Key Insights

The North America Genetic Disorders Market is poised for substantial expansion, reaching an estimated $7.78 million in 2025 and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 10.02% through 2033. This significant growth is fueled by a confluence of factors, primarily the increasing prevalence of genetic diseases and a heightened awareness among the population regarding the benefits of early diagnosis and genetic testing. Key drivers include advancements in molecular testing technologies, such as next-generation sequencing (NGS), which enable more accurate and comprehensive genetic analysis. Furthermore, expanding reimbursement policies for genetic testing and a growing demand for personalized medicine are significantly contributing to market penetration. The market is segmented by type of testing, with diagnostic testing and prenatal testing anticipated to lead in terms of market share due to their critical role in managing inherited conditions and ensuring fetal health. The increasing incidence of chronic and rare diseases, including cancer, cystic fibrosis, and sickle cell anemia, further accentuates the demand for genetic diagnostic solutions.

North America Genetic Disorders Market Market Size (In Million)

The competitive landscape is characterized by the presence of established players like Quest Diagnostics Incorporated, Danaher Corporation, and Abbott Laboratories, alongside emerging innovators like 23&Me Inc. These companies are actively investing in research and development to introduce novel diagnostic platforms and expand their service offerings. Emerging trends indicate a strong focus on the development of genetic screening programs for newborns and the integration of genetic data into routine healthcare practices. While the market exhibits strong growth potential, certain restraints, such as the high cost of advanced genetic testing technologies and a shortage of skilled geneticists and counselors, may temper the pace of expansion. However, ongoing technological innovation and increasing accessibility of testing are expected to mitigate these challenges, ensuring continued upward momentum in the North American genetic disorders market.

North America Genetic Disorders Market Company Market Share

This detailed report delves into the dynamic North America Genetic Disorders Market, offering a comprehensive outlook on its structure, trends, competitive landscape, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this analysis provides critical insights for stakeholders navigating this rapidly evolving sector. The market is segmented by type, disease, and technology, and examines key industry developments and leading players.

North America Genetic Disorders Market Market Structure & Competitive Dynamics

The North America Genetic Disorders Market is characterized by a moderate to high market concentration, driven by a blend of established biotechnology giants and emerging innovators. Leading companies like Quest Diagnostics Incorporated, Danaher Corporation (Cepheid Inc.), Biorad Laboratories Inc, Abbott Laboratories, and F Hoffmann-La Roche Ltd command significant market share through extensive R&D investments and broad product portfolios. The innovation ecosystem thrives on advancements in genetic sequencing, bioinformatics, and diagnostic assay development. Regulatory frameworks, primarily overseen by the FDA in the U.S. and Health Canada, play a crucial role in product approval and market access. While product substitutes exist in traditional diagnostic methods, the precision and speed of genetic testing offer distinct advantages. End-user trends highlight a growing demand for personalized medicine, early disease detection, and proactive health management. Merger and acquisition (M&A) activities are a significant feature, with strategic partnerships and acquisitions aimed at consolidating market position, expanding technological capabilities, and accessing new patient populations. For instance, the acquisition of Luminex Corporation by DiaSorin Spa in 2021 for approximately $1.8 Billion, underscored this consolidation trend. Anticipated M&A deal values in the coming years are projected to be in the hundreds of millions of dollars as companies seek to strengthen their offerings in areas like rare disease diagnostics and precision oncology.

North America Genetic Disorders Market Industry Trends & Insights

The North America Genetic Disorders Market is poised for substantial growth, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 12% from 2025 to 2033. This robust expansion is fueled by several interconnected trends. The increasing prevalence of chronic and genetic diseases across North America, including Alzheimer's Disease, various Cancers, Cystic Fibrosis, and a growing number of Rare Diseases, is a primary demand driver. Enhanced public awareness and patient advocacy for genetic testing and early diagnosis are contributing to higher market penetration. Technological advancements, particularly in Next-Generation Sequencing (NGS), CRISPR gene editing, and liquid biopsy technologies, are revolutionizing diagnostic capabilities, making testing more accessible, accurate, and cost-effective. The adoption of molecular testing technologies is rapidly increasing, outpacing traditional methods due to its superior sensitivity and specificity for identifying genetic mutations. Consumer preferences are shifting towards preventive healthcare and personalized medicine, where genetic information plays a pivotal role in tailoring treatment plans and risk assessments. The market penetration of genetic testing services is expected to reach over 45% for specific high-prevalence genetic conditions by 2033. Furthermore, supportive government initiatives and increased healthcare expenditure dedicated to genomic research and diagnostics are bolstering market growth. The competitive landscape is intense, with companies continuously investing in R&D to develop novel diagnostic panels and therapeutic targets. The integration of artificial intelligence (AI) and machine learning (ML) in data analysis is further accelerating discoveries and improving diagnostic efficiency, driving innovation and market expansion. The market value is estimated to reach over $35,000 Million by 2033.

Dominant Markets & Segments in North America Genetic Disorders Market

The North America Genetic Disorders Market is led by the United States, which accounts for approximately 75% of the total market revenue due to its advanced healthcare infrastructure, substantial R&D investments, and high adoption rate of new technologies. Within the U.S., states with major biotechnology hubs like California, Massachusetts, and New York exhibit the highest market penetration.

Dominant Segments:

By Type:

- Diagnostic Testing represents the largest and fastest-growing segment, driven by the increasing need for accurate disease diagnosis and prognosis. This segment is projected to reach over $15,000 Million by 2033, fueled by advancements in identifying genetic predispositions to conditions like Cancer and Alzheimer's Disease.

- Newborn Screening is a crucial segment due to mandatory screening programs for a range of genetic disorders, ensuring early intervention and improved health outcomes.

- Prenatal Testing is experiencing significant growth due to the desire for proactive health management during pregnancy and the availability of non-invasive prenatal testing (NIPT).

By Disease:

- Cancer is the most dominant disease category within the genetic disorders market, with a substantial portion of the market dedicated to diagnostic and predictive testing for various hereditary cancer syndromes. The market for cancer-related genetic testing is estimated to exceed $10,000 Million by 2033.

- Rare Diseases are gaining traction, with increasing research and diagnostic capabilities leading to better identification and management of these often-undiagnosed conditions.

- Alzheimer's Disease is another significant driver, with growing interest in genetic markers like APOE e4 for risk assessment and early intervention strategies.

By Technology:

- Molecular Testing is the leading technology, encompassing techniques like PCR, sequencing, and microarrays. Its ability to detect specific genetic variations with high accuracy makes it indispensable for a wide range of genetic disorder diagnostics. This segment is expected to grow at a CAGR of over 13%.

- Cytogenetic Testing remains important for detecting chromosomal abnormalities, particularly in newborn screening and prenatal diagnostics.

- Biochemical Testing plays a supporting role, often used in conjunction with genetic tests to confirm or monitor metabolic genetic disorders.

Key drivers for dominance in these segments include robust government funding for research (e.g., National Institutes of Health funding in the U.S.), favorable reimbursement policies for genetic testing, strong academic-industry collaborations, and a high concentration of specialized healthcare professionals. The increasing availability of direct-to-consumer (DTC) genetic testing further expands market reach and consumer engagement.

North America Genetic Disorders Market Product Innovations

Product innovations in the North America Genetic Disorders Market are largely driven by the pursuit of enhanced diagnostic accuracy, reduced turnaround times, and greater accessibility. Companies are focusing on developing advanced next-generation sequencing (NGS) platforms capable of analyzing larger genomic regions more efficiently and affordably. The development of liquid biopsy techniques for early cancer detection and monitoring represents a significant technological leap, offering non-invasive diagnostic possibilities. Innovations in bioinformatics and AI-powered data analysis are crucial for interpreting complex genomic data, enabling faster and more precise diagnoses, and identifying novel therapeutic targets. Furthermore, there's a trend towards the development of multiplex assays that can detect multiple genetic disorders or mutations simultaneously, improving cost-effectiveness and patient convenience.

Report Segmentation & Scope

This report provides an in-depth analysis of the North America Genetic Disorders Market, segmented by Type, Disease, and Technology.

Type: The market is segmented into Carrier Testing, Diagnostic Testing, Newborn Screening, Predictive and Presymptomatic Testing, Prenatal Testing, and Other Types. Diagnostic Testing is projected to hold the largest market share, driven by increasing demand for accurate disease identification. Prenatal Testing is expected to witness robust growth due to advancements in NIPT.

Disease: Key disease segments include Alzheimer's Disease, Cancer, Cystic Fibrosis, Sickle Cell Anemia, Duchenne Muscular Dystrophy, Thalassemia, Huntington's Disease, and Rare Diseases. Cancer diagnostics dominate the market due to its high prevalence and the significant role of genetic predisposition. Rare Diseases represent a growing segment with increasing diagnostic capabilities.

Technology: The market is segmented into Cytogenetic Testing, Biochemical Testing, and Molecular Testing. Molecular Testing, particularly NGS-based solutions, is the most significant and fastest-growing segment, offering unparalleled precision for genetic anomaly detection.

Key Drivers of North America Genetic Disorders Market Growth

Several key drivers are propelling the North America Genetic Disorders Market forward.

- Technological Advancements: Continuous innovation in genetic sequencing technologies (NGS, whole-genome sequencing), CRISPR gene editing, and bioinformatics are enhancing the accuracy, speed, and affordability of genetic testing.

- Rising Prevalence of Genetic and Chronic Diseases: The increasing incidence of genetic disorders like Cystic Fibrosis, Sickle Cell Anemia, and the growing understanding of genetic links to chronic diseases such as Cancer and Alzheimer's Disease are fueling demand for diagnostic and predictive testing.

- Growing Awareness and Demand for Personalized Medicine: Increased public awareness about genetic predispositions and a strong preference for personalized treatment approaches are driving the adoption of genetic testing services.

- Supportive Regulatory Landscape and Reimbursement Policies: Favorable government initiatives, increased R&D funding, and evolving reimbursement policies for genetic testing are crucial growth enablers. For example, expanded Medicare coverage for certain genetic tests has significantly boosted market access.

Challenges in the North America Genetic Disorders Market Sector

Despite robust growth, the North America Genetic Disorders Market faces several challenges.

- High Cost of Advanced Genetic Testing: While costs are declining, advanced genomic sequencing and analysis can still be prohibitively expensive for some patient populations, limiting market access.

- Complex Regulatory Hurdles: Navigating the stringent regulatory pathways for new genetic tests and diagnostic platforms, particularly for novel technologies, can be time-consuming and resource-intensive.

- Data Interpretation and Privacy Concerns: The massive volume of genetic data generated poses challenges in interpretation and analysis. Concerns regarding genetic data privacy and security also need to be addressed to ensure public trust.

- Shortage of Skilled Professionals: A growing demand for genetic counselors, bioinformaticians, and geneticists can lead to a shortage of skilled professionals, potentially impacting market growth and service delivery.

Leading Players in the North America Genetic Disorders Market Market

- Quest Diagnostics Incorporated

- Danaher Corporation (Cepheid Inc.)

- Biorad Laboratories Inc

- Abbott Laboratories

- DiaSorin Spa (Luminex Corporation)

- F Hoffmann-La Roche Ltd

- 23&Me Inc

- Ariosa Diagnostics Inc

- PerkinElmer Inc

- Illumina Inc

Key Developments in North America Genetic Disorders Market Sector

- September 2022: Invitae, a United States-based company, announced a collaboration with Simons Searchlight, an international research program, with the goal of accelerating research and improving lives for people with rare genetic neurodevelopmental disorders. This is intended to help improve treatment, with the goal of ultimately finding a cure for these rare diseases.

- June 2022: Prenetics Group Limited introduced a novel, non-invasive, at-home screening test - ColoClear by Circle (ColoClear), for detecting early signs of colorectal cancer.

Strategic North America Genetic Disorders Market Market Outlook

The strategic outlook for the North America Genetic Disorders Market is exceptionally promising, driven by an ongoing surge in technological innovation and increasing demand for precision healthcare. The integration of AI and machine learning in genomic data analysis will further unlock new diagnostic and therapeutic avenues, particularly for complex diseases like Alzheimer's and rare genetic conditions. The expansion of direct-to-consumer genetic testing services will continue to democratize access and foster greater consumer engagement in proactive health management. Furthermore, strategic collaborations between research institutions, diagnostic companies, and pharmaceutical firms will accelerate the translation of genomic discoveries into clinical applications and novel treatments. Investments in expanding testing capabilities for emerging genetic disorders and optimizing existing workflows will be critical for market leaders aiming to maintain a competitive edge and capture significant market share. The market is anticipated to witness substantial growth, driven by these accelerators.

North America Genetic Disorders Market Segmentation

-

1. Type

- 1.1. Carrier Testing

- 1.2. Diagnostic Testing

- 1.3. Newborn Screening

- 1.4. Predictive and Presymptomatic Testing

- 1.5. Prenatal Testing

- 1.6. Other Types

-

2. Diseases

- 2.1. Alzheimer's Disease

- 2.2. Cancer

- 2.3. Cystic Fibrosis

- 2.4. Sickle Cell Anemia

- 2.5. Duchenne Muscular Dystrophy

- 2.6. Thalassemia

- 2.7. Huntington's Disease

- 2.8. Rare Diseases

-

3. Technology

- 3.1. Cytogenetic Testing

- 3.2. Biochemical Testing

- 3.3. Molecular Testing

North America Genetic Disorders Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

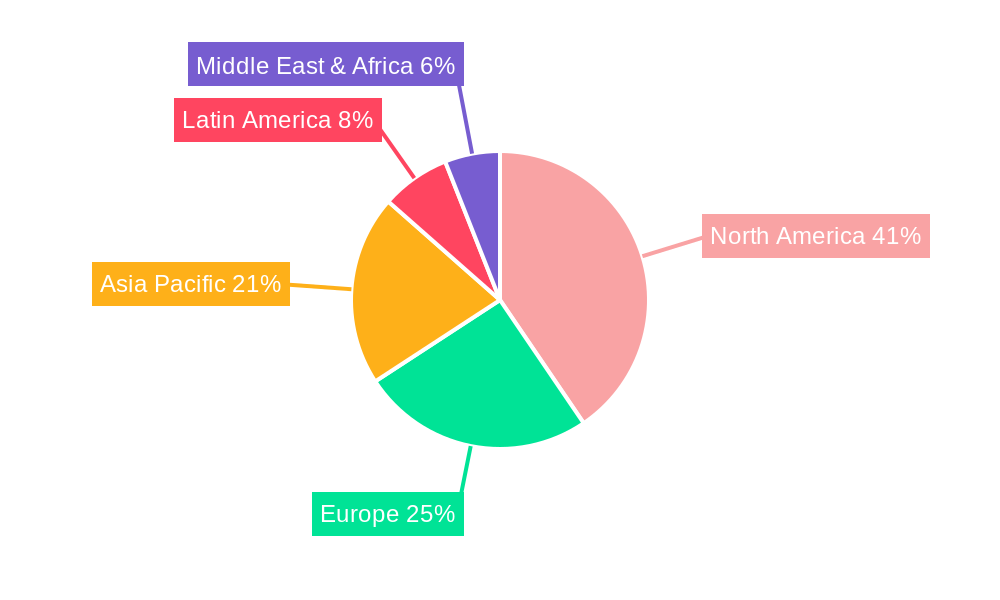

North America Genetic Disorders Market Regional Market Share

Geographic Coverage of North America Genetic Disorders Market

North America Genetic Disorders Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emphasis on Early Disease Detection and Prevention; Growing Demand for Personalized Medicine; Increasing Application of Genetic Testing in Oncology

- 3.3. Market Restrains

- 3.3.1. High Costs of Genetic Testing; Potentially Adverse Personal or Societal Consequences

- 3.4. Market Trends

- 3.4.1. Predictive and Presymptomatic Testing is Expected to be the Major Contributor to the Market over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Genetic Disorders Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carrier Testing

- 5.1.2. Diagnostic Testing

- 5.1.3. Newborn Screening

- 5.1.4. Predictive and Presymptomatic Testing

- 5.1.5. Prenatal Testing

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Diseases

- 5.2.1. Alzheimer's Disease

- 5.2.2. Cancer

- 5.2.3. Cystic Fibrosis

- 5.2.4. Sickle Cell Anemia

- 5.2.5. Duchenne Muscular Dystrophy

- 5.2.6. Thalassemia

- 5.2.7. Huntington's Disease

- 5.2.8. Rare Diseases

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Cytogenetic Testing

- 5.3.2. Biochemical Testing

- 5.3.3. Molecular Testing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Quest Diagnostics Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Danaher Corporation (Cepheid Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biorad Laboratories Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbott Laboratories

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DiaSorin Spa (Luminex Corporation)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 F Hoffmann-La Roche Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 23&Me Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ariosa Diagnostics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PerkinElmer Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Illumina Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Quest Diagnostics Incorporated

List of Figures

- Figure 1: North America Genetic Disorders Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Genetic Disorders Market Share (%) by Company 2025

List of Tables

- Table 1: North America Genetic Disorders Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Genetic Disorders Market Revenue Million Forecast, by Diseases 2020 & 2033

- Table 3: North America Genetic Disorders Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: North America Genetic Disorders Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Genetic Disorders Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: North America Genetic Disorders Market Revenue Million Forecast, by Diseases 2020 & 2033

- Table 7: North America Genetic Disorders Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: North America Genetic Disorders Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Genetic Disorders Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Genetic Disorders Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Genetic Disorders Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Genetic Disorders Market?

The projected CAGR is approximately 10.02%.

2. Which companies are prominent players in the North America Genetic Disorders Market?

Key companies in the market include Quest Diagnostics Incorporated, Danaher Corporation (Cepheid Inc ), Biorad Laboratories Inc, Abbott Laboratories, DiaSorin Spa (Luminex Corporation), F Hoffmann-La Roche Ltd, 23&Me Inc, Ariosa Diagnostics Inc, PerkinElmer Inc, Illumina Inc.

3. What are the main segments of the North America Genetic Disorders Market?

The market segments include Type, Diseases, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Emphasis on Early Disease Detection and Prevention; Growing Demand for Personalized Medicine; Increasing Application of Genetic Testing in Oncology.

6. What are the notable trends driving market growth?

Predictive and Presymptomatic Testing is Expected to be the Major Contributor to the Market over the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs of Genetic Testing; Potentially Adverse Personal or Societal Consequences.

8. Can you provide examples of recent developments in the market?

September 2022: Invitae, a United States-based company, announced a collaboration with Simons Searchlight, an international research program, with the goal of accelerating research and improving lives for people with rare genetic neurodevelopmental disorders. This is intended to help improve treatment, with the goal of ultimately finding a cure for these rare diseases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Genetic Disorders Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Genetic Disorders Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Genetic Disorders Market?

To stay informed about further developments, trends, and reports in the North America Genetic Disorders Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence