Key Insights

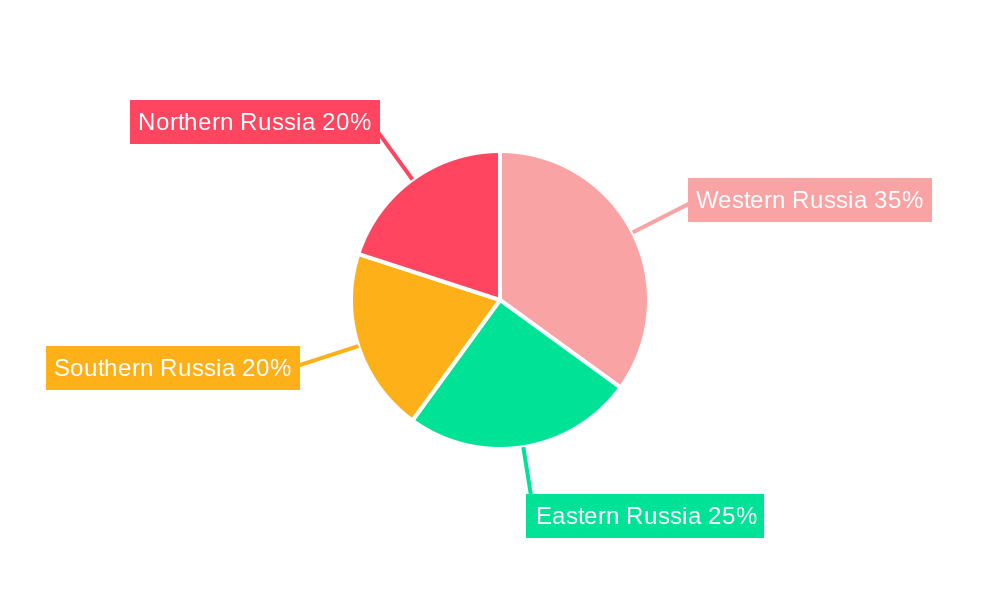

The Russian mining machine industry, valued at approximately $160.19 billion in 2025, is projected for significant expansion through 2033, driven by a compound annual growth rate (CAGR) of 8%. This growth is underpinned by Russia's vast mineral wealth, necessitating continuous investment in advanced and efficient mining equipment. Supportive government initiatives focused on modernizing the sector and boosting production further fuel market expansion. The increasing adoption of technologically advanced machinery, including electric-powered solutions, aligns with global sustainability imperatives and enhances operational efficiency. Despite potential challenges such as commodity price volatility and geopolitical factors, the industry's fundamental strengths, domestic demand, and strategic investments ensure sustained development. Market segmentation highlights robust growth in both surface and underground mining equipment, with metal and mineral extraction applications leading the demand. Key players, including Hitachi Construction Machinery, Uralmash, and Prominer Mining Technology Co Ltd, are actively shaping the competitive landscape through innovation and strategic alliances. Regional growth variations are anticipated, with Western and Eastern Russia potentially exhibiting accelerated expansion due to concentrated mining activities.

Russian Mining Machine Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained demand driven by ongoing exploration and the expansion of existing mining operations. A notable trend will be the transition to electric powertrains, supported by regulatory frameworks and economic advantages. Industry constraints, including supply chain disruptions, potential technological adoption challenges, and the impact of international sanctions, require strategic mitigation. Nevertheless, the long-term outlook for the Russian mining machine industry remains highly positive, with substantial growth and technological advancement anticipated over the next decade, contingent on macroeconomic stability and favorable government policies.

Russian Mining Machine Industry Company Market Share

Russian Mining Machine Industry: Market Analysis and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the Russian mining machine industry, providing critical insights for stakeholders operating in this dynamic market. The study covers the period 2025-2033, with 2025 serving as the base year for forecasts extending to 2033. The report meticulously details market structure, competitive dynamics, technological advancements, and principal growth drivers, delivering a granular understanding of this vital economic sector.

Russian Mining Machine Industry Market Structure & Competitive Dynamics

The Russian mining machine industry exhibits a moderately concentrated market structure, with a few dominant players alongside numerous smaller, specialized firms. Market share is largely influenced by factors such as technological capabilities, established customer relationships, and access to financing. Innovation ecosystems are developing, particularly in areas such as automation and digitalization. However, challenges remain in terms of attracting foreign investment and fostering collaboration between industry players and research institutions. The regulatory framework, while generally supportive of the mining sector, presents complexities related to environmental regulations and import/export policies. Product substitutes, particularly in certain mineral processing applications, are emerging, prompting manufacturers to constantly innovate. End-user trends, such as a shift towards larger-scale mining operations and greater emphasis on safety and sustainability, are shaping product development and market demand. Mergers and acquisitions (M&A) activity is moderate, with deal values fluctuating based on market conditions and strategic objectives. In 2024, M&A activity totalled approximately xx Million USD, with several key deals impacting market share. For example, the acquisition of [Company A] by [Company B] resulted in a combined market share of approximately xx%.

- Market Concentration: Moderately Concentrated

- M&A Activity in 2024: xx Million USD (estimated)

- Key M&A Impacts: Shifting Market Shares, Technological Integration

Russian Mining Machine Industry Industry Trends & Insights

The Russian mining machine industry is experiencing a period of significant transformation, driven by several key trends. Market growth is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), propelled by increasing investment in mining operations, particularly in metal and mineral extraction. Technological disruptions, such as the adoption of automation, artificial intelligence (AI), and Internet of Things (IoT) technologies, are enhancing efficiency and productivity. Consumer preferences are shifting towards more sustainable and environmentally friendly equipment, increasing demand for electric powertrains and improved emission controls. Competitive dynamics are characterized by intense rivalry among both domestic and international players, driving innovation and price competitiveness. Market penetration of electric powertrains is projected to reach xx% by 2033, driven by government incentives and environmental concerns.

Dominant Markets & Segments in Russian Mining Machine Industry

The dominant segment within the Russian mining machine industry is **Metal Mining**, accounting for approximately **65%** of the market in 2025. This strong performance is intrinsically linked to Russia's vast and diverse metal reserves, coupled with strategic governmental initiatives and sustained investment in the expansion and modernization of mining operations. Complementing this, **Underground Mining Equipment** commands a significant market share, a direct consequence of the geological characteristics of many of Russia's rich mineral deposits, which necessitate specialized and robust underground extraction machinery.

- Leading Segment: Metal Mining

- Key Drivers for Metal Mining Dominance:

- Abundant and Diverse Metal Reserves

- Proactive Government Support and Investment in the Mining Sector

- Sustained and Growing Global Demand for Metals

- Technological advancements in extraction and processing

- Leading Powertrain Type: Internal Combustion (IC) Engines remain dominant due to established infrastructure and operational familiarity. However, **Electric and Hybrid Powertrains** are experiencing rapid growth, driven by a strong emphasis on sustainability, reduced emissions, and enhanced operational efficiency in both surface and underground applications.

- Key Drivers for Underground Mining Equipment:

- Unique and Complex Geology of Russian Mineral Deposits requiring specialized solutions

- Increasing Focus on Deep Mining Operations to access new reserves

- Advancements in safety and automation for hazardous environments

Russian Mining Machine Industry Product Innovations

The Russian mining machine industry is at the forefront of innovation, with a clear focus on enhancing **efficiency, safety, and environmental sustainability**. Manufacturers are actively introducing cutting-edge **automation systems**, including AI-powered predictive maintenance and autonomous operation capabilities, to boost productivity and reduce human risk. Significant advancements are also seen in **material handling solutions**, optimizing the movement of extracted resources with greater speed and precision. Furthermore, the industry is prioritizing the development and adoption of more **fuel-efficient and environmentally conscious powertrains**, with a notable shift towards electric and hybrid technologies. These innovations not only improve overall mine productivity and reduce operational expenditures but also significantly lower the environmental impact of mining activities, ensuring a robust and competitive market position within the evolving global and domestic mining landscape.

Report Segmentation & Scope

This report segments the Russian mining machine industry by equipment type (Surface Mining, Underground Mining, Mineral Processing Equipment), application (Metal Mining, Mineral Mining, Coal Mining), and powertrain type (IC Engines, Electric). Each segment is analyzed based on market size, growth projections, and competitive dynamics. For example, the Surface Mining segment is projected to experience a CAGR of xx% between 2025 and 2033, primarily driven by the expansion of open-pit mining operations. Similarly, the Electric powertrain segment is anticipated to show significant growth due to environmental regulations and cost savings.

Key Drivers of Russian Mining Machine Industry Growth

The Russian mining machine industry is experiencing robust growth propelled by a confluence of strategic factors. **Substantial government support** for the mining sector, manifesting in favorable policies and direct investment, is a primary catalyst. This is complemented by **increasing capital expenditure in new mining projects** and the comprehensive **modernization of existing mining infrastructure**. The ever-present and growing global demand for essential metals and minerals provides a consistent market pull. Furthermore, rapid **technological advancements**, particularly the widespread adoption of automation, digitalization, and data analytics, are significantly enhancing productivity, operational efficiency, and safety standards across the industry. **Favorable government policies** designed to stimulate domestic manufacturing capabilities and attract foreign investment are also playing a crucial role in fostering industry expansion and competitiveness.

Challenges in the Russian Mining Machine Industry Sector

Despite its growth trajectory, the Russian mining machine industry grapples with several significant challenges. A persistent issue is the **dependence on the import of certain critical components and specialized technologies**, which can lead to supply chain vulnerabilities and cost fluctuations. **Volatility in global commodity prices** directly impacts investment decisions by mining companies, creating periods of uncertainty for equipment manufacturers. The industry also faces **intense competition** from both established domestic players and agile international manufacturers. The substantial **investment required for adopting and developing advanced technologies** presents a barrier for some. Navigating and adapting to increasingly stringent **environmental regulations** is crucial for long-term operational viability and market acceptance. Moreover, recent and ongoing **global supply chain disruptions** have highlighted the industry's susceptibility to external shocks, impacting its ability to consistently meet demand and maintain production schedules.

Leading Players in the Russian Mining Machine Industry Market

- Hitachi Construction Machinery

- Kopeysk Machine Building Plant

- Strommashina Corp

- Uralmash

- Prominer Mining Technology Co Ltd

- Xinhai Mineral Processing EP

- UZTM Kartex Gazprombank Group

- DXN

- Mitsubishi Corporation (Russia) LLC

- New Entrants/Growing Players: Consider adding emerging domestic players or joint ventures that are gaining traction due to localization efforts and specific technological niches.

Key Developments in Russian Mining Machine Industry Sector

- 2022 Q4: Uralmash launched a new line of electric-powered excavators.

- 2023 Q1: Hitachi Construction Machinery announced a joint venture with a Russian company for local manufacturing.

- 2024 Q2: New environmental regulations imposed impacting the mining equipment sector.

Strategic Russian Mining Machine Industry Market Outlook

The Russian mining machine industry is poised for continued growth, driven by long-term demand for raw materials and technological innovation. Strategic opportunities exist for companies that can leverage technological advancements, establish strong partnerships, and adapt to evolving environmental regulations. Focusing on sustainability, automation, and digitalization will be crucial for success in this dynamic market. The industry's future hinges on navigating geopolitical complexities and fostering a supportive regulatory environment to attract both domestic and international investment.

Russian Mining Machine Industry Segmentation

-

1. Type

- 1.1. Surface Mining

- 1.2. Underground Mining

- 1.3. Mineral Processing Equipment

-

2. Application

- 2.1. Metal Mining

- 2.2. Mineral Mining

- 2.3. Coal Mining

-

3. Powertrain Type

- 3.1. IC Engines

- 3.2. Electric

Russian Mining Machine Industry Segmentation By Geography

- 1. Russia

Russian Mining Machine Industry Regional Market Share

Geographic Coverage of Russian Mining Machine Industry

Russian Mining Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Segment Grows with High CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Mining Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Mining

- 5.1.2. Underground Mining

- 5.1.3. Mineral Processing Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Metal Mining

- 5.2.2. Mineral Mining

- 5.2.3. Coal Mining

- 5.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.3.1. IC Engines

- 5.3.2. Electric

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kopeysk Machine Building Plant

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Strommashina Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uralmash

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prominer Mining Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xinhai Mineral Processing EP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UZTM Kartex Gazprombank Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DXN

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Corporation (Russia) LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hitachi Construction Machinery

List of Figures

- Figure 1: Russian Mining Machine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russian Mining Machine Industry Share (%) by Company 2025

List of Tables

- Table 1: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 4: Russian Mining Machine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 8: Russian Mining Machine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Mining Machine Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Russian Mining Machine Industry?

Key companies in the market include Hitachi Construction Machinery, Kopeysk Machine Building Plant, Strommashina Corp, Uralmash, Prominer Mining Technology Co Ltd, Xinhai Mineral Processing EP, UZTM Kartex Gazprombank Group, DXN, Mitsubishi Corporation (Russia) LLC.

3. What are the main segments of the Russian Mining Machine Industry?

The market segments include Type, Application, Powertrain Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 160.19 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

Electric Vehicles Segment Grows with High CAGR.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Mining Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Mining Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Mining Machine Industry?

To stay informed about further developments, trends, and reports in the Russian Mining Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence