Key Insights

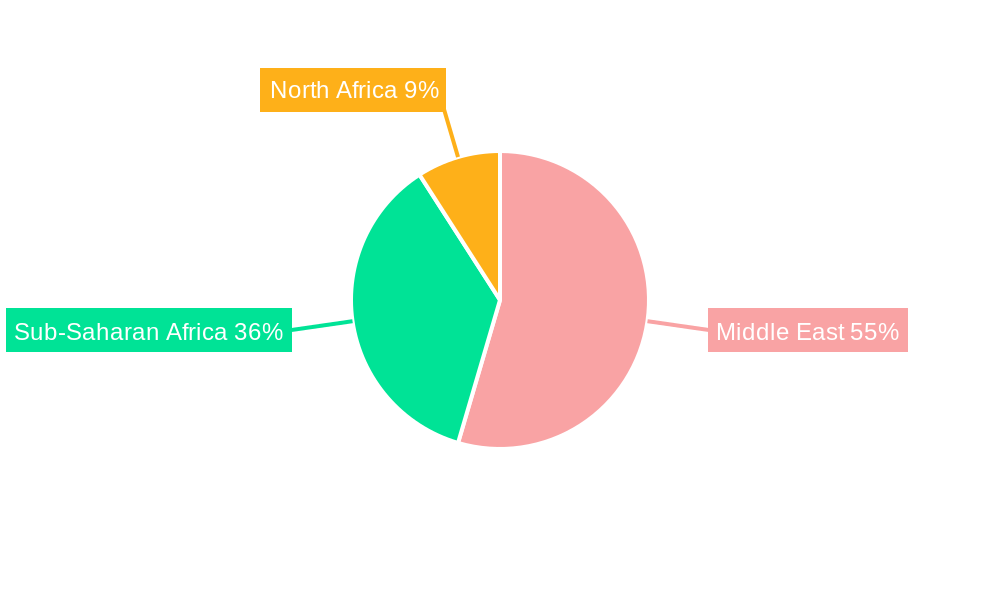

The Middle East and Africa premium chocolate market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 10.40% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across key regions like South Africa, Kenya, and the UAE are empowering consumers to indulge in premium chocolate products. A burgeoning middle class, particularly in urban centers, actively seeks high-quality, artisanal chocolate experiences, driving demand for premium brands. Furthermore, the increasing popularity of gourmet food and beverage trends, coupled with greater access to international brands through expanding online retail channels and upscale supermarkets, contributes significantly to market growth. The premium segment, encompassing dark, milk, and white premium chocolate, caters to discerning consumers who appreciate superior taste and quality ingredients. While fluctuating cocoa prices and economic instability in certain regions pose challenges, the overall market trajectory remains strongly positive. Competitive landscape analysis reveals key players such as Nestlé, Barry Callebaut, Mondelez, and Godiva are leveraging strategic partnerships and product innovation to solidify their market share. The diversity of distribution channels, including supermarkets, convenience stores, and online platforms, provides ample opportunity for growth across diverse consumer segments.

The African market, particularly in countries like South Africa, shows promising growth potential due to a growing consumer base and preference for imported premium chocolate. The Middle East, especially the UAE and other Gulf countries, exhibits high per capita consumption, contributing significantly to the overall regional demand. However, challenges such as fluctuating raw material costs, distribution logistics in certain parts of Africa, and intense competition amongst premium brands require strategic market adaptation and innovative product offerings to sustain long-term growth. Despite these factors, the long-term outlook for the Middle East and Africa premium chocolate market remains positive, driven by expanding consumer purchasing power and a growing appreciation for high-quality confectionery experiences. The market segmentation by product type and distribution channel indicates strong opportunities for tailoring marketing strategies to specific consumer preferences and market dynamics.

Middle East and Africa Premium Chocolate Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Middle East and Africa Premium Chocolate Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. Expect detailed segmentation, competitive landscape analysis, and future market projections, all contributing to a robust understanding of this lucrative market. The report values are expressed in Millions.

Middle East and Africa Premium Chocolate Market Structure & Competitive Dynamics

The Middle East and Africa premium chocolate market exhibits a moderately consolidated structure, with key players like Nestlé SA, Barry Callebaut, and Mondelez International Inc. holding significant market share. However, the presence of regional players like Mirzam Al Quoz and Al Nassma Chocolate LLC indicates a growing competitive landscape. The market is characterized by a dynamic innovation ecosystem, driven by consumer demand for unique flavors and experiences. Regulatory frameworks concerning food safety and labeling standards vary across the region, influencing market operations. Premium chocolate faces competition from confectionery alternatives and other indulgent treats. End-user trends reveal a rising preference for ethically sourced, sustainable chocolate products. Recent years have witnessed modest M&A activity, with deal values averaging xx Million annually. The largest deals have involved xx Million.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share.

- Innovation Ecosystems: Strong, driven by consumer demand for unique flavors and experiences.

- Regulatory Frameworks: Varied across the region, impacting operations.

- Product Substitutes: Confectionery alternatives, other indulgent treats.

- End-User Trends: Growing preference for ethical and sustainable products.

- M&A Activity: Modest, with average annual deal values of xx Million.

Middle East and Africa Premium Chocolate Market Industry Trends & Insights

The Middle East and Africa premium chocolate market is experiencing robust growth, driven by increasing disposable incomes, a burgeoning middle class, and changing consumer preferences toward premiumization. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements in chocolate processing and packaging enhance product quality and shelf life. The market penetration of premium chocolate remains relatively low in certain regions, offering significant growth potential. Competitive dynamics are shaping the market, with companies investing in product innovation, marketing, and distribution channels to gain market share. Consumer preferences are shifting towards healthier options and sustainable production practices.

Dominant Markets & Segments in Middle East and Africa Premium Chocolate Market

The Middle East and Africa premium chocolate market presents a dynamic landscape of growth and opportunity. While comprehensive market share data necessitates a dedicated report, preliminary findings highlight the UAE and South Africa as leading regional markets. Within the product segment, milk chocolate maintains a significant share due to its widespread appeal. However, the dark chocolate segment is experiencing robust growth, driven by the increasing health-consciousness of consumers seeking premium, high-cocoa options. Supermarkets and hypermarkets continue to dominate distribution, leveraging their widespread accessibility. Simultaneously, online retail channels are expanding rapidly, mirroring the broader e-commerce boom across the region.

- Key Markets: The UAE and South Africa demonstrate substantial market leadership, showcasing high consumption rates and strong growth potential.

- Product Segmentation: Milk chocolate remains the dominant product type, though the dark chocolate segment exhibits impressive growth fueled by health trends and premiumization.

- Distribution Channels: Supermarkets/hypermarkets retain their dominance due to accessibility, while online channels represent a rapidly evolving and significant distribution platform.

Market Drivers in Key Regions (UAE & South Africa):

- Rising Disposable Incomes: A burgeoning middle class with increased purchasing power fuels premium product consumption.

- Robust Tourism Sectors: Significant tourist spending contributes significantly to chocolate sales, particularly in prominent tourist destinations.

- Advanced Retail Infrastructure: Well-established retail networks and modern supply chains facilitate efficient product distribution and accessibility.

- Growing Awareness of Premium Chocolate: Increased consumer knowledge and appreciation of high-quality ingredients and artisanal production methods drive market demand.

Middle East and Africa Premium Chocolate Market Product Innovations

Recent innovations focus on unique flavor profiles tailored to regional preferences, such as the introduction of Mackintosh's Quality Street Oriental Selection by Nestlé. Sustainable sourcing and ethical production are also key aspects of product development. The use of innovative packaging materials enhances shelf life and product appeal. Technological advances in chocolate processing are improving the texture and taste of premium products. These innovations strengthen the competitive advantage of leading brands in a highly competitive market.

Report Segmentation & Scope

This detailed report segments the market based on product type (Dark Premium Chocolate, Milk Premium Chocolate, White Premium Chocolate) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Other). Each segment's growth trajectory, market size, competitive landscape, and regional variations are comprehensively analyzed. The report also incorporates detailed consumer preference data, providing granular insights into market dynamics. Rigorous market research underpins the detailed growth projections provided for each segment.

Key Drivers of Middle East and Africa Premium Chocolate Market Growth

The growth of the Middle East and Africa premium chocolate market is fueled by several key factors. The rise in disposable incomes, especially within the expanding middle class, is a major catalyst. The increasing preference for premiumization, the desire for high-quality indulgent experiences, and a growing appreciation for artisanal chocolate are all significant contributing factors. The development of modern retail infrastructure, coupled with the surge in e-commerce, is expanding access to premium chocolate across the region. Furthermore, tourism plays a pivotal role in boosting sales, particularly in major markets like the UAE.

Challenges in the Middle East and Africa Premium Chocolate Market Sector

Despite the considerable growth potential, the Middle East and Africa premium chocolate market faces several challenges. Volatility in cocoa prices poses a significant threat to profitability. Strict food safety and labeling regulations necessitate careful compliance. Supply chain disruptions can cause instability and affect product availability. Finally, intense competition from established international and regional brands creates pressure on margins and necessitates strategic differentiation.

Leading Players in the Middle East and Africa Premium Chocolate Market Market

- Nestle SA

- Barry Callebaut

- Mirzam Al Quoz

- Cocoa Sampaka

- Mars Incorporated

- Al Nassma Chocolate LLC

- Mondelez International Inc

- Godiva

- Kees Beyers Chocolate CC

- Chocoladefabriken Lindt & Sprngli AG

Key Developments in Middle East and Africa Premium Chocolate Market Sector

- December 2022: Läderach, a Swiss chocolatier, opened a new store in Dubai Mall.

- July 2022: Nestlé launched Mackintosh's Quality Street Oriental Selection, a travel retail exclusive with Dubai Duty-Free.

- October 2021: Barry Callebaut opened a new Chocolate Academy in Dubai.

Strategic Middle East and Africa Premium Chocolate Market Outlook

The Middle East and Africa premium chocolate market presents significant growth opportunities for businesses willing to adapt to evolving consumer preferences. Strategic investments in product innovation, sustainable sourcing, and effective distribution channels are crucial for success. Capitalizing on the rising demand for ethically sourced and unique flavor profiles will be key to achieving market leadership. The expansion into online retail channels and targeting younger demographics will unlock further growth potential.

Middle East and Africa Premium Chocolate Market Segmentation

-

1. Product Type

- 1.1. Dark Premium Chocolate

- 1.2. White and Milk Premium Chocolate

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Channels

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. South Africa

- 3.2. Saudi Arabia

- 3.3. United Arab Emirates

- 3.4. Rest of Middle East and Africa

Middle East and Africa Premium Chocolate Market Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. United Arab Emirates

- 4. Rest of Middle East and Africa

Middle East and Africa Premium Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. Health Benefits of High Quality Premium Chocolates Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dark Premium Chocolate

- 5.1.2. White and Milk Premium Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Saudi Arabia

- 5.3.3. United Arab Emirates

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Dark Premium Chocolate

- 6.1.2. White and Milk Premium Chocolate

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets and Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Channels

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Saudi Arabia

- 6.3.3. United Arab Emirates

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Saudi Arabia Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Dark Premium Chocolate

- 7.1.2. White and Milk Premium Chocolate

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets and Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Channels

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Saudi Arabia

- 7.3.3. United Arab Emirates

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. United Arab Emirates Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Dark Premium Chocolate

- 8.1.2. White and Milk Premium Chocolate

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets and Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Channels

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Saudi Arabia

- 8.3.3. United Arab Emirates

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East and Africa Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Dark Premium Chocolate

- 9.1.2. White and Milk Premium Chocolate

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets and Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Channels

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Saudi Arabia

- 9.3.3. United Arab Emirates

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South Africa Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Nestle SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Barry Callebaut

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Mirzam Al Quoz

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Cocoa Sampaka

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Mars Incorporated

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Al Nassma Chocolate LLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Mondelez International Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Godiva

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Kees Beyers Chocolate CC*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Chocoladefabriken Lindt & Sprngli AG

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Nestle SA

List of Figures

- Figure 1: Middle East and Africa Premium Chocolate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Premium Chocolate Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 3: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Product Type 2019 & 2032

- Table 5: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Geography 2019 & 2032

- Table 9: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 11: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 13: South Africa Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 15: Sudan Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Sudan Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 17: Uganda Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Uganda Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 19: Tanzania Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tanzania Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 21: Kenya Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kenya Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Africa Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Africa Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 25: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Product Type 2019 & 2032

- Table 27: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Geography 2019 & 2032

- Table 31: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 33: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Product Type 2019 & 2032

- Table 35: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Distribution Channel 2019 & 2032

- Table 37: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Geography 2019 & 2032

- Table 39: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 41: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 42: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Product Type 2019 & 2032

- Table 43: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 44: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Distribution Channel 2019 & 2032

- Table 45: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Geography 2019 & 2032

- Table 47: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 49: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Product Type 2019 & 2032

- Table 51: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Distribution Channel 2019 & 2032

- Table 53: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Geography 2019 & 2032

- Table 55: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Premium Chocolate Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the Middle East and Africa Premium Chocolate Market?

Key companies in the market include Nestle SA, Barry Callebaut, Mirzam Al Quoz, Cocoa Sampaka, Mars Incorporated, Al Nassma Chocolate LLC, Mondelez International Inc, Godiva, Kees Beyers Chocolate CC*List Not Exhaustive, Chocoladefabriken Lindt & Sprngli AG.

3. What are the main segments of the Middle East and Africa Premium Chocolate Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

Health Benefits of High Quality Premium Chocolates Drives the Market Growth.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

December 2022: The inauguration of a new store in Dubai was announced by Mohammed Rasool Khoory and Sons and Läderach, one of the largest artisanal chocolatiers in Switzerland, producing its own chocolate since 2012. The new Läderach store is situated in Dubai Mall, on the lower ground floor of the complex.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Premium Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Premium Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Premium Chocolate Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Premium Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence