Key Insights

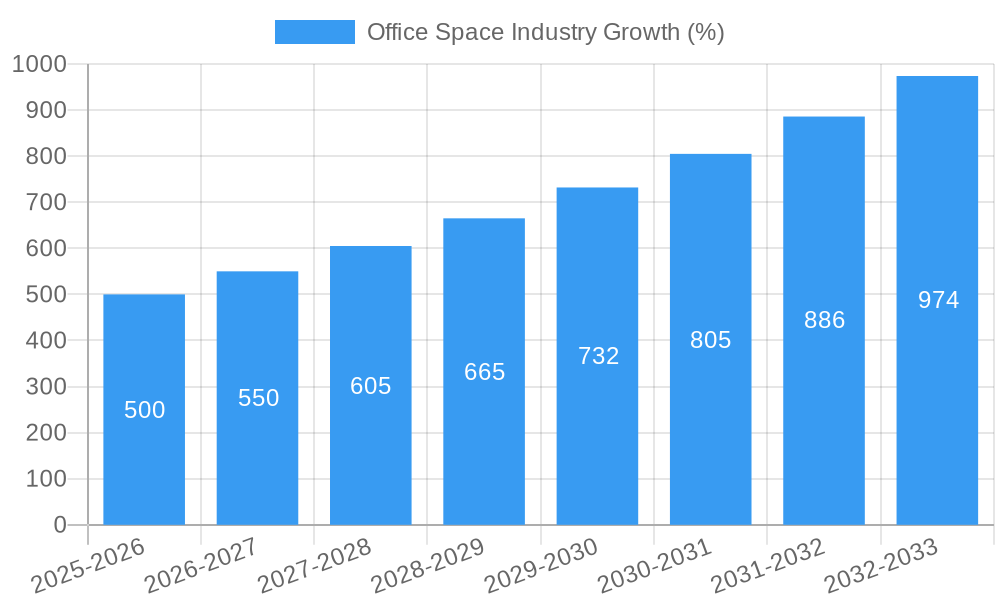

The global office space market, currently experiencing robust growth with a CAGR exceeding 10%, is projected to reach significant value by 2033. This expansion is fueled by several key drivers. The increasing adoption of hybrid work models, while initially impacting demand, has paradoxically stimulated demand for flexible and adaptable office spaces. Businesses are seeking solutions that cater to both in-person collaboration and remote work needs, driving the growth of co-working spaces and serviced offices. Technological advancements, particularly in building management systems and smart office technologies, are enhancing efficiency and attracting tenants seeking modern, sustainable work environments. Furthermore, the expansion of the IT and telecommunications sectors, coupled with growth in media and entertainment, is driving demand for high-quality office space in key urban centers. While economic downturns and evolving remote work preferences could pose challenges, the long-term outlook remains positive, driven by the inherent need for physical collaboration and the ongoing evolution of workspace design to meet changing business requirements.

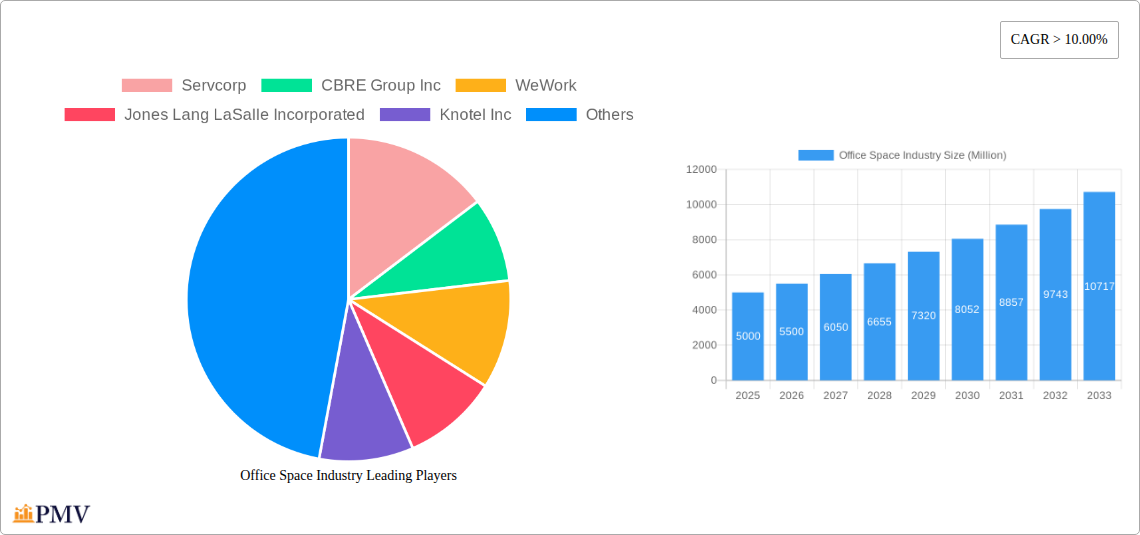

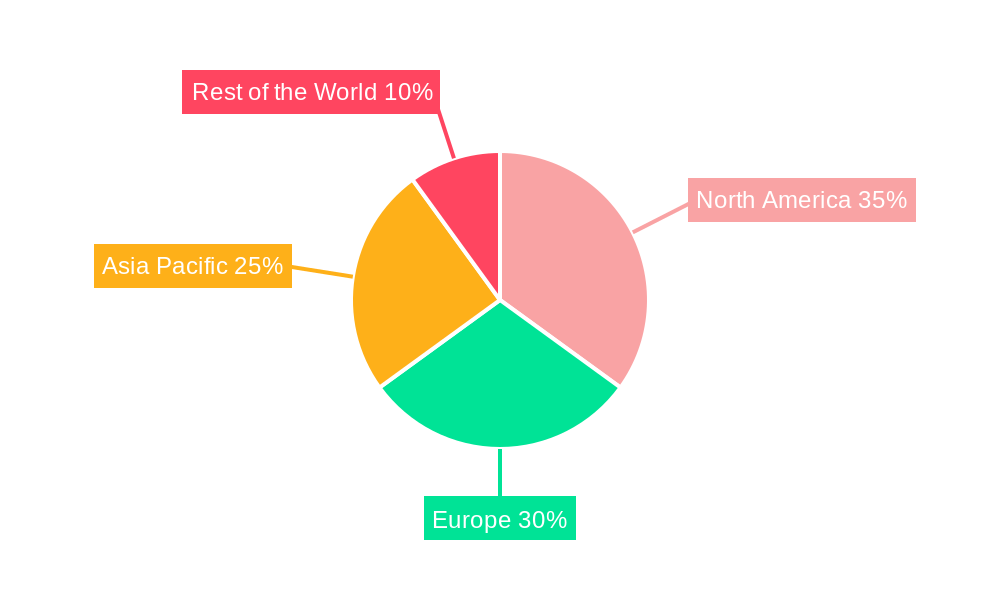

The market segmentation highlights a strong preference for retrofitted spaces in existing buildings, reflecting the cost-effectiveness and sustainability benefits. However, the construction of new buildings, particularly those incorporating innovative design and technology, remains a significant portion of the market. The end-user segment is broadly distributed, with IT and telecommunications, media and entertainment, and retail and consumer goods sectors comprising a large percentage of demand. Major players such as Servcorp, CBRE Group Inc, WeWork, and IWG PLC are actively shaping the market through their diverse offerings and global reach. Regional variations exist, with North America and Europe currently holding significant market shares, but rapid growth is anticipated in the Asia-Pacific region due to economic expansion and urbanization. The continued evolution of work styles and technological advancements will further shape the future of the office space market, creating both opportunities and challenges for existing and emerging players.

Office Space Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global office space industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes a robust methodology, incorporating historical data (2019-2024) and incorporating projected figures, presenting a detailed overview of market size, segmentation, trends, and competitive dynamics. The global office space market is estimated to be valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Office Space Industry Market Structure & Competitive Dynamics

The global office space market exhibits a moderately concentrated structure, with several large multinational corporations holding significant market share. Key players include Servcorp, CBRE Group Inc, WeWork, Jones Lang LaSalle Incorporated, Knotel Inc, IWG PLC, Mitsui Fudosan Co Ltd, The Office Group, Regus, and WOJO, along with 73 other companies. Market share varies significantly, with the top five players accounting for approximately xx% of the global market in 2024.

Innovation ecosystems are vibrant, with ongoing developments in smart building technologies, flexible workspace solutions, and sustainable design. Regulatory frameworks vary across regions, impacting construction regulations, zoning laws, and environmental standards. Product substitutes, such as co-working spaces and remote work arrangements, are influencing market dynamics. End-user trends are shifting towards flexible lease terms, collaborative workspaces, and amenity-rich environments. M&A activity has been robust in recent years, with deal values totaling xx Million in 2024, driven by consolidation and expansion strategies.

Office Space Industry Industry Trends & Insights

The office space industry is experiencing a period of significant transformation, driven by several key factors. The increasing adoption of flexible work arrangements, facilitated by technological advancements, is reshaping demand. Companies are increasingly adopting hybrid work models, leading to a shift in demand away from traditional long-term leases towards shorter-term, flexible options. This trend is further propelled by the rise of co-working spaces and serviced offices, providing businesses with scalable solutions.

Technological disruptions, such as the widespread adoption of cloud computing and remote work technologies, are fundamentally changing how work is conducted. This has led to a growing demand for technologically advanced office spaces equipped with high-speed internet, collaborative tools, and smart building technologies. Consumer preferences are shifting towards sustainable and environmentally friendly office buildings, prompting developers to incorporate green building practices and incorporate environmentally friendly designs. Competitive dynamics are intensifying, with established players facing competition from new entrants offering innovative workspace solutions. The market is witnessing a continuous evolution in design, technology, and operational models, making it imperative for businesses to stay adaptable and innovative.

Dominant Markets & Segments in Office Space Industry

The North American region currently dominates the global office space market, driven by strong economic growth, robust infrastructure, and a large and diverse business community. Within this region, major metropolitan areas such as New York, Los Angeles, and San Francisco exhibit particularly strong demand.

By Building Type:

- New Buildings: Demand for new buildings is primarily driven by technological advancements and growing sustainability concerns. New buildings can incorporate the latest technological features, leading to higher rent values.

- Retrofits: The retrofitting market is driven by the need to upgrade existing buildings to meet modern requirements, particularly for energy efficiency and improved technology infrastructure. This segment’s growth is influenced by government incentives and regulations concerning sustainable building practices.

By End User:

- IT and Telecommunications: This segment represents a significant portion of the market due to the high demand for technologically advanced spaces. This segment is largely concentrated in technology hubs.

- Media and Entertainment: This segment is influenced by the creative nature of the industry, requiring flexible and inspiring workspaces. Proximity to entertainment districts is crucial for this sector.

- Retail and Consumer Goods: This sector displays a diverse demand for office space depending on individual company needs, from warehouse space for logistics to corporate offices for management. This sector's growth is tied to consumer spending patterns and economic growth.

Office Space Industry Product Innovations

Recent product innovations in the office space industry focus heavily on technology integration and sustainability. Smart building technologies, such as automated lighting and climate control systems, are becoming increasingly common. Flexible workspace solutions, including modular designs and adaptable layouts, are gaining popularity. Sustainable building materials and energy-efficient designs are also increasingly prioritized, reflecting growing environmental consciousness among businesses and consumers. These innovations provide businesses with enhanced operational efficiency, cost savings, and improved employee satisfaction.

Report Segmentation & Scope

This report segments the office space market by building type (retrofits and new buildings) and end-user (IT and telecommunications, media and entertainment, and retail and consumer goods). Each segment's analysis includes growth projections, market size estimations for 2025 and 2033, and an assessment of competitive dynamics. The report provides detailed market sizing and growth projections for each of these segments throughout the forecast period, considering factors such as technological advancements, evolving end-user preferences, and economic conditions.

Key Drivers of Office Space Industry Growth

Several factors are driving growth in the office space industry. Technological advancements, particularly in smart building technologies and flexible workspace solutions, are enhancing efficiency and attracting tenants. Strong economic growth in key markets fuels demand for office space. Supportive government policies and regulations promote sustainable building practices and incentivize investment in the sector.

Challenges in the Office Space Industry Sector

The office space industry faces several challenges. High construction costs and land scarcity can constrain supply. Stringent building codes and environmental regulations can increase development costs. Intense competition from existing players and new entrants presents a major hurdle, particularly for smaller firms. The global economic climate and fluctuations in real estate markets affect the sector significantly.

Leading Players in the Office Space Industry Market

- Servcorp

- CBRE Group Inc

- WeWork

- Jones Lang LaSalle Incorporated

- Knotel Inc

- IWG PLC

- Mitsui Fudosan Co Ltd

- The Office Group

- Regus

- WOJO

- 73 Other Companies

Key Developments in Office Space Industry Sector

- 2022 Q4: Increased adoption of hybrid work models by major corporations.

- 2023 Q1: Launch of several new smart building projects incorporating advanced technological features.

- 2023 Q3: Significant M&A activity within the flexible workspace segment.

Strategic Office Space Industry Market Outlook

The future of the office space industry is bright, with significant growth potential driven by ongoing technological advancements, evolving workplace trends, and a growing global economy. Strategic opportunities exist for companies offering innovative workspace solutions, sustainable building designs, and advanced technological integrations. Companies that adapt quickly to changing market dynamics and embrace sustainability will be well-positioned for success in this evolving industry.

Office Space Industry Segmentation

-

1. Building Type

- 1.1. Retrofits

- 1.2. New Buildings

-

2. End User

- 2.1. IT and Telecommunications

- 2.2. Media and Entertainment

- 2.3. Retail and Consumer Goods

Office Space Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Office Space Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market

- 3.4. Market Trends

- 3.4.1. Increase in Office Space Vacancy Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Building Type

- 5.1.1. Retrofits

- 5.1.2. New Buildings

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunications

- 5.2.2. Media and Entertainment

- 5.2.3. Retail and Consumer Goods

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Building Type

- 6. North America Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Building Type

- 6.1.1. Retrofits

- 6.1.2. New Buildings

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. IT and Telecommunications

- 6.2.2. Media and Entertainment

- 6.2.3. Retail and Consumer Goods

- 6.1. Market Analysis, Insights and Forecast - by Building Type

- 7. Europe Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Building Type

- 7.1.1. Retrofits

- 7.1.2. New Buildings

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. IT and Telecommunications

- 7.2.2. Media and Entertainment

- 7.2.3. Retail and Consumer Goods

- 7.1. Market Analysis, Insights and Forecast - by Building Type

- 8. Asia Pacific Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Building Type

- 8.1.1. Retrofits

- 8.1.2. New Buildings

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. IT and Telecommunications

- 8.2.2. Media and Entertainment

- 8.2.3. Retail and Consumer Goods

- 8.1. Market Analysis, Insights and Forecast - by Building Type

- 9. Rest of the World Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Building Type

- 9.1.1. Retrofits

- 9.1.2. New Buildings

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. IT and Telecommunications

- 9.2.2. Media and Entertainment

- 9.2.3. Retail and Consumer Goods

- 9.1. Market Analysis, Insights and Forecast - by Building Type

- 10. North America Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Servcorp

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 CBRE Group Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 WeWork

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Jones Lang LaSalle Incorporated

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Knotel Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 IWG PLC

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Mitsui Fudosan Co Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 The Office Group

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Regus

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 WOJO**List Not Exhaustive 7 3 Other Companie

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Servcorp

List of Figures

- Figure 1: Global Office Space Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Office Space Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Office Space Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Office Space Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Office Space Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Office Space Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Office Space Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Office Space Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Office Space Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Office Space Industry Revenue (Million), by Building Type 2024 & 2032

- Figure 11: North America Office Space Industry Revenue Share (%), by Building Type 2024 & 2032

- Figure 12: North America Office Space Industry Revenue (Million), by End User 2024 & 2032

- Figure 13: North America Office Space Industry Revenue Share (%), by End User 2024 & 2032

- Figure 14: North America Office Space Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Office Space Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Office Space Industry Revenue (Million), by Building Type 2024 & 2032

- Figure 17: Europe Office Space Industry Revenue Share (%), by Building Type 2024 & 2032

- Figure 18: Europe Office Space Industry Revenue (Million), by End User 2024 & 2032

- Figure 19: Europe Office Space Industry Revenue Share (%), by End User 2024 & 2032

- Figure 20: Europe Office Space Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Office Space Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Office Space Industry Revenue (Million), by Building Type 2024 & 2032

- Figure 23: Asia Pacific Office Space Industry Revenue Share (%), by Building Type 2024 & 2032

- Figure 24: Asia Pacific Office Space Industry Revenue (Million), by End User 2024 & 2032

- Figure 25: Asia Pacific Office Space Industry Revenue Share (%), by End User 2024 & 2032

- Figure 26: Asia Pacific Office Space Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Office Space Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Office Space Industry Revenue (Million), by Building Type 2024 & 2032

- Figure 29: Rest of the World Office Space Industry Revenue Share (%), by Building Type 2024 & 2032

- Figure 30: Rest of the World Office Space Industry Revenue (Million), by End User 2024 & 2032

- Figure 31: Rest of the World Office Space Industry Revenue Share (%), by End User 2024 & 2032

- Figure 32: Rest of the World Office Space Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Office Space Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Office Space Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Office Space Industry Revenue Million Forecast, by Building Type 2019 & 2032

- Table 3: Global Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Office Space Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Office Space Industry Revenue Million Forecast, by Building Type 2019 & 2032

- Table 14: Global Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Global Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Office Space Industry Revenue Million Forecast, by Building Type 2019 & 2032

- Table 17: Global Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Global Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Office Space Industry Revenue Million Forecast, by Building Type 2019 & 2032

- Table 20: Global Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 21: Global Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Office Space Industry Revenue Million Forecast, by Building Type 2019 & 2032

- Table 23: Global Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Global Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Office Space Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Office Space Industry?

Key companies in the market include Servcorp, CBRE Group Inc, WeWork, Jones Lang LaSalle Incorporated, Knotel Inc, IWG PLC, Mitsui Fudosan Co Ltd, The Office Group, Regus, WOJO**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Office Space Industry?

The market segments include Building Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market.

6. What are the notable trends driving market growth?

Increase in Office Space Vacancy Rate.

7. Are there any restraints impacting market growth?

4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Office Space Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Office Space Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Office Space Industry?

To stay informed about further developments, trends, and reports in the Office Space Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence