Key Insights

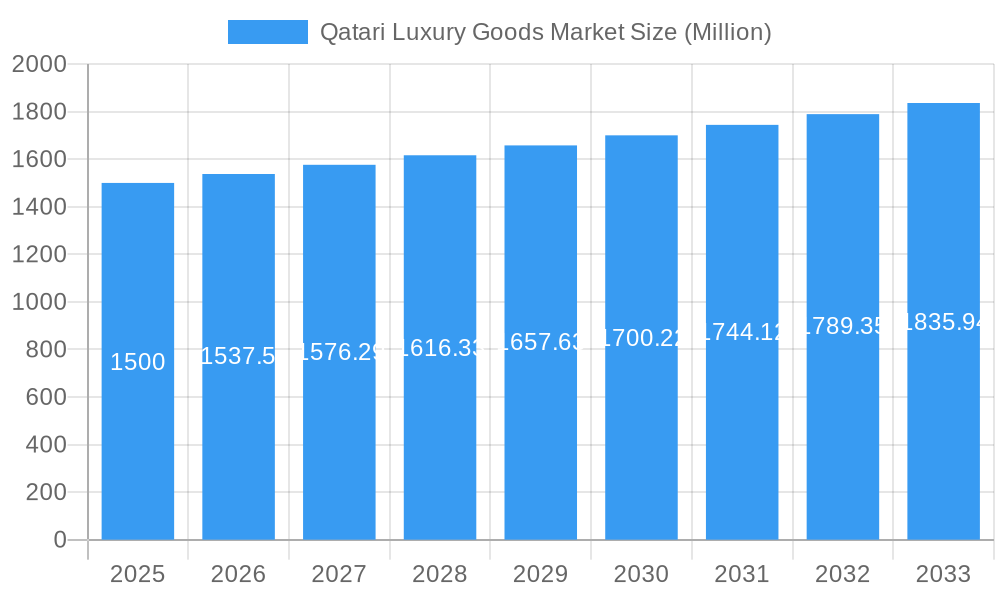

The Qatari luxury goods market, valued at approximately $1.5 billion in 2025, is projected to experience steady growth, driven by a high concentration of high-net-worth individuals, a thriving tourism sector, and a strong preference for high-end brands. The market's 2.5% CAGR suggests a consistent, albeit moderate, expansion throughout the forecast period (2025-2033). Key drivers include rising disposable incomes amongst the Qatari population, a growing appreciation for luxury lifestyles, and the influx of international tourists seeking premium goods and experiences. Trends such as the increasing popularity of e-commerce within the luxury sector and the growing demand for personalized luxury experiences are shaping the market landscape. However, potential restraints include economic volatility impacting consumer spending, geopolitical uncertainties in the region, and the ongoing impact of global economic fluctuations on luxury purchases. The market is segmented by product type (clothing and apparel, footwear, bags, jewelry, watches, and others) and distribution channel (single-branded stores, multi-brand stores, online stores, and others). Major players such as Kering, LVMH, and others are vying for market share, leveraging their brand recognition and established distribution networks. The segment of clothing and apparel is expected to maintain a significant portion of the market share due to the high demand of international and local consumers for luxury clothing.

Qatari Luxury Goods Market Market Size (In Billion)

The growth of the Qatari luxury goods market will be influenced by both internal and external factors. Sustained economic growth in Qatar, coupled with government initiatives promoting tourism and luxury retail, will be crucial for sustaining the predicted CAGR. Furthermore, the market's success hinges on the ability of luxury brands to adapt to evolving consumer preferences, embracing digitalization and personalization to enhance the customer experience. Competition will remain fierce, with brands focusing on building strong brand loyalty and offering exclusive products and services to cater to the discerning Qatari consumer. The Middle East and Africa region, with Qatar as a key market, displays significant growth potential due to the rising affluence and changing lifestyles of the population in countries within this region. The strategic positioning of luxury brands within this market is crucial for establishing a strong foothold and capitalizing on the projected growth trajectory.

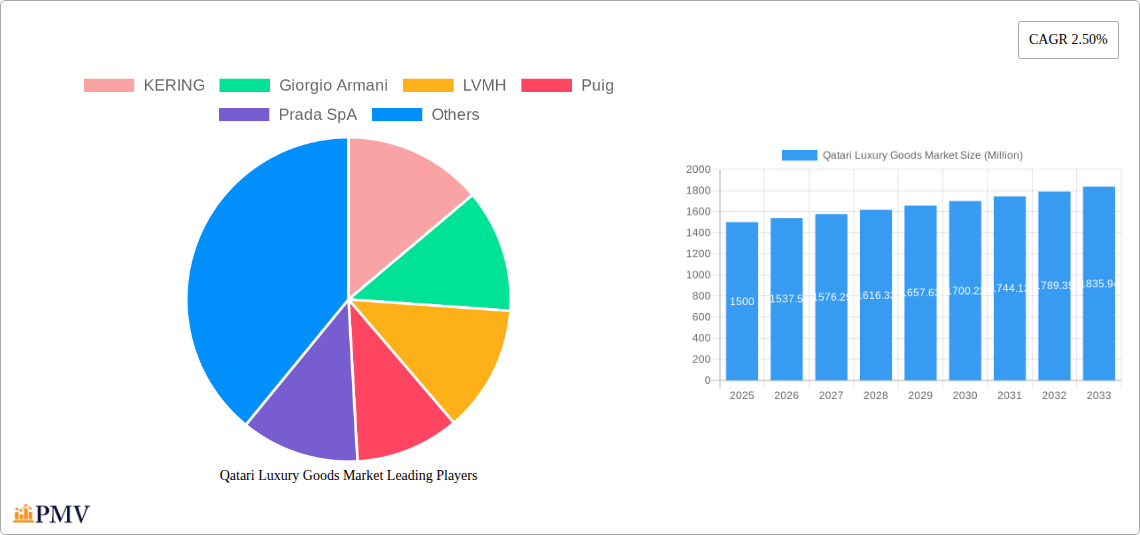

Qatari Luxury Goods Market Company Market Share

Qatari Luxury Goods Market: 2019-2033 Report

This comprehensive report provides a detailed analysis of the Qatari luxury goods market, offering invaluable insights for businesses, investors, and stakeholders seeking to understand this lucrative sector. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market size, growth drivers, competitive dynamics, and future trends.

Qatari Luxury Goods Market Market Structure & Competitive Dynamics

The Qatari luxury goods market exhibits a moderately concentrated structure, with a mix of international luxury conglomerates and local players. Key players such as LVMH, Kering, Prada SpA, CHANEL, and Rolex, alongside regional businesses like Qatar Luxury Group and Joyalukkas, compete fiercely for market share. The market's innovation ecosystem is relatively nascent but is witnessing a gradual increase in investment in localized design and experiences. The regulatory framework is generally supportive of luxury goods, with a focus on attracting high-net-worth individuals and promoting tourism. Product substitutes, primarily through less expensive brands or alternative experiences, pose a competitive threat, particularly in more price-sensitive segments. End-user trends show a rising preference for personalized experiences and sustainable luxury options. M&A activities have been moderate in recent years, with deal values averaging around xx Million.

- Market Concentration: Moderately concentrated, with both international and local players.

- Innovation Ecosystem: Growing, with increasing investment in local design.

- Regulatory Framework: Supportive of luxury goods and tourism.

- Product Substitutes: Moderate competitive threat from less expensive brands.

- End-User Trends: Rising preference for personalized and sustainable options.

- M&A Activity: Moderate, with average deal values around xx Million.

Qatari Luxury Goods Market Industry Trends & Insights

The Qatari luxury goods market is experiencing robust growth, driven by several factors. High disposable incomes, a growing tourism sector, and a significant influx of high-net-worth individuals contribute significantly to market expansion. Technological disruption, manifested through e-commerce and personalized marketing, is transforming the industry landscape. Consumer preferences are increasingly aligning towards unique and exclusive experiences, prompting brands to innovate their offerings. The market's CAGR during the forecast period (2025-2033) is projected to be xx%, while market penetration is anticipated to reach xx% by 2033. Competitive dynamics are marked by both intense rivalry among established brands and the emergence of new niche players catering to the unique demands of the Qatari market. The high level of disposable income and significant government spending on infrastructure development act as major stimulants for luxury market growth. This is further fuelled by the government's continuous efforts to enhance the country's status as a prominent tourist destination. However, the market is also influenced by global economic fluctuations.

Dominant Markets & Segments in Qatari Luxury Goods Market

The Qatari luxury goods market is dominated by Doha, due to its status as the primary economic and commercial hub. By product type, Watches and Jewelry are currently the leading segments, driven by high demand among affluent consumers and the increasing popularity of luxury timepieces as status symbols. Within distribution channels, Single-branded stores hold the largest market share owing to their ability to create an immersive brand experience.

- Key Drivers (Doha): Economic activity concentrated in Doha, strong infrastructure, high concentration of luxury retailers.

- Key Drivers (Watches & Jewelry): High demand among affluent consumers, status symbol, cultural significance.

- Key Drivers (Single-Branded Stores): Brand experience, exclusivity, customer service.

Within the Doha market, the high concentration of luxury hotels and shopping malls drives the market and creates ideal conditions for the growth and sustainability of luxury brands. This concentration makes it a key focal point for the luxury market. The successful implementation of various development projects and tourism initiatives contributes significantly to strengthening this dominance.

Qatari Luxury Goods Market Product Innovations

Recent innovations in the Qatari luxury goods market reflect a global trend toward personalized and sustainable products. Brands are increasingly incorporating advanced materials, cutting-edge technology (like NFTs for exclusivity), and bespoke customization options. Moreover, there is a rising emphasis on ethical sourcing and environmentally responsible manufacturing practices, appealing to the growing segment of conscious consumers. These innovations are driven by the desire to create unique and exclusive experiences for discerning customers. These initiatives are enhancing the attractiveness of brands, particularly for affluent buyers who seek both quality and social responsibility.

Report Segmentation & Scope

This report segments the Qatari luxury goods market by:

By Product Type: Clothing and Apparel (projected market size xx Million in 2025, xx% CAGR), Footwear (xx Million, xx% CAGR), Bags (xx Million, xx% CAGR), Jewelry (xx Million, xx% CAGR), Watches (xx Million, xx% CAGR), and Other Types (xx Million, xx% CAGR). Each segment's competitive landscape varies, with some dominated by international players and others featuring a larger presence of local brands.

By Distribution Channel: Single-branded Stores (projected market size xx Million in 2025, xx% CAGR), Multi-brand Stores (xx Million, xx% CAGR), Online Stores (xx Million, xx% CAGR), and Other Distribution Channels (xx Million, xx% CAGR). The growth of online retail is expected to be a significant trend shaping the industry's future.

Key Drivers of Qatari Luxury Goods Market Growth

The growth of the Qatari luxury goods market is propelled by a confluence of factors:

- High Disposable Incomes: Qatar boasts a high per capita income, fueling demand for luxury goods.

- Tourism Boom: The increasing number of tourists visiting Qatar contributes to revenue growth.

- Government Initiatives: Investments in infrastructure and tourism support the luxury sector.

- Major Sporting Events: Events like the FIFA World Cup significantly boost tourism and spending.

Challenges in the Qatari Luxury Goods Market Sector

Despite its promising outlook, the Qatari luxury goods market faces certain challenges:

- Economic Volatility: Global economic downturns can impact consumer spending on luxury items.

- Competition: Intense competition among both international and domestic brands exists.

- Supply Chain Disruptions: Global supply chain issues can impact product availability and pricing.

- Geopolitical Factors: Regional instability and international relations can affect market sentiment.

Leading Players in the Qatari Luxury Goods Market Market

- KERING

- Giorgio Armani

- LVMH

- Puig

- Prada SpA

- Joyalukkas

- PVH

- Qatar Luxury Group

- HUGO BOSS

- Valentino s p a

- CHANEL

- Rolex

Key Developments in Qatari Luxury Goods Market Sector

- November 2022: The Giantto Group launched a limited-edition timepiece collection timed with the World Cup.

- November 2022: Louis Vuitton launched a limited-edition FIFA World Cup Collection.

- August 2022: CHANEL unveiled new sneaker styles for its Fall/Winter 2022/2023 collection.

- April 2022: Louis Vuitton announced its first store at Qatar Duty-Free in Hamad International Airport.

Strategic Qatari Luxury Goods Market Market Outlook

The Qatari luxury goods market is poised for continued growth, driven by a strong economic outlook, increasing tourism, and evolving consumer preferences. Strategic opportunities lie in leveraging technology for personalized experiences, focusing on sustainability, and developing unique offerings that cater to the specific cultural context of Qatar. Expansion into new segments like experiential luxury and partnerships with local artisans will further enhance market penetration and competitiveness. This presents a compelling environment for both established luxury brands and ambitious new entrants seeking to capitalize on this expanding market.

Qatari Luxury Goods Market Segmentation

-

1. Product Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. Single-branded Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Qatari Luxury Goods Market Segmentation By Geography

- 1. Qatar

Qatari Luxury Goods Market Regional Market Share

Geographic Coverage of Qatari Luxury Goods Market

Qatari Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Qatar is the Regional Luxury Fashion Hub

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatari Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-branded Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KERING

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Giorgio Armani

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LVMH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Puig

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prada SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Joyalukkas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PVH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Qatar Luxury Group*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HUGO BOSS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valentino s p a

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CHANEL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rolex

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 KERING

List of Figures

- Figure 1: Qatari Luxury Goods Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Qatari Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Qatari Luxury Goods Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Qatari Luxury Goods Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Qatari Luxury Goods Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Qatari Luxury Goods Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Qatari Luxury Goods Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Qatari Luxury Goods Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatari Luxury Goods Market?

The projected CAGR is approximately 5.03%.

2. Which companies are prominent players in the Qatari Luxury Goods Market?

Key companies in the market include KERING, Giorgio Armani, LVMH, Puig, Prada SpA, Joyalukkas, PVH, Qatar Luxury Group*List Not Exhaustive, HUGO BOSS, Valentino s p a, CHANEL, Rolex.

3. What are the main segments of the Qatari Luxury Goods Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Qatar is the Regional Luxury Fashion Hub.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

November 2022: The Giantto Group, a prominent LA-based jewelry company, officially launched 300 units of a collector's edition numbered and exclusive timepiece collection, just in time for the World Cup 2022 in Doha, Qatar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatari Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatari Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatari Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Qatari Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence