Key Insights

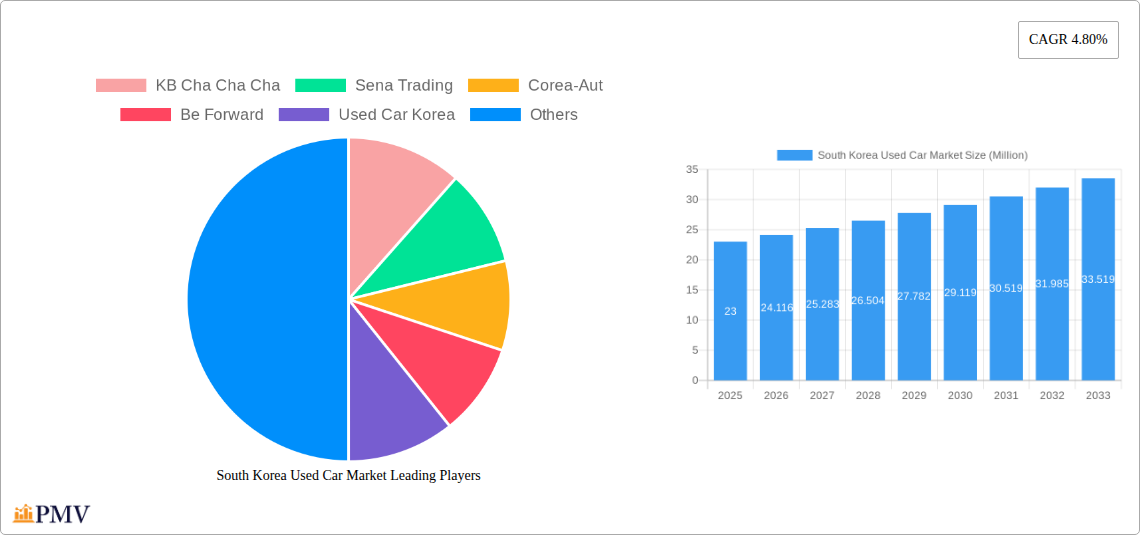

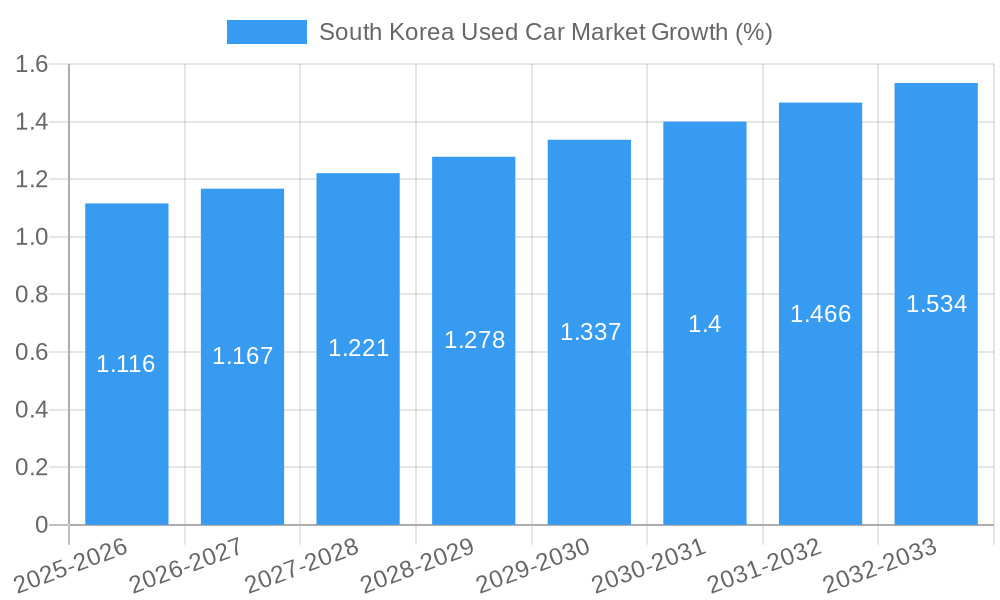

The South Korean used car market, valued at $23 million in 2025, is projected to experience steady growth, driven by increasing affordability compared to new vehicles, a preference for pre-owned options among budget-conscious consumers, and the rising popularity of online used car platforms. The market's segmentation reveals a diverse landscape. SUVs/MPVs are likely the dominant vehicle type, mirroring global trends, followed by sedans and hatchbacks. The organized sector, while growing, may still comprise a smaller percentage of the market compared to the unorganized sector, particularly in smaller cities and rural areas. Petrol and diesel vehicles likely dominate the fuel type segment, although electric vehicle adoption in the used car market is expected to increase gradually, driven by government incentives and the growing availability of used EVs. Online sales channels are gaining traction, but offline dealerships still play a crucial role, offering physical inspection and immediate vehicle handover. Key players like K Car, Encar, and Hyundai Glovis are expected to maintain a strong presence, leveraging their established brands and extensive networks. The market's growth is likely constrained by factors like fluctuating used car prices influenced by new car availability and economic conditions, as well as concerns regarding vehicle history and maintenance transparency. The forecast period (2025-2033) anticipates a compounded annual growth rate (CAGR) of 4.80%, leading to substantial market expansion by 2033.

The competitive landscape is characterized by both large corporations and smaller independent dealers. Companies like KB Cha Cha Cha, Sena Trading, and Autowini Inc. cater to diverse consumer segments. The success of these companies hinges on their ability to provide a transparent and trustworthy buying experience, build consumer confidence through rigorous vehicle inspections, and offer competitive pricing and financing options. Furthermore, the market is likely influenced by government regulations regarding used car sales and emissions standards, potentially impacting the demand for certain vehicle types and fuel options. This dynamic interplay of market drivers, restraints, and evolving consumer preferences will shape the trajectory of the South Korean used car market in the coming years.

This comprehensive report provides an in-depth analysis of the South Korea used car market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report offers a complete understanding of market dynamics, competitive landscape, and future growth potential. The study incorporates data from the historical period (2019-2024) and estimated figures for 2025, providing a robust foundation for informed decision-making. Key players analyzed include KB Cha Cha Cha, Sena Trading, Corea-Aut, Be Forward, Used Car Korea, Aj Sell Car, K Car, Pickplus, Han Sung Motor, Robert's Used Car, Car Vision, Autowini Inc, Encar, Hyundai Glovis, and PicknBuy. The report segments the market by vehicle type (hatchbacks, sedans, SUVs/MPVs), vendor type (organized, unorganized), fuel type (petrol, diesel, electric, others), and sales channel (online, offline).

South Korea Used Car Market Market Structure & Competitive Dynamics

The South Korean used car market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller independent operators. The market share of the top five players is estimated to be xx% in 2025. Innovation in the sector is driven by the adoption of online platforms, improved vehicle inspection technologies, and financing options. The regulatory framework, while evolving, generally favors organized players with robust compliance systems. Product substitutes include leasing options and public transportation, which exert some pressure on market growth. End-user trends reveal a growing preference for SUVs and a shift towards online purchasing channels. M&A activity has been relatively moderate in recent years, with deal values averaging xx Million USD per transaction, primarily driven by consolidations within the organized sector. For instance, the integration of smaller dealerships into larger networks is observed to increase the market dominance of players like K Car and Encar.

- Market Concentration: Moderate, with top 5 players holding xx% market share (2025).

- Innovation Ecosystems: Online platforms, digital inspection, and financing solutions are key drivers.

- Regulatory Framework: Evolving, favoring organized players with compliance.

- Product Substitutes: Leasing, public transport exert moderate competitive pressure.

- End-User Trends: Shift toward SUVs and online purchases.

- M&A Activity: Moderate, average deal value xx Million USD (2019-2024).

South Korea Used Car Market Industry Trends & Insights

The South Korean used car market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing vehicle ownership, rising disposable incomes, and the growing popularity of pre-owned vehicles as a cost-effective alternative to new cars. Technological disruptions, such as the emergence of online marketplaces and AI-powered valuation tools, are reshaping the market landscape. Consumer preferences are shifting towards fuel-efficient vehicles, including electric and hybrid models, reflecting growing environmental concerns and government incentives. The competitive dynamics are marked by increased consolidation among organized players and the ongoing struggle of unorganized vendors to adapt to technological changes. Market penetration of online sales channels is rapidly increasing, expected to reach xx% by 2033, driven by user-friendly platforms and increased trust in online transactions.

Dominant Markets & Segments in South Korea Used Car Market

The Seoul metropolitan area remains the dominant market, accounting for the largest share of used car sales, driven by high population density and robust economic activity. Within segments:

- By Vehicle Type: SUVs/MPVs dominate, fueled by consumer preference for spaciousness and versatility. Sedans maintain a significant share, while hatchbacks cater to a niche market.

- By Vendor Type: The organized sector is rapidly gaining traction, driven by improved infrastructure and customer trust. However, the unorganized sector still plays a significant role, especially in regional markets.

- By Fuel Type: Petrol vehicles maintain the largest share, followed by diesel. The electric vehicle (EV) segment is growing rapidly, supported by government policies and increasing charger availability, but faces constraints including price and charging infrastructure limitations. Other fuel types comprise a relatively small segment.

- By Sales Channel: Online channels exhibit substantial growth, driven by convenience and increased transparency. Offline channels, including traditional dealerships, still account for a significant share but are losing ground to digital platforms.

Key Drivers:

- Economic factors: Growing disposable incomes and consumer spending.

- Government policies: Incentives for used car purchases and regulations promoting the organized sector.

- Infrastructure: Improved online platforms, digital inspection systems.

South Korea Used Car Market Product Innovations

Recent innovations focus on enhancing transparency and trust in the used car market, including advanced vehicle inspection technologies, digital valuation tools, and online platforms with comprehensive vehicle history reports. These innovations aim to improve buyer confidence and streamline the purchasing process. The integration of technology enhances competitive advantages, reducing uncertainties related to used car condition, and enhancing customer experience.

Report Segmentation & Scope

This report segments the South Korea used car market comprehensively:

- By Vehicle Type: Hatchbacks, Sedans, SUVs/MPVs – Growth projections and market size are detailed for each vehicle type, alongside competitive analysis.

- By Vendor Type: Organized and Unorganized – This section analyzes the growth trajectory, market share, and competitive dynamics of each vendor type.

- By Fuel Type: Petrol, Diesel, Electric, and Other Fuel Types (LPG, CNG, etc.) – Detailed analysis of growth rates, market size, and competitive landscape for each fuel type.

- By Sales Channel: Online and Offline – The report analyzes the growth projections and competitive landscape of online versus offline sales channels.

Key Drivers of South Korea Used Car Market Growth

Key drivers include rising disposable incomes, government incentives for used car purchases, the increasing adoption of online platforms, and technological advancements leading to better vehicle condition transparency. Government policies encouraging the shift towards organized vendors also contribute significantly to market expansion.

Challenges in the South Korea Used Car Market Sector

Challenges include the large presence of the informal sector, complexities in regulation, the supply chain disruption due to global events impacting inventory availability, and the increasing competition from organized players pushing the smaller players out of the market. The lack of standardized vehicle inspection procedures also poses a significant hurdle to market growth.

Leading Players in the South Korea Used Car Market Market

- KB Cha Cha Cha

- Sena Trading

- Corea-Aut

- Be Forward

- Used Car Korea

- Aj Sell Car

- K Car

- Pickplus

- Han Sung Motor

- Robert's Used Car

- Car Vision

- Autowini Inc

- Encar

- Hyundai Glovis

- PicknBuy

Key Developments in South Korea Used Car Market Sector

- February 2023: South Korea's used vehicle exports to Russia surged by 1,163% in 2022, reaching 19,626 units (4.9% of total exports).

- August 2022: Han Sung Motor opened its largest service center, integrating Yongdap and Seongdong facilities.

- January 2022: Hyundai Glovis launched the online used car sales platform, Autobell.

Strategic South Korea Used Car Market Market Outlook

The South Korea used car market exhibits strong growth potential, driven by sustained economic growth, technological advancements, and evolving consumer preferences. Strategic opportunities lie in leveraging technology to enhance transparency and efficiency, expanding online sales channels, and focusing on niche segments like EVs. The market is poised for further consolidation, with organized players well-positioned to capitalize on growth.

South Korea Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types (LPG, CNG, etc.)

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

South Korea Used Car Market Segmentation By Geography

- 1. South Korea

South Korea Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Digital Technologies; Others

- 3.3. Market Restrains

- 3.3.1. Presence of Various Unorganized Used Car Dealers in the Market

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types (LPG, CNG, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 KB Cha Cha Cha

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sena Trading

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corea-Aut

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Be Forward

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Used Car Korea

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aj Sell Car

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 K Car

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pickplus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Han Sung Motor

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Robert's Used Car

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Car Vision

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Autowini Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Encar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hyundai Glovis

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 PicknBuy

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 KB Cha Cha Cha

List of Figures

- Figure 1: South Korea Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: South Korea Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: South Korea Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: South Korea Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: South Korea Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: South Korea Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Korea Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 9: South Korea Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 10: South Korea Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 11: South Korea Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 12: South Korea Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Used Car Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the South Korea Used Car Market?

Key companies in the market include KB Cha Cha Cha, Sena Trading, Corea-Aut, Be Forward, Used Car Korea, Aj Sell Car, K Car, Pickplus, Han Sung Motor, Robert's Used Car, Car Vision, Autowini Inc, Encar, Hyundai Glovis, PicknBuy.

3. What are the main segments of the South Korea Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Digital Technologies; Others.

6. What are the notable trends driving market growth?

Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market.

7. Are there any restraints impacting market growth?

Presence of Various Unorganized Used Car Dealers in the Market.

8. Can you provide examples of recent developments in the market?

February 2023: The Korean International Trade Association (KITA) released a report stating South Korea's used vehicle exports to Russia skyrocketed by 1,163% in 2022 as new car releases were banned amid the ongoing war in Ukraine. Further, the association also revealed that Russia contributed to 4.9% of the overall overseas used car shipments from South Korea, totaling a unit shipment of 19,626 used vehicles in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Used Car Market?

To stay informed about further developments, trends, and reports in the South Korea Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence