Key Insights

The global retail-ready packaging market is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.7%. With a market size of 78.31 billion in the base year of 2025, the industry is experiencing significant expansion. This growth is propelled by escalating consumer demand for convenient and aesthetically pleasing packaging that enhances the in-store shopping experience. Key growth drivers include the burgeoning e-commerce sector, which necessitates robust and visually appealing packaging for online shipments, and a heightened focus on environmental sustainability, encouraging the adoption of eco-friendly materials such as recycled paper and paperboard.

Retail Ready Packaging Industry Market Size (In Billion)

The market is strategically segmented by material type, with paperboard dominating due to its cost-effectiveness and recyclability. Package types like corrugated cardboard boxes and die-cut displays are prominent, serving diverse end-user applications, particularly in the food and beverage industry. While plastic containers maintain a notable presence, regulatory pressures and a growing consumer preference for sustainable alternatives are expected to moderate their growth trajectory compared to paper-based solutions.

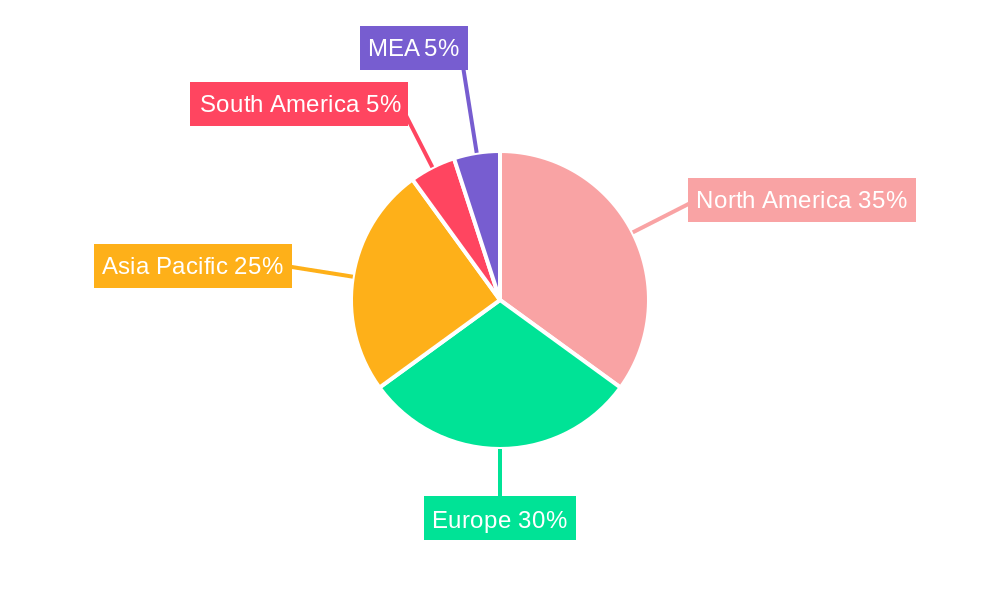

Retail Ready Packaging Industry Company Market Share

Geographically, North America and Europe currently hold substantial market shares. However, the Asia-Pacific region presents significant growth potential, driven by rapid economic development and increasing consumer spending. Intense competition characterizes the market, with leading players like WestRock, Smurfit Kappa, and International Paper actively pursuing market dominance through design innovation, optimized material sourcing, and streamlined supply chain management. Potential restraints include rising raw material costs and global supply chain volatility.

The retail-ready packaging industry is poised for sustained expansion, offering considerable growth opportunities in emerging markets. Innovations in packaging design, incorporating features such as tamper-evidence and enhanced product visibility, are anticipated to fuel demand. Furthermore, the integration of smart packaging technologies, including RFID tags for improved inventory management and anti-counterfeiting measures, will shape future market dynamics. Companies are prioritizing the development of sustainable and recyclable packaging solutions to align with increasing environmental concerns and stringent regulatory requirements.

The industry's future success is contingent upon its ability to adapt to evolving consumer preferences, harness technological advancements, and effectively navigate challenges such as fluctuating raw material costs and supply chain disruptions. Understanding regional variations in consumer behavior and regulatory frameworks will be critical for companies aiming to broaden their market reach. By emphasizing sustainability, innovation, and efficient supply chain practices, market participants are strategically positioned for enduring success.

Retail Ready Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Retail Ready Packaging industry, offering valuable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, challenges, and key players, providing actionable intelligence for strategic decision-making. The global market is projected to reach xx Million by 2033.

Retail Ready Packaging Industry Market Structure & Competitive Dynamics

The Retail Ready Packaging market is characterized by a moderately concentrated structure, with several multinational companies holding significant market share. Key players include WestRock Company, STI Group, Vanguard Packaging Incorporated, Weedon Group, Smurfit Kappa Group, Caps Cases Limited, Cardboard Box Company, DS Smith PLC, Mondi Group, and International Paper Company. However, the market also accommodates numerous smaller players, particularly regional and niche providers. The industry's innovation ecosystem is dynamic, driven by advancements in materials science, automation, and sustainable packaging solutions. Regulatory frameworks, including those related to sustainability and food safety, significantly influence market dynamics. Product substitution, primarily driven by the adoption of eco-friendly materials, poses both a challenge and an opportunity for existing players. End-user trends, particularly the rising demand for e-commerce packaging and sustainable options, are reshaping the market landscape. Mergers and acquisitions (M&A) activities are common, with deal values exceeding xx Million in recent years. For instance, the market witnessed significant M&A activity in the xx Million range during the historical period (2019-2024), consolidating market share and driving innovation. Market share distribution is fluid, with the top five players accounting for approximately xx% of the global market in 2024.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystem: Dynamic, driven by material science and automation.

- Regulatory Landscape: Influenced by sustainability and food safety regulations.

- M&A Activity: Significant, with deal values exceeding xx Million annually.

- Market Share: Top 5 players holding approximately xx% in 2024.

Retail Ready Packaging Industry Industry Trends & Insights

The Retail Ready Packaging market exhibits strong growth momentum, driven by several key factors. The increasing adoption of e-commerce is a significant driver, increasing the demand for efficient and protective packaging solutions. Simultaneously, growing consumer awareness of sustainability is fueling the demand for eco-friendly packaging materials, like recycled paperboard and biodegradable plastics. Technological advancements, such as automated packaging lines and smart packaging solutions, are enhancing efficiency and reducing costs. However, fluctuating raw material prices and supply chain disruptions represent ongoing challenges. The market is witnessing a shift towards more sustainable and customized packaging options. This trend is reflected in the rising popularity of reusable packaging and personalized packaging designs. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, with market penetration of xx% in key segments by 2033. Competitive dynamics remain intense, with established players investing heavily in innovation and expansion, while new entrants are leveraging niche market opportunities.

Dominant Markets & Segments in Retail Ready Packaging Industry

The Retail Ready Packaging market is geographically diverse, with significant regional variations in demand and growth patterns. While specific regional dominance requires detailed data analysis, the current market reveals a strong presence in North America and Europe.

By Material Type:

- Paper and Paperboard: This segment maintains market dominance due to its cost-effectiveness, recyclability, and versatility. Key drivers include stringent environmental regulations and increasing consumer preference for sustainable packaging.

- Plastics: This segment is experiencing growth driven by the demand for lightweight, durable, and customizable packaging solutions. However, concerns about environmental impact are impacting growth.

- Other Material Types: This category, encompassing materials like wood and metal, holds a smaller market share and faces challenges in terms of sustainability and cost.

By Type of Package:

- Corrugated Cardboard Boxes: Remains the most dominant type due to its high strength-to-weight ratio, low cost, and recyclability.

- Die-cut Display Containers: Growing rapidly due to their high visibility and ability to enhance product presentation at the point of sale.

- Other Types of Packages: Includes a variety of packaging types with specialized applications and features.

By End-User Application:

- Food: A significant market segment driven by strict food safety regulations and the need for extended shelf life.

- Beverage: Strong growth due to the large volume of packaged beverages and the focus on attractive packaging designs.

- Household Products: Steady demand with growing interest in sustainable and reusable packaging solutions.

The dominance of each segment is intricately linked to factors such as economic policies, consumer preferences, and infrastructure development in respective regions. For instance, stringent environmental regulations in certain regions drive the adoption of sustainable packaging materials.

Retail Ready Packaging Industry Product Innovations

Recent innovations in retail-ready packaging focus on enhancing sustainability, efficiency, and consumer experience. This includes the development of lightweight, eco-friendly materials, automated packaging systems that reduce labor costs and waste, and innovative designs that improve product presentation and shelf appeal. The integration of smart packaging technologies, such as RFID tags for improved supply chain visibility, is also gaining traction. The successful adoption of these innovations hinges on their ability to deliver cost savings, improved sustainability, and enhanced consumer appeal while maintaining product protection and functionality.

Report Segmentation & Scope

This report segments the Retail Ready Packaging market based on material type (Paper and Paperboard, Plastics, Other Material Types), type of package (Die-cut Display Containers, Corrugated Cardboard Boxes, Shrink Wrapped Trays, Modified Cases, Plastic Containers, Other Type of Packages), and end-user application (Food, Beverage, Household Products, Other End-User Applications). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed. The report incorporates historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033) to provide a complete overview of market trends.

Key Drivers of Retail Ready Packaging Industry Growth

The Retail Ready Packaging industry's growth is fueled by several key factors. The rise of e-commerce has significantly boosted demand for efficient and protective packaging solutions. Simultaneously, increasing consumer awareness of environmental issues is driving the adoption of sustainable packaging materials and designs. Technological advancements, such as automation and smart packaging, contribute to cost efficiency and improved supply chain management. Furthermore, government regulations promoting sustainable packaging practices are stimulating innovation and market growth.

Challenges in the Retail Ready Packaging Industry Sector

The Retail Ready Packaging industry faces several challenges. Fluctuating raw material prices, particularly for paper and plastics, significantly impact profitability. Supply chain disruptions can lead to production delays and increased costs. Intense competition, both from established players and new entrants, necessitates continuous innovation and cost optimization. Meeting stringent regulatory requirements related to sustainability and food safety also presents significant challenges. These factors collectively impact industry margins and profitability. Quantifiable impacts, such as reduced profit margins or increased production costs due to supply chain disruptions, are extensively analyzed within the report.

Leading Players in the Retail Ready Packaging Industry Market

- WestRock Company

- STI Group

- Vanguard Packaging Incorporated

- Weedon Group

- Smurfit Kappa Group

- Caps Cases Limited

- Cardboard Box Company

- DS Smith PLC

- Mondi Group

- International Paper Company

Key Developments in Retail Ready Packaging Industry Sector

- October 2022: ORBIS Corporation showcased integrated reusable packaging solutions at PACK EXPO 2022, emphasizing enhanced supply chain efficiency and sustainability through its XpressBulk retail-ready merchandising trays. This highlights the growing interest in reusable and sustainable packaging solutions within the industry.

- February 2022: Linpac Packaging launched a new line of rigid-plastic, retail-ready packaging, emphasizing flexibility, structural soundness, and impact absorption. This innovation underscores the ongoing efforts to improve product protection and meet the evolving needs of retailers and consumers.

Strategic Retail Ready Packaging Industry Market Outlook

The Retail Ready Packaging market presents significant growth opportunities. The continued expansion of e-commerce and increasing consumer demand for sustainable packaging will drive market expansion. Technological advancements, such as automation and smart packaging, will further enhance efficiency and cost-effectiveness. Companies that can effectively integrate sustainable practices, leverage technological advancements, and meet evolving consumer preferences are poised for significant growth and market share gains. Focus on innovative packaging designs, sustainable materials, and efficient supply chain management are critical success factors for future market leadership.

Retail Ready Packaging Industry Segmentation

-

1. Material Type

- 1.1. Paper and Paperboard

- 1.2. Plastics

- 1.3. Other Material Types

-

2. Type of Package

- 2.1. Die-cut Display Containers

- 2.2. Corrugated Cardboard Boxes

- 2.3. Shrink Wrapped Trays

- 2.4. Modified Cases

- 2.5. Plastic Containers

- 2.6. Other Type of Packages

-

3. End-User Application

- 3.1. Food

- 3.2. Beverage

- 3.3. Household Products

- 3.4. Other End-User Applications

Retail Ready Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdoms

- 2.3. France

- 2.4. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of the Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Retail Ready Packaging Industry Regional Market Share

Geographic Coverage of Retail Ready Packaging Industry

Retail Ready Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Interest Towards Convenient and Eco-friendly Shopping Solutions; Growing Need for Streamlining the Supply Chain Process

- 3.3. Market Restrains

- 3.3.1. Investment in R&D Activities and Additional Capital Expenditure

- 3.4. Market Trends

- 3.4.1. Die-cut Display Container to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper and Paperboard

- 5.1.2. Plastics

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Type of Package

- 5.2.1. Die-cut Display Containers

- 5.2.2. Corrugated Cardboard Boxes

- 5.2.3. Shrink Wrapped Trays

- 5.2.4. Modified Cases

- 5.2.5. Plastic Containers

- 5.2.6. Other Type of Packages

- 5.3. Market Analysis, Insights and Forecast - by End-User Application

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Household Products

- 5.3.4. Other End-User Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Paper and Paperboard

- 6.1.2. Plastics

- 6.1.3. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Type of Package

- 6.2.1. Die-cut Display Containers

- 6.2.2. Corrugated Cardboard Boxes

- 6.2.3. Shrink Wrapped Trays

- 6.2.4. Modified Cases

- 6.2.5. Plastic Containers

- 6.2.6. Other Type of Packages

- 6.3. Market Analysis, Insights and Forecast - by End-User Application

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Household Products

- 6.3.4. Other End-User Applications

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Paper and Paperboard

- 7.1.2. Plastics

- 7.1.3. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Type of Package

- 7.2.1. Die-cut Display Containers

- 7.2.2. Corrugated Cardboard Boxes

- 7.2.3. Shrink Wrapped Trays

- 7.2.4. Modified Cases

- 7.2.5. Plastic Containers

- 7.2.6. Other Type of Packages

- 7.3. Market Analysis, Insights and Forecast - by End-User Application

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Household Products

- 7.3.4. Other End-User Applications

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Paper and Paperboard

- 8.1.2. Plastics

- 8.1.3. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Type of Package

- 8.2.1. Die-cut Display Containers

- 8.2.2. Corrugated Cardboard Boxes

- 8.2.3. Shrink Wrapped Trays

- 8.2.4. Modified Cases

- 8.2.5. Plastic Containers

- 8.2.6. Other Type of Packages

- 8.3. Market Analysis, Insights and Forecast - by End-User Application

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Household Products

- 8.3.4. Other End-User Applications

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Paper and Paperboard

- 9.1.2. Plastics

- 9.1.3. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by Type of Package

- 9.2.1. Die-cut Display Containers

- 9.2.2. Corrugated Cardboard Boxes

- 9.2.3. Shrink Wrapped Trays

- 9.2.4. Modified Cases

- 9.2.5. Plastic Containers

- 9.2.6. Other Type of Packages

- 9.3. Market Analysis, Insights and Forecast - by End-User Application

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Household Products

- 9.3.4. Other End-User Applications

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Paper and Paperboard

- 10.1.2. Plastics

- 10.1.3. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by Type of Package

- 10.2.1. Die-cut Display Containers

- 10.2.2. Corrugated Cardboard Boxes

- 10.2.3. Shrink Wrapped Trays

- 10.2.4. Modified Cases

- 10.2.5. Plastic Containers

- 10.2.6. Other Type of Packages

- 10.3. Market Analysis, Insights and Forecast - by End-User Application

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Household Products

- 10.3.4. Other End-User Applications

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WestRock Company*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 STI Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vanguard Packaging Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Weedon Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smurfit Kappa Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Caps Cases Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cardboard Box Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DS Smith PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mondi Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Paper Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WestRock Company*List Not Exhaustive

List of Figures

- Figure 1: Global Retail Ready Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Ready Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 3: North America Retail Ready Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Retail Ready Packaging Industry Revenue (billion), by Type of Package 2025 & 2033

- Figure 5: North America Retail Ready Packaging Industry Revenue Share (%), by Type of Package 2025 & 2033

- Figure 6: North America Retail Ready Packaging Industry Revenue (billion), by End-User Application 2025 & 2033

- Figure 7: North America Retail Ready Packaging Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 8: North America Retail Ready Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Retail Ready Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Retail Ready Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 11: Europe Retail Ready Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Retail Ready Packaging Industry Revenue (billion), by Type of Package 2025 & 2033

- Figure 13: Europe Retail Ready Packaging Industry Revenue Share (%), by Type of Package 2025 & 2033

- Figure 14: Europe Retail Ready Packaging Industry Revenue (billion), by End-User Application 2025 & 2033

- Figure 15: Europe Retail Ready Packaging Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 16: Europe Retail Ready Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Retail Ready Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Retail Ready Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 19: Asia Pacific Retail Ready Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Asia Pacific Retail Ready Packaging Industry Revenue (billion), by Type of Package 2025 & 2033

- Figure 21: Asia Pacific Retail Ready Packaging Industry Revenue Share (%), by Type of Package 2025 & 2033

- Figure 22: Asia Pacific Retail Ready Packaging Industry Revenue (billion), by End-User Application 2025 & 2033

- Figure 23: Asia Pacific Retail Ready Packaging Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 24: Asia Pacific Retail Ready Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Retail Ready Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Retail Ready Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Latin America Retail Ready Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Latin America Retail Ready Packaging Industry Revenue (billion), by Type of Package 2025 & 2033

- Figure 29: Latin America Retail Ready Packaging Industry Revenue Share (%), by Type of Package 2025 & 2033

- Figure 30: Latin America Retail Ready Packaging Industry Revenue (billion), by End-User Application 2025 & 2033

- Figure 31: Latin America Retail Ready Packaging Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 32: Latin America Retail Ready Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Retail Ready Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Retail Ready Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 35: Middle East and Africa Retail Ready Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Middle East and Africa Retail Ready Packaging Industry Revenue (billion), by Type of Package 2025 & 2033

- Figure 37: Middle East and Africa Retail Ready Packaging Industry Revenue Share (%), by Type of Package 2025 & 2033

- Figure 38: Middle East and Africa Retail Ready Packaging Industry Revenue (billion), by End-User Application 2025 & 2033

- Figure 39: Middle East and Africa Retail Ready Packaging Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 40: Middle East and Africa Retail Ready Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Retail Ready Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 3: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 4: Global Retail Ready Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 7: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 8: Global Retail Ready Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 12: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 13: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 14: Global Retail Ready Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Germany Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: United Kingdoms Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of the Europe Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 20: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 21: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 22: Global Retail Ready Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of the Asia Pacific Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 28: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 29: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 30: Global Retail Ready Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 32: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 33: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 34: Global Retail Ready Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Ready Packaging Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Retail Ready Packaging Industry?

Key companies in the market include WestRock Company*List Not Exhaustive, STI Group, Vanguard Packaging Incorporated, Weedon Group, Smurfit Kappa Group, Caps Cases Limited, Cardboard Box Company, DS Smith PLC, Mondi Group, International Paper Company.

3. What are the main segments of the Retail Ready Packaging Industry?

The market segments include Material Type, Type of Package, End-User Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Interest Towards Convenient and Eco-friendly Shopping Solutions; Growing Need for Streamlining the Supply Chain Process.

6. What are the notable trends driving market growth?

Die-cut Display Container to Hold Significant Share.

7. Are there any restraints impacting market growth?

Investment in R&D Activities and Additional Capital Expenditure.

8. Can you provide examples of recent developments in the market?

October 2022: At the 2022 PACK EXPO, ORBIS Corporation, a global pioneer in reusable packaging, highlighted the importance integrated reusable packaging solutions play in enhancing supply chain effectiveness and sustainability. By enabling a quick and simple transfer of product from the truck directly to the store floor, the XpressBulk retail-ready merchandising trays offer a sustainable, effective solution for the manual shelf replenishment process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Ready Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Ready Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Ready Packaging Industry?

To stay informed about further developments, trends, and reports in the Retail Ready Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence