Key Insights

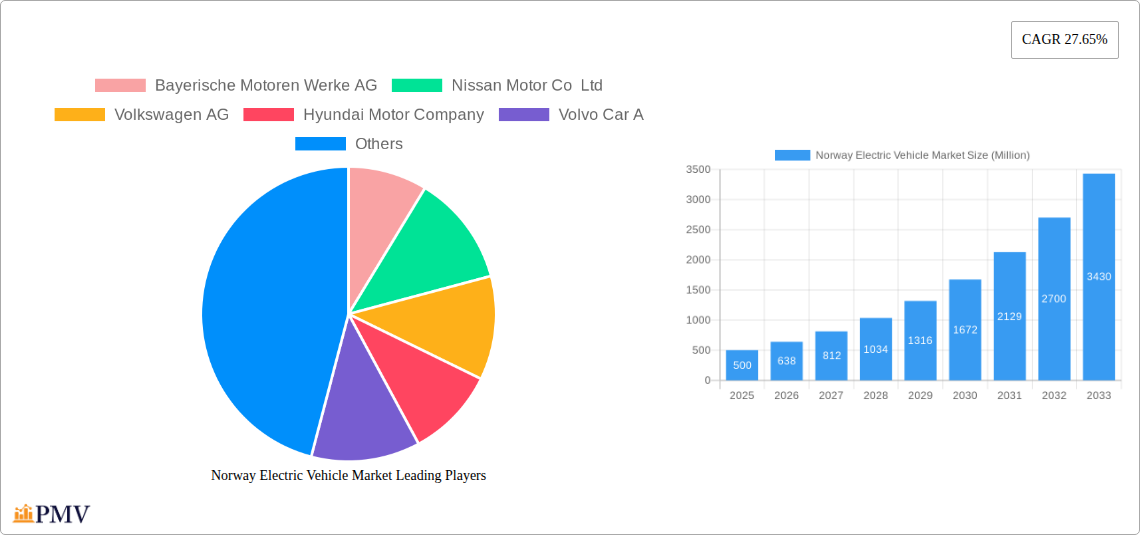

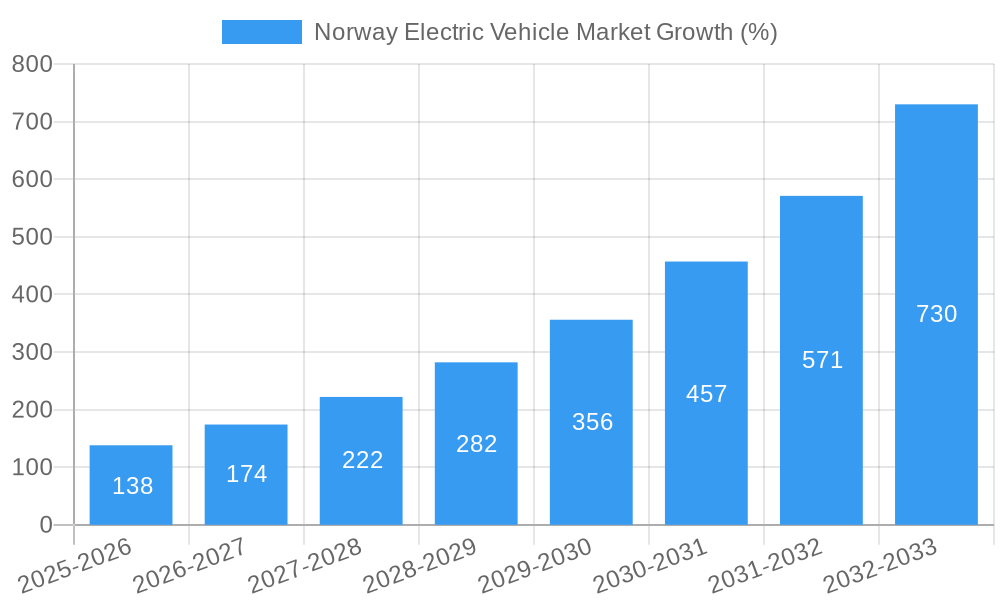

The Norway electric vehicle (EV) market is experiencing robust growth, driven by strong government incentives, a rising environmental consciousness among consumers, and the country's ambitious climate targets. With a CAGR of 27.65% from 2019 to 2024, the market demonstrates significant potential. The base year of 2025 suggests a substantial market size, likely exceeding several hundred million based on the high CAGR and Norway's early adoption of EVs. The market is segmented by fuel category (BEV, FCEV, HEV, PHEV) and vehicle configuration (passenger cars), with BEVs likely dominating due to their technological advancements and increasing affordability. Key players like Tesla, Volkswagen, BMW, and Hyundai are fiercely competing, leading to innovation and price reductions, further fueling market expansion. Norway's strong charging infrastructure and supportive regulatory framework contribute significantly to this growth. While challenges like battery technology limitations and initial high purchase prices persist, these are gradually being mitigated by technological breakthroughs and government subsidies. The forecast period (2025-2033) indicates sustained high growth, with Norway likely solidifying its position as a global leader in EV adoption. The continued expansion of charging infrastructure, further development of battery technology, and the introduction of more affordable EV models will continue to drive market expansion throughout the forecast period. The focus on passenger cars within this market is expected to remain consistent due to Norway's high per capita vehicle ownership rates and strong consumer preferences for electric mobility.

The continued success of the Norwegian EV market hinges on several factors. Maintaining generous government incentives will be critical to sustaining consumer demand. Technological advancements, particularly in battery technology, including battery life, charging speeds, and cost reductions are vital for wider adoption and overcoming range anxiety. Furthermore, ensuring sufficient charging infrastructure across the country, particularly in rural areas, will be essential. Competition amongst manufacturers will undoubtedly continue to drive innovation and affordability, leading to increased market penetration. The ongoing success of this market serves as a strong model for other nations striving to achieve ambitious climate goals through the widespread adoption of electric vehicles.

Norway Electric Vehicle Market: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Norway electric vehicle (EV) market, offering valuable insights for stakeholders across the automotive and energy sectors. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, utilizing 2025 as the base and estimated year. The report analyzes market trends, competitive dynamics, key players, and future growth prospects, incorporating data on various fuel categories (BEV, FCEV, HEV, PHEV) and vehicle configurations (Passenger Cars). The total market size is projected to reach xx Million by 2033.

Norway Electric Vehicle Market Structure & Competitive Dynamics

The Norwegian EV market exhibits a high degree of concentration, with a few dominant players commanding significant market share. The market structure is influenced by strong government incentives, robust charging infrastructure, and a growing consumer preference for environmentally friendly vehicles. Innovation ecosystems are thriving, with substantial investments in battery technology and charging solutions. The regulatory framework, while supportive of EV adoption, continues to evolve. Product substitutes, primarily internal combustion engine (ICE) vehicles, face increasing pressure due to stringent emission regulations and consumer demand. End-user trends show a strong preference for BEVs, driven by their longer range and faster charging capabilities compared to PHEVs. M&A activities are prevalent, with strategic acquisitions aimed at strengthening supply chains and technological capabilities. For example, while precise deal values are unavailable for the Norwegian market specifically, the global EV market experienced M&A activity totaling xx Million in 2024, indicating a significant level of investment. Leading players hold significant market share, with Tesla, Volkswagen, and BMW among the top contenders. Their market share is estimated at xx%, xx%, and xx% respectively (2024 data). Further analysis reveals a competitive landscape characterized by intense rivalry, particularly in innovation and market penetration.

Norway Electric Vehicle Market Industry Trends & Insights

The Norwegian EV market demonstrates exceptional growth, fueled by several key drivers. Government subsidies and tax incentives significantly reduce the upfront cost of EVs, making them more accessible to consumers. A well-developed charging infrastructure network facilitates convenient and reliable charging, addressing range anxiety concerns. Growing environmental awareness among consumers is driving demand for sustainable transportation options. The market is witnessing rapid technological advancements, including improvements in battery technology, resulting in increased range and faster charging times. Consumer preferences are shifting towards fully electric vehicles (BEVs) due to their environmental benefits and performance characteristics. The competitive landscape is highly dynamic, with established automakers and new entrants vying for market share through product innovation and aggressive marketing strategies. The CAGR for the Norwegian EV market during the forecast period (2025-2033) is estimated to be xx%, reflecting the market’s robust growth trajectory. Market penetration is projected to reach xx% by 2033, indicating widespread EV adoption within the Norwegian automotive sector.

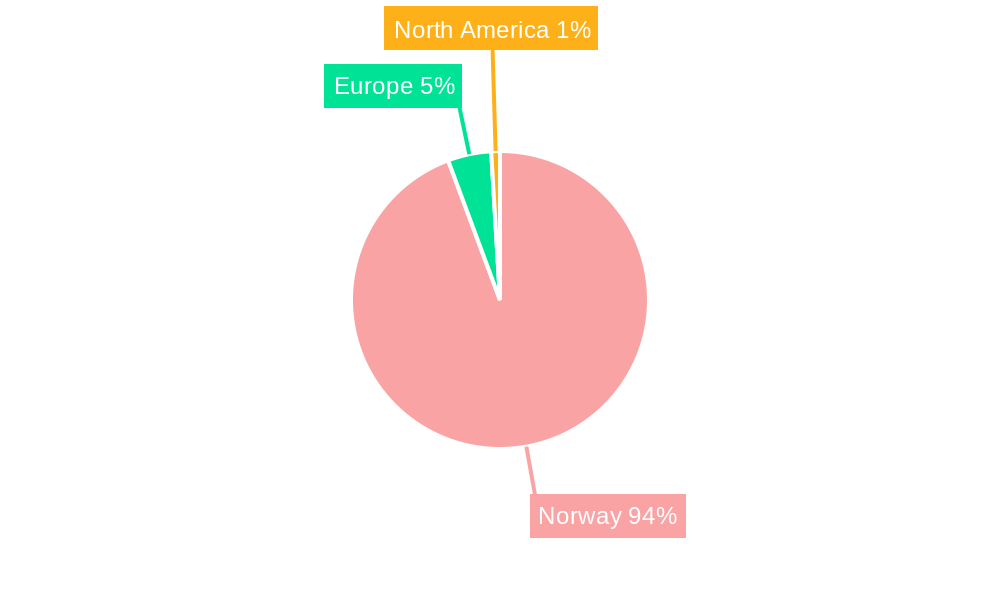

Dominant Markets & Segments in Norway Electric Vehicle Market

The Norwegian EV market shows strong dominance across all regions within the country itself, largely due to the supportive government policies and well-established charging infrastructure. Within the segmentations, several factors drive market dominance:

Fuel Category: BEVs hold the dominant position, accounting for the majority of sales, driven by their longer range and improved performance compared to other EV types. PHEVs also occupy a significant market share due to their flexibility. FCEVs and HEVs have considerably smaller market shares.

Vehicle Configuration: Passenger cars constitute the vast majority of the EV market, owing to high consumer demand for electric passenger vehicles.

Key Drivers of Dominance:

- Government Incentives: Substantial tax breaks and subsidies have made EVs significantly more affordable.

- Charging Infrastructure: Norway boasts one of the most extensive and well-developed EV charging networks globally.

- Environmental Awareness: High levels of environmental consciousness among Norwegians fuel the demand for sustainable transport solutions.

- Technological Advancements: Continuous advancements in battery technology contribute to increased range and reduced charging times.

Norway Electric Vehicle Market Product Innovations

The Norwegian EV market is characterized by continuous product innovations, driven by the need for enhanced range, faster charging, and improved performance. Battery technology is at the forefront of these innovations, with ongoing research and development focused on increasing energy density and improving lifespan. Advancements in charging infrastructure, such as faster charging technologies, are crucial for addressing range anxiety and enhancing the overall user experience. Manufacturers are also integrating advanced driver-assistance systems (ADAS) and connectivity features into their EV models to enhance safety and convenience. These innovations are crucial for meeting evolving consumer preferences and maintaining a competitive edge in the dynamic EV market.

Report Segmentation & Scope

This report segments the Norway electric vehicle market by fuel category (BEV, FCEV, HEV, PHEV) and vehicle configuration (Passenger Cars). Each segment provides a detailed analysis of market size, growth projections, and competitive dynamics.

BEV (Battery Electric Vehicle): This segment is projected to witness significant growth, driven by technological advancements and increasing consumer demand. Competition is intense, with several major automakers vying for market share.

FCEV (Fuel Cell Electric Vehicle): This segment remains relatively small compared to BEVs, but is expected to experience moderate growth driven by technological advancements.

HEV (Hybrid Electric Vehicle): This segment holds a notable market share, serving as a transitional technology towards full electrification.

PHEV (Plug-in Hybrid Electric Vehicle): This segment offers a blend of electric and internal combustion engine technology, providing a balance between range and refueling convenience.

Passenger Cars: This segment constitutes the bulk of the EV market in Norway and is expected to continue its growth trajectory.

Key Drivers of Norway Electric Vehicle Market Growth

Several factors contribute to the growth of the Norwegian EV market. Government policies, including generous subsidies and tax incentives, have made EVs significantly more affordable and attractive to consumers. The extensive and well-developed charging infrastructure addresses range anxiety concerns, further boosting EV adoption. The rising environmental awareness among the Norwegian population fuels the demand for sustainable transportation options. Technological advancements in battery technology, such as improved energy density and faster charging times, enhance the appeal of EVs. Furthermore, the increasing availability of a wide range of EV models from various manufacturers caters to diverse consumer preferences.

Challenges in the Norway Electric Vehicle Market Sector

Despite the robust growth, the Norwegian EV market faces several challenges. While the charging infrastructure is well-developed, challenges remain in expanding it to meet the increasing demand, especially in rural areas. The availability of raw materials for battery production can pose supply chain disruptions, impacting the cost and availability of EVs. The competition among automakers is fierce, demanding continuous product innovation and efficient supply chains. Regulatory changes and uncertainties in government policies could also impact market growth and investment decisions. Moreover, the high initial cost of EVs, even with subsidies, might still be a barrier for some consumers.

Leading Players in the Norway Electric Vehicle Market Market

- Bayerische Motoren Werke AG

- Nissan Motor Co Ltd

- Volkswagen AG

- Hyundai Motor Company

- Volvo Car A

- Tesla Inc

- Mercedes-Benz

- Audi AG

- Toyota Motor Corporation

Key Developments in Norway Electric Vehicle Market Sector

- November 2023: Hyundai Motor's Genesis division opened a new showroom in New York, the United States, signaling expansion efforts in a key market.

- November 2023: Tesla acquired US-based start-up SiILion battery (Battery manufacturer), a strategic move to enhance its battery production capabilities and reduce reliance on external suppliers.

- November 2023: Tesla opened a new single-point electric vehicle super-charging station between the Bay Area and Los Angeles areas in the US, expanding its charging infrastructure network and improving customer convenience. These developments significantly contribute to market expansion and technological advancement in the wider EV landscape, influencing the competitive dynamics within Norway and internationally.

Strategic Norway Electric Vehicle Market Market Outlook

The future of the Norway EV market appears promising, driven by ongoing government support, technological innovation, and increasing consumer preference for electric vehicles. The market is poised for sustained growth, with significant opportunities for automakers, charging infrastructure providers, and battery manufacturers. Strategic investments in charging infrastructure expansion and battery technology development will be crucial for further market penetration. The focus will likely shift towards enhancing charging speed, range, and affordability to make EVs more accessible to a wider range of consumers. The market is ripe for innovation and disruption, particularly in battery technology and charging solutions, presenting significant opportunities for new entrants and established players alike.

Norway Electric Vehicle Market Segmentation

-

1. Vehicle Configuration

-

1.1. Passenger Cars

- 1.1.1. Hatchback

- 1.1.2. Multi-purpose Vehicle

- 1.1.3. Sedan

- 1.1.4. Sports Utility Vehicle

-

1.1. Passenger Cars

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Norway Electric Vehicle Market Segmentation By Geography

- 1. Norway

Norway Electric Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 27.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Setting Up EV Charging Stations Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Passenger Cars

- 5.1.1.1. Hatchback

- 5.1.1.2. Multi-purpose Vehicle

- 5.1.1.3. Sedan

- 5.1.1.4. Sports Utility Vehicle

- 5.1.1. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayerische Motoren Werke AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nissan Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volkswagen AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hyundai Motor Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Volvo Car A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tesla Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mercedes-Benz

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Audi AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toyota Motor Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: Norway Electric Vehicle Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Electric Vehicle Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Electric Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Electric Vehicle Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 3: Norway Electric Vehicle Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: Norway Electric Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Norway Electric Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Norway Electric Vehicle Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 7: Norway Electric Vehicle Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 8: Norway Electric Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Electric Vehicle Market?

The projected CAGR is approximately 27.65%.

2. Which companies are prominent players in the Norway Electric Vehicle Market?

Key companies in the market include Bayerische Motoren Werke AG, Nissan Motor Co Ltd, Volkswagen AG, Hyundai Motor Company, Volvo Car A, Tesla Inc, Mercedes-Benz, Audi AG, Toyota Motor Corporation.

3. What are the main segments of the Norway Electric Vehicle Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of Setting Up EV Charging Stations Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2023: Hyundai Motor's Genesis division has opened a new showroom in New York, the United States.November 2023: Tesla has acquired US-based start-up SiILion battery (Battery manufacturer) to excel the battery production in US.November 2023: Tesla opened its single-point electric vehicle super-charging station between the Bay Area and Los Angeles areas in the US.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Electric Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Electric Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Electric Vehicle Market?

To stay informed about further developments, trends, and reports in the Norway Electric Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence