Key Insights

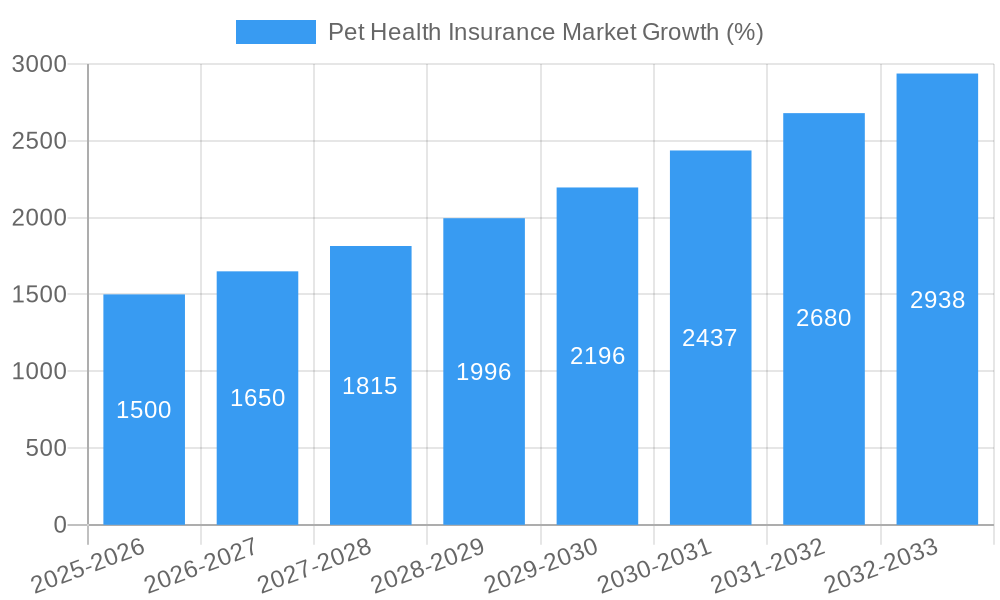

The pet health insurance market is experiencing robust growth, driven by increasing pet ownership, rising veterinary costs, and a growing awareness of the financial burden associated with unexpected pet illnesses or injuries. The study period from 2019-2033 reveals a significant expansion, with a Compound Annual Growth Rate (CAGR) suggesting substantial market expansion throughout the forecast period (2025-2033). While the exact market size for 2025 is not provided, based on industry reports and observed trends, a reasonable estimate would place the market value in the billions of dollars globally. This reflects the increasing acceptance of pet health insurance as a vital financial planning tool for pet owners, mirroring similar trends in human healthcare insurance. The market's growth is further propelled by the introduction of innovative insurance products, including comprehensive coverage options and flexible payment plans, tailored to diverse pet owner needs and budgets. Technological advancements, such as telemedicine and digital platforms for managing insurance policies, are also contributing to market expansion.

The historical period (2019-2024) likely showcased a steady increase in market size, laying the groundwork for the accelerated growth projected during the forecast period. The base year of 2025 provides a crucial benchmark for understanding the market's current state and projecting future trends. Factors such as increasing pet humanization, a willingness to spend on premium pet care, and the expanding availability of insurance options in various regions will continue to drive market penetration. However, challenges such as varying insurance regulations across different geographies and potential limitations in affordable access for low-income pet owners represent aspects to consider in evaluating long-term market stability and growth potential. Further analysis will be crucial in identifying emerging trends and opportunities within specific market segments.

Pet Health Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Pet Health Insurance Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. Key market segments are thoroughly examined, alongside leading players and significant industry developments. The report utilizes robust data and analysis to project a xx Million market size by 2033, showcasing significant growth opportunities.

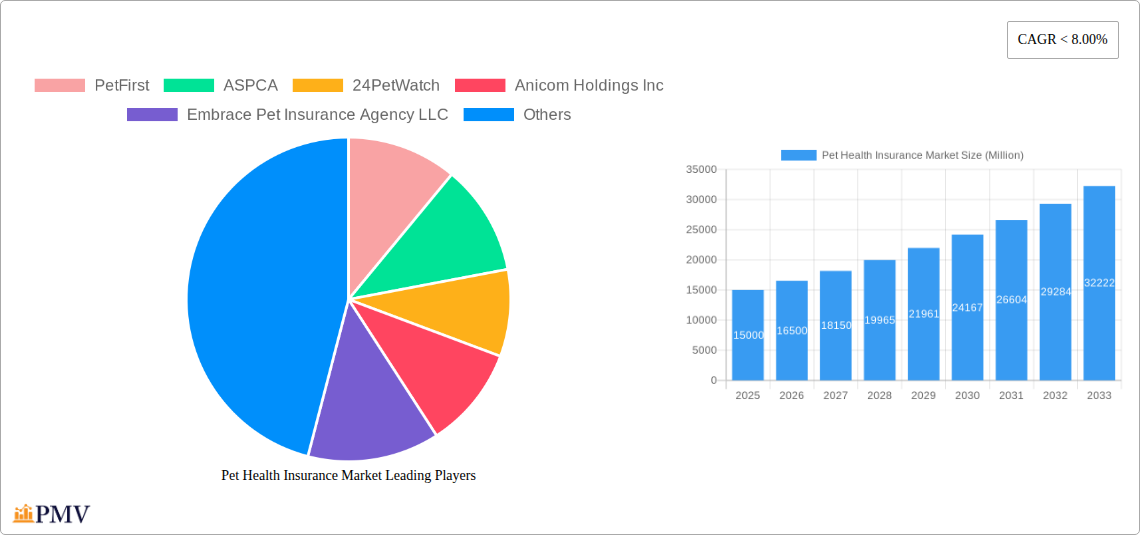

Pet Health Insurance Market Market Structure & Competitive Dynamics

The Pet Health Insurance market exhibits a moderately concentrated structure with a few dominant players and numerous smaller regional or niche providers. The market share of the top 5 players is estimated at xx%, reflecting both established brands and emerging innovators. Competitive dynamics are characterized by intense rivalry based on price, product features (such as wellness add-ons and telehealth integration), and customer service. Innovation ecosystems are evolving rapidly, driven by advancements in veterinary technology and telemedicine.

Regulatory frameworks vary across geographies, impacting market access and product offerings. Product substitutes include self-insurance (saving for potential veterinary costs) but lack the risk mitigation and financial protection offered by insurance. End-user trends reveal increasing pet ownership, higher pet healthcare costs, and growing awareness of pet insurance benefits. M&A activities have been noteworthy, with deal values exceeding xx Million in the past five years, primarily focusing on consolidating market share and expanding geographical reach. For example, the acquisition of [Company Name] by [Acquiring Company] in [Year] exemplifies this trend, expanding their market presence in [Region].

- Market Concentration: xx% held by top 5 players (2024)

- M&A Deal Value (2019-2024): Over xx Million USD

- Key Competitive Factors: Price, Product Features, Customer Service, Geographic Reach

Pet Health Insurance Market Industry Trends & Insights

The Pet Health Insurance market is experiencing robust growth, driven by several key factors. The rising pet ownership rate globally, coupled with increasing pet humanization and willingness to spend on pet healthcare, significantly fuels market expansion. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was estimated at xx%, and a similar CAGR of xx% is projected for the forecast period (2025-2033). This growth is also fueled by technological disruptions, such as the integration of telemedicine and wearable pet health trackers, which enhance convenience and data-driven insights for both pet owners and insurers.

Consumer preferences are shifting towards comprehensive coverage options including wellness plans, accident and illness protection, and additional services like virtual vet visits and grief counseling. This trend presents opportunities for insurers to differentiate their offerings and cater to evolving customer needs. The competitive landscape is dynamic, with established players and new entrants continually vying for market share through innovation and strategic partnerships. Market penetration varies significantly across geographies, with developed markets exhibiting higher adoption rates compared to emerging economies. However, the rising middle class and increased pet ownership in these emerging markets present substantial untapped potential.

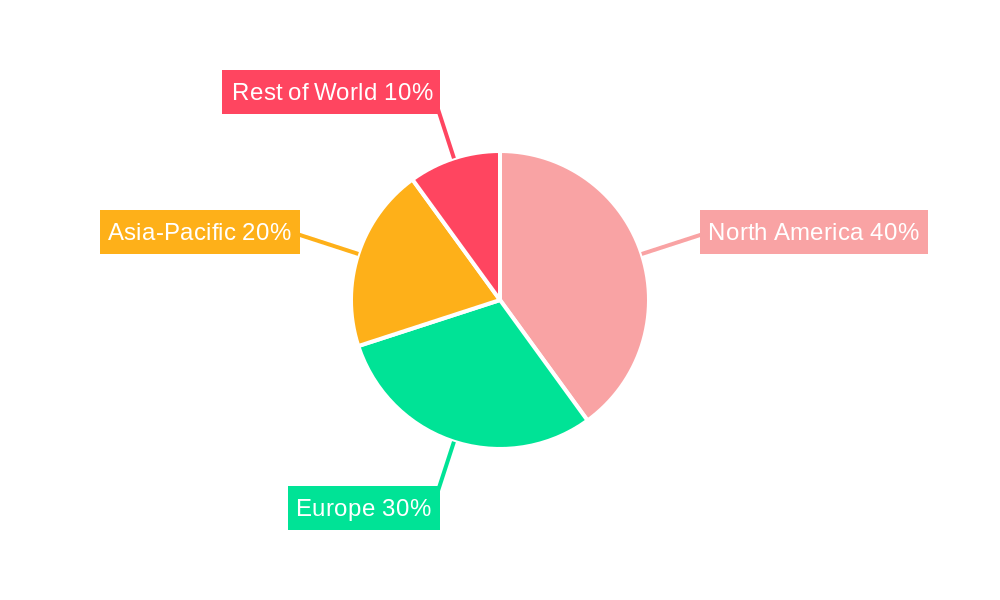

Dominant Markets & Segments in Pet Health Insurance Market

The United States currently dominates the Pet Health Insurance market, driven by factors like high pet ownership, robust pet healthcare infrastructure, and a well-established insurance industry. Other regions, particularly in Europe and Asia-Pacific, are experiencing rapid growth, driven by increasing pet adoption rates and growing awareness of pet insurance benefits.

Key Drivers of US Market Dominance:

- High Pet Ownership Rates

- Advanced Veterinary Infrastructure

- High Disposable Incomes

- Strong Insurance Industry

Key Drivers of Growth in Other Regions:

- Rising Middle Class

- Increased Pet Adoption

- Growing Awareness of Pet Insurance Benefits

- Government Initiatives (where applicable)

The market can be segmented by pet type (dogs, cats, other), coverage type (accident-only, accident & illness, wellness), and distribution channel (direct, brokers). The dog segment currently holds the largest market share due to higher pet ownership and spending on veterinary care. Comprehensive accident & illness coverage is the most popular type, reflecting the demand for comprehensive protection.

Pet Health Insurance Market Product Innovations

Recent product innovations in the Pet Health Insurance market focus on enhancing customer experience and offering greater value. This includes the integration of telehealth services, allowing for remote consultations and reducing the need for in-person visits. Wellness plans, covering routine preventative care, are gaining popularity, emphasizing proactive pet healthcare. The use of data analytics and wearable technology enables personalized pricing and improved risk assessment, leading to more tailored and competitive insurance products. These innovations align with broader industry trends towards digitalization and personalized healthcare solutions.

Report Segmentation & Scope

This report segments the Pet Health Insurance market across various dimensions, providing a granular view of market dynamics. These segments include:

By Pet Type: Dogs, Cats, Other (birds, rabbits, etc.). The dog segment is projected to maintain the largest market share throughout the forecast period.

By Coverage Type: Accident-only, Accident & Illness, Wellness. Comprehensive accident and illness policies show the highest growth.

By Distribution Channel: Direct Sales, Insurance Brokers, Veterinarians. Direct sales channels are expected to maintain dominance, but brokers play a significant role, especially for complex coverage plans.

By Region: North America (United States, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, Rest of Asia Pacific), Rest of the World (Latin America, Middle East & Africa).

Key Drivers of Pet Health Insurance Market Growth

The Pet Health Insurance market's growth is driven by a confluence of factors:

- Rising Pet Ownership: Globally increasing pet adoption rates are a primary growth catalyst.

- Increased Pet Healthcare Costs: The escalating cost of veterinary care encourages pet owners to seek insurance protection.

- Growing Pet Humanization: Treat pets more like family members, leading to increased investment in their health and well-being.

- Technological Advancements: Telemedicine, wearable technology, and data analytics improve insurance services.

- Favorable Regulatory Environment: Supportive regulatory frameworks in certain regions promote market expansion.

Challenges in the Pet Health Insurance Market Sector

Despite the significant growth potential, the Pet Health Insurance market faces several challenges:

- High Acquisition Costs: Attracting new customers requires significant marketing and sales investments.

- Fraudulent Claims: Insurers must implement robust systems to detect and prevent fraudulent claims.

- Accurate Risk Assessment: Precisely assessing the risk profiles of pets is crucial for competitive pricing.

- Data Privacy Concerns: The use of pet health data necessitates strict adherence to privacy regulations.

Leading Players in the Pet Health Insurance Market Market

- PetFirst

- ASPCA

- 24PetWatch

- Anicom Holdings Inc

- Embrace Pet Insurance Agency LLC

- Figo Pet Insurance LLC

- HartVille

- Healthy Paws Pet Insurance LLC

- Hollard

- Oneplan

Key Developments in Pet Health Insurance Market Sector

2021: MetLife expands pet insurance benefits to include virtual vet visits, rollover benefits, family plans, and grief counseling. This significantly enhanced the value proposition for employees and increased market competition.

2021: Wagmo raises 12.5 Million USD to offer pet insurance and a wellness service. This expansion into wellness demonstrates a growing trend in the market, creating new avenues for customer acquisition and increased revenue streams.

Strategic Pet Health Insurance Market Market Outlook

The Pet Health Insurance market presents significant long-term growth potential. Continued innovation, particularly in areas such as telehealth and data-driven risk assessment, will drive market expansion. Strategic partnerships between insurers and veterinary providers will further enhance customer access and improve overall service delivery. Expansion into emerging markets, coupled with targeted marketing campaigns to reach new customer segments, presents further avenues for growth and market share gains. The focus on personalized and comprehensive coverage solutions, catering to the evolving needs of pet owners, will remain a crucial element of success in the dynamic Pet Health Insurance market.

Pet Health Insurance Market Segmentation

-

1. Policy

- 1.1. Illness and Accidents

- 1.2. Chronic Conditions

- 1.3. Others

-

2. Provider

- 2.1. Public

- 2.2. Private

Pet Health Insurance Market Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East and Africa

Pet Health Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance

- 3.3. Market Restrains

- 3.3.1. Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance

- 3.4. Market Trends

- 3.4.1. Increasing Pet Healthcare Act as a Driver for Pet Insurance Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Policy

- 5.1.1. Illness and Accidents

- 5.1.2. Chronic Conditions

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Provider

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Latin America

- 5.3.3. Europe

- 5.3.4. Asia Pacific

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Policy

- 6. North America Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Policy

- 6.1.1. Illness and Accidents

- 6.1.2. Chronic Conditions

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Provider

- 6.2.1. Public

- 6.2.2. Private

- 6.1. Market Analysis, Insights and Forecast - by Policy

- 7. Latin America Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Policy

- 7.1.1. Illness and Accidents

- 7.1.2. Chronic Conditions

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Provider

- 7.2.1. Public

- 7.2.2. Private

- 7.1. Market Analysis, Insights and Forecast - by Policy

- 8. Europe Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Policy

- 8.1.1. Illness and Accidents

- 8.1.2. Chronic Conditions

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Provider

- 8.2.1. Public

- 8.2.2. Private

- 8.1. Market Analysis, Insights and Forecast - by Policy

- 9. Asia Pacific Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Policy

- 9.1.1. Illness and Accidents

- 9.1.2. Chronic Conditions

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Provider

- 9.2.1. Public

- 9.2.2. Private

- 9.1. Market Analysis, Insights and Forecast - by Policy

- 10. Middle East and Africa Pet Health Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Policy

- 10.1.1. Illness and Accidents

- 10.1.2. Chronic Conditions

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Provider

- 10.2.1. Public

- 10.2.2. Private

- 10.1. Market Analysis, Insights and Forecast - by Policy

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 PetFirst

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ASPCA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 24PetWatch

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Anicom Holdings Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Embrace Pet Insurance Agency LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Figo Pet Insurance LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HartVille

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Healthy Paws Pet Insurance LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hollard

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oneplan

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PetFirst

List of Figures

- Figure 1: Global Pet Health Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 3: North America Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 4: North America Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 5: North America Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 6: North America Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 9: Latin America Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 10: Latin America Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 11: Latin America Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 12: Latin America Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Latin America Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 15: Europe Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 16: Europe Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 17: Europe Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 18: Europe Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 21: Asia Pacific Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 22: Asia Pacific Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 23: Asia Pacific Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 24: Asia Pacific Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East and Africa Pet Health Insurance Market Revenue (Million), by Policy 2024 & 2032

- Figure 27: Middle East and Africa Pet Health Insurance Market Revenue Share (%), by Policy 2024 & 2032

- Figure 28: Middle East and Africa Pet Health Insurance Market Revenue (Million), by Provider 2024 & 2032

- Figure 29: Middle East and Africa Pet Health Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 30: Middle East and Africa Pet Health Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Pet Health Insurance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pet Health Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 3: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 4: Global Pet Health Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 6: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 7: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 9: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 10: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 12: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 13: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 15: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 16: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Global Pet Health Insurance Market Revenue Million Forecast, by Policy 2019 & 2032

- Table 18: Global Pet Health Insurance Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 19: Global Pet Health Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Health Insurance Market?

The projected CAGR is approximately < 8.00%.

2. Which companies are prominent players in the Pet Health Insurance Market?

Key companies in the market include PetFirst, ASPCA, 24PetWatch, Anicom Holdings Inc, Embrace Pet Insurance Agency LLC, Figo Pet Insurance LLC, HartVille, Healthy Paws Pet Insurance LLC, Hollard, Oneplan.

3. What are the main segments of the Pet Health Insurance Market?

The market segments include Policy, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance.

6. What are the notable trends driving market growth?

Increasing Pet Healthcare Act as a Driver for Pet Insurance Market Growth.

7. Are there any restraints impacting market growth?

Increasing Number of Pet Adoption; Rising Awareness Regarding Pet Insurance.

8. Can you provide examples of recent developments in the market?

In 2021, MetLife expands pet insurance benefits to include virtual vet visits. Through MetLife's new pet insurance benefit, employers will be able to provide employee pet parents with access to veterinary telehealth services, roll over benefits, family plans for coverage of more than one pet and grief counseling. Additionally, employees switching from one insurance provider to MetLife will not be denied if their dog or cat has a preexisting condition, an exclusive perk of the employee benefit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pet Health Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pet Health Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pet Health Insurance Market?

To stay informed about further developments, trends, and reports in the Pet Health Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence