Key Insights

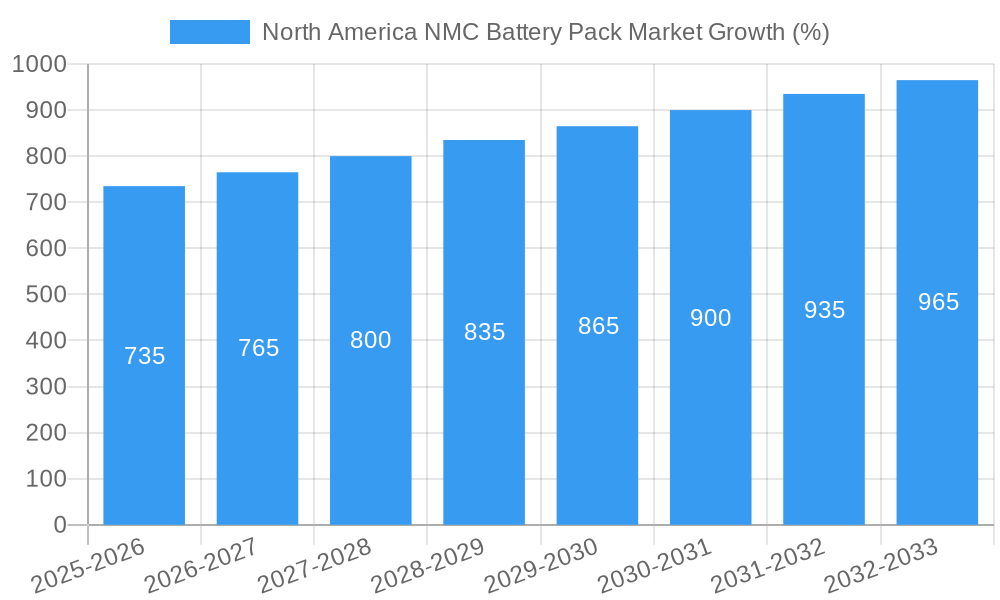

The North American NMC (Nickel Manganese Cobalt) battery pack market is experiencing robust growth, driven by the burgeoning electric vehicle (EV) sector and increasing demand for energy storage solutions. With a current CAGR of 4.90%, the market, valued at (estimated) $XX million in 2025, is projected to reach a substantial size by 2033. Several factors contribute to this expansion. The significant investments in EV infrastructure, supportive government policies promoting EV adoption, and the growing awareness of environmental concerns are key drivers. Furthermore, advancements in battery technology, leading to increased energy density, longer lifespan, and improved safety features, are fueling market demand. Segment-wise, the high-capacity battery packs (above 80 kWh) are witnessing the fastest growth, largely due to their increasing adoption in larger vehicles like buses and M&HDTs (medium and heavy-duty trucks). The cylindrical and prismatic battery form factors dominate the market, reflecting established manufacturing processes and suitability for various vehicle applications. The prevalent material composition involves a mix of Nickel, Manganese, and Cobalt, although there is a growing trend towards exploring alternative materials to mitigate reliance on cobalt due to its ethical and cost considerations. Key players like LG Energy Solution, CATL, and Samsung SDI are aggressively expanding their manufacturing capacities to meet the rising demand. However, challenges remain, such as supply chain constraints for critical raw materials and the need for efficient battery recycling infrastructure to address sustainability concerns.

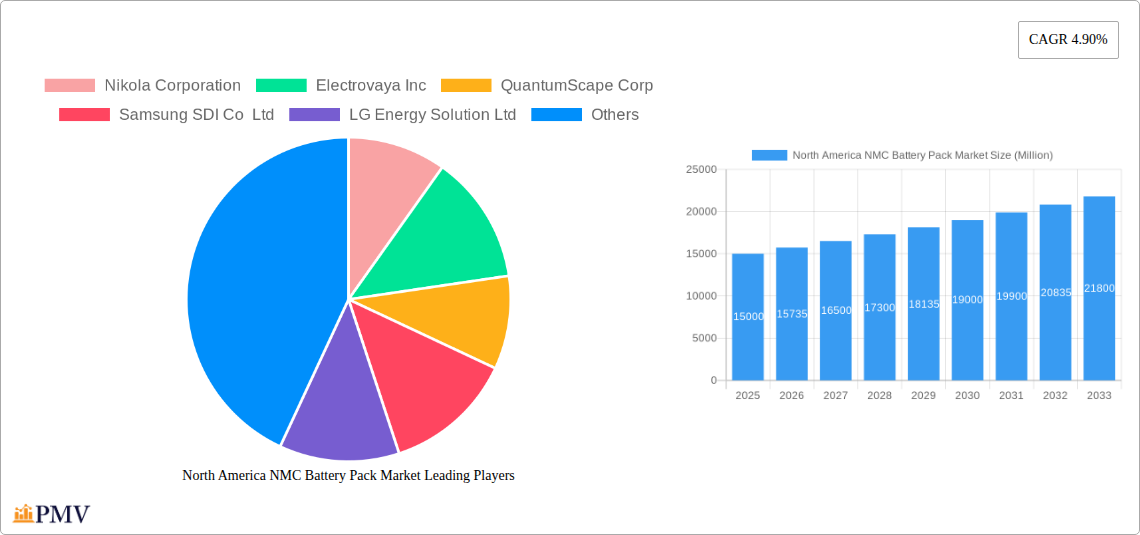

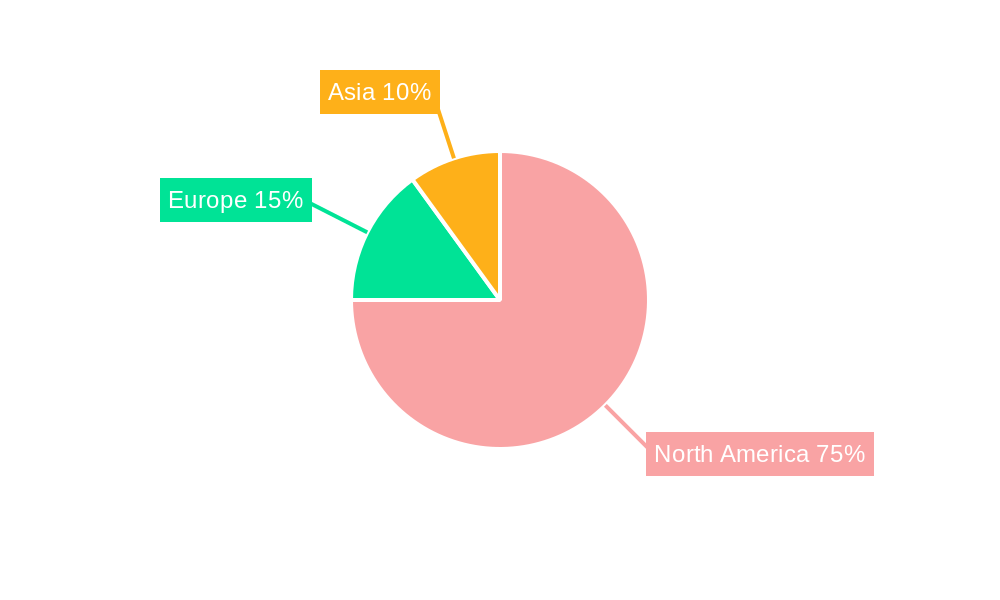

The competitive landscape is highly dynamic, with established players alongside emerging companies vying for market share. Regional analysis shows that the United States and Canada are the primary markets within North America, fueled by the significant growth of the EV industry in these countries. Mexico, while showing promising potential, represents a smaller portion of the market currently. Future growth is expected to be influenced by the continued development of charging infrastructure, advancements in fast-charging technology, and the increasing affordability of EVs. The focus on reducing battery costs through improved manufacturing processes and alternative material usage will be crucial for further market penetration and sustainable growth in the long term. The forecast period, 2025-2033, promises significant expansion, underpinned by the continuous technological innovation and policy support within the North American automotive landscape.

North America NMC Battery Pack Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America NMC (Nickel Manganese Cobalt) battery pack market, offering invaluable insights for stakeholders across the EV and energy storage sectors. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The study period (2019-2024) historical data provides a robust foundation for accurate forecasting.

North America NMC Battery Pack Market Market Structure & Competitive Dynamics

The North American NMC battery pack market exhibits a moderately concentrated structure, with key players like LG Energy Solution Ltd, Samsung SDI Co Ltd, and CATL holding significant market share. However, the landscape is dynamic, driven by continuous innovation and strategic mergers and acquisitions (M&A). The estimated market size in 2025 is xx Million, with a projected CAGR of xx% during the forecast period. Innovation ecosystems are flourishing, particularly in research and development of next-generation battery chemistries and manufacturing processes. Regulatory frameworks, including incentives for EV adoption and stricter emission standards, are major catalysts. The market faces competition from alternative battery technologies like LFP (Lithium Iron Phosphate), but NMC's superior energy density maintains its dominance in high-performance applications. End-user trends favor higher energy density and longer lifespan batteries, boosting demand for advanced NMC pack configurations. M&A activity has been significant, with deals totaling an estimated xx Million in the past five years, aimed at securing supply chains, expanding technological capabilities, and accessing new markets.

- Market Concentration: Moderately concentrated, with top 3 players holding xx% market share in 2025.

- M&A Activity: Significant; xx Million in deal value over the past 5 years.

- Regulatory Landscape: Favorable, with government incentives promoting EV adoption.

- Key Competitors: LG Energy Solution Ltd, Samsung SDI Co Ltd, CATL, A123 Systems LLC, and others.

North America NMC Battery Pack Market Industry Trends & Insights

The North American NMC battery pack market is experiencing robust growth, driven by the burgeoning electric vehicle (EV) sector and increasing demand for energy storage solutions. The market's CAGR from 2025 to 2033 is projected at xx%, propelled by stringent emission regulations, rising fuel prices, and growing environmental consciousness. Technological advancements, such as improved battery chemistries with enhanced energy density and faster charging capabilities, are further fueling market expansion. Consumer preferences are shifting towards longer driving ranges and faster charging times, stimulating demand for high-performance NMC battery packs. Competitive dynamics are intense, with manufacturers focusing on cost reduction, improved performance, and enhanced safety features to gain a competitive edge. Market penetration of NMC battery packs in EVs is expected to reach xx% by 2033, driven by their superior energy density compared to other battery chemistries. However, challenges remain, including supply chain disruptions and the fluctuating prices of raw materials like cobalt, nickel, and manganese. Government initiatives supporting domestic battery production are attempting to mitigate these concerns.

Dominant Markets & Segments in North America NMC Battery Pack Market

The US dominates the North American NMC battery pack market, driven by a larger EV market and substantial government investment in clean energy initiatives. Within segments:

- Capacity: The 40 kWh to 80 kWh capacity segment holds the largest market share, driven by the high demand for passenger cars and light commercial vehicles (LCVs).

- Battery Form: Prismatic cells dominate due to their high energy density and suitability for various pack designs.

- Method: Wire bonding remains the dominant connection method due to its established technology and cost-effectiveness.

- Component: Cathode material research and development are crucial; new cathode materials are driving innovation.

- Material Type: Nickel and Cobalt are key materials driving performance, while the industry explores methods to reduce reliance on cobalt for ethical and supply chain reasons.

- Country: The US significantly outpaces Canada due to a larger automotive market and more established EV infrastructure.

- Body Type: Passenger cars constitute the largest segment, followed by LCVs.

- Propulsion Type: Battery Electric Vehicles (BEVs) dominate the market due to their growing popularity and range capabilities.

Key Drivers:

- Stringent emission regulations: Encouraging EV adoption.

- Government incentives: Supporting EV purchases and battery production.

- Growing environmental awareness: Driving demand for sustainable transportation.

- Technological advancements: Improving battery performance and longevity.

North America NMC Battery Pack Market Product Innovations

Recent product innovations focus on improving energy density, fast charging capabilities, and thermal management. Manufacturers are exploring solid-state battery technologies and advanced cathode materials to enhance battery performance and address safety concerns. These innovations cater to growing demand for higher-performance EVs and energy storage systems, improving market fit and offering competitive advantages. The development of improved battery management systems (BMS) also plays a crucial role in optimizing battery performance and lifespan.

Report Segmentation & Scope

This report segments the North America NMC battery pack market by capacity (Less than 15 kWh, 15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh), battery form (Cylindrical, Pouch, Prismatic), connection method (Laser, Wire), component (Anode, Cathode, Electrolyte, Separator), material type (Cobalt, Lithium, Manganese, Natural Graphite, Nickel, Other Materials), country (US, Canada), body type (Passenger Car, Bus, LCV, M&HDT), and propulsion type (BEV, PHEV). Each segment's growth projections, market size, and competitive dynamics are analyzed, providing a holistic understanding of the market. Growth projections are provided for each segment based on market trends and technological advancements.

Key Drivers of North America NMC Battery Pack Market Growth

The North American NMC battery pack market's growth is fueled by several factors: the increasing demand for electric vehicles due to stringent emission norms and growing environmental awareness; substantial government investments in clean energy initiatives, offering tax credits and subsidies; rapid technological advancements leading to enhanced battery performance, longer lifespan, and faster charging times; and the expanding energy storage systems market, driven by the need for grid stabilization and renewable energy integration.

Challenges in the North America NMC Battery Pack Market Sector

The market faces challenges including the volatility of raw material prices, particularly cobalt and lithium, impacting production costs and profitability. Supply chain disruptions and geopolitical uncertainties pose risks to the consistent supply of essential materials. Competition from alternative battery technologies, such as LFP batteries, is intensifying, putting pressure on pricing and market share. Addressing these challenges requires robust supply chain management, diversification of raw material sources, and technological innovation to improve cost-effectiveness and sustainability.

Leading Players in the North America NMC Battery Pack Market Market

- Nikola Corporation

- Electrovaya Inc

- QuantumScape Corp

- Samsung SDI Co Ltd

- LG Energy Solution Ltd

- A123 Systems LLC

- Farasis Energy (Ganzhou) Co Ltd

- American Battery Solutions Inc

- Contemporary Amperex Technology Co Ltd (CATL)

- Clarios International Inc

- Envision AESC Japan Co Ltd

- ACDELCO (Subsidiary Of General Motors)

Key Developments in North America NMC Battery Pack Market Sector

- Q4 2022: LG Energy Solution announced a significant expansion of its battery production capacity in the US.

- Q1 2023: Samsung SDI launched a new generation of high-energy-density NMC battery cells.

- Q2 2023: Several companies announced new partnerships to secure critical raw materials for battery production. (Further developments to be added)

Strategic North America NMC Battery Pack Market Market Outlook

The North America NMC battery pack market presents significant growth opportunities. Continued investment in EV infrastructure, coupled with advancements in battery technology and supportive government policies, will drive market expansion. Strategic partnerships, focusing on securing raw materials and expanding production capacity, will be crucial for success. Companies focusing on innovation in battery chemistries, improved thermal management, and cost reduction will gain a significant competitive advantage. The market's future is bright, with substantial growth potential driven by the global shift towards electric mobility and sustainable energy solutions.

North America NMC Battery Pack Market Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

- 1.4. Passenger Car

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Capacity

- 3.1. 15 kWh to 40 kWh

- 3.2. 40 kWh to 80 kWh

- 3.3. Above 80 kWh

- 3.4. Less than 15 kWh

-

4. Battery Form

- 4.1. Cylindrical

- 4.2. Pouch

- 4.3. Prismatic

-

5. Method

- 5.1. Laser

- 5.2. Wire

-

6. Component

- 6.1. Anode

- 6.2. Cathode

- 6.3. Electrolyte

- 6.4. Separator

-

7. Material Type

- 7.1. Cobalt

- 7.2. Lithium

- 7.3. Manganese

- 7.4. Natural Graphite

- 7.5. Nickel

- 7.6. Other Materials

North America NMC Battery Pack Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America NMC Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise of Trade Agreements Between Nations; Increasing Volume of International Trade

- 3.3. Market Restrains

- 3.3.1. Surge in Fuel Costs Affecting the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America NMC Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.1.4. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. 15 kWh to 40 kWh

- 5.3.2. 40 kWh to 80 kWh

- 5.3.3. Above 80 kWh

- 5.3.4. Less than 15 kWh

- 5.4. Market Analysis, Insights and Forecast - by Battery Form

- 5.4.1. Cylindrical

- 5.4.2. Pouch

- 5.4.3. Prismatic

- 5.5. Market Analysis, Insights and Forecast - by Method

- 5.5.1. Laser

- 5.5.2. Wire

- 5.6. Market Analysis, Insights and Forecast - by Component

- 5.6.1. Anode

- 5.6.2. Cathode

- 5.6.3. Electrolyte

- 5.6.4. Separator

- 5.7. Market Analysis, Insights and Forecast - by Material Type

- 5.7.1. Cobalt

- 5.7.2. Lithium

- 5.7.3. Manganese

- 5.7.4. Natural Graphite

- 5.7.5. Nickel

- 5.7.6. Other Materials

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. United States North America NMC Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America NMC Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America NMC Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America NMC Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nikola Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Electrovaya Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 QuantumScape Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samsung SDI Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 LG Energy Solution Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 A123 Systems LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Farasis Energy (Ganzhou) Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 American Battery Solutions Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Contemporary Amperex Technology Co Ltd (CATL)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Clarios International Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Envision AESC Japan Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 ACDELCO (Subsidiary Of General Motors)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Nikola Corporation

List of Figures

- Figure 1: North America NMC Battery Pack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America NMC Battery Pack Market Share (%) by Company 2024

List of Tables

- Table 1: North America NMC Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America NMC Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 3: North America NMC Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: North America NMC Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 5: North America NMC Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 6: North America NMC Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 7: North America NMC Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 8: North America NMC Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 9: North America NMC Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America NMC Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States North America NMC Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America NMC Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America NMC Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of North America North America NMC Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: North America NMC Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 16: North America NMC Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 17: North America NMC Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 18: North America NMC Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 19: North America NMC Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 20: North America NMC Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 21: North America NMC Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 22: North America NMC Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United States North America NMC Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Canada North America NMC Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Mexico North America NMC Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America NMC Battery Pack Market?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the North America NMC Battery Pack Market?

Key companies in the market include Nikola Corporation, Electrovaya Inc, QuantumScape Corp, Samsung SDI Co Ltd, LG Energy Solution Ltd, A123 Systems LLC, Farasis Energy (Ganzhou) Co Ltd, American Battery Solutions Inc, Contemporary Amperex Technology Co Ltd (CATL), Clarios International Inc, Envision AESC Japan Co Ltd, ACDELCO (Subsidiary Of General Motors).

3. What are the main segments of the North America NMC Battery Pack Market?

The market segments include Body Type, Propulsion Type, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise of Trade Agreements Between Nations; Increasing Volume of International Trade.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Surge in Fuel Costs Affecting the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America NMC Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America NMC Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America NMC Battery Pack Market?

To stay informed about further developments, trends, and reports in the North America NMC Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence