Key Insights

The global pet orthopedics market is experiencing robust growth, driven by increasing pet ownership, rising pet healthcare expenditure, and advancements in surgical techniques and implant materials. The market, estimated at $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033. This growth is fueled by the increasing prevalence of orthopedic conditions in pets, such as hip dysplasia, cruciate ligament tears, and fractures, particularly in aging canine and feline populations. Technological advancements, including minimally invasive surgical techniques and biocompatible implants, are further enhancing treatment options and driving market expansion. The market is segmented by type (implants, instruments, screws, others) and application (total hip replacement, total knee replacement, total elbow replacement, trauma fixation, others). Implants represent a significant segment, given the rising demand for effective and durable solutions for joint replacements and fracture repair. The North American market currently holds a dominant share, driven by high pet ownership rates and advanced veterinary infrastructure. However, Asia-Pacific is poised for significant growth due to rising disposable incomes and increasing awareness of pet healthcare. Challenges include the high cost of procedures, limited veterinary specialist availability in certain regions, and the potential for complications associated with orthopedic surgeries.

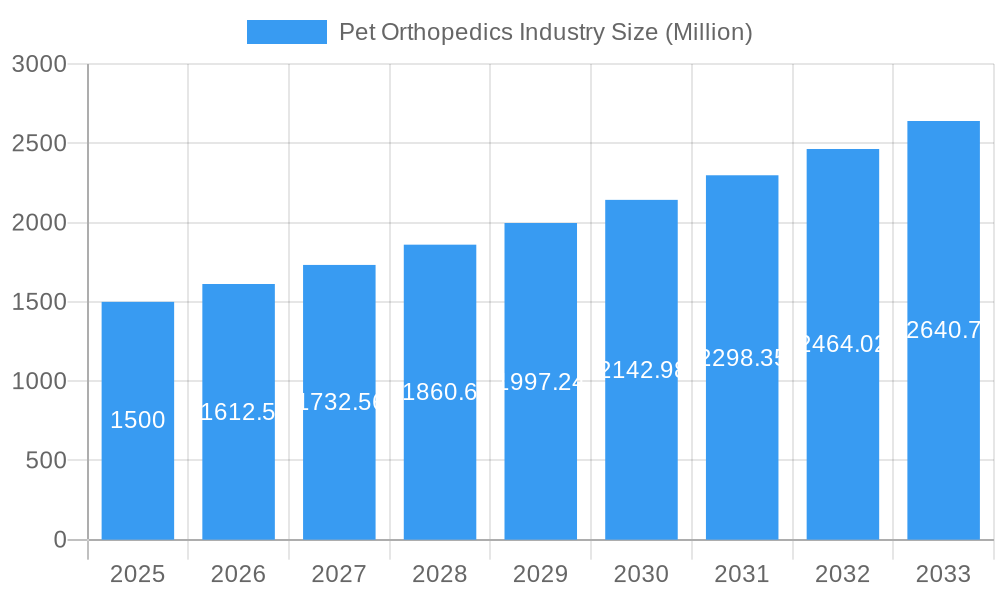

Pet Orthopedics Industry Market Size (In Billion)

Despite these challenges, the pet orthopedics market is expected to maintain its strong growth trajectory. The increasing humanization of pets, coupled with owners' willingness to invest in their pets' well-being, plays a significant role in shaping market dynamics. Further growth will be driven by the development of innovative products, such as biodegradable implants and advanced imaging techniques, enhancing surgical precision and reducing recovery times. The expanding veterinary profession, especially the specialization in veterinary orthopedics, contributes to the rising demand for high-quality orthopedic implants and instruments. Strategic partnerships between veterinary clinics and manufacturers are expected to further strengthen the market, promoting wider access to advanced treatment options and improving patient outcomes. The focus is shifting towards less invasive procedures, improved implant designs, and better pain management strategies, all contributing to a more positive patient experience and improved market prospects.

Pet Orthopedics Industry Company Market Share

Pet Orthopedics Industry Market Report: 2019-2033

A comprehensive analysis of the $XX Million pet orthopedics market, offering in-depth insights into growth drivers, competitive dynamics, and future opportunities. This report provides a detailed examination of the pet orthopedics market, covering the period from 2019 to 2033, with a focus on the key segments, leading players, and emerging trends. The study period is 2019-2033, with the base year being 2025, and the forecast period spanning 2025-2033. The estimated year is 2025. This report is crucial for businesses seeking to understand and capitalize on the growth potential within this rapidly evolving market.

Pet Orthopedics Industry Market Structure & Competitive Dynamics

This section analyzes the market structure, competitive landscape, and key dynamics influencing the pet orthopedics industry. The market is characterized by a mix of established players and emerging companies, resulting in a moderately concentrated market structure. Market share data reveals that Johnson & Johnson, Johnson & Johnson, holds a significant share, followed by GerMedUSA, and KYON PHARMA INC. However, the presence of numerous smaller players and the ongoing emergence of innovative solutions contribute to a dynamic competitive environment.

The industry witnesses considerable M&A activity, driven by the desire for expansion and technological advancements. Deal values have ranged from $XX Million to $XX Million in recent years, showcasing the high stakes of market consolidation. Innovation ecosystems are flourishing, with significant R&D investments focused on developing minimally invasive surgical techniques, biocompatible materials, and advanced implants. Regulatory frameworks vary across geographical regions, influencing product approval timelines and market access strategies. End-user trends, such as increasing pet ownership and rising awareness of pet healthcare, are major drivers. The substitution of traditional materials and technologies by advanced biomaterials contributes to a shift towards advanced technologies and more effective surgical treatments.

- Market Concentration: Moderately concentrated, with a few major players and many smaller companies.

- Innovation Ecosystem: Active, with significant R&D investment in materials science, minimally invasive surgery and biocompatible materials.

- Regulatory Frameworks: Vary across regions, impacting product approval processes.

- Product Substitutes: Emerging technologies and materials constantly change product substitutes.

- End-User Trends: Growing pet ownership and pet healthcare expenditure.

- M&A Activity: Significant, with deal values ranging from $XX Million to $XX Million.

Pet Orthopedics Industry Industry Trends & Insights

The global pet orthopedics market is experiencing robust growth, fueled by several key factors. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of $XX Million by 2033. This significant expansion is driven by several interlinked factors. Technological advancements, such as the development of biocompatible implants and minimally invasive surgical techniques, have greatly improved treatment outcomes and broadened market access. Increased pet ownership and rising pet healthcare expenditure in developed and emerging economies are significantly boosting market demand. Changing consumer preferences are also influencing the market, with pet owners increasingly demanding high-quality and technologically advanced treatment options for their beloved companions. Competitive dynamics are shaping the landscape, pushing innovation, improving pricing strategies, and fostering market expansion. Market penetration of advanced implants, such as total hip and knee replacements, is also rising steadily, contributing to market growth.

Dominant Markets & Segments in Pet Orthopedics Industry

The North American market currently dominates the pet orthopedics industry, driven primarily by high pet ownership rates, advanced veterinary infrastructure, and high disposable incomes. The United States holds the largest share within North America, followed by Canada and Mexico. Europe also presents a substantial market opportunity, with Germany, the United Kingdom, and France showing strong growth potential.

Key Drivers of Regional Dominance:

- High Pet Ownership Rates: A significant factor impacting market growth.

- Advanced Veterinary Infrastructure: Supports the adoption of sophisticated surgical techniques.

- High Disposable Incomes: Allows pet owners to afford advanced treatment options.

- Favorable Regulatory Environment: Facilitates market entry and growth.

Segment Dominance:

- By Type: Implants represent the largest segment, owing to their crucial role in surgical procedures, with total hip replacements, knee replacements, and elbow replacements being major drivers. The instruments segment follows, given their use in surgeries. Screws, due to their frequent usage in procedures, also form a sizeable segment. The others category includes various ancillary products.

- By Application: Total hip replacement and total knee replacement surgeries represent substantial segments, indicating high demand for such treatments. Trauma fixation is also a significant application, with fractures representing a sizable segment within the animal care sector.

Pet Orthopedics Industry Product Innovations

Recent product innovations focus on improved biocompatibility, minimally invasive surgical techniques, and enhanced implant designs. These advancements aim to reduce post-operative complications, improve recovery times, and enhance the overall patient experience. The use of advanced materials, such as bioresorbable polymers and innovative alloys, offers enhanced performance and longevity compared to traditional materials. This aligns with the growing market demand for superior product efficacy and safety. Market fit is directly enhanced by improved recovery rates, minimal invasiveness, and cost efficiency.

Report Segmentation & Scope

The report segments the pet orthopedics market based on:

By Type: Implants (including plates, screws, rods, and custom-made implants), Instruments (including drills, reamers, and saws), Screws (various sizes and materials), Others (including bone cement, surgical accessories, and aftercare products).

By Application: Total hip replacement, Total knee replacement, Total elbow replacement, Trauma fixation (including fractures, ligament injuries, and other traumatic conditions), Others (including spinal surgery, arthroscopy, and other procedures).

Each segment's growth projections, market sizes, and competitive dynamics are examined in detail within the full report.

Key Drivers of Pet Orthopedics Industry Growth

Several factors propel the growth of the pet orthopedics industry. Technological advancements, such as the development of biocompatible materials and minimally invasive surgical techniques, significantly enhance the efficacy of treatments and expand market reach. Rising pet ownership and increasing pet healthcare spending are also major drivers, fueling the industry’s expansion. The favorable regulatory environment in certain regions supports market entry and growth.

Challenges in the Pet Orthopedics Industry Sector

The industry faces challenges such as stringent regulatory approvals, which can lengthen the product development timelines. Supply chain complexities can affect the availability of raw materials and components. Furthermore, intense competition among manufacturers, including pricing pressures, can hinder profitability and hinder business growth.

Leading Players in the Pet Orthopedics Industry Market

- GerMedUSA

- KYON PHARMA INC

- Johnson & Johnson

- EVEROST INC

- B Braun Melsungen AG

- BioMedtrix LLC

- Integra lifesciences

- Veterinary Orthopedic Implants

Key Developments in Pet Orthopedics Industry Sector

- 2022 Q3: Launch of a new biocompatible implant by GerMedUSA.

- 2023 Q1: Acquisition of a smaller competitor by Johnson & Johnson.

- 2024 Q2: FDA approval of a novel surgical instrument by KYON PHARMA INC. (Further details on specific developments and their impact are included in the complete report.)

Strategic Pet Orthopedics Industry Market Outlook

The pet orthopedics market holds significant future potential, driven by continuous technological innovation, rising pet ownership rates globally, and a growing awareness of pet health among owners. Strategic opportunities exist in developing innovative products that cater to unmet clinical needs, expanding into new geographical markets, and focusing on cost-effective solutions. The adoption of advanced technologies and minimally invasive surgical techniques will further fuel industry growth.

Pet Orthopedics Industry Segmentation

-

1. Type

- 1.1. Implants

- 1.2. Instruments

- 1.3. Screws

- 1.4. Others

-

2. Application

- 2.1. Total hip replacement

- 2.2. Total knee replacement

- 2.3. Total elbow replacement

- 2.4. Trauma fixation

- 2.5. Others

Pet Orthopedics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pet Orthopedics Industry Regional Market Share

Geographic Coverage of Pet Orthopedics Industry

Pet Orthopedics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Number of Pet Owners & Veterinary Practitioners; Growing Number of Government Initiatives; Increasing Incidence of Obesity

- 3.3. Market Restrains

- 3.3.1. ; High Surgery and Pet Care Cost

- 3.4. Market Trends

- 3.4.1. Implants segment in Veterinary Orthopedics market is Estimated to Witness a Healthy Growth in Future.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pet Orthopedics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Implants

- 5.1.2. Instruments

- 5.1.3. Screws

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Total hip replacement

- 5.2.2. Total knee replacement

- 5.2.3. Total elbow replacement

- 5.2.4. Trauma fixation

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Pet Orthopedics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Implants

- 6.1.2. Instruments

- 6.1.3. Screws

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Total hip replacement

- 6.2.2. Total knee replacement

- 6.2.3. Total elbow replacement

- 6.2.4. Trauma fixation

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Pet Orthopedics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Implants

- 7.1.2. Instruments

- 7.1.3. Screws

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Total hip replacement

- 7.2.2. Total knee replacement

- 7.2.3. Total elbow replacement

- 7.2.4. Trauma fixation

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Pet Orthopedics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Implants

- 8.1.2. Instruments

- 8.1.3. Screws

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Total hip replacement

- 8.2.2. Total knee replacement

- 8.2.3. Total elbow replacement

- 8.2.4. Trauma fixation

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Pet Orthopedics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Implants

- 9.1.2. Instruments

- 9.1.3. Screws

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Total hip replacement

- 9.2.2. Total knee replacement

- 9.2.3. Total elbow replacement

- 9.2.4. Trauma fixation

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Pet Orthopedics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Implants

- 10.1.2. Instruments

- 10.1.3. Screws

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Total hip replacement

- 10.2.2. Total knee replacement

- 10.2.3. Total elbow replacement

- 10.2.4. Trauma fixation

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GerMedUSA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KYON PHARMA INC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Johnson & Johnson*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EVEROST INC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 B Braun Melsungen AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BioMedtrix LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Integra lifesciences

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Veterinary Orthopedic Implants

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 GerMedUSA

List of Figures

- Figure 1: Global Pet Orthopedics Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Pet Orthopedics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Pet Orthopedics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Pet Orthopedics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Pet Orthopedics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Pet Orthopedics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Pet Orthopedics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pet Orthopedics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Pet Orthopedics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Pet Orthopedics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Pet Orthopedics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Pet Orthopedics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Pet Orthopedics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pet Orthopedics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Pet Orthopedics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Pet Orthopedics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Pet Orthopedics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Pet Orthopedics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Pet Orthopedics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Pet Orthopedics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East and Africa Pet Orthopedics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Pet Orthopedics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Middle East and Africa Pet Orthopedics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Pet Orthopedics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Pet Orthopedics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Pet Orthopedics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: South America Pet Orthopedics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Pet Orthopedics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: South America Pet Orthopedics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Pet Orthopedics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Pet Orthopedics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pet Orthopedics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Pet Orthopedics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Pet Orthopedics Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Pet Orthopedics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Pet Orthopedics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Pet Orthopedics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Pet Orthopedics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Pet Orthopedics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Pet Orthopedics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Pet Orthopedics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Pet Orthopedics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: Global Pet Orthopedics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Pet Orthopedics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global Pet Orthopedics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Pet Orthopedics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Pet Orthopedics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 35: Global Pet Orthopedics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Global Pet Orthopedics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Pet Orthopedics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Orthopedics Industry?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Pet Orthopedics Industry?

Key companies in the market include GerMedUSA, KYON PHARMA INC, Johnson & Johnson*List Not Exhaustive, EVEROST INC, B Braun Melsungen AG, BioMedtrix LLC, Integra lifesciences, Veterinary Orthopedic Implants.

3. What are the main segments of the Pet Orthopedics Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising Number of Pet Owners & Veterinary Practitioners; Growing Number of Government Initiatives; Increasing Incidence of Obesity.

6. What are the notable trends driving market growth?

Implants segment in Veterinary Orthopedics market is Estimated to Witness a Healthy Growth in Future..

7. Are there any restraints impacting market growth?

; High Surgery and Pet Care Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pet Orthopedics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pet Orthopedics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pet Orthopedics Industry?

To stay informed about further developments, trends, and reports in the Pet Orthopedics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence