Key Insights

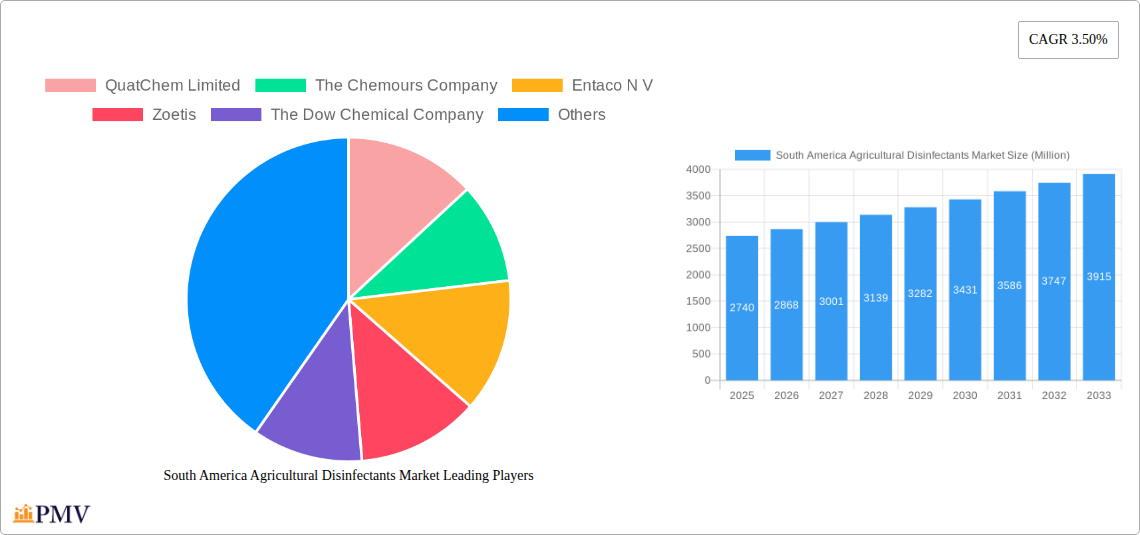

The South American agricultural disinfectants market is poised for robust growth, projected to reach an estimated $2.74 billion in 2025. This expansion is driven by a confluence of factors essential for modern agriculture. Increasing concerns regarding biosecurity and the prevention of zoonotic diseases in livestock, coupled with the imperative to protect crops from devastating pathogens, are primary catalysts. The region's significant agricultural output and its role as a major global food supplier necessitate stringent disease control measures. Furthermore, a growing awareness among farmers about the economic impact of disease outbreaks, leading to reduced yields and financial losses, is compelling them to adopt advanced disinfectant solutions. Government initiatives promoting sustainable farming practices and food safety standards also contribute to the rising demand for effective and environmentally responsible agricultural disinfectants. The market is expected to witness a CAGR of 4.7%, underscoring its dynamic nature and sustained upward trajectory.

South America Agricultural Disinfectants Market Market Size (In Billion)

This growth is further fueled by several emerging trends. The development and adoption of novel, broad-spectrum disinfectants with enhanced efficacy against resistant strains of pathogens are gaining traction. Innovations in application technologies, such as electrostatic spraying and drone-based disinfection, are improving coverage and efficiency, making them increasingly attractive to large-scale agricultural operations. The demand for eco-friendly and biodegradable disinfectant formulations is also on the rise, aligning with global sustainability goals and consumer preferences for responsibly produced food. While challenges such as the high cost of certain advanced disinfectants and the need for proper training and handling protocols exist, the overarching need for disease prevention and management in South America's vital agricultural sector ensures a positive market outlook. Key players are actively investing in research and development to introduce more effective and sustainable solutions, further stimulating market expansion.

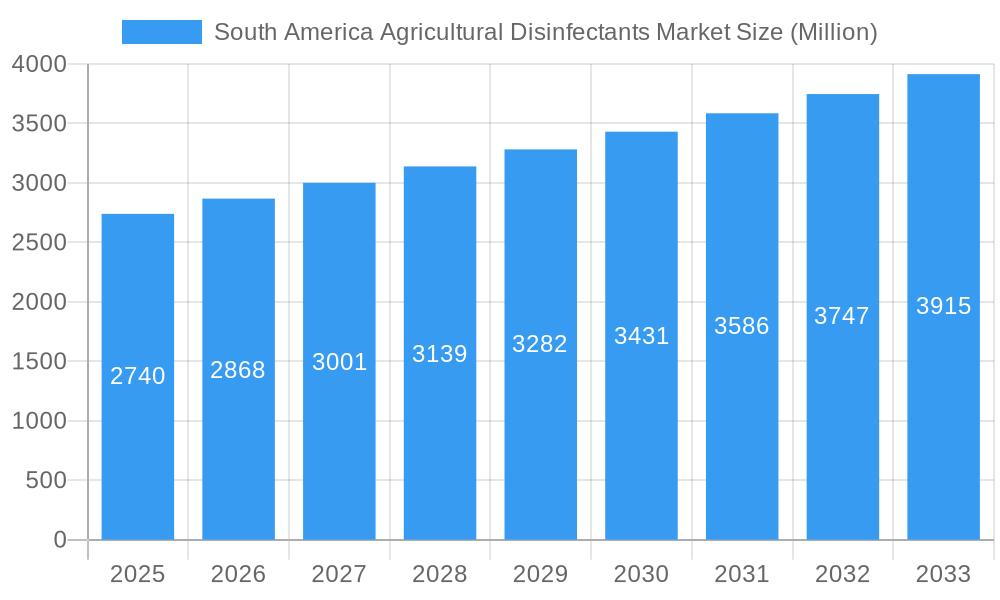

South America Agricultural Disinfectants Market Company Market Share

This in-depth market research report offers a detailed analysis of the South America Agricultural Disinfectants Market, encompassing production, consumption, trade, pricing, and key industry developments from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study provides actionable insights for stakeholders seeking to capitalize on the burgeoning demand for advanced agricultural hygiene solutions in the region. The report leverages high-ranking keywords such as "agricultural disinfectants South America," "crop protection chemicals," "livestock hygiene solutions," "plant disease prevention," "biosecurity in agriculture," and "South American agrochemicals market."

South America Agricultural Disinfectants Market Market Structure & Competitive Dynamics

The South America Agricultural Disinfectants Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Innovation ecosystems are thriving, driven by increasing R&D investments in developing more effective, eco-friendly, and cost-efficient disinfectant formulations. Regulatory frameworks, while evolving, are increasingly focused on ensuring product safety and environmental compliance, impacting market entry and product approvals. Product substitutes, such as traditional sanitation methods and integrated pest management (IPM) strategies, are present but often fall short of the comprehensive disease prevention offered by specialized disinfectants. End-user trends reveal a growing preference for broad-spectrum disinfectants, particularly those effective against emerging and resistant pathogens. Mergers and acquisitions (M&A) activities are expected to shape the competitive landscape, with strategic deals aimed at expanding product portfolios and geographical reach. For instance, recent M&A activities in the broader South American agrochemical sector have seen deal values reaching upwards of $1.5 billion. The market share of leading players is estimated to range from 10% to 25%, with strategic alliances and partnerships playing a crucial role in market consolidation.

South America Agricultural Disinfectants Market Industry Trends & Insights

The South America Agricultural Disinfectants Market is poised for substantial growth, driven by a confluence of factors that underscore the critical need for robust biosecurity in the region's vital agricultural sector. The estimated market size for agricultural disinfectants in South America is projected to reach $8.5 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period. This robust growth is underpinned by several key market growth drivers, including the escalating demand for increased agricultural productivity to feed a growing global population and the persistent threat of transboundary animal and plant diseases that can decimate livestock and crop yields. Furthermore, a rising awareness among farmers and agricultural enterprises regarding the economic losses incurred from disease outbreaks is propelling the adoption of proactive biosecurity measures, with disinfectants at the forefront.

Technological disruptions are also playing a pivotal role. Innovations in disinfectant formulations, such as the development of nano-based disinfectants, biodegradable options, and those targeting specific microbial strains, are enhancing efficacy and environmental sustainability. The integration of digital technologies in farm management, including sensor-based monitoring of hygiene conditions, is also indirectly fueling the demand for precise and effective disinfectant application.

Consumer preferences are evolving, with a growing emphasis on food safety and quality. This translates into increased scrutiny of agricultural practices, necessitating the use of proven disinfectant solutions to ensure produce and animal products meet stringent national and international standards. Consumers are increasingly favoring produce and animal products from farms with demonstrated biosecurity protocols, thus incentivizing farmers to invest in high-quality disinfectants.

The competitive dynamics are intensifying, with both established multinational corporations and emerging regional players vying for market dominance. Companies are investing heavily in product differentiation, offering customized solutions for specific agricultural challenges, and building strong distribution networks across diverse South American geographies. Strategic collaborations and partnerships are becoming more prevalent as companies seek to leverage each other's strengths in R&D, manufacturing, and market access. The market penetration of advanced agricultural disinfectants is steadily increasing, moving from niche applications to widespread adoption across various farming segments.

Dominant Markets & Segments in South America Agricultural Disinfectants Market

The South America Agricultural Disinfectants Market is characterized by significant regional variations in production, consumption, imports, exports, and pricing trends. Brazil stands out as the dominant market, leading in both Production Analysis and Consumption Analysis.

Production Analysis: Brazil's extensive agricultural output, particularly in soybean, corn, and sugarcane, necessitates large-scale disinfectant usage. Government initiatives supporting agricultural modernization and increased investment in animal husbandry further bolster production capabilities. Argentina and Colombia also exhibit notable production, driven by their strong presence in livestock and crop cultivation respectively. Key drivers for production include access to raw materials, advanced manufacturing facilities, and favorable government policies promoting domestic production of agrochemicals. The production volume in Brazil is estimated to be in the range of 1.2 billion liters annually.

Consumption Analysis: The consumption patterns closely mirror production, with Brazil again leading due to its vast agricultural land and diverse farming operations. The growing poultry and swine industries in Brazil and Argentina contribute significantly to the demand for disinfectants used in animal housing and sanitation. Colombia and Chile are also significant consumers, driven by their burgeoning fruit and vegetable exports that require stringent hygiene standards. Economic policies that support agricultural subsidies and investments in farm infrastructure are key drivers of consumption. The estimated annual consumption volume for agricultural disinfectants in South America is approximately 1.5 billion liters.

Import Market Analysis (Value & Volume): While domestic production is strong, certain specialized disinfectant formulations and raw materials are imported, particularly into countries like Chile and Peru, which have a high reliance on imported agricultural inputs. The value of imports is estimated to be around $700 million annually, with key import origins being North America and Europe. Volume-wise, imports contribute approximately 300 million liters, often comprising high-efficacy, specialized products. Factors influencing import markets include trade agreements, currency exchange rates, and the availability of domestic alternatives.

Export Market Analysis (Value & Volume): Brazil and Argentina are key exporters of agricultural disinfectants, primarily to neighboring South American countries and increasingly to markets in Africa and Asia. The value of exports is estimated at $900 million annually, with an export volume of around 400 million liters. Growth in export markets is driven by competitive pricing, product quality, and strategic trade partnerships. The demand for cost-effective and reliable disinfectants in developing agricultural economies presents a significant opportunity for South American producers.

Price Trend Analysis: Price trends are influenced by raw material costs, currency fluctuations, and competitive pressures. The average price per liter is estimated to be around $4.50, with variations based on product type (e.g., quaternary ammonium compounds, aldehydes, phenolics) and formulation. The price of agricultural disinfectants in South America is projected to see a moderate increase of 3-5% annually, driven by rising production costs and increasing demand for premium, high-efficacy products.

South America Agricultural Disinfectants Market Product Innovations

Product innovations in the South America Agricultural Disinfectants Market are focused on enhancing efficacy, sustainability, and user-friendliness. Developments include the introduction of bio-based disinfectants derived from natural sources, offering a greener alternative with reduced environmental impact. Advanced formulations are targeting a broader spectrum of pathogens, including resistant strains, and improved residual activity for prolonged protection. Furthermore, innovations in delivery systems, such as effervescent tablets and concentrated solutions, are improving ease of application and reducing transportation costs. These advancements provide a significant competitive advantage by addressing evolving regulatory demands and farmer needs for more effective and responsible pest and disease management.

Report Segmentation & Scope

This report provides a granular segmentation of the South America Agricultural Disinfectants Market across critical areas. The Production Analysis segment examines the manufacturing capabilities and output across key South American nations, with projected growth of 6.8% in production volume by 2033. The Consumption Analysis segment details the demand patterns across different agricultural sectors and countries, forecasting a market size of $8.5 billion by 2033. The Import Market Analysis (Value & Volume) segment offers insights into inbound trade, identifying key product types and sourcing regions, with an estimated annual import value of $700 million. The Export Market Analysis (Value & Volume) segment highlights outbound trade opportunities, with a projected export value of $900 million annually and a competitive advantage in certain formulations. Finally, the Price Trend Analysis segment tracks pricing dynamics influenced by raw material costs and market competition, predicting an average annual price increase of 3-5%.

Key Drivers of South America Agricultural Disinfectants Market Growth

The growth of the South America Agricultural Disinfectants Market is propelled by several potent drivers. Technologically, advancements in disinfectant formulations are leading to more effective and targeted solutions against a wider array of pathogens. Economically, the increasing value of agricultural exports and the need to prevent costly disease outbreaks are driving investment in biosecurity. For example, losses from foot-and-mouth disease in livestock can run into hundreds of millions of dollars, making preventative measures like disinfectants economically viable. Regulatory factors, such as stricter food safety standards and biosecurity mandates, are compelling farmers to adopt advanced disinfectant practices to ensure compliance and market access. The growing recognition of the importance of plant and animal health for overall agricultural sustainability is a fundamental driver.

Challenges in the South America Agricultural Disinfectants Market Sector

Despite robust growth prospects, the South America Agricultural Disinfectants Market faces several challenges. Regulatory hurdles, including lengthy approval processes for new products and varying standards across different countries, can impede market entry and product diffusion. Supply chain issues, such as the availability and cost of raw materials and efficient distribution networks, can impact product availability and pricing. Competitive pressures from generic products and the emergence of new disinfectant technologies create a dynamic market environment. Moreover, the economic vulnerability of smallholder farmers in some regions can limit their ability to invest in premium disinfectant solutions, impacting market penetration at the grassroots level. The estimated impact of these challenges can lead to a 2-3% reduction in projected market growth if not adequately addressed.

Leading Players in the South America Agricultural Disinfectants Market Market

- QuatChem Limited

- The Chemours Company

- Entaco N V

- Zoetis

- The Dow Chemical Company

- Fink Tec GmbH

- Nufarm Limited

- Stepan Company

- Neogen Corporation

- Thymox Technology

Key Developments in South America Agricultural Disinfectants Market Sector

- 2023/08: Launch of a novel broad-spectrum disinfectant with enhanced residual activity by The Dow Chemical Company, targeting common bacterial and viral pathogens in poultry farms across Brazil.

- 2023/11: Zoetis announced strategic partnerships with several agricultural cooperatives in Argentina to promote integrated biosecurity programs, including the use of their advanced livestock disinfectants.

- 2024/02: Nufarm Limited expanded its distribution network in Colombia, focusing on making its crop disinfectant range more accessible to small and medium-sized farms.

- 2024/05: Neogen Corporation introduced a new range of rapid detection kits for pathogen presence, designed to work in conjunction with their disinfectant product lines for comprehensive farm hygiene management.

- 2024/07: QuatChem Limited invested in upgrading its manufacturing facility in Chile to meet the growing demand for eco-friendly disinfectant formulations.

Strategic South America Agricultural Disinfectants Market Market Outlook

The strategic outlook for the South America Agricultural Disinfectants Market is highly positive, driven by increasing agricultural intensification and a growing emphasis on food safety and biosecurity. Key growth accelerators include the adoption of precision agriculture techniques that integrate disinfectant application into broader farm management systems, and the continued development of sustainable and bio-based disinfectant solutions that align with global environmental trends. Furthermore, strategic market entry into underserved regions within South America and partnerships with local agricultural organizations will unlock significant growth potential. The continuous threat of disease outbreaks will ensure sustained demand for effective agricultural disinfectants, making this a crucial sector for future agricultural resilience and economic stability in the region.

South America Agricultural Disinfectants Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Agricultural Disinfectants Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Agricultural Disinfectants Market Regional Market Share

Geographic Coverage of South America Agricultural Disinfectants Market

South America Agricultural Disinfectants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Availability of Skilled Labor; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery

- 3.4. Market Trends

- 3.4.1. Increase in Area Under Protective Farming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Agricultural Disinfectants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 QuatChem Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Chemours Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Entaco N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zoetis

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Dow Chemical Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fink Tec GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nufarm Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stepan Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Neogen Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Thymox Technology

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 QuatChem Limited

List of Figures

- Figure 1: South America Agricultural Disinfectants Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Agricultural Disinfectants Market Share (%) by Company 2025

List of Tables

- Table 1: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South America Agricultural Disinfectants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Agricultural Disinfectants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina South America Agricultural Disinfectants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Chile South America Agricultural Disinfectants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Colombia South America Agricultural Disinfectants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Peru South America Agricultural Disinfectants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Venezuela South America Agricultural Disinfectants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Ecuador South America Agricultural Disinfectants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Bolivia South America Agricultural Disinfectants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Paraguay South America Agricultural Disinfectants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Uruguay South America Agricultural Disinfectants Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Agricultural Disinfectants Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the South America Agricultural Disinfectants Market?

Key companies in the market include QuatChem Limited, The Chemours Company, Entaco N V, Zoetis, The Dow Chemical Company, Fink Tec GmbH, Nufarm Limited, Stepan Company, Neogen Corporation, Thymox Technology.

3. What are the main segments of the South America Agricultural Disinfectants Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Low Availability of Skilled Labor; Technological Advancements.

6. What are the notable trends driving market growth?

Increase in Area Under Protective Farming.

7. Are there any restraints impacting market growth?

Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Agricultural Disinfectants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Agricultural Disinfectants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Agricultural Disinfectants Market?

To stay informed about further developments, trends, and reports in the South America Agricultural Disinfectants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence