Key Insights

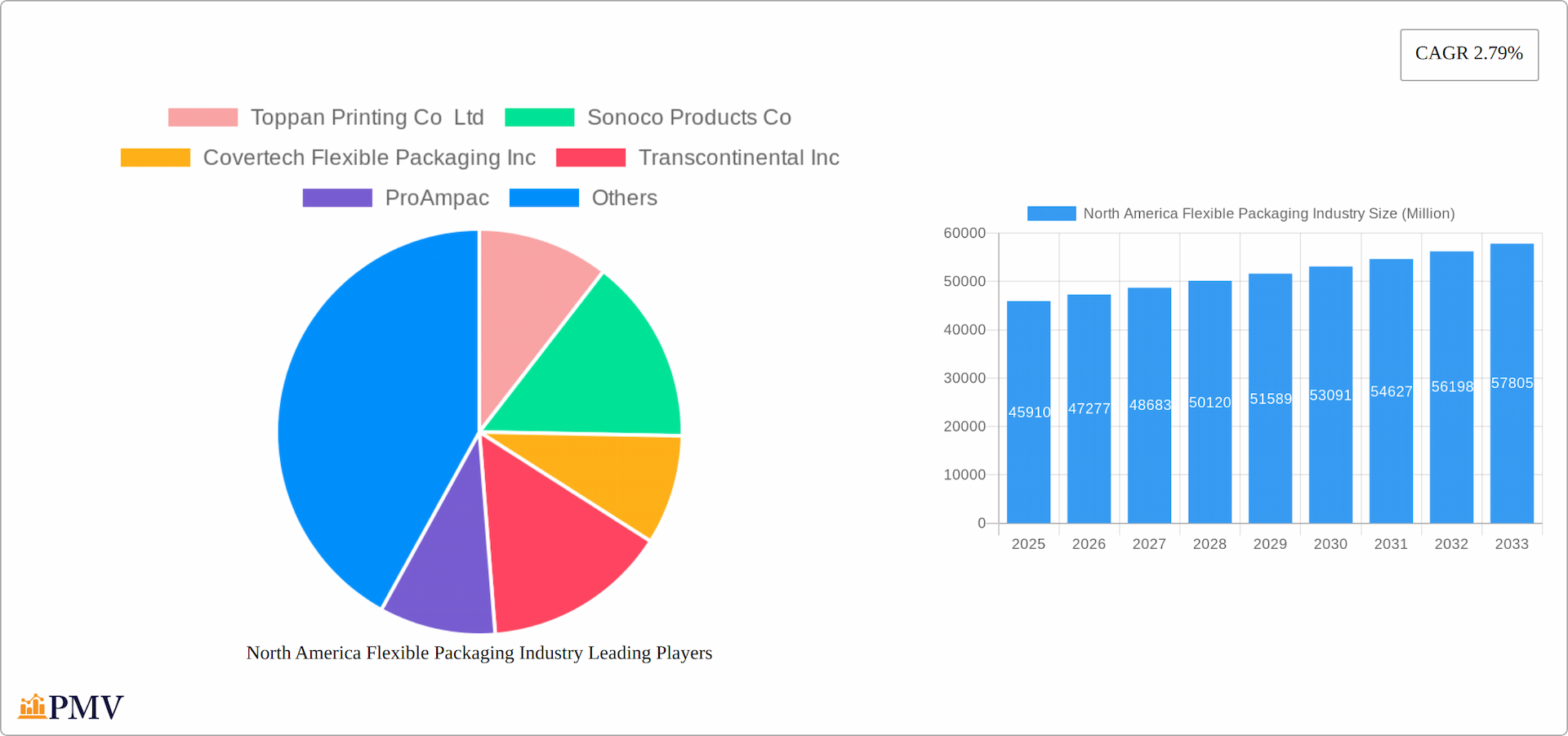

The North American flexible packaging market, valued at $45.91 billion in 2025, is projected to experience steady growth, driven by factors such as the rising demand for convenient and lightweight packaging across various end-use industries, particularly food and beverages. The increasing adoption of e-commerce and the subsequent need for tamper-evident and durable packaging solutions further fuels market expansion. Growth is also influenced by technological advancements in flexible packaging materials, leading to the development of sustainable and eco-friendly options like biodegradable plastics and recyclable films. While the overall market demonstrates consistent growth at a CAGR of 2.79%, segment-specific variations exist. For instance, pouches are expected to maintain a strong market share due to their versatility and cost-effectiveness, while the demand for sustainable materials like paper and aluminum foil is likely to increase significantly as consumer awareness regarding environmental impact grows. Competition in the market is intense, with major players like Amcor, Sonoco, and Berry Global constantly innovating to meet evolving consumer and regulatory demands. Regional variations within North America are also notable, with the United States holding the largest market share, followed by Canada, due to differences in population density, consumption patterns, and industrial development.

North America Flexible Packaging Industry Market Size (In Billion)

The market's growth trajectory will depend on several factors, including fluctuating raw material prices, economic conditions, and evolving consumer preferences. Government regulations related to sustainable packaging and waste management will also play a significant role. The ongoing innovation in barrier technologies, ensuring food preservation and product freshness, and advancements in printing and labeling technologies enhancing branding and consumer appeal will continue to shape the market landscape. The increased focus on traceability and food safety necessitates the development of smart packaging solutions, presenting growth opportunities for manufacturers specializing in specialized coatings and integrated technologies. The emergence of new materials and packaging designs that improve product shelf life, minimize environmental impact, and meet consumer demands for convenience will be crucial determinants of future market growth.

North America Flexible Packaging Industry Company Market Share

This comprehensive report provides an in-depth analysis of the North America flexible packaging industry, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, competitive landscapes, and future growth potential. The study utilizes a robust methodology combining primary and secondary research to deliver precise and actionable intelligence. The North American flexible packaging market is segmented by country (United States, Canada), material type (plastics, paper, aluminum foil, other types including PVC and PA), product type (pouches, bags, films and wraps, other product types), and end-user industry (food, beverages, household and personal care, other end-user industries). The report projects a market size of xx Million for 2025 and a CAGR of xx% during the forecast period (2025-2033).

North America Flexible Packaging Industry Market Structure & Competitive Dynamics

The North American flexible packaging market is characterized by a moderately concentrated structure, with several large multinational players and a number of smaller regional companies. Key players like Amcor PLC, Berry Global Inc., and Sealed Air Corp. hold significant market share, while regional players like Covertech Flexible Packaging Inc. and ProAmpac cater to niche markets. The industry exhibits a dynamic innovation ecosystem, driven by advancements in materials science, printing technologies, and sustainable packaging solutions. Stringent regulatory frameworks, particularly concerning food safety and environmental sustainability, influence product development and manufacturing processes. The market also experiences competition from alternative packaging types, including rigid containers and reusable packaging. Ongoing mergers and acquisitions (M&A) activity reshape the competitive landscape, with deal values reaching xx Million in recent years. Examples of M&A activity include partnerships between major players like Berry Global and Printpack.

- Market Concentration: Moderately concentrated, with significant share held by multinational corporations.

- Innovation Ecosystem: Driven by advancements in materials, printing, and sustainability.

- Regulatory Landscape: Stringent regulations impacting product development and manufacturing.

- Product Substitutes: Competition from rigid containers and reusable packaging solutions.

- M&A Activity: Significant M&A activity shaping the market structure, with total deal value reaching xx Million in recent years.

North America Flexible Packaging Industry Industry Trends & Insights

The North America flexible packaging market is experiencing dynamic growth, propelled by evolving consumer preferences and technological innovations. A significant driver is the escalating demand for convenient, portable, and safely packaged food and beverage products, a trend amplified by the robust expansion of e-commerce and online grocery delivery services. These channels necessitate packaging that is not only protective and efficient but also lightweight and aesthetically pleasing. Furthermore, the industry is witnessing a paradigm shift towards sustainability, with a surge in demand for eco-friendly packaging solutions. Innovations in materials science are leading to the development of flexible packaging with enhanced barrier properties, extended shelf life, and a reduced environmental footprint, including the increasing adoption of recycled content and bio-based polymers. These advancements resonate strongly with environmentally conscious consumers. However, the market faces headwinds from fluctuating raw material prices and ongoing concerns regarding plastic waste management, prompting a concentrated focus on circular economy principles and advanced recycling technologies. The competitive landscape is characterized by a drive for innovation, strategic collaborations and mergers, and a growing emphasis on reducing the environmental impact of packaging throughout its lifecycle. The compound annual growth rate (CAGR) is projected to reach approximately XX% during the forecast period (2025-2033), with notable market penetration anticipated within the food and beverage sector. Continuous innovation in developing advanced, sustainable packaging solutions that align with consumer expectations is a key determinant of future growth.

Dominant Markets & Segments in North America Flexible Packaging Industry

The United States dominates the North American flexible packaging market, driven by its large population, robust economy, and extensive food and beverage processing industries. Within material types, plastics maintain a significant market share due to their versatility and cost-effectiveness, although paper and aluminum foil packaging are also experiencing growth, driven by sustainability concerns. Pouches and bags are the most prevalent product types, reflecting consumer preference for convenience. The food and beverage industry remains the largest end-user sector.

By Country:

- United States: Dominant market due to large population, robust economy, and strong food and beverage industry. Key drivers include robust consumer spending, advanced infrastructure, and favorable regulatory environment.

- Canada: Smaller market compared to the US, with growth driven by expanding food processing and consumer goods sectors. Key drivers include stable economic growth and expanding e-commerce sector.

By Material Type:

- Plastics: Largest segment due to versatility and cost-effectiveness.

- Paper: Growing segment driven by increasing demand for sustainable packaging.

- Aluminum Foil: Significant presence, particularly in food and beverage packaging.

By Product Type:

- Pouches and Bags: Largest segments due to consumer preference for convenience.

- Films and Wraps: Significant market share, used extensively in various applications.

By End-User Industry:

- Food and Beverages: Largest end-user segment due to high demand for flexible packaging.

- Household and Personal Care: Significant segment with growth driven by demand for convenient and safe packaging.

North America Flexible Packaging Industry Product Innovations

Recent advancements in flexible packaging are revolutionizing the industry, with a strong emphasis on sustainable materials, enhanced barrier properties, and cutting-edge printing technologies. The industry is actively transitioning towards eco-friendly alternatives, prominently featuring recycled and bio-based polymers derived from renewable resources. Active and intelligent packaging solutions are increasingly being adopted, playing a crucial role in extending product shelf life, maintaining product integrity, and enhancing consumer safety through features like spoilage indicators and tamper-evident seals. These innovations provide significant competitive advantages by offering superior product protection against environmental factors, extending the usability of products, and significantly boosting consumer appeal. The integration of advanced printing technologies is also enabling greater customization, allowing for intricate branding, dynamic graphics, and personalized packaging designs that capture consumer attention.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the North America flexible packaging market based on country (United States, Canada), material type (plastics, paper, aluminum foil, other types), product type (pouches, bags, films and wraps, other types), and end-user industry (food, beverages, household and personal care, other end-user industries). Each segment's growth projections, market size estimates, and competitive dynamics are thoroughly analyzed, providing a detailed understanding of market opportunities and challenges.

Key Drivers of North America Flexible Packaging Industry Growth

The North American flexible packaging market's robust growth is underpinned by a confluence of powerful drivers. The persistent and increasing demand for convenient, portable, and on-the-go food and beverage options is a primary catalyst. The rapid expansion of e-commerce and online grocery delivery platforms further amplifies the need for efficient, protective, and visually appealing flexible packaging solutions. A significant and growing consumer preference for sustainable and eco-friendly packaging materials, driven by environmental awareness, is pushing manufacturers to innovate and adopt greener alternatives. Concurrently, substantial advancements in materials science and sophisticated printing technologies are enabling the creation of packaging with enhanced functionalities, improved aesthetics, and reduced environmental impact. The escalating demand for customized and branded packaging, allowing businesses to differentiate their products and connect with consumers on a deeper level, also plays a vital role in stimulating market expansion.

Challenges in the North America Flexible Packaging Industry Sector

Significant challenges include fluctuations in raw material prices, environmental concerns related to plastic waste, stringent regulatory requirements for food safety and environmental compliance, and the increasing pressure to adopt sustainable packaging practices. Supply chain disruptions and intense competition further add to these challenges. These challenges collectively impact the market's profitability and sustainability.

Leading Players in the North America Flexible Packaging Industry Market

- Toppan Printing Co Ltd

- Sonoco Products Co

- Covertech Flexible Packaging Inc

- Transcontinental Inc

- ProAmpac

- American Packaging Corporation

- Cascades Flexible Packaging

- St Johns Packaging

- Emmerson Packaging

- Amcor PLC

- Novolex Holdings Inc

- Mondi PLC

- Sealed Air Corp

- Constantia Flexibles

- Tetra Pak International SA

- Berry Global Inc

- Printpack Inc

- Winpak Limited

- Sigma Plastics Group Inc

- Sit Group SpA

Key Developments in North America Flexible Packaging Industry Sector

- October 2022: Berry Global and Printpack collaborated to introduce innovative sustainable packaging solutions. Their joint launch of the Preserve PE PCR recyclable polyethylene pouch, incorporating 30% post-consumer recycled content, signifies a substantial industry shift towards embracing circular economy principles and reducing virgin plastic usage.

- December 2022: Amcor PLC announced a strategic five-year contract with ExxonMobil to secure certified-circular polyethylene. This agreement is a cornerstone of Amcor's commitment to incorporating 30% recycled material across its global portfolio by 2030, marking a significant and ambitious step towards enhancing the sustainability of its packaging offerings.

Strategic North America Flexible Packaging Industry Market Outlook

The North American flexible packaging market exhibits significant growth potential, driven by the increasing demand for sustainable and innovative packaging solutions. Strategic opportunities lie in developing eco-friendly materials, enhancing product functionalities through active and intelligent packaging, and focusing on efficient and customized packaging solutions to meet the evolving demands of the food and beverage, healthcare, and e-commerce sectors. Companies focused on sustainability and innovation are expected to experience the most significant growth.

North America Flexible Packaging Industry Segmentation

-

1. Material Type

-

1.1. Plastics

- 1.1.1. Polyethene (PE)

- 1.1.2. Bi-orientated Polypropylene (BOPP)

- 1.1.3. Cast Polypropylene (CPP)

- 1.1.4. Ethylene Vinyl Alcohol (EVOH)

- 1.1.5. Other Types (PVC, PA, Bioplastics)

- 1.2. Paper

- 1.3. Aluminium Foil

-

1.1. Plastics

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Frozen & Chilled Food

- 3.1.2. Meat, Poultry & Fish

- 3.1.3. Fruits & Vegetables

- 3.1.4. Bakery & Confectionary

- 3.1.5. Dried & Ready Meals

- 3.1.6. Pet Food

- 3.1.7. Other Food Products

- 3.2. Beverages

- 3.3. Tobacco

- 3.4. Cosmetics & Personal Care

- 3.5. Other End-user Industries

-

3.1. Food

North America Flexible Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Flexible Packaging Industry Regional Market Share

Geographic Coverage of North America Flexible Packaging Industry

North America Flexible Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding the Environment and Recycling

- 3.4. Market Trends

- 3.4.1. The Increased Demand for Convenient Packaging to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.1.1. Polyethene (PE)

- 5.1.1.2. Bi-orientated Polypropylene (BOPP)

- 5.1.1.3. Cast Polypropylene (CPP)

- 5.1.1.4. Ethylene Vinyl Alcohol (EVOH)

- 5.1.1.5. Other Types (PVC, PA, Bioplastics)

- 5.1.2. Paper

- 5.1.3. Aluminium Foil

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Frozen & Chilled Food

- 5.3.1.2. Meat, Poultry & Fish

- 5.3.1.3. Fruits & Vegetables

- 5.3.1.4. Bakery & Confectionary

- 5.3.1.5. Dried & Ready Meals

- 5.3.1.6. Pet Food

- 5.3.1.7. Other Food Products

- 5.3.2. Beverages

- 5.3.3. Tobacco

- 5.3.4. Cosmetics & Personal Care

- 5.3.5. Other End-user Industries

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Toppan Printing Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Covertech Flexible Packaging Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Transcontinental Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ProAmpac

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 American Packaging Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cascades Flexible Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 St Johns Packaging*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emmerson Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Novolex Holdings Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mondi PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sealed Air Corp

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Constantia Flexibles

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Tetra Pak International SA

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Berry Global Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Printpack Inc

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Winpak Limited

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Sigma Plastics Group Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Sit Group SpA

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Toppan Printing Co Ltd

List of Figures

- Figure 1: North America Flexible Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Flexible Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: North America Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: North America Flexible Packaging Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: North America Flexible Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: North America Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: North America Flexible Packaging Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: North America Flexible Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flexible Packaging Industry?

The projected CAGR is approximately 2.79%.

2. Which companies are prominent players in the North America Flexible Packaging Industry?

Key companies in the market include Toppan Printing Co Ltd, Sonoco Products Co, Covertech Flexible Packaging Inc, Transcontinental Inc, ProAmpac, American Packaging Corporation, Cascades Flexible Packaging, St Johns Packaging*List Not Exhaustive, Emmerson Packaging, Amcor PLC, Novolex Holdings Inc, Mondi PLC, Sealed Air Corp, Constantia Flexibles, Tetra Pak International SA, Berry Global Inc, Printpack Inc, Winpak Limited, Sigma Plastics Group Inc, Sit Group SpA.

3. What are the main segments of the North America Flexible Packaging Industry?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

The Increased Demand for Convenient Packaging to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Concerns Regarding the Environment and Recycling.

8. Can you provide examples of recent developments in the market?

December 2022: Amcor PLC, a global leader in developing and producing packaging solutions, has announced a five-year contract with ExxonMobil to purchase certified-circular polyethylene material in support of its target to achieve 30% recycled material across its portfolio by 2030. Amcor plans to leverage this material across its global portfolio, focusing on the healthcare and food industries, which are needed to meet stringent safety requirements for recycled plastic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flexible Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flexible Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flexible Packaging Industry?

To stay informed about further developments, trends, and reports in the North America Flexible Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence