Key Insights

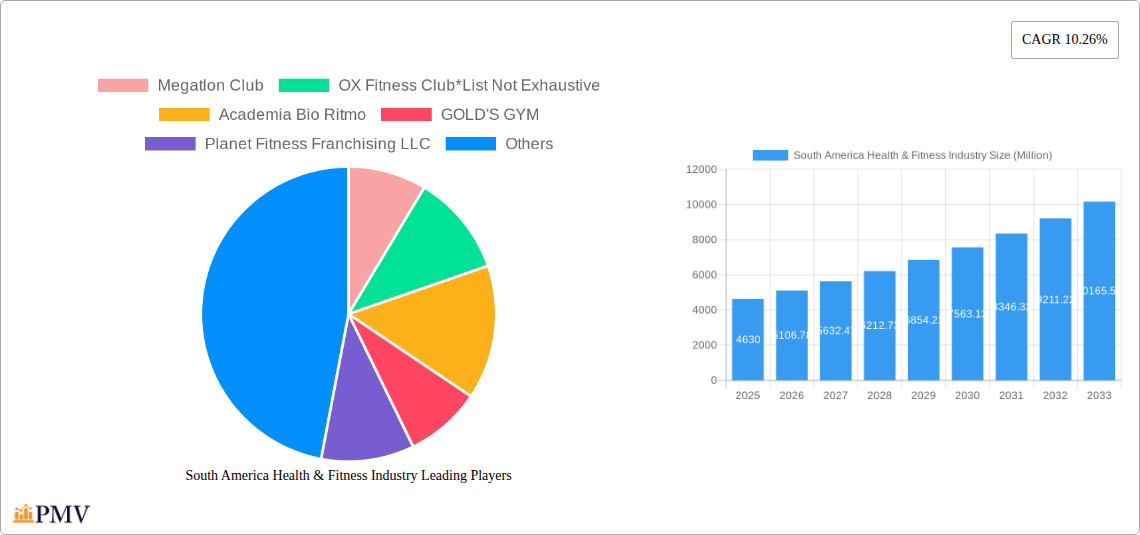

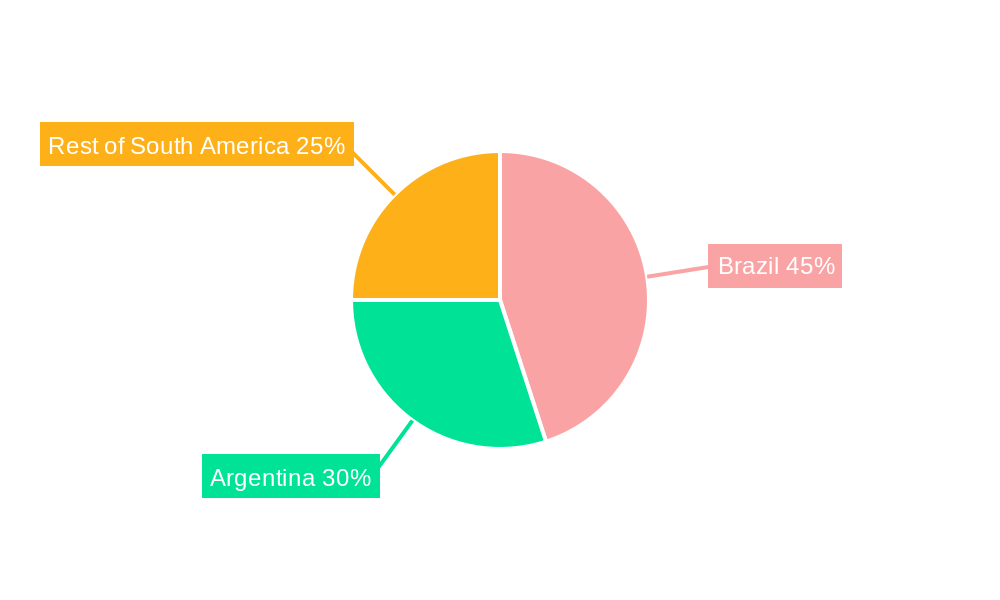

The South American health and fitness industry is experiencing robust growth, projected to reach a market size of $4.63 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.26% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing health consciousness among the burgeoning middle class is a significant factor, coupled with rising disposable incomes enabling greater spending on fitness and wellness activities. The popularity of fitness trends such as functional training, group fitness classes, and personalized workout plans further contributes to this growth. Furthermore, the industry benefits from an expanding range of service offerings, including membership fees, admission fees, and personalized training, catering to diverse consumer needs and preferences. Major players like Megatlon Club, OX Fitness Club, Academia Bio Ritmo, GOLD'S GYM, Planet Fitness, Bodytech Sports Medicine, Anytime Fitness, and AYO Fitness Club are actively shaping the market landscape through innovation and expansion. Competition is strong, necessitating continuous innovation in service offerings and marketing strategies to attract and retain customers in this dynamic market. Brazil and Argentina are currently the dominant markets within South America, driving a substantial portion of the overall regional revenue, however, growth potential exists in the "Rest of South America" segment as awareness and access to fitness facilities increase.

South America Health & Fitness Industry Market Size (In Billion)

Growth in the South American health and fitness market is, however, not without its challenges. Economic volatility in certain regions of South America can impact consumer spending on discretionary items like gym memberships. Furthermore, infrastructure limitations in some areas may hinder the expansion of fitness facilities. Nevertheless, the overall positive growth trajectory driven by increasing health awareness, rising incomes, and expanding service offerings presents a compelling opportunity for industry players. The industry is expected to witness significant innovation and consolidation in the coming years as companies seek to capitalize on the burgeoning market. Strategies focused on accessibility, affordability, and personalized experiences will likely prove crucial for success.

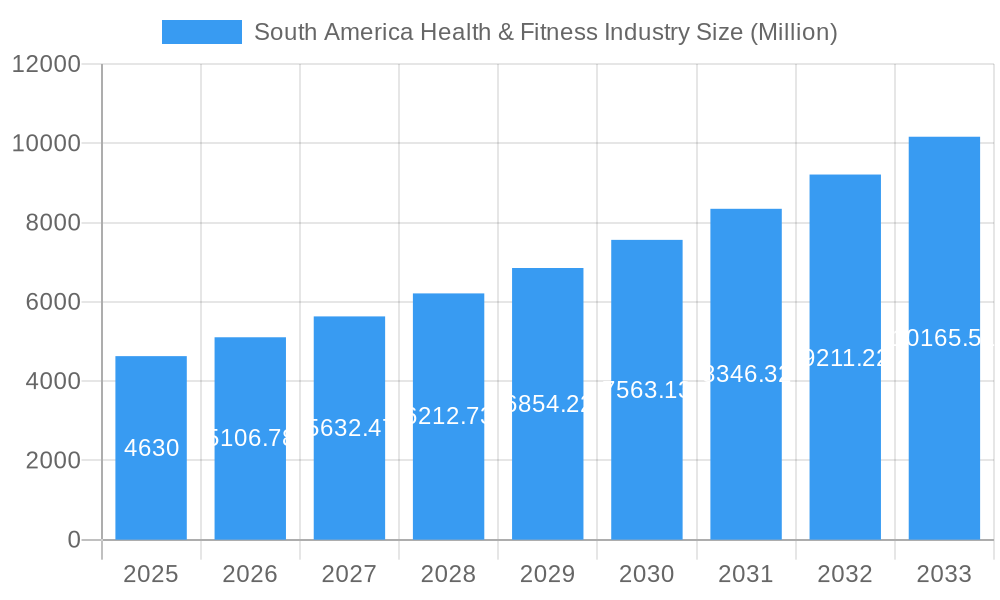

South America Health & Fitness Industry Company Market Share

South America Health & Fitness Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South America health & fitness industry, offering invaluable insights for investors, industry professionals, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, competitive dynamics, growth drivers, and future outlook. The report meticulously analyzes market segments including Membership Fees, Total Admission Fees, and Personal Training and Instruction Services, providing detailed market sizing and projections in Millions.

South America Health & Fitness Industry Market Structure & Competitive Dynamics

The South American health and fitness market is characterized by a moderately concentrated structure, with established large-scale operators such as Megatlon Club and GOLD'S GYM holding substantial market sway. Projections for 2025 estimate their respective market shares at [Insert Specific Percentage]% and [Insert Specific Percentage]%. Complementing these giants, a vibrant ecosystem of smaller, regional fitness centers and specialized boutique studios contribute significantly to the industry's overall dynamism. This sector is fueled by a robust innovation pipeline, propelled by advancements in fitness technology, including cutting-edge equipment and sophisticated digital platforms. The regulatory landscape, however, presents a varied picture across different South American nations, influencing market accessibility and the cost of operations. The competitive pressure from substitute offerings, such as home fitness solutions and online workout programs, is steadily increasing. Consumer trends highlight a pronounced shift towards personalized fitness journeys and a strong demand for convenient, easily accessible fitness solutions. Mergers and acquisitions have been a noteworthy, though not dominant, feature in recent years, with aggregate deal values estimated at [Insert Specific Amount] Million USD between 2019 and 2024. While specific deal details are often proprietary, the trend indicates strategic consolidation and investment within the sector. Key M&A activities include: [If specific deals are available, list them here; otherwise, state "Data unavailable"].

- Market Concentration: The market is moderately concentrated, with the leading players collectively accounting for an estimated [Insert Specific Percentage]% of the total market share in 2025.

- Innovation: A significant emphasis is placed on integrating technology, including wearable devices, mobile applications, and data-driven fitness programs, alongside a growing demand for personalized fitness experiences.

- Regulatory Landscape: The varying regulatory frameworks across South American countries impact market entry strategies and operational expenditures.

- Substitutes: The competitive landscape is increasingly shaped by the availability and popularity of home fitness equipment and digital fitness platforms.

- End-User Trends: A clear and growing preference among consumers for tailored fitness experiences and highly convenient access to facilities is evident.

- M&A Activity: The sector has seen moderate M&A activity, with an estimated total deal value of [Insert Specific Amount] Million USD recorded from 2019 to 2024.

South America Health & Fitness Industry Industry Trends & Insights

The South American health & fitness market is experiencing robust growth, driven by several factors. Rising disposable incomes, increased health consciousness, and the growing adoption of a fitness-oriented lifestyle are key market growth drivers. Technological disruptions, particularly the rise of fitness technology and digital platforms, are transforming consumer engagement and service delivery. Consumer preferences are shifting towards personalized, convenient, and technologically advanced fitness solutions. Competitive dynamics are characterized by increasing consolidation, product differentiation, and the emergence of niche fitness segments. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in South America Health & Fitness Industry

Brazil stands out as the undisputed leader in the South American health and fitness industry, projected to command [Insert Specific Percentage]% of the total market value by 2025. This market dominance is underpinned by its substantial population, a burgeoning middle class with increasing disposable income, and generally favorable economic conditions. Argentina and Colombia also represent significant and growing markets within the region.

- By Service Type:

- Membership Fees: This segment represents the largest revenue stream, largely propelled by the widespread popularity of gym memberships and fitness club subscriptions. Brazil leads this segment significantly, owing to its high concentration of large fitness chains and a vast consumer base. The key growth catalysts include rising disposable incomes and a heightened public awareness of health and well-being.

- Total Admission Fees: This segment is experiencing consistent growth, driven by the increasing appeal of boutique fitness studios and specialized class offerings. Growth is particularly robust in urban centers where disposable incomes are higher and there's a greater demand for niche fitness experiences.

- Personal Training and Instruction Services: This segment is witnessing rapid expansion, a direct reflection of the escalating demand for individualized fitness guidance and bespoke training regimens. This growth is fueled by consumers' increasing health consciousness and their willingness to invest in premium, personalized fitness services.

South America Health & Fitness Industry Product Innovations

The health and fitness industry across South America is in the midst of a significant wave of product innovation, predominantly driven by rapid technological advancements. Wearable fitness trackers, sophisticated mobile fitness applications, and immersive virtual reality fitness programs are gaining considerable traction. These innovations are instrumental in enhancing user engagement, providing highly personalized feedback, and offering more dynamic workout experiences. The market is also observing a rise in smart fitness equipment that facilitates interactive, data-driven training sessions. This pervasive integration of technology is fundamentally improving the user experience and acting as a powerful catalyst for market growth.

Report Segmentation & Scope

This report meticulously segments the South American health and fitness market based on key service types: Membership Fees, Total Admission Fees, and Personal Training and Instruction Services. Each segment is further dissected and analyzed through country-specific data and granular market dynamics. The report provides comprehensive growth projections, detailed market size estimations, and insightful analyses of competitive landscapes for each segment, thereby offering an in-depth and precise view of the market's structure and the emerging opportunities within it.

- Membership Fees: Projected to reach [Insert Specific Amount] Million USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of [Insert Specific Percentage]%.

- Total Admission Fees: Expected to reach [Insert Specific Amount] Million USD by 2033, with a CAGR of [Insert Specific Percentage]%.

- Personal Training and Instruction Services: Projected to reach [Insert Specific Amount] Million USD by 2033, demonstrating a CAGR of [Insert Specific Percentage]%.

Key Drivers of South America Health & Fitness Industry Growth

The robust growth of the South American health and fitness industry is propelled by a confluence of significant factors. Paramount among these are rising disposable incomes and an increasing health consciousness among the expanding middle-class population. Technological advancements, including the proliferation of smart fitness equipment and innovative fitness applications, are significantly enhancing the user experience and broadening the market's appeal. Furthermore, proactive government initiatives aimed at promoting physical activity and healthy lifestyles are playing a crucial role in fostering a supportive environment for industry expansion.

Challenges in the South America Health & Fitness Industry Sector

The South American health & fitness industry faces several challenges. Economic instability in some countries can impact consumer spending on fitness services. High operational costs, including rent and staff salaries, can constrain profitability. Competition from both established players and new entrants can pressure margins. Furthermore, infrastructure limitations in certain regions may hinder the expansion of fitness facilities.

Leading Players in the South America Health & Fitness Industry Market

- Megatlon Club

- OX Fitness Club

- Academia Bio Ritmo

- GOLD'S GYM

- Planet Fitness Franchising LLC

- Bodytech Sports Medicine

- Anytime Fitness LLC

- AYO Fitness Club

Key Developments in South America Health & Fitness Industry Sector

- 2022-Q4: Launch of a new fitness app by Megatlon Club integrating AI-powered workout recommendations.

- 2023-Q1: Acquisition of a regional fitness chain by GOLD'S GYM in Brazil.

- 2023-Q3: Introduction of a new subscription model with personalized training packages by OX Fitness Club. (Further details can be added based on available information).

Strategic South America Health & Fitness Industry Market Outlook

The South American health & fitness market presents significant long-term growth potential. Continued economic development, rising health awareness, and technological innovations will drive market expansion. Strategic opportunities lie in leveraging technology to personalize fitness experiences, catering to specific demographics, and expanding into underserved markets. Investing in high-quality facilities, experienced trainers, and innovative fitness programs will be crucial for success.

South America Health & Fitness Industry Segmentation

-

1. Service Type

- 1.1. Membership Fees

- 1.2. Total Admission Fees

- 1.3. Personal Training and Instruction Services

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Health & Fitness Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Health & Fitness Industry Regional Market Share

Geographic Coverage of South America Health & Fitness Industry

South America Health & Fitness Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Increasing Inclination toward Health Clubs for Fitness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Membership Fees

- 5.1.2. Total Admission Fees

- 5.1.3. Personal Training and Instruction Services

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Brazil South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Membership Fees

- 6.1.2. Total Admission Fees

- 6.1.3. Personal Training and Instruction Services

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Argentina South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Membership Fees

- 7.1.2. Total Admission Fees

- 7.1.3. Personal Training and Instruction Services

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Colombia South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Membership Fees

- 8.1.2. Total Admission Fees

- 8.1.3. Personal Training and Instruction Services

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of South America South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Membership Fees

- 9.1.2. Total Admission Fees

- 9.1.3. Personal Training and Instruction Services

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Megatlon Club

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 OX Fitness Club*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Academia Bio Ritmo

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GOLD'S GYM

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Planet Fitness Franchising LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bodytech Sports Medicine

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Anytime Fitness LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AYO Fitness Club

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Megatlon Club

List of Figures

- Figure 1: South America Health & Fitness Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Health & Fitness Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: South America Health & Fitness Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Health & Fitness Industry?

The projected CAGR is approximately 10.26%.

2. Which companies are prominent players in the South America Health & Fitness Industry?

Key companies in the market include Megatlon Club, OX Fitness Club*List Not Exhaustive, Academia Bio Ritmo, GOLD'S GYM, Planet Fitness Franchising LLC, Bodytech Sports Medicine, Anytime Fitness LLC, AYO Fitness Club.

3. What are the main segments of the South America Health & Fitness Industry?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Increasing Inclination toward Health Clubs for Fitness.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Health & Fitness Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Health & Fitness Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Health & Fitness Industry?

To stay informed about further developments, trends, and reports in the South America Health & Fitness Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence