Key Insights

The Qatari major home appliances market, valued at approximately $250 million in 2025, exhibits robust growth potential, driven by a rising population, increasing disposable incomes, and a preference for modern, technologically advanced appliances. The market's Compound Annual Growth Rate (CAGR) exceeding 4% from 2019 to 2024 suggests a sustained upward trajectory. Key growth drivers include urbanization, rising standards of living, and government initiatives promoting infrastructure development and sustainable housing. The market is segmented by distribution channel (offline and online) and product type (refrigerators and freezers, washing machines, air conditioners, microwave ovens, cooking appliances, dishwashers, and others). Online sales are expected to gain momentum, fueled by increasing internet penetration and e-commerce adoption. Refrigerators and air conditioners constitute significant market segments, benefiting from the region's hot climate. However, challenges include fluctuating energy prices and potential import restrictions, which could influence market dynamics. Leading players like Whirlpool, LG, Samsung, and Panasonic are actively competing to capture market share through strategic pricing, product innovation, and brand building.

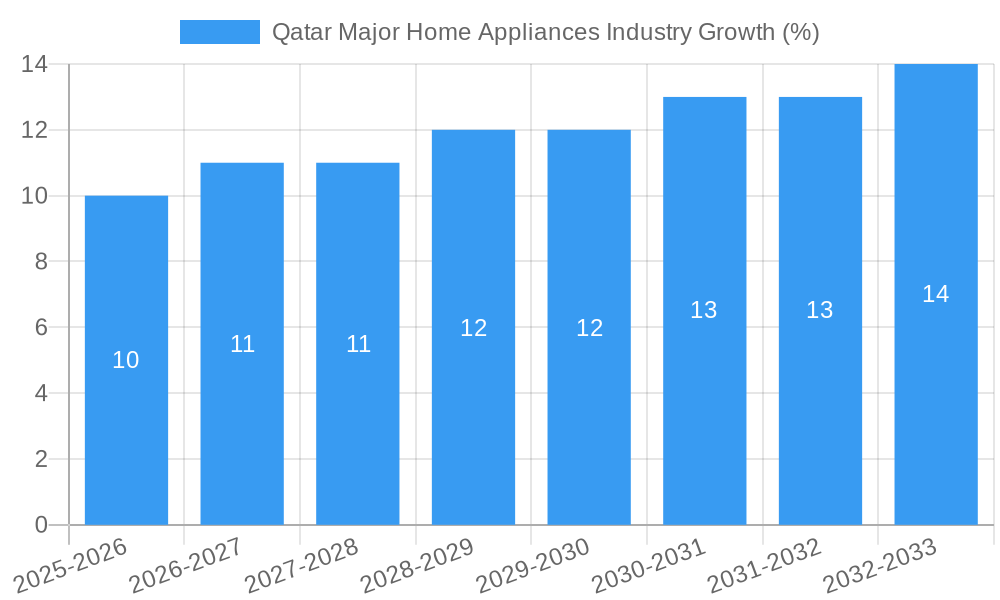

The forecast period (2025-2033) anticipates continued market expansion, propelled by factors such as planned infrastructure projects, anticipated population growth, and sustained economic activity. The dominance of offline channels is likely to persist, though online penetration will steadily increase. Product innovation, particularly in energy-efficient appliances, will play a vital role in shaping market trends. Competitive intensity is expected to remain high, with established players vying for market dominance and emerging brands striving for a foothold. Successful players will need to adapt to evolving consumer preferences, prioritize efficient supply chains, and navigate fluctuating economic conditions to maintain a strong market position.

This detailed report provides an in-depth analysis of the Qatar major home appliances industry, offering valuable insights for businesses, investors, and stakeholders. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The study encompasses a comprehensive overview of market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key challenges. The market size is expected to reach xx Million by 2033, presenting significant growth opportunities. Key players like Whirlpool Corporation, LG Electronics Inc, Samsung Electronics Co Ltd, and Panasonic Corporation are analyzed, along with their market share and strategies.

Qatar Major Home Appliances Industry Market Structure & Competitive Dynamics

The Qatar major home appliances market exhibits a moderately concentrated structure, with a few multinational giants and several local players vying for market share. The industry is characterized by a dynamic innovation ecosystem, driven by technological advancements and consumer demand for energy-efficient and smart appliances. The regulatory framework, while largely supportive of market growth, includes certain standards and safety regulations that companies must adhere to. Product substitution is a factor, with consumers considering alternative technologies (e.g., energy-efficient models, smart home integration) impacting purchasing decisions. End-user trends indicate a strong preference for premium-quality appliances with advanced features, coupled with online shopping convenience. M&A activity has been relatively low in recent years, with deal values totaling approximately xx Million in the historical period (2019-2024). Key market share indicators show:

- Whirlpool Corporation: xx%

- LG Electronics Inc: xx%

- Samsung Electronics Co Ltd: xx%

- Others: xx%

Qatar Major Home Appliances Industry Industry Trends & Insights

The Qatar major home appliances market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a preference for modern home appliances. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, including the advent of smart home appliances and IoT integration, are transforming the consumer experience and creating new revenue streams. Consumers show a strong preference for energy-efficient models due to rising electricity costs and environmental awareness. The market is also witnessing increasing penetration of online sales channels, providing consumers with more choices and convenience. Competitive dynamics remain intense, with major players focusing on product differentiation, brand building, and strategic partnerships to gain a competitive edge. Market penetration of smart appliances is projected to reach xx% by 2033.

Dominant Markets & Segments in Qatar Major Home Appliances Industry

The offline distribution channel currently dominates the Qatar major home appliances market, owing to consumer preference for hands-on product experience and immediate availability. However, online sales are witnessing rapid growth and are projected to capture a significant share in the coming years. Among product segments, refrigerators and freezers constitute the largest segment, followed by air conditioners and washing machines. This dominance is primarily due to high demand resulting from the region’s climate and lifestyle.

- Key Drivers for Offline Dominance: Established retail networks, consumer preference for physical inspection.

- Key Drivers for Refrigerator and Freezer Segment Dominance: High household penetration, essential appliances in every home, and high replacement rate.

- Key Drivers for Air Conditioner Segment Growth: High temperatures, need for cooling, and ongoing construction growth.

The high demand and growth in these key segments is fueled by factors including rapid urbanization, rising disposable incomes, and the increasing adoption of modern lifestyles. The government's focus on infrastructure development and housing projects also significantly contributes to the market growth.

Qatar Major Home Appliances Industry Product Innovations

Recent product innovations focus heavily on energy efficiency, smart features, and enhanced user experience. Manufacturers are increasingly incorporating IoT connectivity, allowing for remote control and monitoring of appliances. Smart refrigerators with built-in touchscreens and advanced food management systems are gaining traction. Improved energy-efficient technologies, coupled with sleek designs and intuitive interfaces, are driving consumer demand. The market is witnessing increased competition on features such as improved washing cycles, enhanced cooking functions, and superior cooling systems.

Report Segmentation & Scope

This report segments the Qatar major home appliances market by distribution channel (Offline and Online) and product type (Refrigerators and Freezers, Washing Machines, Air Conditioners, Microwave Ovens, Cooking Appliances (Ranges/Hobs), Dishwashers, Others). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. Growth projections vary across segments based on market penetration, consumer preferences and technological advancements. For instance, the online segment is anticipated to show faster growth than the offline segment. Similarly, the smart home appliance segment within each product category demonstrates a significantly higher growth trajectory.

Key Drivers of Qatar Major Home Appliances Industry Growth

Several factors drive the growth of the Qatar major home appliances industry. Rising disposable incomes empower consumers to purchase premium products, fueling demand. Government initiatives to improve infrastructure and living standards contribute significantly. Technological advancements, such as the introduction of energy-efficient and smart appliances, create additional demand and improve the product lifecycle. Lastly, urbanization patterns contribute to the rise in new households and individual units, further enhancing overall demand.

Challenges in the Qatar Major Home Appliances Industry Sector

The industry faces challenges including dependence on imports, fluctuations in global commodity prices, and intense competition from established international players. Supply chain disruptions can impact production and sales, as seen recently with global supply constraints. Stringent regulatory requirements related to safety and energy efficiency add to the manufacturing and compliance costs. Maintaining profitability while offering competitive prices in a saturated market requires innovative strategies from all market participants.

Leading Players in the Qatar Major Home Appliances Industry Market

- Whirlpool Corporation

- Kitchen Line

- Mitsubishi Electric Corp

- LG Electronics Inc

- Gettco

- Samsung Electronics Co Ltd

- Gorenje Group

- Electro

- BSH Hausgerate GmbH

- Panasonic Corporation

Key Developments in Qatar Major Home Appliances Industry Sector

- September 2021: LG Electronics opened its fourth premium brand showroom in Qatar, signifying its commitment to the market.

- November 2021: LG Electronics launched its 2021 range of OLED & NanoCell televisions, showcasing advancements in technology and user experience. These developments highlight the ongoing innovation and expansion strategies of major players in the Qatar major home appliances market.

Strategic Qatar Major Home Appliances Industry Market Outlook

The Qatar major home appliances market presents a promising outlook, driven by sustained economic growth, increasing urbanization, and a growing preference for advanced appliances. Strategic opportunities exist for companies focusing on energy efficiency, smart home integration, and superior customer service. Expanding online sales channels and exploring strategic partnerships with local retailers will further drive growth. The market is expected to consolidate further, with larger players benefiting from economies of scale and superior brand recognition. The continued focus on innovation and customer satisfaction will remain pivotal for success in this dynamic market.

Qatar Major Home Appliances Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Qatar Major Home Appliances Industry Segmentation By Geography

- 1. Qatar

Qatar Major Home Appliances Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Smart Home is boosting the Market

- 3.3. Market Restrains

- 3.3.1. Flactuting Raw Material Cost

- 3.4. Market Trends

- 3.4.1. Rising Construction activities in Qatar is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Major Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kitchen Line

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Electric Corp**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Electronics Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gettco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samsung Electronics Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gorenje Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Electro

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BSH Hausgerate GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Qatar Major Home Appliances Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Major Home Appliances Industry Share (%) by Company 2024

List of Tables

- Table 1: Qatar Major Home Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Major Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Qatar Major Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Qatar Major Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Qatar Major Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Qatar Major Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Qatar Major Home Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Qatar Major Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Qatar Major Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Qatar Major Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Qatar Major Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Qatar Major Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Qatar Major Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Qatar Major Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Major Home Appliances Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Qatar Major Home Appliances Industry?

Key companies in the market include Whirlpool Corporation, Kitchen Line, Mitsubishi Electric Corp**List Not Exhaustive, LG Electronics Inc, Gettco, Samsung Electronics Co Ltd, Gorenje Group, Electro, BSH Hausgerate GmbH, Panasonic Corporation.

3. What are the main segments of the Qatar Major Home Appliances Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Smart Home is boosting the Market.

6. What are the notable trends driving market growth?

Rising Construction activities in Qatar is Driving the Market.

7. Are there any restraints impacting market growth?

Flactuting Raw Material Cost.

8. Can you provide examples of recent developments in the market?

November 2021 - Electronics major and global conglomerate LG Electronics has announced its 2021 range of OLED & NanoCell televisions in Qatar. The new TVs will be running on webOS 6.0 which will provide users with faster access to apps and better personalisation experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Major Home Appliances Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Major Home Appliances Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Major Home Appliances Industry?

To stay informed about further developments, trends, and reports in the Qatar Major Home Appliances Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence