Key Insights

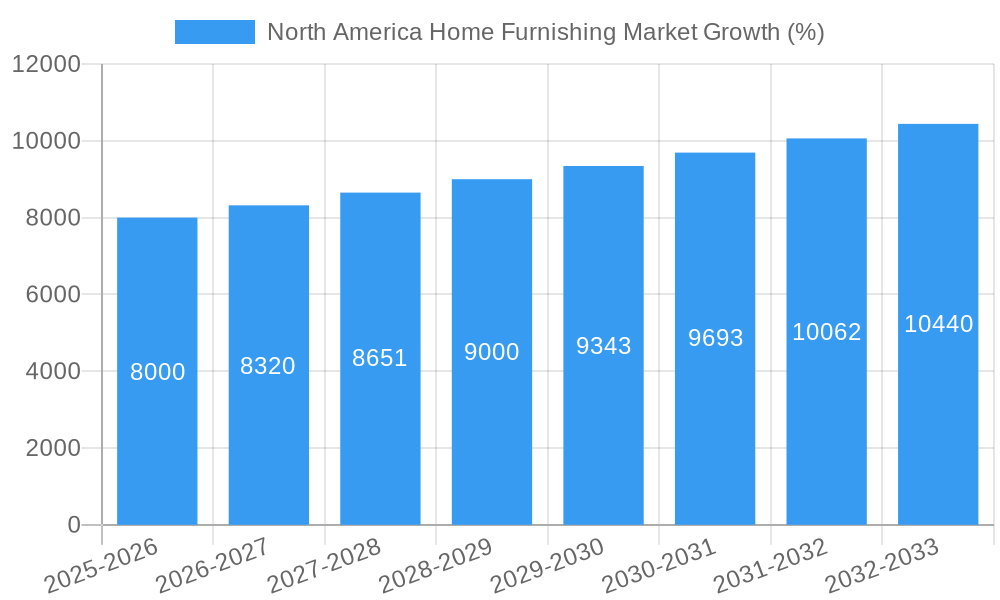

The North American home furnishing market, currently exhibiting robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes, particularly amongst millennials and Gen Z, are leading to increased spending on home improvement and furnishing. The burgeoning trend of homeownership, coupled with a preference for personalized and aesthetically pleasing living spaces, further stimulates demand. E-commerce penetration continues to grow, offering consumers wider selection and convenience, while simultaneously increasing competition amongst established and emerging brands. Market segmentation reveals strong performance across various furniture categories, with living room and bedroom furniture consistently holding significant market shares. While wood remains a popular material choice, the market also witnesses growing adoption of sustainable and eco-friendly alternatives, reflecting consumer awareness of environmental concerns. The increasing popularity of multifunctional furniture and smart home integration is another prominent trend shaping the market landscape. However, challenges remain. Supply chain disruptions, fluctuations in raw material prices, and increasing labor costs pose potential constraints on market growth.

Despite these restraints, the North American home furnishing market’s trajectory remains positive. The continued focus on home improvement and the incorporation of design trends into home decor will likely support sustained growth over the forecast period. Competition is fierce, with established players like IKEA, La-Z-Boy, and Ashley Furniture competing with smaller, niche brands that often emphasize sustainability or unique design elements. The market shows clear potential for continued expansion, particularly as the focus on creating comfortable and stylish home environments persists, and innovation in design and material utilization continues to capture consumer attention. The ongoing adoption of online retail channels indicates a shift towards a more digitally-driven marketplace, further encouraging growth and facilitating access for a wider range of brands and consumers.

This comprehensive report provides an in-depth analysis of the North America home furnishing market, covering the period from 2019 to 2033. It offers invaluable insights into market size, segmentation, growth drivers, challenges, and key players, equipping businesses with the knowledge to navigate this dynamic sector. The report utilizes data from 2019-2024 (historical period), with 2025 serving as the base and estimated year, and forecasts extending to 2033.

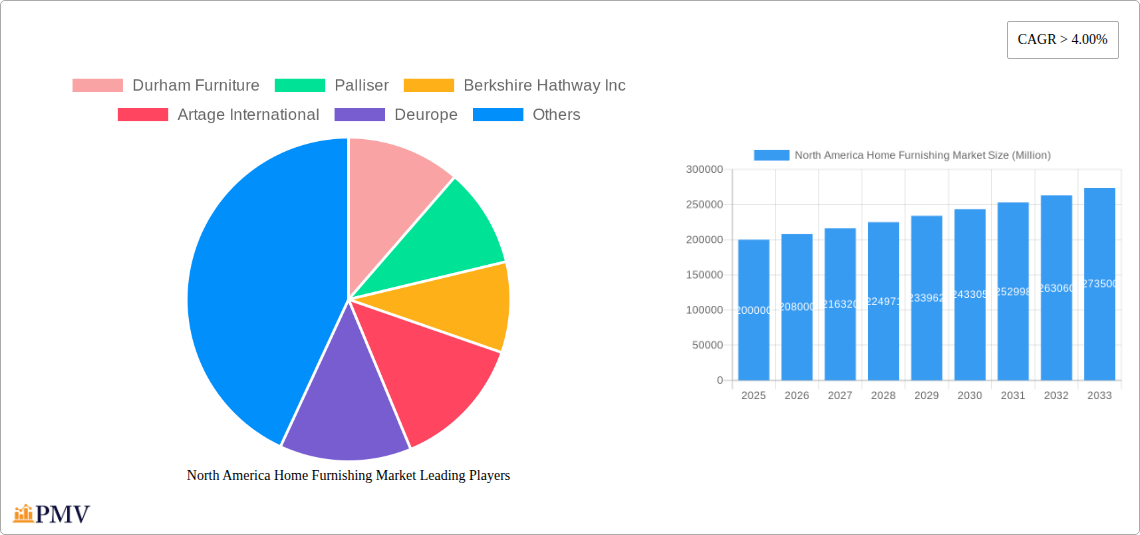

North America Home Furnishing Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the North American home furnishing market, analyzing market concentration, innovation, regulatory aspects, and key trends impacting industry participants. The market is characterized by a mix of large multinational corporations and smaller specialized businesses. Market share is highly fragmented, with no single entity dominating. However, key players like IKEA and Ashley Furniture exert significant influence through brand recognition and extensive distribution networks. Recent M&A activity, while not reaching record levels, reflects ongoing consolidation.

- Market Concentration: Moderately fragmented, with top 5 players holding an estimated xx% market share in 2024.

- Innovation Ecosystems: Focus on sustainable materials, smart home integration, and personalized design experiences is driving innovation.

- Regulatory Frameworks: Regulations related to material safety, labor practices, and environmental sustainability are significant considerations.

- Product Substitutes: Second-hand furniture markets and DIY options present competitive pressures.

- End-User Trends: Increasing demand for aesthetically pleasing and functional furniture, reflecting shifting lifestyles and preferences.

- M&A Activity: Recent deals, such as Berkshire Hathaway's investments in related sectors (USD 99 Million in Floor & Decor and USD 475 Million in Royalty Pharma in 2021), signal interest in adjacent markets and potential for future consolidation. Deal values have averaged approximately USD xx Million in recent years.

North America Home Furnishing Market Industry Trends & Insights

The North American home furnishing market exhibits robust growth driven by several key factors. The CAGR from 2019-2024 is estimated at xx%, indicating a healthy expansion trajectory. This growth is fueled by rising disposable incomes, increasing urbanization, and a growing preference for home improvement projects. Technological disruptions, such as the rise of e-commerce and the integration of smart technologies, are reshaping the market. Consumer preferences are shifting towards sustainable and ethically sourced products, creating opportunities for businesses aligned with these values. Market penetration of online sales continues to grow steadily, expected to reach xx% by 2033. Competitive dynamics are shaped by brands differentiating themselves through design, quality, sustainability initiatives, and personalized customer experiences.

Dominant Markets & Segments in North America Home Furnishing Market

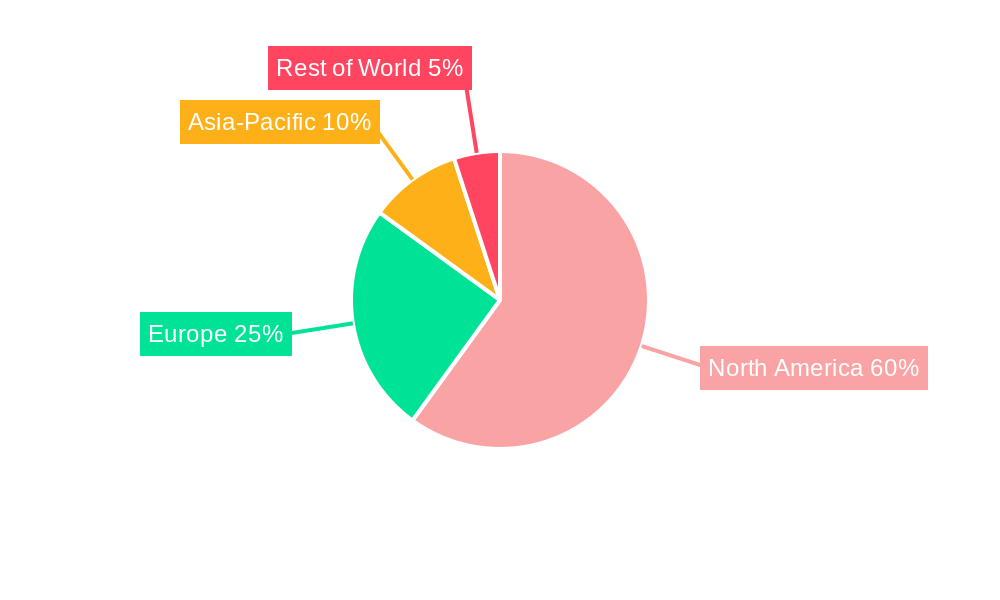

The US remains the dominant market within North America, accounting for approximately xx% of total market value. Within the segmentation, several key trends are observed:

By Material:

- Wood: Remains the most popular material, driven by its aesthetic appeal and perceived durability. Key growth drivers include sustainable forestry practices and innovative wood finishing techniques.

- Metal: Growing popularity in certain segments, particularly for modern and industrial styles.

- Plastic: Primarily used in lower-priced furniture segments, with ongoing innovation in material science and recycling efforts.

- Other Furniture: This segment includes a variety of materials such as rattan, wicker, and upholstery, each with its own niche market.

By Type:

- Living Room Furniture: This remains the largest segment, reflecting the centrality of the living room as a social and relaxation space.

- Bedroom Furniture: Strong and consistent demand, with trends towards customizable options and storage solutions.

- Dining Room Furniture: Moderate growth driven by changing social dynamics and an emphasis on family gatherings.

- Kitchen Furniture: Growing due to the increasing popularity of kitchen renovations and integrated storage solutions.

By Distribution Channel:

- Online & Others: This segment is experiencing the fastest growth, driven by e-commerce adoption and improved logistics.

- Specialty Stores: Maintain a strong presence through personalized customer service and curated product selections.

- Supermarkets & Hypermarkets: Offer convenience and a wider range of products, contributing moderately to overall sales.

North America Home Furnishing Market Product Innovations

Recent innovations in the home furnishing market include the integration of smart technology (e.g., adjustable lighting and temperature controls within furniture), the use of sustainable and recycled materials, and personalized customization options through online design tools. These innovations are improving both functionality and customer experience, enhancing market fit and competitive advantages.

Report Segmentation & Scope

This report segments the North American home furnishing market by material (wood, metal, plastic, other), type (living room, dining room, bedroom, kitchen, other), and distribution channel (supermarkets & hypermarkets, specialty stores, wholesalers, online & others). Each segment is analyzed in terms of its market size, growth projections, and competitive dynamics. Growth projections vary by segment, reflecting differing consumer demand and industry trends.

Key Drivers of North America Home Furnishing Market Growth

Several factors contribute to the market’s growth. Rising disposable incomes allow consumers to invest more in home furnishings. The increasing popularity of home improvement and renovation projects directly drives demand. The shift towards more comfortable and aesthetically pleasing home environments is also a key driver. Finally, the growth of e-commerce provides convenient access to a wider selection of products.

Challenges in the North America Home Furnishing Market Sector

The North American home furnishing market faces challenges such as fluctuating raw material prices, supply chain disruptions impacting manufacturing and delivery times, and increasing competition from both domestic and international players. These factors can directly affect profitability and market share. Furthermore, stricter environmental regulations impact manufacturing processes and cost structures.

Leading Players in the North America Home Furnishing Market Market

- Durham Furniture

- Palliser

- Berkshire Hathaway Inc

- Artage International

- Deurope

- Ashley Furniture Store

- American Eco Furniture LLC

- MiseWell

- Bermex

- IKEA

- La-Z-Boy

- Rooms To Go

- Bassett Furniture

Key Developments in North America Home Furnishing Market Sector

- 2021 (Q[Month Unavailable]): Berkshire Hathaway invested USD 99 Million in Floor & Decor and USD 475 Million in Royalty Pharma, signifying diversification into related sectors.

- 2021 (Q[Month Unavailable]): Bassett Furniture Industries leased a 123,000 sq ft manufacturing facility in Newton, NC, expanding production capacity across various product lines.

Strategic North America Home Furnishing Market Outlook

The North American home furnishing market is poised for continued growth, driven by ongoing consumer demand and technological advancements. Strategic opportunities lie in focusing on sustainable and ethically sourced products, personalizing customer experiences, and leveraging e-commerce to reach broader markets. Businesses that adapt to changing consumer preferences and integrate technological innovations will be well-positioned to capitalize on future growth prospects.

North America Home Furnishing Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Furniture

-

2. Type

- 2.1. Living Room Furniture

- 2.2. Dining Room Furniture

- 2.3. Bedroom Furniture

- 2.4. Kitchen Furniture

- 2.5. Other Furniture

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Wholesalers

- 3.4. Online & Others

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Home Furnishing Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Home Furnishing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Activities; Increase in Demand for Luxury Vinyl Tiles is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. United States Witnessing Rising Demand for Home Furniture Due to Increased Construction Activity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Living Room Furniture

- 5.2.2. Dining Room Furniture

- 5.2.3. Bedroom Furniture

- 5.2.4. Kitchen Furniture

- 5.2.5. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Wholesalers

- 5.3.4. Online & Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. United States North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Wood

- 6.1.2. Metal

- 6.1.3. Plastic

- 6.1.4. Other Furniture

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Living Room Furniture

- 6.2.2. Dining Room Furniture

- 6.2.3. Bedroom Furniture

- 6.2.4. Kitchen Furniture

- 6.2.5. Other Furniture

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets & Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Wholesalers

- 6.3.4. Online & Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Canada North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Wood

- 7.1.2. Metal

- 7.1.3. Plastic

- 7.1.4. Other Furniture

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Living Room Furniture

- 7.2.2. Dining Room Furniture

- 7.2.3. Bedroom Furniture

- 7.2.4. Kitchen Furniture

- 7.2.5. Other Furniture

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets & Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Wholesalers

- 7.3.4. Online & Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. United States North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 9. Canada North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 10. Mexico North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of North America North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Durham Furniture

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Palliser

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Berkshire Hathway Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Artage International

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Deurope

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Ashely Furniture Store

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 American Eco Furniture LLC**List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 MiseWell

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Bermex

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 IKEA

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 La-Z-Boy

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Rooms To Go

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Bassett Furniture

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Durham Furniture

List of Figures

- Figure 1: North America Home Furnishing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Home Furnishing Market Share (%) by Company 2024

List of Tables

- Table 1: North America Home Furnishing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Home Furnishing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 3: North America Home Furnishing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: North America Home Furnishing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Home Furnishing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Home Furnishing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Home Furnishing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Home Furnishing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Home Furnishing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Home Furnishing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Home Furnishing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 13: North America Home Furnishing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: North America Home Furnishing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: North America Home Furnishing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North America Home Furnishing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 18: North America Home Furnishing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: North America Home Furnishing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: North America Home Furnishing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home Furnishing Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the North America Home Furnishing Market?

Key companies in the market include Durham Furniture, Palliser, Berkshire Hathway Inc, Artage International, Deurope, Ashely Furniture Store, American Eco Furniture LLC**List Not Exhaustive, MiseWell, Bermex, IKEA, La-Z-Boy, Rooms To Go, Bassett Furniture.

3. What are the main segments of the North America Home Furnishing Market?

The market segments include Material, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Activities; Increase in Demand for Luxury Vinyl Tiles is Driving the Market.

6. What are the notable trends driving market growth?

United States Witnessing Rising Demand for Home Furniture Due to Increased Construction Activity.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In 2021, Berkshire Hathway built new stakes in Floor & Decor and Royalty Pharma. It disclosed a new, USD 99 million position in Floor & Decor, a flooring retailer, and a USD 475 million stake in Royalty Pharma, which funds clinical trials in exchange for royalties.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home Furnishing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home Furnishing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home Furnishing Market?

To stay informed about further developments, trends, and reports in the North America Home Furnishing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence