Key Insights

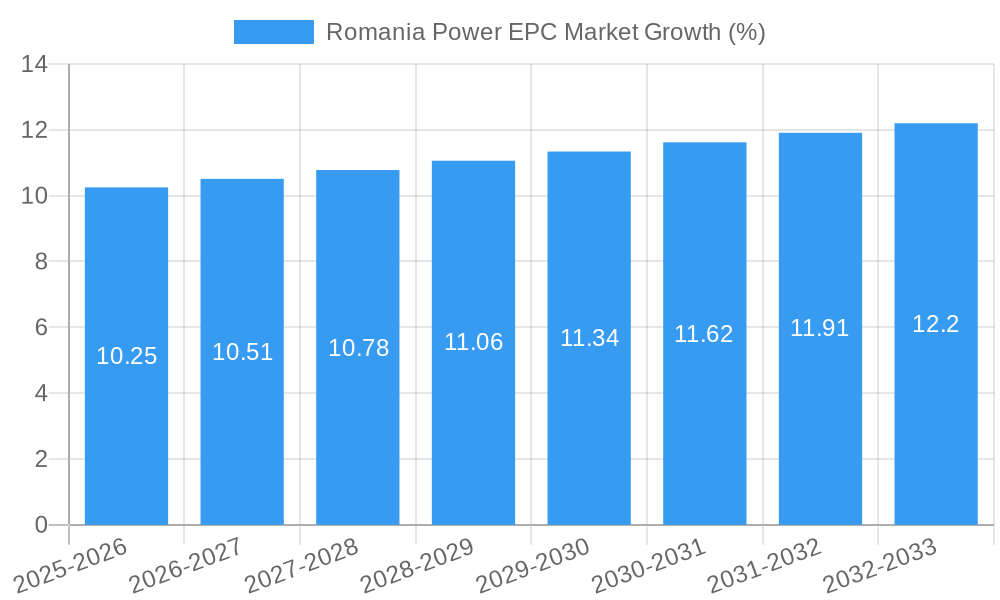

The Romania Power EPC (Engineering, Procurement, and Construction) market is experiencing robust growth, driven by increasing energy demand, government initiatives promoting renewable energy sources, and the need for upgrading aging infrastructure. The market size in 2025 is estimated at €500 million (this is an estimation based on typical market sizes for similar countries and the provided CAGR), exhibiting a Compound Annual Growth Rate (CAGR) exceeding 2.05% from 2025 to 2033. Key drivers include the expansion of renewable energy projects, particularly solar and wind power, alongside modernization efforts within the thermal and hydropower sectors. The government's focus on energy security and EU-mandated renewable energy targets are significant catalysts. Market segmentation reveals a strong presence across various end-users, including utilities, industrial companies, and commercial entities. The residential sector, while smaller in comparative terms, is also contributing to market growth fueled by incentives for rooftop solar installations. Constraints include the fluctuating costs of raw materials and potential labor shortages, though these are mitigated by the influx of international EPC companies and government support for skill development.

The competitive landscape features a mix of both international and domestic players. While companies such as JinkoSolar, Enel, and Siemens represent significant global players, local companies like Transelectrica and Nuclearelectrica play crucial roles, particularly in larger-scale projects and infrastructure development. Future growth will be significantly influenced by the pace of renewable energy deployment, government policies related to energy efficiency, and the overall economic health of Romania. The long-term outlook for the Romanian Power EPC market remains positive, driven by sustained energy demand and the ongoing transition towards a cleaner and more diversified energy mix. The strategic focus on modernization and infrastructure development promises continued market expansion in the coming years, particularly within renewable energy, resulting in significant opportunities for both established and emerging players.

Romania Power EPC Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Romania Power EPC market, offering invaluable insights for stakeholders across the energy sector. Covering the period from 2019 to 2033, with a focus on 2025, this study dissects market dynamics, competitive landscapes, and future growth trajectories. Key players like JinkoSolar, Transelectrica, Romelectro, Societatea Nationala Nuclearelectrica, Mytilineos, Enel, E.ON, Siemens, Electroalfa, and Trina Solar are analyzed, providing a detailed understanding of the industry's current state and future potential. The report is essential for investors, EPC contractors, energy companies, and policymakers seeking a robust understanding of this evolving market.

Romania Power EPC Market Market Structure & Competitive Dynamics

The Romanian Power EPC market exhibits a moderately concentrated structure, with a few large players holding significant market share. The market share of the top 5 players in 2025 is estimated at xx%. This concentration is driven by the significant capital investment required for large-scale projects and the specialized expertise needed for complex power plant construction and commissioning. Innovation in the sector is largely driven by the adoption of renewable energy technologies and the increasing focus on digitalization and smart grids. Regulatory frameworks, while supportive of renewable energy development, are subject to ongoing changes which impact investment decisions and project timelines. Product substitution is primarily evident in the increasing adoption of renewable energy sources as alternatives to traditional thermal power generation. End-user trends demonstrate a rising demand for sustainable and cost-effective power solutions, further accelerating the adoption of renewables. M&A activity in the sector has been moderate in recent years, with total deal values estimated at approximately xx Million in the period 2019-2024. Notable acquisitions have focused on expanding portfolios of renewable energy projects and bolstering technological capabilities.

- Market Concentration: xx% held by top 5 players in 2025.

- M&A Activity (2019-2024): Total deal value estimated at xx Million.

- Key Regulatory Factors: Ongoing changes affecting investment and project timelines.

- Innovation Focus: Renewable energy integration and smart grid technologies.

Romania Power EPC Market Industry Trends & Insights

The Romanian Power EPC market is experiencing robust growth, driven by increasing energy demand, government support for renewable energy, and modernization of the country's aging power infrastructure. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological disruptions are significantly impacting the market, with the integration of renewable energy sources (solar, wind, hydro) playing a pivotal role. Consumer preferences are shifting towards cleaner and more sustainable energy solutions, impacting project development and investor interest. Competitive dynamics are intense, characterized by both domestic and international players competing for market share. This competition is driving innovation and efficiency improvements across the value chain. Market penetration of renewable energy technologies is steadily increasing, projected to reach xx% by 2033. Further growth drivers include EU funding for energy transition projects and increasing private sector investment in the sector.

Dominant Markets & Segments in Romania Power EPC Market

The renewable energy segment is currently the fastest-growing sector within the Romanian Power EPC market, driven primarily by the government's commitment to achieving its renewable energy targets. The utilities sector remains the dominant end-user, accounting for the largest share of EPC projects.

Dominant Segment (By Power Generation): Renewables

- Key Drivers:

- Government support and incentives for renewable energy projects.

- EU funding for energy transition initiatives.

- Falling costs of renewable energy technologies.

- Increasing consumer demand for clean energy.

Dominant Segment (By End User): Utilities

- Key Drivers:

- Large-scale infrastructure projects undertaken by utility companies.

- Government mandates for grid modernization.

- Significant investment in renewable energy capacity expansion.

The dominance of renewables is expected to continue throughout the forecast period due to its favorable regulatory environment and the increasing cost-competitiveness of renewable energy technologies compared to traditional fossil fuel-based power generation.

Romania Power EPC Market Product Innovations

Recent product innovations in the Romanian Power EPC market have primarily focused on enhancing the efficiency and cost-effectiveness of renewable energy projects. This includes advancements in solar panel technology, wind turbine design, and energy storage solutions. These innovations are improving the competitiveness of renewable energy and driving their wider adoption. The market is also seeing increased integration of smart grid technologies for improved energy management and grid stability. This contributes to creating a more sustainable and reliable energy infrastructure.

Report Segmentation & Scope

This report segments the Romanian Power EPC market based on power generation (Thermal, Hydropower, Nuclear, Renewables) and end-user (Utilities, Industrial companies, Commercial companies, Residential customers). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed. For instance, the renewable energy segment is expected to experience the most significant growth, driven by government policies and decreasing technology costs. Conversely, the thermal power segment is projected to show slower growth or decline due to environmental concerns. The Utilities segment holds the largest market share, reflecting the significant infrastructure investments undertaken by major utility providers.

Key Drivers of Romania Power EPC Market Growth

The growth of the Romanian Power EPC market is primarily driven by several factors. Government policies promoting renewable energy sources, such as subsidies and tax incentives, are stimulating significant investment in renewable energy projects. Furthermore, the increasing demand for electricity, driven by economic growth and population increase, fuels the need for expanded power generation capacity. The modernization and upgrading of existing power infrastructure also presents significant opportunities for EPC contractors. Finally, the integration of smart grid technologies enhances efficiency and reliability, further attracting investment.

Challenges in the Romania Power EPC Market Sector

Despite the positive growth outlook, the Romanian Power EPC market faces several challenges. Regulatory hurdles and bureaucratic processes can sometimes delay project approvals and implementation. Supply chain disruptions, particularly in the context of global economic uncertainties, can impact project costs and timelines. Moreover, intense competition among both domestic and international EPC contractors can put downward pressure on margins. These factors need to be carefully considered by investors and industry players.

Leading Players in the Romania Power EPC Market Market

- JinkoSolar Holding Co Ltd

- Transelectrica SA

- Romelectro SA

- Societatea Nationala Nuclearelectrica SA

- Mytilineos SA

- Enel SpA

- E.ON SE

- Siemens AG

- Electroalfa

- Trina Solar Ltd *List Not Exhaustive

Key Developments in Romania Power EPC Market Sector

- 2023 Q3: Government announces increased funding for offshore wind energy projects.

- 2022 Q4: Major merger between two leading Romanian EPC companies expands market share.

- 2021 Q2: New regulations streamline permitting processes for renewable energy projects.

- 2020 Q1: Significant investment in smart grid technologies by a major utility.

Strategic Romania Power EPC Market Market Outlook

The future of the Romanian Power EPC market appears promising, with continued growth fueled by renewable energy expansion, infrastructure modernization, and increasing energy demand. Strategic opportunities lie in leveraging technological advancements, such as AI and digital twins, to enhance project efficiency and reduce costs. Partnerships and collaborations across the value chain will be critical for navigating regulatory complexities and securing funding. A strong focus on sustainability and ESG considerations will attract investments and shape the market landscape in the coming years. The market is poised for significant growth, particularly within the renewable energy sector, with substantial opportunities for players who effectively adapt to the changing market dynamics.

Romania Power EPC Market Segmentation

-

1. Power Generation

- 1.1. Thermal

- 1.2. Hydropower

- 1.3. Nuclear

- 1.4. Renewables

- 2. Power Transmission and Distribution

Romania Power EPC Market Segmentation By Geography

- 1. Romania

Romania Power EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; The High Costs of Renewable Aviation Fuel

- 3.4. Market Trends

- 3.4.1. Hydropower to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Romania Power EPC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Thermal

- 5.1.2. Hydropower

- 5.1.3. Nuclear

- 5.1.4. Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Romania

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JinkoSolar Holding Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Transelectrica SARomelectro SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Societatea Nationala Nuclearelectrica SAMytilineos SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Enel SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 E ON SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Electroalfa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trina Solar Ltd*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Romania Power EPC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Romania Power EPC Market Share (%) by Company 2024

List of Tables

- Table 1: Romania Power EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Romania Power EPC Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 3: Romania Power EPC Market Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 4: Romania Power EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Romania Power EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Romania Power EPC Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 7: Romania Power EPC Market Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 8: Romania Power EPC Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Romania Power EPC Market?

The projected CAGR is approximately > 2.05%.

2. Which companies are prominent players in the Romania Power EPC Market?

Key companies in the market include JinkoSolar Holding Co Ltd, Transelectrica SARomelectro SA, Societatea Nationala Nuclearelectrica SAMytilineos SA, Enel SpA, E ON SE, Siemens AG, Electroalfa, Trina Solar Ltd*List Not Exhaustive.

3. What are the main segments of the Romania Power EPC Market?

The market segments include Power Generation, Power Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel.

6. What are the notable trends driving market growth?

Hydropower to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The High Costs of Renewable Aviation Fuel.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Romania Power EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Romania Power EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Romania Power EPC Market?

To stay informed about further developments, trends, and reports in the Romania Power EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence