Key Insights

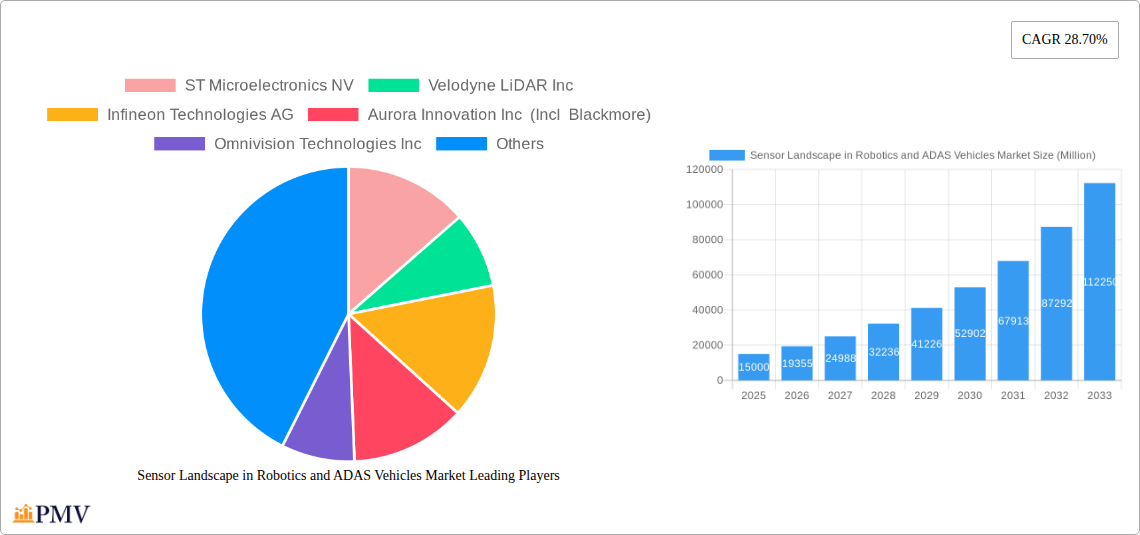

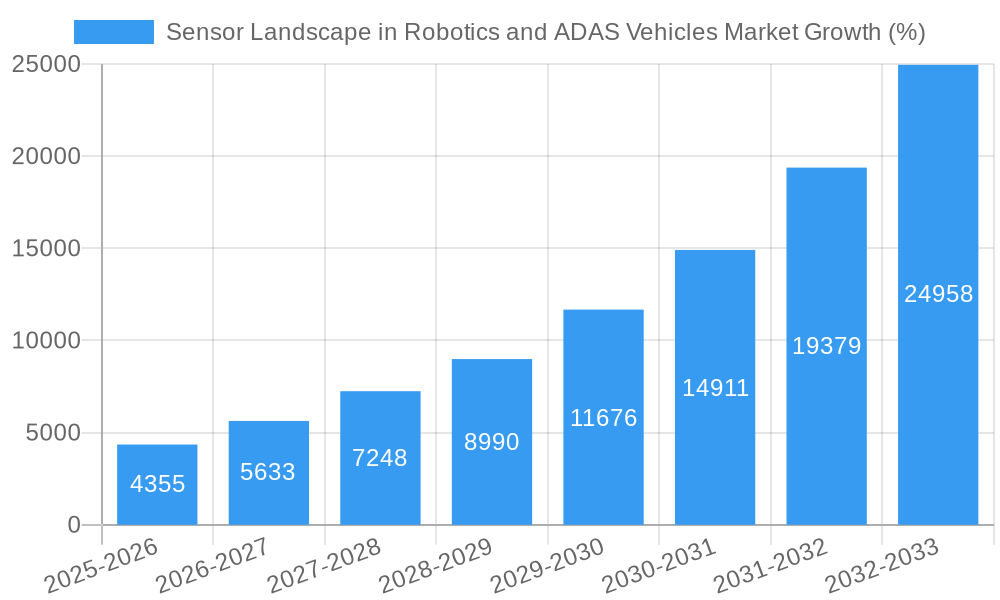

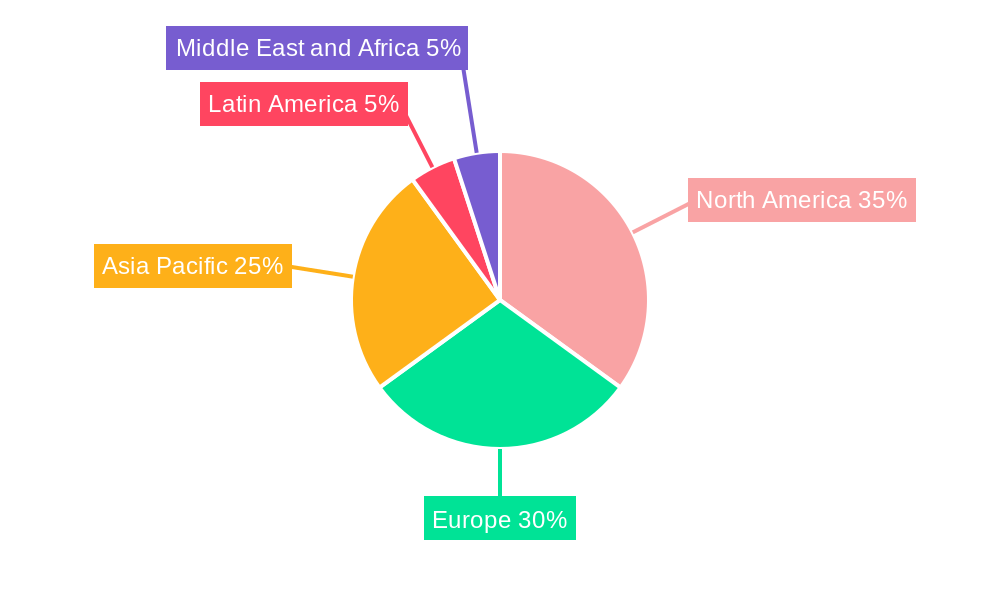

The Sensor Landscape in Robotics and ADAS Vehicles Market is experiencing explosive growth, driven by the increasing adoption of autonomous driving technologies and advancements in robotics. With a Compound Annual Growth Rate (CAGR) of 28.70% from 2019 to 2033, the market is projected to reach substantial value by 2033. This growth is fueled by several key factors. The demand for enhanced safety features in Advanced Driver-Assistance Systems (ADAS) is a major driver, pushing automotive manufacturers to integrate more sophisticated sensor technologies like LiDAR, radar, and cameras for functionalities such as lane keeping assist, adaptive cruise control, and automatic emergency braking. Simultaneously, the robotics sector is witnessing a surge in the deployment of autonomous robots across various applications, necessitating advanced sensing capabilities for navigation, object detection, and manipulation. Within the sensor types, LiDAR is anticipated to hold a significant market share due to its high accuracy in 3D mapping and object recognition. However, the high cost of LiDAR systems is a significant restraint. Radar sensors, while less expensive, provide robust performance in challenging weather conditions, making them a crucial component in both robotic and ADAS applications. Camera modules are increasingly used for image processing and object recognition, leveraging advanced computer vision techniques. Competition among established players like STMicroelectronics, Infineon Technologies, and Bosch, alongside innovative startups like Luminar and Ouster, is driving innovation and price reductions. The market is geographically diverse, with North America and Europe currently leading in adoption, but Asia Pacific is poised for substantial growth in the coming years, given its strong manufacturing base and expanding automotive sector.

The market segmentation highlights the distinct needs of robotic and ADAS applications. While both utilize similar sensor types, the specific requirements vary. Robotics often integrates GNSS and Inertial Measurement Units for precise localization and motion tracking, whereas ADAS focuses primarily on LiDAR, radar, and camera modules for environmental perception. This differentiation is shaping the technological landscape and influencing investment strategies within the industry. Future growth will likely be shaped by further miniaturization of sensor technology, the development of more robust and reliable sensor fusion algorithms, and the increasing integration of artificial intelligence for real-time data processing and decision-making. The development and integration of 5G and edge computing are anticipated to accelerate progress by enabling seamless data transmission and faster processing speeds for real-time applications.

This detailed report provides an in-depth analysis of the Sensor Landscape in Robotics and ADAS Vehicles Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033, using 2025 as the base year. The report segments the market by sensor type (LiDAR, Radar, Camera Modules, GNSS, and Inertial Measurement Units), vehicle type (robotic vehicles vs. ADAS vehicles), and geographic regions, providing a granular understanding of the market's dynamics and growth potential. The report includes detailed profiles of key players such as ST Microelectronics NV, Velodyne LiDAR Inc, Infineon Technologies AG, Aurora Innovation Inc (Incl Blackmore), Omnivision Technologies Inc, Ouster Inc, NXP Semiconductor N V, ON Semiconductor Corp, Continental AG, Waymo LLC, Luminar Technologies Inc, Robert Bosch GmbH, Valeo SA, and Texas Instruments Incorporated. This is not an exhaustive list.

Sensor Landscape in Robotics and ADAS Vehicles Market Market Structure & Competitive Dynamics

The Sensor Landscape in Robotics and ADAS Vehicles Market exhibits a moderately consolidated structure, with a few major players holding significant market share. The market is characterized by intense competition, driven by rapid technological advancements and increasing demand for autonomous vehicles. Innovation ecosystems are crucial, fostering collaborations and partnerships among sensor manufacturers, automotive companies, and technology providers. Regulatory frameworks, particularly concerning safety and data privacy, play a significant role in shaping market dynamics. Product substitution is a potential threat, with new sensor technologies continually emerging. End-user trends, particularly the growing adoption of autonomous driving features, are a key market growth driver. Significant M&A activities have reshaped the competitive landscape, with deal values exceeding xx Million in recent years. For example, the acquisition of [Company A] by [Company B] in [Year] significantly altered market share distribution.

- Market Concentration: Moderately consolidated, with the top 5 players holding approximately xx% of the market share in 2025.

- Innovation Ecosystems: Strong collaborations between sensor manufacturers, automotive OEMs, and technology companies.

- Regulatory Frameworks: Stringent safety regulations influence product development and adoption.

- M&A Activities: Significant consolidation through acquisitions, with total deal values exceeding xx Million from 2019-2024.

Sensor Landscape in Robotics and ADAS Vehicles Market Industry Trends & Insights

The Sensor Landscape in Robotics and ADAS Vehicles Market is experiencing robust growth, driven by several key factors. The increasing demand for autonomous vehicles and advanced driver-assistance systems (ADAS) is a primary growth catalyst. Technological advancements, such as the development of high-resolution LiDAR sensors and improved image processing algorithms, are further fueling market expansion. Consumer preferences for enhanced safety and convenience features are also driving demand. The market is characterized by a high CAGR of xx% during the forecast period (2025-2033). Market penetration of LiDAR sensors in ADAS vehicles is expected to reach xx% by 2033, significantly impacting market dynamics. Competitive dynamics are intensifying, with companies investing heavily in R&D to develop innovative and cost-effective sensor solutions. The rise of software-defined sensors is also changing the competitive landscape, allowing for greater flexibility and customization.

Dominant Markets & Segments in Sensor Landscape in Robotics and ADAS Vehicles Market

The North American region is currently the dominant market for sensor technologies in robotics and ADAS vehicles, driven by strong demand from the automotive industry and significant investments in autonomous vehicle development. Within sensor types, the LiDAR segment is experiencing the fastest growth, particularly in robotic vehicles, due to its ability to provide high-resolution 3D mapping. The Camera Modules segment maintains a significant share, particularly in ADAS vehicles, due to its cost-effectiveness and wide-ranging applications.

- Key Drivers of North American Dominance:

- Strong government support for autonomous vehicle development.

- High adoption rates of ADAS features.

- Presence of major automotive manufacturers and technology companies.

- LiDAR Segment Dominance:

- Superior 3D mapping capabilities.

- Increasing accuracy and decreasing costs.

- Camera Module Segment Significance:

- Cost-effectiveness and mature technology.

- Wide range of applications in ADAS.

Sensor Landscape in Robotics and ADAS Vehicles Market Product Innovations

Recent innovations include the development of solid-state LiDAR sensors, offering improved durability and reliability compared to mechanical LiDAR systems. The integration of artificial intelligence (AI) and machine learning (ML) algorithms is enhancing sensor performance and enabling advanced features like object recognition and scene understanding. These advancements are expanding the applications of sensors across diverse sectors, improving safety and efficiency in robotic vehicles and enhancing driver assistance in ADAS vehicles. The competitive advantage lies in developing highly accurate, reliable, and cost-effective sensors capable of operating in challenging environmental conditions.

Report Segmentation & Scope

This report segments the Sensor Landscape in Robotics and ADAS Vehicles Market by sensor type: LiDAR (robotic vehicles vs. ADAS vehicles), Radar (robotic vehicles vs. ADAS vehicles), Camera Modules (robotic vehicles vs. ADAS vehicles), GNSS (robotic vehicles), and Inertial Measurement Units (robotic vehicles). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. For instance, the LiDAR market is projected to grow at a CAGR of xx% from 2025 to 2033, driven by increasing demand from the autonomous vehicle sector. The Radar segment is experiencing steady growth, with a CAGR of xx%, largely attributed to its robustness and reliability in various weather conditions. The Camera Modules segment, while mature, continues to witness growth driven by the proliferation of ADAS features. The GNSS and Inertial Measurement Units segments are vital for precise positioning and navigation in robotic vehicles.

Key Drivers of Sensor Landscape in Robotics and ADAS Vehicles Market Growth

The market's growth is primarily fueled by the burgeoning demand for autonomous vehicles, increasing adoption of ADAS features, and technological advancements leading to more accurate, reliable, and cost-effective sensors. Government regulations mandating safety features and supportive policies for autonomous vehicle development further stimulate growth. The decreasing cost of sensor technologies and the increasing availability of high-performance computing capabilities are also significant drivers.

Challenges in the Sensor Landscape in Robotics and ADAS Vehicles Market Sector

Significant challenges include the high cost of development and production of certain sensor types, particularly advanced LiDAR systems. Supply chain disruptions can affect the availability and pricing of critical components. Competition among manufacturers is fierce, requiring continuous innovation and cost optimization. Regulatory hurdles and safety concerns related to autonomous driving also pose challenges. The complexity of integrating multiple sensor types into a cohesive system adds to development complexity and cost.

Leading Players in the Sensor Landscape in Robotics and ADAS Vehicles Market Market

- ST Microelectronics NV

- Velodyne LiDAR Inc

- Infineon Technologies AG

- Aurora Innovation Inc (Incl Blackmore)

- Omnivision Technologies Inc

- Ouster Inc

- NXP Semiconductor N V

- ON Semiconductor Corp

- Continental AG

- Waymo LLC

- Luminar Technologies Inc

- Robert Bosch GmbH

- Valeo SA

- Texas Instruments Incorporated

- *List Not Exhaustive

Key Developments in Sensor Landscape in Robotics and ADAS Vehicles Market Sector

- January 2023: Company X launched a new solid-state LiDAR sensor with improved range and accuracy.

- April 2022: Company Y announced a strategic partnership with Company Z to develop advanced sensor fusion algorithms.

- October 2021: Company A acquired Company B, expanding its sensor portfolio and market reach.

- Further key developments to be included in the final report.

Strategic Sensor Landscape in Robotics and ADAS Vehicles Market Market Outlook

The Sensor Landscape in Robotics and ADAS Vehicles Market presents significant growth opportunities in the coming years. The increasing adoption of autonomous vehicles and the continuous development of advanced sensor technologies will drive market expansion. Strategic partnerships and collaborations will become even more crucial in navigating the competitive landscape. Companies that can effectively integrate multiple sensor types, leverage AI and ML algorithms, and offer cost-effective solutions will be best positioned for success. The market is expected to reach xx Million by 2033, presenting lucrative opportunities for both established players and new entrants.

Sensor Landscape in Robotics and ADAS Vehicles Market Segmentation

-

1. Type

- 1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 1.3. Camera M

- 1.4. GNSS (Robotic Vehicles)

- 1.5. Inertial Measurement Units (Robotic Vehicles)

Sensor Landscape in Robotics and ADAS Vehicles Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Sensor Landscape in Robotics and ADAS Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 28.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Rising awareness on worker safety & stringent regulations; Steady increase in industrial sector in key emerging countries in Asia-Pacific

- 3.2.2 coupled with expansion projects

- 3.3. Market Restrains

- 3.3.1. High Intial Investment

- 3.4. Market Trends

- 3.4.1. Radar Sensor is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 5.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 5.1.3. Camera M

- 5.1.4. GNSS (Robotic Vehicles)

- 5.1.5. Inertial Measurement Units (Robotic Vehicles)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 6.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 6.1.3. Camera M

- 6.1.4. GNSS (Robotic Vehicles)

- 6.1.5. Inertial Measurement Units (Robotic Vehicles)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 7.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 7.1.3. Camera M

- 7.1.4. GNSS (Robotic Vehicles)

- 7.1.5. Inertial Measurement Units (Robotic Vehicles)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 8.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 8.1.3. Camera M

- 8.1.4. GNSS (Robotic Vehicles)

- 8.1.5. Inertial Measurement Units (Robotic Vehicles)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 9.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 9.1.3. Camera M

- 9.1.4. GNSS (Robotic Vehicles)

- 9.1.5. Inertial Measurement Units (Robotic Vehicles)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 10.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 10.1.3. Camera M

- 10.1.4. GNSS (Robotic Vehicles)

- 10.1.5. Inertial Measurement Units (Robotic Vehicles)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 ST Microelectronics NV

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Velodyne LiDAR Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Infineon Technologies AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Aurora Innovation Inc (Incl Blackmore)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Omnivision Technologies Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Ouster Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 NXP Semiconductor N V

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ON Semiconductor Corp

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Continental AG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Waymo LLC

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Luminar Technologies Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Robert Bosch GmbH

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Valeo SA

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Texas Instruments Incorporated*List Not Exhaustive

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 ST Microelectronics NV

List of Figures

- Figure 1: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sensor Landscape in Robotics and ADAS Vehicles Market?

The projected CAGR is approximately 28.70%.

2. Which companies are prominent players in the Sensor Landscape in Robotics and ADAS Vehicles Market?

Key companies in the market include ST Microelectronics NV, Velodyne LiDAR Inc, Infineon Technologies AG, Aurora Innovation Inc (Incl Blackmore), Omnivision Technologies Inc, Ouster Inc, NXP Semiconductor N V, ON Semiconductor Corp, Continental AG, Waymo LLC, Luminar Technologies Inc, Robert Bosch GmbH, Valeo SA, Texas Instruments Incorporated*List Not Exhaustive.

3. What are the main segments of the Sensor Landscape in Robotics and ADAS Vehicles Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising awareness on worker safety & stringent regulations; Steady increase in industrial sector in key emerging countries in Asia-Pacific. coupled with expansion projects.

6. What are the notable trends driving market growth?

Radar Sensor is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Intial Investment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sensor Landscape in Robotics and ADAS Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sensor Landscape in Robotics and ADAS Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sensor Landscape in Robotics and ADAS Vehicles Market?

To stay informed about further developments, trends, and reports in the Sensor Landscape in Robotics and ADAS Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence