Key Insights

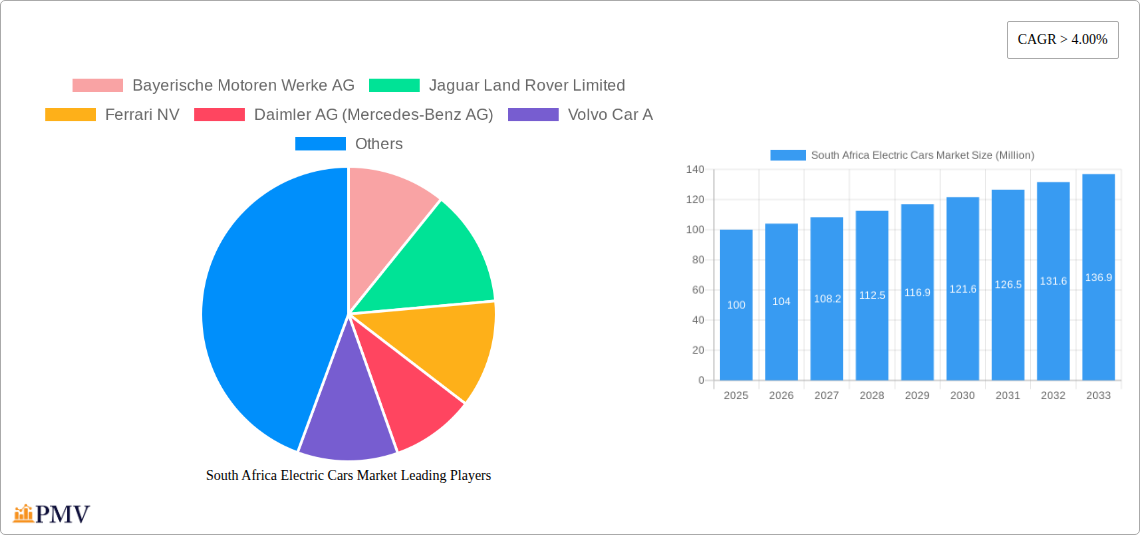

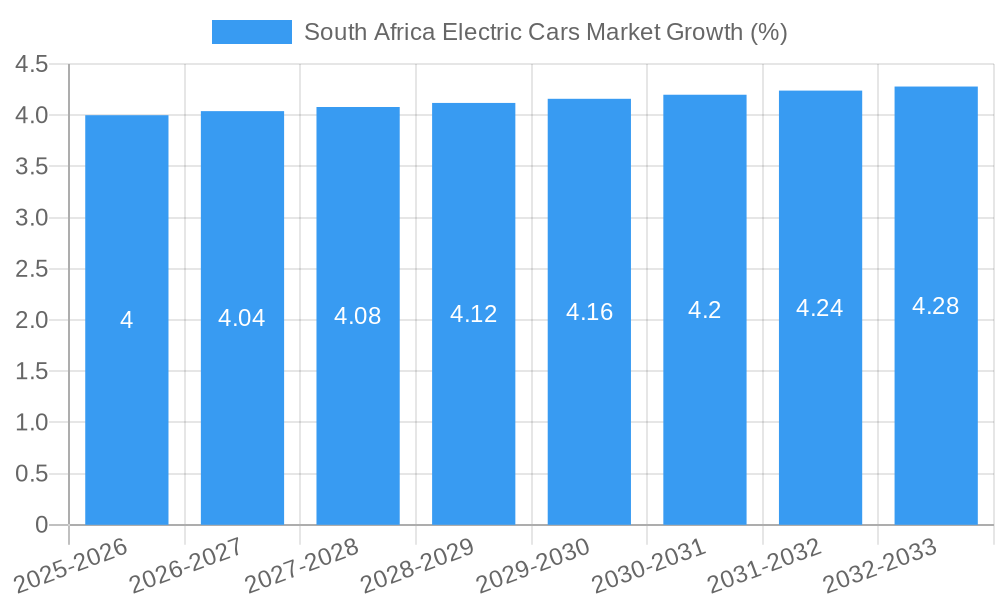

The South African electric car market, while nascent, exhibits significant growth potential driven by increasing environmental awareness, government incentives promoting sustainable transportation, and rising fuel prices. The market's Compound Annual Growth Rate (CAGR) exceeding 4% indicates a steadily expanding demand for Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and potentially Fuel Cell Electric Vehicles (FCEVs), although the latter segment is currently less developed. Passenger cars constitute the dominant vehicle configuration within this market. Key players like BMW, Jaguar Land Rover, and Toyota are already establishing a presence, recognizing the long-term opportunities presented by this developing market. However, challenges remain, including the relatively high initial purchase cost of electric vehicles, limited charging infrastructure, and the need for greater consumer education about the benefits of electric mobility. Overcoming these restraints will be crucial for accelerating market penetration.

Looking ahead to 2033, the South African electric car market is projected to experience substantial growth, driven by continuous technological advancements leading to lower vehicle prices and improved battery technology. Government policies aimed at reducing carbon emissions and promoting local manufacturing could further stimulate demand. The expansion of charging infrastructure, facilitated by both public and private investment, will play a crucial role in boosting consumer confidence and market uptake. Furthermore, increased awareness campaigns highlighting the environmental and economic benefits of electric vehicles are expected to further drive market expansion. The specific growth trajectory will depend on the effectiveness of government policies, infrastructure development, and the pace of technological advancements. Competitive pricing strategies from manufacturers will also be instrumental in shaping the market's future.

South Africa Electric Cars Market: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the South Africa electric cars market, covering the period from 2019 to 2033. It offers actionable insights for stakeholders across the automotive value chain, including manufacturers, suppliers, investors, and policymakers. With a focus on market segmentation, competitive dynamics, and future trends, this report is essential for navigating the evolving landscape of the South African electric vehicle sector. The report uses 2025 as its base year and provides forecasts until 2033, with historical data spanning 2019-2024.

South Africa Electric Cars Market Structure & Competitive Dynamics

The South African electric car market is characterized by a relatively low market concentration, with several international and local players vying for market share. The innovation ecosystem is nascent but growing, with some local companies developing charging infrastructure and related technologies. The regulatory framework is evolving, with government incentives aiming to stimulate EV adoption, although challenges remain in terms of grid capacity and charging infrastructure development. Product substitutes include conventional internal combustion engine (ICE) vehicles, and competition from used ICE vehicles is significant. End-user trends show a gradual shift towards EVs, driven by environmental concerns and government policy, yet affordability remains a major barrier. Mergers and acquisitions (M&A) activity in the South African electric car market is currently limited; however, we predict an increase in M&A activity in the coming years, with predicted M&A deal values reaching xx Million by 2033. Key players are strategically focusing on expanding their charging infrastructure and local partnerships to penetrate the market more effectively. The current market share is dominated by established international players, with local players holding a smaller, but growing, share.

South Africa Electric Cars Market Industry Trends & Insights

The South African electric car market is experiencing a period of significant transformation. Market growth is primarily driven by increasing environmental awareness, government regulations promoting EVs, and technological advancements leading to improved battery technology and reduced vehicle prices. The Compound Annual Growth Rate (CAGR) for the market is projected to be xx% during the forecast period (2025-2033). Market penetration remains low compared to global averages, but is expected to increase significantly over the next decade due to supportive government policies and falling battery costs. Consumer preferences are shifting towards electric vehicles due to increasing affordability and convenience, especially among younger demographics. However, range anxiety, charging infrastructure limitations, and the high initial purchase price remain significant barriers to widespread adoption. Competitive dynamics are intense, with both global and local players striving to establish a strong presence in the market.

Dominant Markets & Segments in South Africa Electric Cars Market

Leading Region/Segment: The Gauteng province is expected to dominate the South African electric car market due to its high population density, better infrastructure, and higher concentration of affluent consumers. The BEV (Battery Electric Vehicle) segment is projected to experience the fastest growth within the Fuel Category, driven by technological advancements and falling battery costs. Within Vehicle Configuration, Passenger Cars account for the largest market share due to their widespread use and high demand.

Key Drivers for Dominance:

- Economic Policies: Government incentives such as tax breaks and subsidies are accelerating EV adoption in Gauteng.

- Infrastructure: The province has a relatively well-developed electricity grid and growing charging infrastructure compared to other regions.

- Consumer Preferences: Gauteng’s affluent population exhibits a higher propensity to adopt new technologies, including electric vehicles.

The dominance of Gauteng is expected to persist, but other provinces are likely to witness increasing adoption rates as charging infrastructure improves and affordability increases. The BEV segment will continue to lead, although PHEVs (Plug-in Hybrid Electric Vehicles) and HEVs (Hybrid Electric Vehicles) will maintain a sizable market share, particularly in the initial stages of EV market development.

South Africa Electric Cars Market Product Innovations

Recent product innovations focus on enhancing battery technology to extend driving range, improving charging infrastructure, and reducing the overall cost of electric vehicles. The market is witnessing a growing trend toward advanced driver-assistance systems (ADAS) and connectivity features, differentiating products and improving consumer appeal. These innovations are crucial for addressing range anxiety and improving the overall user experience, thereby stimulating market growth. Manufacturers are also focusing on designing vehicles suitable for the specific geographic and climatic conditions prevalent in South Africa.

Report Segmentation & Scope

The report segments the South Africa electric car market by Fuel Category (BEV, FCEV, HEV, PHEV) and Vehicle Configuration (Passenger Cars). Each segment is analyzed in detail, providing market size estimates, growth projections, and competitive dynamics. The BEV segment is projected to dominate, driven by technological advancements and decreasing battery costs. The FCEV (Fuel Cell Electric Vehicle) segment is expected to remain small due to limited infrastructure. The HEV and PHEV segments will play a transitional role in the transition to EVs. Passenger cars constitute the largest share of the vehicle configuration segment, driven by high consumer demand.

Key Drivers of South Africa Electric Cars Market Growth

Several factors are driving the growth of the South African electric car market. Government regulations promoting EV adoption through tax incentives and emission standards are creating a favorable environment for market expansion. The decreasing cost of battery technology is making EVs more affordable and accessible to a wider consumer base. Technological advancements, such as improved battery range and faster charging times, further enhance consumer appeal. Increasing environmental awareness among consumers is also contributing to the rise in demand for eco-friendly vehicles.

Challenges in the South Africa Electric Cars Market Sector

The South African electric car market faces several challenges. Limited charging infrastructure outside of major urban centers hinders wider adoption. The high initial cost of EVs remains a barrier for many consumers, especially those in lower-income groups. The reliability and affordability of electricity supply pose challenges for widespread EV use. Furthermore, the dependence on imports for critical components creates vulnerability in the supply chain. These factors together limit the pace of market expansion.

Leading Players in the South Africa Electric Cars Market Market

- Bayerische Motoren Werke AG

- Jaguar Land Rover Limited

- Ferrari NV

- Daimler AG (Mercedes-Benz AG)

- Volvo Car A

- Porsche

- Audi AG

- Toyota Motor Corporation

- Honda Motor Co Ltd

Key Developments in South Africa Electric Cars Market Sector

- August 2023: Toyota Argentina's expansion of its vehicle conversion area signals increased focus on adapting vehicles to diverse customer needs, potentially influencing the South African market indirectly through regional supply chains.

- August 2023: The Dubai Police Department's adoption of the electric Mercedes EQS 580 highlights the growing acceptance of EVs amongst high-profile organizations, influencing perceptions and potentially accelerating demand.

- August 2023: Tesla's launch of car insurance services in California could influence insurance offerings for EVs in South Africa, impacting market accessibility and overall cost.

Strategic South Africa Electric Cars Market Outlook

The South African electric car market holds significant long-term growth potential. Continued government support, coupled with decreasing battery costs and technological improvements, will drive increased adoption rates. Strategic opportunities exist for companies to invest in charging infrastructure, develop localized supply chains, and tailor vehicles to suit the specific needs of the South African market. The focus on sustainable mobility solutions will accelerate market expansion, creating a promising outlook for the future.

South Africa Electric Cars Market Segmentation

-

1. Vehicle Configuration

-

1.1. Passenger Cars

- 1.1.1. Hatchback

- 1.1.2. Multi-purpose Vehicle

- 1.1.3. Sedan

- 1.1.4. Sports Utility Vehicle

-

1.1. Passenger Cars

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

South Africa Electric Cars Market Segmentation By Geography

- 1. South Africa

South Africa Electric Cars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Passenger Cars

- 5.1.1.1. Hatchback

- 5.1.1.2. Multi-purpose Vehicle

- 5.1.1.3. Sedan

- 5.1.1.4. Sports Utility Vehicle

- 5.1.1. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. South Africa South Africa Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Bayerische Motoren Werke AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Jaguar Land Rover Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Ferrari NV

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Daimler AG (Mercedes-Benz AG)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Volvo Car A

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Porsche

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Audi AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Toyota Motor Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Honda Motor Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: South Africa Electric Cars Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Electric Cars Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Electric Cars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Electric Cars Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 3: South Africa Electric Cars Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: South Africa Electric Cars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa Electric Cars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa South Africa Electric Cars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan South Africa Electric Cars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda South Africa Electric Cars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania South Africa Electric Cars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya South Africa Electric Cars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa South Africa Electric Cars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Electric Cars Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 13: South Africa Electric Cars Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 14: South Africa Electric Cars Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Electric Cars Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the South Africa Electric Cars Market?

Key companies in the market include Bayerische Motoren Werke AG, Jaguar Land Rover Limited, Ferrari NV, Daimler AG (Mercedes-Benz AG), Volvo Car A, Porsche, Audi AG, Toyota Motor Corporation, Honda Motor Co Ltd.

3. What are the main segments of the South Africa Electric Cars Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

August 2023: Toyota Argentina announced that as it begins production of the Hiace in 2024 at its plant in Zárate, it will continue and enlarge the mission of the Conversions area, dedicated to designing and producing vehicles adapted to the specific needs of multiple customers.August 2023: The Dubai Police Department has placed an electric Mercedes EQS 580 on its fleet of luxury cars and environmentally conscious vehicles to patrol the streets.August 2023: Tesla has introduced the car insurance services in California, the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Electric Cars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Electric Cars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Electric Cars Market?

To stay informed about further developments, trends, and reports in the South Africa Electric Cars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence