Key Insights

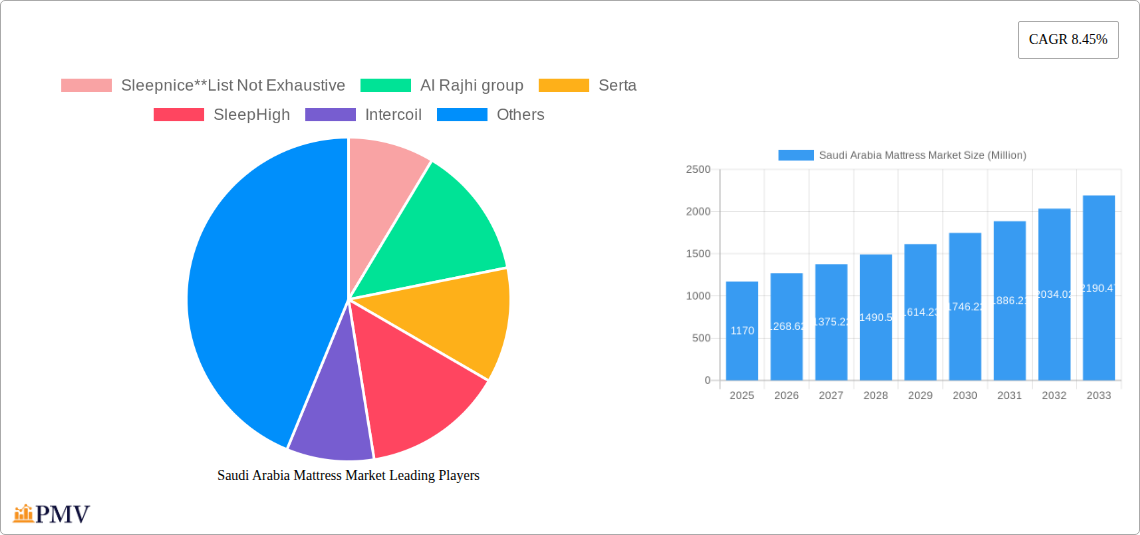

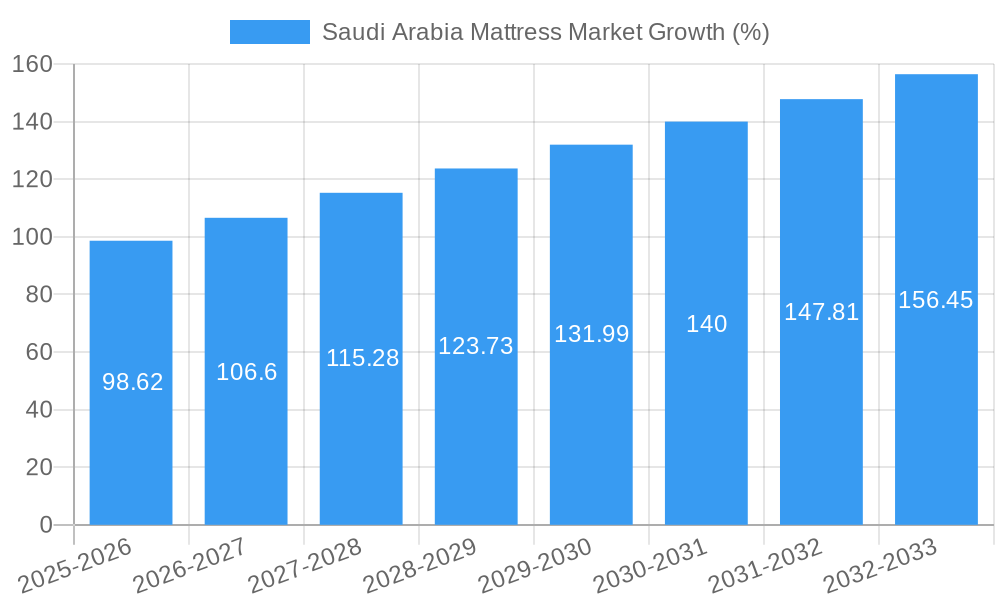

The Saudi Arabia mattress market, valued at $1.17 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.45% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes and a burgeoning middle class are driving increased consumer spending on home furnishings, including higher-quality mattresses. A growing awareness of the importance of sleep hygiene and its impact on overall health is also contributing to demand for more comfortable and supportive mattresses. Further propelling market growth is the increasing popularity of online retail channels, providing consumers with greater choice and convenience. The market is segmented by type (inner spring, memory foam, latex, and others), application (residential and commercial), and distribution channel (online and offline). The preference for premium mattress types like memory foam and latex is expected to increase, driven by rising awareness of their health benefits and enhanced comfort. The residential segment dominates the market, although the commercial sector is anticipated to show significant growth, driven by the hospitality industry's increasing focus on guest comfort.

Competition in the Saudi Arabian mattress market is intense, with both international and domestic players vying for market share. Established brands like Serta, Sealy, and Tempur compete alongside regional players such as Sleepnice, AI Rajhi Group, and ALMazro. These companies are focusing on product innovation, strategic partnerships, and targeted marketing campaigns to capture a larger share of the expanding market. However, challenges remain, including the fluctuating price of raw materials and the potential impact of economic downturns on consumer spending. Nevertheless, the long-term outlook for the Saudi Arabian mattress market remains positive, driven by sustained economic growth and evolving consumer preferences. The market is expected to witness a significant expansion in the coming years, presenting lucrative opportunities for both established and emerging players.

Saudi Arabia Mattress Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia mattress market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to understand and capitalize on this dynamic sector. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. Expect detailed segmentation by type (Inner Spring, Memory Foam, Latex, Other Types), application (Residential, Commercial), and distribution channel (Online, Offline), revealing market size and growth projections in Millions.

Saudi Arabia Mattress Market Market Structure & Competitive Dynamics

The Saudi Arabian mattress market exhibits a moderately concentrated structure, with several key players holding significant market share. The market is characterized by a mix of both international and domestic brands, competing on factors such as price, quality, technology, and branding. Innovation within the ecosystem is driven by the introduction of technologically advanced mattresses incorporating features such as pressure-relieving systems, temperature regulation, and smart functionalities. The regulatory framework plays a significant role in shaping market practices, impacting product safety standards and import/export regulations. Product substitutes, such as traditional bedding or customized sleep solutions, represent a moderate level of competition. End-user trends are heavily influenced by rising disposable incomes, changing lifestyle preferences, and increased awareness of sleep hygiene. The market has seen a moderate level of M&A activity in recent years, with deal values ranging from xx Million to xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Innovation Ecosystem: Active, focused on technological advancements in mattress materials and functionalities.

- Regulatory Framework: Influences product safety, labeling, and import/export processes.

- Product Substitutes: Traditional bedding and customized sleep solutions pose a moderate competitive threat.

- End-User Trends: Growing disposable incomes and awareness of sleep quality are key drivers.

- M&A Activity: Moderate activity observed, with deal values fluctuating yearly.

Saudi Arabia Mattress Market Industry Trends & Insights

The Saudi Arabia mattress market is experiencing robust growth, driven by a confluence of factors. Rising disposable incomes among the population are fueling demand for higher-quality and more technologically advanced mattresses. A growing awareness of the importance of sleep hygiene and its impact on overall health is further boosting market expansion. The market has demonstrated a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Technological advancements, including the incorporation of smart features and innovative materials, are reshaping the competitive landscape. Consumer preferences are shifting towards premium, technologically advanced mattresses offering enhanced comfort, support, and health benefits. Market penetration of advanced mattress technologies remains relatively low, presenting significant growth opportunities for innovative players.

Dominant Markets & Segments in Saudi Arabia Mattress Market

The residential segment dominates the Saudi Arabia mattress market, driven by a large population and increasing urbanization. Within the product type segment, inner spring mattresses currently hold the largest market share, although memory foam mattresses are experiencing strong growth due to increasing consumer preference for enhanced comfort and support. The offline distribution channel remains the primary sales avenue, although online sales are gradually gaining traction.

- Leading Segment: Residential applications represent the largest segment by application.

- Key Drivers (Residential Segment): Increasing urbanization, rising disposable incomes, and a young population.

- Dominant Product Type: Inner spring mattresses hold the largest market share, followed by memory foam.

- Key Drivers (Memory Foam): Growing awareness of comfort and support benefits.

- Primary Distribution Channel: Offline channels dominate, but online sales are showing growth.

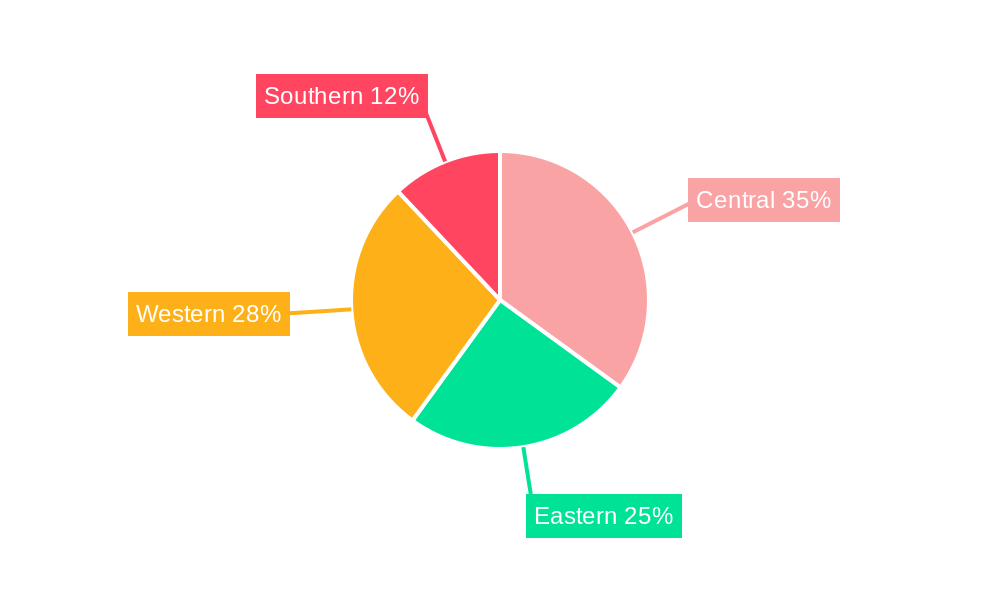

Regional Dominance: The major cities in Saudi Arabia contribute the majority of market value, mainly due to higher population density and purchasing power.

Saudi Arabia Mattress Market Product Innovations

Recent years have witnessed a surge in product innovation within the Saudi Arabian mattress market. Key trends include the incorporation of advanced technologies such as pressure-relieving systems, temperature regulation, and smart features. Manufacturers are focusing on developing mattresses that offer enhanced comfort, support, and health benefits, catering to the evolving needs and preferences of consumers. The introduction of eco-friendly and sustainable materials is also gaining traction, in line with the growing environmental consciousness among consumers. These innovative products are gaining competitive advantages by offering superior comfort, improved sleep quality, and differentiated value propositions.

Report Segmentation & Scope

This report provides a detailed segmentation of the Saudi Arabia mattress market based on type, application, and distribution channel.

- By Type: Inner spring, memory foam, latex, and other types, with detailed analysis of market size, growth projections, and competitive dynamics for each segment.

- By Application: Residential and commercial sectors, with analysis of market trends, growth drivers, and specific applications within each sector.

- By Distribution Channel: Online and offline channels, exploring the market share, growth potential, and strategic considerations for each.

Key Drivers of Saudi Arabia Mattress Market Growth

Several key factors are driving the growth of the Saudi Arabia mattress market:

- Rising Disposable Incomes: Increasing purchasing power fuels demand for higher-quality mattresses.

- Growing Awareness of Sleep Hygiene: Increased understanding of the importance of sleep for overall well-being.

- Technological Advancements: Innovation in materials and features enhances comfort and functionality.

- Government Initiatives: Supporting economic development and infrastructure development.

Challenges in the Saudi Arabia Mattress Market Sector

The Saudi Arabia mattress market faces several challenges:

- Competition: Intense competition from both domestic and international players.

- Supply Chain Disruptions: Global events can impact raw material availability and production.

- Economic Fluctuations: Changes in economic conditions may affect consumer spending.

Leading Players in the Saudi Arabia Mattress Market Market

- Sleepnice

- AI Rajhi group

- Serta

- SleepHigh

- Intercoil

- King Koil

- ALMazro

- Sealy

- Tempur

- AI-Mutlaq

Key Developments in Saudi Arabia Mattress Market Sector

- February 2022: King Koil launched a new mattress, "Sleep your aches and pains away," featuring advanced technologies like the APS system, Bio Cool Body Balance technology, iFusion technology, and Smart Cushion Aero System technology. This launch signifies a focus on technological advancements to enhance sleep quality and address consumer needs.

- March 2021: Intercoil significantly expanded its manufacturing capacity, aiming for a global market reach. This expansion highlights the ambition and growth potential within the industry.

Strategic Saudi Arabia Mattress Market Market Outlook

The Saudi Arabia mattress market presents significant growth potential, driven by factors such as increasing urbanization, rising disposable incomes, and a growing awareness of sleep hygiene. Strategic opportunities exist for companies that can leverage technological innovation, focus on sustainability, and effectively target specific consumer segments. The market is expected to witness continued expansion and diversification, with a focus on premium, technologically advanced products.

Saudi Arabia Mattress Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Saudi Arabia Mattress Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Challenges in Distribution and Logistics

- 3.4. Market Trends

- 3.4.1. Increase in Home Ownership Drives the Demand for Mattress

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Mattress Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Central Saudi Arabia Mattress Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Mattress Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Mattress Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Mattress Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Sleepnice**List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 AI Rajhi group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Serta

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SleepHigh

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Intercoil

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 King Koil

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ALMazro

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sealy

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Tempur

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AI-Mutlaq

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Sleepnice**List Not Exhaustive

List of Figures

- Figure 1: Saudi Arabia Mattress Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Mattress Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Mattress Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Mattress Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Saudi Arabia Mattress Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Saudi Arabia Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Saudi Arabia Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Saudi Arabia Mattress Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Saudi Arabia Mattress Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Saudi Arabia Mattress Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Central Saudi Arabia Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Eastern Saudi Arabia Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Western Saudi Arabia Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Southern Saudi Arabia Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Saudi Arabia Mattress Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: Saudi Arabia Mattress Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: Saudi Arabia Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: Saudi Arabia Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: Saudi Arabia Mattress Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: Saudi Arabia Mattress Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Mattress Market?

The projected CAGR is approximately 8.45%.

2. Which companies are prominent players in the Saudi Arabia Mattress Market?

Key companies in the market include Sleepnice**List Not Exhaustive, AI Rajhi group, Serta, SleepHigh, Intercoil, King Koil, ALMazro, Sealy, Tempur, AI-Mutlaq.

3. What are the main segments of the Saudi Arabia Mattress Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Home Ownership Drives the Demand for Mattress.

7. Are there any restraints impacting market growth?

Challenges in Distribution and Logistics.

8. Can you provide examples of recent developments in the market?

February 2022: King Koil launched a new mattress "Sleep your aches and pains away". The mattress is integrated with various technologies like the Advanced Pressure Support (APS) system, a revolutionary support that gives necessary support to the spine, taking into consideration the weight distribution of the human body. Other technologies in the mattress include Bio Cool Body Balance technology, iFusion technology, Smart Cushion Aero System technology, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Mattress Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence