Key Insights

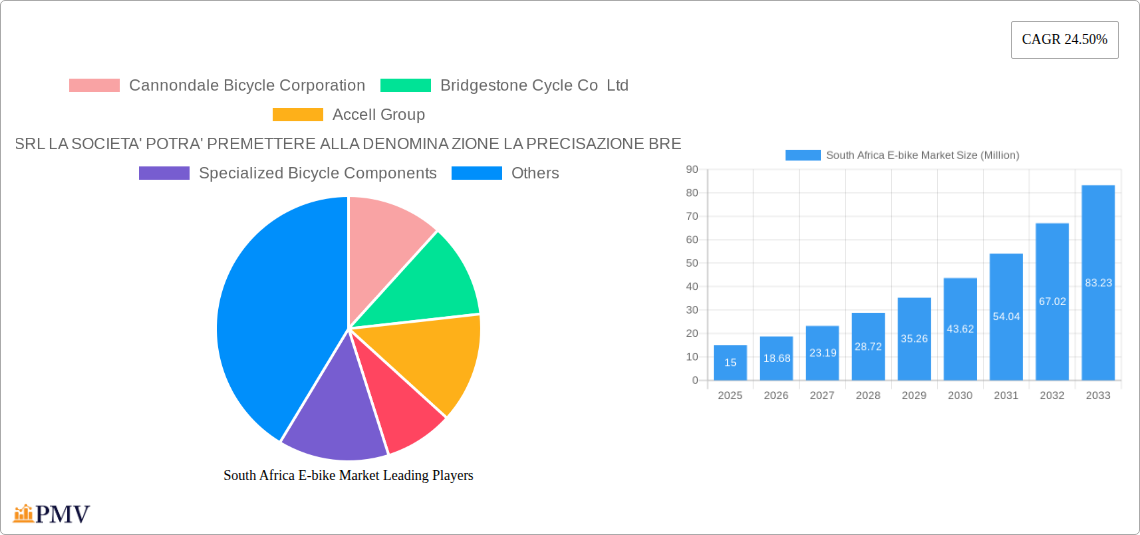

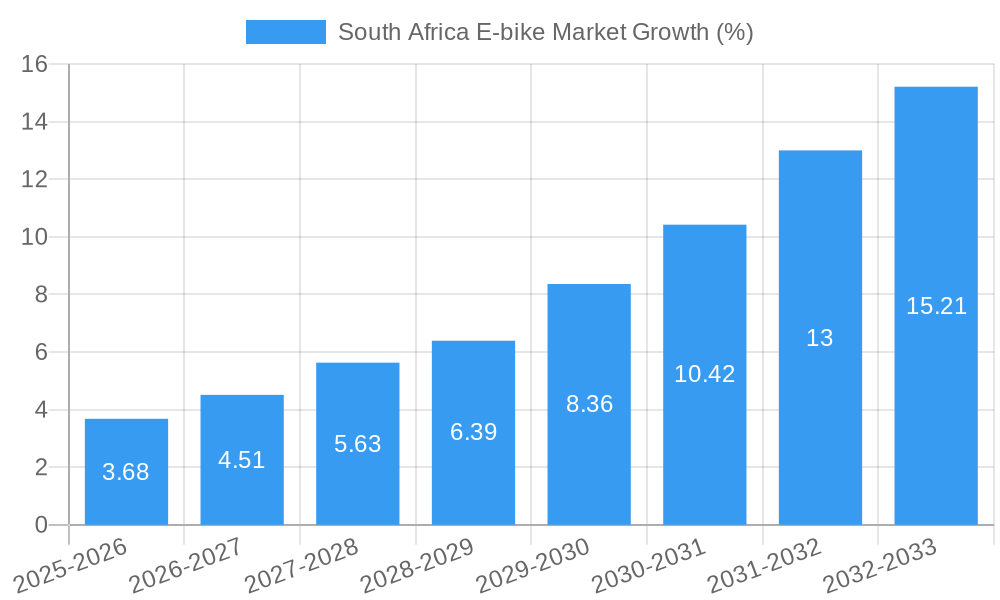

The South African e-bike market, while currently smaller than many global counterparts, exhibits significant growth potential, fueled by a 24.50% CAGR (2019-2024). This burgeoning market is driven by increasing environmental awareness, rising fuel costs, and the need for efficient urban transportation solutions within South Africa's major cities. Government initiatives promoting sustainable transportation could further accelerate adoption. The market is segmented by propulsion type (pedal-assisted, speed pedelec, throttle-assisted), application (cargo/utility, city/urban, trekking), and battery type (lead-acid, lithium-ion). Lithium-ion batteries, owing to their superior performance and longer lifespan, are likely to dominate the market. The city/urban segment is expected to be the largest, driven by commuters seeking a faster, cleaner alternative to cars and public transport. While challenges remain, such as the relatively high initial cost of e-bikes and limited charging infrastructure in certain areas, the long-term outlook for the South African e-bike market remains positive. The presence of international brands like Cannondale, Specialized, and Giant, alongside local players, indicates a competitive landscape ripe for innovation and expansion.

The forecast period (2025-2033) will witness continued market expansion, driven by improvements in battery technology, decreasing e-bike prices, and potentially government subsidies to encourage adoption. Increased awareness campaigns highlighting the health and environmental benefits of e-bikes can further boost demand. The growth will likely be uneven across segments, with the lithium-ion battery segment expected to experience faster growth than its lead-acid counterpart. Similarly, the city/urban application segment will likely maintain its market leadership due to increasing urbanization and traffic congestion in major South African cities. However, the cargo/utility segment also holds potential for growth, catering to businesses and individuals needing efficient last-mile delivery or heavy-duty transport solutions. Addressing infrastructure limitations and raising consumer awareness will be crucial to unlocking the full potential of this dynamic market.

South Africa E-bike Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa e-bike market, covering market size, segmentation, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is essential for businesses, investors, and policymakers seeking to understand and navigate this rapidly evolving market. The South Africa e-bike market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

South Africa E-bike Market Structure & Competitive Dynamics

The South Africa e-bike market exhibits a moderately concentrated structure, with a few major players holding significant market share, while numerous smaller companies compete in niche segments. The market is characterized by an active innovation ecosystem, driven by advancements in battery technology, motor systems, and frame designs. Regulatory frameworks, while evolving, are increasingly supportive of e-bike adoption, promoting sustainable transportation. Product substitutes include traditional bicycles and motorized scooters; however, e-bikes offer a unique combination of fitness and convenience. End-user trends reveal a growing preference for e-bikes amongst urban commuters, leisure cyclists, and cargo transportation operators. M&A activity has been relatively moderate but is expected to increase as larger companies seek to consolidate their market position and acquire specialized technologies. Recent M&A deal values have averaged approximately xx Million, with xx deals recorded in the last five years. Key metrics show a market share distribution as follows:

- Top 3 Players: Holding approximately xx% of the market share.

- Mid-sized Players: Representing approximately xx% of the market share.

- Smaller Players: Comprising the remaining xx% of the market share.

South Africa E-bike Market Industry Trends & Insights

The South Africa e-bike market is experiencing significant growth, driven by several key factors. Increasing urbanization and traffic congestion are pushing consumers towards eco-friendly and efficient transportation solutions. Government initiatives promoting sustainable mobility and the rising disposable incomes of the middle class further fuel market expansion. Technological advancements in battery technology, resulting in longer ranges and faster charging times, are enhancing the appeal of e-bikes. Consumer preferences are shifting towards lighter, more stylish, and feature-rich e-bikes. The competitive landscape is dynamic, with both domestic and international players vying for market share through product innovation, aggressive marketing, and strategic partnerships. The market's growth is influenced by factors such as increasing fuel prices and environmental awareness. The CAGR for the period 2025-2033 is expected to be xx%, with market penetration projected to reach xx% by 2033.

Dominant Markets & Segments in South Africa E-bike Market

The City/Urban segment dominates the South Africa e-bike market, accounting for approximately xx% of total sales in 2024. This segment's dominance is attributed to several factors.

- Key Drivers:

- Growing urbanization and traffic congestion

- Increased demand for efficient and sustainable commuting solutions

- Government incentives and infrastructure development supporting cycling.

- Dominance Analysis: The ease of use, compact size, and suitability for short-distance travel make city e-bikes highly appealing to urban commuters. This preference is further amplified by supportive government policies and improving cycling infrastructure in major urban centers. The Lithium-ion battery segment also holds the highest market share owing to its longer lifespan and higher energy density. The Pedal Assisted propulsion type leads the market because of its efficient energy usage.

Other segments, including Trekking and Cargo/Utility, are showing promising growth rates, driven by increasing outdoor recreation activities and the rise of e-commerce.

South Africa E-bike Market Product Innovations

Recent product innovations in the South Africa e-bike market focus on enhancing battery performance, integrating smart technologies, and improving design aesthetics. Manufacturers are incorporating features such as GPS tracking, smartphone integration, and advanced safety systems. Technological trends point towards the adoption of lighter, more powerful, and longer-lasting batteries, as well as the integration of advanced motor systems to improve efficiency and performance. These innovations cater to the evolving preferences of consumers, emphasizing both functionality and style, thereby enhancing market fit.

Report Segmentation & Scope

This report segments the South Africa e-bike market based on various parameters:

- Propulsion Type: Pedal Assisted, Speed Pedelec, Throttle Assisted. Pedal-assisted e-bikes are expected to maintain their dominance due to their energy efficiency. Speed Pedelecs are experiencing increasing adoption amongst commuters.

- Application Type: Cargo/Utility, City/Urban, Trekking. Each segment is analyzed based on its unique features and target market. The growth of the Cargo/Utility segment is fuelled by logistics needs and last-mile delivery services.

- Battery Type: Lead Acid Battery, Lithium-ion Battery, Others. Lithium-ion batteries are expected to maintain a dominant position owing to their superior performance.

Each segment's growth projections, market size estimates, and competitive dynamics are thoroughly analyzed within the report.

Key Drivers of South Africa E-bike Market Growth

Several key factors are propelling the growth of the South Africa e-bike market. These include the increasing popularity of cycling as a recreational activity, coupled with government initiatives promoting sustainable transportation and environmentally friendly vehicles. Furthermore, advancements in battery technology and the availability of more affordable e-bike models are significantly broadening market access. Finally, improved cycling infrastructure and the development of dedicated e-bike lanes in urban areas are facilitating wider adoption.

Challenges in the South Africa E-bike Market Sector

Despite its growth potential, the South Africa e-bike market faces several challenges. High initial purchase costs can be a barrier to entry for many consumers, while inadequate charging infrastructure remains a concern. Furthermore, the safety of e-bike riders on roads shared with motor vehicles remains a critical issue requiring improved regulations and road safety education. These factors currently contribute to a slower-than-expected adoption rate, and are impacting sales of mid-range and higher priced models.

Leading Players in the South Africa E-bike Market Market

- Cannondale Bicycle Corporation

- Bridgestone Cycle Co Ltd

- Accell Group

- CAMPAGNOLO SRL LA SOCIETA' POTRA' PREMETTERE ALLA DENOMINA ZIONE LA PRECISAZIONE BREVETTI INTERNAZIONALI

- Specialized Bicycle Components

- Trek Bicycle Corporation

- Dorel Industries Inc

- MHW Bike-House GmbH (CUBE Bikes)

- Merida Industry Co Ltd

- Scott Corporation SA (Scott Sports)

- Giant Manufacturing Co Ltd

- Riese & Müller

- Orbea S Coop

- Cervélo Cycles Inc

Key Developments in South Africa E-bike Market Sector

- November 2022: Cannondale announced a new global unified organizational structure, aiming to enhance operations and growth.

- December 2022: Scott Sports launched the Solace, a new electric road bike leveraging TQ’s HPR550 motor system.

- January 2023: Campagnolo and Rapha launched a global partnership, offering exclusive experiences for RCC members.

Strategic South Africa E-bike Market Outlook

The South Africa e-bike market presents significant growth opportunities. Strategic partnerships, investments in research and development, and expansion into new market segments will play pivotal roles in shaping the industry's future. Focus on enhancing battery technology, improving safety features, and developing innovative designs will be key to driving future growth. The government's continued support for sustainable transportation, along with a growing awareness of environmental concerns, positions the e-bike sector for sustained expansion in the coming years.

South Africa E-bike Market Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

South Africa E-bike Market Segmentation By Geography

- 1. South Africa

South Africa E-bike Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa E-bike Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. South Africa South Africa E-bike Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa E-bike Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa E-bike Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa E-bike Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa E-bike Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa E-bike Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cannondale Bicycle Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bridgestone Cycle Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Accell Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 CAMPAGNOLO SRL LA SOCIETA' POTRA' PREMETTERE ALLA DENOMINA ZIONE LA PRECISAZIONE BREVETTI INTERNAZIONALI

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Specialized Bicycle Components

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Trek Bicycle Corporatio

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dorel Industries Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 MHW Bike-House GmbH (CUBE Bikes)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Merida Industry Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Scott Corporation SA (Scott Sports)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Giant Manufacturing Co Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Riese & Müller

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Orbea S Coop

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Cervélo Cycles Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Cannondale Bicycle Corporation

List of Figures

- Figure 1: South Africa E-bike Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa E-bike Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa E-bike Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa E-bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: South Africa E-bike Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 4: South Africa E-bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 5: South Africa E-bike Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Africa E-bike Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa South Africa E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan South Africa E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda South Africa E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania South Africa E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya South Africa E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa South Africa E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South Africa E-bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 14: South Africa E-bike Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 15: South Africa E-bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 16: South Africa E-bike Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa E-bike Market?

The projected CAGR is approximately 24.50%.

2. Which companies are prominent players in the South Africa E-bike Market?

Key companies in the market include Cannondale Bicycle Corporation, Bridgestone Cycle Co Ltd, Accell Group, CAMPAGNOLO SRL LA SOCIETA' POTRA' PREMETTERE ALLA DENOMINA ZIONE LA PRECISAZIONE BREVETTI INTERNAZIONALI, Specialized Bicycle Components, Trek Bicycle Corporatio, Dorel Industries Inc, MHW Bike-House GmbH (CUBE Bikes), Merida Industry Co Ltd, Scott Corporation SA (Scott Sports), Giant Manufacturing Co Ltd, Riese & Müller, Orbea S Coop, Cervélo Cycles Inc.

3. What are the main segments of the South Africa E-bike Market?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

January 2023: Campagnolo and Rapha launch a global partnership. The new partnership means RCC members now have the opportunity to ride Campagnolo’s 13-speed gravel groupset and gravel-specific wheelset, delivering an exclusive experience for global RCC members.December 2022: Scott sports has launched the Solace, a new electric road bike aimed new drop-bar electric bike range that is based on TQ’s HPR550 motor system.November 2022: Cannondale announced a new global unified organizational structure that will eliminate regional GM and, the company said, leverage Pon.Bike to enhance operations and growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa E-bike Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa E-bike Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa E-bike Market?

To stay informed about further developments, trends, and reports in the South Africa E-bike Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence