Key Insights

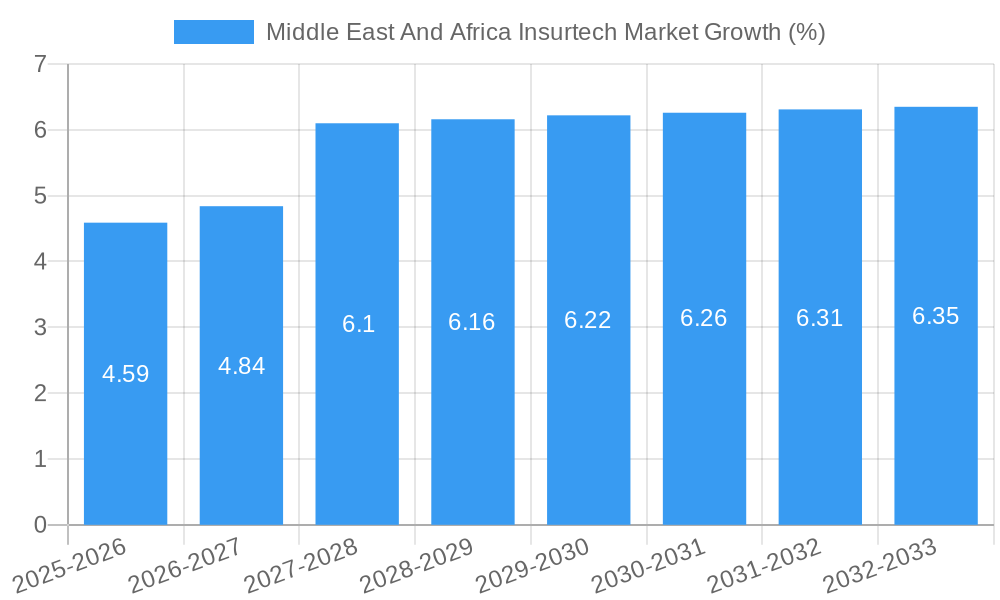

The Middle East and Africa Insurtech market, valued at $76.32 million in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, rising internet usage, and a young, tech-savvy population. This burgeoning market is characterized by a Compound Annual Growth Rate (CAGR) of 6.0%, indicating significant expansion opportunities over the forecast period (2025-2033). Key drivers include the region's expanding digital economy, government initiatives promoting financial inclusion, and the need for efficient and accessible insurance solutions. The increasing adoption of mobile-first solutions, AI-powered risk assessment, and blockchain technology for fraud prevention are shaping market trends. While regulatory hurdles and infrastructural limitations in certain regions pose challenges, the overall market outlook remains positive. Significant growth is anticipated in areas like embedded insurance, personalized policies, and telematics-based offerings, catering to the evolving needs of consumers and businesses. The competitive landscape is dynamic, with both established players like Old Mutual and Liberty Holdings and innovative startups like Bayzat and Yallacompare vying for market share. This competition fosters innovation and drives the development of increasingly sophisticated and customer-centric solutions.

The forecast period (2025-2033) will witness a continuous rise in the adoption of Insurtech solutions across the Middle East and Africa. This growth will be fueled by the expansion of digital infrastructure, a rising middle class with increasing disposable incomes, and a growing awareness of the benefits of insurance. The market will see significant investments in technological advancements aimed at improving customer experience, operational efficiency, and risk management. The competitive intensity is expected to increase, encouraging players to differentiate their offerings through strategic partnerships, mergers and acquisitions, and the development of niche products. Geographical expansion will also play a crucial role, with companies targeting underserved markets and expanding their reach across diverse regions within the MEA landscape. This expansion will be driven by opportunities to deliver insurance solutions to a broader customer base and tap into the region's immense growth potential.

Middle East & Africa Insurtech Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa Insurtech market, covering the period from 2019 to 2033. It offers invaluable insights into market structure, competitive dynamics, industry trends, dominant segments, and key growth drivers, enabling businesses to make informed strategic decisions. The report leverages extensive data analysis and expert insights to present a detailed forecast for the period 2025-2033, with 2025 serving as the base and estimated year. The historical period covered is 2019-2024.

Middle East And Africa Insurtech Market Market Structure & Competitive Dynamics

The Middle East and Africa Insurtech market is characterized by a dynamic interplay of established players and emerging startups. Market concentration is currently [xx]% with the top 5 players holding approximately [xx]% of the market share in 2024. The competitive landscape is shaped by factors such as regulatory frameworks, varying levels of technological adoption across countries, and consumer preferences. Innovation ecosystems are developing rapidly, particularly in the UAE and South Africa, fostering the growth of Insurtech startups. Significant M&A activity has been observed, with deal values exceeding [xx] Million in the past five years. These activities reflect the increasing consolidation within the sector and the pursuit of expansion by both regional and global players.

- Market Concentration: [xx]% in 2024, with top 5 players holding [xx]%.

- M&A Activity: Deal values exceeding [xx] Million (2019-2024).

- Key Players: ERGO Sigorta, Harel Insurance Investments & Finance Services, Bayzat, Aqeed, Yallacompare, Migdal Holdings, Old Mutual, Liberty Holdings, Clal Insurance Enterprises Holdings Ltd, Momentum Metropolitan Life Assurers, Emirates Retakaful Limited (List Not Exhaustive).

- Regulatory Frameworks: Vary significantly across the region, impacting market entry and operations.

- Product Substitutes: Traditional insurance models still hold significant market share, posing a competitive challenge to Insurtech solutions.

- End-User Trends: Growing adoption of digital channels and increasing demand for personalized insurance solutions.

Middle East And Africa Insurtech Market Industry Trends & Insights

The Middle East and Africa Insurtech market is experiencing robust growth, driven by factors such as rising smartphone penetration, increasing internet usage, and a young, tech-savvy population. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at [xx]%, indicating significant expansion potential. Technological disruptions, such as AI, blockchain, and big data analytics, are revolutionizing the insurance sector, enabling personalized offerings, improved risk assessment, and streamlined claims processing. Consumer preferences are shifting towards digital-first solutions offering convenience, transparency, and cost-effectiveness. This trend is further fueled by the increasing adoption of mobile payment gateways and digital wallets. The market penetration of Insurtech solutions is projected to reach [xx]% by 2033, significantly exceeding current levels. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of innovative startups.

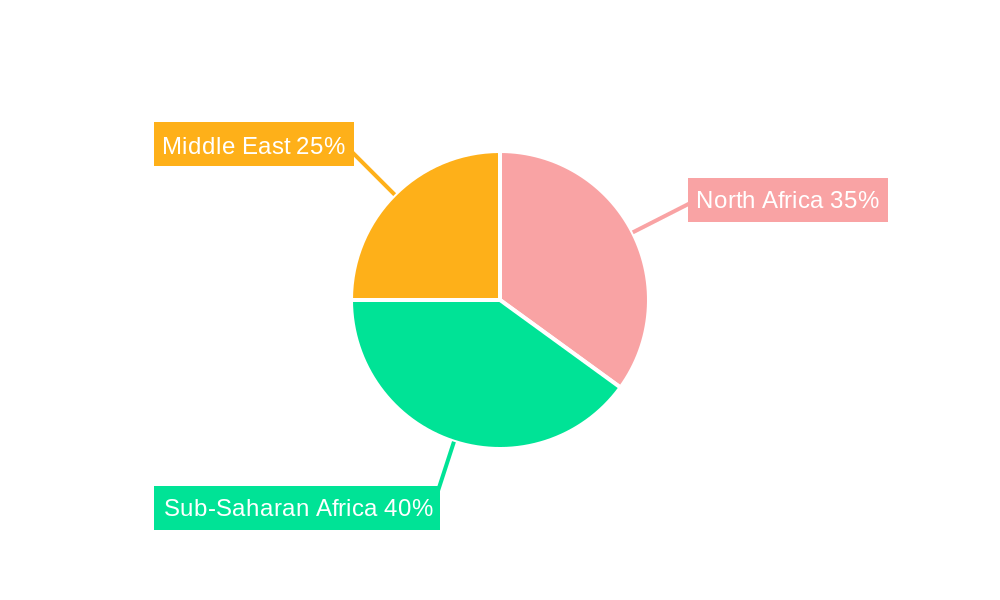

Dominant Markets & Segments in Middle East And Africa Insurtech Market

The UAE and South Africa currently dominate the Middle East and Africa Insurtech market, driven by favorable regulatory environments, robust technological infrastructure, and a significant concentration of Insurtech companies.

- UAE:

- Key Drivers: Strong government support for technological innovation, advanced digital infrastructure, and a large expatriate population familiar with digital services.

- South Africa:

- Key Drivers: Developed financial sector, relatively advanced digital infrastructure, and a burgeoning startup ecosystem.

- Other Key Markets: Kenya, Nigeria, and Egypt are also emerging as important markets, driven by increasing smartphone penetration and a growing demand for affordable insurance solutions. However, challenges remain related to infrastructure and digital literacy.

The dominance of the UAE and South Africa stems from a confluence of factors including proactive government policies supporting technological advancements, investments in digital infrastructure, a vibrant startup ecosystem, and a significant pool of tech-savvy consumers. These factors create a fertile ground for Insurtech development and growth, attracting significant investment and fostering innovation within the industry.

Middle East And Africa Insurtech Market Product Innovations

Significant product innovations are transforming the insurance landscape. These include AI-powered chatbots for customer service, telematics-based auto insurance, blockchain-based fraud detection systems, and personalized health insurance plans leveraging wearable technology data. These innovations enhance customer experience, improve risk assessment, and optimize operational efficiency. The market is witnessing a rapid shift towards embedded insurance, seamlessly integrating insurance solutions within other platforms and services. This trend is driving widespread accessibility and reducing friction in the customer journey.

Report Segmentation & Scope

The Middle East and Africa Insurtech market is segmented by insurance type (life, non-life, health), technology (AI, blockchain, IoT), distribution channel (online, offline), and geography. Each segment exhibits unique growth dynamics and competitive landscapes. For example, the health Insurtech segment is experiencing rapid growth driven by rising healthcare costs and increasing awareness of health and wellness. The market size for each segment is projected to expand significantly during the forecast period, with variations in growth rates across different segments.

Key Drivers of Middle East And Africa Insurtech Market Growth

Several factors are driving the growth of the Middle East and Africa Insurtech market. These include:

- Technological advancements: AI, machine learning, and big data analytics are improving efficiency and personalization.

- Favorable regulatory environment: Governments in several countries are promoting fintech and Insurtech innovation.

- Rising smartphone penetration and internet usage: Increasing digital adoption facilitates the reach of Insurtech solutions.

- Growing demand for affordable and accessible insurance: Insurtech offers solutions that cater to the needs of underserved populations.

Challenges in the Middle East And Africa Insurtech Market Sector

Despite strong growth potential, several challenges hinder the Middle East and Africa Insurtech market's expansion. These include regulatory hurdles in some countries, concerns over data privacy and security, infrastructure limitations in certain regions, and the need for greater digital literacy among consumers. These factors contribute to a slower-than-expected adoption rate in certain areas, creating barriers for seamless growth. The impact of these challenges is estimated at a [xx]% reduction in market potential.

Leading Players in the Middle East And Africa Insurtech Market Market

- ERGO Sigorta

- Harel Insurance Investments & Finance Services

- Bayzat

- Aqeed

- Yallacompare

- Migdal Holdings

- Old Mutual

- Liberty Holdings

- Clal Insurance Enterprises Holdings Ltd

- Momentum Metropolitan Life Assurers

- Emirates Retakaful Limited

Key Developments in Middle East And Africa Insurtech Market Sector

- May 2022: Turtlemint Insurance Services Pvt. Ltd. launched its Dubai office to expand in the Middle East.

- July 2022: Wellx, a UAE-based health Insurtech platform, secured USD 2 Million in seed funding.

Strategic Middle East And Africa Insurtech Market Market Outlook

The Middle East and Africa Insurtech market presents significant opportunities for growth and innovation. The increasing adoption of digital technologies, coupled with supportive regulatory frameworks and a growing demand for insurance solutions, will drive considerable market expansion. Strategic partnerships between established insurers and Insurtech startups will play a crucial role in shaping the future of the industry. Focus on developing innovative products and services catering to specific regional needs will be key to achieving success in this dynamic market.

Middle East And Africa Insurtech Market Segmentation

-

1. Service

- 1.1. Consulting

- 1.2. Support and Maintenance

- 1.3. Managed Services

-

2. Insurance type

- 2.1. Life

- 2.2. Non-Life

- 2.3. Other Segments

Middle East And Africa Insurtech Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Insurtech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In Expenditure On Digital Innovation By Insurance Companies; Increase In Number Of Fintech Companies In The Region

- 3.3. Market Restrains

- 3.3.1. Rise In Expenditure On Digital Innovation By Insurance Companies; Increase In Number Of Fintech Companies In The Region

- 3.4. Market Trends

- 3.4.1. Rising Digitization of Insurance Business

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Insurtech Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Consulting

- 5.1.2. Support and Maintenance

- 5.1.3. Managed Services

- 5.2. Market Analysis, Insights and Forecast - by Insurance type

- 5.2.1. Life

- 5.2.2. Non-Life

- 5.2.3. Other Segments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ERGO Sigorta

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Harel Insurance Investments & Finance Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayzat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aqeed

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yallacompare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Migdal Holdings

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Old Mutual

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Liberty Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Clal Insurance Enterprises Holdings Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Momentum Metropolitan Life Assurers

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Emirates Retakaful Limited**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 ERGO Sigorta

List of Figures

- Figure 1: Middle East And Africa Insurtech Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East And Africa Insurtech Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East And Africa Insurtech Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East And Africa Insurtech Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Middle East And Africa Insurtech Market Revenue Million Forecast, by Service 2019 & 2032

- Table 4: Middle East And Africa Insurtech Market Volume Million Forecast, by Service 2019 & 2032

- Table 5: Middle East And Africa Insurtech Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: Middle East And Africa Insurtech Market Volume Million Forecast, by Insurance type 2019 & 2032

- Table 7: Middle East And Africa Insurtech Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle East And Africa Insurtech Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Middle East And Africa Insurtech Market Revenue Million Forecast, by Service 2019 & 2032

- Table 10: Middle East And Africa Insurtech Market Volume Million Forecast, by Service 2019 & 2032

- Table 11: Middle East And Africa Insurtech Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 12: Middle East And Africa Insurtech Market Volume Million Forecast, by Insurance type 2019 & 2032

- Table 13: Middle East And Africa Insurtech Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Middle East And Africa Insurtech Market Volume Million Forecast, by Country 2019 & 2032

- Table 15: Saudi Arabia Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Saudi Arabia Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: United Arab Emirates Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Israel Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Qatar Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Qatar Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Kuwait Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Kuwait Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Oman Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Oman Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Bahrain Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Bahrain Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Jordan Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Jordan Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 31: Lebanon Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Lebanon Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Insurtech Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Middle East And Africa Insurtech Market?

Key companies in the market include ERGO Sigorta, Harel Insurance Investments & Finance Services, Bayzat, Aqeed, Yallacompare, Migdal Holdings, Old Mutual, Liberty Holdings, Clal Insurance Enterprises Holdings Ltd, Momentum Metropolitan Life Assurers, Emirates Retakaful Limited**List Not Exhaustive.

3. What are the main segments of the Middle East And Africa Insurtech Market?

The market segments include Service, Insurance type.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In Expenditure On Digital Innovation By Insurance Companies; Increase In Number Of Fintech Companies In The Region.

6. What are the notable trends driving market growth?

Rising Digitization of Insurance Business.

7. Are there any restraints impacting market growth?

Rise In Expenditure On Digital Innovation By Insurance Companies; Increase In Number Of Fintech Companies In The Region.

8. Can you provide examples of recent developments in the market?

In May 2022, Turtlemint Insurance Services Pvt. Ltd which exists as an Indian-based Insurtech firm launched its office in Dubai as a central hub for the company’s business expansion in the Middle East region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Insurtech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Insurtech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Insurtech Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Insurtech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence