Key Insights

The South African anesthesia devices market is poised for significant expansion, estimated to reach $370 million in 2025, with a projected compound annual growth rate (CAGR) of 6.94% through 2033. This robust growth is propelled by several key drivers, including the increasing demand for advanced healthcare infrastructure, a rising prevalence of chronic diseases necessitating complex surgical interventions, and growing government initiatives to improve healthcare accessibility and quality across the nation. The market is also influenced by technological advancements in anesthesia delivery systems, such as integrated anesthesia workstations and sophisticated anesthesia monitors that enhance patient safety and procedural efficiency. Furthermore, an aging population contributes to a higher incidence of surgical procedures, thereby bolstering the demand for anesthesia devices.

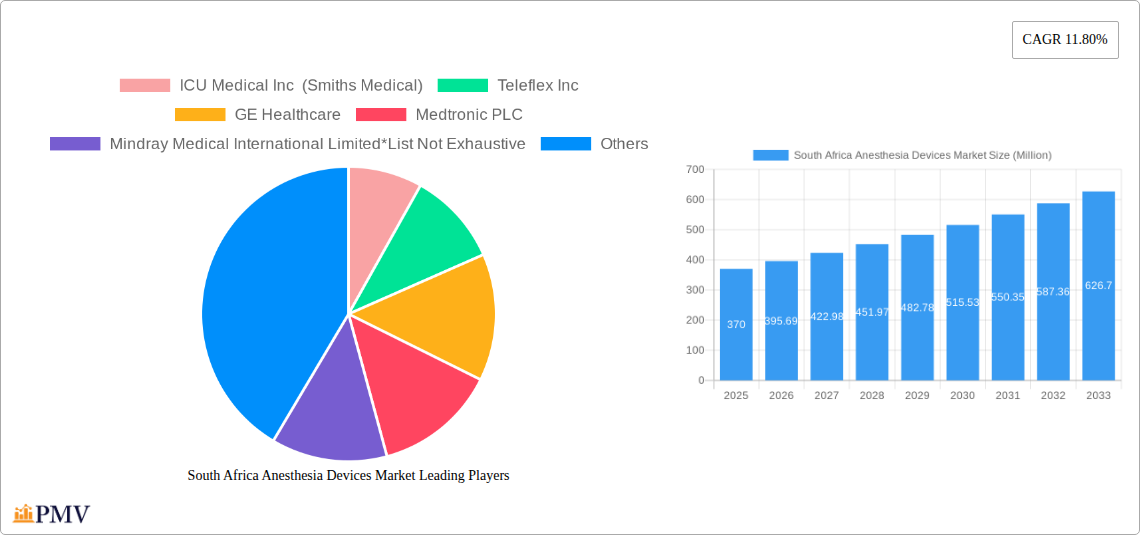

South Africa Anesthesia Devices Market Market Size (In Million)

The anesthesia devices market in South Africa is segmented into two primary categories: Anesthesia Machines and Disposables and Accessories. Within Anesthesia Machines, product types include Anesthesia Workstations, Anesthesia Delivery Machines, Anesthesia Ventilators, and Anesthesia Monitors, with Anesthesia Workstations likely leading market share due to their comprehensive functionalities. The Disposables and Accessories segment, encompassing Anesthesia Circuits (Breathing Circuits), Anesthesia Masks, and Others, is also expected to witness steady growth, driven by the high consumption rates and recurring purchase needs. Key market players like GE Healthcare, Medtronic PLC, and Koninklijke Philips NV are actively expanding their presence and product offerings in South Africa, contributing to market dynamism. However, potential restraints such as the high cost of advanced anesthesia equipment and the availability of skilled personnel to operate them could pose challenges to the market's full potential. Despite these, the overall outlook for the South African anesthesia devices market remains highly positive, supported by an increasing focus on patient care and surgical outcomes.

South Africa Anesthesia Devices Market Company Market Share

This in-depth report provides a detailed analysis of the South Africa Anesthesia Devices Market, offering critical insights into market size, growth drivers, trends, and competitive landscape from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this study is an essential resource for stakeholders seeking to understand the dynamics of anesthesia equipment in South Africa. We cover key segments including anesthesia machines (workstations, delivery machines, ventilators, monitors) and disposables and accessories (anesthesia circuits, masks).

This report offers actionable intelligence on the South African healthcare devices market, focusing on surgical equipment, medical technology, and patient monitoring systems. It delves into the impact of regulatory approvals, healthcare infrastructure development, and technological advancements on market growth. Understand the competitive strategies of leading players like ICU Medical Inc (Smiths Medical), Teleflex Inc, GE Healthcare, Medtronic PLC, Mindray Medical International Limited, Koninklijke Philips NV, B Braun Melsungen AG, Aspen, and Draegerwerk AG.

South Africa Anesthesia Devices Market Market Structure & Competitive Dynamics

The South Africa Anesthesia Devices Market exhibits a moderately concentrated structure, with key global players holding significant market share. Innovation ecosystems are driven by continuous research and development in areas like AI-powered anesthesia delivery and advanced patient monitoring. The regulatory framework, while evolving, is crucial for market entry and product approval, influencing the pace of adoption for new anesthesia technologies. Product substitutes, though limited for core anesthesia delivery, exist in the form of older generation devices and alternative pain management techniques. End-user trends are leaning towards sophisticated, integrated anesthesia workstations that enhance workflow efficiency and patient safety. Mergers and acquisitions (M&A) activities, though not highly frequent, have been strategic, aimed at expanding product portfolios and market reach. For instance, M&A deals in the broader African healthcare sector have seen valuations in the hundreds of millions of US dollars, indicating the significant investment potential. The market share of leading players is estimated to be between 10-20% individually, with the top five accounting for over 60% of the market.

- Market Concentration: Moderate to high, driven by a few dominant international players.

- Innovation Ecosystems: Focus on R&D for connected devices, AI-driven diagnostics, and minimally invasive technologies.

- Regulatory Frameworks: Evolving standards for safety, efficacy, and data privacy impacting product launches.

- Product Substitutes: Limited for critical anesthesia delivery, but present in older equipment and alternative therapies.

- End-User Trends: Demand for integrated solutions, user-friendly interfaces, and advanced patient safety features.

- M&A Activities: Strategic acquisitions to enhance market presence and product diversification.

South Africa Anesthesia Devices Market Industry Trends & Insights

The South Africa Anesthesia Devices Market is poised for robust growth, driven by several key factors including increasing healthcare expenditure, a growing prevalence of chronic diseases requiring surgical interventions, and a continuous drive towards modernization of healthcare facilities. The aging population in South Africa also contributes to higher demand for surgical procedures and, consequently, anesthesia devices. Furthermore, the government's focus on improving healthcare infrastructure, especially in underserved areas, is a significant growth accelerator. Technological disruptions are profoundly impacting the market, with the introduction of smart anesthesia machines featuring integrated software for data logging, predictive analytics, and remote monitoring capabilities. The penetration of these advanced anesthesia delivery systems is expected to rise significantly. Consumer preferences are shifting towards more automated and less invasive anesthesia techniques, emphasizing patient comfort and faster recovery times. Competitive dynamics are characterized by a blend of global manufacturers and local distributors, with a strong emphasis on after-sales service and technical support. The CAGR for the South Africa Anesthesia Devices Market is projected to be around 7.5% during the forecast period. Market penetration for advanced anesthesia ventilators and anesthesia monitors is increasing as hospitals upgrade their existing infrastructure. The growing awareness of anesthetic risks and the need for precise drug delivery are also fuelling the demand for sophisticated anesthesia workstations. The rising incidence of non-communicable diseases like cancer and cardiovascular ailments necessitates a greater number of complex surgical procedures, directly boosting the demand for high-quality anesthesia equipment. The expansion of private healthcare facilities, which often adopt the latest medical technologies, further propels market growth.

Dominant Markets & Segments in South Africa Anesthesia Devices Market

The Anesthesia Machines segment is expected to dominate the South Africa Anesthesia Devices Market, driven by the increasing need for advanced and integrated anesthesia delivery systems in operating rooms across the nation. Within this segment, Anesthesia Workstations are anticipated to lead due to their comprehensive functionalities, encompassing ventilation, gas delivery, and advanced monitoring, catering to a wide range of surgical procedures. The demand for these sophisticated anesthesia workstations is bolstered by investments in upgrading hospital infrastructure and the adoption of newer surgical techniques. Key drivers for this dominance include:

- Economic Policies: Government initiatives aimed at improving healthcare access and quality, leading to increased capital expenditure on medical equipment.

- Infrastructure Development: Expansion and modernization of hospitals, particularly in urban centers and emerging economic zones, creating demand for state-of-the-art operating room equipment.

- Technological Advancements: Continuous innovation in anesthesia workstation design, offering enhanced safety features, improved user interfaces, and better integration with other hospital systems.

- Prevalence of Surgical Procedures: Rising rates of complex surgeries, from general to specialized procedures, necessitating reliable and precise anesthesia delivery.

The Disposables and Accessories segment, particularly Anesthesia Circuits (Breathing Circuits), also holds significant market share, driven by their recurring consumption nature in every anesthetic procedure. The increasing number of surgical procedures directly translates to a higher demand for these essential consumables. Factors contributing to the strong performance of this segment include:

- Hygiene and Safety Standards: The emphasis on infection control and single-use disposables in healthcare settings.

- Cost-Effectiveness: While individual disposables may be low-cost, their high volume usage contributes significantly to the overall market value.

- Compatibility Requirements: The need for specific anesthesia circuits and anesthesia masks to be compatible with a wide range of anesthesia machines, driving demand for diverse product offerings.

The dominance of Anesthesia Machines is further supported by the ongoing replacement of older, less sophisticated models with advanced anesthesia delivery machines and anesthesia ventilators that offer improved patient outcomes and operational efficiency. The market penetration of anesthesia monitors is also on an upward trajectory as healthcare providers prioritize comprehensive patient monitoring during surgical procedures.

South Africa Anesthesia Devices Market Product Innovations

Product innovation in the South Africa Anesthesia Devices Market is primarily focused on enhancing patient safety, improving workflow efficiency, and enabling remote patient management. Key developments include the integration of artificial intelligence for real-time predictive analytics of patient conditions during anesthesia and the development of wireless connectivity for seamless data integration with hospital information systems. These innovations aim to provide anesthesiologists with more comprehensive insights, allowing for proactive adjustments and minimizing adverse events. The competitive advantage lies in devices that offer superior precision in drug delivery, advanced ventilation modes, and intuitive user interfaces, reducing the learning curve for healthcare professionals and improving the overall patient experience.

Report Segmentation & Scope

This report segmentations include Product Type: Anesthesia Machines (comprising Anesthesia Workstation, Anesthesia Delivery Machines, Anesthesia Ventilators, and Anesthesia Monitors) and Disposables and Accessories (including Anesthesia Circuits (Breathing Circuits), Anesthesia Masks, and Others). The Anesthesia Machines segment is projected to hold the largest market share, estimated at approximately 70-75% of the total market value by 2033, with a projected market size of over USD 500 million in the forecast period. The Anesthesia Workstation sub-segment is expected to witness the highest CAGR within this category. The Disposables and Accessories segment, while smaller in individual product value, demonstrates consistent growth due to its recurring demand, with Anesthesia Circuits being a key contributor. The overall market is expected to reach USD 700 million by 2033.

Key Drivers of South Africa Anesthesia Devices Market Growth

Several factors are propelling the growth of the South Africa Anesthesia Devices Market. Firstly, the increasing burden of non-communicable diseases and the subsequent rise in the number of surgical procedures are direct catalysts. Secondly, significant investments in upgrading healthcare infrastructure, coupled with government initiatives to improve access to quality healthcare, are creating a fertile ground for advanced medical devices. Technological advancements, such as the development of smart anesthesia machines with enhanced patient monitoring capabilities and AI-driven insights, are also key drivers. Furthermore, the growing adoption of minimally invasive surgical techniques necessitates the use of sophisticated anesthesia equipment, further stimulating market demand. The expanding private healthcare sector also plays a crucial role, as these facilities often invest in cutting-edge medical technology.

Challenges in the South Africa Anesthesia Devices Market Sector

Despite the promising growth trajectory, the South Africa Anesthesia Devices Market faces several challenges. High import duties on medical devices can inflate costs, making advanced equipment less accessible for some healthcare providers. The stringent regulatory approval processes can also lead to delays in market entry for new products. Furthermore, a shortage of skilled healthcare professionals, particularly trained anesthesiologists and biomedical engineers, can hinder the effective utilization and maintenance of complex anesthesia equipment. Supply chain disruptions, exacerbated by global logistics issues, can also impact the availability of critical devices and consumables. Intense competition from both global and local players can also lead to price pressures, impacting profit margins.

Leading Players in the South Africa Anesthesia Devices Market Market

- ICU Medical Inc (Smiths Medical)

- Teleflex Inc

- GE Healthcare

- Medtronic PLC

- Mindray Medical International Limited

- Koninklijke Philips NV

- B Braun Melsungen AG

- Aspen

- Draegerwerk AG

Key Developments in South Africa Anesthesia Devices Market Sector

- September 2022: Gradian Health Systems and Penlon launched the Prima Anesthesia Machine, a high-specification anesthesia machine designed for use in busy operating rooms in South Africa and 49 other African countries, enhancing accessibility to advanced anesthesia technology.

- October 2021: Aspen launched one of the leading anesthetics production lines with an investment of USD 204 million in South Africa, bolstering local manufacturing capabilities and ensuring a more stable supply of essential anesthetic agents.

Strategic South Africa Anesthesia Devices Market Market Outlook

The strategic outlook for the South Africa Anesthesia Devices Market is highly positive, driven by a confluence of factors including a growing healthcare demand, supportive government policies, and rapid technological advancements. Future growth will likely be characterized by an increasing adoption of integrated and intelligent anesthesia systems that offer enhanced patient safety and operational efficiency. Strategic opportunities lie in expanding access to these advanced devices in underserved regions through partnerships and localized manufacturing initiatives. The market is expected to witness continued innovation in areas such as point-of-care diagnostics, telemedicine integration for anesthesia management, and sustainable anesthesia practices. Companies that can effectively navigate the regulatory landscape, address supply chain challenges, and provide comprehensive after-sales support will be well-positioned for sustained success in this dynamic market. The focus on patient-centric care and improved clinical outcomes will continue to shape product development and market strategies.

South Africa Anesthesia Devices Market Segmentation

-

1. Product Type

-

1.1. Anesthesia Machines

- 1.1.1. Anesthesia Workstation

- 1.1.2. Anesthesia Delivery Machines

- 1.1.3. Anesthesia Ventilators

- 1.1.4. Anesthesia Monitors

-

1.2. Disposables and Accessories

- 1.2.1. Anesthesia Circuits (Breathing Circuits)

- 1.2.2. Anesthesia Masks

- 1.2.3. Others

-

1.1. Anesthesia Machines

South Africa Anesthesia Devices Market Segmentation By Geography

- 1. South Africa

South Africa Anesthesia Devices Market Regional Market Share

Geographic Coverage of South Africa Anesthesia Devices Market

South Africa Anesthesia Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in Anesthesia Delivery and Monitoring Technology; Increasing Prevalence of Chronic Diseases Coupled with Rising Number of Surgeries

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment Coupled with Reimbursement Issues; Difficulties Associated with the Usage of Anesthesia Devices

- 3.4. Market Trends

- 3.4.1. Anesthesia Monitors Segment is Expected to Register a Significant CAGR in the Anesthesia Devices Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Anesthesia Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Anesthesia Machines

- 5.1.1.1. Anesthesia Workstation

- 5.1.1.2. Anesthesia Delivery Machines

- 5.1.1.3. Anesthesia Ventilators

- 5.1.1.4. Anesthesia Monitors

- 5.1.2. Disposables and Accessories

- 5.1.2.1. Anesthesia Circuits (Breathing Circuits)

- 5.1.2.2. Anesthesia Masks

- 5.1.2.3. Others

- 5.1.1. Anesthesia Machines

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ICU Medical Inc (Smiths Medical)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Teleflex Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mindray Medical International Limited*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koninklijke Philips NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 B Braun Melsungen AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aspen

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Draegerwerk AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 ICU Medical Inc (Smiths Medical)

List of Figures

- Figure 1: South Africa Anesthesia Devices Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South Africa Anesthesia Devices Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Anesthesia Devices Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: South Africa Anesthesia Devices Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: South Africa Anesthesia Devices Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: South Africa Anesthesia Devices Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Anesthesia Devices Market?

The projected CAGR is approximately 6.94%.

2. Which companies are prominent players in the South Africa Anesthesia Devices Market?

Key companies in the market include ICU Medical Inc (Smiths Medical), Teleflex Inc, GE Healthcare, Medtronic PLC, Mindray Medical International Limited*List Not Exhaustive, Koninklijke Philips NV, B Braun Melsungen AG, Aspen, Draegerwerk AG.

3. What are the main segments of the South Africa Anesthesia Devices Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Advancements in Anesthesia Delivery and Monitoring Technology; Increasing Prevalence of Chronic Diseases Coupled with Rising Number of Surgeries.

6. What are the notable trends driving market growth?

Anesthesia Monitors Segment is Expected to Register a Significant CAGR in the Anesthesia Devices Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Equipment Coupled with Reimbursement Issues; Difficulties Associated with the Usage of Anesthesia Devices.

8. Can you provide examples of recent developments in the market?

September 2022: Gradian Health Systems and Penlon launched the Prima Anesthesia Machine, a high-specification anesthesia machine designed for use in busy operating rooms in South Africa and 49 other African countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Anesthesia Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Anesthesia Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Anesthesia Devices Market?

To stay informed about further developments, trends, and reports in the South Africa Anesthesia Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence