Key Insights

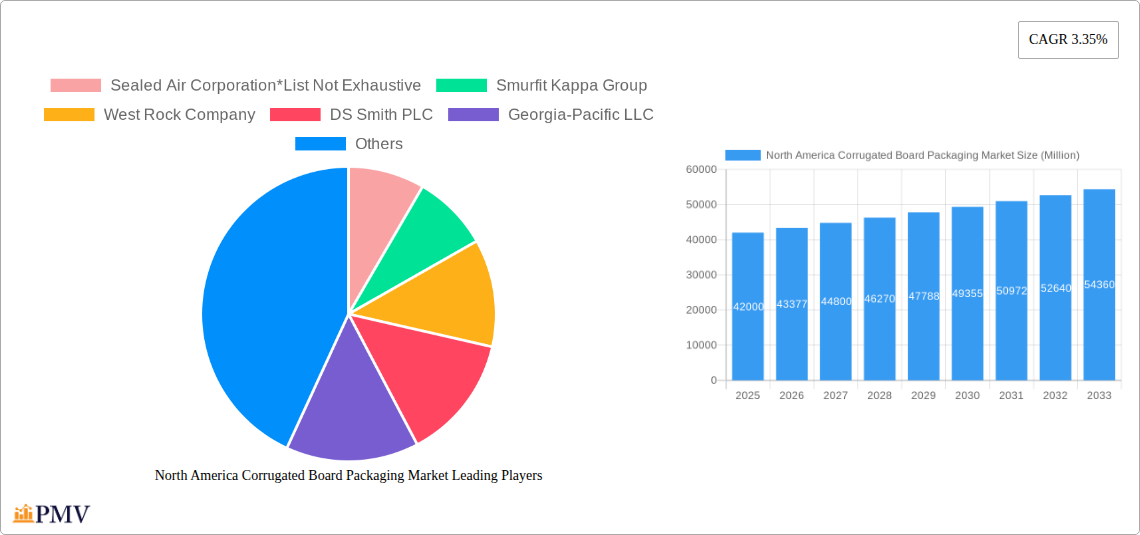

The North America corrugated board packaging market, valued at $42 billion in 2025, is projected to experience steady growth, driven by the expanding e-commerce sector and increasing demand for sustainable packaging solutions. The market's 3.35% CAGR suggests a consistent upward trajectory through 2033. Key growth drivers include the rising preference for lightweight yet durable packaging, particularly within the processed foods, fresh food and produce, and beverage sectors. The increasing adoption of corrugated board packaging by electrical product manufacturers, aiming for enhanced product protection during transit, further fuels market expansion. While the market faces some restraints, such as fluctuations in raw material prices (primarily recycled paperboard) and evolving environmental regulations impacting packaging design, innovative solutions like recyclable and compostable corrugated board alternatives are mitigating these challenges. Furthermore, strategic partnerships between packaging manufacturers and end-users, fostering collaboration on sustainable packaging solutions, is a positive trend. The regional breakdown within North America shows strong performance across the United States, Canada, and Mexico, reflecting robust domestic consumption and regional trade dynamics. Leading players such as Sealed Air Corporation, Smurfit Kappa Group, and West Rock Company are leveraging their technological capabilities and distribution networks to maintain market leadership and capitalize on emerging opportunities. The forecast period (2025-2033) will likely witness a continued emphasis on efficient supply chain management and cost optimization, influencing the overall market dynamics and shaping future growth patterns.

North America Corrugated Board Packaging Market Market Size (In Billion)

The competitive landscape is characterized by both large multinational corporations and regional players. These companies are investing heavily in research and development to introduce innovative packaging solutions that meet the evolving demands of various end-user industries. For instance, the trend towards customized and personalized packaging is likely to drive further growth in the market. The increasing focus on automation and advanced manufacturing technologies will also play a crucial role in enhancing production efficiency and reducing costs, thereby impacting the market’s overall growth trajectory. Government regulations related to sustainable packaging and waste management are influencing packaging design and material choices, leading to greater adoption of eco-friendly corrugated board alternatives. The continued growth of e-commerce will remain a key driver, demanding robust and protective packaging solutions for online deliveries.

North America Corrugated Board Packaging Market Company Market Share

North America Corrugated Board Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America corrugated board packaging market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market trends, competitive dynamics, and future growth potential. The study incorporates detailed segmentation by end-user industry (Processed Foods, Fresh Food and Produce, Beverages, Paper Products, Electrical Products, Other End-user Industries) and by country (United States, Canada, Mexico). The report’s forecasts are based on rigorous research and data analysis, providing a reliable foundation for strategic decision-making. Key players like Sealed Air Corporation, Smurfit Kappa Group, West Rock Company, DS Smith PLC, Georgia-Pacific LLC, Mondi PLC, Oji Holdings Corporation, International Paper Company, Nippon Paper Industries Co Ltd, Packaging Corporation of America, and Cascades Inc. are profiled, offering a detailed understanding of the competitive landscape. The report values are expressed in Millions.

North America Corrugated Board Packaging Market Market Structure & Competitive Dynamics

The North American corrugated board packaging market exhibits a moderately consolidated structure. Major players hold significant market share, driving intense competition. The market's innovation ecosystem is vibrant, with ongoing developments in sustainable packaging materials and automation technologies. Regulatory frameworks, such as those concerning recyclability and environmental impact, significantly influence market dynamics. Product substitutes, including plastic packaging, pose a challenge, although the growing preference for eco-friendly options is bolstering demand for corrugated board. End-user trends, driven by e-commerce growth and changing consumer preferences, are shaping packaging requirements. Mergers and acquisitions (M&A) activities have been substantial, with deal values exceeding XX Million in recent years, resulting in increased market concentration.

- Market Concentration: The top 5 players account for approximately xx% of the market share.

- Innovation Ecosystem: Focus on sustainable materials like recycled fiber and biodegradable coatings.

- Regulatory Framework: Stringent environmental regulations are driving innovation in sustainable packaging.

- M&A Activities: Significant consolidation through acquisitions and mergers, averaging xx M&A deals annually in the historical period with an average deal value of xx Million.

North America Corrugated Board Packaging Market Industry Trends & Insights

The North American corrugated board packaging market is experiencing dynamic growth and transformation, fueled by a confluence of powerful trends. The relentless expansion of e-commerce continues to be a primary driver, necessitating robust and efficient packaging solutions for direct-to-consumer shipments. Simultaneously, a significant consumer and regulatory push towards sustainability is reshaping the industry. This includes a heightened demand for packaging made from recycled fibers, biodegradable materials, and those that are easily recyclable, aligning with circular economy principles. Furthermore, the critical need for enhanced food safety and preservation in the burgeoning food and beverage sector is spurring innovation in specialized corrugated board solutions. Technological advancements are playing a pivotal role, with automation streamlining manufacturing processes and digital printing offering unprecedented levels of customization, faster turnaround times, and superior graphic quality. The market is characterized by intense competition, compelling industry players to invest heavily in research and development to introduce novel products and expand production capacities. The Compound Annual Growth Rate (CAGR) for the North American corrugated board packaging market is projected to be approximately [Insert Specific CAGR Here]% during the forecast period of 2025-2033. Market penetration in key segments is anticipated to reach around [Insert Specific Penetration Percentage Here]% by 2033. However, the market navigates challenges such as volatility in raw material prices, particularly for pulp, and the increasing adoption of alternative packaging materials, necessitating continuous adaptation and innovation.

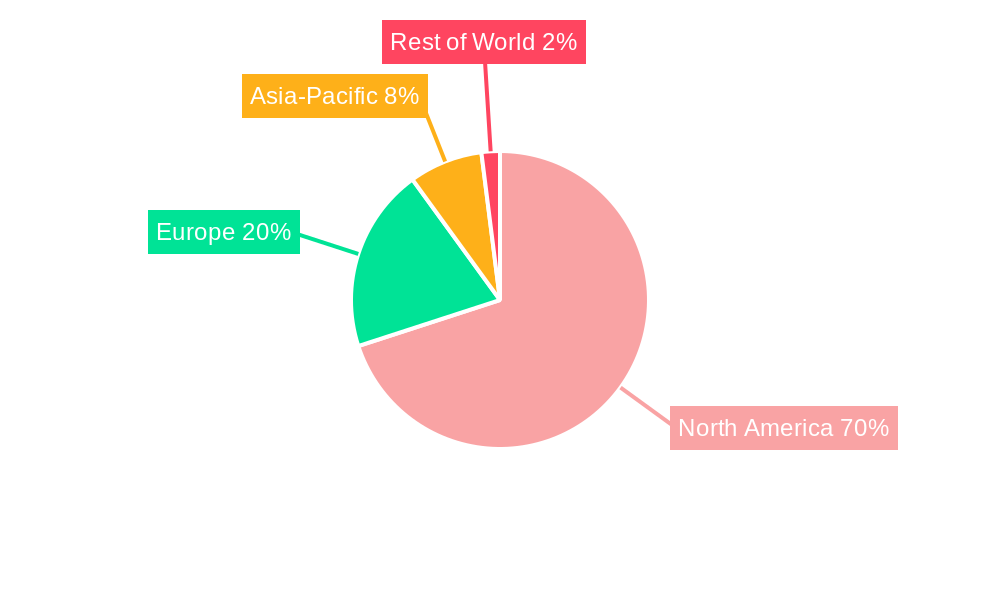

Dominant Markets & Segments in North America Corrugated Board Packaging Market

The United States dominates the North American corrugated board packaging market, owing to its large and diversified economy, extensive manufacturing base, and high consumer spending. Within end-user industries, the processed foods segment is the largest, driven by high demand for packaging solutions that ensure food safety and extend shelf life.

Dominant Region: United States

- Key Drivers: Large and diverse economy, robust manufacturing sector, high consumer spending.

Dominant Segment (End-user Industry): Processed Foods

- Key Drivers: Stringent food safety regulations, demand for extended shelf life, and diverse product packaging needs.

Dominant Segment (Country): United States

- Key Drivers: Large population, established retail infrastructure, high consumption rates.

Canada and Mexico show steady growth, although at a slower pace than the US due to factors including smaller market sizes and different consumer preferences.

North America Corrugated Board Packaging Market Product Innovations

Innovation within the North American corrugated board packaging market is sharply focused on enhancing both performance and sustainability. A key area of development involves the integration of advanced materials and processes to improve environmental credentials. This includes the increased use of high-post-consumer recycled fiber content, the development of novel biodegradable and compostable coatings, and the wider adoption of eco-friendly water-based inks. Cutting-edge printing technologies are enabling brands to achieve vibrant, high-definition graphics and intricate customized designs, thereby elevating product appeal and brand recognition. Furthermore, significant strides are being made in engineering lightweight yet exceptionally durable corrugated board. These advancements not only optimize packaging for the rigors of shipping and handling but also contribute to substantial efficiencies in logistics and a reduction in transportation-related carbon emissions. These innovations are crucial in reinforcing the market position of corrugated board packaging by effectively addressing evolving consumer expectations for eco-conscious products while delivering superior functional performance.

Report Segmentation & Scope

This report segments the North American corrugated board packaging market by end-user industry and country.

By End-user Industry: The report details market size, growth projections, and competitive dynamics for Processed Foods, Fresh Food and Produce, Beverages, Paper Products, Electrical Products, and Other End-user Industries. Each segment's growth rate is expected to vary significantly, with Processed Foods and e-commerce-driven segments exhibiting the strongest growth.

By Country: The report provides a detailed analysis of the market in the United States, Canada, and Mexico, incorporating regional growth drivers, economic factors, and regulatory landscapes. The US market holds the largest share, followed by Canada and Mexico. Each country's analysis incorporates specific market dynamics and growth projections.

Key Drivers of North America Corrugated Board Packaging Market Growth

Several potent drivers are propelling the growth of the North American corrugated board packaging market. The unparalleled surge in e-commerce, often referred to as the "e-commerce boom," is a monumental factor, driving sustained demand for sturdy and versatile shipping boxes. Concurrently, a rapidly growing consumer and corporate preference for sustainable packaging solutions is a significant catalyst, pushing manufacturers towards recyclable, reusable, and biodegradable options. The food and beverage industry's increasing emphasis on food safety, extended shelf life, and preservation is also contributing to the demand for specialized, high-performance corrugated packaging. Moreover, continuous advancements in printing and converting technologies are enhancing the aesthetic appeal and functional capabilities of corrugated packaging, making it a more attractive choice for brands. Supportive government regulations and initiatives aimed at promoting sustainable business practices further bolster the market's expansion.

Challenges in the North America Corrugated Board Packaging Market Sector

The North American corrugated board packaging market is not without its hurdles. A persistent challenge lies in the price volatility of key raw materials, most notably pulp, which can significantly impact production costs and profit margins. The market also faces intense competition from a diverse range of alternative packaging materials, including various plastics and other innovative solutions, which often present their own set of advantages and drawbacks. Increasingly stringent environmental regulations and compliance requirements necessitate ongoing investment in cleaner production processes and sustainable material sourcing. Furthermore, the potential for supply chain disruptions, whether due to global events, transportation issues, or labor shortages, can impact production schedules and the timely delivery of finished goods. Navigating these challenges requires agility, strategic sourcing, and a commitment to continuous operational improvement.

Leading Players in the North America Corrugated Board Packaging Market Market

- Sealed Air Corporation

- Smurfit Kappa Group

- West Rock Company

- DS Smith PLC

- Georgia-Pacific LLC

- Mondi PLC

- Oji Holdings Corporation

- International Paper Company

- Nippon Paper Industries Co Ltd

- Packaging Corporation of America

- Cascades Inc

Key Developments in North America Corrugated Board Packaging Market Sector

- January 2023: Smurfit Kappa announced a significant investment in a new recycling facility in the US, boosting its commitment to sustainable practices.

- March 2022: West Rock launched a new line of eco-friendly corrugated board packaging, incorporating recycled content and biodegradable coatings.

- October 2021: International Paper acquired a smaller packaging company, expanding its market reach in the food and beverage sector. (Further developments to be added based on available information)

Strategic North America Corrugated Board Packaging Market Market Outlook

The future of the North American corrugated board packaging market looks promising, driven by continued growth in e-commerce, a focus on sustainability, and ongoing innovation in packaging materials and technologies. Strategic opportunities exist for companies that invest in advanced automation, sustainable packaging solutions, and customized packaging designs. The market is poised for sustained growth, with the potential for significant expansion in specialized segments like food packaging and e-commerce solutions.

North America Corrugated Board Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Corrugated Board Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Corrugated Board Packaging Market Regional Market Share

Geographic Coverage of North America Corrugated Board Packaging Market

North America Corrugated Board Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Demand from the E-commerce Sector; Growing Adoption of Light Weighting Materials and Scope for Printing Innovations

- 3.3. Market Restrains

- 3.3.1. Strict Environmental Regulation Regarding Deforestation

- 3.4. Market Trends

- 3.4.1. Strong Demand from the E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Corrugated Board Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sealed Air Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Smurfit Kappa Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 West Rock Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DS Smith PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Georgia-Pacific LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mondi PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oji Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 International Paper Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nippon Paper Industries Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Packaging Corporation of America

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cascades Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Sealed Air Corporation*List Not Exhaustive

List of Figures

- Figure 1: North America Corrugated Board Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Corrugated Board Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Corrugated Board Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Corrugated Board Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Corrugated Board Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Corrugated Board Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Corrugated Board Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Corrugated Board Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Corrugated Board Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Corrugated Board Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Corrugated Board Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Corrugated Board Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Corrugated Board Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Corrugated Board Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Corrugated Board Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Corrugated Board Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Corrugated Board Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Corrugated Board Packaging Market?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the North America Corrugated Board Packaging Market?

Key companies in the market include Sealed Air Corporation*List Not Exhaustive, Smurfit Kappa Group, West Rock Company, DS Smith PLC, Georgia-Pacific LLC, Mondi PLC, Oji Holdings Corporation, International Paper Company, Nippon Paper Industries Co Ltd, Packaging Corporation of America, Cascades Inc.

3. What are the main segments of the North America Corrugated Board Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Demand from the E-commerce Sector; Growing Adoption of Light Weighting Materials and Scope for Printing Innovations.

6. What are the notable trends driving market growth?

Strong Demand from the E-commerce Sector.

7. Are there any restraints impacting market growth?

Strict Environmental Regulation Regarding Deforestation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Corrugated Board Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Corrugated Board Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Corrugated Board Packaging Market?

To stay informed about further developments, trends, and reports in the North America Corrugated Board Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence