Key Insights

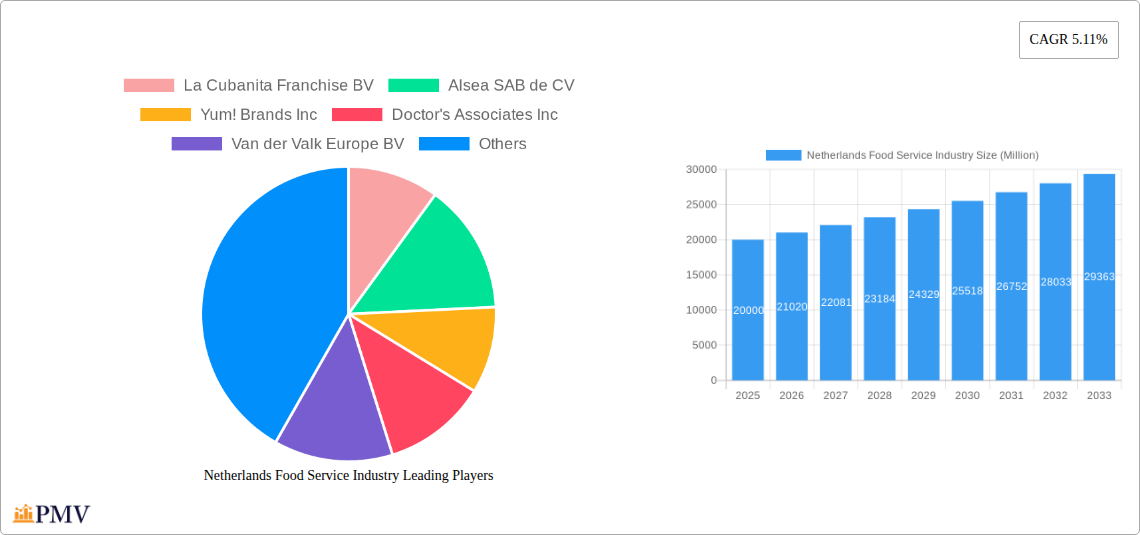

The Netherlands food service industry, valued at approximately €XX million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 5.11% from 2025 to 2033. This growth is fueled by several key drivers. A rising population and increasing disposable incomes contribute to higher consumer spending on food away from home. The increasing popularity of quick-service restaurants (QSRs) and diverse culinary experiences, coupled with a surge in tourism, further fuels demand. Strong performance from both chained and independent outlets across various segments—cafes, bars, other QSR cuisines, and locations encompassing leisure, lodging, retail, standalone establishments, and travel hubs—indicates a dynamic and diversified market. While potential restraints like fluctuating food prices and labor shortages exist, the overall outlook remains positive. Major players like McDonald's Corporation, Domino's Pizza Enterprises Ltd, and Alsea SAB de CV are well-positioned to capitalize on growth opportunities, indicating a competitive yet expanding market landscape. The Netherlands' strategic location within Europe and its thriving tourism sector will continue to bolster market expansion.

The segmentation within the Netherlands food service industry reveals significant opportunities. The QSR segment, particularly cafes and bars, shows strong growth potential driven by consumer preferences for convenience and diverse culinary offerings. The success of international franchises like Five Guys and Domino's highlights the appeal of globally recognized brands. However, independent outlets continue to thrive, reflecting the dynamism of the local culinary scene. Location-based segmentation reveals substantial contributions from leisure and tourism sectors, which are expected to further expand along with increasing numbers of tourists. Analyzing these segments allows for a deeper understanding of market dynamics and enables businesses to develop tailored strategies to leverage existing opportunities and mitigate potential challenges. The ongoing evolution of consumer preferences, technological advancements in ordering and delivery, and sustainability initiatives all present considerable opportunities for innovation and future growth within the Dutch food service sector.

Netherlands Food Service Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Netherlands food service industry, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic market. The report covers the period 2019-2033, with a focus on 2025 as the base and estimated year. We analyze market structure, competitive dynamics, key trends, dominant segments, and leading players, equipping you with the data-driven intelligence needed to make informed decisions. Projected market values are in Millions.

Netherlands Food Service Industry Market Structure & Competitive Dynamics

The Netherlands food service market exhibits a diverse structure, characterized by both established multinational chains and independent operators. Market concentration is moderate, with a few dominant players holding significant market share but numerous smaller businesses contributing substantially to the overall landscape. Innovation is driven by both large corporations investing in technological advancements and smaller businesses introducing novel concepts and cuisines. The regulatory framework, while generally supportive of business activity, includes food safety regulations and labor laws impacting operational costs. Product substitutes, such as home-cooked meals and meal delivery services, pose a competitive threat, especially within specific segments. End-user trends, including increasing demand for healthy and sustainable options and personalized experiences, are reshaping the market. M&A activity is relatively active, reflecting consolidation and expansion strategies. Recent deals include the acquisition of eight KFC restaurants by Collins Foods (February 2023). The estimated value of these transactions are approximately xx Million.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2025 est.).

- Innovation Ecosystem: Strong, driven by both established players and startups.

- Regulatory Framework: Generally supportive, with emphasis on food safety and labor standards.

- M&A Activity: Active, with deals averaging xx Million in value (2019-2024 average).

Netherlands Food Service Industry Industry Trends & Insights

The Netherlands food service industry is experiencing robust growth, driven by several key factors. The increasing urbanization and a growing young, working population fuel demand for convenient and diverse food options. Rising disposable incomes contribute to higher spending on food away from home. Technological disruptions, particularly in online ordering, delivery platforms, and contactless payments, are reshaping consumer behavior and operational efficiencies. Consumer preferences are shifting towards healthier options, sustainable practices, and personalized experiences, creating opportunities for businesses that cater to these demands. The CAGR for the industry is estimated at xx% during the forecast period (2025-2033), with market penetration of xx% by 2033. The competitive landscape remains dynamic, with existing players constantly adapting to changing consumer preferences and new entrants seeking market share.

Dominant Markets & Segments in Netherlands Food Service Industry

Within the Netherlands food service market, chained outlets dominate, driven by brand recognition, consistent quality, and efficient operations. The urban areas, particularly Amsterdam and Rotterdam, represent the strongest performing regions. Key segments include cafes & bars, and other QSR cuisines (Quick Service Restaurants).

- Key Drivers for Chained Outlets: Brand recognition, consistent quality, efficient operations, economies of scale.

- Key Drivers for Urban Areas: Higher population density, higher disposable incomes, greater tourism.

- Dominant Foodservice Type: QSR Cuisines, reflecting consumer preference for speed and convenience.

- Dominant Outlet Type: Chained Outlets, reflecting consumer preference for brand recognition and consistency.

- Dominant Location: Retail locations show high growth due to increasing convenience and foot traffic.

Netherlands Food Service Industry Product Innovations

Recent innovations focus on technological integration, enhancing customer experience, and adapting to health and sustainability trends. Digital ordering systems, loyalty programs, personalized meal options, and the adoption of sustainable packaging materials are prominent examples. These innovations aim to improve efficiency, customer satisfaction, and brand differentiation in a competitive market. The integration of technology also enables data-driven decision-making, optimization of supply chains, and personalized marketing strategies.

Report Segmentation & Scope

This report segments the Netherlands food service market by foodservice type (Cafes & Bars, Other QSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel). Each segment is analyzed for growth projections, market size, and competitive dynamics. For example, the cafes & bars segment shows a growth projection of xx% annually (2025-2033), driven by demand for social experiences. Chained outlets dominate in terms of market share due to their brand recognition and efficiency. Retail locations consistently show high growth due to ease of access and increased foot traffic. Growth projections vary across segments based on market trends, consumer preferences, and competitive dynamics.

Key Drivers of Netherlands Food Service Industry Growth

Several key factors are driving growth in the Netherlands food service industry. These include rising disposable incomes leading to increased spending on food outside the home, rapid urbanization, increasing tourism, and changing consumer preferences toward convenience and diverse culinary experiences. Government policies supporting small and medium-sized enterprises also play a role, along with technological advancements streamlining operations and enhancing customer experiences.

Challenges in the Netherlands Food Service Industry Sector

The industry faces challenges including rising labor costs, increasing competition from both established players and new entrants, and fluctuating food prices impacting profitability. Supply chain disruptions, especially those related to imported ingredients, pose significant risks. Meeting increasingly stringent food safety and environmental regulations represents an additional operational hurdle. These factors can all impact profitability and growth. The total impact in Millions is estimated to be xx during 2025-2033.

Leading Players in the Netherlands Food Service Industry Market

- La Cubanita Franchise BV

- Alsea SAB de CV

- Yum! Brands Inc

- Doctor's Associates Inc

- Van der Valk Europe BV

- Inter IKEA Holding BV

- Franchise Friendly Concepts BV

- Five Guys Enterprises LLC

- Spar International

- Autogrill SpA

- Bagels & Beans BV

- Domino's Pizza Enterprises Ltd

- Papa John's International Inc

- Meyer Horeca Group

- McDonald's Corporation

Key Developments in Netherlands Food Service Industry Sector

- March 2023: Bagels & Beans launched its food truck concept, "Bagelbus," expanding its reach and catering to mobile consumers.

- February 2023: Collins Foods Netherlands acquired eight KFC restaurants, increasing its market share and strengthening its presence.

- July 2022: The planned merger of Autogrill and Dufry, significantly altering the competitive landscape within the travel food service sector.

Strategic Netherlands Food Service Industry Market Outlook

The Netherlands food service industry is poised for continued growth, driven by evolving consumer preferences, technological advancements, and strategic investments. Businesses that adapt to the changing dynamics, embrace innovation, and focus on delivering exceptional customer experiences will be best positioned to capitalize on future market opportunities. Focus on sustainability, health consciousness, and personalized services will be crucial for success in the coming years. The market presents significant potential for both established players and new entrants, particularly those leveraging technology and data-driven strategies.

Netherlands Food Service Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Netherlands Food Service Industry Segmentation By Geography

- 1. Netherlands

Netherlands Food Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Penetration of various global brands in the market and the popularity of fast food make QSR the major segment in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 La Cubanita Franchise BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alsea SAB de CV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yum! Brands Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Doctor's Associates Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Van der Valk Europe BV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Inter IKEA Holding BV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Franchise Friendly Concepts BV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Five Guys Enterprises LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Spar International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Autogrill SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bagels & Beans BV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Domino's Pizza Enterprises Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Papa John's International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Meyer Horeca Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 McDonald's Corporation

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 La Cubanita Franchise BV

List of Figures

- Figure 1: Netherlands Food Service Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Food Service Industry Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Netherlands Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Netherlands Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Netherlands Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Netherlands Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Netherlands Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 8: Netherlands Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 9: Netherlands Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 10: Netherlands Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Food Service Industry?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the Netherlands Food Service Industry?

Key companies in the market include La Cubanita Franchise BV, Alsea SAB de CV, Yum! Brands Inc, Doctor's Associates Inc, Van der Valk Europe BV, Inter IKEA Holding BV, Franchise Friendly Concepts BV, Five Guys Enterprises LLC, Spar International, Autogrill SpA, Bagels & Beans BV, Domino's Pizza Enterprises Ltd, Papa John's International Inc, Meyer Horeca Group, McDonald's Corporation.

3. What are the main segments of the Netherlands Food Service Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

Penetration of various global brands in the market and the popularity of fast food make QSR the major segment in the country.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: Bagels & Beans launched its food truck concept called "Bagelbus".February 2023: Collins Foods Netherlands Operations, the fully owned Dutch subsidiary of Australia-based Collins Foods, signed a share purchase agreement to acquire eight KFC restaurants in the Netherlands. It will buy the restaurants from R Sambo Holding. Following the completion of the deal, the KFC restaurant network in the Netherlands under Collins Foods will increase to 56.July 2022: Autogrill and Dufry announced plans for a merger. Edizione, the investment arm of Italy's Benetton family, will transfer its entire stake of 50.3% in Autogrill to Dufry. Edizione will ultimately become Dufry's largest shareholder, with a stake of about 25% and 20% at the end of the transaction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Food Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Food Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Food Service Industry?

To stay informed about further developments, trends, and reports in the Netherlands Food Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence