Key Insights

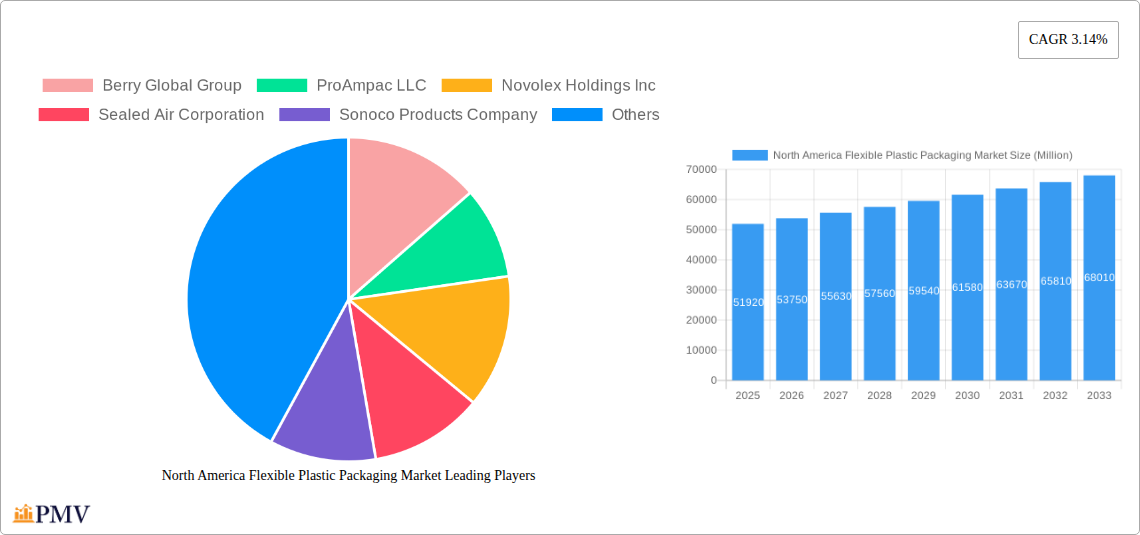

The North American Flexible Plastic Packaging Market is poised for substantial growth, projected to reach USD 51.92 billion in 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 3.51% anticipated from 2025 to 2033. The market's dynamism is fueled by evolving consumer preferences for convenience and sustainability, alongside increasing demand from key end-user industries such as food and beverage, personal care, and pharmaceuticals. Innovations in material science, leading to enhanced barrier properties, extended shelf life, and improved recyclability, are also significant drivers. The widespread adoption of flexible packaging formats like pouches and films, favored for their lightweight nature, cost-effectiveness, and superior product protection, underpins this positive market trajectory. Furthermore, the growing emphasis on e-commerce and the need for secure, attractive product presentation are contributing to the sustained demand for flexible plastic packaging solutions across the region.

North America Flexible Plastic Packaging Market Market Size (In Billion)

Several key trends are shaping the North American Flexible Plastic Packaging Market. A dominant trend is the escalating demand for sustainable packaging solutions, pushing manufacturers to invest in recyclable, compostable, and biodegradable materials like Bi-oriented Polypropylene (BOPP) and Ethylene Vinyl Alcohol (EVOH), alongside advancements in mono-material structures. The food and beverage sector, particularly frozen foods, dry foods, and fresh produce, continues to be a primary consumer due to the inherent ability of flexible packaging to preserve freshness and extend shelf life. The personal care and household care industries are also witnessing increased adoption, driven by product innovation and consumer appeal. While the market benefits from strong demand drivers, it faces restraints such as fluctuating raw material prices, stringent environmental regulations concerning plastic waste, and the ongoing need for significant investment in advanced recycling technologies. Despite these challenges, the market is expected to witness continued innovation and strategic collaborations among leading companies like Berry Global Group, ProAmpac LLC, and Amcor Group GmbH to address these complexities and capitalize on growth opportunities.

North America Flexible Plastic Packaging Market Company Market Share

This in-depth report provides a detailed analysis of the North America Flexible Plastic Packaging Market, encompassing a comprehensive study of market structure, industry trends, dominant segments, product innovations, growth drivers, challenges, and a strategic outlook. With an estimated market size of XX billion USD in 2025, the market is projected to experience robust growth driven by evolving consumer preferences, technological advancements, and increasing demand across key end-user industries. Our analysis covers the historical period from 2019 to 2024, the base and estimated year of 2025, and a detailed forecast period extending from 2025 to 2033. We leverage high-ranking keywords such as "flexible plastic packaging," "North America packaging market," "pouches," "films and wraps," "food packaging," "beverage packaging," "medical packaging," and "sustainable packaging solutions" to ensure optimal search visibility and engagement with industry professionals.

North America Flexible Plastic Packaging Market Market Structure & Competitive Dynamics

The North America Flexible Plastic Packaging Market is characterized by a moderately concentrated structure, with several large, established players holding significant market share, alongside a growing number of niche and regional manufacturers. Innovation ecosystems are robust, fueled by continuous investment in R&D for enhanced barrier properties, sustainable materials, and advanced printing technologies. Regulatory frameworks, particularly those concerning food safety, recyclability, and plastic waste reduction, play a crucial role in shaping market dynamics and driving product development. Product substitutes, while present in the form of rigid packaging, are increasingly challenged by the versatility, cost-effectiveness, and reduced material usage of flexible plastic packaging. End-user trends favoring convenience, extended shelf life, and eco-friendly packaging solutions are paramount. Mergers and acquisitions (M&A) activities remain a key strategy for market consolidation and expansion, with recent deals indicating a focus on acquiring innovative technologies and expanding geographical reach. For instance, the market share of the top 5 players is estimated to be around XX%, with M&A deal values in the past two years exceeding XX billion USD, aimed at strengthening portfolios and capturing new market segments.

- Market Concentration: Moderately concentrated, with key players dominating a significant portion of the market.

- Innovation Ecosystems: Driven by advancements in material science, barrier technologies, and sustainable solutions.

- Regulatory Frameworks: Influenced by stringent food safety, environmental protection, and recycling mandates.

- Product Substitutes: Primarily rigid packaging, facing increasing competition from flexible alternatives.

- End-User Trends: Emphasis on convenience, shelf-life extension, sustainability, and product appeal.

- M&A Activities: Strategic consolidation for portfolio enhancement and market expansion.

North America Flexible Plastic Packaging Market Industry Trends & Insights

The North America Flexible Plastic Packaging Market is experiencing dynamic growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This upward trajectory is primarily propelled by the escalating demand from the food and beverage sectors, driven by changing consumer lifestyles, the rise of e-commerce, and the need for extended shelf life and product preservation. Technological disruptions are a significant influence, with advancements in high-barrier films, retort pouch technology, and smart packaging solutions enhancing product performance and consumer appeal. Consumer preferences are increasingly leaning towards sustainable and recyclable packaging options, compelling manufacturers to invest in eco-friendly materials like recycled polyethylene (rPE) and bio-based plastics. Furthermore, the growing awareness of plastic waste and the implementation of Extended Producer Responsibility (EPR) schemes are shaping the competitive landscape, fostering innovation in circular economy models. The healthcare and personal care sectors are also contributing to market expansion due to the demand for sterile, safe, and convenient packaging solutions. The market penetration of flexible packaging continues to rise across various applications, underscoring its versatility and cost-effectiveness compared to traditional packaging formats.

Dominant Markets & Segments in North America Flexible Plastic Packaging Market

The Food end-user industry stands as the dominant segment within the North America Flexible Plastic Packaging Market, representing an estimated XX% of the total market value in 2025. This dominance is fueled by a wide array of sub-segments, including:

- Frozen Foods: Demand for efficient, moisture-resistant packaging to maintain product quality and extend shelf life.

- Dry Foods: Growth driven by convenience foods and pantry staples requiring robust barrier properties.

- Meat, Poultry, and Seafood: Increasing use of vacuum-sealed pouches and modified atmosphere packaging (MAP) for freshness and safety.

- Candy & Confectionery: Emphasis on visually appealing, resealable packaging to enhance consumer experience.

- Pet Food: Significant demand for large-format, durable bags with resealability features.

- Fresh Produce: Growing adoption of breathable films and specialized packaging to reduce spoilage.

- Dairy Products: Need for high-barrier films to protect against oxygen and light, extending shelf life.

Geographically, the United States is the largest market within North America, accounting for an estimated XX% of the total market value in 2025. This leadership is attributed to its mature economy, large consumer base, advanced manufacturing capabilities, and a well-established supply chain.

In terms of Material Type, Polyethene (PE) remains the most dominant material, capturing an estimated XX% market share in 2025, due to its versatility, cost-effectiveness, and a wide range of applications. Bi-oriented Polypropylene (BOPP) follows closely, particularly for its clarity and tensile strength.

Analyzing Product Type, Pouches are the leading segment, driven by their convenience, resealability, and diverse applications across various industries. Films and Wraps also hold a substantial share, essential for product protection and branding.

- Dominant End-User Industry: Food (XX% of market value in 2025)

- Key Drivers: Convenience, shelf-life extension, diverse product categories.

- Sub-segments: Frozen Foods, Dry Foods, Meat, Poultry, Seafood, Candy & Confectionery, Pet Food, Fresh Produce, Dairy Products.

- Dominant Geographical Market: United States (XX% of market value in 2025)

- Key Drivers: Mature economy, large consumer base, advanced manufacturing.

- Dominant Material Type: Polyethene (PE) (XX% of market value in 2025)

- Key Drivers: Versatility, cost-effectiveness, broad application range.

- Dominant Product Type: Pouches (XX% of market value in 2025)

- Key Drivers: Convenience, resealability, diverse applications.

North America Flexible Plastic Packaging Market Product Innovations

Product innovations in the North America Flexible Plastic Packaging Market are primarily focused on enhancing sustainability, functionality, and consumer appeal. This includes the development of advanced barrier technologies that extend product shelf life while reducing material usage, and the incorporation of features like reclosability, tamper-evidence, and ease of opening. The trend towards monomaterial structures, such as all-PE pouches, is gaining momentum to improve recyclability. Furthermore, the integration of smart packaging elements, offering features like temperature monitoring or authentication, is an emerging area. These innovations provide a significant competitive advantage by meeting evolving consumer demands for convenience, safety, and environmental responsibility.

Report Segmentation & Scope

This comprehensive report segments the North America Flexible Plastic Packaging Market by Material Type, Product Type, and End-user Industry.

- Material Type: The market is analyzed across Polyethene (PE), Bi-oriented Polypropylene (BOPP), Cast Polypropylene (CPP), Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), and Other Materials. Polyethene is expected to lead, with significant growth also projected for BOPP and emerging sustainable materials.

- Product Type: Key product categories covered include Pouches, Bags, Films and Wraps, and Other Product Types (e.g., Blister Packs, Liners). Pouches are anticipated to maintain their dominant position due to their versatility.

- End-user Industry: The report provides detailed insights into the Food (including sub-segments like Frozen Foods, Dry Foods, Meat, Poultry, and Seafood, Candy & Confectionery, Pet Food, Fresh Produce, Dairy Products), Beverage, Personal Care and Household Care, Medical and Pharmaceutical, and Other End-user Industries. The food sector is projected to exhibit the highest growth.

Key Drivers of North America Flexible Plastic Packaging Market Growth

The growth of the North America Flexible Plastic Packaging Market is propelled by several key drivers. The increasing consumer demand for convenience and on-the-go consumption, particularly in the food and beverage sectors, fuels the need for lightweight and easy-to-use flexible packaging formats like pouches and stand-up bags. Advancements in material science and processing technologies have enabled the creation of high-performance flexible packaging with superior barrier properties, extending product shelf life and reducing food waste. The growing emphasis on sustainability, driven by consumer awareness and regulatory pressures, is pushing the development and adoption of recyclable and bio-based flexible packaging solutions. E-commerce growth necessitates robust, protective, and lightweight packaging for efficient shipping, further bolstering the demand for flexible options.

- Convenience and Lifestyle Trends: Growing preference for single-serve and easy-to-open packaging.

- Technological Advancements: Development of high-barrier films and sustainable materials.

- Sustainability Initiatives: Consumer and regulatory push for recyclable and biodegradable packaging.

- E-commerce Expansion: Demand for lightweight and protective packaging for online retail.

Challenges in the North America Flexible Plastic Packaging Market Sector

Despite its robust growth, the North America Flexible Plastic Packaging Market faces several challenges. Increasing regulatory scrutiny and public concern regarding plastic waste and its environmental impact are driving stricter regulations on single-use plastics and promoting the adoption of alternative materials. The volatility in raw material prices, particularly for petrochemicals, can impact manufacturing costs and profit margins. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can affect production and delivery timelines. Furthermore, competition from alternative packaging materials and the ongoing efforts to develop truly circular economy solutions for flexible plastics present ongoing challenges that require continuous innovation and adaptation.

- Environmental Concerns & Regulations: Growing pressure for reduced plastic waste and increased recyclability.

- Raw Material Price Volatility: Fluctuations in the cost of petrochemical-based resins.

- Supply Chain Disruptions: Potential impacts on production and distribution.

- Competition from Alternatives: Ongoing development of sustainable and novel packaging solutions.

Leading Players in the North America Flexible Plastic Packaging Market Market

- Berry Global Group

- ProAmpac LLC

- Novolex Holdings Inc

- Sealed Air Corporation

- Sonoco Products Company

- American Packaging Corporation

- Printpack Inc

- Sigma Plastics Group Inc

- Amcor Group GmbH

- Constantia Flexibles Group GmbH

- Winpak Co Limited

- Mondi PLC

- Uflex Limited

- Transcontinental Inc

- PPC Flex Company Inc

- C-P Flexible Packaging

- ePac Holdings LLC

Key Developments in North America Flexible Plastic Packaging Market Sector

- January 2024: ProAmpac LLC announced the collaboration with Aptar CSP Technologies to launch ProActive Intelligence Moisture Protect (MP-1000), which will eliminate the need for desiccant packets. This innovation helps lower the moisture level in the packaging headspace, making it ideal for applications for products that require optimal moisture control.

- November 2023: NOVA Chemicals Corporation, a Canadian petrochemical company, announced a partnership with Amcor Group GmbH to supply mechanically recycled polyethylene resin (rPE) for the manufacture of flexible packaging films by Amcor. Increasing the use of recycled polyester (rPE) in flexible packaging is a key component of Amcor's circularity strategy. Such constant developments toward sustainability across the country would drive the demand for flexible plastic packaging across the region.

Strategic North America Flexible Plastic Packaging Market Market Outlook

The strategic outlook for the North America Flexible Plastic Packaging Market is highly promising, driven by sustained innovation and a growing commitment to sustainability. The increasing adoption of advanced recycling technologies and the development of high-performance, eco-friendly materials will be critical growth accelerators. Strategic opportunities lie in catering to the expanding e-commerce sector with specialized packaging solutions and in capturing market share within the burgeoning medical and pharmaceutical packaging segments that demand stringent quality and safety standards. Partnerships and collaborations focused on developing closed-loop systems for flexible packaging will be crucial for long-term success and environmental stewardship, ensuring the market's continued expansion and relevance.

North America Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types (Blister Packs, Liners, etc.)

-

3. End-user Industry

-

3.1. Food

- 3.1.1. Frozen Foods

- 3.1.2. Dry Foods

- 3.1.3. Meat, Poultry, and Sea Food

- 3.1.4. Candy & Confectionery

- 3.1.5. Pet Food

- 3.1.6. Fresh Produce

- 3.1.7. Dairy Products

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Personal Care and Household Care

- 3.4. Medical and Pharmaceutical

- 3.5. Other En

-

3.1. Food

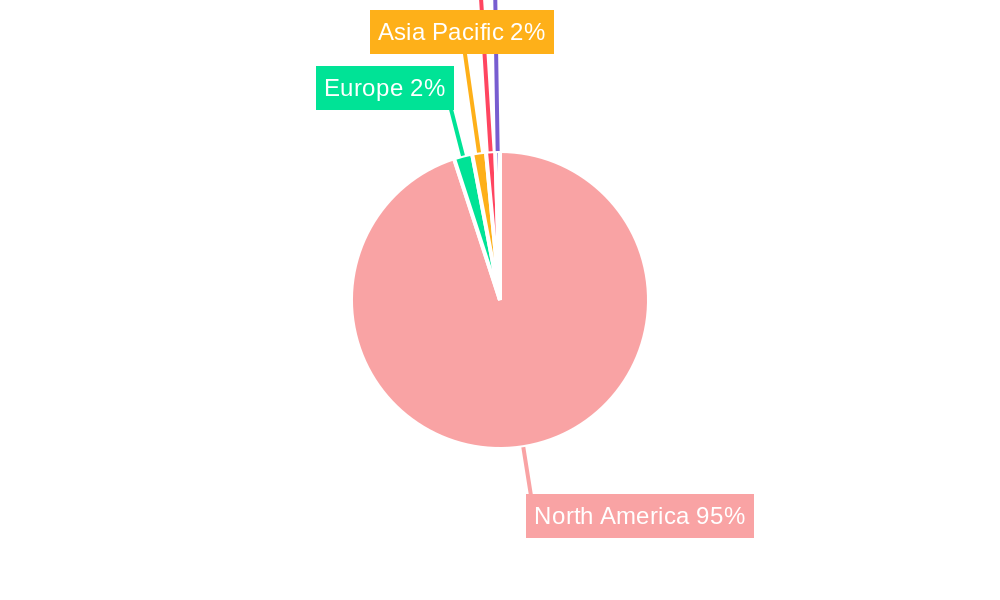

North America Flexible Plastic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Flexible Plastic Packaging Market Regional Market Share

Geographic Coverage of North America Flexible Plastic Packaging Market

North America Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of the E-commerce Sector in the Region; Rising Demand for Barrier Packaging Solutions from the Food Industry

- 3.3. Market Restrains

- 3.3.1. Expansion of the E-commerce Sector in the Region; Rising Demand for Barrier Packaging Solutions from the Food Industry

- 3.4. Market Trends

- 3.4.1. Innovative Packaging Solutions are Driving the Market’s Growth due to the Demand from Frozen-Food Categories

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types (Blister Packs, Liners, etc.)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.1.1. Frozen Foods

- 5.3.1.2. Dry Foods

- 5.3.1.3. Meat, Poultry, and Sea Food

- 5.3.1.4. Candy & Confectionery

- 5.3.1.5. Pet Food

- 5.3.1.6. Fresh Produce

- 5.3.1.7. Dairy Products

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Personal Care and Household Care

- 5.3.4. Medical and Pharmaceutical

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Berry Global Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ProAmpac LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novolex Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sealed Air Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 American Packaging Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Printpack Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sigma Plastics Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amcor Group GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Constantia Flexibles Group GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Winpak Co Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mondi PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Uflex Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Transcontinental Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 PPC Flex Company Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 C-P Flexible Packaging

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 ePac Holdings LL

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Berry Global Group

List of Figures

- Figure 1: North America Flexible Plastic Packaging Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Flexible Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Flexible Plastic Packaging Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 2: North America Flexible Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: North America Flexible Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Flexible Plastic Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Flexible Plastic Packaging Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 6: North America Flexible Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: North America Flexible Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: North America Flexible Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States North America Flexible Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Flexible Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Flexible Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flexible Plastic Packaging Market?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the North America Flexible Plastic Packaging Market?

Key companies in the market include Berry Global Group, ProAmpac LLC, Novolex Holdings Inc, Sealed Air Corporation, Sonoco Products Company, American Packaging Corporation, Printpack Inc, Sigma Plastics Group Inc, Amcor Group GmbH, Constantia Flexibles Group GmbH, Winpak Co Limited, Mondi PLC, Uflex Limited, Transcontinental Inc, PPC Flex Company Inc, C-P Flexible Packaging, ePac Holdings LL.

3. What are the main segments of the North America Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Expansion of the E-commerce Sector in the Region; Rising Demand for Barrier Packaging Solutions from the Food Industry.

6. What are the notable trends driving market growth?

Innovative Packaging Solutions are Driving the Market’s Growth due to the Demand from Frozen-Food Categories.

7. Are there any restraints impacting market growth?

Expansion of the E-commerce Sector in the Region; Rising Demand for Barrier Packaging Solutions from the Food Industry.

8. Can you provide examples of recent developments in the market?

January 2024: ProAmpac LLC announced the collaboration with Aptar CSP Technologies to launch ProActive Intelligence Moisture Protect (MP-1000), which will eliminate the need for desiccant packets. It will help the company lower the moisture level in the packaging headspace, making it ideal for applications for products that require optimal moisture control.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the North America Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence