Key Insights

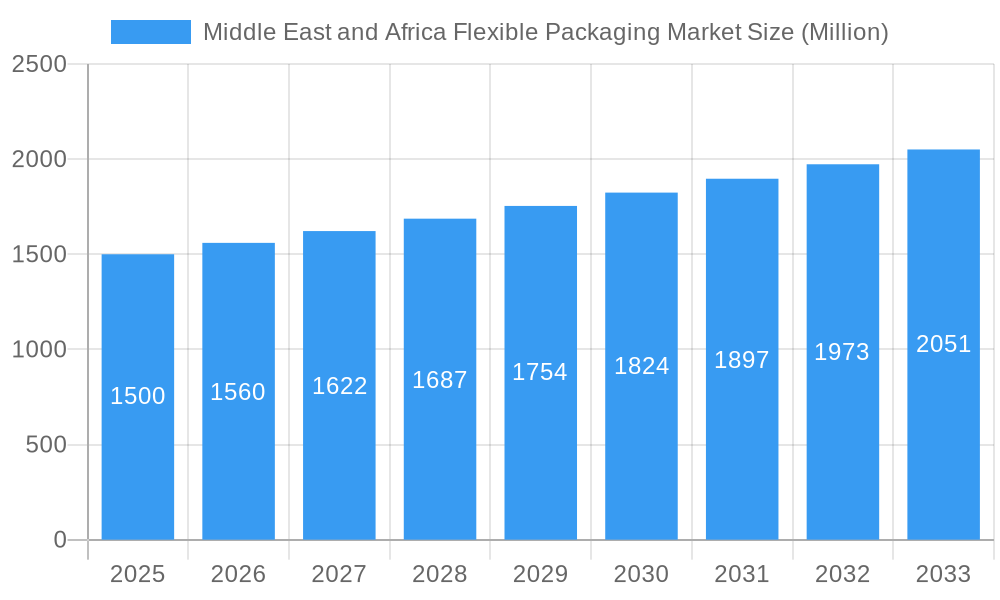

The Middle East and Africa (MEA) flexible packaging market is poised for significant expansion, projected to reach $301.2 billion by 2025 and grow at a compound annual growth rate (CAGR) of 4.2% from 2025 to 2033. This growth is primarily attributed to the expanding food and beverage sector across key markets like the UAE, Saudi Arabia, and Nigeria, driven by increasing consumer demand for convenient food options. The rise of e-commerce and online grocery services also necessitates advanced, safe, and freshness-preserving packaging solutions. Innovations in packaging technology, including retort and stand-up pouches offering extended shelf life and improved product presentation, further fuel market demand. While raw material price volatility and the demand for sustainable packaging present challenges, manufacturers are actively investing in eco-friendly alternatives. Regional segmentation indicates strong opportunities in economically developing and rapidly urbanizing nations. The market offers diverse product types, such as pouches, bags, and films, alongside a variety of resin options to meet specific application needs. Leading global players like Amcor, Uflex Limited, and Huhtamaki Group are key participants in this evolving landscape.

Middle East and Africa Flexible Packaging Market Market Size (In Billion)

Polyethylene (PE) and Bi-oriented Polypropylene (BOPP) remain dominant resin types in the MEA flexible packaging market due to their cost-effectiveness and versatility. However, a notable growth opportunity lies in the increasing adoption of sustainable materials, including biodegradable polymers, aligning with growing environmental consciousness. The food industry continues to lead end-user adoption, with significant growth potential anticipated in the personal care and healthcare sectors as they evolve and require enhanced packaging quality. The MEA region's demographic and economic dynamics are expected to drive growth surpassing other global markets. Geographical expansion is particularly robust in North Africa and Sub-Saharan Africa, fueled by a growing middle class. These trends present considerable investment prospects for established companies and new entrants targeting specialized market segments across the diverse MEA region.

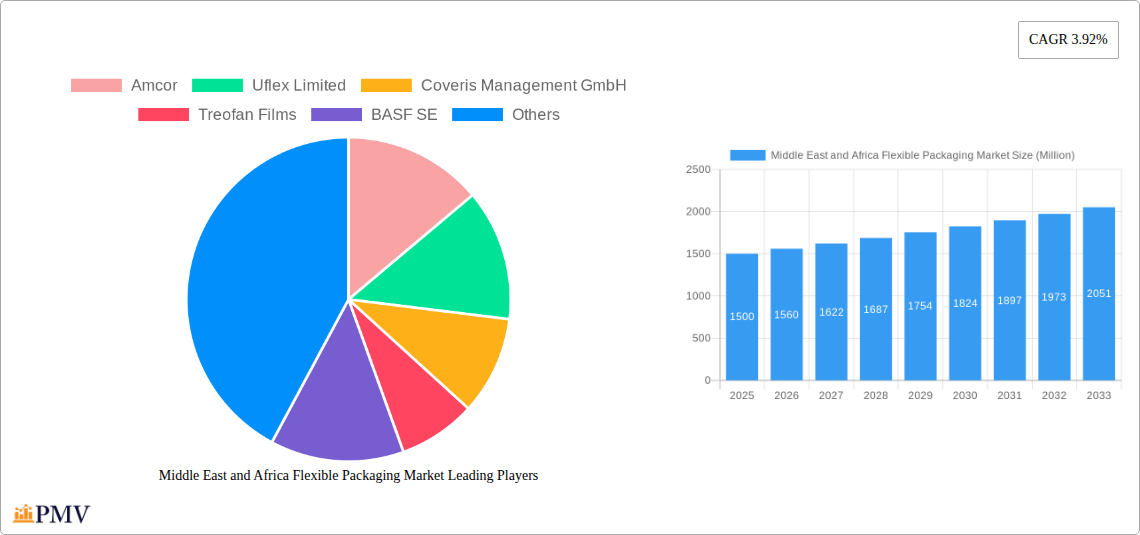

Middle East and Africa Flexible Packaging Market Company Market Share

Middle East and Africa Flexible Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Middle East and Africa (MEA) flexible packaging market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The report utilizes a combination of qualitative and quantitative data to provide a holistic understanding of this dynamic market. The total market value in 2025 is estimated at xx Million, projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Middle East and Africa Flexible Packaging Market Market Structure & Competitive Dynamics

The MEA flexible packaging market exhibits a moderately concentrated structure, with several multinational corporations and regional players vying for market share. Amcor, Uflex Limited, Coveris Management GmbH, Treofan Films, BASF SE, Huhtamaki Group, Napco Group, Gulf Packaging Industries Limited, Mondi Plc, and DowDuPont are some of the key players, although the market also includes numerous smaller, localized businesses. The market share held by the top five players in 2024 was approximately xx%, indicating room for both consolidation and the emergence of new competitors.

Innovation is crucial, with ongoing developments in materials science, printing technologies (like flexo printing), and sustainable packaging solutions. Regulatory frameworks concerning food safety, recyclability, and material composition significantly influence market trends. Substitute packaging materials, such as rigid containers, present competitive pressure, while the increasing demand for convenience and extended shelf life fuels growth. Mergers and acquisitions (M&A) are prominent, with recent deals (like Huhtamaki's acquisition of Elif) reshaping the competitive landscape. The total value of M&A deals within the MEA flexible packaging market between 2019 and 2024 was approximately xx Million. These activities often aim to enhance technological capabilities, expand market reach, and improve product portfolios.

Middle East and Africa Flexible Packaging Market Industry Trends & Insights

The MEA flexible packaging market is experiencing robust growth, driven by several key factors. The expanding food and beverage industry, particularly in rapidly growing economies like Saudi Arabia and Nigeria, fuels strong demand for flexible packaging solutions. The rising popularity of convenient, ready-to-eat meals and single-serve portions further intensifies this growth. Technological advancements, such as improved barrier films and sustainable materials (with increased recyclability), are transforming the market. Consumer preferences are shifting towards eco-friendly and functional packaging, creating opportunities for innovative solutions. Competitive dynamics are characterized by both intense rivalry and collaborative partnerships, with companies focusing on differentiation through product innovation and enhanced sustainability. Market penetration of sustainable packaging is gradually increasing, although challenges remain regarding the necessary infrastructure and consumer awareness.

Dominant Markets & Segments in Middle East and Africa Flexible Packaging Market

The UAE and Saudi Arabia dominate the MEA flexible packaging market, driven by their robust economies, developed infrastructure, and growing consumer demand. Nigeria and South Africa are also emerging as significant markets, with increasing urbanization and rising disposable incomes. Within segments:

- By Resin Type: Polyethylene (PE) holds the largest market share, due to its cost-effectiveness and versatility. However, BOPP and CPP are gaining traction due to improved barrier properties.

- By Product Type: Pouches (particularly stand-up pouches) and bags are high-demand product types, driven by convenience and appealing presentation.

- By End-user: The food and beverage sector is the primary end-user, accounting for the largest proportion of market revenue. The healthcare and personal care sectors also demonstrate significant growth potential.

- By Country: The UAE's sophisticated infrastructure, high consumer spending, and presence of major food and beverage companies contribute to its market leadership. Saudi Arabia shows similar trends, bolstered by its large population and growing retail sector. Nigeria and South Africa are characterized by rapidly expanding populations and a rising middle class, driving demand, though infrastructure limitations pose challenges.

Key drivers vary by region: the UAE and Saudi Arabia benefit from supportive economic policies and robust infrastructure, while Nigeria and South Africa require investments in logistics and manufacturing capabilities to fully unlock their potential.

Middle East and Africa Flexible Packaging Market Product Innovations

Recent innovations focus on enhanced barrier properties, improved recyclability, and improved printing capabilities. Active and intelligent packaging technologies are gaining prominence, extending shelf life and enhancing product safety. Sustainable materials, such as bio-based polymers and recycled content, are attracting significant attention, aligning with growing environmental consciousness. These innovations cater to the evolving demands of consumers and regulatory pressures, offering competitive advantages to businesses adopting these advancements.

Report Segmentation & Scope

This report provides a granular segmentation of the MEA flexible packaging market:

By Country: UAE, Saudi Arabia, Nigeria, South Africa, Egypt, and Rest of MEA. By Resin Type: Polyethylene (PE), Bi-oriented Polypropylene (BOPP), Cast Polypropylene (CPP), Polyvinyl Chloride (PVC), PET, and Other Material Types (EVOH, PA, etc.). By Product Type: Pouches (Retort & Stand-up), Bags (Gussetted & Wicketed), and Packaging Films. By End-user: Food, Beverage, Healthcare, Personal Care & Cosmetics, and Other End-users.

Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing a comprehensive understanding of the market's various components.

Key Drivers of Middle East and Africa Flexible Packaging Market Growth

The MEA flexible packaging market’s growth is propelled by several key factors: a rapidly expanding population, particularly in sub-Saharan Africa; rising disposable incomes; a booming food and beverage industry; increased consumer preference for convenient packaging; and governmental initiatives promoting local manufacturing. Technological advancements in materials science and printing technologies also contribute significantly.

Challenges in the Middle East and Africa Flexible Packaging Market Sector

Challenges include limited access to advanced technologies in some regions, infrastructural constraints affecting supply chain efficiency, intense competition from both established and emerging players, and fluctuating raw material prices. Regulatory hurdles related to food safety and environmental regulations add complexity. These factors often lead to increased production costs and reduced profitability for some companies.

Leading Players in the Middle East and Africa Flexible Packaging Market Market

- Amcor

- Uflex Limited

- Coveris Management GmbH

- Treofan Films

- BASF SE

- Huhtamaki Group

- Napco Group

- Gulf Packaging Industries Limited

- Mondi Plc

- DowDuPont

*List Not Exhaustive

Key Developments in Middle East and Africa Flexible Packaging Market Sector

- September 2021: Huhtamaki acquired Elif, a flexible packaging company known for its nearly recyclable products and advanced flexo printing and polyethylene (PE) film production technologies. This acquisition significantly enhanced Huhtamaki's position in the MEA market, boosting its sustainability profile and competitiveness.

Strategic Middle East and Africa Flexible Packaging Market Market Outlook

The MEA flexible packaging market presents significant opportunities for growth in the coming years. The continued expansion of the food and beverage sector, coupled with the increasing adoption of sustainable packaging solutions, will drive demand. Strategic investments in advanced technologies and sustainable materials, along with targeted expansion into high-growth markets within the region, will be crucial for success in this dynamic sector. Furthermore, collaborations and partnerships to overcome infrastructural challenges and enhance supply chain efficiency will be key to unlocking the full market potential.

Middle East and Africa Flexible Packaging Market Segmentation

-

1. Material Type

-

1.1. Plastics

- 1.1.1. Polyethene (PE)

- 1.1.2. Polypropylene (PP)

- 1.1.3. Polyethylene Terephthalate (PET )

- 1.1.4. Other Plastics (PVC, PA, etc.)

- 1.2. Paper

- 1.3. Aluminum

- 1.4. Compostable Materials (PLA, PBS, PHA, PBAT, etc.)

-

1.1. Plastics

-

2. Product Type

- 2.1. Pouches And Bags

-

2.2. Films And Wraps

- 2.2.1. Thermoforming Film

- 2.2.2. Stretch Films

- 2.2.3. Shrink Film

- 2.2.4. Cling Film

- 2.3. Labels And Sleeves

- 2.4. Lidding And Liners

- 2.5. Blister Packaging

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverages

- 3.3. Pharmaceuticals

- 3.4. Cosmetics And Personal Care

- 3.5. Household Care

- 3.6. Pet Care

- 3.7. Tobacco

- 3.8. Other En

Middle East and Africa Flexible Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Flexible Packaging Market Regional Market Share

Geographic Coverage of Middle East and Africa Flexible Packaging Market

Middle East and Africa Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Steady Rise in Demand for Processing Food; Move Towards Light Weighting Expected to Spur Volume Demand

- 3.3. Market Restrains

- 3.3.1. Flexible Packaging is Increasingly Turning into a Competitive Market Place Which Could Impact the Growth Products of New Entrants; Environmental Challenges Related to Recycling Although There are Expected to be Offset by Move Towards Bio-Based Products

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.1.1. Polyethene (PE)

- 5.1.1.2. Polypropylene (PP)

- 5.1.1.3. Polyethylene Terephthalate (PET )

- 5.1.1.4. Other Plastics (PVC, PA, etc.)

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.4. Compostable Materials (PLA, PBS, PHA, PBAT, etc.)

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches And Bags

- 5.2.2. Films And Wraps

- 5.2.2.1. Thermoforming Film

- 5.2.2.2. Stretch Films

- 5.2.2.3. Shrink Film

- 5.2.2.4. Cling Film

- 5.2.3. Labels And Sleeves

- 5.2.4. Lidding And Liners

- 5.2.5. Blister Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Pharmaceuticals

- 5.3.4. Cosmetics And Personal Care

- 5.3.5. Household Care

- 5.3.6. Pet Care

- 5.3.7. Tobacco

- 5.3.8. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Uflex Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coveris Management GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Treofan Films

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huhtamaki Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Napco Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gulf Pakcaging Industries Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondi Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DowDuPont*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amcor

List of Figures

- Figure 1: Middle East and Africa Flexible Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Flexible Packaging Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Middle East and Africa Flexible Packaging Market?

Key companies in the market include Amcor, Uflex Limited, Coveris Management GmbH, Treofan Films, BASF SE, Huhtamaki Group, Napco Group, Gulf Pakcaging Industries Limited, Mondi Plc, DowDuPont*List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Flexible Packaging Market?

The market segments include Material Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 301.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Steady Rise in Demand for Processing Food; Move Towards Light Weighting Expected to Spur Volume Demand.

6. What are the notable trends driving market growth?

Food and Beverage Industry is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

Flexible Packaging is Increasingly Turning into a Competitive Market Place Which Could Impact the Growth Products of New Entrants; Environmental Challenges Related to Recycling Although There are Expected to be Offset by Move Towards Bio-Based Products.

8. Can you provide examples of recent developments in the market?

September 2021-Huhtamaki acquired Elif, a flexible packaging company with nearly recyclable products. Flexo printing and polyethylene (PE) film production technologies round out the company portfolio across Europe, the Middle East, and Africa. The acquisition aligned with the company's goals of promoting talent and sustainability and aided the company's growth and competitiveness plan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence