Key Insights

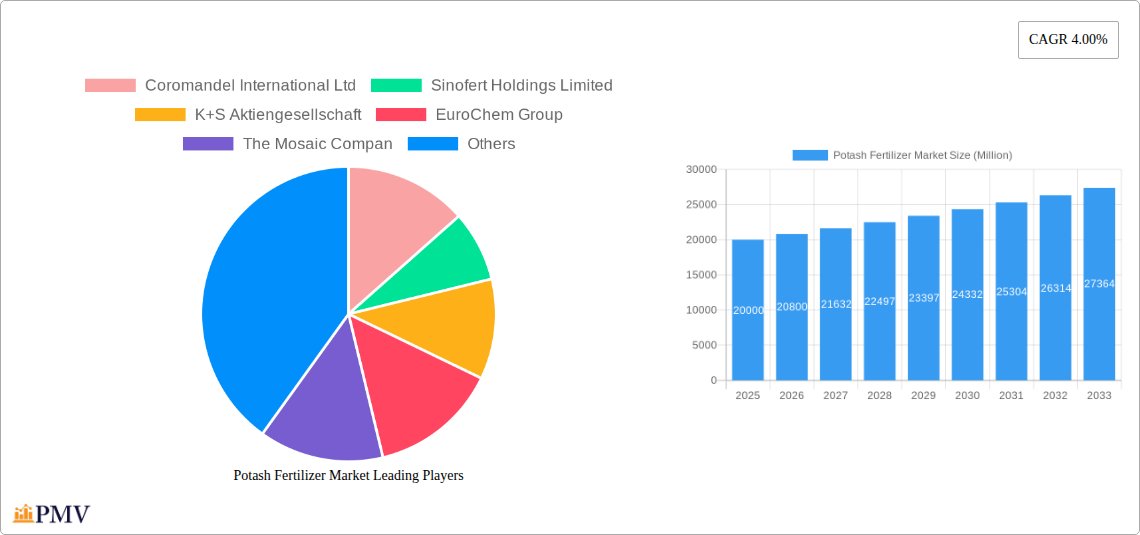

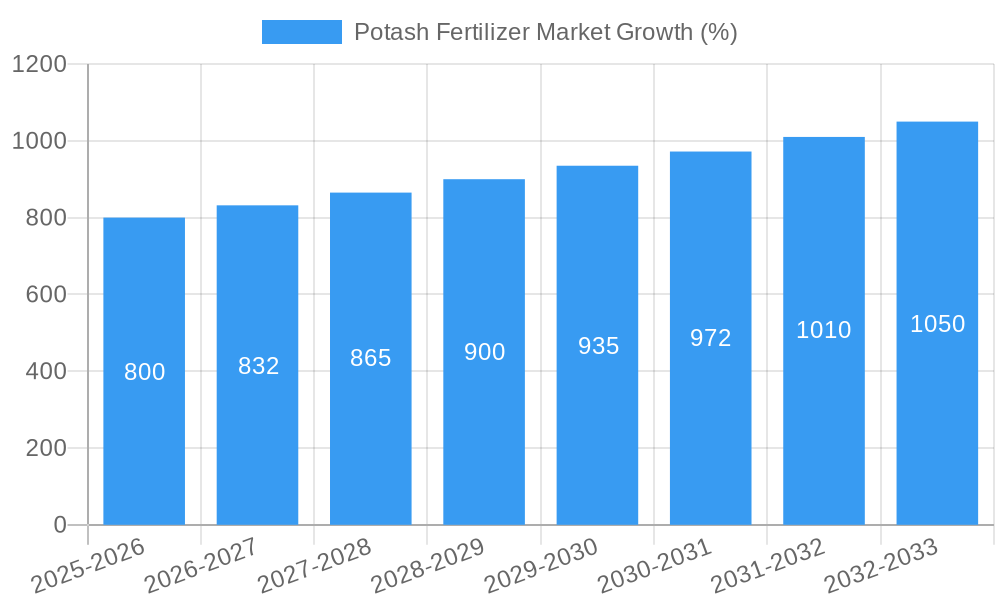

The potash fertilizer market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.00% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the rising global population necessitates increased food production, driving demand for fertilizers to enhance crop yields. Secondly, the growing adoption of modern agricultural practices, including precision farming and fertigation, optimizes fertilizer application and boosts efficiency, contributing to market growth. Furthermore, increasing government initiatives promoting sustainable agriculture and food security in various regions are also bolstering market expansion. The market is segmented by application mode (fertigation, foliar, soil), crop type (field crops, horticultural crops, turf & ornamental), and type (straight, others). While the dominance of field crops is expected to continue, the horticultural and turf & ornamental segments are projected to witness significant growth driven by rising disposable incomes and urbanization leading to increased landscaping and gardening activities. However, the market faces certain restraints, including price volatility of potash due to geopolitical factors and supply chain disruptions, as well as environmental concerns related to excessive fertilizer use. Major players like Coromandel International Ltd, Sinofert Holdings Limited, K+S Aktiengesellschaft, EuroChem Group, The Mosaic Company, Nutrien Ltd, Intrepid Potash Inc, and Sociedad Quimica y Minera de Chile SA are shaping market competition through strategic partnerships, technological advancements, and expansion into new markets.

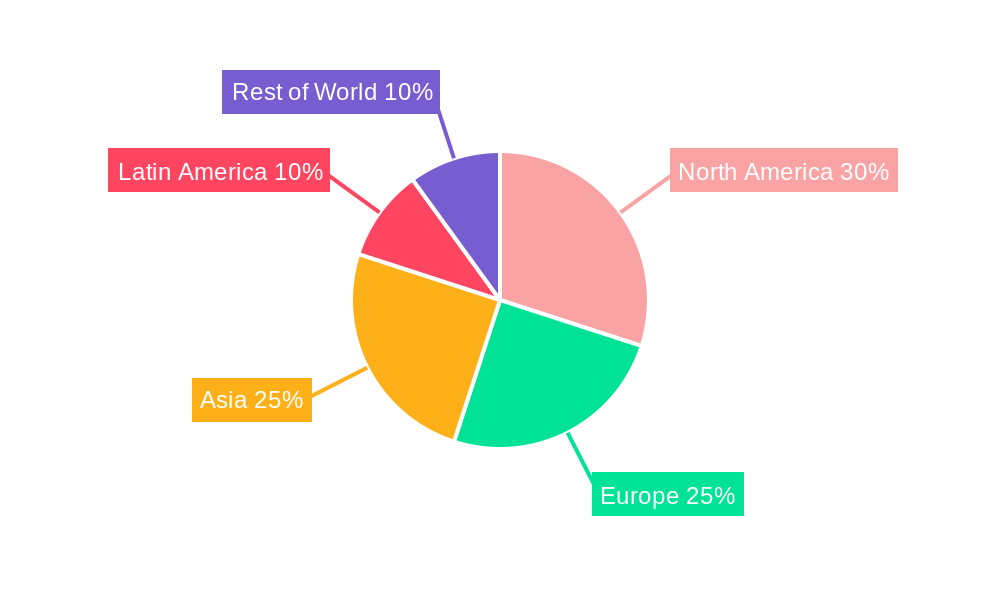

The forecast period (2025-2033) anticipates continued market expansion, though the growth rate might fluctuate year-on-year depending on factors such as global economic conditions, agricultural policies, and weather patterns impacting crop yields. The straight potash segment will likely maintain its leading position due to its wide applicability across various crops. Regional variations in market growth are expected, with regions like North America and Europe maintaining significant market shares, while emerging economies in Asia and Latin America are poised for substantial growth due to their expanding agricultural sectors and increasing adoption of modern farming techniques. Competitive dynamics will remain intense, with companies focusing on product innovation, sustainable practices, and strategic acquisitions to gain market share. Overall, the potash fertilizer market presents a promising investment opportunity for stakeholders across the value chain, supported by long-term growth prospects fueled by the growing global food demand.

Potash Fertilizer Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Potash Fertilizer market, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils key market trends, competitive dynamics, and future growth prospects. The report meticulously segments the market by application mode (fertigation, foliar, soil), crop type (field crops, horticultural crops, turf & ornamental), and type (straight, others), providing granular data for informed decision-making.

Potash Fertilizer Market Structure & Competitive Dynamics

The global potash fertilizer market exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share. The competitive landscape is characterized by intense rivalry, driven by factors such as pricing strategies, product innovation, and geographical expansion. Innovation ecosystems are evolving, with companies investing heavily in research and development to improve fertilizer efficiency and sustainability. Regulatory frameworks vary across regions, impacting production costs and market access. Product substitutes, such as organic fertilizers, pose a growing challenge, forcing incumbents to adapt their offerings. End-user trends, such as increasing demand for high-yield crops and sustainable agricultural practices, are shaping market growth. Mergers and acquisitions (M&A) are frequent, as companies seek to expand their market reach, enhance their product portfolios, and secure access to raw materials. Notable M&A activities, with estimated values (in Million) where available, include:

- K+S Aktiengesellschaft's acquisition of a 75% share in Industrial Commodities Holdings (Pty) Ltd (ICH) in April 2023 for an estimated xx Million, strengthening its presence in southern and eastern Africa.

- EuroChem Group's purchase of 51.48% of Fertilizantes Heringer SA in March 2022, for an estimated xx Million, enhancing its Brazilian distribution network.

- Other M&A activities with values ranging from xx Million to xx Million have occurred in the recent past, driving consolidation in the market.

Market share data reveals that the top five players command approximately xx% of the global market, indicating a level of concentration that is likely to remain relatively stable in the near future. However, emerging players continue to challenge the established order through product differentiation and cost-effective strategies.

Potash Fertilizer Market Industry Trends & Insights

The global potash fertilizer market is experiencing robust growth, driven by several key factors. The increasing global population and rising demand for food are fueling the need for enhanced agricultural productivity. Technological advancements in fertilizer formulations are leading to improved nutrient use efficiency and reduced environmental impact. Consumer preferences are shifting towards sustainable and environmentally friendly agricultural practices, creating opportunities for eco-friendly potash fertilizer solutions. However, fluctuations in raw material prices, geopolitical instability, and environmental regulations pose significant challenges.

The market is estimated to reach xx Million by 2025 and exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration in developing economies remains relatively low, presenting substantial growth potential. Technological disruptions, such as precision farming techniques and the use of digital technologies in fertilizer application, are transforming the industry and enabling greater efficiency. Competitive dynamics are intense, with companies vying for market share through product innovation, pricing strategies, and strategic partnerships.

Dominant Markets & Segments in Potash Fertilizer Market

The Potash Fertilizer market demonstrates varied regional dominance and segment-specific growth trajectories. While precise market share allocation by region and segment is unavailable, based on industry analysis, a probable outcome is presented:

Leading Region: North America is likely to remain a dominant region due to its established agricultural sector and robust infrastructure.

Leading Country: The United States is projected to retain its position as the leading country due to extensive agricultural lands and high fertilizer consumption.

Dominant Application Mode: Soil application continues to be the dominant application mode due to its wide acceptance and established practices across the globe.

Dominant Crop Type: Field crops (e.g., corn, wheat, soybeans) dominate consumption owing to their large-scale cultivation and high nutrient requirements.

Dominant Type: Straight potash fertilizers maintain a dominant position due to their cost-effectiveness and widespread usability.

Key Drivers by Segment:

- North America: Strong agricultural sector, favorable government policies, advanced technology adoption, and established distribution networks.

- Field Crops: High demand due to large-scale cultivation and necessity for high crop yields.

- Soil Application: Established infrastructure, ease of application, and cost-effectiveness.

- Straight Potash: Cost-effectiveness, widespread availability, and simple application process.

The dominance analysis reveals a strong correlation between established agricultural sectors, advanced technologies, supportive government policies, and market leadership in respective segments. Other regions are expected to show significant growth, driven by increasing agricultural investments and government initiatives.

Potash Fertilizer Market Product Innovations

Recent product innovations focus on improving nutrient use efficiency, reducing environmental impact, and enhancing crop yields. Companies are developing slow-release fertilizers, coated fertilizers, and specialized blends tailored to specific crop needs. Technological trends emphasize precision agriculture technologies, which allow for optimized fertilizer application and reduced waste. These innovations enhance market fit by addressing the growing concerns regarding sustainability and resource efficiency in agriculture.

Report Segmentation & Scope

This report segments the potash fertilizer market based on application mode (fertigation, foliar, soil), crop type (field crops, horticultural crops, turf & ornamental), and type (straight, others). Each segment is analyzed in detail, including market size, growth projections, and competitive dynamics. Growth projections for each segment vary based on factors like adoption rates, technological advancements, and regional economic trends.

Application Mode: Each application mode (fertigation, foliar, soil) shows differentiated growth rates influenced by factors like cost-effectiveness, convenience, and crop-specific requirements.

Crop Type: The field crops segment dominates due to its scale and high fertilizer demand, while horticultural crops and turf & ornamental segments showcase significant growth potential.

Type: Straight potash fertilizers currently lead, with other types showing growth potential with technological advances and adoption of blended fertilizers.

Key Drivers of Potash Fertilizer Market Growth

The growth of the potash fertilizer market is primarily driven by:

- Rising Global Population: Increased food demand necessitates higher agricultural output.

- Growing Demand for Food: A rising global population fuels the need for increased food production.

- Technological Advancements: Improved fertilizer formulations enhance nutrient use efficiency.

- Government Support: Agricultural subsidies and initiatives support fertilizer usage.

Challenges in the Potash Fertilizer Market Sector

Several factors challenge the potash fertilizer market:

- Price Volatility: Fluctuating raw material costs impact production costs and profitability.

- Environmental Concerns: Environmental regulations regarding fertilizer use impose restrictions.

- Supply Chain Disruptions: Geopolitical instability can disrupt supply chains.

- Competition from Substitutes: Organic fertilizers and other alternatives pose competition. These factors cumulatively decrease market accessibility, affecting production and sales.

Leading Players in the Potash Fertilizer Market Market

- Coromandel International Ltd

- Sinofert Holdings Limited

- K+S Aktiengesellschaft

- EuroChem Group

- The Mosaic Company

- Nutrien Ltd

- Intrepid Potash Inc

- Sociedad Quimica y Minera de Chile SA

Key Developments in Potash Fertilizer Market Sector

- April 2023: K+S Aktiengesellschaft acquired a 75% share of Industrial Commodities Holdings (Pty) Ltd's fertilizer business, expanding its African operations.

- March 2022: EuroChem Group purchased 51.48% of Fertilizantes Heringer SA, strengthening its Brazilian presence.

- February 2022: Sinochem Fertilizer Macao Limited and Arab Potash Company PLC signed an MOU, solidifying Sinochem's role as China's exclusive APC potash marketer until 2025.

These developments illustrate strategic expansions and collaborations shaping market dynamics.

Strategic Potash Fertilizer Market Outlook

The future of the potash fertilizer market is promising, driven by increasing food demand, technological advancements, and supportive government policies. Strategic opportunities exist in developing sustainable fertilizer solutions, improving nutrient use efficiency, and expanding market access in developing economies. The market is poised for continued growth, with significant opportunities for innovation and expansion across various segments and geographical regions. Companies that invest in research and development, adopt sustainable practices, and focus on customer needs will be well-positioned to succeed in this dynamic market.

Potash Fertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Potash Fertilizer Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Potash Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness of Landscaping Maintenance; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Potash Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Potash Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Potash Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Potash Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Potash Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Potash Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Coromandel International Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sinofert Holdings Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 K+S Aktiengesellschaft

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EuroChem Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Mosaic Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nutrien Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Intrepid Potash Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sociedad Quimica y Minera de Chile SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Coromandel International Ltd

List of Figures

- Figure 1: Global Potash Fertilizer Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Potash Fertilizer Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 3: North America Potash Fertilizer Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 4: North America Potash Fertilizer Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 5: North America Potash Fertilizer Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 6: North America Potash Fertilizer Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 7: North America Potash Fertilizer Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 8: North America Potash Fertilizer Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 9: North America Potash Fertilizer Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 10: North America Potash Fertilizer Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 11: North America Potash Fertilizer Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 12: North America Potash Fertilizer Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Potash Fertilizer Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Potash Fertilizer Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 15: South America Potash Fertilizer Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 16: South America Potash Fertilizer Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 17: South America Potash Fertilizer Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 18: South America Potash Fertilizer Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 19: South America Potash Fertilizer Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 20: South America Potash Fertilizer Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 21: South America Potash Fertilizer Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 22: South America Potash Fertilizer Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 23: South America Potash Fertilizer Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 24: South America Potash Fertilizer Market Revenue (Million), by Country 2024 & 2032

- Figure 25: South America Potash Fertilizer Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Potash Fertilizer Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 27: Europe Potash Fertilizer Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 28: Europe Potash Fertilizer Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 29: Europe Potash Fertilizer Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 30: Europe Potash Fertilizer Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 31: Europe Potash Fertilizer Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 32: Europe Potash Fertilizer Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 33: Europe Potash Fertilizer Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 34: Europe Potash Fertilizer Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 35: Europe Potash Fertilizer Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 36: Europe Potash Fertilizer Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Europe Potash Fertilizer Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East & Africa Potash Fertilizer Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 39: Middle East & Africa Potash Fertilizer Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 40: Middle East & Africa Potash Fertilizer Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 41: Middle East & Africa Potash Fertilizer Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 42: Middle East & Africa Potash Fertilizer Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 43: Middle East & Africa Potash Fertilizer Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 44: Middle East & Africa Potash Fertilizer Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 45: Middle East & Africa Potash Fertilizer Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 46: Middle East & Africa Potash Fertilizer Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 47: Middle East & Africa Potash Fertilizer Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 48: Middle East & Africa Potash Fertilizer Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East & Africa Potash Fertilizer Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Pacific Potash Fertilizer Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 51: Asia Pacific Potash Fertilizer Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 52: Asia Pacific Potash Fertilizer Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 53: Asia Pacific Potash Fertilizer Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 54: Asia Pacific Potash Fertilizer Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 55: Asia Pacific Potash Fertilizer Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 56: Asia Pacific Potash Fertilizer Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 57: Asia Pacific Potash Fertilizer Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 58: Asia Pacific Potash Fertilizer Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 59: Asia Pacific Potash Fertilizer Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 60: Asia Pacific Potash Fertilizer Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Asia Pacific Potash Fertilizer Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Potash Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Potash Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global Potash Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global Potash Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global Potash Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global Potash Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global Potash Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Potash Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 9: Global Potash Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 10: Global Potash Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Global Potash Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Global Potash Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Global Potash Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Potash Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: Global Potash Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 19: Global Potash Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Global Potash Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 21: Global Potash Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 22: Global Potash Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Potash Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 27: Global Potash Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: Global Potash Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 29: Global Potash Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 30: Global Potash Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 31: Global Potash Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Italy Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Benelux Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Nordics Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Potash Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 42: Global Potash Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 43: Global Potash Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 44: Global Potash Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 45: Global Potash Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 46: Global Potash Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Turkey Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Israel Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: GCC Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: North Africa Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Africa Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East & Africa Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Potash Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 54: Global Potash Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 55: Global Potash Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 56: Global Potash Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 57: Global Potash Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 58: Global Potash Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: China Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: India Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Japan Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: South Korea Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: ASEAN Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Oceania Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Asia Pacific Potash Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Potash Fertilizer Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Potash Fertilizer Market?

Key companies in the market include Coromandel International Ltd, Sinofert Holdings Limited, K+S Aktiengesellschaft, EuroChem Group, The Mosaic Compan, Nutrien Ltd, Intrepid Potash Inc, Sociedad Quimica y Minera de Chile SA.

3. What are the main segments of the Potash Fertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Awareness of Landscaping Maintenance; Technological Advancements.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns.

8. Can you provide examples of recent developments in the market?

April 2023: K+S acquired a 75% share of the fertilizer business of a South African trading company, Industrial Commodities Holdings (Pty) Ltd (ICH). In addition to expanding the core business, K+S is strengthening its operations in southern and eastern Africa as a result of this acquisition. The newly acquired fertilizer business in the future is to be operated in a joint venture under the name of FertivPty Ltd.March 2022: EuroChem Group has purchased 51.48% of the shares of the Brazilian distributor Fertilizantes Heringer SA, this purchase will further strengthen its production and distribution capacity in Brazil.February 2022: Sinochem Fertilizer Macao Limited and Arab Potash Company PLC (“APC”) signed their Memorandum of Understanding (“MOU”). By the Memorandum of Understanding, from 2023 to 2025 Sinochem Fertilizer will still be China's exclusive marketing company for APC potash.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Potash Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Potash Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Potash Fertilizer Market?

To stay informed about further developments, trends, and reports in the Potash Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence