Key Insights

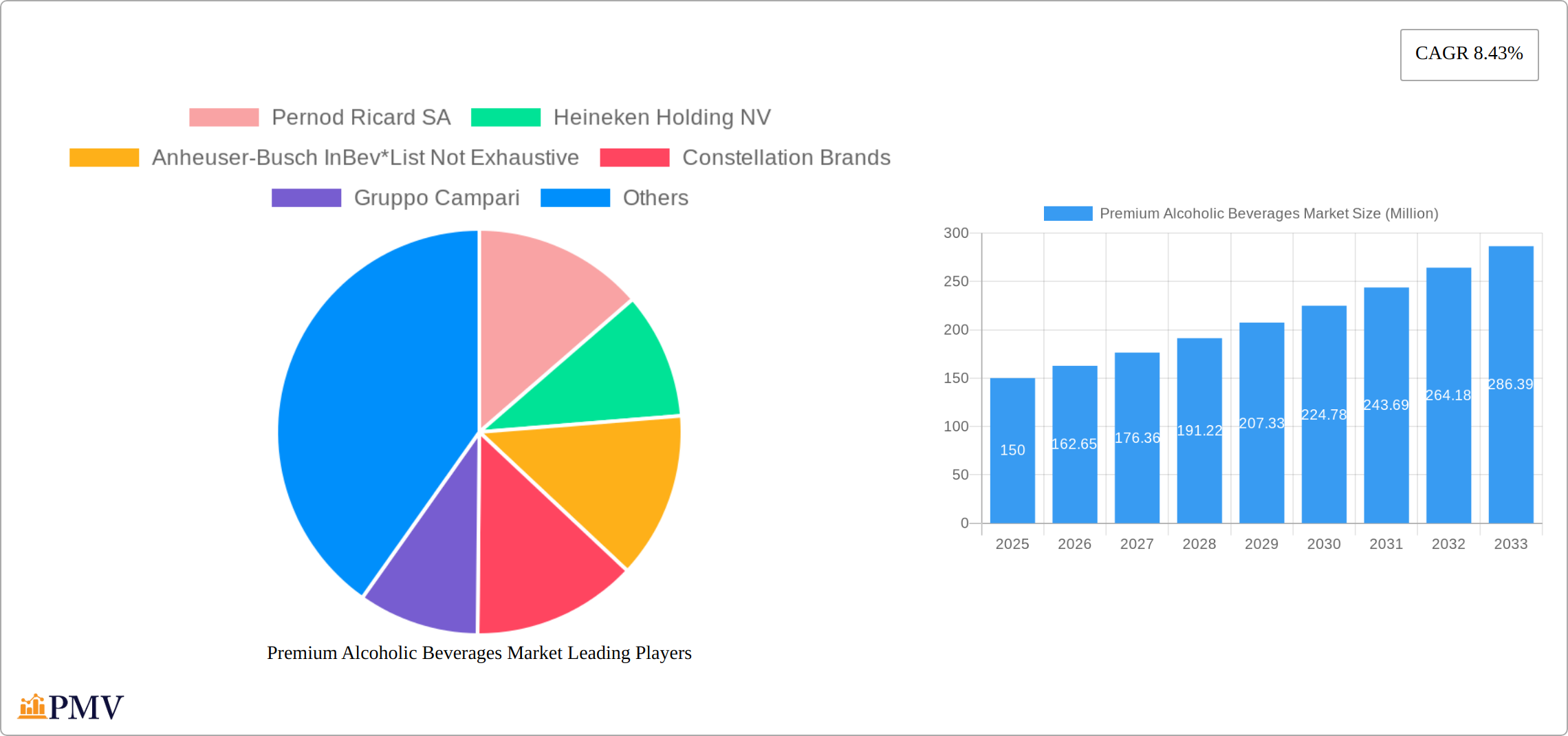

The Premium Alcoholic Beverages Market is projected to grow significantly, reaching a market size of $150 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.43% over the forecast period from 2025 to 2033. This growth is driven by increasing consumer demand for high-quality and unique alcoholic beverages, as well as a rising trend towards premiumization across various beverage categories. Key segments within the market include Beer, Wine, and Spirits, with distribution channels split between On-Trade and Off-Trade. Major players such as Pernod Ricard SA, Heineken Holding NV, and Anheuser-Busch InBev are actively expanding their premium offerings to capture this lucrative market. The trend towards craft and artisanal products is particularly notable, with consumers showing a preference for beverages that offer a unique taste and experience.

Regionally, North America, especially the United States and Canada, holds a significant share of the Premium Alcoholic Beverages Market, driven by high disposable incomes and a culture of premium drinking. Europe follows closely, with countries like the United Kingdom, Germany, and France contributing to market growth through their rich tradition of wine and spirits consumption. The Asia Pacific region, led by markets such as China, Japan, and Australia, is witnessing rapid growth due to increasing urbanization and a burgeoning middle class with a taste for premium products. South America and the Middle East and Africa are also emerging markets, with Brazil and South Africa showing promising growth potential. The market's dynamics are influenced by trends such as sustainability and health consciousness, which are shaping the development of new product lines and marketing strategies.

Premium Alcoholic Beverages Market Market Structure & Competitive Dynamics

The Premium Alcoholic Beverages Market is characterized by a mix of high concentration and dynamic innovation, shaped by a robust ecosystem of key players such as Pernod Ricard SA, Heineken Holding NV, and Diageo PLC. Market concentration is evident, with the top companies holding significant market shares; for instance, Diageo PLC holds around 15% of the global market. The innovation ecosystem thrives on continuous product development, with companies investing heavily in R&D to introduce premium variants. Regulatory frameworks vary by region but generally focus on quality control and responsible marketing, influencing market dynamics significantly.

Product substitutes like non-alcoholic beverages and craft beers pose challenges, yet the premium segment continues to grow due to increasing consumer preference for luxury and quality. End-user trends show a shift towards premiumization, with consumers willing to pay more for unique and high-quality offerings. M&A activities have been prominent, with deal values reaching up to 5 Million in recent years, aimed at expanding market reach and enhancing product portfolios. These activities not only consolidate the market but also fuel innovation and competition.

- Market Concentration: Dominated by key players like Diageo PLC with a 15% share.

- Innovation Ecosystem: Continuous R&D investments leading to premium product launches.

- Regulatory Frameworks: Varying by region, focused on quality and marketing standards.

- Product Substitutes: Non-alcoholic beverages and craft beers as alternatives.

- End-User Trends: Increasing demand for premium and luxury products.

- M&A Activities: Deal values up to 5 Million, driving market consolidation and innovation.

Premium Alcoholic Beverages Market Industry Trends & Insights

The Premium Alcoholic Beverages Market is experiencing robust growth, fueled by a confluence of factors. A key driver is the escalating global disposable income, particularly within emerging markets, fostering a significant shift towards premium product consumption. Market projections indicate a Compound Annual Growth Rate (CAGR) of 5.5% for the premium segment from 2025 to 2033, highlighting substantial market potential. Furthermore, technological advancements, such as the integration of AI in brewing and distilling, are enhancing both product quality and production efficiency, thereby accelerating market penetration. This technological disruption allows for greater precision and consistency, leading to higher-quality products that appeal to discerning consumers.

Consumer preferences are dynamically evolving, showcasing a pronounced inclination towards craft and artisanal beverages. This shift reflects a growing demand for authenticity and unique sensory experiences. In response, companies are aggressively innovating to cater to these niche markets and capture the attention of consumers seeking distinctive and high-quality offerings. The competitive landscape is intensely dynamic, with industry giants like Pernod Ricard and Diageo actively engaged in strategic marketing campaigns and aggressive product differentiation strategies. The recent introduction of premium brands like Heineken Silver and Jack Daniel's super-premium line extensions perfectly illustrate the industry's proactive response to these evolving consumer demands and the pursuit of capturing market share within the expanding premium segment.

Macroeconomic trends significantly influence the market, with premium beverages often perceived as status symbols reflecting aspirational lifestyles. The burgeoning growth of e-commerce and direct-to-consumer (DTC) sales channels has dramatically increased market accessibility and broadened the reach of premium brands to a wider consumer base. However, the market also faces challenges, including stringent regulatory restrictions on alcohol advertising and distribution, which can impede market expansion and profitability. Despite these hurdles, the premium segment remains poised for sustained growth, driven by continuous innovation, evolving consumer preferences, and strategic global market expansion initiatives.

Dominant Markets & Segments in Premium Alcoholic Beverages Market

The Premium Alcoholic Beverages Market exhibits distinct regional, national, and segmental dominance, each influenced by specific economic conditions and regulatory frameworks. North America, particularly the United States, stands out as a leading region, characterized by high consumer spending on premium beverages, reflecting strong economic conditions and a well-established culture of luxury consumption.

- Economic Policies: Supportive tax policies and favorable regulations within the US actively encourage the expansion of the premium segment.

- Infrastructure: Sophisticated distribution networks and robust retail environments facilitate the seamless expansion of premium brands.

The Spirits segment holds a particularly dominant position, with a projected market size of 120 Million by 2033. This dominance stems from the global trend towards premiumization, where consumers increasingly prioritize high-quality spirits for both special occasions and everyday enjoyment. The Spirits segment further benefits from strong brand loyalty and the strategic introduction of premium and super-premium product lines by leading players such as Diageo and Pernod Ricard.

- Beer: The premium beer market is experiencing robust growth, driven by innovative products such as Heineken Silver.

- Wine: The wine segment demonstrates steady growth, propelled by the increasing popularity of boutique wineries and premium wine labels.

- Spirits: Leading the market with a projected size of 120 Million by 2033, driven by the ongoing premiumization trend.

- On-Trade: The on-trade channel, encompassing bars and restaurants, remains significant due to its strong association with luxury and social experiences.

- Off-Trade: This segment is exhibiting rapid growth, facilitated by enhanced retail availability and the exponential rise of e-commerce, providing consumers with a broader range of purchasing options for premium products.

Regarding distribution channels, the On-Trade segment maintains significant importance, largely due to its association with luxury and social contexts. However, the Off-Trade segment is experiencing remarkable growth, driven by the convenience of retail and online purchasing. This shift is particularly pronounced in regions such as Europe and Asia-Pacific, where consumers are increasingly choosing to purchase premium beverages for home consumption.

Premium Alcoholic Beverages Market Product Innovations

Product innovation within the Premium Alcoholic Beverages Market is significantly driven by technological advancements and the dynamic evolution of consumer preferences. Recent notable examples include the launch of Heineken Silver, a premium beer strategically positioned to expand the market in India, and the introduction of Jack Daniel's Bonded and Triple Mash, representing the brand's first super-premium line extensions in 25 years. These innovations underscore a strong focus on premiumization and unwavering commitment to quality, directly aligning with the market's increasing demand for unique and high-quality offerings. The competitive edge within this market is increasingly determined by the ability to effectively cater to niche market demands and consistently meet consumer expectations for luxury and authenticity.

Report Segmentation & Scope

The Premium Alcoholic Beverages Market is segmented by Type and Distribution Channel, each with distinct growth trajectories and competitive dynamics.

- Type: The market is divided into Beer, Wine, and Spirits. Spirits lead the segment, projected to reach a market size of 120 Million by 2033, driven by premiumization trends. Beer and Wine segments are also growing, with premium offerings like Heineken Silver and boutique wines gaining traction.

- Distribution Channel: Segments include On-Trade and Off-Trade. The On-Trade channel is significant for premium consumption in bars and restaurants, while the Off-Trade channel is growing due to the rise of e-commerce and retail availability.

These segments are influenced by consumer trends, economic factors, and strategic market expansions, shaping the overall market dynamics.

Key Drivers of Premium Alcoholic Beverages Market Growth

The Premium Alcoholic Beverages Market is driven by several key factors, including technological advancements, economic growth, and regulatory environments. Technological innovations, such as AI in brewing and distilling, enhance product quality and efficiency. Economic growth in emerging markets increases disposable income, leading to higher demand for premium products. Regulatory environments that support quality control and responsible marketing also contribute to market growth. For instance, favorable tax policies in North America encourage the expansion of premium beverages.

Challenges in the Premium Alcoholic Beverages Market Sector

The Premium Alcoholic Beverages Market faces significant challenges that directly impact its growth trajectory. Regulatory hurdles, such as stringent advertising and distribution laws, pose substantial limitations on market expansion, with compliance costs estimated at approximately 2 Million annually. Supply chain disruptions, particularly during periods of global uncertainty, can significantly affect product availability and pricing stability. The intensely competitive landscape necessitates ongoing innovation from major players to maintain market share, leading to substantial marketing and R&D expenses. Addressing these challenges effectively requires strategic management and proactive adaptation to maintain sustainable growth within the premium segment.

Leading Players in the Premium Alcoholic Beverages Market Market

- Pernod Ricard SA

- Heineken Holding NV

- Anheuser-Busch InBev *List Not Exhaustive

- Constellation Brands

- Gruppo Campari

- Bacardi Limited

- Treasury Wine Estates

- The Brown-Forman Corporation

- Carlsberg Group

- Diageo PLC

Key Developments in Premium Alcoholic Beverages Market Sector

- September 2022: The Heineken Group announced the launch of Heineken Silver, aimed at expanding its position in the premium beer market in India. This launch is expected to accelerate the growth of the premium beer segment in the region.

- May 2022: Jack Daniel's distillery introduced Jack Daniel's Bonded and Jack Daniel's Triple Mash, marking the brand's first super-premium line extensions in 25 years. These products are part of a long-term strategy to "premiumize" American whiskeys.

- April 2022: Frisky Whiskey launched a new premium flavored whiskey, crafted in small batches in Charleston, South Carolina. Infused with pure caramel and raw vanilla, this product is an extension of the Landis' William Wolf Whiskey line, focusing on great taste and quality.

Strategic Premium Alcoholic Beverages Market Market Outlook

The Premium Alcoholic Beverages Market is poised for significant growth, driven by rising consumer demand for luxury and quality. Future market potential lies in emerging markets, where increasing disposable incomes and a growing middle class fuel demand for premium products. Strategic opportunities include expanding product portfolios to include more niche and artisanal offerings, leveraging e-commerce for broader market reach, and investing in sustainable practices to appeal to environmentally conscious consumers. The focus on innovation and premiumization will continue to be key accelerators of market growth.

Premium Alcoholic Beverages Market Segmentation

-

1. Type

- 1.1. Beer

- 1.2. Wine

- 1.3. Spirits

-

2. Distribution Channel

- 2.1. On-Trade

- 2.2. Off-Trade

Premium Alcoholic Beverages Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Premium Alcoholic Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Craft Beer Gaining Importance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beer

- 5.1.2. Wine

- 5.1.3. Spirits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Beer

- 6.1.2. Wine

- 6.1.3. Spirits

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Beer

- 7.1.2. Wine

- 7.1.3. Spirits

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Beer

- 8.1.2. Wine

- 8.1.3. Spirits

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Beer

- 9.1.2. Wine

- 9.1.3. Spirits

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Beer

- 10.1.2. Wine

- 10.1.3. Spirits

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Rest of Europe

- 13. Asia Pacific Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 United Arab Emirates

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Pernod Ricard SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Heineken Holding NV

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Anheuser-Busch InBev*List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Constellation Brands

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Gruppo Campari

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Bacardi Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Treasury Wine Estates

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 The Brown-Forman Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Carlsberg Group

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Diageo PLC

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Pernod Ricard SA

List of Figures

- Figure 1: Global Premium Alcoholic Beverages Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Premium Alcoholic Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Premium Alcoholic Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Premium Alcoholic Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Premium Alcoholic Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Premium Alcoholic Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Premium Alcoholic Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Premium Alcoholic Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Premium Alcoholic Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Premium Alcoholic Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Premium Alcoholic Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Premium Alcoholic Beverages Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Premium Alcoholic Beverages Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Premium Alcoholic Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: North America Premium Alcoholic Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: North America Premium Alcoholic Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Premium Alcoholic Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Premium Alcoholic Beverages Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Premium Alcoholic Beverages Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Premium Alcoholic Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe Premium Alcoholic Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe Premium Alcoholic Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Premium Alcoholic Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Premium Alcoholic Beverages Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Premium Alcoholic Beverages Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Premium Alcoholic Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 27: Asia Pacific Premium Alcoholic Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 28: Asia Pacific Premium Alcoholic Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Premium Alcoholic Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Premium Alcoholic Beverages Market Revenue (Million), by Type 2024 & 2032

- Figure 31: South America Premium Alcoholic Beverages Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: South America Premium Alcoholic Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: South America Premium Alcoholic Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: South America Premium Alcoholic Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Premium Alcoholic Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Premium Alcoholic Beverages Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Premium Alcoholic Beverages Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Premium Alcoholic Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: Middle East and Africa Premium Alcoholic Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: Middle East and Africa Premium Alcoholic Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Premium Alcoholic Beverages Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: India Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: South Africa Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United Arab Emirates Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Middle East and Africa Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 34: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United States Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Mexico Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of North America Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United Kingdom Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Germany Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Russia Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 51: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: India Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: China Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Australia Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Asia Pacific Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 59: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Argentina Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of South America Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Type 2019 & 2032

- Table 64: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 65: Global Premium Alcoholic Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: South Africa Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: United Arab Emirates Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East and Africa Premium Alcoholic Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Premium Alcoholic Beverages Market?

The projected CAGR is approximately 8.43%.

2. Which companies are prominent players in the Premium Alcoholic Beverages Market?

Key companies in the market include Pernod Ricard SA, Heineken Holding NV, Anheuser-Busch InBev*List Not Exhaustive, Constellation Brands, Gruppo Campari, Bacardi Limited, Treasury Wine Estates, The Brown-Forman Corporation, Carlsberg Group, Diageo PLC.

3. What are the main segments of the Premium Alcoholic Beverages Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Craft Beer Gaining Importance.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

September 2022: The Heineken Group, located in Amsterdam, announced the launch of Heineken Silver, increasing its position in the premium beer market in India. They asserted that the launch would fuel and hasten the expansion of the premium beer market in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Premium Alcoholic Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Premium Alcoholic Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Premium Alcoholic Beverages Market?

To stay informed about further developments, trends, and reports in the Premium Alcoholic Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence