Key Insights

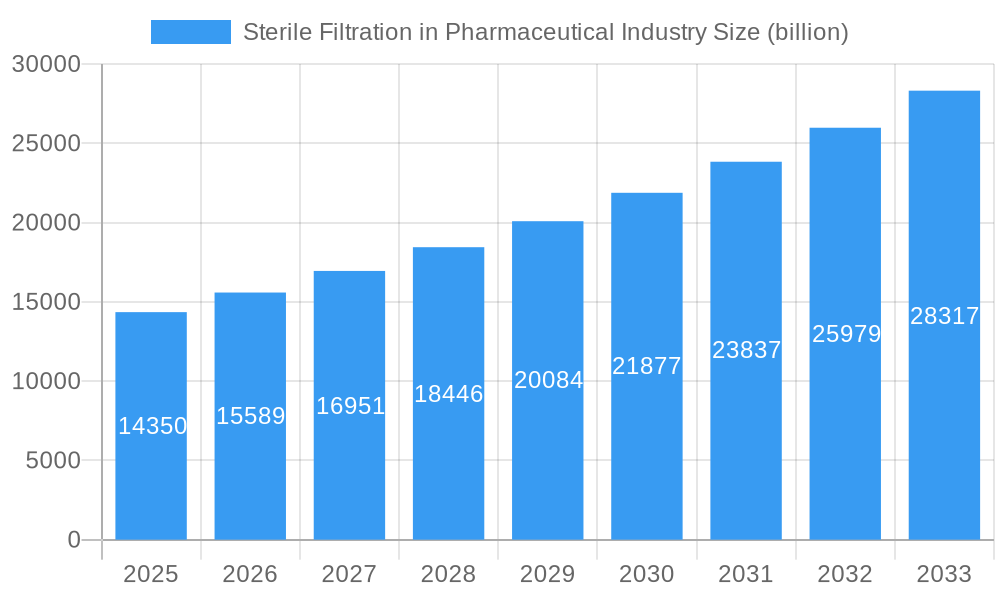

The global Sterile Filtration market within the pharmaceutical industry is poised for robust expansion, projected to reach an estimated $14.35 billion in 2025 and exhibit a compound annual growth rate (CAGR) of 8.7% through 2033. This significant growth is primarily fueled by the escalating demand for high-purity pharmaceuticals, the increasing prevalence of complex biopharmaceutical drug development, and stringent regulatory requirements for sterile manufacturing processes. The pharmaceutical and biopharmaceutical companies are the leading end-users, driving adoption of advanced filtration technologies to ensure product safety and efficacy. Contract research organizations (CROs) and research laboratories also contribute significantly to market demand as they play a crucial role in drug discovery and development.

Sterile Filtration in Pharmaceutical Industry Market Size (In Billion)

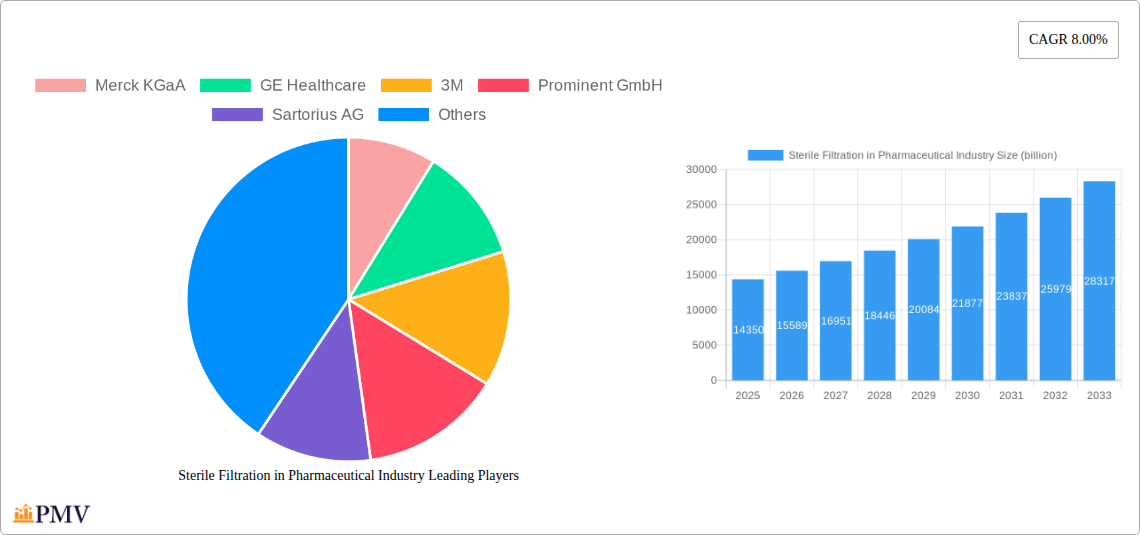

The market is segmented by product type, with cartridge filters and capsule filters holding substantial market share due to their versatility and efficiency in various pharmaceutical applications. Syringe filters and other membrane filters cater to specialized laboratory and point-of-use filtration needs. Key market drivers include the continuous innovation in membrane technology, leading to improved filtration efficiency and broader applicability. Furthermore, the growing outsourcing of pharmaceutical manufacturing and research activities to specialized organizations bolsters the demand for sterile filtration solutions. Emerging economies, particularly in the Asia Pacific region, are witnessing accelerated growth due to increasing healthcare investments and the expansion of the pharmaceutical manufacturing base. The competitive landscape is characterized by the presence of major global players such as Merck KGaA, GE Healthcare, 3M, and Sartorius AG, who are actively involved in research and development to introduce advanced and cost-effective sterile filtration solutions.

Sterile Filtration in Pharmaceutical Industry Company Market Share

This in-depth report provides an exhaustive analysis of the global sterile filtration market in the pharmaceutical industry, a critical segment valued in the billions. Spanning the historical period of 2019-2024, with a base year of 2025 and an extensive forecast period up to 2033, this study offers unparalleled insights into market dynamics, technological advancements, and strategic opportunities. We cover key market segments including Cartridge Filters, Capsule Filters, Syringe Filters, Other Membrane Filters, and Accessories, alongside end-users such as Pharmaceutical and Biopharmaceutical Companies, Contract Research Organizations, and Research Laboratories. Discover the driving forces behind the pharmaceutical filtration market, understand competitive landscapes, and navigate future growth trajectories with actionable intelligence.

Sterile Filtration in Pharmaceutical Industry Market Structure & Competitive Dynamics

The sterile filtration market for pharmaceuticals exhibits a moderately concentrated structure, characterized by the presence of both large, diversified players and specialized filtration solution providers. Key companies like Merck KGaA, GE Healthcare, 3M, Sartorius AG, and Danaher Corporation command significant market share, leveraging their extensive product portfolios and established distribution networks. Innovation ecosystems are thriving, fueled by continuous research and development in advanced membrane technologies and single-use filtration systems. Regulatory frameworks, primarily driven by agencies like the FDA and EMA, significantly influence market entry and product approval, demanding high standards for sterility assurance and validation. Product substitutes are limited due to the stringent requirements of pharmaceutical manufacturing, though advancements in alternative sterilization methods could pose a long-term challenge. End-user trends indicate a strong preference for efficient, cost-effective, and compliant filtration solutions, with a growing adoption of single-use technologies to mitigate cross-contamination risks and streamline manufacturing processes. Mergers and Acquisitions (M&A) are a notable feature, with estimated deal values in the hundreds of millions of dollars, as companies seek to expand their technological capabilities, geographical reach, and product offerings within the biopharmaceutical filtration market.

Sterile Filtration in Pharmaceutical Industry Industry Trends & Insights

The pharmaceutical sterile filtration market is poised for robust growth, driven by a confluence of factors including the escalating demand for biopharmaceuticals, a burgeoning pipeline of complex drug molecules, and stringent regulatory mandates for product safety and purity. The projected Compound Annual Growth Rate (CAGR) for this sector is expected to be approximately xx% over the forecast period, propelling the market size to several billion dollars by 2033. Technological disruptions are at the forefront, with the increasing integration of advanced membrane materials offering enhanced flow rates, superior retention capabilities, and extended product lifespans. The development and widespread adoption of single-use filtration systems represent a significant trend, reducing validation burdens, minimizing cleaning requirements, and improving operational flexibility, particularly for biologics manufacturing. Consumer preferences, defined by pharmaceutical manufacturers, lean towards filtration solutions that guarantee microbial removal, reduce process downtime, and offer a lower total cost of ownership. Competitive dynamics are characterized by intense R&D efforts to develop novel filtration media, improve filter design for higher efficiency, and provide integrated solutions that encompass both filtration and downstream processing. The market penetration of advanced sterile filtration technologies is steadily increasing across both established and emerging pharmaceutical hubs, reflecting a global commitment to producing safe and effective medicines. The growing complexity of drug formulations, including vaccines and personalized therapies, further necessitates highly reliable sterile filtration to maintain product integrity.

Dominant Markets & Segments in Sterile Filtration in Pharmaceutical Industry

The global sterile filtration market is dominated by North America and Europe, owing to the established presence of major pharmaceutical and biopharmaceutical companies, significant R&D investments, and stringent regulatory oversight. Within these regions, the United States and Germany represent key national markets, driven by extensive manufacturing capabilities and a strong emphasis on drug innovation.

Product Segment Dominance:

- Cartridge Filters: These hold a dominant position within the pharmaceutical filtration market.

- Key Drivers: High throughput, wide range of pore sizes, compatibility with various chemical and biological fluids, and established validation protocols make them indispensable for large-scale pharmaceutical production.

- Dominance Analysis: Cartridge filters are the workhorses for bulk filtration of APIs, intermediates, and final drug products. Their versatility in handling diverse volumes and fluid types ensures their continued market leadership. The market for cartridge filters is estimated to be in the billions.

- Capsule Filters: Growing rapidly in importance.

- Key Drivers: Ease of use, reduced validation efforts due to integrated design, suitability for small to medium-scale production, and minimized risk of contamination.

- Dominance Analysis: Capsule filters are gaining traction, especially in biopharmaceutical applications and during process development, offering a convenient and efficient sterile filtration solution. Their adoption is projected to further increase the overall market share.

- Syringe Filters: Crucial for laboratory and point-of-use applications.

- Key Drivers: Convenience for small-volume filtration, sample preparation, and quality control testing.

- Dominance Analysis: While smaller in market value compared to cartridge or capsule filters, syringe filters are essential for research and development laboratories and quality control departments within pharmaceutical organizations, contributing a significant portion to the overall membrane filter market.

- Other Membrane Filters: This category includes depth filters and other specialized membrane types.

- Key Drivers: Specific applications requiring pre-filtration, clarification, and removal of larger particulates.

- Dominance Analysis: These filters often serve as complementary solutions to primary sterile filters, playing a vital role in optimizing overall filtration efficiency and protecting downstream sterile filters.

- Accessories: This includes housings, connectors, and validation consumables.

- Key Drivers: Essential for the effective and compliant use of filtration systems.

- Dominance Analysis: The demand for accessories is directly proportional to the use of primary filtration products, ensuring a consistent revenue stream within the sterile filtration ecosystem.

End-User Segment Dominance:

- Pharmaceutical and Biopharmaceutical Companies: This segment represents the largest consumer of sterile filtration products.

- Key Drivers: High-volume production of drugs, vaccines, and biologics, strict quality control, and regulatory compliance.

- Dominance Analysis: These companies invest heavily in advanced sterile filtration technologies to ensure the safety and efficacy of their products. The market value within this segment is in the billions.

- Contract Research Organizations (CROs) & Contract Development and Manufacturing Organizations (CDMOs): Significant and growing users.

- Key Drivers: Outsourcing of drug development and manufacturing, need for flexible and scalable filtration solutions.

- Dominance Analysis: As more pharmaceutical development is outsourced, CROs and CDMOs are becoming increasingly important markets for sterile filtration suppliers.

- Research Laboratories: Essential for early-stage research and development.

- Key Drivers: Small-scale filtration needs for sample preparation, cell culture, and analytical testing.

- Dominance Analysis: While individual purchase volumes are smaller, the sheer number of research laboratories contributes significantly to the demand for syringe filters and other laboratory-grade filtration consumables.

Sterile Filtration in Pharmaceutical Industry Product Innovations

Product innovations in pharmaceutical sterile filtration are primarily focused on enhancing efficiency, reducing processing time, and improving the sustainability of filtration solutions. Companies are developing advanced membrane materials with higher surface areas and improved pore structures for increased throughput and lower pressure drops. The trend towards single-use filtration systems continues, with innovations in disposable capsule and cartridge designs offering improved ergonomics, reduced validation requirements, and enhanced sterility assurance. Furthermore, there is a growing emphasis on integrating smart technologies for real-time monitoring of filtration performance, enabling predictive maintenance and proactive issue resolution. These advancements provide competitive advantages by offering manufacturers more reliable, cost-effective, and compliant sterile filtration solutions, supporting the production of high-quality biopharmaceuticals and novel drug therapies. The market for these innovative products is projected to reach several billion dollars by 2033.

Report Segmentation & Scope

This report meticulously segments the sterile filtration market in the pharmaceutical industry to provide a granular understanding of its various facets. The segmentation is categorized by product type and end-user industry.

Product Segmentation:

- Cartridge Filter: This segment encompasses various cartridge filter types, including pleated, depth, and membrane cartridges, crucial for bulk fluid processing in pharmaceutical manufacturing. The market for cartridge filters is estimated to be in the billions, with a strong projected growth rate.

- Capsule Filter: This segment focuses on integrated, ready-to-use capsule filter units, ideal for pilot-scale operations, sterile sampling, and applications where ease of use and minimal validation are paramount. This segment is experiencing rapid expansion.

- Syringe Filter: This segment includes disposable syringe filters used for small-volume filtration, sample preparation, and critical laboratory applications. This segment caters to research and quality control needs and is a significant contributor to the overall market.

- Other Membrane Filters: This broad category includes specialized membrane filters not covered in the primary segments, such as tangential flow filtration (TFF) membranes and specific filter media designed for unique applications.

- Accessories: This segment comprises essential components like filter housings, connectors, tubing, and validation consumables that support the operation and maintenance of sterile filtration systems.

End-User Segmentation:

- Pharmaceutical and Biopharmaceutical Companies: This is the largest end-user segment, representing companies involved in the research, development, and manufacturing of a wide range of therapeutic drugs and biologics. This segment's market size is in the billions, driven by high production volumes and stringent quality requirements.

- Contract Research Organizations (CROs): This segment includes organizations that provide outsourced research and development services to the pharmaceutical industry, requiring efficient and validated sterile filtration solutions for their projects.

- Research Laboratories: This segment comprises academic, government, and private research institutions engaged in fundamental and applied scientific research, utilizing sterile filtration for experimental procedures and sample analysis.

Key Drivers of Sterile Filtration in Pharmaceutical Industry Growth

The growth of the pharmaceutical sterile filtration market is propelled by several interconnected factors. Firstly, the escalating demand for biologics and complex drug molecules, such as monoclonal antibodies and vaccines, inherently requires stringent sterile filtration processes to ensure product safety and efficacy, representing a market shift towards advanced filtration needs valued in the billions. Secondly, increasingly rigorous regulatory guidelines from global health authorities, mandating higher standards for microbial control and product purity, drive the adoption of advanced sterile filtration technologies. Thirdly, continuous technological advancements in membrane science and filter design, leading to improved filtration efficiency, higher throughput, and reduced processing times, present significant market opportunities. Furthermore, the growing trend of outsourcing drug development and manufacturing to CROs and CDMOs fuels demand for scalable and flexible sterile filtration solutions across diverse production scales. The projected market expansion is estimated to be in the billions by 2033.

Challenges in the Sterile Filtration in Pharmaceutical Industry Sector

Despite the strong growth trajectory, the sterile filtration market in pharmaceuticals faces several challenges that can impact its expansion. The stringent and evolving regulatory landscape, while a driver, also presents a hurdle, requiring significant investment in validation and compliance for new technologies and products. The high cost associated with advanced sterile filtration systems and consumables, particularly for single-use technologies, can be a deterrent for smaller manufacturers or research institutions with limited budgets. Supply chain disruptions, as evidenced by recent global events, can lead to material shortages and increased lead times for critical filtration components, impacting production schedules. Moreover, the development of alternative sterilization methods or advancements in drug formulation that may reduce the reliance on traditional sterile filtration could pose a long-term threat. The competitive pressure among existing players to innovate and maintain cost-effectiveness also presents an ongoing challenge, with significant market value at stake.

Leading Players in the Sterile Filtration in Pharmaceutical Industry Market

- Merck KGaA

- GE Healthcare

- 3M

- Prominent GmbH

- Sartorius AG

- Danaher Corporation

- Sterlitech Corporation

- Koch Membrane Systems Inc

- Porvair Filtration Group

- Cole-Parmer Instrument Company LLC

- ThermoFisher Scientific Inc

- Eaton Corporation

Key Developments in Sterile Filtration in Pharmaceutical Industry Sector

- September 2022: Industrial Sonomechanics, LLC (ISM) announced the commercial availability of its Large-Capacity In-Line Cartridge, which improves the efficiency of the nanoemulsion production process while lowering costs. This development offers enhanced processing capabilities for specific pharmaceutical formulations.

- April 2022: Merck announced investing approximately EUR 100 million (USD 105 million) to expand its first Asia-Pacific Mobius single-use manufacturing center in China. This investment signifies a strategic move to enhance the supply of single-use filtration solutions in a key growth region for the biopharmaceutical industry.

Strategic Sterile Filtration in Pharmaceutical Industry Market Outlook

The strategic outlook for the sterile filtration market in the pharmaceutical industry is highly optimistic, driven by continuous innovation and increasing demand for safe and effective therapeutics. Growth accelerators include the expanding biologics market, the rise of personalized medicine, and the increasing global emphasis on drug quality and patient safety, all contributing to a market valued in the billions. Companies are strategically focusing on developing and expanding their portfolios of single-use filtration systems, recognizing their advantages in flexibility, reduced validation time, and contamination control. Furthermore, strategic partnerships and collaborations are expected to play a crucial role in addressing complex filtration challenges and expanding market reach. Investments in emerging markets, coupled with a focus on providing comprehensive filtration solutions that encompass both hardware and services, will be key to capitalizing on future market potential. The ongoing evolution of regulatory requirements will continue to drive demand for advanced, validated sterile filtration technologies, ensuring a robust growth trajectory for the industry.

Sterile Filtration in Pharmaceutical Industry Segmentation

-

1. Product

- 1.1. Cartridge Filter

- 1.2. Capsule Filter

- 1.3. Syringe Filter

- 1.4. Other Membrane Filters

- 1.5. Accessories

-

2. End User

- 2.1. Pharmaceutical and Biopharmaceutical Companies

- 2.2. Contract Research Organization

- 2.3. Research Laboratories

Sterile Filtration in Pharmaceutical Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Sterile Filtration in Pharmaceutical Industry Regional Market Share

Geographic Coverage of Sterile Filtration in Pharmaceutical Industry

Sterile Filtration in Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Chronic Diseases; Growing Pharmaceutical and Biopharmaceutical Industries

- 3.3. Market Restrains

- 3.3.1. High Cost of Sterile Filtration

- 3.4. Market Trends

- 3.4.1. Cartridge Filter Segment Expected to Exhibit Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sterile Filtration in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Cartridge Filter

- 5.1.2. Capsule Filter

- 5.1.3. Syringe Filter

- 5.1.4. Other Membrane Filters

- 5.1.5. Accessories

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Pharmaceutical and Biopharmaceutical Companies

- 5.2.2. Contract Research Organization

- 5.2.3. Research Laboratories

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Sterile Filtration in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Cartridge Filter

- 6.1.2. Capsule Filter

- 6.1.3. Syringe Filter

- 6.1.4. Other Membrane Filters

- 6.1.5. Accessories

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Pharmaceutical and Biopharmaceutical Companies

- 6.2.2. Contract Research Organization

- 6.2.3. Research Laboratories

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Sterile Filtration in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Cartridge Filter

- 7.1.2. Capsule Filter

- 7.1.3. Syringe Filter

- 7.1.4. Other Membrane Filters

- 7.1.5. Accessories

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Pharmaceutical and Biopharmaceutical Companies

- 7.2.2. Contract Research Organization

- 7.2.3. Research Laboratories

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Sterile Filtration in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Cartridge Filter

- 8.1.2. Capsule Filter

- 8.1.3. Syringe Filter

- 8.1.4. Other Membrane Filters

- 8.1.5. Accessories

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Pharmaceutical and Biopharmaceutical Companies

- 8.2.2. Contract Research Organization

- 8.2.3. Research Laboratories

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Sterile Filtration in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Cartridge Filter

- 9.1.2. Capsule Filter

- 9.1.3. Syringe Filter

- 9.1.4. Other Membrane Filters

- 9.1.5. Accessories

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Pharmaceutical and Biopharmaceutical Companies

- 9.2.2. Contract Research Organization

- 9.2.3. Research Laboratories

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Sterile Filtration in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Cartridge Filter

- 10.1.2. Capsule Filter

- 10.1.3. Syringe Filter

- 10.1.4. Other Membrane Filters

- 10.1.5. Accessories

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Pharmaceutical and Biopharmaceutical Companies

- 10.2.2. Contract Research Organization

- 10.2.3. Research Laboratories

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Merck KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GE Healthcare

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 3M

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Prominent GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sartorius AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danaher Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sterlitech Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Koch Membrane Systems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Porvair Filtration Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cole-Parmer Instrument Company LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ThermoFisher Scientific Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eaton Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Merck KGaA

List of Figures

- Figure 1: Global Sterile Filtration in Pharmaceutical Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by Product 2025 & 2033

- Figure 9: Europe Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by Product 2025 & 2033

- Figure 15: Asia Pacific Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by Product 2025 & 2033

- Figure 21: Middle East and Africa Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East and Africa Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Middle East and Africa Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by Product 2025 & 2033

- Figure 27: South America Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: South America Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Sterile Filtration in Pharmaceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Sterile Filtration in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 11: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 20: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 21: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 29: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 35: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 36: Global Sterile Filtration in Pharmaceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Sterile Filtration in Pharmaceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sterile Filtration in Pharmaceutical Industry?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Sterile Filtration in Pharmaceutical Industry?

Key companies in the market include Merck KGaA, GE Healthcare, 3M, Prominent GmbH, Sartorius AG, Danaher Corporation, Sterlitech Corporation, Koch Membrane Systems Inc , Porvair Filtration Group, Cole-Parmer Instrument Company LLC, ThermoFisher Scientific Inc, Eaton Corporation.

3. What are the main segments of the Sterile Filtration in Pharmaceutical Industry?

The market segments include Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Chronic Diseases; Growing Pharmaceutical and Biopharmaceutical Industries.

6. What are the notable trends driving market growth?

Cartridge Filter Segment Expected to Exhibit Significant Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Sterile Filtration.

8. Can you provide examples of recent developments in the market?

In September 2022, Industrial Sonomechanics, LLC (ISM) announced the commercial availability of its Large-Capacity In-Line Cartridge, which improves the efficiency of the nanoemulsion production process while lowering costs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sterile Filtration in Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sterile Filtration in Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sterile Filtration in Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Sterile Filtration in Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence