Key Insights

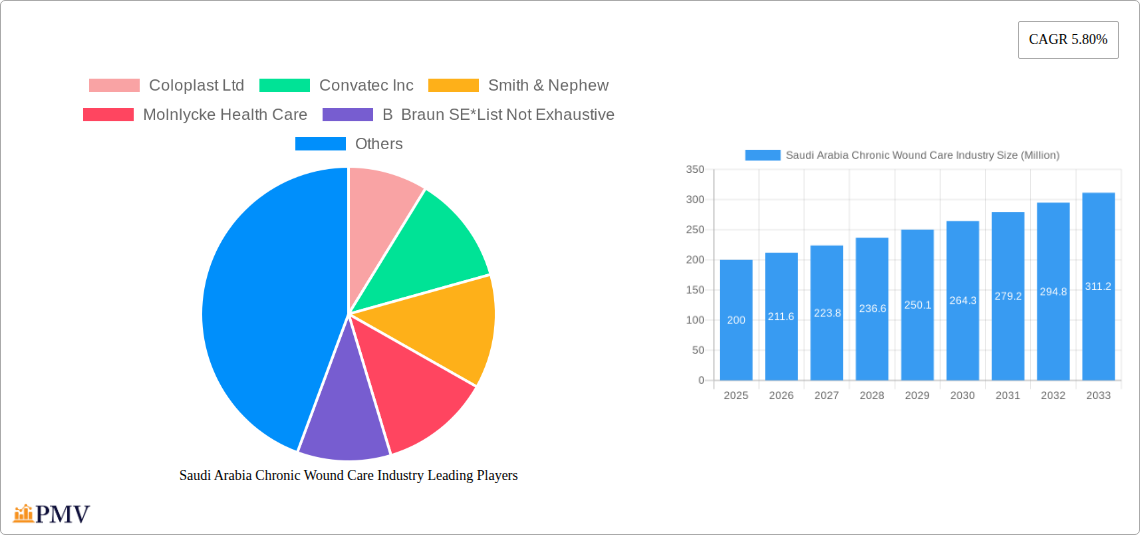

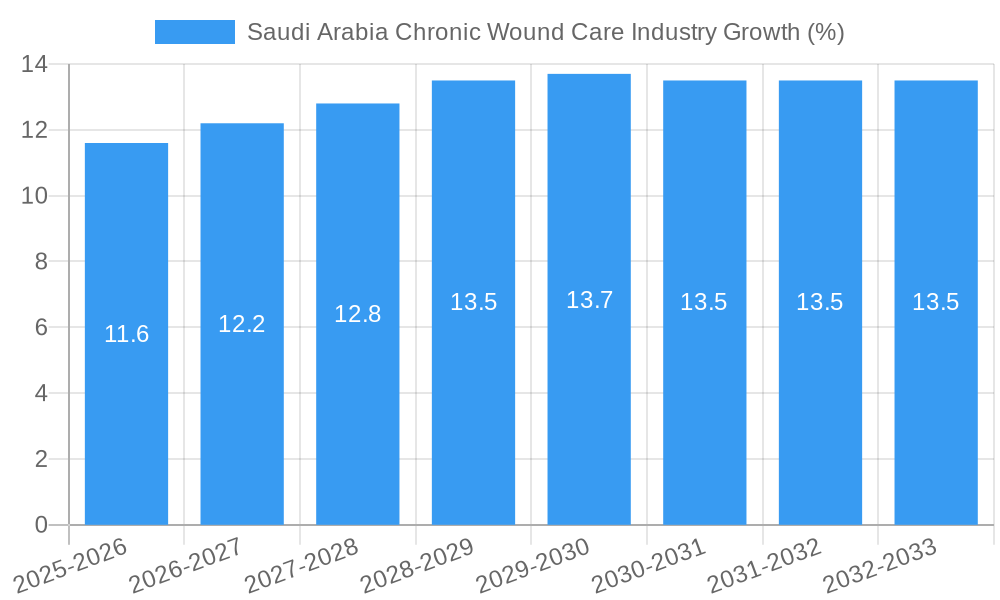

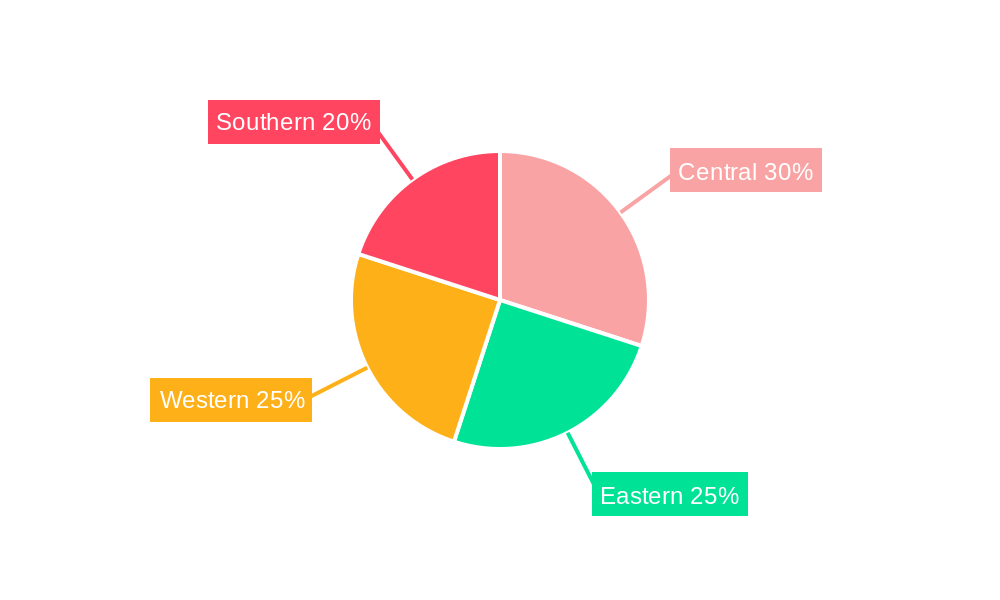

The Saudi Arabian chronic wound care market, exhibiting a CAGR of 5.80%, presents a significant growth opportunity. Driven by factors such as an aging population, rising prevalence of diabetes and related complications (leading to diabetic foot ulcers), increasing healthcare expenditure, and improved awareness regarding advanced wound care techniques, the market is poised for substantial expansion. The market segmentation reveals a dominance of chronic wound treatment over acute wound care, reflecting the higher prevalence and longer treatment duration associated with chronic conditions. Within product categories, wound care dressings and devices for wound closure represent substantial market segments, fueled by technological advancements leading to more effective and less invasive treatment options. Competition in the market is robust, with key players such as Coloplast, Convatec, Smith & Nephew, Molnlycke, B. Braun, 3M, Johnson & Johnson, and Medtronic vying for market share through innovation and strategic partnerships. The regional distribution across Saudi Arabia (Central, Eastern, Western, Southern) indicates varying market penetration, potentially influenced by healthcare infrastructure disparities and population density.

Considering the 5.80% CAGR and a base year of 2025, a reasonable projection of the market's evolution is possible. Assuming the market size in 2025 is approximately $200 million (a plausible estimate based on comparable markets), the market size would grow to roughly $211.6 million in 2026, $223.8 million in 2027, and continue this trajectory. This growth is fueled by factors outlined above. However, potential restraints such as healthcare access limitations in certain regions and the price sensitivity of some wound care products could moderately impact this growth. The distribution of market share across regions within Saudi Arabia will likely depend on local population health profiles, healthcare infrastructure availability and government healthcare initiatives. Further research into specific regional demographics and healthcare policies would refine these regional market share predictions.

Saudi Arabia Chronic Wound Care Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Saudi Arabia chronic wound care industry, covering market size, growth projections, competitive landscape, and key industry trends from 2019 to 2033. The study period encompasses historical data (2019-2024), the base year (2025), and a forecast period (2025-2033). This in-depth analysis is crucial for stakeholders seeking to understand market dynamics and make informed business decisions in this rapidly evolving sector. The report includes a detailed look at key players like Coloplast Ltd, Convatec Inc, Smith & Nephew, Molnlycke Health Care, B Braun SE, 3M Company, Johnson & Johnson, and Medtronic Plc, offering valuable insights into their strategies and market share. The market is segmented by wound type (chronic wounds, acute wounds) and product type (wound care, wound closure devices). The report projects a xx Million market size by 2025 and reveals a compelling CAGR of xx% during the forecast period.

Saudi Arabia Chronic Wound Care Industry Market Structure & Competitive Dynamics

The Saudi Arabian chronic wound care market exhibits a moderately concentrated structure, with a few multinational corporations holding significant market share. However, the presence of several regional players and the growing adoption of innovative technologies indicate a dynamic competitive landscape. The market's innovation ecosystem is driven by government initiatives promoting healthcare advancements and collaborations between research institutions and industry players. Regulatory frameworks, including those focused on medical device approvals and reimbursement policies, significantly impact market access and growth. Product substitutes, particularly in wound dressings, create competitive pressures, forcing companies to constantly innovate and enhance product offerings. End-user trends, particularly the increasing demand for advanced wound care solutions and minimally invasive procedures, are driving market expansion.

M&A activity in the sector has been relatively modest in recent years, with deal values averaging approximately xx Million per transaction. Major players are increasingly focusing on strategic partnerships and collaborations to expand their market reach and access newer technologies. Market share estimates for the leading players are as follows: Smith & Nephew (xx%), Convatec Inc (xx%), 3M Company (xx%), with the remaining share distributed among other national and international companies.

Saudi Arabia Chronic Wound Care Industry Industry Trends & Insights

The Saudi Arabian chronic wound care market is experiencing substantial growth driven by several key factors. The rising prevalence of chronic diseases like diabetes and obesity, which significantly increase the risk of developing chronic wounds, is a major driver. Technological advancements in wound care, such as the introduction of advanced dressings, bioengineered skin substitutes, and innovative wound closure devices, have enhanced treatment effectiveness and reduced healing times. Furthermore, increasing healthcare expenditure and a growing awareness among patients about advanced wound care options contribute to the expanding market.

The market is also witnessing a shift towards minimally invasive procedures and outpatient care settings, driving demand for convenient and effective at-home wound care products. The adoption of digital health technologies is transforming wound care management, enabling remote patient monitoring and facilitating timely interventions. Competitive dynamics are characterized by continuous innovation, strategic partnerships, and increased market consolidation. The overall market growth demonstrates a considerable CAGR of xx% over the forecast period, with market penetration of advanced wound care solutions projected to reach xx% by 2033.

Dominant Markets & Segments in Saudi Arabia Chronic Wound Care Industry

Dominant Segment: The chronic wound segment is the largest and fastest-growing segment within the Saudi Arabian wound care market due to the high prevalence of diabetes and other chronic diseases.

Key Drivers for Chronic Wound Segment Dominance:

- Rising prevalence of diabetes and other chronic diseases.

- Increased geriatric population.

- Growing awareness about advanced wound care options.

- Government initiatives focused on improving healthcare infrastructure.

Other Chronic Wound (Acute Wound) Segment: This segment demonstrates steady growth, driven by accidents, surgical procedures, and other traumatic injuries.

By Product: The wound care devices segment, specifically wound closure devices, is experiencing faster growth than the overall wound care market. The demand for minimally invasive and effective wound closure solutions is contributing significantly.

Regional Dominance: The major cities, including Riyadh, Jeddah, and Dammam, dominate the market due to higher concentrations of healthcare facilities and specialized wound care centers.

The dominance analysis indicates that the chronic wound segment, particularly in major urban centers, presents the most significant growth opportunity due to the interplay of high prevalence of chronic diseases, and the increasing investment in modern healthcare facilities.

Saudi Arabia Chronic Wound Care Industry Product Innovations

Recent product innovations include the introduction of advanced wound dressings with antimicrobial properties, bioengineered skin substitutes like S2Medical AB’s Epiprotect, and innovative wound closure devices. PolyNovo's NovoSorb BTM synthetic wound matrix technology, launched at Arab Health 2022, offers a significant advancement in treating full-thickness and deep dermal wounds, providing a more robust foundation for wound reconstruction than traditional grafting. These innovations are characterized by enhanced efficacy, reduced healing times, and improved patient comfort, strongly aligning with market demand for advanced and effective wound care solutions. Technological advancements in material science and bioengineering drive these innovations, enhancing market competition and driving industry growth.

Report Segmentation & Scope

The report segments the Saudi Arabia chronic wound care market based on wound type (chronic wounds and acute wounds) and product type (wound care and wound closure devices). The chronic wound segment is projected to exhibit a higher CAGR than the acute wound segment due to the escalating prevalence of chronic diseases. The wound care product segment holds a larger market share compared to the wound closure devices segment, but the latter is experiencing faster growth, driven by the increasing preference for minimally invasive procedures. Competitive dynamics within each segment vary, with established multinational corporations competing with regional players and emerging innovative companies. Market size projections for each segment are detailed within the full report.

Key Drivers of Saudi Arabia Chronic Wound Care Industry Growth

The Saudi Arabian chronic wound care market is propelled by several key drivers: the rising prevalence of chronic diseases (diabetes, obesity), an aging population increasing susceptibility to chronic wounds, increased government spending on healthcare infrastructure and advanced medical technologies, and a growing awareness among patients and healthcare professionals regarding advanced wound care techniques. Technological advancements, such as the introduction of innovative wound dressings, advanced wound closure devices, and digital health solutions, significantly contribute to market expansion. The government’s focus on improving healthcare access and quality further enhances market growth.

Challenges in the Saudi Arabia Chronic Wound Care Industry Sector

Challenges to the Saudi Arabian chronic wound care market include the relatively high cost of advanced wound care products, which can limit accessibility for some patients. Supply chain disruptions and logistics challenges, particularly given the geographic spread of the country, can hinder timely access to essential supplies. Furthermore, navigating the regulatory landscape for medical device approvals and reimbursement processes can present significant hurdles for market entrants. These factors, in combination, can impact market growth and profitability.

Leading Players in the Saudi Arabia Chronic Wound Care Industry Market

- Coloplast Ltd

- Convatec Inc

- Smith & Nephew

- Molnlycke Health Care

- B Braun SE

- 3M Company

- Johnson & Johnson

- Medtronic Plc

Key Developments in Saudi Arabia Chronic Wound Care Industry Sector

- January 2022: PolyNovo launched NovoSorb BTM synthetic wound matrix technology at Arab Health 2022, expanding treatment options for various wound types.

- February 2022: S2Medical AB received payment for Epiprotect dressings from Arabian Trade House, highlighting growing demand for synthetic skin substitutes in the Saudi market.

Strategic Saudi Arabia Chronic Wound Care Industry Market Outlook

The Saudi Arabian chronic wound care market presents substantial growth potential driven by the increasing prevalence of chronic diseases, a growing elderly population, and continuous advancements in wound care technologies. Strategic opportunities lie in developing innovative and cost-effective wound care solutions tailored to the specific needs of the Saudi population. Focus on digital health integration, partnerships with healthcare providers, and addressing supply chain challenges are key to capitalizing on the market’s long-term growth prospects. The market is poised for significant expansion, offering lucrative opportunities for both established and emerging players in the industry.

Saudi Arabia Chronic Wound Care Industry Segmentation

-

1. Product

-

1.1. Wound Care

- 1.1.1. Dressings

- 1.1.2. Bandages

- 1.1.3. Topical Agents

- 1.1.4. Wound Care Devices

-

1.2. Wound Closure

- 1.2.1. Suture

- 1.2.2. Surgical Staplers

- 1.2.3. Tissue Adhesive, Sealant, and Glue

-

1.1. Wound Care

-

2. Wound Type

-

2.1. Chronic Wound

- 2.1.1. Diabetic Foot Ulcer

- 2.1.2. Pressure Ulcer

- 2.1.3. Arterial and Venous Ulcer

- 2.1.4. Other Chronic Wound

-

2.2. Acute Wound

- 2.2.1. Surgical Wounds

- 2.2.2. Burns

- 2.2.3. Other Acute Wounds

-

2.1. Chronic Wound

Saudi Arabia Chronic Wound Care Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Chronic Wound Care Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Incidences of Chronic Wounds

- 3.2.2 Ulcers and Diabetic Ulcers; Increase in Volume of Surgical Procedures Worldwide

- 3.3. Market Restrains

- 3.3.1. High-cost of Procedures

- 3.4. Market Trends

- 3.4.1. Dressing is Expected to Witness a Significant CAGR Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Chronic Wound Care Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Wound Care

- 5.1.1.1. Dressings

- 5.1.1.2. Bandages

- 5.1.1.3. Topical Agents

- 5.1.1.4. Wound Care Devices

- 5.1.2. Wound Closure

- 5.1.2.1. Suture

- 5.1.2.2. Surgical Staplers

- 5.1.2.3. Tissue Adhesive, Sealant, and Glue

- 5.1.1. Wound Care

- 5.2. Market Analysis, Insights and Forecast - by Wound Type

- 5.2.1. Chronic Wound

- 5.2.1.1. Diabetic Foot Ulcer

- 5.2.1.2. Pressure Ulcer

- 5.2.1.3. Arterial and Venous Ulcer

- 5.2.1.4. Other Chronic Wound

- 5.2.2. Acute Wound

- 5.2.2.1. Surgical Wounds

- 5.2.2.2. Burns

- 5.2.2.3. Other Acute Wounds

- 5.2.1. Chronic Wound

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Central Saudi Arabia Chronic Wound Care Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Chronic Wound Care Industry Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Chronic Wound Care Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Chronic Wound Care Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Coloplast Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Convatec Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Smith & Nephew

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Molnlycke Health Care

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 B Braun SE*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 3M Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Johnson and Johnson

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Medtronic Plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Coloplast Ltd

List of Figures

- Figure 1: Saudi Arabia Chronic Wound Care Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Chronic Wound Care Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Chronic Wound Care Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Chronic Wound Care Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Saudi Arabia Chronic Wound Care Industry Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 4: Saudi Arabia Chronic Wound Care Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia Chronic Wound Care Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Central Saudi Arabia Chronic Wound Care Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Saudi Arabia Chronic Wound Care Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Saudi Arabia Chronic Wound Care Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Saudi Arabia Chronic Wound Care Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Chronic Wound Care Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 11: Saudi Arabia Chronic Wound Care Industry Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 12: Saudi Arabia Chronic Wound Care Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Chronic Wound Care Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Saudi Arabia Chronic Wound Care Industry?

Key companies in the market include Coloplast Ltd, Convatec Inc, Smith & Nephew, Molnlycke Health Care, B Braun SE*List Not Exhaustive, 3M Company, Johnson and Johnson, Medtronic Plc.

3. What are the main segments of the Saudi Arabia Chronic Wound Care Industry?

The market segments include Product, Wound Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Chronic Wounds. Ulcers and Diabetic Ulcers; Increase in Volume of Surgical Procedures Worldwide.

6. What are the notable trends driving market growth?

Dressing is Expected to Witness a Significant CAGR Over the Forecast Period.

7. Are there any restraints impacting market growth?

High-cost of Procedures.

8. Can you provide examples of recent developments in the market?

February 2022- S2Medical AB received payment for dressings in the Epiprotect series from the Saudi Arabian distributor Arabian Trade House of approximately 300,000 SEK. Epiprotect is a synthetic skin substitute used in the treatment of burn wounds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Chronic Wound Care Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Chronic Wound Care Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Chronic Wound Care Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Chronic Wound Care Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence