Key Insights

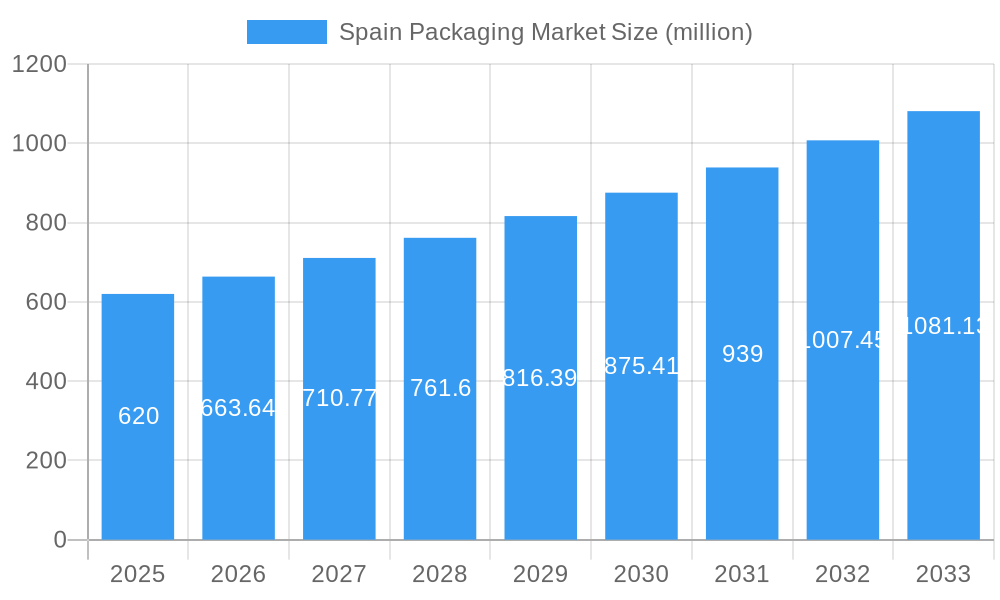

The Spanish packaging market is poised for robust expansion, projected to reach USD 620 million in 2025 and grow at a significant Compound Annual Growth Rate (CAGR) of 7.01% from 2025 to 2033. This impressive growth is fueled by a confluence of factors, including the increasing demand for convenient and sustainable packaging solutions across various end-user industries, particularly food & beverage and healthcare. The evolving consumer preferences towards eco-friendly materials are driving innovation in plastic, paper, and metal packaging, with a notable shift towards recyclable and biodegradable options. Furthermore, the expansion of the e-commerce sector in Spain necessitates more specialized and protective secondary and tertiary packaging, contributing to market dynamism. The pharmaceutical and healthcare industries also represent a key growth segment, driven by stringent regulatory requirements and the need for safe and secure primary packaging.

Spain Packaging Market Market Size (In Million)

The market's trajectory is further shaped by key trends such as the rise of rigid and flexible plastic packaging, the continued importance of paper-based solutions, and advancements in glass and metal container technologies. While the market enjoys strong growth drivers, potential restraints include the fluctuating costs of raw materials and increasing environmental regulations that may impact production processes. Key players like Amcor PLC, Berry Global Inc., and Sealed Air Corporation are actively investing in research and development to align their offerings with these evolving market demands. The segmentation of the market, encompassing primary, secondary, and tertiary layers of packaging, along with diverse packaging materials and end-user applications, highlights the multifaceted nature of Spain's packaging industry and its capacity for sustained development.

Spain Packaging Market Company Market Share

Dive into the dynamic Spain packaging market with our in-depth report, meticulously crafted for industry stakeholders seeking actionable insights and strategic advantage. This comprehensive analysis covers the historical period (2019-2024), base year (2025), and an extended forecast period through 2033, providing unparalleled foresight into Spanish packaging solutions. We dissect the market by packaging layers (primary, secondary, tertiary), packaging materials (plastic – rigid and flexible, paper, glass, metal), and key end-user industries (food & beverage, healthcare & pharmaceutical, beauty & personal care, industrial, and others). Uncover critical market trends, growth drivers, and challenges shaping the European packaging sector and specifically the Iberian peninsula's packaging landscape. With a focus on sustainable packaging, innovative packaging technologies, and regulatory impacts, this report is your definitive guide to navigating the evolving Spanish packaging industry.

Spain Packaging Market Market Structure & Competitive Dynamics

The Spain packaging market exhibits a moderately concentrated structure, with several multinational players alongside a robust base of local manufacturers. Innovation ecosystems are thriving, driven by increasing demand for sustainable and functional packaging solutions. Regulatory frameworks, particularly those related to environmental protection and circular economy principles, significantly influence market dynamics and product development. The report details the intricate interplay of market share among key companies, the impact of product substitutes such as compostable and biodegradable alternatives, and emerging end-user trends demanding customization and efficiency. Merger and acquisition (M&A) activities are a key feature, with strategic consolidations aimed at expanding market reach, acquiring new technologies, and achieving economies of scale. Recent M&A deal values and their implications for market consolidation in the Spanish packaging sector are thoroughly analyzed. Understanding these structural elements is crucial for businesses seeking to establish or expand their presence within the Spanish packaging industry.

- Market Concentration Analysis: Evaluation of key players' market share and competitive intensity.

- Innovation Ecosystems: Identification of R&D hubs and collaborative initiatives driving packaging advancements.

- Regulatory Frameworks: Detailed overview of compliance requirements and their influence on market entry and product design.

- Product Substitutes: Analysis of emerging alternative materials and their competitive impact.

- End-User Trends: Mapping evolving demands from various sectors impacting packaging design and functionality.

- M&A Activities: In-depth examination of recent consolidation trends and their strategic implications.

Spain Packaging Market Industry Trends & Insights

The Spain packaging market is experiencing robust growth, projected to achieve a significant Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is fueled by a confluence of factors, including the rising disposable incomes, a burgeoning e-commerce sector, and a strong food and beverage industry that relies heavily on sophisticated packaging for preservation and market appeal. Technological disruptions are at the forefront, with the adoption of advanced materials, smart packaging solutions, and automation in packaging lines. Consumer preferences are increasingly skewed towards sustainable packaging, driving demand for recyclable, reusable, and biodegradable options. This shift is prompting manufacturers to invest in eco-friendly packaging materials and processes. Competitive dynamics are intensifying, with companies differentiating themselves through product innovation, supply chain efficiency, and tailored solutions for diverse end-user needs. The report provides granular insights into market penetration of various packaging types and materials, and forecasts future trends in flexible packaging, rigid packaging, and specialized solutions for sectors like pharmaceutical packaging and cosmetic packaging. The overall market penetration of advanced packaging solutions continues to rise, indicating a mature yet dynamic market landscape.

Dominant Markets & Segments in Spain Packaging Market

The Spain packaging market is characterized by distinct dominance across its various segments. Within Layers of Packing, primary packaging commands the largest market share, directly interacting with the product and crucial for preservation, safety, and consumer appeal across all end-user industries. Secondary packaging plays a vital role in bundling and distribution, while tertiary packaging is essential for bulk transport and logistics.

In terms of Packaging Material, plastic packaging leads, with significant contributions from both rigid packaging (bottles, containers) and flexible packaging (pouches, films), driven by its versatility, cost-effectiveness, and barrier properties. The increasing focus on sustainable packaging is, however, fueling a substantial growth in paper packaging, particularly for secondary and tertiary applications, as well as certain primary packaging formats. Glass packaging retains its importance in sectors like beverages and pharmaceuticals due to its inertness and premium perception. Metal packaging, predominantly for canned goods and aerosols, also holds a steady market position.

The Food & Beverage industry is the dominant end-user sector for packaging in Spain, accounting for the largest market share. This is attributed to the high consumption rates, stringent safety and shelf-life requirements, and the need for attractive branding. The Healthcare & Pharmaceutical sector represents another critical and growing segment, demanding high-barrier, sterile, and tamper-evident packaging solutions. The Beauty & Personal Care sector also contributes significantly, driven by premiumization and the demand for visually appealing and functional packaging. The Industrial sector, while less prominent in volume, utilizes specialized packaging for protection and transport of goods.

- Key Drivers for Dominant Segments:

- Food & Beverage: High domestic consumption, export demands, stringent food safety regulations, brand differentiation requirements.

- Plastic Packaging: Cost-effectiveness, design flexibility, good barrier properties for shelf-life extension, innovation in recycled and biodegradable plastics.

- Primary Packaging: Direct product protection, consumer interaction, branding opportunities, regulatory compliance for product safety.

- Economic Policies: Government initiatives supporting manufacturing, import/export trade agreements, and consumer spending power.

- Infrastructure: Advanced logistics networks supporting efficient distribution and supply chain management.

Spain Packaging Market Product Innovations

Product innovations in the Spain packaging market are predominantly focused on enhancing sustainability, functionality, and consumer convenience. Key developments include the introduction of advanced barrier films for extending shelf life in food packaging, the widespread adoption of lightweighting technologies in plastic and glass containers to reduce material usage and transportation emissions, and the increasing integration of smart packaging features such as QR codes for traceability and interactive consumer experiences. The development of monomaterial flexible packaging solutions is gaining traction, simplifying recycling processes. Furthermore, advancements in recycled content integration across plastic, paper, and metal packaging demonstrate a strong commitment to the circular economy. These innovations provide a competitive edge by addressing evolving consumer demands and stricter environmental regulations.

Report Segmentation & Scope

This report segments the Spain packaging market comprehensively. The Layers of Packing segment is divided into Primary, Secondary, and Tertiary packaging, each with distinct market sizes and growth projections. The Packaging Material segment is further broken down into Plastic (further categorized into Rigid Packaging and Flexible Packaging), Paper, Glass, and Metal. Each material type's market share, growth potential, and competitive dynamics are analyzed. The End Users segment covers Food & Beverage, Healthcare & Pharmaceutical, Beauty & Personal Care, Industrial, and Other End Users, with detailed assessments of their specific packaging needs, market sizes, and growth forecasts, considering factors like evolving consumer preferences and regulatory mandates.

Key Drivers of Spain Packaging Market Growth

Several key drivers are propelling the Spain packaging market forward. The sustained growth of the food and beverage industry, coupled with increasing demand for convenience and ready-to-eat meals, is a significant factor. The booming e-commerce sector necessitates robust and protective packaging for online retail. Stringent environmental regulations and a growing consumer consciousness are driving the demand for sustainable packaging solutions, including recyclable, biodegradable, and compostable materials. Technological advancements in packaging machinery and materials are also contributing to market expansion, enabling more efficient production and innovative product designs. Furthermore, the expansion of the healthcare and pharmaceutical sectors in Spain requires specialized, high-barrier packaging to ensure product safety and efficacy.

Challenges in the Spain Packaging Market Sector

Despite its growth, the Spain packaging market faces several challenges. Increasing raw material costs, particularly for plastics and paper, can impact profit margins and pricing strategies. The complexity of recycling infrastructure and varying levels of consumer participation in waste segregation can hinder the widespread adoption of circular economy models. Evolving and sometimes fragmented regulatory landscapes across different regions within Spain and the EU can create compliance challenges for businesses. Intense competition, both from domestic and international players, puts pressure on pricing and necessitates continuous innovation. Supply chain disruptions, as witnessed in recent global events, can also pose a significant risk to operational continuity and cost management in the Spanish packaging industry.

Leading Players in the Spain Packaging Market Market

- Becton Dickinson and Company (BD)

- Ball Corporation

- Crown Holdings Inc

- Quadpack Industries SA

- Amcor PLC

- Agrado SA

- International Paper Company

- Coveris Holdings

- Berry Global Inc

- Sealed Air Corporation

Key Developments in Spain Packaging Market Sector

- November 2022: Plastipak opened a new PET recycling plant at its Toledo, Spain, manufacturing location. This initiative aims to convert PET flake into food-grade recycled PET (rPET) pellets for use in bottles, new preforms, and containers. The facility is planned to produce 20,000 Tonnes of food-grade pellets annually, significantly boosting recycled plastic packaging capacity.

- November 2022: Smurfit Kappa acquired Pusa Pack, a bag-in-box packaging plant located in Onda, Valencia. This strategic acquisition is designed to meet the growing customer demand for bag-in-box solutions, particularly for bulk storage and transport of liquid and semi-liquid products within the food, cosmetics, and pharmaceutical industries.

Strategic Spain Packaging Market Market Outlook

The strategic outlook for the Spain packaging market is highly promising, characterized by sustained growth driven by innovation and sustainability. The increasing adoption of advanced flexible packaging and rigid packaging solutions tailored for the burgeoning e-commerce and convenience food sectors will be a key growth accelerator. Investments in sustainable packaging technologies, including the development of novel biodegradable materials and enhanced recycling infrastructure, are crucial for long-term market leadership. Opportunities lie in catering to the growing demand for personalized and premium packaging in the beauty and personal care segments, as well as ensuring compliance with evolving EU regulations on packaging waste and recycling. Strategic partnerships and mergers will continue to play a vital role in consolidating market share and expanding capabilities, particularly in eco-friendly packaging solutions and circular economy initiatives.

Spain Packaging Market Segmentation

-

1. Layers of Packing

- 1.1. Primary

- 1.2. Secondary & Tertiary

-

2. Packaging Material

-

2.1. Plastic

- 2.1.1. Rigid Packaging

- 2.1.2. Flexible Packaging

- 2.2. Paper

- 2.3. Glass

- 2.4. Metal

-

2.1. Plastic

-

3. End Users

- 3.1. Food & Beverage

- 3.2. Healthcare & Pharmaceutical

- 3.3. Beauty & Personal Care

- 3.4. Industrial

- 3.5. Other End Users

Spain Packaging Market Segmentation By Geography

- 1. Spain

Spain Packaging Market Regional Market Share

Geographic Coverage of Spain Packaging Market

Spain Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Food & Pharmaceutical Sectors; Rising Demand for Small and Convenient Packaging

- 3.3. Market Restrains

- 3.3.1. Stringent Rules and Regulations on Packaging Materials

- 3.4. Market Trends

- 3.4.1. Surging Demand For Packaging in Food and Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Layers of Packing

- 5.1.1. Primary

- 5.1.2. Secondary & Tertiary

- 5.2. Market Analysis, Insights and Forecast - by Packaging Material

- 5.2.1. Plastic

- 5.2.1.1. Rigid Packaging

- 5.2.1.2. Flexible Packaging

- 5.2.2. Paper

- 5.2.3. Glass

- 5.2.4. Metal

- 5.2.1. Plastic

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Food & Beverage

- 5.3.2. Healthcare & Pharmaceutical

- 5.3.3. Beauty & Personal Care

- 5.3.4. Industrial

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Layers of Packing

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company (BD)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ball Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Crown Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Quadpack Industries SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amcor PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agrado SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Paper Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Coveris Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Berry Global Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sealed Air Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company (BD)

List of Figures

- Figure 1: Spain Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Spain Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Packaging Market Revenue million Forecast, by Layers of Packing 2020 & 2033

- Table 2: Spain Packaging Market Revenue million Forecast, by Packaging Material 2020 & 2033

- Table 3: Spain Packaging Market Revenue million Forecast, by End Users 2020 & 2033

- Table 4: Spain Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Spain Packaging Market Revenue million Forecast, by Layers of Packing 2020 & 2033

- Table 6: Spain Packaging Market Revenue million Forecast, by Packaging Material 2020 & 2033

- Table 7: Spain Packaging Market Revenue million Forecast, by End Users 2020 & 2033

- Table 8: Spain Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Packaging Market?

The projected CAGR is approximately 7.01%.

2. Which companies are prominent players in the Spain Packaging Market?

Key companies in the market include Becton Dickinson and Company (BD), Ball Corporation, Crown Holdings Inc, Quadpack Industries SA, Amcor PLC, Agrado SA, International Paper Company, Coveris Holdings, Berry Global Inc, Sealed Air Corporation.

3. What are the main segments of the Spain Packaging Market?

The market segments include Layers of Packing, Packaging Material, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 620 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Food & Pharmaceutical Sectors; Rising Demand for Small and Convenient Packaging.

6. What are the notable trends driving market growth?

Surging Demand For Packaging in Food and Beverage Industry.

7. Are there any restraints impacting market growth?

Stringent Rules and Regulations on Packaging Materials.

8. Can you provide examples of recent developments in the market?

November 2022: Plastipak opened a new PET recycling plant at its Toledo, Spain, manufacturing location. The recycling plant would ensure that PET flake is converted into food-grade recycled PET (rPET) pellets for use in bottles, new preforms, and containers at the new recycling facility. The recycling factory, which was scheduled to begin operations in the summer of 2022, is planned to produce 20,000 Tonnes of food-grade pellets per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Packaging Market?

To stay informed about further developments, trends, and reports in the Spain Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence