Key Insights

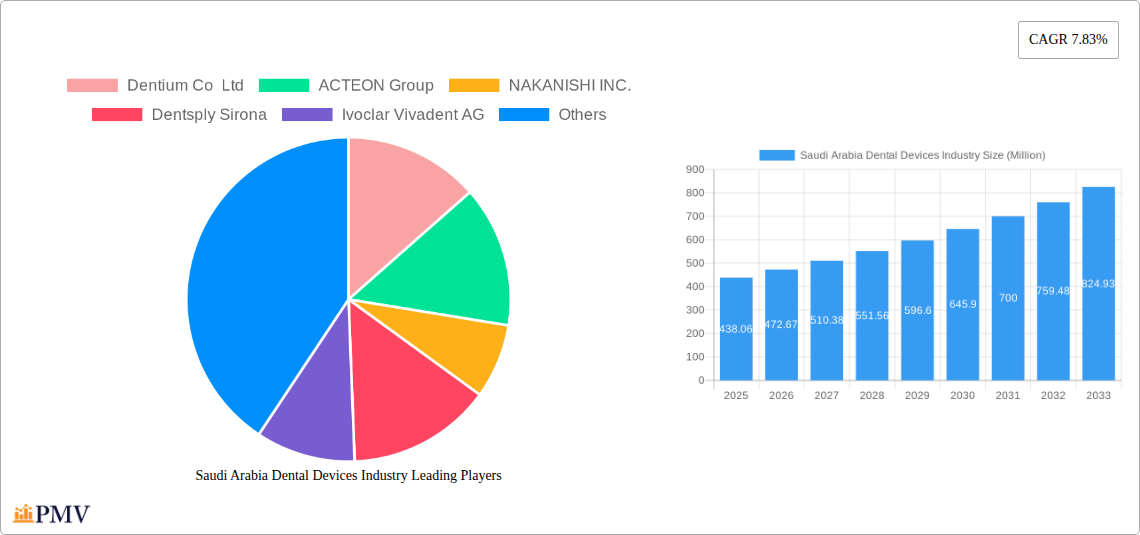

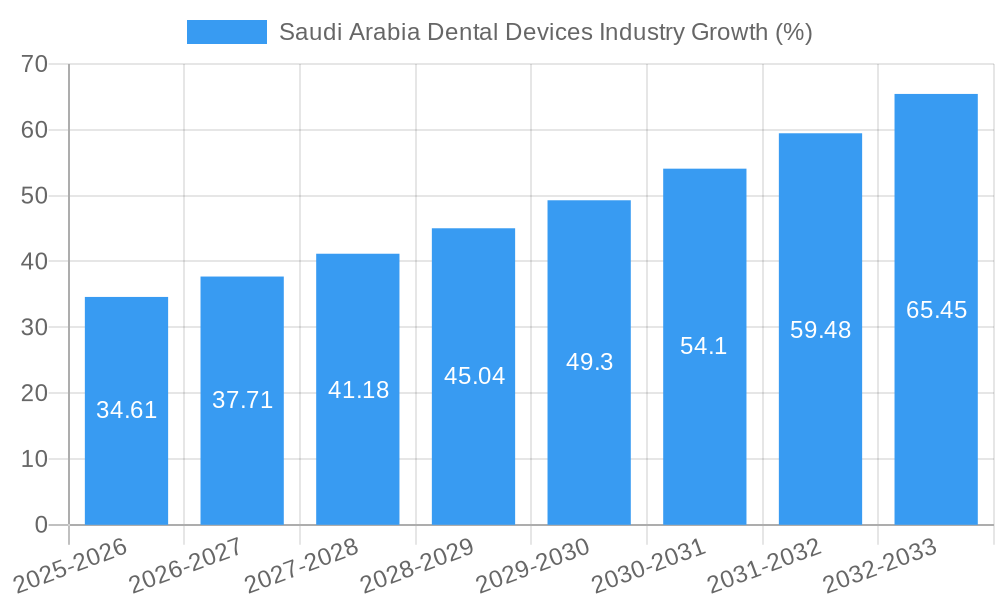

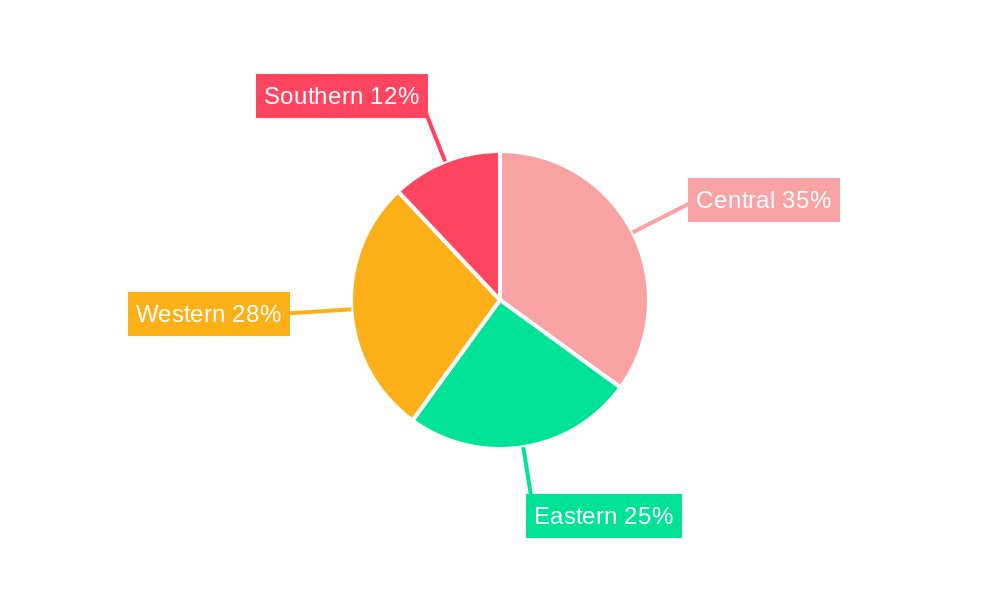

The Saudi Arabian dental devices market, valued at $438.06 million in 2025, is projected to experience robust growth, driven by factors such as rising dental awareness among the population, increasing prevalence of dental diseases, and a growing emphasis on cosmetic dentistry. Government initiatives promoting healthcare infrastructure development and the increasing disposable incomes within the Kingdom further contribute to market expansion. The market is segmented by product type (general and diagnostic equipment, dental consumables, and other dental devices) and treatment type (orthodontic, endodontic, periodontic, and prosthodontic). General and diagnostic equipment currently holds a significant market share, while the consumables segment is expected to witness rapid growth due to the increasing number of dental procedures. The orthodontic treatment segment is also experiencing significant traction, reflecting a growing demand for aesthetic dental solutions. Key players like Dentsply Sirona, 3M Company, and Straumann are actively competing in this market, leveraging advanced technologies and strategic partnerships to capture market share. The regional distribution of the market across Saudi Arabia's Central, Eastern, Western, and Southern regions shows variations in growth potential depending on factors such as population density and healthcare infrastructure availability. Future growth will likely be influenced by technological advancements in dental implants, digital dentistry, and minimally invasive procedures.

The 7.83% CAGR projected for the period 2025-2033 suggests a continuously expanding market. However, potential restraints include high treatment costs, which may limit accessibility for certain segments of the population. Furthermore, the market’s reliance on imported devices presents vulnerability to global supply chain disruptions. Nevertheless, the long-term outlook remains positive, driven by continuous improvements in dental healthcare infrastructure and technology, increasing health consciousness, and a growing focus on preventative dental care. The increasing number of dental clinics and specialists in the Kingdom further supports the market's growth trajectory. Competition among established players and emerging companies is expected to intensify, leading to innovation and improved offerings for consumers.

Saudi Arabia Dental Devices Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Saudi Arabia dental devices industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this report forecasts robust growth and explores the dynamic market landscape. The report segments the market by product (General and Diagnostic Equipment, Dental Consumables, Other Dental Devices) and treatment (Orthodontic, Endodontic, Periodontic, Prosthodontic), providing a granular understanding of market size, growth projections, and competitive dynamics. The estimated market value in 2025 is expected to be xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025-2033.

Saudi Arabia Dental Devices Industry Market Structure & Competitive Dynamics

The Saudi Arabia dental devices market exhibits a moderately concentrated structure, with both multinational corporations and local players vying for market share. Key multinational companies like Dentsply Sirona, Ivoclar Vivadent AG, 3M Company, Institut Straumann AG, and Planmeca OY hold significant market share, leveraging their established brand reputation and technological prowess. Local manufacturers such as Watan Surgical Instruments Factory also contribute to the market.

Market concentration is influenced by several factors, including the regulatory environment, technological advancements, and the increasing adoption of advanced dental procedures. The Saudi Arabian government’s investments in healthcare infrastructure and initiatives to improve oral health are key drivers, further shaping the competitive landscape. Innovation ecosystems are growing, fostering the development of new dental devices and technologies. Mergers and acquisitions (M&A) activity remains relatively modest, with deal values in the xx Million range in recent years. However, strategic partnerships and collaborations are increasingly common. Product substitution is a factor, particularly with the emergence of cost-effective alternatives. End-user trends are shifting towards minimally invasive procedures, digital dentistry, and advanced materials.

Saudi Arabia Dental Devices Industry Industry Trends & Insights

The Saudi Arabia dental devices market is characterized by significant growth potential, driven by rising disposable incomes, increasing awareness of oral hygiene, and a growing elderly population. The market's CAGR from 2019 to 2024 stood at approximately xx%, highlighting the sector's dynamism. Technological advancements, including the integration of AI and robotics, are reshaping the industry, leading to improved diagnostic capabilities, minimally invasive procedures, and personalized treatments. This is accompanied by an increasing demand for digital dentistry solutions, including CAD/CAM systems and intraoral scanners. Consumer preferences are shifting towards advanced, aesthetically pleasing, and technologically superior products.

Competitive dynamics are intensifying as both established players and emerging companies strive to offer innovative solutions and cater to changing customer demands. Market penetration of advanced dental devices is increasing, driven by a growing preference for sophisticated treatments and an improved healthcare infrastructure. The government's Vision 2030 initiative aims to improve healthcare access and quality, further fueling market growth. Factors such as advancements in materials science, the rise of digital dentistry, and increasing awareness of preventive dental care are major contributors to the industry’s expansion.

Dominant Markets & Segments in Saudi Arabia Dental Devices Industry

Within the Saudi Arabian dental devices market, the general and diagnostic equipment segment currently holds the largest market share, followed by dental consumables. The strong growth of this segment is driven by an increasing number of dental clinics and hospitals, coupled with the government’s investments in healthcare infrastructure.

- Key Drivers for General and Diagnostic Equipment: Increasing investments in healthcare infrastructure, rising demand for advanced diagnostic tools, and government initiatives to improve healthcare access.

- Key Drivers for Dental Consumables: The rising number of dental procedures, increasing prevalence of dental diseases, and preference for high-quality consumables.

- Orthodontic segment dominance: Driven by an increase in the number of orthodontic treatments.

- Prosthodontic segment growth: is fueled by increased demand for cosmetic dentistry and dental implants.

The major cities such as Riyadh, Jeddah, and Dammam represent significant market opportunities, benefiting from higher healthcare spending and a dense population. The significant market share of these segments is attributable to factors such as a growing awareness of oral health, the rising prevalence of dental diseases, and increased adoption of advanced dental technologies.

Saudi Arabia Dental Devices Industry Product Innovations

Recent product innovations in the Saudi Arabian dental devices market include the introduction of advanced imaging systems, such as the iTero Element 5D Plus imaging system by Align Technology Inc. This signifies a significant shift towards digital dentistry, streamlining workflows and enhancing precision. Other innovations involve improved biocompatible materials for dental implants and restorations, minimally invasive surgical instruments, and sophisticated CAD/CAM systems. These innovations enhance treatment efficiency, patient comfort, and treatment outcomes, leading to increased market adoption and competitive differentiation.

Report Segmentation & Scope

This report meticulously segments the Saudi Arabia dental devices market into various categories.

General and Diagnostic Equipment: This segment encompasses a broad range of products, including X-ray machines, intraoral scanners, and sterilization equipment. The segment is expected to witness significant growth, driven by the increasing adoption of advanced diagnostic technologies.

Dental Consumables: This segment comprises a wide variety of consumables used in dental procedures, including restorative materials, impression materials, and disinfectants. Growth is anticipated to remain consistent, fuelled by the growing demand for high-quality consumables.

Other Dental Devices: This category includes a broad spectrum of products not explicitly classified elsewhere. It's expected to grow modestly due to the diverse nature of the products included.

Orthodontic Devices: This segment focuses on orthodontic appliances and technologies used for teeth alignment. The segment is anticipated to experience substantial growth due to the increasing prevalence of malocclusion and the rising demand for aesthetic improvements.

Endodontic Devices: This segment encompasses instruments and materials used in root canal treatments. Growth is expected to remain steady, driven by rising prevalence of endodontic diseases.

Periodontic Devices: This segment comprises instruments and materials used in periodontal treatments. Growth is anticipated to be driven by the increasing prevalence of periodontal diseases.

Prosthodontic Devices: This segment includes dental implants, crowns, and bridges. Growth is driven by rising demand for cosmetic dentistry and dental implant procedures.

Key Drivers of Saudi Arabia Dental Devices Industry Growth

Several factors contribute to the growth of the Saudi Arabia dental devices industry. These include:

Government Initiatives: The Saudi Arabian government's investment in healthcare infrastructure, including dental clinics and hospitals, is a significant driver. Furthermore, initiatives promoting oral health awareness play a crucial role.

Rising Disposable Incomes: The increasing disposable incomes of the Saudi population translate to greater affordability of dental care and advanced devices.

Technological Advancements: Innovations in dental technology, such as digital dentistry and minimally invasive procedures, are fueling market growth.

Aging Population: The growing elderly population increases the demand for dental care and specialized devices.

Challenges in the Saudi Arabia Dental Devices Industry Sector

The Saudi Arabia dental devices industry faces certain challenges:

Regulatory Hurdles: Navigating regulatory processes for product approvals can be complex and time-consuming, impacting market entry and expansion.

Price Sensitivity: Price sensitivity among consumers can limit the adoption of premium-priced dental devices.

Competition: Competition from both international and local players can intensify, creating pressure on pricing and margins.

Supply Chain Disruptions: Global events can significantly impact the availability of raw materials and components.

Leading Players in the Saudi Arabia Dental Devices Industry Market

- Dentium Co Ltd

- ACTEON Group

- NAKANISHI INC.

- Dentsply Sirona

- Ivoclar Vivadent AG

- 3M Company

- 3D Systems Inc (Vertex Dental)

- Planmeca OY

- Institut Straumann AG

- Watan Surgical Instruments Factory

- ZimVie Inc

Key Developments in Saudi Arabia Dental Devices Industry Sector

July 2022: Makkah Healthcare Cluster signed an agreement to establish a mobile dental clinic at Al-Haram Emergency Hospital, equipped with modern capabilities and staffed by 32 medical and operational personnel. This enhances accessibility to dental care.

June 2022: Align Technology Inc. launched its iTero Element 5D Plus imaging system in the Middle East, significantly boosting digital dentistry capabilities in the region.

Strategic Saudi Arabia Dental Devices Industry Market Outlook

The Saudi Arabia dental devices market exhibits strong future growth potential, driven by ongoing investments in healthcare infrastructure, rising awareness of oral health, and technological advancements. Strategic opportunities exist for companies focusing on digital dentistry, minimally invasive procedures, and personalized treatments. Companies that adapt to evolving consumer preferences and successfully navigate regulatory hurdles will be well-positioned for success in this dynamic market. The projected growth from 2025-2033 underscores the sector's attractiveness for both domestic and international players.

Saudi Arabia Dental Devices Industry Segmentation

-

1. Product

-

1.1. General and Diagnostic Equipment

- 1.1.1. Dental Lasers

- 1.1.2. Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. General and Diagnostic Equipment

- 1.2. Dental Consumables

- 1.3. Dental Devices

-

1.1. General and Diagnostic Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Periodontic

- 2.4. Prosthodontic

Saudi Arabia Dental Devices Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Dental Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Oral Diseases and Aging Population; Technological Advancements in Dentistry

- 3.3. Market Restrains

- 3.3.1. Excessive Costs Involved in Health Insurance

- 3.4. Market Trends

- 3.4.1. The Prosthodontic Segment is Expected to Have a Significant Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Dental Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostic Equipment

- 5.1.1.1. Dental Lasers

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. General and Diagnostic Equipment

- 5.1.2. Dental Consumables

- 5.1.3. Dental Devices

- 5.1.1. General and Diagnostic Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Periodontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Central Saudi Arabia Dental Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Dental Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Dental Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Dental Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Dentium Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ACTEON Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NAKANISHI INC.

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dentsply Sirona

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ivoclar Vivadent AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 3M Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 3D Systems Inc (Vertex Dental)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Planmeca OY

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Institut Straumann AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Watan Surgical Instruments Factory

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ZimVie Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Dentium Co Ltd

List of Figures

- Figure 1: Saudi Arabia Dental Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Dental Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Dental Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Dental Devices Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Dental Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Saudi Arabia Dental Devices Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 5: Saudi Arabia Dental Devices Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 6: Saudi Arabia Dental Devices Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 7: Saudi Arabia Dental Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Saudi Arabia Dental Devices Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 9: Saudi Arabia Dental Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Saudi Arabia Dental Devices Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 11: Central Saudi Arabia Dental Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Central Saudi Arabia Dental Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: Eastern Saudi Arabia Dental Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Eastern Saudi Arabia Dental Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Western Saudi Arabia Dental Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Western Saudi Arabia Dental Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Southern Saudi Arabia Dental Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Southern Saudi Arabia Dental Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Saudi Arabia Dental Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 20: Saudi Arabia Dental Devices Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 21: Saudi Arabia Dental Devices Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 22: Saudi Arabia Dental Devices Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 23: Saudi Arabia Dental Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Saudi Arabia Dental Devices Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Dental Devices Industry?

The projected CAGR is approximately 7.83%.

2. Which companies are prominent players in the Saudi Arabia Dental Devices Industry?

Key companies in the market include Dentium Co Ltd, ACTEON Group, NAKANISHI INC., Dentsply Sirona, Ivoclar Vivadent AG, 3M Company, 3D Systems Inc (Vertex Dental), Planmeca OY, Institut Straumann AG, Watan Surgical Instruments Factory, ZimVie Inc.

3. What are the main segments of the Saudi Arabia Dental Devices Industry?

The market segments include Product, Treatment.

4. Can you provide details about the market size?

The market size is estimated to be USD 438.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Oral Diseases and Aging Population; Technological Advancements in Dentistry.

6. What are the notable trends driving market growth?

The Prosthodontic Segment is Expected to Have a Significant Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Excessive Costs Involved in Health Insurance.

8. Can you provide examples of recent developments in the market?

In July 2022, Makkah Healthcare Cluster signed an agreement with a medical company specializing in providing dental services to establish a mobile dental clinic stationed at the Al-Haram Emergency Hospital area. The mobile dental clinic includes 32 medical and operational cadres equipped with modern capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Dental Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Dental Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Dental Devices Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Dental Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence