Key Insights

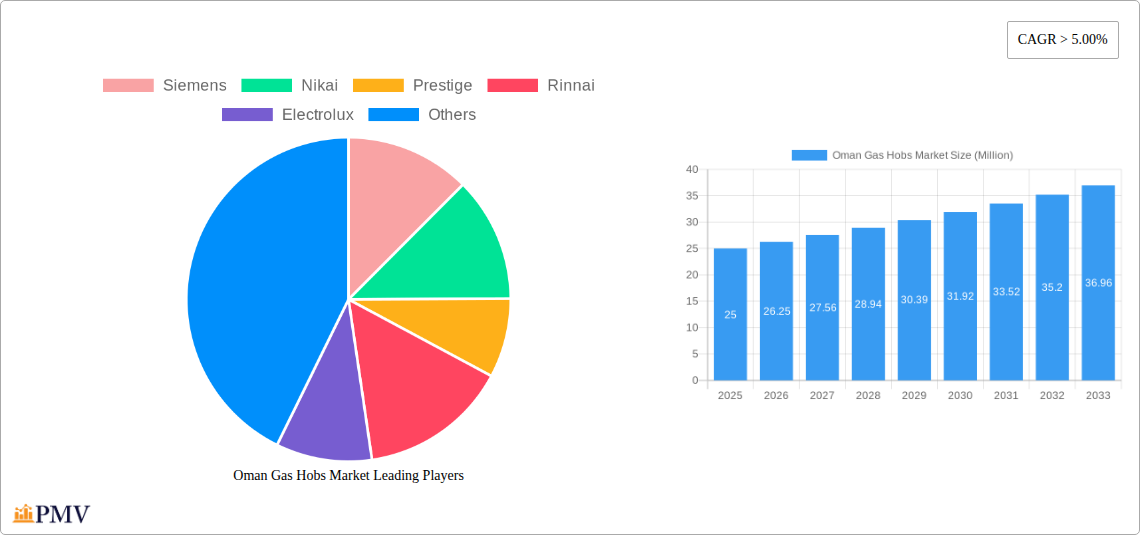

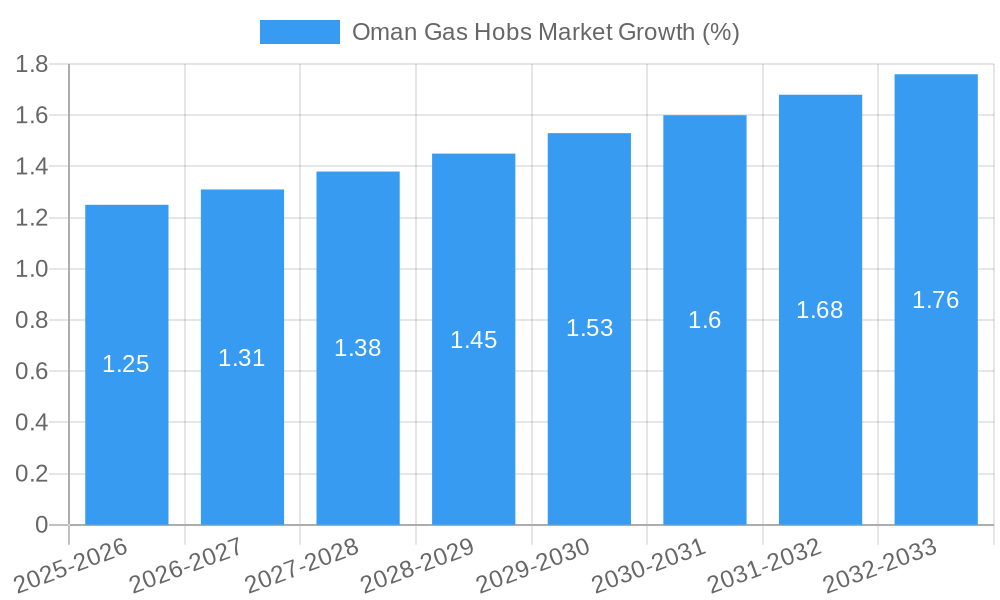

The Oman gas hob market, valued at approximately $25 million in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes and a growing preference for modern, convenient kitchen appliances among Oman's expanding middle class are driving demand. Furthermore, the increasing popularity of open-plan kitchen designs, which often feature prominently displayed gas hobs, contributes to market growth. The construction boom in Oman, particularly residential developments, further fuels demand for new gas hob installations. The market is segmented by end-user (household and commercial), distribution channel (online and offline), and product type (desktop and embedded gas hobs). The household segment currently dominates, though commercial applications, particularly in the hospitality sector, are showing significant growth potential. Online sales are gradually increasing, albeit from a relatively small base, reflecting the broader trend towards e-commerce adoption in Oman. Key players, including Siemens, Nikai, Prestige, Rinnai, Electrolux, Haier, Sonashi, Bosch, Simfer, and Candy Home Appliances, compete through product differentiation, pricing strategies, and distribution networks. While the market faces constraints such as fluctuating gas prices and the potential competition from induction cooktops, the overall outlook remains positive, supported by government initiatives focused on infrastructure development and improving living standards.

The competitive landscape is characterized by a mix of international and local brands. International players leverage their brand recognition and technological advancements, while local brands focus on affordability and localized distribution networks. A key trend observed is the increasing adoption of energy-efficient gas hobs with advanced safety features, such as automatic ignition and flame failure devices. This trend is driven by increasing consumer awareness of energy costs and safety concerns. Looking ahead, manufacturers are likely to focus on innovation in product design, smart features, and enhanced safety mechanisms to further penetrate the market. The shift towards online sales channels presents both opportunities and challenges for companies. Successful strategies will involve effective digital marketing and a robust e-commerce platform to reach a wider audience.

Oman Gas Hobs Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oman Gas Hobs Market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth potential, equipping stakeholders with actionable intelligence for strategic decision-making. The report incorporates extensive data analysis, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. Key players like Siemens, Nikai, Prestige, Rinnai, Electrolux, Haier, Sonashi, Bosch, Simfer, and Candy Home Appliances are analyzed in detail. The market is segmented by end-user (Household, Commercial), distribution channel (Online, Offline), and product type (Desktop Gas Hobs, Embedded Gas Hobs). The report's estimated market value in 2025 is expected to be xx Million.

Oman Gas Hobs Market Market Structure & Competitive Dynamics

The Oman gas hob market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The competitive landscape is characterized by intense rivalry, fueled by product innovation, aggressive pricing strategies, and strategic partnerships. The market is subject to a relatively stable regulatory framework, although evolving consumer preferences and technological advancements are shaping the competitive dynamics. Innovation in gas hob technology, including energy efficiency features and smart connectivity, is becoming increasingly important. Product substitutes, such as induction hobs, are gaining traction, presenting a challenge to traditional gas hob manufacturers. Mergers and acquisitions (M&A) activity within the sector remains relatively low, with deal values estimated at xx Million in the historical period. Market share data reveals that the top three players collectively command approximately xx% of the market.

- Market Concentration: Moderately Concentrated

- Innovation Ecosystem: Active, focusing on energy efficiency and smart features

- Regulatory Framework: Stable

- Product Substitutes: Induction hobs

- End-User Trends: Increasing demand for energy-efficient and stylish appliances

- M&A Activity: Low, with deal values totaling approximately xx Million (2019-2024)

Oman Gas Hobs Market Industry Trends & Insights

The Oman gas hob market is experiencing steady growth, driven by factors such as rising disposable incomes, urbanization, and a preference for modern kitchen appliances. The market's compound annual growth rate (CAGR) during the historical period (2019-2024) was approximately xx%, and the forecast period (2025-2033) is projected to maintain a CAGR of xx%. Market penetration for gas hobs in households remains high, but the growing popularity of alternative cooking technologies presents a challenge. Consumer preferences are shifting towards energy-efficient and feature-rich gas hobs, influencing product innovation. Competitive dynamics are intensified by both established international brands and local players striving for market share. The increasing focus on online sales channels is also significantly impacting the market.

Dominant Markets & Segments in Oman Gas Hobs Market

The household segment dominates the Oman gas hob market, accounting for approximately xx% of total market value in 2025. This dominance is primarily fueled by the large and growing population, increasing urbanization, and the widespread adoption of modern kitchens. The offline distribution channel continues to hold the largest market share due to the preference of consumers for physical product inspection and purchase. Desktop gas hobs remain the preferred product type among consumers because of their cost-effectiveness and ease of installation.

- Key Drivers for Household Segment Dominance: Rising disposable incomes, urbanization, preference for modern kitchens.

- Key Drivers for Offline Channel Dominance: Consumer preference for physical inspection and purchase.

- Key Drivers for Desktop Gas Hob Dominance: Cost-effectiveness and ease of installation.

Oman Gas Hobs Market Product Innovations

Recent innovations in the Oman gas hob market focus on improved energy efficiency, safety features, and user-friendly designs. Manufacturers are increasingly incorporating smart features, such as automated ignition and safety shut-off systems. These advancements enhance both the functionality and appeal of gas hobs, meeting evolving consumer expectations for convenience and safety. The market is witnessing the introduction of gas hobs with sleek designs, mirroring current kitchen aesthetic trends.

Report Segmentation & Scope

The Oman Gas Hobs Market is segmented by End-User (Household, Commercial), Distribution Channel (Online, Offline), and Product Type (Desktop Gas Hobs, Embedded Gas Hobs). The Household segment is expected to show substantial growth due to rising disposable incomes, while the commercial segment is also experiencing steady growth driven by hospitality expansion. Online distribution is gaining traction, although offline channels still dominate. Desktop gas hobs maintain significant market share due to affordability, but embedded gas hobs are gaining popularity in new constructions.

Key Drivers of Oman Gas Hobs Market Growth

Growth in the Oman gas hob market is driven by several factors, including increasing disposable incomes fueling demand for modern kitchen appliances, the expansion of the hospitality and food service industries boosting demand in the commercial segment, and ongoing infrastructure development supporting residential and commercial construction. Moreover, government initiatives promoting energy efficiency are fostering innovation in energy-saving gas hob technologies.

Challenges in the Oman Gas Hobs Market Sector

The Oman gas hob market faces challenges, such as increased competition from international brands, fluctuating energy prices impacting consumer spending, and potential supply chain disruptions impacting product availability and pricing. The market is also subject to occasional import restrictions, and the dependence on global supply chains leaves the market susceptible to geopolitical instability.

Leading Players in the Oman Gas Hobs Market Market

- Siemens

- Nikai

- Prestige

- Rinnai

- Electrolux

- Haier

- Sonashi

- Bosch

- Simfer

- Candy Home Appliances

Key Developments in Oman Gas Hobs Market Sector

- 2020, July: Muscat Kitchen Appliances established, becoming a leading distributor of European brands in Oman.

- 2022, October: Jashanmal opens its first department store in Oman, introducing several high-end kitchen appliance brands.

Strategic Oman Gas Hobs Market Market Outlook

The Oman gas hob market holds significant growth potential driven by increasing urbanization, rising disposable incomes, and the ongoing development of the hospitality sector. Strategic opportunities exist for manufacturers focusing on energy efficiency, smart features, and innovative designs to cater to the evolving consumer preferences. Expansion into online channels and strategic partnerships with distributors will be crucial for success.

Oman Gas Hobs Market Segmentation

-

1. Product Type

- 1.1. Desktop Gas Hobs

- 1.2. Embedded Gas Hobs

-

2. End User

- 2.1. Household

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

Oman Gas Hobs Market Segmentation By Geography

- 1. Oman

Oman Gas Hobs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Tech-Savvy Millennial Population; Increasing Purchasing Power and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Risk of Malware Attacks; Higher Cost of Maintenance4.3.2.1; Market Opportunities4.; Technological Advancements in Smart Fridges

- 3.4. Market Trends

- 3.4.1. Rising Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Desktop Gas Hobs

- 5.1.2. Embedded Gas Hobs

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Household

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Siemens

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nikai

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prestige

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rinnai

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electrolux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonashi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Simfer

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Candy Home Appliances

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Siemens

List of Figures

- Figure 1: Oman Gas Hobs Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Gas Hobs Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Gas Hobs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Gas Hobs Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Oman Gas Hobs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Oman Gas Hobs Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Oman Gas Hobs Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Oman Gas Hobs Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 7: Oman Gas Hobs Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Oman Gas Hobs Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: Oman Gas Hobs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Oman Gas Hobs Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Oman Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Oman Gas Hobs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Oman Gas Hobs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Oman Gas Hobs Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 15: Oman Gas Hobs Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Oman Gas Hobs Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 17: Oman Gas Hobs Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Oman Gas Hobs Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 19: Oman Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Oman Gas Hobs Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Gas Hobs Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Oman Gas Hobs Market?

Key companies in the market include Siemens, Nikai, Prestige, Rinnai, Electrolux, Haier, Sonashi, Bosch, Simfer, Candy Home Appliances.

3. What are the main segments of the Oman Gas Hobs Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Tech-Savvy Millennial Population; Increasing Purchasing Power and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Rising Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

Risk of Malware Attacks; Higher Cost of Maintenance4.3.2.1; Market Opportunities4.; Technological Advancements in Smart Fridges.

8. Can you provide examples of recent developments in the market?

2022 - Jashanmal, carrying its 100-year legacy of trust and quality, announced the opening of its first department store in Oman, bringing some of the world's best brands under one roof. Jashanmal is retailing many leading, bestselling brands like De Longhi, Kenwood, Nespresso, Blendtec, Jura, Hoover, and Bertazzoni.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Gas Hobs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Gas Hobs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Gas Hobs Market?

To stay informed about further developments, trends, and reports in the Oman Gas Hobs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence