Key Insights

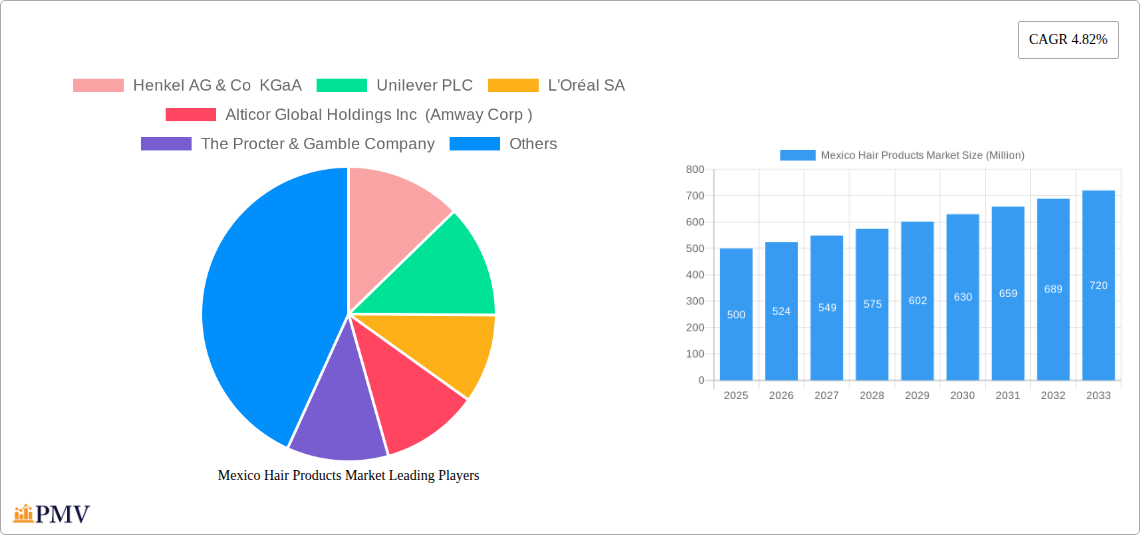

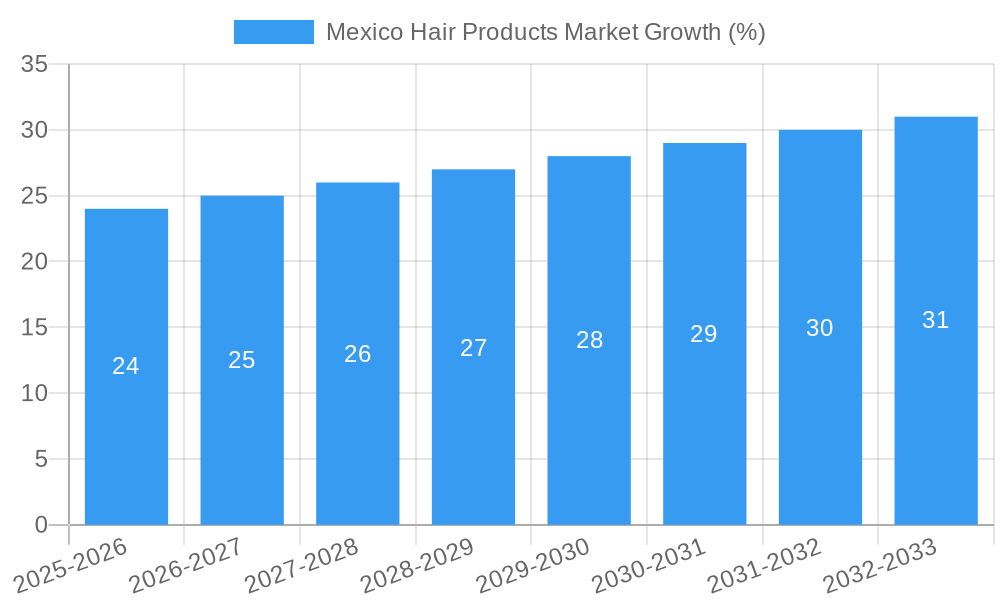

The Mexico hair products market, valued at approximately $XXX million in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing awareness of personal grooming, and the expanding influence of social media trends impacting beauty standards. The market's Compound Annual Growth Rate (CAGR) of 4.82% from 2019-2024 suggests a continued upward trajectory through 2033. Key segments driving this growth include hair styling products, catering to evolving fashion trends, and hair loss treatment products reflecting a growing focus on hair health and wellness. The distribution channels are diverse, with supermarkets/hypermarkets holding a significant share, but online stores exhibiting the fastest growth, fueled by increasing internet penetration and e-commerce adoption. While brand loyalty plays a role, the presence of established international players like L'Oréal, Procter & Gamble, and Unilever alongside strong local brands creates a competitive landscape. Price sensitivity remains a factor, especially in certain segments and distribution channels, influencing consumer purchasing decisions. Challenges include economic fluctuations impacting consumer spending and increasing competition from both established and emerging brands. The forecast for the Mexican hair products market is positive, with the continued expansion of online retail and a focus on innovation in product formulations expected to further propel growth in the coming years.

The success of players in the Mexican hair products market hinges on adapting to evolving consumer preferences. This includes offering diverse product lines to meet a range of needs, leveraging digital marketing to reach a wider audience, and strategically pricing products to remain competitive across various market segments. Developing product formulations tailored to specific hair types common in the Mexican population will also be crucial for market penetration. Effective supply chain management, ensuring product availability across all distribution channels, will be vital in sustaining growth. The market’s sensitivity to economic conditions suggests that a flexible pricing strategy and a focus on value-added services could mitigate risks. By understanding these market nuances and leveraging strategic positioning, businesses can capitalize on the significant opportunities available within the thriving Mexican hair products sector.

Mexico Hair Products Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico hair products market, covering the period from 2019 to 2033. With a focus on market size, segmentation, competitive dynamics, and future growth projections, this report is an essential resource for industry players, investors, and market researchers seeking actionable insights into this dynamic sector. The report uses 2025 as the base year and provides forecasts until 2033. The total market value is estimated at xx Million USD in 2025.

Mexico Hair Products Market Structure & Competitive Dynamics

The Mexico hair products market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players like Henkel AG & Co KGaA, Unilever PLC, L'Oréal SA, Alticor Global Holdings Inc (Amway Corp), The Procter & Gamble Company, The Estee Lauder Companies Inc, Genomma Lab Internacional S A B de C V, Johnson & Johnson, Kao Corporation, and Beiersdorf AG compete fiercely, driving innovation and shaping market trends. However, the market also features a sizable number of smaller, regional players.

Market share is largely determined by brand recognition, product quality, distribution reach, and marketing strategies. Recent M&A activities have been relatively limited in the past few years, with reported deal values totaling approximately xx Million USD during the historical period (2019-2024), primarily focused on smaller acquisitions to expand product portfolios or regional presence. The regulatory framework is generally supportive of market growth, although evolving regulations related to product labeling and ingredient safety present ongoing challenges. Consumers increasingly prioritize natural and organic products, driving the demand for innovative, sustainable formulations. Product substitutes, such as homemade hair care remedies, represent a niche but growing segment.

Mexico Hair Products Market Industry Trends & Insights

The Mexico hair products market has experienced consistent growth in recent years, with a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is fueled by several factors: increasing disposable incomes, rising consumer awareness of hair care, and the growing popularity of salon-quality products accessible at retail. Technological advancements, including the development of personalized hair care solutions and the adoption of e-commerce platforms, are further driving market transformation. Consumer preferences are evolving, with a shift towards natural and sustainable hair care products that cater to specific hair types and concerns. The market penetration of premium hair care brands is also increasing, fueled by a desire for high-quality results. Competitive dynamics are characterized by intense rivalry, especially among leading multinational players, who constantly innovate and improve their products to gain market share. Market segmentation by price points, product type, and distribution channel continues to evolve, creating specialized niches and opportunities. The projected CAGR for the forecast period (2025-2033) is estimated to be xx%.

Dominant Markets & Segments in Mexico Hair Products Market

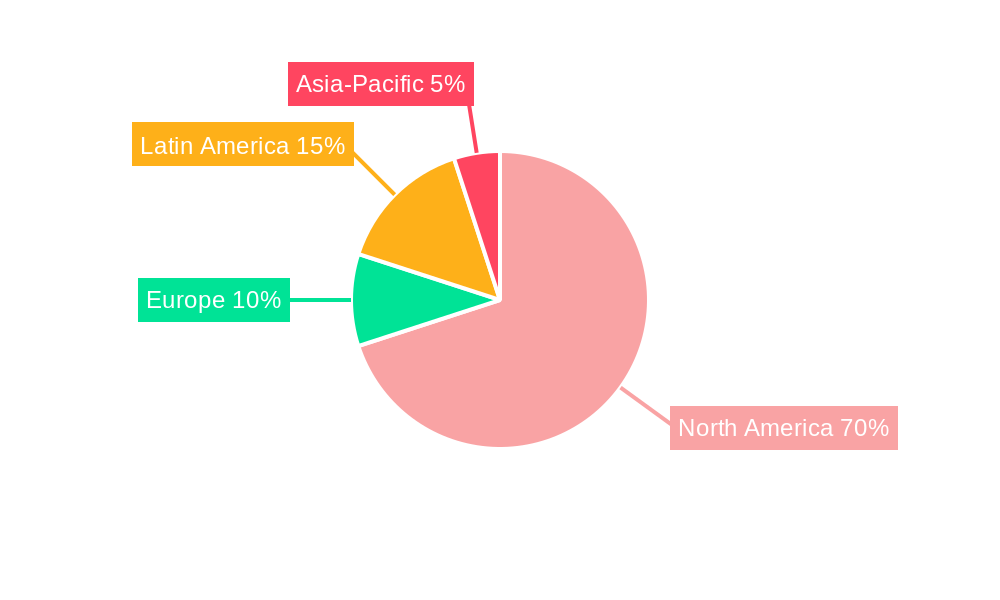

Leading Region: Central Mexico is currently the dominant market, driven by higher population density, greater disposable income, and established retail infrastructure.

Dominant Distribution Channels: Supermarkets/hypermarkets represent the largest distribution channel, followed by pharmacy/drug stores. Online stores are a rapidly growing segment, capitalizing on rising e-commerce penetration in the country. Convenience stores play a relatively smaller role.

Leading Product Types: Shampoo and conditioner continue to dominate the market. Hair colorants and hair styling products are also significant segments, driven by aesthetic trends and evolving consumer preferences. The hair loss treatment segment shows significant potential for growth.

Key Drivers for Dominance:

Economic Policies: Government initiatives supporting small and medium-sized enterprises (SMEs) and fostering economic growth have indirectly aided the market expansion.

Infrastructure: The well-developed retail infrastructure in major cities facilitates efficient product distribution and availability.

Mexico Hair Products Market Product Innovations

Recent product innovations are focused on sustainability, personalization, and enhanced user experience. Companies are developing eco-friendly packaging, water-soluble pouches, and personalized hair care solutions tailored to individual needs. Technological advancements, such as AI-powered hair color systems, are streamlining application and enhancing results. These innovations offer a competitive advantage by meeting growing consumer demand for convenience, sustainability, and efficacy.

Report Segmentation & Scope

The report segments the market by Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores/Grocery Stores, Pharmacy/Drug Stores, Online Stores, Other Distribution Channels; and by Product Type: Shampoo, Conditioner, Hair Loss Treatment Products, Hair Colorants, Hair Styling Products, Perms and Relaxants, Other Product Types. Each segment is analyzed in terms of its market size, growth projections, and competitive dynamics. Market sizes are estimated for each segment, with growth projections extending to 2033. The competitive landscape within each segment is assessed, noting key players and their market positions.

Key Drivers of Mexico Hair Products Market Growth

Several factors drive growth in the Mexico hair products market. Rising disposable incomes enable consumers to invest more in personal care products. The increasing awareness of hair health and beauty is another significant driver. Finally, the growing popularity of convenient and effective products, along with technological innovations, further fuels market expansion.

Challenges in the Mexico Hair Products Market Sector

The market faces certain challenges, such as the fluctuating economic conditions that can affect consumer spending. The intense competition amongst major players creates pressure on pricing and profit margins. Supply chain disruptions can also impact product availability and market stability. Furthermore, evolving regulations and stringent labeling requirements require continuous adaptation by companies.

Leading Players in the Mexico Hair Products Market Market

- Henkel AG & Co KGaA

- Unilever PLC

- L'Oréal SA

- Alticor Global Holdings Inc (Amway Corp)

- The Procter & Gamble Company

- The Estee Lauder Companies Inc

- Genomma Lab Internacional S A B de C V

- Johnson & Johnson

- Kao Corporation

- Beiersdorf AG

Key Developments in Mexico Hair Products Market Sector

February 2023: Unilever announced a USD 400 Million investment in a new plant in Nuevo Leon, boosting production capacity for beauty and personal care products.

February 2022: Procter & Gamble filed a patent for dissolvable hair care pouches, promoting sustainability.

January 2022: L'Oréal launched Colorsonic and Coloright, innovative hair color solutions, enhancing consumer convenience and professional salon services.

Strategic Mexico Hair Products Market Outlook

The Mexico hair products market presents significant future growth potential driven by increasing consumer spending, a burgeoning e-commerce sector, and evolving consumer preferences toward natural and sustainable products. Companies that effectively adapt to these trends, leverage technological innovations, and cater to diverse consumer needs will achieve market leadership. Strategic opportunities exist in expanding into underserved regions, developing personalized solutions, and focusing on sustainable product offerings.

Mexico Hair Products Market Segmentation

-

1. Product Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Loss Treatment Products

- 1.4. Hair Colorants

- 1.5. Hair Styling Products

- 1.6. Perms and Relaxants

- 1.7. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores/Grocery Stores

- 2.3. Pharmacy/ Drug Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

Mexico Hair Products Market Segmentation By Geography

- 1. Mexico

Mexico Hair Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.82% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal For Natural and Organic Hair Care Products; Increased Consumer Spending on Hair Care Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increased Concerns Towards Hair care

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Hair Products Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Loss Treatment Products

- 5.1.4. Hair Colorants

- 5.1.5. Hair Styling Products

- 5.1.6. Perms and Relaxants

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores/Grocery Stores

- 5.2.3. Pharmacy/ Drug Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States Mexico Hair Products Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada Mexico Hair Products Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Mexico Hair Products Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Henkel AG & Co KGaA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Unilever PLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 L'Oréal SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Alticor Global Holdings Inc (Amway Corp )

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 The Procter & Gamble Company

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 The Estee Lauder Companies Inc*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Genomma Lab Internacional S A B de C V

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Johnson & Johnson

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Kao Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Beiersdorf AG

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Mexico Hair Products Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Hair Products Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Hair Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Hair Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Mexico Hair Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Mexico Hair Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico Hair Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Mexico Hair Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Mexico Hair Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Mexico Hair Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Hair Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Mexico Hair Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 11: Mexico Hair Products Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Hair Products Market?

The projected CAGR is approximately 4.82%.

2. Which companies are prominent players in the Mexico Hair Products Market?

Key companies in the market include Henkel AG & Co KGaA, Unilever PLC, L'Oréal SA, Alticor Global Holdings Inc (Amway Corp ), The Procter & Gamble Company, The Estee Lauder Companies Inc*List Not Exhaustive, Genomma Lab Internacional S A B de C V, Johnson & Johnson, Kao Corporation, Beiersdorf AG.

3. What are the main segments of the Mexico Hair Products Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal For Natural and Organic Hair Care Products; Increased Consumer Spending on Hair Care Products.

6. What are the notable trends driving market growth?

Increased Concerns Towards Hair care.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

February 2023: Unilever announced an approximately USD 400 million investment to build a new plant in Mexico's Nuevo Leon region. The new facility will manufacture beauty and personal care products, including shampoo, conditioners, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Hair Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Hair Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Hair Products Market?

To stay informed about further developments, trends, and reports in the Mexico Hair Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence