Key Insights

The North America Swine Feed Market is projected for robust expansion, anticipated to reach $112.86 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033. Growth drivers include rising global pork demand, advancements in animal nutrition for efficient and healthy feed formulations, and a growing emphasis on animal welfare and sustainable livestock practices. The market is witnessing a trend towards specialized feeds for optimal growth, improved feed conversion, and enhanced herd health. Demand for supplements such as amino acids, enzymes, and probiotics is surging, crucial for gut health and nutrient absorption, leading to more productive and profitable farming. Strategic focus on preventative health via optimized nutrition also significantly boosts market growth, reducing antibiotic reliance.

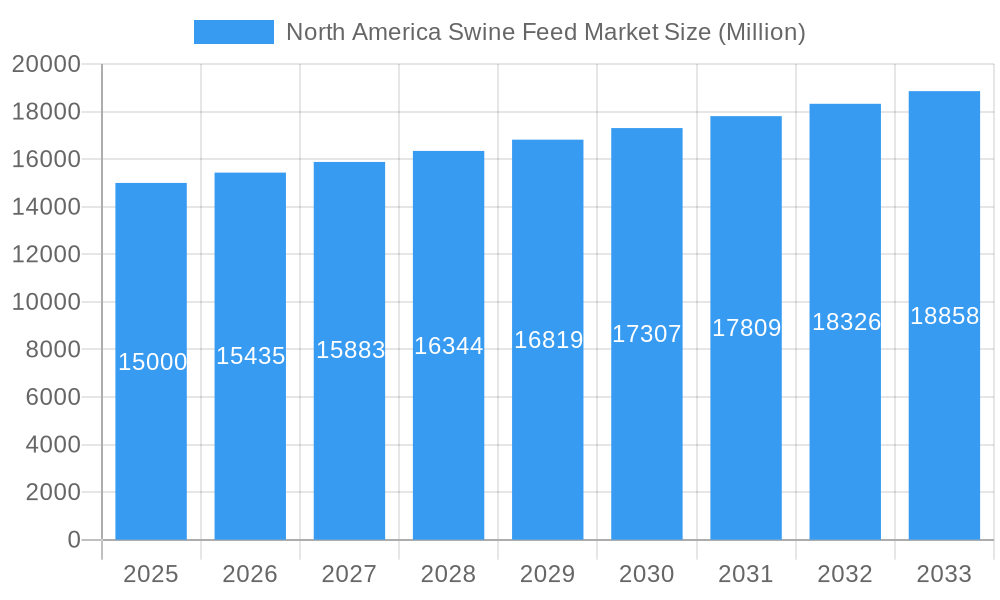

North America Swine Feed Market Market Size (In Billion)

Market restraints include raw material price volatility for corn and soybean meal, impacting manufacturer margins. Stringent environmental regulations on manure management and greenhouse gas emissions necessitate investments in sustainable feed solutions. The United States leads the North American market due to its substantial swine population and advanced agricultural practices. Key segments include Cereals and Oilseed Meals, holding the largest share, and Supplement Types, with strong demand for Vitamins, Amino Acids, and Enzymes. Leading players like Cargill Incorporated, Alltech, and ADM Animal Nutrition are actively innovating feed technologies and expanding market presence, shaping the competitive landscape. The North America Swine Feed Market outlook remains positive, driven by the ongoing need for efficient pork production and evolving consumer preferences for sustainably sourced animal protein.

North America Swine Feed Market Company Market Share

This comprehensive market research report provides a strategic analysis of the North America swine feed sector. Covering the historical period 2019-2024, with a base year of 2025 and a forecast period extending to 2033, the report examines market structure, industry trends, dominant segments, product innovations, key drivers, challenges, leading players, and future outlook. Actionable insights are offered for stakeholders navigating this dynamic sector. With an estimated market size in the billions of USD and a significant CAGR, this report is vital for understanding the evolution of swine nutrition, animal feed additives, and livestock farming across the United States, Canada, and Mexico.

North America Swine Feed Market Market Structure & Competitive Dynamics

The North America swine feed market exhibits a moderately concentrated structure, with a mix of large multinational corporations and regional players vying for market share. Key competitive dynamics are shaped by innovation in feed formulations, the integration of advanced animal health solutions, and strategic mergers and acquisitions (M&A). The market is characterized by a robust innovation ecosystem driven by advancements in feed efficiency, gut health, and sustainable feed ingredients. Regulatory frameworks, particularly concerning animal welfare, feed safety, and the use of antibiotics in animal feed, play a crucial role in shaping market entry and product development. Product substitutes, while present, often involve compromises in terms of efficacy or cost-effectiveness, maintaining strong demand for specialized swine feed. End-user trends highlight a growing demand for performance-enhancing feeds, disease prevention strategies, and traceable feed ingredients. M&A activities, such as strategic acquisitions of smaller animal nutrition companies or technology providers, are common strategies employed by major players to expand their product portfolios and geographic reach. For instance, significant M&A deals, valued in the hundreds of millions of USD, have been observed, indicating consolidation and a drive for market dominance.

- Market Concentration: Moderate, with a few dominant players and several emerging competitors.

- Innovation Ecosystem: Strong, fueled by R&D in feed additives, nutritional supplements, and precision feeding.

- Regulatory Frameworks: Strict regulations on feed safety, ingredient sourcing, and antibiotic usage.

- Product Substitutes: Limited in terms of comprehensive nutritional and health benefits, but alternative feed ingredients are explored.

- End-User Trends: Increasing demand for high-quality swine feed, sustainable feed options, and disease management solutions.

- M&A Activities: Strategic acquisitions and partnerships aimed at market expansion and technology integration.

North America Swine Feed Market Industry Trends & Insights

The North America swine feed market is experiencing robust growth, projected to reach substantial market value by 2033, driven by a confluence of factors including a rising global demand for pork products, coupled with advancements in swine farming techniques. The estimated market size in 2025 is expected to be in the billions of USD, with a projected CAGR of xx% during the forecast period. Technological disruptions are significantly reshaping the industry, with the adoption of precision feeding systems, AI-driven feed optimization, and novel feed ingredients like insect protein and algae playing an increasingly important role. These innovations aim to enhance feed conversion ratios (FCR), reduce environmental impact, and improve overall herd health. Consumer preferences are also evolving, with a growing emphasis on ethically raised pork and a demand for transparency in the animal feed supply chain. This is pushing producers to adopt more sustainable and welfare-friendly practices, which in turn influences the types of swine feed formulations being developed. Competitive dynamics are intensifying, with companies focusing on developing specialized feed solutions tailored to different life stages of swine, from piglets to finishing hogs. The market penetration of specialized feed supplements for gut health, immune support, and growth promotion is steadily increasing. The ongoing research into the microbiome of swine is leading to the development of advanced probiotics and prebiotics as key components in swine feed formulations, aiming to reduce reliance on antibiotics and improve disease resistance. Furthermore, the demand for cost-effective and nutrient-dense feed ingredients, such as cereal by-products and oilseed meals, remains high, driven by the need to optimize production costs for pork producers. The integration of digital technologies for feed management and traceability is also a growing trend, enabling better inventory control and ensuring compliance with food safety regulations. The market is also witnessing a paradigm shift towards reducing the environmental footprint of swine production, leading to increased interest in sustainable feed sourcing and waste reduction technologies within the feed industry.

Dominant Markets & Segments in North America Swine Feed Market

The United States stands as the dominant market within the North America swine feed market, owing to its extensive pork production infrastructure, significant swine population, and advanced agricultural practices. In 2025, the US is estimated to contribute the largest share of the market value, driven by strong domestic consumption and export demand for pork products. Within the feed Type segmentation, Cereals and Cereal By-products collectively represent the largest segment, forming the foundational components of most swine feed formulations. Their widespread availability and cost-effectiveness make them indispensable. However, the Supplements segment, particularly Amino Acids, Vitamins, and Enzymes, is witnessing the fastest growth due to increasing awareness of the impact of specific nutrients on swine growth, health, and feed efficiency.

In terms of Supplement Type, Amino Acids are crucial for optimizing protein utilization and reducing nitrogen excretion, a key area of focus for sustainable swine farming. The demand for Vitamins is also substantial, as they are essential for various metabolic functions and disease prevention. Enzymes are gaining traction for their ability to improve the digestibility of complex carbohydrates and other nutrients, leading to better feed conversion. The Geography segmentation clearly illustrates the dominance of the United States, followed by Mexico and Canada. Mexico's growing swine herd and increasing demand for pork present a significant growth opportunity. Canada also plays a vital role, with its established swine industry and focus on technological advancements in feed. The "Rest of North America" segment, though smaller, represents potential for niche market development and specialized feed solutions. Key drivers for the dominance of the United States include favorable economic policies supporting agriculture, robust research and development in animal nutrition, and well-developed infrastructure for feed production and distribution. The increasing adoption of precision feeding technologies and advanced animal health management practices further solidifies its leading position. The growth in feed efficiency and the demand for specialty swine feed are also contributing factors.

- Dominant Region: United States

- Key Drivers: Large swine population, high pork consumption, advanced agricultural technology, strong R&D investment in animal nutrition.

- Market Share Contribution: Estimated to be over xx% of the North America market in 2025.

- Dominant Feed Type: Cereals and Cereal By-products

- Key Drivers: Cost-effectiveness, widespread availability, fundamental energy and nutrient source for swine.

- Market Share: Projected to exceed xx% of the total feed volume.

- Fastest Growing Feed Supplement Type: Amino Acids

- Key Drivers: Optimization of protein synthesis, reduction of nitrogen waste, enhanced growth performance, increased reliance on synthetic amino acids.

- Market Share Growth: Expected to grow at a CAGR of xx% during the forecast period.

- Dominant Supplement Type: Vitamins and Enzymes

- Key Drivers: Essential for metabolic functions, immune support, improved nutrient digestibility, and reducing the need for antibiotics.

- Market Penetration: High penetration in commercial swine operations.

- Geographical Dominance Breakdown:

- United States: Leading market due to scale and technology.

- Mexico: Significant growth potential driven by expanding swine production.

- Canada: Established industry with a focus on quality and efficiency.

North America Swine Feed Market Product Innovations

The North America swine feed market is characterized by continuous product innovation aimed at enhancing swine health, improving growth performance, and promoting sustainability. Recent developments include the introduction of novel feed additives that support gut health, such as specialized probiotics and prebiotics and targeted acidifiers to manage gut pH. Innovations in amino acid formulations are leading to more precise nutrient profiles, minimizing waste and optimizing protein utilization. The development of enzymes that improve the digestibility of non-starch polysaccharides and phytate is enhancing nutrient absorption and reducing anti-nutritional factors. Furthermore, there is a growing focus on natural antioxidants to combat oxidative stress and improve the shelf-life of feed. Companies are also investing in research for alternative protein sources and the optimization of existing feed ingredients to reduce the environmental footprint of swine farming. These innovations not only provide competitive advantages but also address evolving consumer demands for responsibly produced pork.

Report Segmentation & Scope

This comprehensive report segments the North America swine feed market by Type, including Cereals, Cereal By-products, Oilseed Meals, Molasses, Supplements, and Others. The Supplements segment is further broken down into Vitamins, Amino Acids, Antibiotics, Enzymes, Anti-oxidants, Acidifiers, Probiotics & Prebiotics, and Others. Geographically, the market is analyzed across the United States, Canada, Mexico, and the Rest of North America. The scope includes detailed analysis of market sizes, growth projections, and competitive dynamics within each segment, providing a granular view of the market landscape. The United States segment is expected to hold the largest market share due to its extensive swine industry, while Amino Acids and Probiotics & Prebiotics are anticipated to exhibit the highest growth rates within the supplements category.

- Type Segmentation: Includes major feed components like Cereals and Cereal By-products, as well as value-added Supplements.

- Supplement Type Segmentation: Covers critical additives like Vitamins, Amino Acids, Enzymes, and Probiotics & Prebiotics, crucial for optimizing swine health and performance.

- Geographical Segmentation: Provides regional insights into the United States, Canada, Mexico, and the Rest of North America, highlighting market variations and opportunities.

Key Drivers of North America Swine Feed Market Growth

Several key drivers are propelling the growth of the North America swine feed market. Firstly, the increasing global demand for pork products, driven by population growth and rising disposable incomes, directly fuels the need for more efficient swine production, necessitating advanced swine feed solutions. Secondly, advancements in animal nutrition science and feed technology are leading to the development of more specialized and effective feed formulations that improve feed conversion ratios (FCR) and overall animal health. Thirdly, growing concerns about food safety and the desire to reduce antibiotic use in animal agriculture are driving the adoption of feed additives such as probiotics, prebiotics, and natural immune enhancers. Finally, government initiatives and industry-led programs promoting sustainable agriculture and improved animal welfare are encouraging the use of innovative swine feed that minimizes environmental impact and enhances animal well-being.

Challenges in the North America Swine Feed Market Sector

Despite robust growth, the North America swine feed market faces several challenges. Fluctuations in the prices of key feed ingredients, such as corn and soybeans, due to weather patterns, geopolitical events, and global demand, can significantly impact production costs and profitability. Stringent regulatory requirements concerning feed safety, ingredient sourcing, and the permissible use of antibiotics and additives can create compliance burdens and necessitate significant investment in R&D and quality control. The increasing consumer scrutiny on animal welfare and the demand for sustainable feed practices require continuous adaptation and innovation from feed manufacturers, which can be resource-intensive. Furthermore, the presence of established players and the need for significant capital investment to scale production can pose barriers to entry for new companies, intensifying competitive pressures within the market. Supply chain disruptions, whether due to transportation issues, trade disputes, or unforeseen events like pandemics, can also pose significant challenges to the consistent availability of essential feed ingredients and finished products.

Leading Players in the North America Swine Feed Market Market

- Cargill Incorporated

- Alltech

- Provimi North America Inc

- Kent Nutrition Group

- Land O Lakes Inc

- GVF Group of Companies

- United Animal Health

- ADM Animal Nutrition

- Lallemand Inc

Key Developments in North America Swine Feed Market Sector

- 2023/09: Launch of a new line of enzyme-enhanced swine feed by Provimi North America Inc, designed to improve nutrient digestibility and reduce feed costs.

- 2023/05: Alltech announces significant investment in R&D for sustainable insect-based protein as a novel swine feed ingredient.

- 2022/11: Cargill Incorporated expands its animal nutrition portfolio with the acquisition of a leading swine feed additive manufacturer.

- 2022/07: Kent Nutrition Group introduces a new probiotic and prebiotic blend for piglet starter feeds to enhance gut health and immunity.

- 2021/04: ADM Animal Nutrition forms a strategic partnership to develop digitally-enabled precision feeding solutions for the swine industry.

Strategic North America Swine Feed Market Market Outlook

The North America swine feed market presents a strategic outlook characterized by continued growth and innovation. The increasing demand for high-quality, safe, and sustainably produced pork will drive the adoption of advanced swine nutrition solutions. Key growth accelerators include the ongoing development of feed additives that enhance gut health, immune function, and feed efficiency, alongside the exploration of novel and sustainable feed ingredients. Precision feeding technologies and digital integration in feed management will further optimize production and reduce resource utilization. Strategic opportunities lie in catering to the rising demand for antibiotic-free swine feed, developing specialized formulations for emerging markets within North America, and investing in research and development to address evolving regulatory landscapes and consumer preferences. Companies that focus on delivering value through enhanced animal performance, improved sustainability, and transparent supply chains are poised for significant success in this evolving market.

North America Swine Feed Market Segmentation

-

1. Type

- 1.1. Cereals

- 1.2. Cereal By-products

- 1.3. Oilseed Meals

- 1.4. Molasses

- 1.5. Supplements

- 1.6. Others

-

2. Supplement Type

- 2.1. Vitamins

- 2.2. Amino Acids

- 2.3. Antibiotics

- 2.4. Enzymes

- 2.5. Anti-oxidants

- 2.6. Acidifiers

- 2.7. Probiotics & Prebiotics

- 2.8. Others

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Swine Feed Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Swine Feed Market Regional Market Share

Geographic Coverage of North America Swine Feed Market

North America Swine Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Pork Meat

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cereals

- 5.1.2. Cereal By-products

- 5.1.3. Oilseed Meals

- 5.1.4. Molasses

- 5.1.5. Supplements

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Supplement Type

- 5.2.1. Vitamins

- 5.2.2. Amino Acids

- 5.2.3. Antibiotics

- 5.2.4. Enzymes

- 5.2.5. Anti-oxidants

- 5.2.6. Acidifiers

- 5.2.7. Probiotics & Prebiotics

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cereals

- 6.1.2. Cereal By-products

- 6.1.3. Oilseed Meals

- 6.1.4. Molasses

- 6.1.5. Supplements

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Supplement Type

- 6.2.1. Vitamins

- 6.2.2. Amino Acids

- 6.2.3. Antibiotics

- 6.2.4. Enzymes

- 6.2.5. Anti-oxidants

- 6.2.6. Acidifiers

- 6.2.7. Probiotics & Prebiotics

- 6.2.8. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cereals

- 7.1.2. Cereal By-products

- 7.1.3. Oilseed Meals

- 7.1.4. Molasses

- 7.1.5. Supplements

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Supplement Type

- 7.2.1. Vitamins

- 7.2.2. Amino Acids

- 7.2.3. Antibiotics

- 7.2.4. Enzymes

- 7.2.5. Anti-oxidants

- 7.2.6. Acidifiers

- 7.2.7. Probiotics & Prebiotics

- 7.2.8. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cereals

- 8.1.2. Cereal By-products

- 8.1.3. Oilseed Meals

- 8.1.4. Molasses

- 8.1.5. Supplements

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Supplement Type

- 8.2.1. Vitamins

- 8.2.2. Amino Acids

- 8.2.3. Antibiotics

- 8.2.4. Enzymes

- 8.2.5. Anti-oxidants

- 8.2.6. Acidifiers

- 8.2.7. Probiotics & Prebiotics

- 8.2.8. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cereals

- 9.1.2. Cereal By-products

- 9.1.3. Oilseed Meals

- 9.1.4. Molasses

- 9.1.5. Supplements

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Supplement Type

- 9.2.1. Vitamins

- 9.2.2. Amino Acids

- 9.2.3. Antibiotics

- 9.2.4. Enzymes

- 9.2.5. Anti-oxidants

- 9.2.6. Acidifiers

- 9.2.7. Probiotics & Prebiotics

- 9.2.8. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Cargill Incorporated

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alltech

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Provimi North America Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kent Nutrition Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Land O Lakes Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GVF Group of Companies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 United Animal Healt

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ADM Animal Nutrition

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Lallemand Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Cargill Incorporated

List of Figures

- Figure 1: North America Swine Feed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Swine Feed Market Share (%) by Company 2025

List of Tables

- Table 1: North America Swine Feed Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 3: North America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Swine Feed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Swine Feed Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 7: North America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Swine Feed Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 11: North America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Swine Feed Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 15: North America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Swine Feed Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 19: North America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Swine Feed Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Swine Feed Market?

Key companies in the market include Cargill Incorporated, Alltech, Provimi North America Inc, Kent Nutrition Group, Land O Lakes Inc, GVF Group of Companies, United Animal Healt, ADM Animal Nutrition, Lallemand Inc.

3. What are the main segments of the North America Swine Feed Market?

The market segments include Type, Supplement Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 112.86 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Growing Demand for Pork Meat.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Swine Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Swine Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Swine Feed Market?

To stay informed about further developments, trends, and reports in the North America Swine Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence