Key Insights

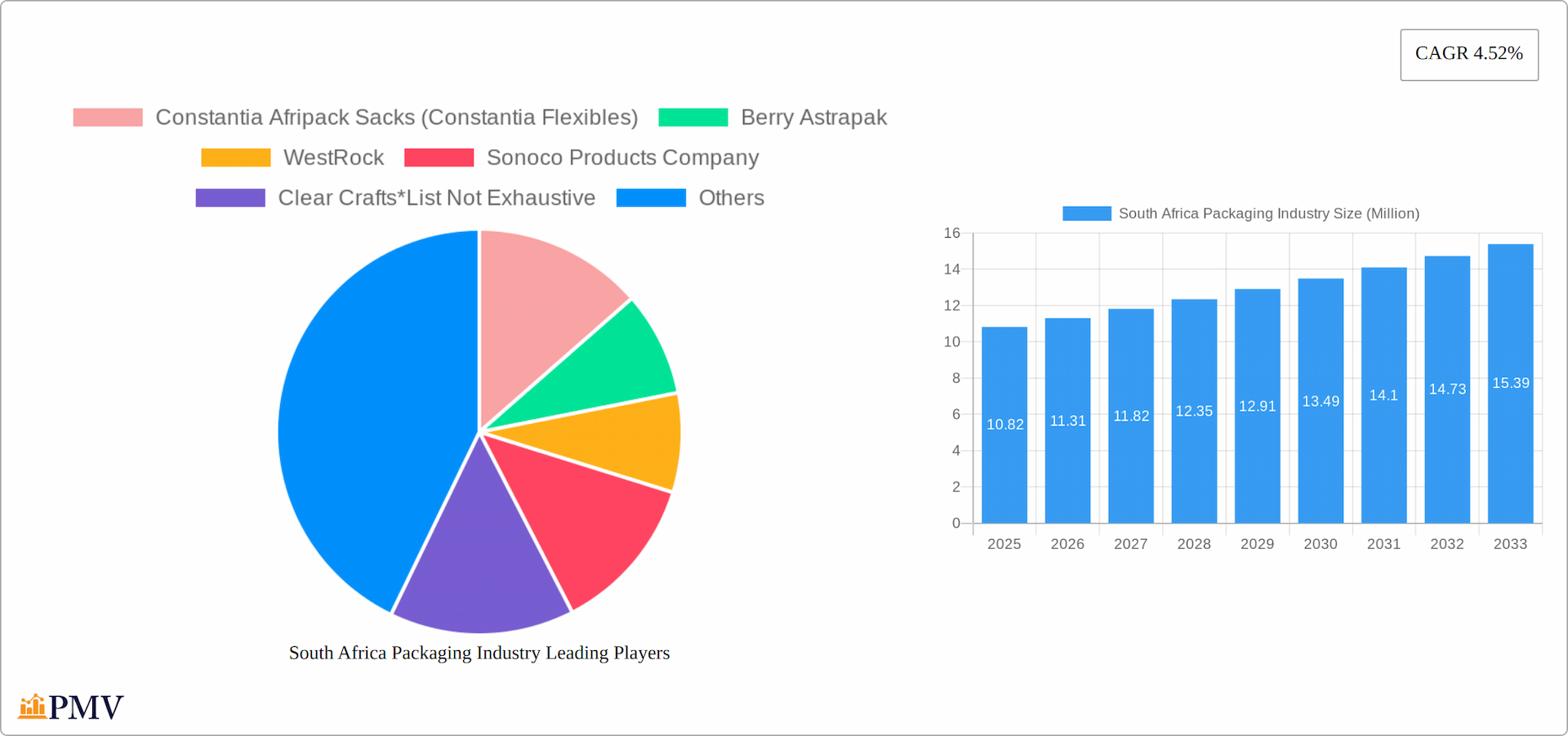

The South Africa packaging industry, valued at $10.82 million in 2025, is poised for steady growth with a forecasted CAGR of 4.52% through to 2033. This growth is driven by increasing demand across various end-user industries including food and beverage, household and personal care, and pharmaceuticals and healthcare. The market is segmented by product types such as bottles, bags and pouches, corrugated boxes, and metal cans, with plastic and paper being the dominant packaging materials. Key players like Constantia Afripack Sacks, Berry Astrapak, and WestRock are at the forefront, leveraging innovation to meet the evolving needs of consumers and businesses. The rise in consumer awareness about sustainable packaging solutions is also influencing market dynamics, pushing companies to explore eco-friendly options like biodegradable plastics and recyclable materials.

South Africa Packaging Industry Market Size (In Million)

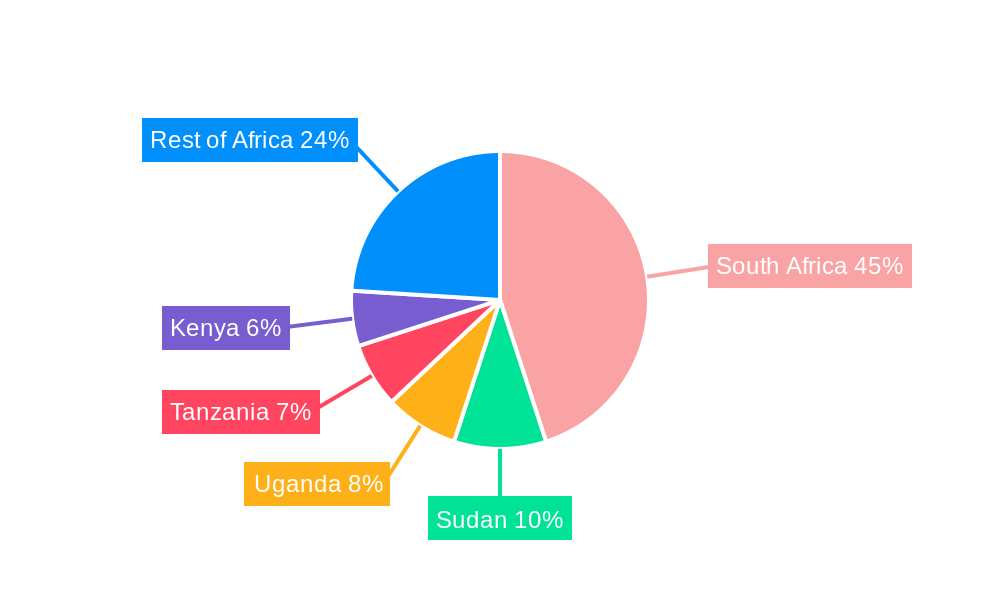

Regionally, South Africa remains a significant hub within Africa, with other notable markets including Sudan, Uganda, Tanzania, and Kenya. The industry's growth is further supported by trends such as urbanization and the expansion of the retail sector, which necessitate more efficient and attractive packaging solutions. However, challenges such as fluctuating raw material prices and stringent regulations on packaging materials pose restraints. Despite these, the industry is expected to navigate these challenges effectively, driven by technological advancements and a shift towards more sustainable practices. The forecast period from 2025 to 2033 will be crucial in shaping the future landscape of the South Africa packaging industry, with a focus on innovation and sustainability being key to long-term success.

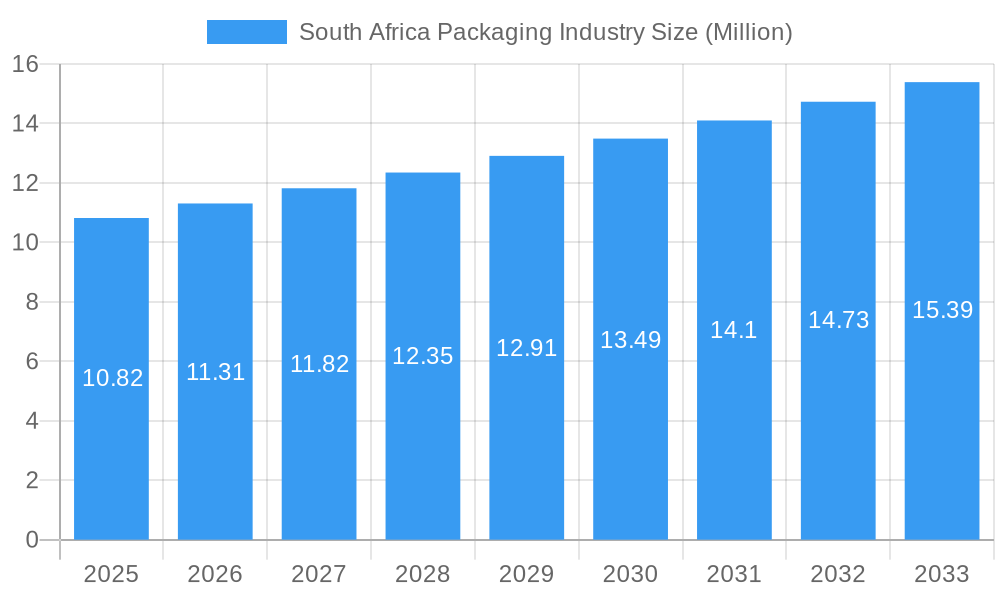

South Africa Packaging Industry Company Market Share

South Africa Packaging Industry Market Structure & Competitive Dynamics

The South African packaging industry is a dynamic market with a blend of local and international players competing for market share through innovation and strategic partnerships. While market concentration is moderate, key players like Constantia Afripack Sacks, Berry Astrapak, and Mondi Merebank hold significant shares, shaping the competitive landscape. The industry's innovation ecosystem is driven by technological advancements focused on sustainability and efficiency, particularly in eco-friendly packaging solutions. Stringent regulatory frameworks, including policies aimed at reducing plastic waste, significantly influence market dynamics and incentivize the adoption of biodegradable and compostable alternatives. This regulatory pressure, coupled with evolving consumer preferences, is accelerating the adoption of sustainable packaging materials.

End-user demand is robust, with the food and beverage sector being a major driver. The industry exhibits a pattern of consolidation, evidenced by recent mergers and acquisitions (M&A) exceeding $500 million USD. This activity reflects strategic moves to enhance market position and expand capabilities within high-growth segments such as pharmaceuticals and healthcare. This trend is expected to continue as companies seek to leverage scale and diversify their product portfolios.

- Market Share: The top five players hold approximately 40% of the market, with a concentration trend expected to continue.

- M&A Activity: Recent transactions have valued over $500 million USD, highlighting industry consolidation.

- End-user Trends: Strong growth in the food and beverage sector, fueled by rising consumption and evolving consumer preferences.

- Regulatory Impact: Increased scrutiny on plastic waste is driving innovation in sustainable and recyclable packaging options.

South Africa Packaging Industry Industry Trends & Insights

The South Africa packaging industry is experiencing robust growth, propelled by several key drivers. The market's expansion is significantly influenced by the rise in consumer goods demand, particularly in the food and beverage sector, which is witnessing a CAGR of approximately 4.5% over the forecast period from 2025 to 2033. Technological disruptions are reshaping the industry, with the adoption of smart packaging solutions that offer enhanced product safety and consumer engagement. These innovations, such as RFID tags and QR codes, are penetrating the market at an estimated rate of 10% annually.

Consumer preferences are shifting towards sustainable and recyclable packaging materials, driven by heightened environmental awareness. This trend is compelling companies to invest in research and development to produce eco-friendly packaging solutions, which is expected to grow at a CAGR of 6% through 2033. Competitive dynamics are intensifying, with firms like Tetra Laval Group and WestRock leading the charge in product innovation and market expansion strategies.

The industry is also witnessing a surge in the use of plastic and paperboard materials, driven by their versatility and sustainability. Metal and glass packaging, while still significant, are facing challenges from the growing preference for lightweight and eco-friendly alternatives. The competitive landscape is further complicated by the entry of new players, particularly in the e-commerce packaging segment, which is expected to grow at a CAGR of 7% over the forecast period.

Dominant Markets & Segments in South Africa Packaging Industry

The South African packaging market is segmented by several key end-user industries and material types, each contributing to overall market growth. The food and beverage sector retains its position as the largest end-user, driven by the consistent need for effective and sustainable packaging solutions. This sector is projected for sustained growth, with a projected CAGR exceeding 4.5%.

- Food and Beverage:

- Key Driver: Expanding consumer demand and a focus on product preservation and brand presentation.

- Infrastructure: Ongoing investments in modern packaging facilities to meet the growing demand.

Plastic remains the dominant packaging material due to its versatility and cost-effectiveness. However, growth in this segment is expected to be moderated by increasingly stringent environmental regulations. A projected CAGR of 5% from 2025 to 2033 reflects this balance of demand and regulatory pressure.

- Plastic:

- Key Driver: Lightweight and durable properties, suitable for diverse applications.

- Economic Policies: Government incentives and regulations are pushing innovation towards recyclability and reduction in environmental impact.

Corrugated boxes maintain their strong position, favored for their strength, recyclability, and suitability for e-commerce and industrial packaging. This segment is expected to demonstrate steady growth, with a projected CAGR of 3.5%.

- Corrugated Boxes:

- Key Driver: Significant growth in e-commerce and industrial packaging applications.

- Economic Policies: Government incentives promote sustainable packaging practices.

The pharmaceuticals and healthcare sector is a significant growth area, demanding sterile and tamper-evident packaging. Stringent regulations and the need for secure product handling contribute to this segment's projected CAGR of 6% through 2033.

- Pharmaceuticals and Healthcare:

- Key Driver: Expansion of healthcare infrastructure and growing demand for medical supplies.

- Infrastructure: Investments in manufacturing facilities that comply with strict regulatory standards.

The dominance of these segments is a result of economic policies, infrastructure development, and evolving consumer preferences, all pushing the industry toward more sustainable and innovative packaging solutions.

South Africa Packaging Industry Product Innovations

The South Africa packaging industry is witnessing a wave of product innovations focused on sustainability and functionality. Companies are increasingly developing packaging solutions that incorporate biodegradable materials and smart technologies. For instance, the use of RFID technology in packaging allows for better tracking and consumer interaction, enhancing product safety and brand loyalty. These innovations are not only meeting the growing demand for eco-friendly products but also providing competitive advantages by aligning with consumer preferences and regulatory requirements.

Report Segmentation & Scope

This report provides a comprehensive analysis of the South African packaging industry, segmented by product type, end-user industry, and packaging material. This granular approach offers a detailed understanding of market dynamics and growth potential.

- By Product Type: Bottles, bags and pouches, corrugated boxes, metal cans, and other product types. Corrugated boxes are anticipated to grow at a CAGR of 3.5%, driven by the ongoing expansion of e-commerce.

- By End-user Industry: Food and beverage, household and personal care, pharmaceuticals and healthcare, and other end-user industries. The food and beverage sector is projected to show a CAGR of 4.5%, fueled by consumer demand.

- By Packaging Material: Plastic, paper and paperboard, metal, and glass. Plastic packaging is anticipated to grow at a CAGR of 5%, balanced by growing concerns about environmental sustainability and the rise of eco-friendly alternatives.

Each segment is thoroughly analyzed, providing insights into market size, growth projections, and competitive landscapes, enabling stakeholders to make informed decisions.

Key Drivers of South Africa Packaging Industry Growth

The growth of the South Africa packaging industry is driven by several key factors. Technological advancements are enabling the development of innovative packaging solutions, such as smart packaging that enhances product safety and consumer engagement. Economic factors, including the rise in disposable income and urbanization, are boosting demand for packaged goods, particularly in the food and beverage sector. Regulatory initiatives aimed at promoting sustainability are also pushing companies to adopt eco-friendly packaging materials, thereby fostering market growth.

Challenges in the South Africa Packaging Industry Sector

The South Africa packaging industry faces several challenges that could impede its growth. Regulatory hurdles, such as stringent environmental regulations, are increasing the cost of compliance for companies. Supply chain disruptions, often caused by global events, can lead to delays and increased costs. Additionally, intense competition from both local and international players is putting pressure on profit margins, with some companies experiencing a decline in market share by up to 2% annually.

Leading Players in the South Africa Packaging Industry Market

- Constantia Afripack Sacks (Constantia Flexibles)

- Berry Astrapak

- WestRock

- Sonoco Products Company

- Clear Crafts

- Dalgen Packaging cc

- Huhtamaki Springs South Africa

- Detpak

- ACS Promotions (Pty) Ltd

- Mondi Merebank (Mondi PLC)

- Win-Pak

- Tetra Laval Group

Key Developments in South Africa Packaging Industry Sector

- December 2022: Tetra Pak South Africa joined the PET Recycling Company (Petco), aiming to enhance the collection and recycling of liquid packaging board (LBP) in South Africa. This move is expected to significantly improve the industry's sustainability efforts.

- May 2022: Ardagh Group planned to invest in new furnaces following the acquisition of Consol Glass, which serves various beverage sectors. The acquisition included a further USD 200 Million investment in two furnaces, potentially impacting the glass packaging market dynamics.

Strategic South Africa Packaging Industry Market Outlook

The South African packaging industry presents a positive outlook, driven by several key factors. The increasing demand for sustainable and eco-friendly packaging solutions is a major growth catalyst, pushing innovation and market expansion. Strategic opportunities exist in developing smart packaging technologies, exploring new materials, and expanding into regional markets. Companies that proactively adapt to evolving consumer preferences, offering innovative and sustainable solutions, are well-positioned to thrive in this dynamic market. This includes not only material innovation but also advancements in packaging design and supply chain efficiency. The focus on circular economy principles and waste reduction will be key for long-term success.

South Africa Packaging Industry Segmentation

-

1. Packaging Material

- 1.1. Plastic

- 1.2. Paper and Paperboard

- 1.3. Metal

- 1.4. Glass

-

2. Product Type

- 2.1. Bottles

- 2.2. Bags and Pouches

- 2.3. Corrugated Boxes

- 2.4. Metal Cans

- 2.5. Other Product Types

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Household and Personal Care

- 3.3. Pharmaceuticals and Healthcare

- 3.4. Other End-user Industries

South Africa Packaging Industry Segmentation By Geography

- 1. South Africa

South Africa Packaging Industry Regional Market Share

Geographic Coverage of South Africa Packaging Industry

South Africa Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Food and Beverage Industry; The Rising Demand of Packaging from Retail Sector

- 3.3. Market Restrains

- 3.3.1. ; Alternative Forms of Packaging

- 3.4. Market Trends

- 3.4.1. Growing Urbanization in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 5.1.1. Plastic

- 5.1.2. Paper and Paperboard

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles

- 5.2.2. Bags and Pouches

- 5.2.3. Corrugated Boxes

- 5.2.4. Metal Cans

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Household and Personal Care

- 5.3.3. Pharmaceuticals and Healthcare

- 5.3.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Constantia Afripack Sacks (Constantia Flexibles)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Astrapak

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WestRock

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sonoco Products Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Clear Crafts*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dalgen Packaging cc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Huhtamaki Springs South Africa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Detpak

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ACS Promotions (Pty) Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mondi Merebank (Mondi PLC)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Win-Pak

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Tetra Laval Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Constantia Afripack Sacks (Constantia Flexibles)

List of Figures

- Figure 1: South Africa Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Packaging Industry Revenue Million Forecast, by Packaging Material 2020 & 2033

- Table 2: South Africa Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: South Africa Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: South Africa Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South Africa Packaging Industry Revenue Million Forecast, by Packaging Material 2020 & 2033

- Table 6: South Africa Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: South Africa Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: South Africa Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Packaging Industry?

The projected CAGR is approximately 4.52%.

2. Which companies are prominent players in the South Africa Packaging Industry?

Key companies in the market include Constantia Afripack Sacks (Constantia Flexibles), Berry Astrapak, WestRock, Sonoco Products Company, Clear Crafts*List Not Exhaustive, Dalgen Packaging cc, Huhtamaki Springs South Africa, Detpak, ACS Promotions (Pty) Ltd, Mondi Merebank (Mondi PLC), Win-Pak, Tetra Laval Group.

3. What are the main segments of the South Africa Packaging Industry?

The market segments include Packaging Material, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Food and Beverage Industry; The Rising Demand of Packaging from Retail Sector.

6. What are the notable trends driving market growth?

Growing Urbanization in the Country.

7. Are there any restraints impacting market growth?

; Alternative Forms of Packaging.

8. Can you provide examples of recent developments in the market?

December 2022 - Tetra Pak South Africa will join the PET Recycling Company (Petco), a well-established producer responsibility organization.The decision for Tetra Pak to join Petco was driven by the need for greater collaboration to improve the collection and recycling of LBP in South Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Packaging Industry?

To stay informed about further developments, trends, and reports in the South Africa Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence