Key Insights

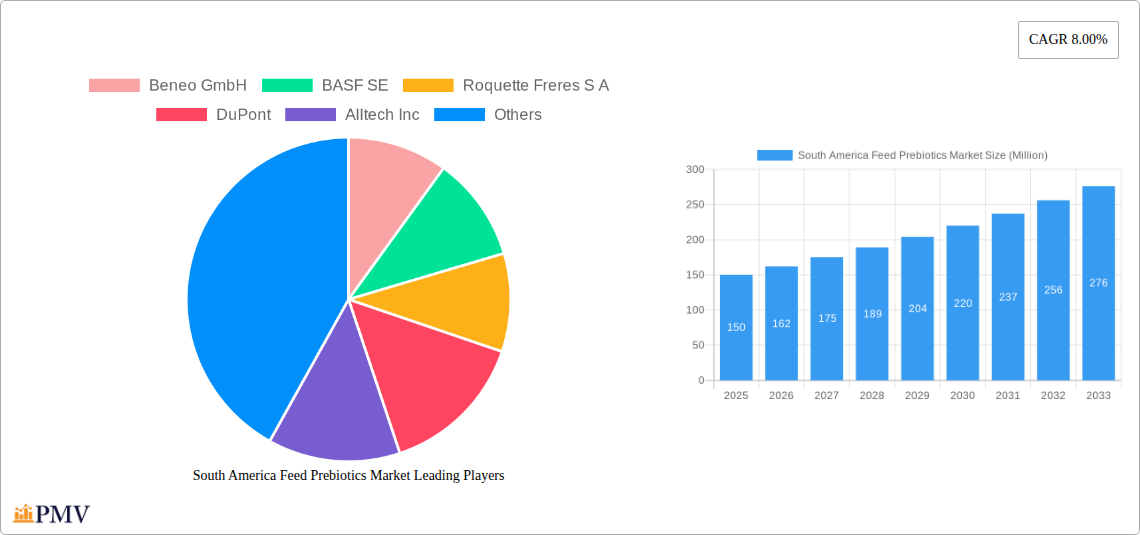

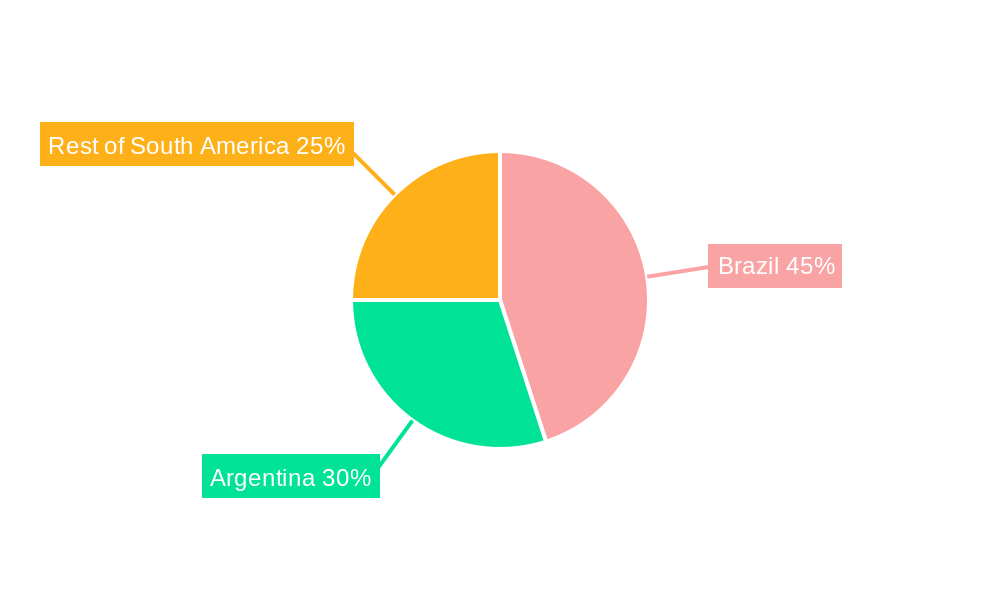

The South American feed prebiotics market is projected for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of 14.6%. This expansion is driven by heightened awareness of animal gut health's crucial role in enhancing productivity and disease resistance. The market is anticipated to reach 11.1 billion by 2025. Demand for prebiotics in animal feed is particularly strong within the ruminant and poultry sectors, which are dominant in the region's livestock production. The increasing preference for natural and sustainable feed additives aligns with consumer demand for ethically sourced animal products, further fueling market growth. Leading market players are investing in research and development and expanding their product offerings to meet the evolving needs of the South American livestock industry. Brazil and Argentina are expected to remain key contributors, with emerging markets in the "Rest of South America" sub-region also showing significant development potential through modern farming investments and growing awareness of prebiotic benefits.

South America Feed Prebiotics Market Market Size (In Billion)

Market segmentation highlights the prominence of inulin, fructo-oligosaccharides (FOS), and galacto-oligosaccharides (GOS). Innovations in prebiotic research and the introduction of novel solutions are expected to drive expansion in the "Other Types" segment. While regulatory hurdles and pricing pressures may present moderate challenges, the overall market outlook is highly optimistic, underpinned by continuous advancements in prebiotic technologies and their proven benefits for livestock production. The market's projected CAGR of 14.6% indicates significant opportunities for investors and industry participants in the South American feed prebiotics sector.

South America Feed Prebiotics Market Company Market Share

South America Feed Prebiotics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America Feed Prebiotics Market, offering valuable insights for businesses, investors, and stakeholders seeking to understand this dynamic sector. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, and includes key market metrics, trends, and future projections. The base year for this analysis is 2025, and the estimated year is also 2025. The report features detailed segmentation by animal type (ruminants, poultry, swine, aquaculture, other animal types) and prebiotic type (inulin, fructo-oligosaccharides, galacto-oligosaccharides, other types). Major players like Beneo GmbH, BASF SE, Roquette Freres S A, DuPont, Alltech Inc, Cosucra Groupe Warcoing SA, Cargill Inc, Tereos, and Adisseo are profiled, revealing their market strategies and competitive landscape. The market size is projected to reach xx Million by 2033.

South America Feed Prebiotics Market Structure & Competitive Dynamics

The South America feed prebiotics market exhibits a moderately concentrated structure, with a few large multinational corporations holding significant market share. Beneo GmbH, BASF SE, and Roquette Freres S A are among the leading players, collectively accounting for an estimated xx% of the market in 2025. The market is characterized by a dynamic innovation ecosystem, with ongoing research and development efforts focused on improving prebiotic efficacy, exploring new applications, and developing sustainable production methods. Regulatory frameworks vary across South American countries, impacting market access and product approvals. Substitutes for feed prebiotics, such as antibiotics and other feed additives, pose competitive pressure. End-user trends are shifting towards increased demand for natural and sustainable feed solutions, benefiting prebiotic adoption. M&A activity has been moderate, with deal values averaging xx Million in recent years. Key factors driving M&A activity include expansion into new markets, access to technology, and diversification of product portfolios.

- Market Concentration: Moderately Concentrated

- Top 3 Players Market Share (2025): xx%

- Average M&A Deal Value (2019-2024): xx Million

South America Feed Prebiotics Market Industry Trends & Insights

The South America feed prebiotics market is experiencing robust growth, driven by increasing awareness of animal health and welfare, rising demand for high-quality animal protein, and growing consumer preference for sustainably produced animal products. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements in prebiotic production and formulation, leading to enhanced efficacy and cost-effectiveness. Consumer preferences are increasingly focused on natural and sustainable feed ingredients, creating a strong market for prebiotics. Competitive dynamics are shaped by product innovation, pricing strategies, and distribution networks. Market penetration of prebiotics in animal feed remains relatively low in certain segments, presenting significant growth opportunities. However, challenges remain, including price volatility of raw materials and regulatory hurdles in some markets.

Dominant Markets & Segments in South America Feed Prebiotics Market

The poultry segment is currently the dominant segment in the South America feed prebiotics market, accounting for xx% of the total market value in 2025. This dominance is primarily driven by the significant poultry production industry in the region and increasing adoption of prebiotics for improving gut health and productivity in poultry. Inulin is the leading prebiotic type in terms of market share, attributed to its proven efficacy and wide availability. Brazil is the largest national market, owing to its substantial agricultural sector and significant investments in the animal feed industry.

Key Drivers for Poultry Segment Dominance:

- High Poultry Production Volumes

- Focus on Improved Poultry Health and Productivity

- Wide Availability and Affordable Price of Inulin

- Government Support for Agricultural Development

Key Drivers for Brazil's Market Dominance:

- Large Agricultural Sector

- Significant Investments in Animal Feed Infrastructure

- Growing Demand for Animal Protein

South America Feed Prebiotics Market Product Innovations

Recent product innovations focus on developing novel prebiotic formulations with enhanced efficacy and targeted benefits for specific animal species. For example, there's a growing trend towards incorporating prebiotics with other feed additives, such as probiotics and enzymes, to create synergistic effects on animal health and performance. This strategy aims to improve gut health, boost immunity, enhance nutrient utilization, and reduce reliance on antibiotics. The emphasis on natural and sustainable production processes also drives innovation in the prebiotic market.

Report Segmentation & Scope

Animal Type: The report segments the market by animal type, including ruminants (cattle, sheep, goats), poultry (chickens, turkeys), swine (pigs), aquaculture (fish, shrimp), and other animal types. Each segment's growth projection and market size are analyzed, considering specific animal nutritional needs and prebiotic applications. Competitive dynamics also vary considerably across these segments.

Type: The report categorizes the market by prebiotic type, including inulin, fructo-oligosaccharides (FOS), galacto-oligosaccharides (GOS), and other types. The analysis includes market share, growth rates, and price trends for each type. The assessment reflects the distinct functionalities and market demand for different prebiotic types.

Key Drivers of South America Feed Prebiotics Market Growth

The South America feed prebiotics market is driven by several factors. Growing consumer demand for sustainably produced animal products is pushing the adoption of natural feed additives like prebiotics. Furthermore, the increasing focus on animal welfare and the reduction in antibiotic use are positively impacting market growth. Technological advancements in prebiotic production and formulation have made prebiotics more accessible and cost-effective. Supportive government policies and investments in the agricultural sector also contribute to the market's expansion.

Challenges in the South America Feed Prebiotics Market Sector

The South America feed prebiotics market faces certain challenges. Fluctuations in raw material prices, particularly sugar and other agricultural commodities used in prebiotic production, impact profitability. The market also experiences inconsistent regulatory frameworks across different countries in the region, creating hurdles for product registration and market access. Intense competition from existing feed additives and other substitutes presents a challenge to market penetration.

Leading Players in the South America Feed Prebiotics Market Market

Key Developments in South America Feed Prebiotics Market Sector

- June 2023: Launch of a new inulin-based prebiotic product for poultry by a major player.

- October 2022: Acquisition of a smaller prebiotic producer by a leading multinational company.

- March 2022: Successful completion of a clinical trial demonstrating the efficacy of a novel prebiotic for improving swine gut health.

Strategic South America Feed Prebiotics Market Outlook

The South America feed prebiotics market presents significant growth potential. Expanding consumer preference for natural and sustainable food products will drive demand. Further technological advancements and product innovation will continue to enhance the efficacy and market accessibility of prebiotics. Strategic partnerships and collaborations between prebiotic manufacturers and feed producers are expected to accelerate market growth. The increasing investment in research and development within the sector suggests a bright future for the market, leading to the introduction of innovative products with superior efficacy and targeted benefits for specific animal species.

South America Feed Prebiotics Market Segmentation

-

1. Type

- 1.1. Inulin

- 1.2. Fructo-Oligosaccharides

- 1.3. Galacto-Oligosaccharides

- 1.4. Other Types

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Other Animal Types

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Feed Prebiotics Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Feed Prebiotics Market Regional Market Share

Geographic Coverage of South America Feed Prebiotics Market

South America Feed Prebiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Fish Consumption; Rise in Export-oriented Aquaculture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets

- 3.4. Market Trends

- 3.4.1. Rising Feed production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Prebiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inulin

- 5.1.2. Fructo-Oligosaccharides

- 5.1.3. Galacto-Oligosaccharides

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Feed Prebiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inulin

- 6.1.2. Fructo-Oligosaccharides

- 6.1.3. Galacto-Oligosaccharides

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Other Animal Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Feed Prebiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inulin

- 7.1.2. Fructo-Oligosaccharides

- 7.1.3. Galacto-Oligosaccharides

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Other Animal Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Feed Prebiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inulin

- 8.1.2. Fructo-Oligosaccharides

- 8.1.3. Galacto-Oligosaccharides

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Other Animal Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Beneo GmbH

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 BASF SE

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Roquette Freres S A

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 DuPont

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Alltech Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cosucra Groupe Warcoing SA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Cargill Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Tereos

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Adisseo

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Beneo GmbH

List of Figures

- Figure 1: South America Feed Prebiotics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Feed Prebiotics Market Share (%) by Company 2025

List of Tables

- Table 1: South America Feed Prebiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Feed Prebiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: South America Feed Prebiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Feed Prebiotics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Feed Prebiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: South America Feed Prebiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 7: South America Feed Prebiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Feed Prebiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Feed Prebiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: South America Feed Prebiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: South America Feed Prebiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Feed Prebiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Feed Prebiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Feed Prebiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 15: South America Feed Prebiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Feed Prebiotics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Prebiotics Market?

The projected CAGR is approximately 14.6%.

2. Which companies are prominent players in the South America Feed Prebiotics Market?

Key companies in the market include Beneo GmbH, BASF SE, Roquette Freres S A, DuPont, Alltech Inc, Cosucra Groupe Warcoing SA, Cargill Inc, Tereos, Adisseo.

3. What are the main segments of the South America Feed Prebiotics Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Fish Consumption; Rise in Export-oriented Aquaculture.

6. What are the notable trends driving market growth?

Rising Feed production Drives the Market.

7. Are there any restraints impacting market growth?

Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Prebiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Prebiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Prebiotics Market?

To stay informed about further developments, trends, and reports in the South America Feed Prebiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence