Key Insights

The pharmaceutical packaging machinery market is poised for substantial expansion, propelled by escalating global demand for pharmaceuticals, stringent regulatory mandates for drug safety and traceability, and the growing integration of cutting-edge packaging technologies. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.74% from a base year of 2025. This upward trajectory is significantly influenced by the escalating need for efficient, automated packaging solutions capable of accommodating diverse drug formats while maintaining product integrity. Key market segments include primary packaging (e.g., blister packs, bottles, vials) and secondary packaging (e.g., cartons, labels, serialization). The industry is undergoing a transformation driven by automation and digitalization, with considerable investment in advanced technologies such as robotics, AI, and data analytics to optimize efficiency, traceability, and regulatory compliance. This includes the widespread adoption of serialization and track-and-trace systems to combat counterfeiting and enhance supply chain security. Geographically, North America and Europe currently dominate market share, attributed to their well-established pharmaceutical sectors and rigorous regulatory environments. However, the Asia-Pacific region is anticipated to experience significant growth due to its expanding pharmaceutical manufacturing base and rising healthcare expenditures.

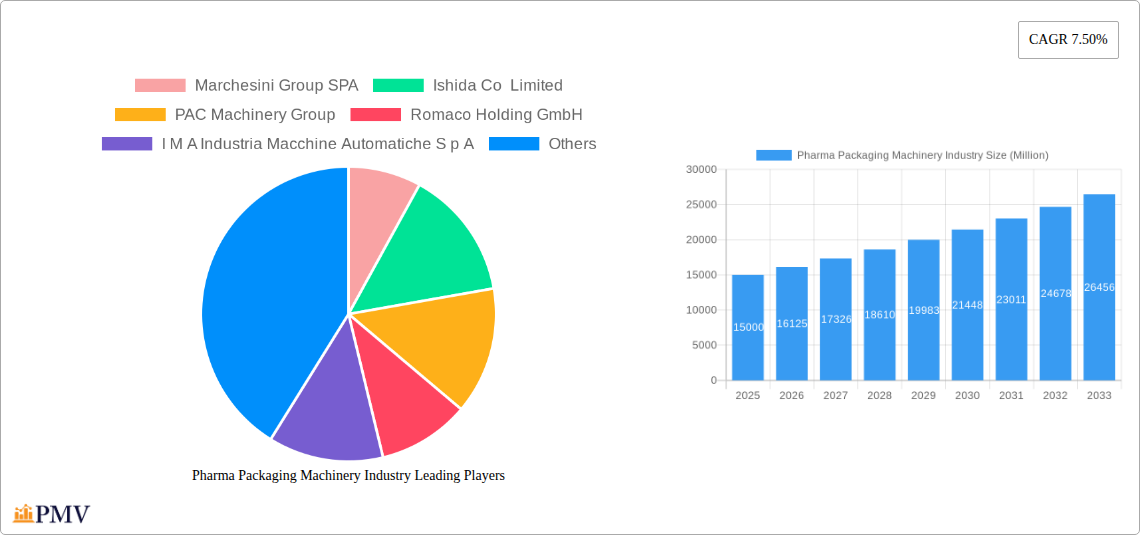

Pharma Packaging Machinery Industry Market Size (In Billion)

Key challenges within the pharmaceutical packaging machinery market encompass the considerable initial investment required for advanced equipment, the demand for skilled personnel for operation and maintenance, and the dynamic evolution of regulatory standards necessitating continuous upgrades. Intense market competition from established players and emerging innovators further shapes market dynamics. Despite these hurdles, the long-term outlook for the pharmaceutical packaging machinery market remains highly positive, underpinned by the sustained growth of the pharmaceutical industry, the increasing demand for efficient and secure packaging, and the widespread adoption of advanced technologies. The market is forecast to reach a valuation of 6.62 billion by 2033, driven by a robust CAGR. Strategic agility is crucial for companies to navigate market complexities and capitalize on this significant growth potential.

Pharma Packaging Machinery Industry Company Market Share

Pharma Packaging Machinery Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Pharma Packaging Machinery industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous data analysis and industry expertise to deliver actionable intelligence. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Pharma Packaging Machinery Industry Market Structure & Competitive Dynamics

The Pharma Packaging Machinery industry is characterized by a moderately consolidated market structure, with several key players holding significant market share. The top 10 companies, including Marchesini Group SPA, Ishida Co Limited, PAC Machinery Group, Romaco Holding GmbH, I M A Industria Macchine Automatiche S p A, Uhlmann Group, MG2 s r l, Syntegon Technology GmbH (Robert Bosch GmbH), MULTIVAC Group, and Optima Packaging Group GmbH, collectively account for approximately xx% of the global market. However, the presence of numerous smaller players and emerging technological advancements contribute to a competitive landscape.

Innovation ecosystems are crucial, with companies investing heavily in R&D to develop advanced packaging solutions catering to evolving pharmaceutical needs. Regulatory frameworks, particularly regarding serialization and track-and-trace capabilities, significantly impact market dynamics. Product substitutes are limited, given the specialized nature of pharmaceutical packaging. End-user trends towards automation, enhanced security, and sustainable packaging solutions drive demand.

M&A activity has played a significant role in shaping the market structure. Over the historical period (2019-2024), approximately xx Million worth of M&A deals were recorded, primarily focused on expanding product portfolios and geographical reach. Future M&A activity is anticipated, driven by the need for scale and technological expertise. The average deal size is estimated at xx Million. The increasing regulatory scrutiny and the need for compliant packaging solutions further consolidate this industry.

Pharma Packaging Machinery Industry Industry Trends & Insights

The Pharma Packaging Machinery market is experiencing robust growth, propelled by several key factors. The increasing demand for pharmaceutical products globally, fueled by an aging population and rising prevalence of chronic diseases, is a primary driver. Technological advancements, such as the adoption of automation, robotics, and advanced packaging materials, enhance efficiency and product safety, boosting market growth. Consumer preference for convenient and tamper-evident packaging also contributes to demand.

The market is witnessing a shift towards sustainable and eco-friendly packaging solutions, driven by growing environmental concerns and stricter regulations. The increasing adoption of serialization and track-and-trace technologies to combat counterfeiting further fuels market expansion. Competitive dynamics are shaped by continuous innovation, strategic partnerships, and the emergence of new technologies. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a similar growth trajectory during the forecast period (2025-2033). Market penetration of advanced technologies, such as AI-powered inspection systems, is increasing rapidly, further driving innovation and market growth. The increasing adoption of these technologies is expected to contribute to an xx% market penetration by 2033.

Dominant Markets & Segments in Pharma Packaging Machinery Industry

The North American region currently holds the largest market share in the Pharma Packaging Machinery industry. This dominance is primarily attributed to robust pharmaceutical manufacturing activities, a strong regulatory framework supporting advanced packaging technologies, and high per capita healthcare spending. Europe and Asia Pacific also represent significant markets, but growth potential in developing economies within these regions holds promising future prospects.

Key Drivers in North America:

- Strong pharmaceutical R&D and manufacturing base.

- High adoption of advanced packaging technologies.

- Stringent regulatory environment promoting innovation.

- Favorable economic conditions and high per capita healthcare expenditure.

Primary Packaging Machinery: This segment dominates the overall market due to the essential nature of primary packaging for drug safety and efficacy. Growth is driven by increased demand for blister packaging, bottles, and vials.

Secondary Packaging Machinery: This segment is experiencing growth fueled by demand for cartoners, case packers, and palletizers, all necessary for efficient handling and transportation of pharmaceuticals.

Labelling and Serialization: This segment exhibits strong growth, driven by increasing regulatory requirements for product traceability and anti-counterfeiting measures.

Pharma Packaging Machinery Industry Product Innovations

Recent product innovations focus on enhanced automation, improved efficiency, and increased safety features. Technological advancements such as integrated vision systems for quality control, robotic handling systems for improved throughput, and sustainable packaging materials are transforming the industry. These innovations provide competitive advantages by improving product quality, reducing production costs, and enhancing compliance with stringent regulatory requirements. The market is witnessing the emergence of connected packaging solutions that integrate data analytics and track-and-trace functionalities, further enhancing product security and supply chain visibility.

Report Segmentation & Scope

This report segments the Pharma Packaging Machinery market by machinery type:

Primary Packaging: This segment encompasses machines for blister packaging, bottle filling, vial filling, and other primary containment methods. The market size for primary packaging is projected to reach xx Million by 2033, with a CAGR of xx%. Competition is intense, with established players vying for market share through product innovation and strategic partnerships.

Secondary Packaging: This segment includes machines for cartoning, case packing, and palletizing. The market size for secondary packaging is projected to reach xx Million by 2033, with a CAGR of xx%. Growth is driven by the demand for efficient and automated secondary packaging solutions.

Labelling and Serialization: This segment focuses on machines for applying labels and implementing serialization and track-and-trace features. The market size for labelling and serialization is projected to reach xx Million by 2033, with a CAGR of xx%. This segment is driven by stringent regulatory requirements and the increasing need to combat counterfeiting.

Key Drivers of Pharma Packaging Machinery Growth

Several factors contribute to the growth of the Pharma Packaging Machinery industry. Technological advancements, such as automation and robotics, enhance production efficiency and reduce costs. Stringent regulatory requirements for product safety and traceability drive demand for advanced packaging solutions. Growing demand for pharmaceutical products globally, especially in emerging markets, fuels market expansion. Furthermore, the increasing adoption of sustainable packaging practices contributes to market growth.

Challenges in the Pharma Packaging Machinery Industry Sector

The industry faces challenges, including high initial investment costs for advanced machinery, stringent regulatory compliance requirements, and intense competition among established players and new entrants. Supply chain disruptions can impact production and delivery schedules, causing delays and increased costs. Fluctuations in raw material prices can also affect profitability. Meeting the growing demand for customized packaging solutions while managing operational costs remains a significant challenge for companies operating in this space. Overall these challenges account for an estimated xx% reduction in overall industry profitability.

Leading Players in the Pharma Packaging Machinery Industry Market

- Marchesini Group SPA

- Ishida Co Limited

- PAC Machinery Group

- Romaco Holding GmbH

- I M A Industria Macchine Automatiche S p A

- Uhlmann Group

- MG2 s r l

- Syntegon Technology GmbH (Robert Bosch GmbH)

- MULTIVAC Group

- Accutek Packaging Equipment Companies Inc

- Mesoblast Limited

- Vanguard Pharmaceutical Machinery Inc

- Optima Packaging Group GmbH

Key Developments in Pharma Packaging Machinery Industry Sector

- 2022 Q4: Syntegon launched a new high-speed cartoner for improved efficiency.

- 2023 Q1: Marchesini Group acquired a smaller packaging company, expanding its product portfolio.

- 2023 Q2: New regulations on serialization came into effect in several key markets.

- 2024 Q1: MULTIVAC unveiled a sustainable packaging solution using recycled materials. (Further developments will be added as they occur during the report's lifespan).

Strategic Pharma Packaging Machinery Industry Market Outlook

The Pharma Packaging Machinery industry is poised for continued growth, driven by technological advancements, increasing demand for pharmaceutical products, and stringent regulatory requirements. Strategic opportunities exist for companies focused on innovation, sustainable packaging solutions, and efficient automation. Further consolidation through mergers and acquisitions is likely, with companies seeking to expand their product portfolios and geographic reach. The focus on advanced technologies, including artificial intelligence and machine learning for quality control and process optimization, will shape the future market landscape. The increasing demand for connected packaging solutions and digitalization of the supply chain will create further growth opportunities for players in this industry.

Pharma Packaging Machinery Industry Segmentation

-

1. Machinery Type

-

1.1. Primary Packaging

- 1.1.1. Aseptic Filling and Sealing Equipmen

- 1.1.2. Bottle Filling and Capping Equipment

- 1.1.3. Blister Packaging Equipment

- 1.1.4. Others

-

1.2. Secondary Packaging

- 1.2.1. Cartoning Equipment

- 1.2.2. Case Packaging Equipment

- 1.2.3. Wrapping Equipment

- 1.2.4. Tray Packing Equipment

-

1.3. Labelling and Serialization

- 1.3.1. Bottle a

- 1.3.2. Carton Labelling and Serialization Equipment

-

1.1. Primary Packaging

Pharma Packaging Machinery Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Pharma Packaging Machinery Industry Regional Market Share

Geographic Coverage of Pharma Packaging Machinery Industry

Pharma Packaging Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; High Demand in Key End-user Markets; Ongoing Technological Developments; Impact of Safety Standards & Regulations in the Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. ; High Costs and Import Duties Pose a Challenge for New Customers; Capital Intensive Manufacturing Process

- 3.4. Market Trends

- 3.4.1. The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Primary Packaging

- 5.1.1.1. Aseptic Filling and Sealing Equipmen

- 5.1.1.2. Bottle Filling and Capping Equipment

- 5.1.1.3. Blister Packaging Equipment

- 5.1.1.4. Others

- 5.1.2. Secondary Packaging

- 5.1.2.1. Cartoning Equipment

- 5.1.2.2. Case Packaging Equipment

- 5.1.2.3. Wrapping Equipment

- 5.1.2.4. Tray Packing Equipment

- 5.1.3. Labelling and Serialization

- 5.1.3.1. Bottle a

- 5.1.3.2. Carton Labelling and Serialization Equipment

- 5.1.1. Primary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. North America Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Primary Packaging

- 6.1.1.1. Aseptic Filling and Sealing Equipmen

- 6.1.1.2. Bottle Filling and Capping Equipment

- 6.1.1.3. Blister Packaging Equipment

- 6.1.1.4. Others

- 6.1.2. Secondary Packaging

- 6.1.2.1. Cartoning Equipment

- 6.1.2.2. Case Packaging Equipment

- 6.1.2.3. Wrapping Equipment

- 6.1.2.4. Tray Packing Equipment

- 6.1.3. Labelling and Serialization

- 6.1.3.1. Bottle a

- 6.1.3.2. Carton Labelling and Serialization Equipment

- 6.1.1. Primary Packaging

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. Europe Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Primary Packaging

- 7.1.1.1. Aseptic Filling and Sealing Equipmen

- 7.1.1.2. Bottle Filling and Capping Equipment

- 7.1.1.3. Blister Packaging Equipment

- 7.1.1.4. Others

- 7.1.2. Secondary Packaging

- 7.1.2.1. Cartoning Equipment

- 7.1.2.2. Case Packaging Equipment

- 7.1.2.3. Wrapping Equipment

- 7.1.2.4. Tray Packing Equipment

- 7.1.3. Labelling and Serialization

- 7.1.3.1. Bottle a

- 7.1.3.2. Carton Labelling and Serialization Equipment

- 7.1.1. Primary Packaging

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Asia Pacific Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Primary Packaging

- 8.1.1.1. Aseptic Filling and Sealing Equipmen

- 8.1.1.2. Bottle Filling and Capping Equipment

- 8.1.1.3. Blister Packaging Equipment

- 8.1.1.4. Others

- 8.1.2. Secondary Packaging

- 8.1.2.1. Cartoning Equipment

- 8.1.2.2. Case Packaging Equipment

- 8.1.2.3. Wrapping Equipment

- 8.1.2.4. Tray Packing Equipment

- 8.1.3. Labelling and Serialization

- 8.1.3.1. Bottle a

- 8.1.3.2. Carton Labelling and Serialization Equipment

- 8.1.1. Primary Packaging

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Latin America Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Primary Packaging

- 9.1.1.1. Aseptic Filling and Sealing Equipmen

- 9.1.1.2. Bottle Filling and Capping Equipment

- 9.1.1.3. Blister Packaging Equipment

- 9.1.1.4. Others

- 9.1.2. Secondary Packaging

- 9.1.2.1. Cartoning Equipment

- 9.1.2.2. Case Packaging Equipment

- 9.1.2.3. Wrapping Equipment

- 9.1.2.4. Tray Packing Equipment

- 9.1.3. Labelling and Serialization

- 9.1.3.1. Bottle a

- 9.1.3.2. Carton Labelling and Serialization Equipment

- 9.1.1. Primary Packaging

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Middle East Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Primary Packaging

- 10.1.1.1. Aseptic Filling and Sealing Equipmen

- 10.1.1.2. Bottle Filling and Capping Equipment

- 10.1.1.3. Blister Packaging Equipment

- 10.1.1.4. Others

- 10.1.2. Secondary Packaging

- 10.1.2.1. Cartoning Equipment

- 10.1.2.2. Case Packaging Equipment

- 10.1.2.3. Wrapping Equipment

- 10.1.2.4. Tray Packing Equipment

- 10.1.3. Labelling and Serialization

- 10.1.3.1. Bottle a

- 10.1.3.2. Carton Labelling and Serialization Equipment

- 10.1.1. Primary Packaging

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Marchesini Group SPA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ishida Co Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PAC Machinery Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Romaco Holding GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 I M A Industria Macchine Automatiche S p A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Uhlmann Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MG2 s r l *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Syntegon Technology GmbH (Robert Bosch GmbH)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MULTIVAC Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accutek Packaging Equipment Companies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mesoblast Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vanguard Pharmaceutical Machinery Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Optima Packaging Group GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Marchesini Group SPA

List of Figures

- Figure 1: Global Pharma Packaging Machinery Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 3: North America Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: North America Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 7: Europe Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 8: Europe Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 11: Asia Pacific Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 12: Asia Pacific Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 15: Latin America Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 16: Latin America Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 19: Middle East Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 20: Middle East Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 2: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 4: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 6: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 8: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 10: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 12: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharma Packaging Machinery Industry?

The projected CAGR is approximately 7.74%.

2. Which companies are prominent players in the Pharma Packaging Machinery Industry?

Key companies in the market include Marchesini Group SPA, Ishida Co Limited, PAC Machinery Group, Romaco Holding GmbH, I M A Industria Macchine Automatiche S p A, Uhlmann Group, MG2 s r l *List Not Exhaustive, Syntegon Technology GmbH (Robert Bosch GmbH), MULTIVAC Group, Accutek Packaging Equipment Companies Inc, Mesoblast Limited, Vanguard Pharmaceutical Machinery Inc, Optima Packaging Group GmbH.

3. What are the main segments of the Pharma Packaging Machinery Industry?

The market segments include Machinery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.62 billion as of 2022.

5. What are some drivers contributing to market growth?

; High Demand in Key End-user Markets; Ongoing Technological Developments; Impact of Safety Standards & Regulations in the Pharmaceutical Industry.

6. What are the notable trends driving market growth?

The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market.

7. Are there any restraints impacting market growth?

; High Costs and Import Duties Pose a Challenge for New Customers; Capital Intensive Manufacturing Process.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharma Packaging Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharma Packaging Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharma Packaging Machinery Industry?

To stay informed about further developments, trends, and reports in the Pharma Packaging Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence