africa Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: South Africa Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global Suncare Powder Product Revenue billion Forecast, by Application 2020 & 2033

- Table 74: Global Suncare Powder Product Volume K Forecast, by Application 2020 & 2033

- Table 75: Global Suncare Powder Product Revenue billion Forecast, by Types 2020 & 2033

- Table 76: Global Suncare Powder Product Volume K Forecast, by Types 2020 & 2033

- Table 77: Global Suncare Powder Product Revenue billion Forecast, by Country 2020 & 2033

- Table 78: Global Suncare Powder Product Volume K Forecast, by Country 2020 & 2033

- Table 79: China Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: China Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: India Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Japan Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Korea Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Oceania Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Suncare Powder Product Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Suncare Powder Product Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Suncare Powder Product?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Suncare Powder Product?

Key companies in the market include Blackstone Group Inc, Crescita Skin Sciences, Edgewell Personal Care Company, Jane Iredale Cosmetics, Inc, LG H&H Co. Ltd, Pep Technologies Pvt. Ltd, Pierre Fabre USA, Inc, SPF Ventures.

3. What are the main segments of the Suncare Powder Product?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.47 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Suncare Powder Product," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Suncare Powder Product report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Suncare Powder Product?

To stay informed about further developments, trends, and reports in the Suncare Powder Product, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence