Key Insights

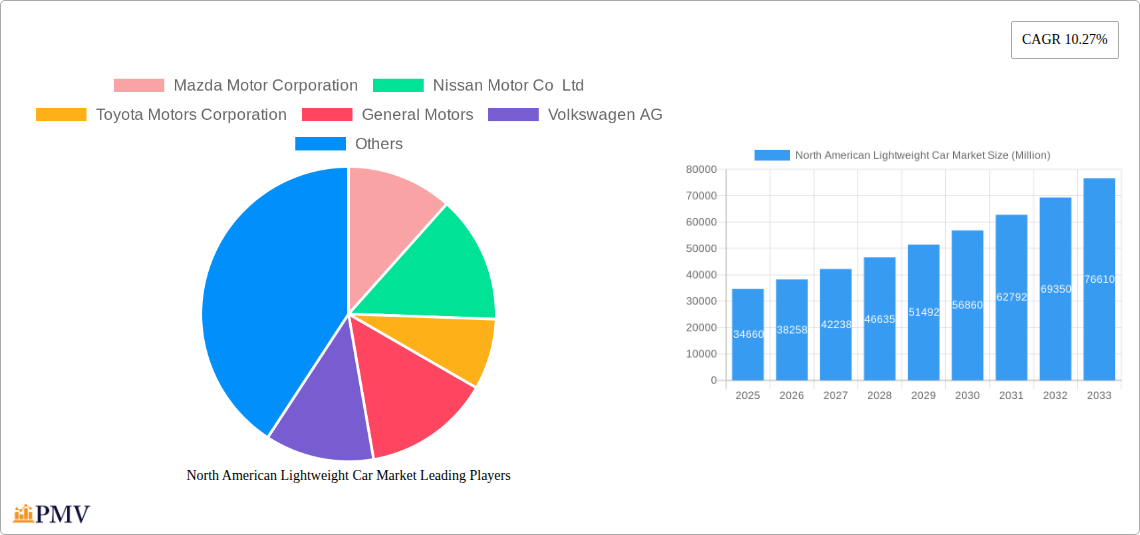

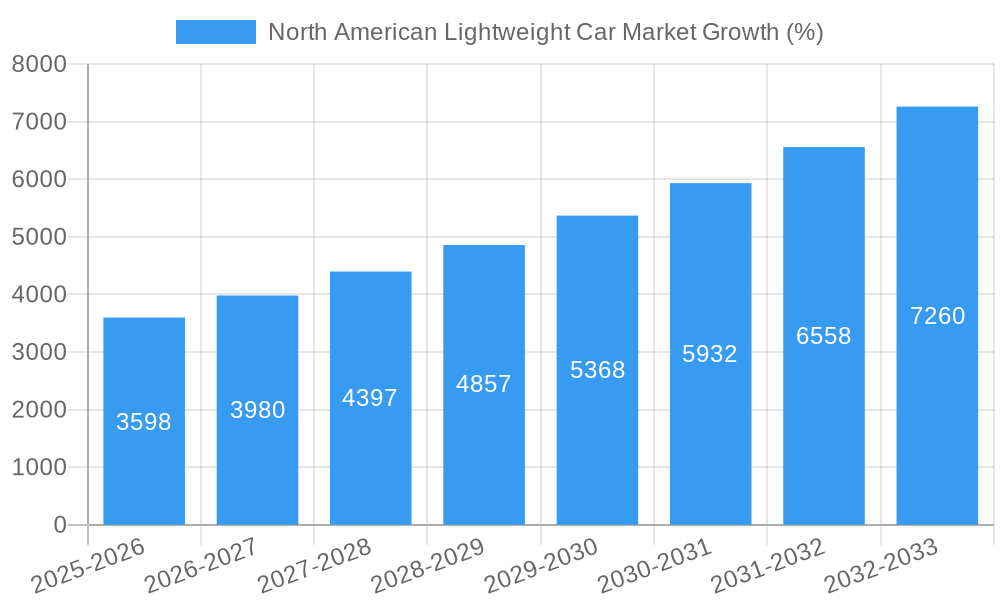

The North American lightweight car market, valued at $34.66 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.27% from 2025 to 2033. This expansion is driven by stringent government fuel efficiency regulations, the increasing demand for enhanced vehicle fuel economy, and a growing consumer preference for lighter, more fuel-efficient vehicles. The automotive industry's ongoing focus on reducing emissions further fuels this market's trajectory. Key material segments include metals, composites, and plastics, each contributing to the diverse lightweighting strategies employed by manufacturers. The extrusion, stamping, and forging processes dominate the manufacturing landscape, reflecting the industry's established techniques and the ongoing development of advanced manufacturing processes. Significant application areas include powertrain components, exterior and interior systems, and the vehicle frame itself, highlighting the comprehensive impact of lightweighting across various vehicle architectures. Leading automotive manufacturers like Toyota, General Motors, Ford, and others are actively investing in lightweighting technologies, driving innovation and competition within the market. Regional variations in market penetration exist, with the United States holding a dominant market share within North America, followed by Canada and Mexico.

The forecast period (2025-2033) anticipates a substantial increase in market value, primarily propelled by technological advancements in material science and manufacturing processes. The development of advanced high-strength steel, carbon fiber composites, and innovative manufacturing techniques like additive manufacturing (3D printing) will contribute to greater weight reduction and improved performance. However, challenges remain, including the higher initial costs associated with some lightweight materials and the need for further infrastructure development to support the adoption of these technologies. Nevertheless, the long-term outlook for the North American lightweight car market remains positive, with continued growth expected throughout the forecast period driven by sustained government support, consumer demand, and ongoing technological breakthroughs.

North American Lightweight Car Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American lightweight car market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously segments the market by material type (metals, composites, plastics, others), manufacturing process (extrusion, stamping, forging, casting, others), application (powertrain, exterior systems, interior systems, frame), and country (United States, Canada, Rest of North America). The report is invaluable for automotive manufacturers, suppliers, investors, and industry analysts seeking to understand and capitalize on the evolving lightweight car market in North America. The total market value in 2025 is estimated at xx Million, with a projected CAGR of xx% during the forecast period (2025-2033).

North American Lightweight Car Market Market Structure & Competitive Dynamics

The North American lightweight car market exhibits a moderately consolidated structure, with key players like Mazda Motor Corporation, Nissan Motor Co Ltd, Toyota Motors Corporation, General Motors, Volkswagen AG, Kia Motors Corporation, Chevrolet, Subaru, Honda Motor Co Ltd, Hyundai Motors, and Ford Motor Company holding significant market share. The market share distribution among these companies fluctuates based on technological advancements, product launches, and consumer preferences. Innovation ecosystems are robust, with ongoing R&D efforts focused on advanced materials, manufacturing processes, and design optimization.

The regulatory framework, particularly concerning fuel efficiency standards and safety regulations (like FMVSS), significantly influences the adoption of lightweight materials and technologies. Competition is fierce, driving innovation and cost reduction strategies. Product substitutes, such as alternative vehicle designs and materials, constantly pose a challenge. End-user trends, primarily focusing on fuel efficiency, safety, and environmental concerns, drive the demand for lightweight vehicles. M&A activities in the sector are moderately frequent, with deal values ranging from xx Million to xx Million annually, primarily focused on acquiring specialized technology or expanding market reach. Market concentration is expected to remain relatively stable, with existing players focusing on innovation and strategic partnerships.

North American Lightweight Car Market Industry Trends & Insights

The North American lightweight car market is witnessing robust growth, driven by stringent fuel efficiency regulations, increasing consumer demand for fuel-efficient vehicles, and the rising adoption of electric and hybrid vehicles. Technological disruptions, such as the development of advanced lightweight materials (like carbon fiber and high-strength steels) and innovative manufacturing processes, are significantly impacting market dynamics. The market is experiencing a shift towards the utilization of composites and plastics over traditional metals, although metals still hold a substantial market share. Consumer preferences are shifting towards lighter vehicles due to their enhanced fuel efficiency, performance, and reduced environmental impact.

The CAGR for the market during the historical period (2019-2024) is estimated at xx%, while market penetration of lightweight materials is gradually increasing, with metals still dominant but facing a decline in market share as composites and plastics gain traction. Competitive dynamics remain intense, with companies constantly striving to improve their technological capabilities and reduce manufacturing costs to maintain a competitive edge. The growing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies further fuels the need for lightweight vehicle designs to optimize energy consumption and enhance safety.

Dominant Markets & Segments in North American Lightweight Car Market

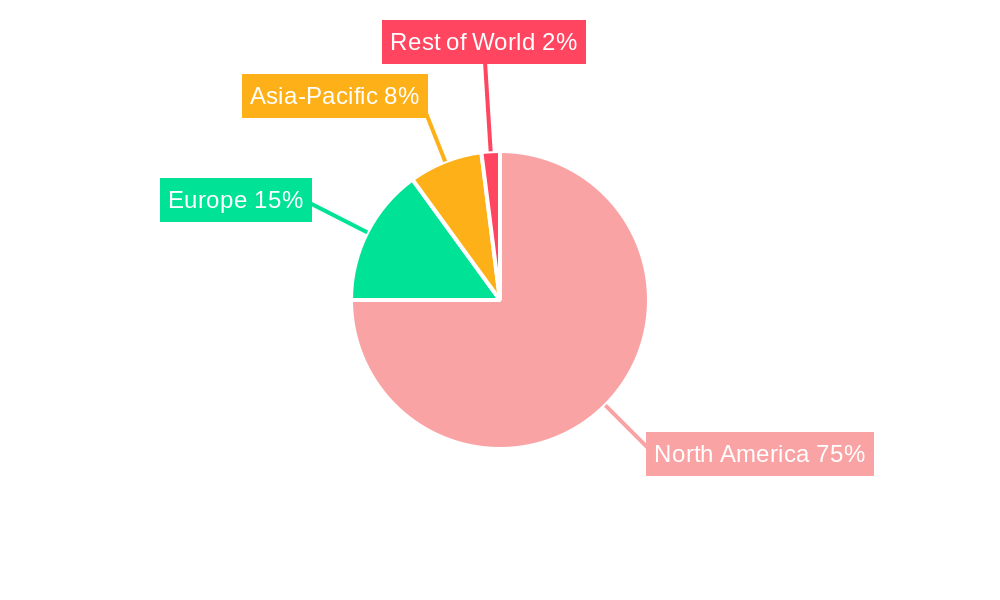

By Country: The United States holds the largest market share in North America, owing to its large automotive industry and high vehicle ownership rates. Canada follows, while the Rest of North America has a comparatively smaller market size. Key drivers for dominance in the US include a well-established automotive manufacturing base, supportive government policies, and a significant consumer demand for fuel-efficient vehicles. Canada benefits from a strong automotive sector and close ties with the US market, while the Rest of North America's market remains less developed due to relatively smaller economies and vehicle sales.

By Material Type: Metals (steel and aluminum alloys) currently hold the largest market share, despite facing pressure from increasing adoption of composites and plastics. The use of high-strength steels and aluminum alloys, however, is continuously increasing. Composites are showing strong growth, driven by their high strength-to-weight ratio and design flexibility. Plastics are increasingly utilized for interior and exterior components, offering cost-effectiveness and design freedom.

By Manufacturing Process: Stamping remains the most dominant manufacturing process, due to its suitability for mass production. Extrusion and casting are also prevalent, with forging catering to niche high-performance applications.

By Application: The powertrain segment holds a significant market share, driven by the need for lightweight components to improve fuel efficiency. Exterior and interior systems are also significant applications for lightweight materials. The Frame segment benefits from the adoption of lightweight materials to improve vehicle handling and fuel efficiency.

North American Lightweight Car Market Product Innovations

Recent advancements in lightweighting technologies focus on the development of high-strength, lightweight materials, such as advanced high-strength steel (AHSS), aluminum alloys, carbon fiber reinforced polymers (CFRP), and innovative manufacturing techniques like additive manufacturing and hydroforming. These innovations enhance fuel efficiency, improve vehicle performance, and reduce emissions. The market is also witnessing increasing integration of lightweight materials across various vehicle components, driving the adoption of multi-material designs to optimize weight reduction without compromising safety or performance. The development of lighter batteries for electric and hybrid vehicles is a significant area of focus, aiming to increase range and overall performance.

Report Segmentation & Scope

This report segments the North American lightweight car market across various dimensions:

By Material Type: The market is categorized into metals (steel, aluminum, and magnesium alloys), composites (carbon fiber, fiberglass, and others), plastics (polymers, thermoplastics), and others (elastomers and other materials). Growth projections for each segment are provided, along with an analysis of competitive dynamics and market size.

By Manufacturing Process: The report covers extrusion, stamping, forging, casting, and other processes, offering insights into their adoption rates, cost-effectiveness, and suitability for various lightweight materials. Market size and growth projections are provided for each segment.

By Application: The market is segmented into powertrain, exterior systems and components, interior systems and components, and frame. Growth projections, competitive landscapes, and market size for each segment are discussed.

By Country: The report analyzes the market in the United States, Canada, and the Rest of North America, presenting market size, growth prospects, and country-specific trends and challenges.

Key Drivers of North American Lightweight Car Market Growth

Several factors contribute to the market's growth: stringent fuel efficiency standards, the growing adoption of electric and hybrid vehicles (demanding lighter components for extended range), the increasing focus on reducing carbon emissions, and advancements in lightweight materials and manufacturing processes. The development of advanced high-strength steels, aluminum alloys, and composites provides lighter and stronger components while reducing manufacturing costs. Government incentives and regulations further support the adoption of lightweight vehicle technologies.

Challenges in the North American Lightweight Car Market Sector

The market faces challenges including the high cost of some advanced lightweight materials, potential supply chain disruptions, the complexity of designing and manufacturing multi-material vehicles, and the need for stringent quality control measures to meet safety standards. Furthermore, regulatory hurdles and the need for infrastructure development to support the manufacturing and recycling of certain lightweight materials pose constraints. Balancing cost-effectiveness with performance and safety remains a crucial challenge.

Leading Players in the North American Lightweight Car Market Market

- Mazda Motor Corporation

- Nissan Motor Co Ltd

- Toyota Motors Corporation

- General Motors

- Volkswagen AG

- Kia Motors Corporation

- Chevrolet

- Subaru

- Honda Motor Co Ltd

- Hyundai Motors

- Ford Motor Company

Key Developments in North American Lightweight Car Market Sector

August 2023: Clemson University's research team developed a 32% lighter vehicle door using carbon fiber and thermoplastic resin, meeting safety standards. This signifies progress in lightweight material applications.

March 2023: Lamborghini unveiled the LB744, a lightweight HPEV, highlighting the growing use of lightweight materials in high-performance vehicles.

September 2022: Atlis Motor Vehicles partnered with ArcelorMittal to accelerate lightweight product development using advanced steel solutions. This demonstrates collaborative efforts to optimize lightweighting strategies.

Strategic North American Lightweight Car Market Market Outlook

The North American lightweight car market presents significant growth opportunities, driven by sustained demand for fuel-efficient and environmentally friendly vehicles. Continuous innovation in lightweight materials and manufacturing technologies will further propel market expansion. Companies adopting strategic partnerships, investing in R&D, and focusing on cost-effective solutions will gain a competitive advantage. The market is poised for considerable growth, particularly in the adoption of composites and advanced manufacturing processes, shaping the future of automotive design and manufacturing.

North American Lightweight Car Market Segmentation

-

1. Material Type

- 1.1. Metals

- 1.2. Composites

- 1.3. Plastics

- 1.4. Others (Elastomer, etc.)

-

2. Manufacturing Process

- 2.1. Extrusion

- 2.2. Stamping

- 2.3. Forging

- 2.4. Casting

- 2.5. Others (Molding, etc.)

-

3. Application

- 3.1. Powertrain

- 3.2. Exterior Systems and Components

- 3.3. Interior Systems and Components

- 3.4. Frame

North American Lightweight Car Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Lightweight Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Enhancement in Advanced High-Strength Steels (AHSS) Technology to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Raw Material Hampers the Market Growth

- 3.4. Market Trends

- 3.4.1. Composite Material Segment to gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Lightweight Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Metals

- 5.1.2. Composites

- 5.1.3. Plastics

- 5.1.4. Others (Elastomer, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 5.2.1. Extrusion

- 5.2.2. Stamping

- 5.2.3. Forging

- 5.2.4. Casting

- 5.2.5. Others (Molding, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Powertrain

- 5.3.2. Exterior Systems and Components

- 5.3.3. Interior Systems and Components

- 5.3.4. Frame

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. United States North American Lightweight Car Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North American Lightweight Car Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North American Lightweight Car Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North American Lightweight Car Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Mazda Motor Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nissan Motor Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toyota Motors Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 General Motors

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Volkswagen AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kia Motors Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Chevrolet

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Subar

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Honda Motor Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hyundai Motors

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Ford Motor Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Mazda Motor Corporation

List of Figures

- Figure 1: North American Lightweight Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North American Lightweight Car Market Share (%) by Company 2024

List of Tables

- Table 1: North American Lightweight Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North American Lightweight Car Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: North American Lightweight Car Market Revenue Million Forecast, by Manufacturing Process 2019 & 2032

- Table 4: North American Lightweight Car Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: North American Lightweight Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North American Lightweight Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North American Lightweight Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North American Lightweight Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North American Lightweight Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North American Lightweight Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North American Lightweight Car Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 12: North American Lightweight Car Market Revenue Million Forecast, by Manufacturing Process 2019 & 2032

- Table 13: North American Lightweight Car Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: North American Lightweight Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North American Lightweight Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North American Lightweight Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North American Lightweight Car Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Lightweight Car Market?

The projected CAGR is approximately 10.27%.

2. Which companies are prominent players in the North American Lightweight Car Market?

Key companies in the market include Mazda Motor Corporation, Nissan Motor Co Ltd, Toyota Motors Corporation, General Motors, Volkswagen AG, Kia Motors Corporation, Chevrolet, Subar, Honda Motor Co Ltd, Hyundai Motors, Ford Motor Company.

3. What are the main segments of the North American Lightweight Car Market?

The market segments include Material Type, Manufacturing Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Enhancement in Advanced High-Strength Steels (AHSS) Technology to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Composite Material Segment to gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Raw Material Hampers the Market Growth.

8. Can you provide examples of recent developments in the market?

In August 2023, a team of researchers led by Clemson University created a lightweight vehicle door that increases fuel efficiency while meeting federal safety regulations using carbon fiber, thermoplastic resin, and cutting-edge computer design techniques. The research team reduced the weight of a steel door by 32% before exposing it to a battery of tests to ensure it fulfilled FMVSS and Honda's safety guidelines, another project partner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Lightweight Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Lightweight Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Lightweight Car Market?

To stay informed about further developments, trends, and reports in the North American Lightweight Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence