Key Insights

The Saudi Arabian industrial electrical components market is poised for significant expansion, propelled by substantial investments in infrastructure across the power utility and oil & gas sectors. This growth is primarily fueled by the nation's ambitious Vision 2030 initiative, which prioritizes economic diversification and infrastructure modernization. The market is projected to grow at a compound annual growth rate (CAGR) of 11.7%. The estimated market size for the base year 2023 is 1.81 billion. Key growth drivers include the increasing demand for switchgears and transformers due to expanding power generation and transmission capacity, the rising adoption of automation technologies in substation automation, and the growing integration of energy-efficient LED lighting. While precise market figures for future years require ongoing analysis, continued infrastructure investment is expected to support robust market growth. This market encompasses a wide range of components including switchgears, transformers, electric motors, control devices, automation systems, and LED lighting. Potential market restraints, such as fluctuations in oil prices and global economic volatility, are mitigated by strong government initiatives promoting industrialization and technological advancement. Leading companies are well-positioned to leverage this growth, though competitive intensity is anticipated to rise. Regional market dynamics are expected to vary, with higher growth anticipated in the Eastern and Central regions due to concentrated industrial activity.

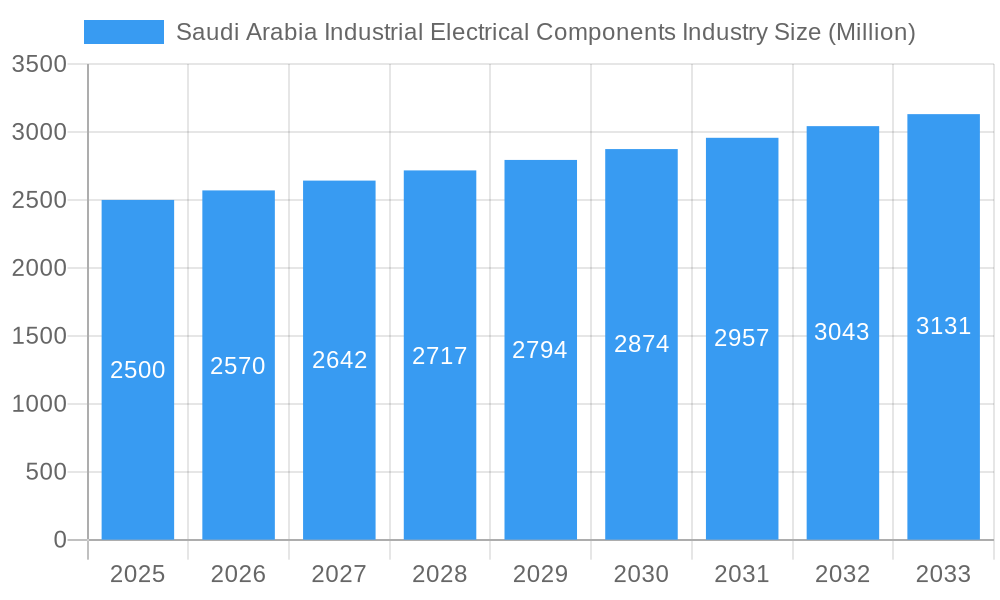

Saudi Arabia Industrial Electrical Components Industry Market Size (In Billion)

Future market expansion in Saudi Arabia's industrial electrical components sector is intrinsically linked to the sustained success of Vision 2030 and ongoing infrastructure development. The burgeoning renewable energy sector, particularly solar and wind power, will generate increased demand for related electrical components. Furthermore, stringent government regulations promoting energy efficiency will accelerate the adoption of advanced technologies and energy-saving solutions. The market segmentation by end-users (power utility, oil & gas, infrastructure) and component types (switchgears, transformers, etc.) presents strategic opportunities for specialized companies to address specific market niches. Despite existing challenges, the Saudi Arabian industrial electrical components market offers substantial potential for both domestic and international enterprises, particularly those offering innovative, cost-effective, and technologically advanced solutions.

Saudi Arabia Industrial Electrical Components Industry Company Market Share

Saudi Arabia Industrial Electrical Components Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Saudi Arabia industrial electrical components market, offering invaluable insights for businesses operating within or seeking to enter this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The report forecasts market trends from 2025 to 2033, leveraging data from the historical period (2019-2024). Key segments analyzed include power utility, oil and gas, and infrastructure end-users, along with components such as switchgears, transformers, electric motors, and LED lighting. Leading players like TIEPCO, Saudi Power Transformer Company, and Al-Abdulkarim Holding (AKH) Co. are profiled, providing a complete market overview.

Saudi Arabia Industrial Electrical Components Industry Market Structure & Competitive Dynamics

The Saudi Arabian industrial electrical components market exhibits a moderately concentrated structure, with a few major players holding significant market share. TIEPCO and Saudi Power Transformer Company, for example, command a combined xx% market share in the transformer segment as of 2024. The market is characterized by a developing innovation ecosystem, driven by government initiatives promoting technological advancements in energy efficiency and renewable energy. Regulatory frameworks, including those set by the Saudi Electricity Company (SEC), heavily influence industry practices and product standards. Substitutes, such as alternative energy solutions, pose a moderate threat, although the current market dominance of traditional electrical components remains strong. End-user trends show a growing demand for smart grid technologies and automation solutions, shaping product development strategies. M&A activity has been relatively moderate in recent years, with deal values averaging approximately xx Million USD annually during 2019-2024. Notable transactions included the acquisition of xx by xx in 2022, valued at xx Million USD. This reflects both opportunities and the challenges inherent in consolidating market share.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% of market share (2024).

- Innovation Ecosystem: Developing, driven by government initiatives and private investments.

- Regulatory Landscape: Influenced by SEC regulations and international standards.

- Product Substitutes: Moderate threat from renewable energy solutions and alternative technologies.

- End-User Trends: Growing demand for smart grid, automation, and energy efficiency solutions.

- M&A Activity: Moderate activity, with average annual deal values of xx Million USD (2019-2024).

Saudi Arabia Industrial Electrical Components Industry Industry Trends & Insights

The Saudi Arabia industrial electrical components market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the country’s ambitious Vision 2030 economic diversification plan, which significantly emphasizes infrastructure development and industrialization. The increasing adoption of smart grid technologies and renewable energy sources contributes to this expansion. The market penetration of energy-efficient components, such as LED lighting and smart switchgears, is rapidly increasing, driven by both government incentives and rising consumer awareness. However, fluctuating oil prices and global economic uncertainties present some challenges. Technological disruptions, particularly in the areas of automation and digitalization, are reshaping the competitive landscape, with companies investing heavily in R&D to stay ahead of the curve. The adoption of Industry 4.0 principles is anticipated to drive significant advancements in the coming years, boosting productivity and efficiency. Competitive dynamics are characterized by both local and international players vying for market share, resulting in price competition and product differentiation strategies.

Dominant Markets & Segments in Saudi Arabia Industrial Electrical Components Industry

The Power Utility segment is the dominant end-user in the Saudi Arabia industrial electrical components market, accounting for xx% of total revenue in 2024. This dominance is due to the ongoing investments in upgrading and expanding the nation's power grid infrastructure. Within components, switchgears and transformers constitute the largest segments, driven by the high demand for reliable power transmission and distribution systems. The Eastern Province displays the strongest regional growth due to its robust industrial sector, including oil and gas operations.

- Key Drivers for Power Utility Dominance:

- Massive investments in grid modernization and expansion.

- Government initiatives promoting renewable energy integration.

- Stringent regulations on grid reliability and safety.

- Key Drivers for Switchgear and Transformer Segment Dominance:

- Crucial role in power transmission and distribution infrastructure.

- High capital expenditure on grid upgrades and expansions.

- Continuous demand for advanced switchgears and transformers with improved efficiency.

The Oil and Gas sector is another key end-user, driven by the expansion of existing facilities and the continuous exploration for new reserves. Infrastructure projects, particularly in transportation and construction, are steadily growing, further enhancing the demand for various electrical components. The market is influenced by ongoing mega projects, such as NEOM and Red Sea Project, which significantly boost demand in specific regions.

Saudi Arabia Industrial Electrical Components Industry Product Innovations

Recent product innovations focus on enhancing energy efficiency, improving safety features, and integrating smart technologies. Several manufacturers are introducing smart switchgears with advanced monitoring and control capabilities, enabling predictive maintenance and optimizing grid performance. The integration of IoT (Internet of Things) sensors in various components allows for real-time data analysis, contributing to operational efficiency and reduced downtime. The adoption of advanced materials and designs in transformers results in improved energy efficiency and reduced losses. The growing popularity of LED lighting reflects the increasing focus on energy conservation. These innovations are well-aligned with the market’s demand for smarter, more efficient, and safer electrical infrastructure.

Report Segmentation & Scope

This report segments the Saudi Arabia industrial electrical components market based on both end-user and component type. The end-user segment comprises Power Utility, Oil and Gas, and Infrastructure sectors, each characterized by specific growth projections and competitive dynamics. Component-wise segmentation includes Switchgears, Transformers, Electric Motors and Starters, Monitoring and Controlling Devices, Automation (Feeder Automation and Substation Automation), LED Lighting, and Other Components (Switches, MCBs, etc.). Each segment's market size, growth rate, and competitive landscape are analyzed in detail. For instance, the LED Lighting segment is expected to grow at a CAGR of xx% due to government initiatives promoting energy efficiency. Similarly, the Automation segment showcases strong growth driven by the increasing adoption of smart grid technologies.

Key Drivers of Saudi Arabia Industrial Electrical Components Industry Growth

The growth of the Saudi Arabia industrial electrical components market is driven by several factors: Firstly, Vision 2030's focus on infrastructure development and industrial diversification is a major catalyst. Secondly, the increasing investments in renewable energy projects, such as solar and wind farms, create significant demand for associated electrical components. Thirdly, government initiatives promoting energy efficiency and smart grid technologies are driving the adoption of advanced electrical components. Lastly, the growth of the oil and gas sector, along with mega-projects like NEOM, fuels consistent demand for reliable and robust electrical infrastructure.

Challenges in the Saudi Arabia Industrial Electrical Components Industry Sector

The Saudi Arabia industrial electrical components market faces challenges including supply chain disruptions, particularly for imported components. Furthermore, price volatility of raw materials and fluctuations in global energy prices impact profitability. Regulatory compliance and obtaining necessary certifications can also present barriers to entry for new players. Intense competition, both from domestic and international players, necessitates continuous innovation and cost optimization strategies. These factors influence investment decisions and market growth.

Leading Players in the Saudi Arabia Industrial Electrical Components Industry Market

- TIEPCO

- Saudi Power Transformer Company

- Al-Abdulkarim Holding (AKH) Co

- Electrical Industries Company (EIC)

- GEDAC Electric Company

- Saudi Electric Supply Company Limited (SESCO)

Key Developments in Saudi Arabia Industrial Electrical Components Industry Sector

- August 2021: Larsen & Toubro secures a turnkey order for a 380 kV GIS substation, highlighting demand for advanced switchgear technology.

- February 2020: R&S Rauscher & Stoecklin receives an order for industrial plugs and sockets for a 5G telecommunication project, indicating growth in supporting infrastructure.

Strategic Saudi Arabia Industrial Electrical Components Industry Market Outlook

The Saudi Arabia industrial electrical components market holds significant potential for future growth, fueled by Vision 2030's ambitious infrastructure plans and the increasing adoption of smart grid technologies. Strategic opportunities lie in capitalizing on the demand for energy-efficient and smart components, focusing on research and development to offer innovative solutions, and establishing robust supply chains to mitigate disruptions. Companies focusing on localized manufacturing and partnerships with government entities will be well-positioned to capitalize on these opportunities. The market's trajectory suggests a positive outlook for companies strategically investing in this dynamic sector.

Saudi Arabia Industrial Electrical Components Industry Segmentation

-

1. End-User

- 1.1. Power Utility

- 1.2. Oil and Gas

- 1.3. Infrastructure Sector

-

2. Component

- 2.1. Switchgears

- 2.2. Transformers

- 2.3. Electric Motors and Starters

- 2.4. Monitoring and Controlling Devices

- 2.5. Automative

- 2.6. LED Lighting

- 2.7. Others

Saudi Arabia Industrial Electrical Components Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Industrial Electrical Components Industry Regional Market Share

Geographic Coverage of Saudi Arabia Industrial Electrical Components Industry

Saudi Arabia Industrial Electrical Components Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improved Viability Of Offshore Oil And Gas Projects

- 3.3. Market Restrains

- 3.3.1. Ban On Offshore Exploration And Production Activities In Multiple Regions

- 3.4. Market Trends

- 3.4.1. Electric Motors and Starters Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Industrial Electrical Components Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Power Utility

- 5.1.2. Oil and Gas

- 5.1.3. Infrastructure Sector

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Switchgears

- 5.2.2. Transformers

- 5.2.3. Electric Motors and Starters

- 5.2.4. Monitoring and Controlling Devices

- 5.2.5. Automative

- 5.2.6. LED Lighting

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TIEPCO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saudi Power Transformer Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al-Abdulkarim Holding (AKH) Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrical Industries Company (EIC)*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GEDAC Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saudi Electric Supply Company Limited (SESCO)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 TIEPCO

List of Figures

- Figure 1: Saudi Arabia Industrial Electrical Components Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Industrial Electrical Components Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 3: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 6: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Industrial Electrical Components Industry?

The projected CAGR is approximately 11.7%.

2. Which companies are prominent players in the Saudi Arabia Industrial Electrical Components Industry?

Key companies in the market include TIEPCO, Saudi Power Transformer Company, Al-Abdulkarim Holding (AKH) Co, Electrical Industries Company (EIC)*List Not Exhaustive, GEDAC Electric Company, Saudi Electric Supply Company Limited (SESCO).

3. What are the main segments of the Saudi Arabia Industrial Electrical Components Industry?

The market segments include End-User, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Improved Viability Of Offshore Oil And Gas Projects.

6. What are the notable trends driving market growth?

Electric Motors and Starters Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Ban On Offshore Exploration And Production Activities In Multiple Regions.

8. Can you provide examples of recent developments in the market?

In August 2021, Larsen & Toubro has bagged a turnkey order for construction of a power substation in Saudi Arabia. The company stated that the scope of the gas insulated switchgear (GIS) substation involves four different voltages up to 380 kV. The scope of works entails associated control, protection, automation, telecommunication systems, apart from civil and electromechanical works. The order will be executed by the power transmission and distribution business of L&T Construction - the construction-related arm of Larsen & Toubro Ltd.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Industrial Electrical Components Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Industrial Electrical Components Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Industrial Electrical Components Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Industrial Electrical Components Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence