Key Insights

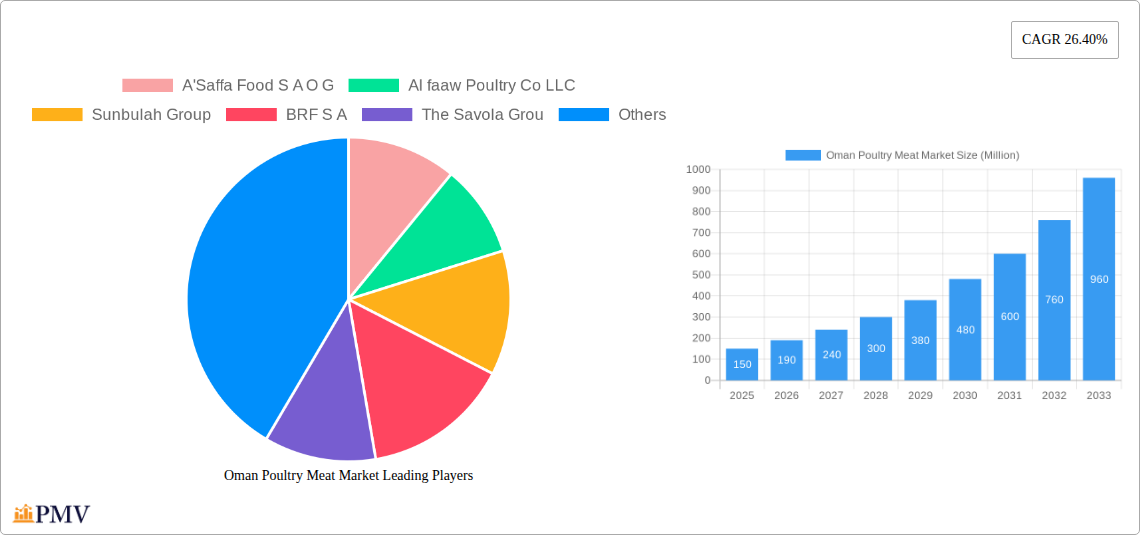

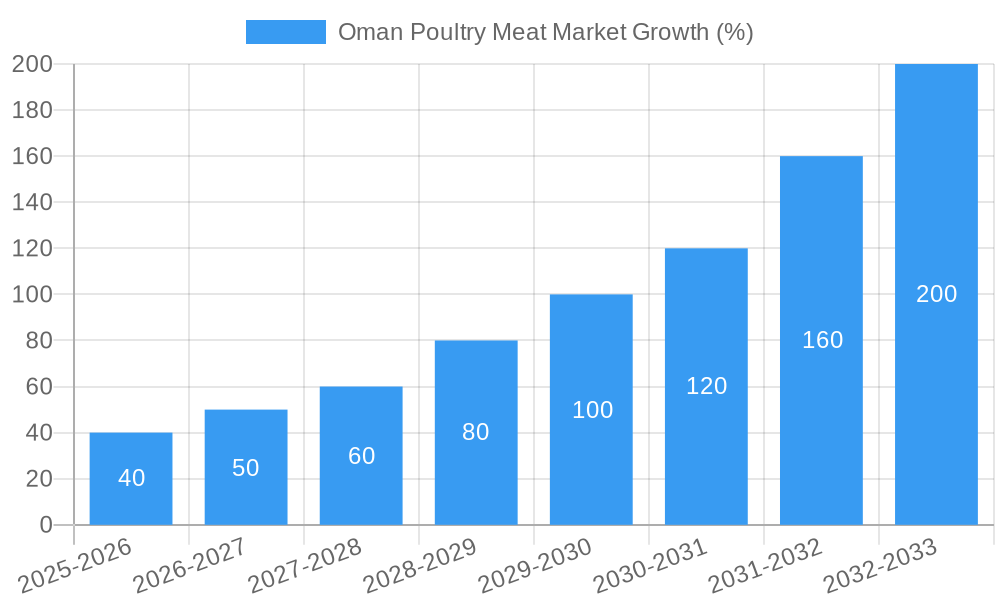

The Oman poultry meat market is experiencing robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 26.40% from 2019 to 2024. This signifies a significant expansion within a relatively short period, driven by several key factors. Increasing consumer demand for affordable protein sources, coupled with rising urbanization and changing dietary habits, are fueling market expansion. The preference for convenient and readily available poultry products, particularly canned and processed options, contributes to the market's dynamism. Growth is further bolstered by government initiatives promoting food security and diversification within the agricultural sector. While precise market size figures for 2025 are unavailable, extrapolation from the CAGR and considering the market dynamics suggests a substantial increase from the 2024 value. Key players like A'Saffa Food S A O G, Al faaw Poultry Co LLC, and Sunbulah Group are actively shaping the market landscape through product innovation, expansion of distribution channels (both off-trade and on-trade), and strategic investments.

However, the market faces certain challenges. Fluctuations in feed prices, a significant input cost, can impact profitability and potentially hinder growth. Competition from imported poultry products may also pose a constraint, necessitating domestic producers to focus on quality, innovation, and branding to maintain a competitive edge. Furthermore, maintaining sustainable and ethical farming practices is crucial for long-term market success and consumer trust. Segment-wise, the canned and processed poultry segment is anticipated to maintain significant traction, owing to its convenience and longer shelf life compared to fresh/chilled options. The off-trade distribution channel (supermarkets, hypermarkets, etc.) likely commands a larger market share due to its widespread reach and accessibility. Future growth will depend on addressing challenges, embracing sustainable practices, and adapting to evolving consumer preferences.

Oman Poultry Meat Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Oman poultry meat market, offering valuable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with 2025 as the base year, this report forecasts market trends and growth opportunities within this dynamic sector. The report uses Million for all value units.

Oman Poultry Meat Market Structure & Competitive Dynamics

The Oman poultry meat market exhibits a moderately concentrated structure, with key players like A'Saffa Food S A O G, Al faaw Poultry Co LLC, and Sunbulah Group holding significant market share. Market concentration is estimated at xx% in 2025, with the top 5 players controlling approximately xx% of the market. The regulatory framework, while supportive of domestic production, also faces challenges related to import regulations and food safety standards. Innovation is driven by product diversification (organic, gluten-free options), improvements in processing techniques (e.g., automation), and the adoption of sustainable farming practices. Product substitution is limited, with red meat being the primary competitor. However, increasing health consciousness and cost considerations could increase the demand for plant-based alternatives in the future. The market has witnessed some M&A activity, though the deal values are relatively modest, averaging around xx Million in the last five years.

- Market Concentration: xx% (2025)

- Top 5 Player Market Share: xx% (2025)

- Average M&A Deal Value (last 5 years): xx Million

- Key Innovation Areas: Product diversification, processing technology, sustainable farming.

Oman Poultry Meat Market Industry Trends & Insights

The Oman poultry meat market demonstrates robust growth, driven primarily by increasing population, rising disposable incomes, and a shift towards convenient and affordable protein sources. The CAGR for the period 2019-2024 is estimated at xx%, and is projected to reach xx% during 2025-2033. Consumer preferences are increasingly favoring value-added products such as processed poultry, ready-to-cook meals, and organic options. Technological advancements in poultry farming, processing, and distribution are improving efficiency and reducing costs. However, fluctuating feed prices and competition from imported poultry remain key challenges. Market penetration of processed poultry products is on the rise, expected to reach xx% by 2033. Competitive dynamics are shaped by both domestic and international players, vying for market share through product differentiation and strategic pricing.

Dominant Markets & Segments in Oman Poultry Meat Market

The fresh/chilled segment dominates the Oman poultry meat market, accounting for approximately xx% of total volume in 2025. This dominance is primarily driven by consumer preference for freshness and taste. The Off-Trade distribution channel (supermarkets, hypermarkets, traditional retail) also holds a significant share, exceeding xx% in 2025.

- Fresh/Chilled Segment Dominance Drivers: Consumer preference for freshness, widespread availability.

- Off-Trade Channel Dominance Drivers: Established retail infrastructure, consumer familiarity with traditional channels.

- Frozen Segment Growth Drivers: Convenience, longer shelf life, increasing demand from food service sector.

Oman Poultry Meat Market Product Innovations

Recent innovations focus on value-added products, such as marinated and ready-to-cook poultry, and respond to growing health consciousness with organic and gluten-free options. Technological advancements are streamlining production processes, improving food safety, and reducing waste. These innovations enhance product appeal, broaden market reach, and provide competitive advantages to key players.

Report Segmentation & Scope

This report segments the Oman poultry meat market by distribution channel (Off-Trade, On-Trade) and product form (Canned, Fresh/Chilled, Frozen, Processed). Each segment is analyzed based on historical data (2019-2024), current market size (2025), and future projections (2025-2033). The report also provides a detailed competitive landscape analysis for each segment, including market share data and competitive strategies of key players.

- Distribution Channel: Off-Trade is projected to grow at a CAGR of xx% during the forecast period, while the On-Trade channel is expected to show a CAGR of xx%.

- Product Form: The Fresh/Chilled segment is expected to maintain its dominance, while the Processed segment is projected to witness the highest growth rate.

Key Drivers of Oman Poultry Meat Market Growth

Several factors are driving growth in the Oman poultry meat market. These include increasing population and urbanization leading to higher demand, rising disposable incomes boosting consumer spending, and government initiatives promoting food security and agricultural development. Furthermore, the expansion of modern retail infrastructure enhances market accessibility.

Challenges in the Oman Poultry Meat Market Sector

The Oman poultry meat market faces challenges such as fluctuating feed prices, which impacts production costs, and increasing competition from imported poultry. Maintaining high food safety standards and complying with regulatory requirements also pose challenges for producers. These factors influence profitability and market competitiveness.

Leading Players in the Oman Poultry Meat Market Market

- A'Saffa Food S A O G

- Al faaw Poultry Co LLC

- Sunbulah Group

- BRF S A

- The Savola Group

- IFFCO Group

- JBS SA

- Al Zain Farms LLC

Key Developments in Oman Poultry Meat Market Sector

- January 2021: IFFCO Group announced plans to expand its manufacturing base through its acquisition of 3 Fuji Foods in India, aiming to consolidate its market presence.

- January 2021: Sunbulah Group launched a range of organic and gluten-free poultry products, catering to growing health-conscious consumer demand.

Strategic Oman Poultry Meat Market Market Outlook

The Oman poultry meat market presents significant growth potential, driven by favorable demographics, rising incomes, and a focus on food security. Strategic opportunities exist in value-added product development, expansion into niche segments (organic, halal), and leveraging technology to improve efficiency and sustainability. Investing in modern farming techniques and strengthening supply chain infrastructure will further enhance market competitiveness.

Oman Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Oman Poultry Meat Market Segmentation By Geography

- 1. Oman

Oman Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Advancements in payment and delivery technologies propelling retail stores' sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Form

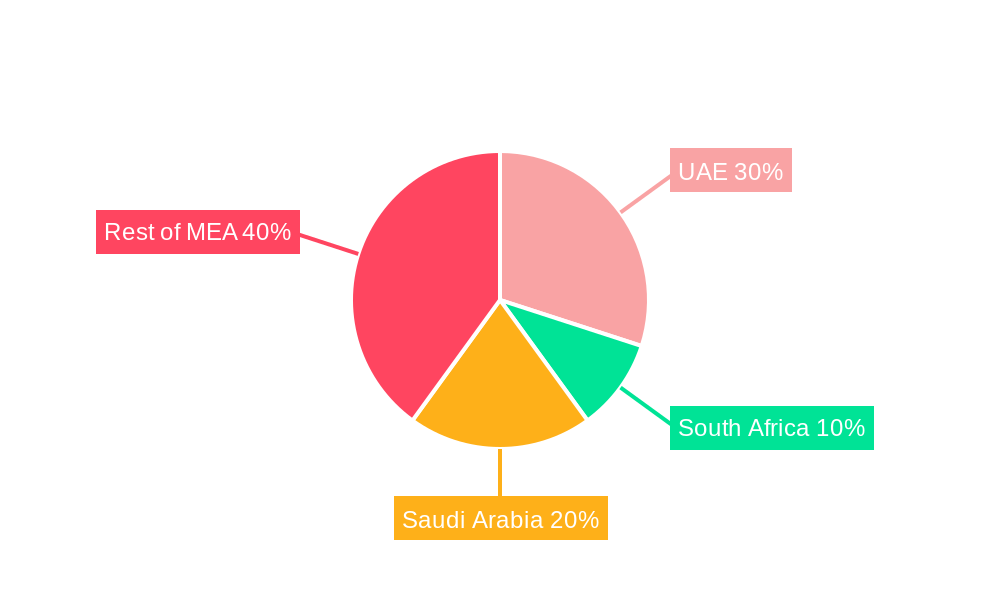

- 6. UAE Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 A'Saffa Food S A O G

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Al faaw Poultry Co LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sunbulah Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BRF S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Savola Grou

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IFFCO Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JBS SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Al Zain Farms LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 A'Saffa Food S A O G

List of Figures

- Figure 1: Oman Poultry Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Poultry Meat Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Oman Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Oman Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Oman Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Oman Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 11: Oman Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Oman Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Poultry Meat Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Oman Poultry Meat Market?

Key companies in the market include A'Saffa Food S A O G, Al faaw Poultry Co LLC, Sunbulah Group, BRF S A, The Savola Grou, IFFCO Group, JBS SA, Al Zain Farms LLC.

3. What are the main segments of the Oman Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Advancements in payment and delivery technologies propelling retail stores' sales.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

January 2021: IFFCO Group has planned to turn 3 Fuji Foods, its recently acquired company in India, into a major manufacturing base to serve customers across various markets and to consolidate its portfolio by exploring new opportunities.January 2021: Sunbulah Group announced the launch of a range of organic and gluten-free products and SKUs to meet the increasing demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Oman Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence