Key Insights

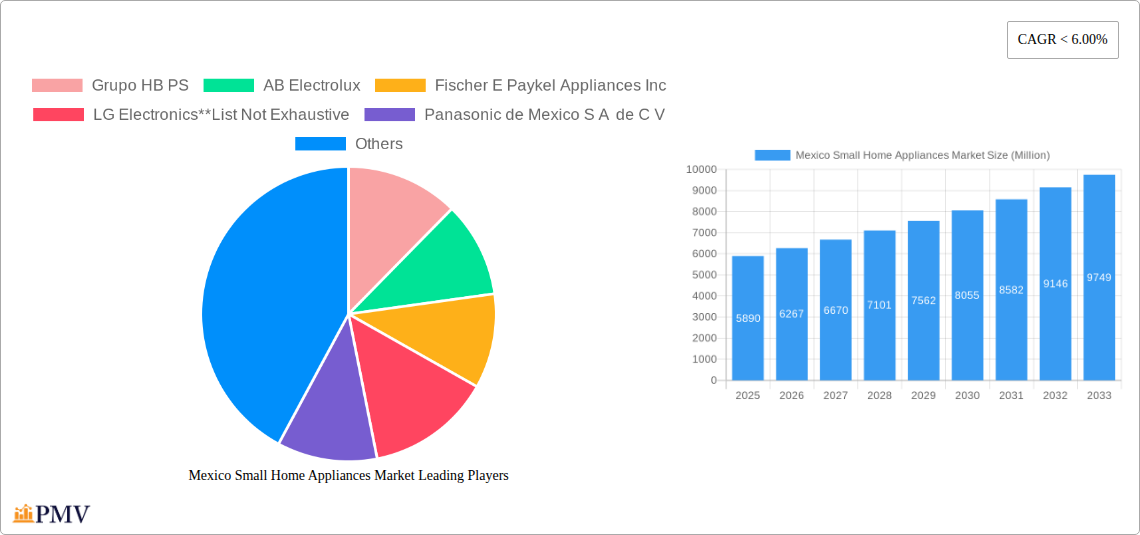

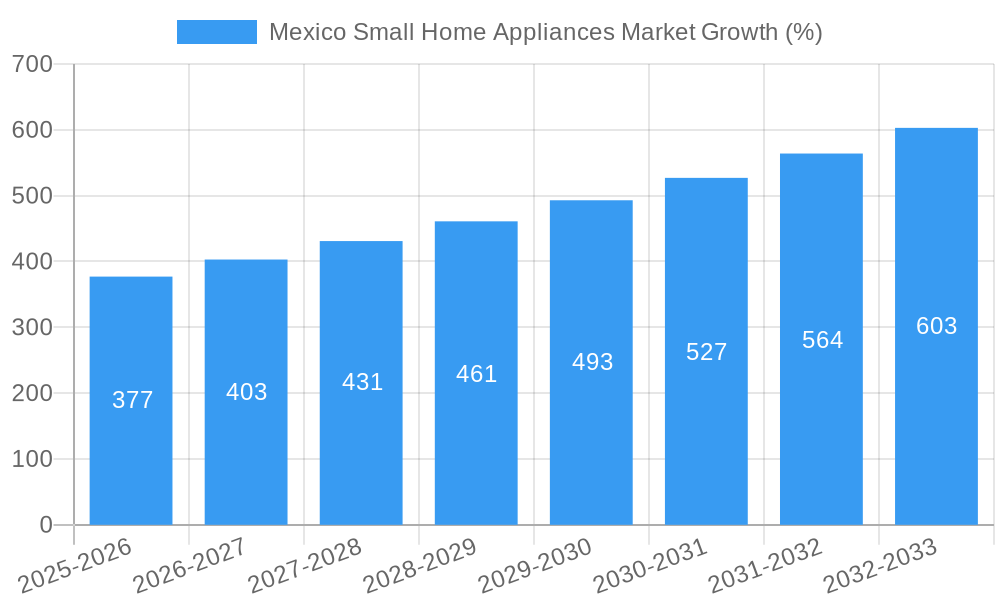

The Mexico small home appliances market, valued at $5.89 billion in 2025, is poised for robust growth throughout the forecast period (2025-2033). Driven by factors such as rising disposable incomes, increasing urbanization, and a shift towards convenience-focused lifestyles, the market demonstrates strong potential. The historical period (2019-2024) likely witnessed a steady expansion, laying the groundwork for the accelerated growth projected for the coming years. Key product segments within this market include blenders, coffee makers, toasters, microwaves, and kitchen robots. The demand is fueled by a growing young population embracing modern kitchen appliances and a burgeoning middle class seeking enhanced home comfort and convenience. Furthermore, the increasing adoption of e-commerce platforms and the expansion of retail networks contribute significantly to market accessibility and sales growth. Competition is likely intense among both domestic and international brands, with companies focusing on innovative product designs, energy efficiency, and competitive pricing to capture market share.

The market's CAGR (Compound Annual Growth Rate) from 2019 to 2033, while not explicitly stated, can be reasonably estimated based on the 2025 market size and industry trends. Considering comparable markets and economic projections for Mexico, a conservative yet optimistic CAGR of 6-8% for the forecast period appears plausible. This indicates a substantial increase in market value by 2033, exceeding $10 billion. This projection accounts for potential economic fluctuations and evolving consumer preferences, reflecting a dynamic and promising market outlook. Government initiatives aimed at boosting the economy and infrastructure further enhance the positive growth trajectory.

Mexico Small Home Appliances Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico small home appliances market, offering valuable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, competitive landscape, key trends, and future growth potential. The report utilizes data from 2019-2024 as its historical period, 2025 as its base and estimated year, and projects the market outlook from 2025-2033. The total market size in 2025 is estimated at xx Million USD.

Mexico Small Home Appliances Market Structure & Competitive Dynamics

The Mexican small home appliances market exhibits a moderately concentrated structure, with both international and domestic players vying for market share. Key players like AB Electrolux, LG Electronics, Panasonic Corporation, Mabe S A de C V Av, BSH Hausgerate GmbH, and Grupo HB PS hold significant portions of the market. However, the presence of numerous smaller, regional players contributes to a dynamic competitive environment. Market share data for 2025 reveals that Mabe holds approximately xx% followed by LG Electronics and AB Electrolux at xx% and xx% respectively. The remaining share is distributed among other players.

Innovation ecosystems are emerging, driven by technological advancements and consumer demand for smart and energy-efficient appliances. Regulatory frameworks, including those related to energy efficiency and safety standards, influence product design and market access. The market witnesses continuous product substitution with newer technologies like cordless vacuum cleaners replacing traditional models. End-user trends favor compact, multi-functional appliances catering to space-constrained urban lifestyles. Recent M&A activity, while not frequent, reflects consolidation efforts. For example, the USD 4.3 Billion acquisition of Spectrum Brands’ HHI segment illustrates larger corporations’ interest in the market, although this is outside the direct small home appliances sector.

Mexico Small Home Appliances Market Industry Trends & Insights

The Mexican small home appliances market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Several factors drive this growth. Rising disposable incomes, particularly within the burgeoning middle class, fuel increased consumer spending on home appliances. Urbanization contributes to higher demand for space-saving, modern appliances. The increasing adoption of e-commerce platforms also significantly impacts market expansion. Technological advancements, such as the integration of smart features and energy-efficient designs, further enhance market appeal. Competition remains intense, with international brands focusing on branding, product differentiation, and aggressive marketing strategies to capture market share. Market penetration of smart appliances is growing at a CAGR of xx%, indicating a shift towards technologically advanced products. Consumer preferences are increasingly influenced by sustainability concerns and the desire for convenience.

Dominant Markets & Segments in Mexico Small Home Appliances Market

- Leading Product Segment: Vacuum cleaners represent the largest segment, driven by increasing urbanization and a preference for convenient cleaning solutions.

- Leading Distribution Channel: Multi-branded stores dominate distribution, offering consumers a wide selection under one roof. Online sales are growing rapidly, though still a smaller segment compared to traditional retail.

Key Drivers:

- Economic Growth: A growing middle class and increasing disposable incomes directly correlate with higher demand for small home appliances.

- Infrastructure Development: Improved infrastructure and logistics networks enhance the efficiency of distribution, supporting market expansion.

- Government Policies: Supportive government policies related to consumer protection and market liberalization foster a favorable business environment.

The dominance of vacuum cleaners stems from their practicality and necessity in diverse household settings. Multi-branded stores benefit from established retail networks, broad customer reach, and promotional capabilities.

Mexico Small Home Appliances Market Product Innovations

Recent innovations in the Mexican small home appliances market showcase a focus on energy efficiency, smart connectivity, and user-friendly design. Vacuum cleaners with advanced filtration systems and cordless models are gaining popularity, alongside coffee machines featuring automated brewing and milk frothing capabilities. The integration of smart technology, enabling remote control and monitoring, is becoming a significant differentiator. These innovations are driven by the increasing demand for convenience, sustainability, and technological integration.

Report Segmentation & Scope

The report segments the market by product type (Vacuum Cleaners, Coffee Machines, Food Processors, Irons, Toasters, Grills & Roasters, Tea Machines, Hair Dryers, Other Small Home Appliances) and distribution channel (Multi-branded stores, Specialty Stores, Online, Other Distribution Channels). Each segment’s growth projection, market size, and competitive dynamics are analyzed. For example, the Vacuum Cleaner segment is projected to grow at xx% CAGR in the forecast period due to demand from increasing urbanization, while online distribution is expected to see significant growth, driven by increased internet penetration.

Key Drivers of Mexico Small Home Appliances Market Growth

The growth of the Mexican small home appliances market is fueled by several key factors. Rising disposable incomes are boosting consumer spending on home improvement and convenience products. Urbanization patterns lead to increased demand for compact and efficient appliances. Technological advancements, including smart features and energy-efficient designs, are enhancing product appeal. Furthermore, supportive government policies and favorable investment climate encourage market expansion.

Challenges in the Mexico Small Home Appliances Market Sector

Challenges include fluctuating currency exchange rates, potential supply chain disruptions, and intense competition from both domestic and international brands. Regulatory hurdles and compliance requirements also pose challenges. Economic downturns can impact consumer spending, affecting sales. These factors can create uncertainties for market participants.

Leading Players in the Mexico Small Home Appliances Market Market

- Grupo HB PS

- AB Electrolux

- Fischer E Paykel Appliances Inc

- LG Electronics

- Panasonic de Mexico S A de C V

- BSH Hausgerate GmbH

- Mabe S A de C V Av

- Daewoo Electronics Mexico

- Panasonic Corporation

- Hamilton Beach Brands

- Diehl Controls

Key Developments in Mexico Small Home Appliances Market Sector

- March 2022: BSH Group and Hisense Group announced new home appliance plant constructions in Nuevo Leon, each investing USD 260 Million. This signifies significant foreign investment in the Mexican market driven by rising demand.

- June 2023: Spectrum Brands Holdings, Inc. sold its HHI segment for USD 4.3 Billion. While not directly impacting small home appliances, it showcases ongoing M&A activity within the broader consumer goods sector.

Strategic Mexico Small Home Appliances Market Outlook

The Mexican small home appliances market presents significant future growth potential, driven by continued economic expansion, rising urbanization, and the adoption of smart home technologies. Companies can capitalize on this potential by focusing on product innovation, efficient distribution strategies, and targeted marketing campaigns. Investing in research and development to cater to specific consumer preferences and needs will be crucial for success. The increasing demand for eco-friendly appliances and smart home integration presents lucrative opportunities for businesses to create products tailored to the evolving market needs.

Mexico Small Home Appliances Market Segmentation

-

1. Product

- 1.1. Vacuum Cleaners

- 1.2. Coffee Machines

- 1.3. Food Processors

- 1.4. Irons

- 1.5. Toasters

- 1.6. Grills & Roasters

- 1.7. Tea Machines

- 1.8. Hair Dryers

- 1.9. Other Small Home Appliances*

-

2. Distribution Channel

- 2.1. Multi branded stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Mexico Small Home Appliances Market Segmentation By Geography

- 1. Mexico

Mexico Small Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The rapid growth of e-commerce in Mexico has made it easier for consumers to access a wide range of small home appliances. Online shopping platforms offer consumers greater convenience

- 3.2.2 competitive pricing

- 3.2.3 and a broader selection of products

- 3.2.4 contributing to the market’s growth.

- 3.3. Market Restrains

- 3.3.1 A significant portion of the Mexican consumer base is price-sensitive

- 3.3.2 especially in the lower-income segments. This price sensitivity can limit the market for premium or high-end small home appliances

- 3.3.3 with many consumers opting for more affordable options.

- 3.4. Market Trends

- 3.4.1 The adoption of smart home technology is growing in Mexico

- 3.4.2 with increasing demand for smart and connected small home appliances. Consumers are looking for appliances that can be controlled remotely via smartphones and integrated into broader smart home ecosystems

- 3.4.3 such as smart ovens

- 3.4.4 connected coffee makers

- 3.4.5 and IoT-enabled air purifiers.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Small Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Vacuum Cleaners

- 5.1.2. Coffee Machines

- 5.1.3. Food Processors

- 5.1.4. Irons

- 5.1.5. Toasters

- 5.1.6. Grills & Roasters

- 5.1.7. Tea Machines

- 5.1.8. Hair Dryers

- 5.1.9. Other Small Home Appliances*

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi branded stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Grupo HB PS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AB Electrolux

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fischer E Paykel Appliances Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Electronics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic de Mexico S A de C V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BSH Hausgerate GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mabe S A de C V Av

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daewoo Electronics Mexico

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hamilton Beach Brands

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Diehl Controls

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Grupo HB PS

List of Figures

- Figure 1: Mexico Small Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Small Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Small Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Small Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Mexico Small Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Mexico Small Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico Small Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexico Small Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Mexico Small Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Mexico Small Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Small Home Appliances Market?

The projected CAGR is approximately < 6.00%.

2. Which companies are prominent players in the Mexico Small Home Appliances Market?

Key companies in the market include Grupo HB PS, AB Electrolux, Fischer E Paykel Appliances Inc, LG Electronics**List Not Exhaustive, Panasonic de Mexico S A de C V, BSH Hausgerate GmbH, Mabe S A de C V Av, Daewoo Electronics Mexico, Panasonic Corporation, Hamilton Beach Brands, Diehl Controls.

3. What are the main segments of the Mexico Small Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.89 Million as of 2022.

5. What are some drivers contributing to market growth?

The rapid growth of e-commerce in Mexico has made it easier for consumers to access a wide range of small home appliances. Online shopping platforms offer consumers greater convenience. competitive pricing. and a broader selection of products. contributing to the market’s growth..

6. What are the notable trends driving market growth?

The adoption of smart home technology is growing in Mexico. with increasing demand for smart and connected small home appliances. Consumers are looking for appliances that can be controlled remotely via smartphones and integrated into broader smart home ecosystems. such as smart ovens. connected coffee makers. and IoT-enabled air purifiers..

7. Are there any restraints impacting market growth?

A significant portion of the Mexican consumer base is price-sensitive. especially in the lower-income segments. This price sensitivity can limit the market for premium or high-end small home appliances. with many consumers opting for more affordable options..

8. Can you provide examples of recent developments in the market?

March 2022: the German BSH Group, a subsidiary of Bosch, as well as the Chinese Hisense Group, announced the construction of new home appliance plants in the state of Nuevo Leon, each investing USD 260 Mio. With an increase in demand, international companies began investing heavily in their Mexican locations or even opening new ones.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Small Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Small Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Small Home Appliances Market?

To stay informed about further developments, trends, and reports in the Mexico Small Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence