Key Insights

The Saudi Arabian interior design market, valued at $3.66 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 4.81% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, significant investments in infrastructure development and construction projects across the Kingdom are creating substantial demand for interior design services for both residential and commercial spaces. Secondly, a rising affluent population with a growing disposable income is increasingly focusing on enhancing the aesthetics and functionality of their homes and businesses, leading to higher spending on premium interior design solutions. Thirdly, the Saudi Vision 2030 initiative is playing a crucial role, promoting diversification of the economy and encouraging investments in tourism and hospitality, thereby fueling demand for high-quality interior design within hotels, resorts, and entertainment venues. Furthermore, the growing adoption of sustainable and smart home technologies within interior design projects contributes to market expansion.

Saudi Arabia Interior Design Market Market Size (In Billion)

However, the market also faces certain restraints. Fluctuations in oil prices can impact overall economic growth and potentially affect investment in the construction and design sectors. Competition among numerous design firms, both local and international, can lead to price pressures. Furthermore, the availability of skilled labor and designers capable of meeting the increasing demand for specialized services represents a potential challenge. Despite these constraints, the long-term outlook for the Saudi Arabian interior design market remains positive, driven by sustained government investment, economic diversification, and a rising demand for aesthetically pleasing and functional spaces. The market segmentation is likely diverse, encompassing residential, commercial, hospitality, and retail segments, each with unique growth trajectories and competitive landscapes. Prominent players such as Idegree Design, Huda Lighting, and others contribute to the dynamic market landscape.

Saudi Arabia Interior Design Market Company Market Share

Saudi Arabia Interior Design Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia interior design market, encompassing market structure, competitive dynamics, industry trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers crucial insights for businesses, investors, and stakeholders seeking to navigate this dynamic market. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024.

Saudi Arabia Interior Design Market Structure & Competitive Dynamics

The Saudi Arabia interior design market exhibits a moderately concentrated structure, with a mix of large multinational firms and smaller, locally established businesses. Key players include Idegree Design, Huda Lighting, JIDA Design, Esperiri Milano, Yasmin Interiors, Aljeel Architects, Amsad Architectural Associates, Architectural Scene, C&P, Comelite Architecture and Structure, and D&D Est. However, the list is not exhaustive. Market share data for individual players is currently unavailable (xx), but the market shows signs of increasing consolidation through mergers and acquisitions (M&A) activity. Recent significant M&A activity includes:

- March 2022: Saudi Arabia's Public Investment Fund (PIF) acquired a controlling stake in Depa, an interior design and specialty contracting firm, for USD 480 Million. This deal significantly impacted market dynamics, consolidating the sector's power structure.

The regulatory framework is generally supportive of market growth, with ongoing infrastructure developments and government initiatives promoting real estate and construction projects fueling demand. Innovation is driven by technological advancements in materials, design software, and project management tools. The market also faces competitive pressures from substitute products, such as pre-fabricated interior solutions and modular designs. End-user trends indicate a growing preference for sustainable, technologically advanced, and customized interior solutions, further shaping the market landscape. The total value of M&A deals within the past five years is estimated at USD xx Million.

Saudi Arabia Interior Design Market Industry Trends & Insights

The Saudi Arabia interior design market is experiencing robust growth, driven by several key factors. The country's Vision 2030 initiative, aimed at diversifying the economy and improving the quality of life, has significantly boosted the real estate and construction sectors. This increased investment in infrastructure projects—residential, commercial, and hospitality—is a major driver for the interior design market. Technological disruptions, such as the adoption of Building Information Modeling (BIM) and virtual reality (VR) in design processes, are enhancing efficiency and creating new market opportunities. Consumer preferences are shifting towards sophisticated and bespoke designs, emphasizing sustainability and incorporating smart home technologies. The market's competitive landscape is becoming more intense, with both local and international players vying for market share. The Compound Annual Growth Rate (CAGR) for the market during the period 2019-2024 is estimated at xx%, with an expected market penetration of xx% by 2033.

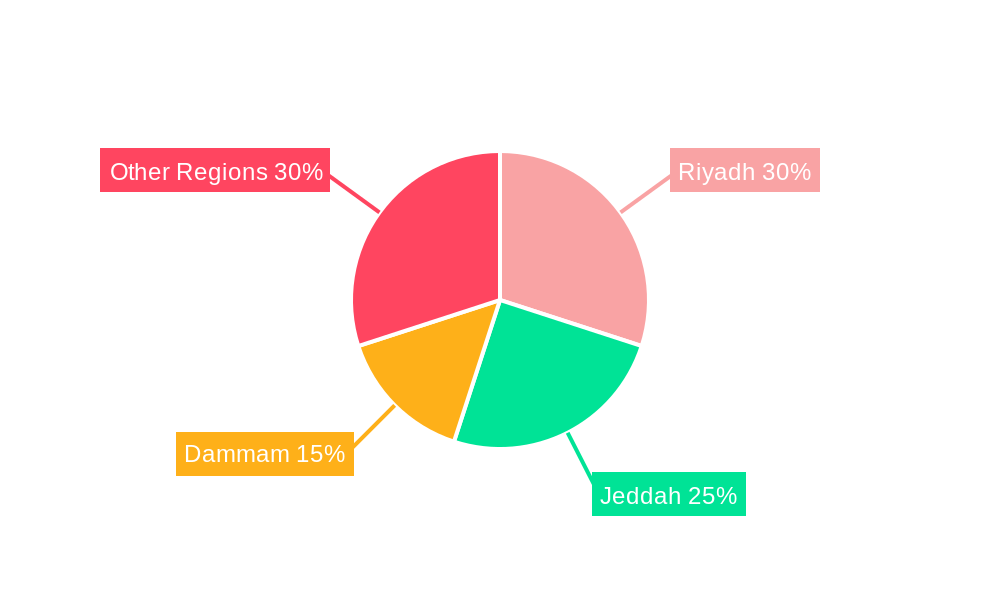

Dominant Markets & Segments in Saudi Arabia Interior Design Market

The Riyadh region is currently the dominant market for interior design services in Saudi Arabia. This is attributed to the concentration of major commercial and residential developments within the city. The high concentration of corporate headquarters and significant government projects in Riyadh further contributes to this dominance. Key drivers contributing to this region's prominence include:

- Economic Policies: Vision 2030 initiatives prioritize infrastructure development, leading to increased construction activity.

- Infrastructure Development: Massive investments in infrastructure—including the development of new cities and urban regeneration projects—create substantial demand.

- Government Spending: Significant government spending on mega-projects further stimulates the market.

- High Population Density: Riyadh’s large and growing population base creates a sustained demand for residential and commercial interior design services.

This dominance is expected to continue throughout the forecast period, although other major cities, such as Jeddah and Dammam, are also experiencing significant growth.

Saudi Arabia Interior Design Market Product Innovations

Recent product innovations in the Saudi Arabia interior design market focus on sustainable materials, smart home integration, and technologically advanced design solutions. The increasing adoption of BIM and VR technologies is streamlining design processes and improving collaboration among stakeholders. These innovations offer improved efficiency, enhanced customization options, and meet the growing demand for sustainable and technologically integrated spaces. The market is also seeing a rise in the use of eco-friendly and locally sourced materials, aligning with global sustainability trends and government initiatives promoting local content.

Report Segmentation & Scope

The Saudi Arabia Interior Design Market is segmented by project type (residential, commercial, hospitality, retail), design style (modern, traditional, contemporary), and service type (interior design, space planning, project management). Each segment displays varying growth rates and competitive dynamics. The residential segment is expected to maintain significant growth driven by rising urbanization and disposable incomes. The commercial segment is projected to grow steadily, driven by increasing investments in office spaces and retail infrastructure. The hospitality segment also presents significant opportunities due to the ongoing expansion of the tourism and hospitality sector. Market size projections for each segment are available within the full report.

Key Drivers of Saudi Arabia Interior Design Market Growth

Several factors are driving the growth of the Saudi Arabia interior design market. The government's Vision 2030 initiative is creating unprecedented opportunities. Significant investments in infrastructure development are fueling demand for interior design services across all sectors. Technological advancements in design software and materials are enhancing efficiency and creating new possibilities for innovative solutions. Furthermore, a rising middle class with increased disposable income is driving demand for sophisticated interior designs for both residential and commercial spaces. Finally, a growing emphasis on sustainability and green building practices is reshaping consumer preferences and leading to new market niches.

Challenges in the Saudi Arabia Interior Design Market Sector

The Saudi Arabia interior design market faces challenges, including reliance on imported materials, leading to supply chain vulnerabilities and potential price fluctuations. Competition from regional and international players can intensify price pressures. Although the regulatory environment is generally supportive, navigating bureaucratic processes and obtaining necessary permits can sometimes pose challenges. Skill shortages in specific areas of expertise within the design profession and fluctuating energy prices may also impact project costs and timelines. These factors could collectively impede the growth trajectory of the market, although the overall outlook remains positive.

Leading Players in the Saudi Arabia Interior Design Market Market

- Idegree Design

- Huda Lighting

- JIDA Design

- Esperiri Milano

- Yasmin Interiors

- Aljeel Architects

- Amsad Architectural Associates

- Architectural Scene

- C&P

- Comelite Architecture and Structure

- D&D Est

(List Not Exhaustive)

Key Developments in Saudi Arabia Interior Design Market Sector

- October 2023: Aljazira Capital and Osus Real Estate Co. launched a USD 453.2 Million real estate investment fund focused on northern Riyadh, boosting demand for interior design services in residential, hotel, office, and commercial projects.

- March 2022: Saudi Arabia's PIF acquired a controlling stake in Depa for USD 480 Million, signifying significant consolidation within the sector.

Strategic Saudi Arabia Interior Design Market Outlook

The Saudi Arabia interior design market presents substantial growth opportunities over the next decade. Continued government investments, population growth, and the ongoing implementation of Vision 2030 will all fuel strong demand. Strategic players focusing on sustainable design practices, incorporating smart home technologies, and offering bespoke solutions will be best positioned to capitalize on this expanding market. Furthermore, collaborations between local and international firms can foster innovation and market penetration. The market's long-term outlook is promising, with consistent growth expected throughout the forecast period.

Saudi Arabia Interior Design Market Segmentation

-

1. End-Use

- 1.1. Residential

-

1.2. Commercial

- 1.2.1. Hospitality

- 1.2.2. Healthcare

- 1.2.3. Education

- 1.2.4. Offices

- 1.2.5. Others

Saudi Arabia Interior Design Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Interior Design Market Regional Market Share

Geographic Coverage of Saudi Arabia Interior Design Market

Saudi Arabia Interior Design Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of Real Estate in the Country; Increasing Rate of Urbanization

- 3.3. Market Restrains

- 3.3.1. Expansion of Real Estate in the Country; Increasing Rate of Urbanization

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Residential Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Interior Design Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-Use

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.2.1. Hospitality

- 5.1.2.2. Healthcare

- 5.1.2.3. Education

- 5.1.2.4. Offices

- 5.1.2.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End-Use

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Idegree Design

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Huda lighting

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JIDA Design

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Esperiri Milano

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yasmin Interiors

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aljeel Architects

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amsad Architectural Associates

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Architectural Scene

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C&P

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Comelite Architecture and Structure

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 D&D Est**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Idegree Design

List of Figures

- Figure 1: Saudi Arabia Interior Design Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Interior Design Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Interior Design Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 2: Saudi Arabia Interior Design Market Volume Billion Forecast, by End-Use 2020 & 2033

- Table 3: Saudi Arabia Interior Design Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Interior Design Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Interior Design Market Revenue Million Forecast, by End-Use 2020 & 2033

- Table 6: Saudi Arabia Interior Design Market Volume Billion Forecast, by End-Use 2020 & 2033

- Table 7: Saudi Arabia Interior Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Interior Design Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Interior Design Market?

The projected CAGR is approximately 4.81%.

2. Which companies are prominent players in the Saudi Arabia Interior Design Market?

Key companies in the market include Idegree Design, Huda lighting, JIDA Design, Esperiri Milano, Yasmin Interiors, Aljeel Architects, Amsad Architectural Associates, Architectural Scene, C&P, Comelite Architecture and Structure, D&D Est**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Interior Design Market?

The market segments include End-Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of Real Estate in the Country; Increasing Rate of Urbanization.

6. What are the notable trends driving market growth?

Increasing Demand for Residential Real Estate.

7. Are there any restraints impacting market growth?

Expansion of Real Estate in the Country; Increasing Rate of Urbanization.

8. Can you provide examples of recent developments in the market?

October 2023: Saudi Arabia’s Aljazira Capital and Osus Real Estate Co. launched a private closed-end real estate investment fund with a target investment volume of more than USD 453.2 Million focused on developing residential, hotel, office, and commercial properties in northern Riyadh, expanding the business of Interior design market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Interior Design Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Interior Design Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Interior Design Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Interior Design Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence