Key Insights

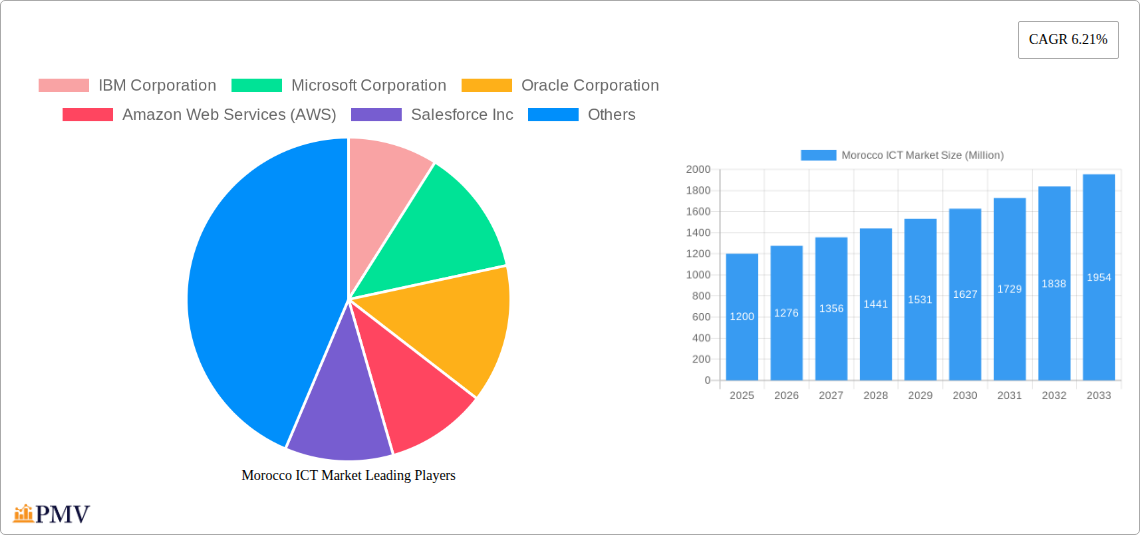

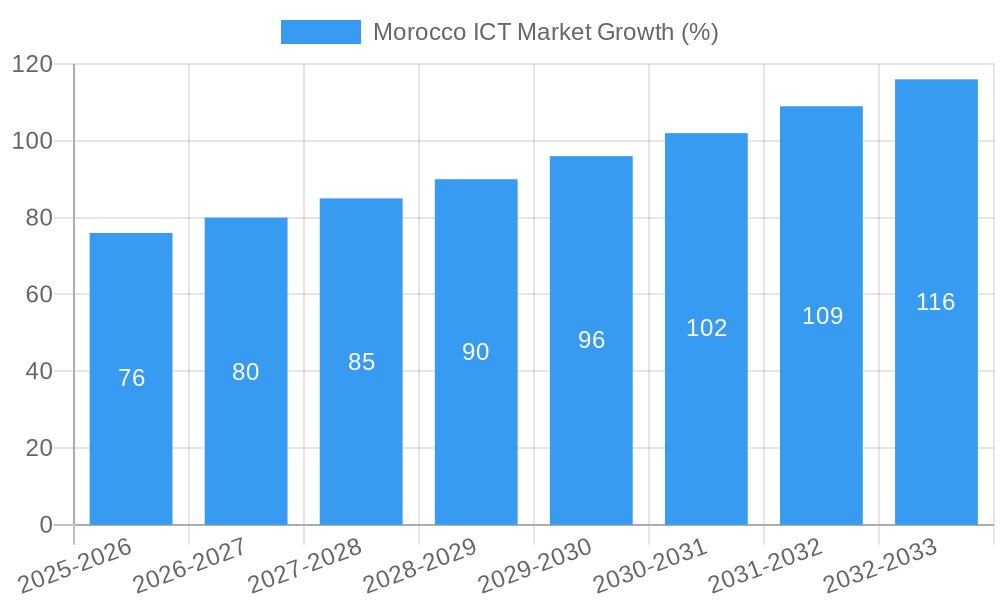

The Morocco ICT market, exhibiting a Compound Annual Growth Rate (CAGR) of 6.21% from 2019 to 2024, is poised for significant expansion over the forecast period of 2025-2033. While the precise market size in 2025 is not provided, considering a conservative estimate based on the CAGR and a likely upward trajectory due to increasing government investments in digital infrastructure and rising internet penetration, the market value could be projected in the range of $1-1.5 billion (USD). This growth is fueled by several key drivers: a burgeoning young and tech-savvy population driving demand for mobile devices and internet services, government initiatives promoting digital inclusion and e-governance, and increasing foreign direct investment (FDI) in the sector. Furthermore, the growing adoption of cloud computing, big data analytics, and Artificial Intelligence (AI) across various sectors (telecommunications, finance, and healthcare) is creating new opportunities for ICT companies operating in Morocco.

However, certain challenges remain. Limited digital literacy in certain segments of the population, infrastructure gaps in rural areas, and cybersecurity concerns represent potential restraints to the market's full potential. Nevertheless, the government's strategic focus on developing a robust digital ecosystem, coupled with the increasing adoption of mobile financial services (MFS) and the expansion of 4G and 5G networks, is expected to mitigate these challenges. Segmentation of the market likely includes areas such as telecommunications, software & services, IT hardware, and B2B & B2C ICT solutions. Major players like IBM, Microsoft, Oracle, AWS, and Salesforce are already active in the region, often collaborating with local providers such as Wipro and Capgemini to navigate the market nuances and cater to specific customer needs. The growth of the Moroccan ICT sector is strongly correlated with the nation's overall economic development, suggesting a bright outlook for sustained growth in the coming years.

Morocco ICT Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Morocco ICT market, covering its structure, competitive landscape, industry trends, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for businesses operating in or planning to enter the dynamic Moroccan ICT sector. The report utilizes data from the historical period (2019-2024) to predict market trends and growth opportunities until 2033. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Morocco ICT Market Market Structure & Competitive Dynamics

The Moroccan ICT market exhibits a moderately concentrated structure, with a few dominant players alongside numerous smaller, specialized firms. The market's innovation ecosystem is developing rapidly, driven by government initiatives to boost digitalization and attract foreign investment. The regulatory framework is undergoing constant evolution, aiming to balance promoting competition with ensuring cybersecurity and data privacy. Product substitution is a significant factor, particularly in the telecom sector with the rise of VoIP and mobile data services. End-user trends show a strong preference for mobile-first solutions and cloud-based services. M&A activity has been moderate, with deal values averaging xx Million per transaction in the past five years. Key metrics highlight that the top three players hold approximately 60% of the market share, indicative of the moderate concentration within the market. Future market dynamics will likely be shaped by further regulatory changes influencing data sovereignty, ongoing investments in digital infrastructure and the emergence of new technologies.

Morocco ICT Market Industry Trends & Insights

The Moroccan ICT market is experiencing robust growth, driven by increasing internet penetration, government investment in digital infrastructure, and the rising adoption of cloud computing and AI solutions. The Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033). Market penetration for key technologies like 4G/5G and cloud services is rapidly increasing, while the growth of e-commerce and fintech further fuels the demand for robust ICT infrastructure. Technological disruptions like the expanding adoption of IoT and the emergence of Edge computing are reshaping the competitive landscape. Consumer preferences are shifting towards personalized services, secure online transactions, and seamless digital experiences. This trend necessitates increased innovation and adaptation in the sector. Competitive dynamics are characterized by both local and international players vying for market share, leading to innovative solutions and price competition. The market is seeing increased collaboration in various sectors resulting in the emergence of new technologies and business models.

Dominant Markets & Segments in Morocco ICT Market

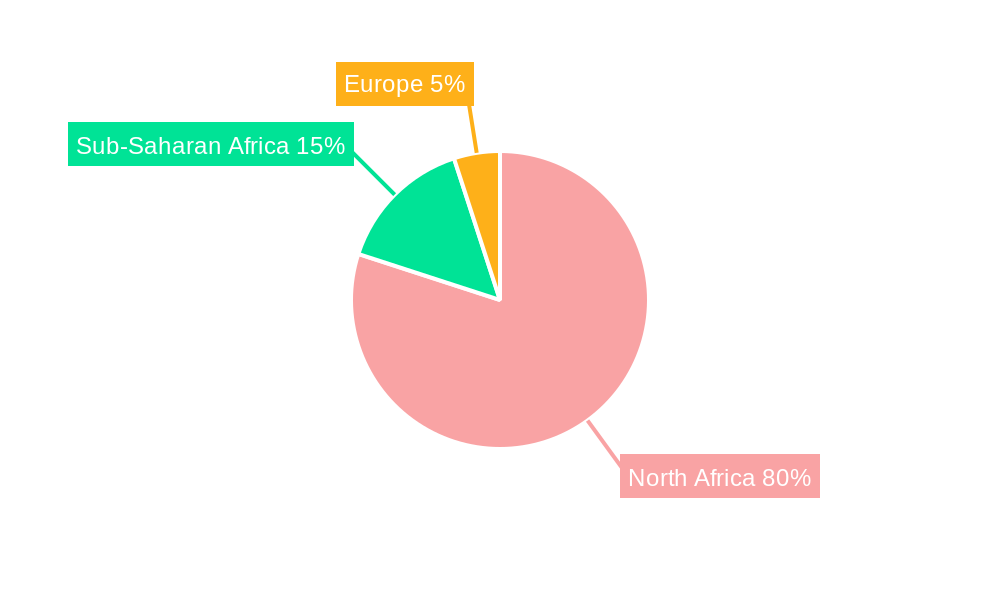

The largest segments of the Moroccan ICT market include telecommunications, IT services, and software. The Casablanca-Settat region demonstrates the most significant growth, driven by its concentration of businesses and a highly developed infrastructure.

- Key Drivers for Casablanca-Settat's Dominance:

- High concentration of businesses and skilled workforce.

- Well-developed telecommunications infrastructure.

- Government initiatives promoting ICT sector growth.

- Strong foreign investment in the region.

The dominance of Casablanca-Settat is further reinforced by its central location and access to major transportation networks. This strategic positioning facilitates efficient data transfer and connectivity, attracting significant investment in the region. This trend is expected to continue in the coming years.

Morocco ICT Market Product Innovations

Recent product innovations in the Moroccan ICT market have focused on cloud-based solutions, AI-powered services, and cybersecurity enhancements. Companies are emphasizing the development of products tailored to the specific needs of the Moroccan market, addressing issues such as affordability and language support. This focus on localization and addressing particular market needs significantly enhances market fit and fuels product adoption.

Report Segmentation & Scope

This report segments the Morocco ICT market based on technology (telecommunications, IT services, software), end-user (government, enterprises, consumers), and geographic location. Growth projections vary significantly across segments. The telecommunications segment is predicted to maintain a substantial market share, while the software segment experiences rapid growth propelled by increasing adoption of software-as-a-service (SaaS) models. Competitive dynamics within each segment vary based on the specific technological landscape and market size.

Key Drivers of Morocco ICT Market Growth

Several factors are driving the growth of the Morocco ICT market, including:

- Government initiatives to promote digitalization and attract foreign investment.

- Increasing internet and mobile phone penetration.

- Rising adoption of cloud computing and AI solutions.

- Growth of the e-commerce and fintech sectors.

- Investment in infrastructure development, particularly broadband networks.

These factors collectively create a favorable environment for growth and innovation within the Moroccan ICT sector.

Challenges in the Morocco ICT Market Sector

Despite the significant growth potential, the Moroccan ICT market faces several challenges:

- Limited access to financing for smaller ICT companies.

- Digital literacy gaps within the population.

- Cybersecurity threats and data privacy concerns.

- Competition from established international players.

- Infrastructure gaps in certain regions of the country.

Addressing these challenges is crucial for unlocking the full potential of the Moroccan ICT market.

Leading Players in the Morocco ICT Market Market

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Amazon Web Services (AWS)

- Salesforce Inc

- Wipro Limited

- Telefonaktiebolaget LM Ericsson

- Capgemini SE

- DXC Technology Company

- OnnVision

*List Not Exhaustive

Key Developments in Morocco ICT Market Sector

- July 2023: HCL Technologies inaugurated its Global Delivery Center (GDC) in Rabat, expanding its presence in the Moroccan IT services market. This signifies the growing importance of Morocco as a regional hub for IT services.

- January 2024: Inwi's partnership with the Medusa submarine cable system enhances Morocco's international connectivity, improving internet speed and reliability, creating a more competitive environment for businesses.

Strategic Morocco ICT Market Market Outlook

The Moroccan ICT market is poised for continued strong growth, driven by ongoing investment in digital infrastructure, expanding internet penetration, and the increasing adoption of advanced technologies. Strategic opportunities exist for companies that can offer innovative solutions tailored to the specific needs of the Moroccan market, focusing on affordability, accessibility, and digital inclusion. The government’s commitment to digital transformation will further propel market expansion, creating exciting prospects for both domestic and international players in the coming years.

Morocco ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication services

-

2. Size of Enterprises

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Morocco ICT Market Segmentation By Geography

- 1. Morocco

Morocco ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Digital Transformation Across the Industries; Rapid Development of 5G Network Across the Nation

- 3.3. Market Restrains

- 3.3.1. Rising Digital Transformation Across the Industries; Rapid Development of 5G Network Across the Nation

- 3.4. Market Trends

- 3.4.1. Rising Digital Transformation across Industries is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprises

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microsoft Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oracle Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amazon Web Services (AWS)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Salesforce Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wipro Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Telefonaktiebolaget LM Ericsson

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Capgemini SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DXC Technology Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OnnVision*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Morocco ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Morocco ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Morocco ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Morocco ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Morocco ICT Market Revenue Million Forecast, by Size of Enterprises 2019 & 2032

- Table 4: Morocco ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Morocco ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Morocco ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Morocco ICT Market Revenue Million Forecast, by Size of Enterprises 2019 & 2032

- Table 8: Morocco ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 9: Morocco ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco ICT Market?

The projected CAGR is approximately 6.21%.

2. Which companies are prominent players in the Morocco ICT Market?

Key companies in the market include IBM Corporation, Microsoft Corporation, Oracle Corporation, Amazon Web Services (AWS), Salesforce Inc, Wipro Limited, Telefonaktiebolaget LM Ericsson, Capgemini SE, DXC Technology Company, OnnVision*List Not Exhaustive.

3. What are the main segments of the Morocco ICT Market?

The market segments include Type, Size of Enterprises, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Digital Transformation Across the Industries; Rapid Development of 5G Network Across the Nation.

6. What are the notable trends driving market growth?

Rising Digital Transformation across Industries is Driving the Market.

7. Are there any restraints impacting market growth?

Rising Digital Transformation Across the Industries; Rapid Development of 5G Network Across the Nation.

8. Can you provide examples of recent developments in the market?

January 2024: Inwi, a telecommunication operator headquartered in Morocco, partnered with the Medusa submarine cable system. This collaboration is set to bolster Inwi's trans-Mediterranean connectivity. The Medusa cable, spanning from Nador in Morocco to Marseille in Southern Europe, is strategically positioned to cater to the escalating demands in fixed and internet traffic. It is designed to offer Inwi's clientele – both individual and corporate – a robust and varied network, ensuring heightened security and reliability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco ICT Market?

To stay informed about further developments, trends, and reports in the Morocco ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence