Key Insights

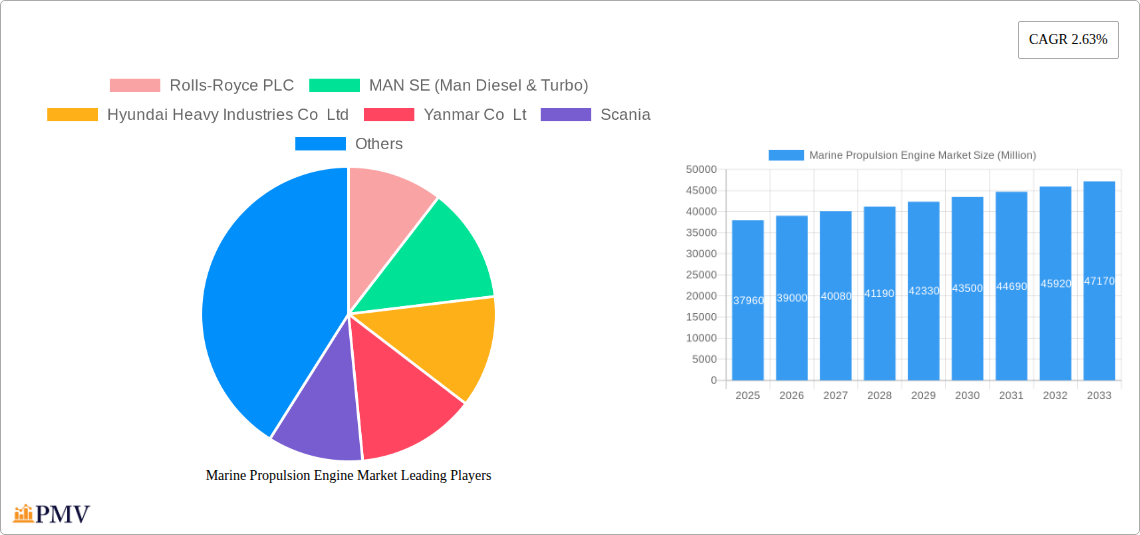

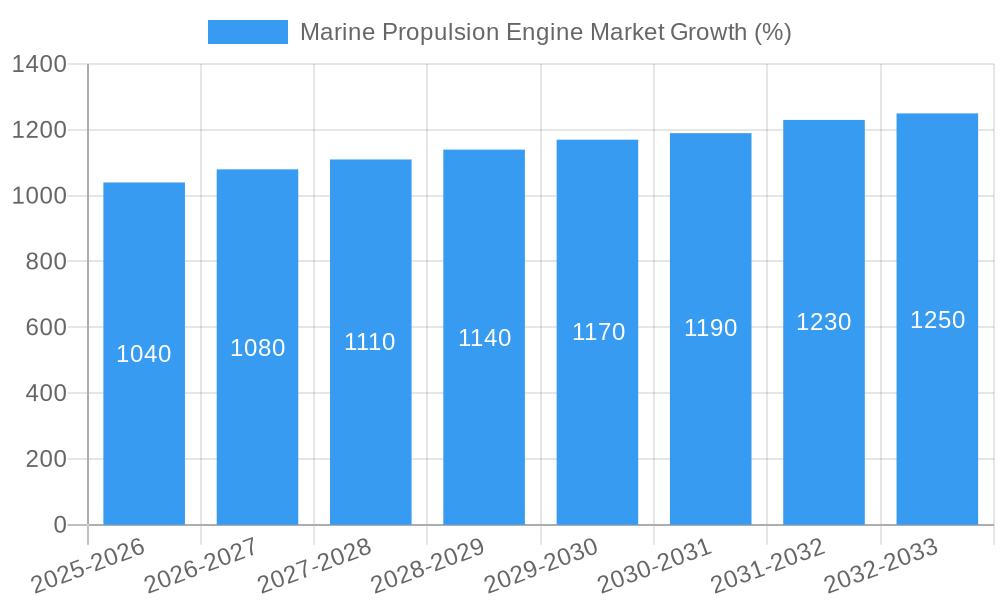

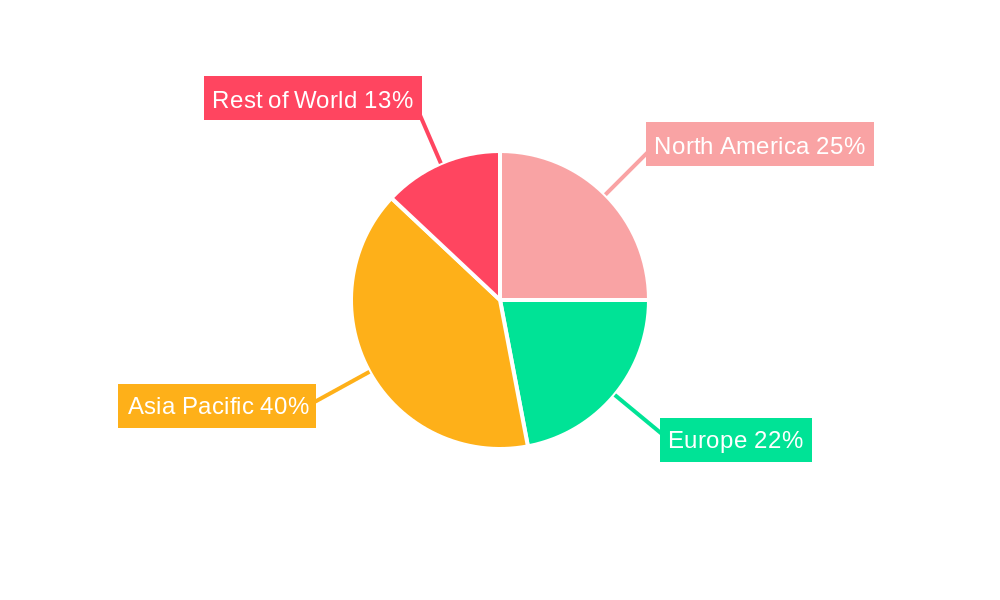

The global marine propulsion engine market, valued at $37.96 billion in 2025, is projected to experience steady growth, driven primarily by increasing global trade, expanding maritime transportation, and the ongoing demand for efficient and environmentally friendly vessels. The market's Compound Annual Growth Rate (CAGR) of 2.63% from 2025 to 2033 indicates a consistent, albeit moderate, expansion. Key growth drivers include the rising popularity of container ships and tankers, fueled by globalization and e-commerce, as well as the growing demand for offshore support vessels within the oil and gas industry. Furthermore, investments in naval modernization and passenger ship upgrades across various regions are contributing to market expansion. Segmentation by engine type reveals a significant share held by diesel engines, though gas turbine engines are witnessing notable growth due to their higher power-to-weight ratio, particularly in high-speed applications. Stricter emission regulations, however, are likely to restrain the growth of traditional diesel engine technology, pushing the market towards cleaner alternatives like natural gas and hybrid propulsion systems. Regional analysis indicates that Asia-Pacific, driven by robust shipbuilding activity in countries like China, Japan, and South Korea, holds a substantial market share. North America and Europe also represent significant markets, largely influenced by the presence of major engine manufacturers and a robust maritime sector.

The competitive landscape is characterized by the presence of established players like Rolls-Royce, MAN SE, Wärtsilä, and Caterpillar, alongside regional players like Hyundai Heavy Industries and Yanmar. These companies are investing heavily in research and development to enhance engine efficiency, reduce emissions, and cater to the evolving needs of the shipping industry. Technological advancements, such as the integration of digitalization and automation in engine management systems, are expected to further shape the market's trajectory. The forecast period (2025-2033) will likely see a continued shift towards cleaner, more fuel-efficient engine technologies, alongside a growing focus on optimizing vessel design for improved fuel consumption and reduced environmental impact. This transition will present both challenges and opportunities for established manufacturers and new entrants in the marine propulsion engine market.

Marine Propulsion Engine Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Marine Propulsion Engine Market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth projections. The study encompasses detailed segmentation by engine type, application, and ship type, providing granular data for informed decision-making.

Marine Propulsion Engine Market Market Structure & Competitive Dynamics

The Marine Propulsion Engine market is characterized by a moderately concentrated structure, with a few major players holding significant market share. Rolls-Royce PLC, MAN SE (Man Diesel & Turbo), Wärtsilä, and Caterpillar are amongst the leading companies, each possessing a strong global presence and diverse product portfolios. The market exhibits a complex innovation ecosystem involving engine manufacturers, component suppliers, research institutions, and regulatory bodies. Stringent emission regulations, such as IMO Tier III, are driving innovation towards cleaner and more efficient propulsion technologies. Product substitution is also a significant factor, with the rising adoption of alternative fuels like methanol and hydrogen challenging the dominance of traditional diesel engines. End-user trends toward larger vessels and increasing demand for fuel efficiency are influencing product development and market growth. M&A activity has been moderate in recent years, with deal values ranging from xx Million to xx Million, driven primarily by strategic expansion and technology acquisition. Major players continuously strive to enhance their market positioning through strategic collaborations and technological advancements. The market share for the top five players is estimated at approximately 65% in 2025, leaving significant opportunity for smaller players to compete through specialization and innovation.

Marine Propulsion Engine Market Industry Trends & Insights

The global marine propulsion engine market is experiencing significant growth, driven by increasing global trade, expanding maritime infrastructure, and the rising demand for efficient and environmentally friendly propulsion systems. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), exceeding a market value of xx Million by 2033. Technological disruptions, particularly in alternative fuel technologies (methanol, LNG, hydrogen) and hybrid propulsion systems, are reshaping the market landscape. The market penetration of these technologies is still relatively low (approximately xx% in 2025), but is expected to grow rapidly due to stringent environmental regulations and the increasing focus on sustainability within the shipping industry. Consumer preferences are shifting towards fuel-efficient, low-emission engines, compelling manufacturers to invest heavily in R&D to meet these demands. The competitive landscape is characterized by intense competition, particularly amongst the leading players, resulting in continuous innovation and price pressures.

Dominant Markets & Segments in Marine Propulsion Engine Market

- Leading Region: Asia-Pacific, driven by strong economic growth, significant shipbuilding activity, and increasing maritime trade.

- Leading Country: China, due to its expansive shipbuilding industry and its burgeoning demand for marine transport.

- Dominant Engine Type: Diesel engines currently dominate the market (xx% market share in 2025), however, gas turbine and other engine types are projected to experience significant growth fueled by innovation in alternative fuel technologies.

- Leading Application Type: Commercial shipping, owing to the high volume of cargo movement globally. The defense segment is also a significant contributor, driven by the need for advanced and reliable propulsion systems for naval vessels.

- Leading Ship Type: Container ships lead the market due to increasing global trade volumes, however, the tanker and bulk carrier segments are also substantial contributors.

Key Drivers for Dominant Markets:

- Asia-Pacific: Rapid economic growth, increasing infrastructure investments in ports and shipping, and robust domestic and international trade.

- China: Massive shipbuilding capacity, a large domestic market for shipping, and government support for the maritime industry.

- Diesel Engines: Established technology, cost-effectiveness, and wide availability.

- Commercial Shipping: High volume of cargo movement globally, continuous fleet expansion, and demand for efficient transportation.

Marine Propulsion Engine Market Product Innovations

Recent product developments highlight a strong focus on sustainable and efficient propulsion systems. Key innovations include the introduction of methanol-powered engines, hybrid propulsion systems integrating battery technology, and exploration of hydrogen fuel cell technology. These advancements aim to meet stricter emission regulations and reduce the environmental impact of marine transportation. The competitive advantage lies in offering superior fuel efficiency, reduced emissions, and enhanced reliability, appealing to environmentally conscious shipping companies and governments seeking to reduce carbon footprints.

Report Segmentation & Scope

The report segments the marine propulsion engine market based on engine type (Diesel, Gas Turbine, Natural Engine, Other Engine Types), application type (Passenger, Commercial, Defense), and ship type (Container Ship, Tanker, Bulk Carrier, Offshore Vessel, Naval Ship, Passenger Ship). Each segment's growth projections, market size estimations, and competitive dynamics are analyzed separately. For example, the diesel engine segment is expected to maintain its dominance but will see its market share gradually reduce with the rising adoption of alternative fuel engines. The commercial shipping application type is projected to experience the highest growth, owing to increased global trade, while the defense segment is expected to drive demand for high-performance and advanced propulsion systems. Container ships continue to represent the largest ship type segment, while the offshore vessel segment is expected to experience moderate growth.

Key Drivers of Marine Propulsion Engine Market Growth

Several factors fuel the growth of the marine propulsion engine market. Stringent environmental regulations, like IMO Tier III emission standards, are pushing manufacturers towards cleaner and more efficient engines. Growing global trade and the need for reliable and efficient marine transportation are driving demand for improved propulsion systems. Furthermore, technological advancements in alternative fuels (methanol, LNG, hydrogen) and hybrid propulsion technologies are expanding the market's potential. Government initiatives promoting sustainable shipping practices further contribute to market expansion.

Challenges in the Marine Propulsion Engine Market Sector

The marine propulsion engine market faces certain challenges. Meeting stringent emission regulations requires significant investment in R&D and new technologies, potentially impacting profitability. Supply chain disruptions, particularly regarding raw materials and components, can affect production and delivery timelines. Intense competition amongst established players and the emergence of new entrants create pressure on pricing and margins. Fluctuations in fuel prices also influence the overall cost of operation and impact market demand.

Leading Players in the Marine Propulsion Engine Market Market

- Rolls-Royce PLC

- MAN SE (Man Diesel & Turbo)

- Hyundai Heavy Industries Co Ltd

- Yanmar Co Ltd

- Scania

- Cummins Inc

- Daihatsu Diesel Mfg Co Ltd

- Wartsila

- Caterpillar

- Mitsubishi Heavy Industries Ltd

Key Developments in Marine Propulsion Engine Market Sector

- September 2022: Wartsila Corporation secured propulsion machinery orders for four fishing vessels.

- September 2022: Wartsila Corporation announced an order for electrical systems for a German research vessel.

- September 2022: Wider in Italy announced two MAN engines for its Moonflower 72 Project.

- October 2022: Rolls-Royce MTU premiered new methanol, hybrid, and hydrogen fuel systems.

- October 2022: MAN Energy Solutions SE won an order for six methanol-powered engines.

- November 2022: Volvo Penta received an order for two D16-650 IMO III engines.

- May 2022: Yanmar Co. Ltd delivered three marine engines to Naviera Orca Chile SA.

These developments underscore the ongoing shift towards sustainable and technologically advanced propulsion systems within the marine industry.

Strategic Marine Propulsion Engine Market Market Outlook

The marine propulsion engine market is poised for continued growth, driven by the increasing demand for efficient and environmentally friendly solutions. Strategic opportunities exist for companies investing in the development and commercialization of alternative fuel technologies, particularly methanol, LNG, and hydrogen-based propulsion systems. Collaboration within the industry and strategic partnerships with fuel suppliers and technology providers will be crucial for success. The market is expected to witness further consolidation through M&A activities, leading to a more concentrated landscape. Companies with a strong focus on innovation, sustainability, and customer service are well-positioned to capitalize on the expanding market potential.

Marine Propulsion Engine Market Segmentation

-

1. Engine Type

- 1.1. Diesel

- 1.2. Gas Turbine

- 1.3. Natural Engine

- 1.4. Other Engine Types

-

2. Application Type

- 2.1. Passenger

- 2.2. Commercial

- 2.3. Defense

-

3. Ship Type

- 3.1. Container Ship

- 3.2. Tanker

- 3.3. Bulk Carrier

- 3.4. Offshore Vessel

- 3.5. Naval Ship

- 3.6. Passenger Ship

Marine Propulsion Engine Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Other Countries

Marine Propulsion Engine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. Marine Propulsion Engine Market is Expected to Grow at a Steady Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Marine Propulsion Engine Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 5.1.1. Diesel

- 5.1.2. Gas Turbine

- 5.1.3. Natural Engine

- 5.1.4. Other Engine Types

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Passenger

- 5.2.2. Commercial

- 5.2.3. Defense

- 5.3. Market Analysis, Insights and Forecast - by Ship Type

- 5.3.1. Container Ship

- 5.3.2. Tanker

- 5.3.3. Bulk Carrier

- 5.3.4. Offshore Vessel

- 5.3.5. Naval Ship

- 5.3.6. Passenger Ship

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 6. North America Marine Propulsion Engine Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 6.1.1. Diesel

- 6.1.2. Gas Turbine

- 6.1.3. Natural Engine

- 6.1.4. Other Engine Types

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Passenger

- 6.2.2. Commercial

- 6.2.3. Defense

- 6.3. Market Analysis, Insights and Forecast - by Ship Type

- 6.3.1. Container Ship

- 6.3.2. Tanker

- 6.3.3. Bulk Carrier

- 6.3.4. Offshore Vessel

- 6.3.5. Naval Ship

- 6.3.6. Passenger Ship

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 7. Europe Marine Propulsion Engine Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 7.1.1. Diesel

- 7.1.2. Gas Turbine

- 7.1.3. Natural Engine

- 7.1.4. Other Engine Types

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Passenger

- 7.2.2. Commercial

- 7.2.3. Defense

- 7.3. Market Analysis, Insights and Forecast - by Ship Type

- 7.3.1. Container Ship

- 7.3.2. Tanker

- 7.3.3. Bulk Carrier

- 7.3.4. Offshore Vessel

- 7.3.5. Naval Ship

- 7.3.6. Passenger Ship

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 8. Asia Pacific Marine Propulsion Engine Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 8.1.1. Diesel

- 8.1.2. Gas Turbine

- 8.1.3. Natural Engine

- 8.1.4. Other Engine Types

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Passenger

- 8.2.2. Commercial

- 8.2.3. Defense

- 8.3. Market Analysis, Insights and Forecast - by Ship Type

- 8.3.1. Container Ship

- 8.3.2. Tanker

- 8.3.3. Bulk Carrier

- 8.3.4. Offshore Vessel

- 8.3.5. Naval Ship

- 8.3.6. Passenger Ship

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 9. Rest of the World Marine Propulsion Engine Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 9.1.1. Diesel

- 9.1.2. Gas Turbine

- 9.1.3. Natural Engine

- 9.1.4. Other Engine Types

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Passenger

- 9.2.2. Commercial

- 9.2.3. Defense

- 9.3. Market Analysis, Insights and Forecast - by Ship Type

- 9.3.1. Container Ship

- 9.3.2. Tanker

- 9.3.3. Bulk Carrier

- 9.3.4. Offshore Vessel

- 9.3.5. Naval Ship

- 9.3.6. Passenger Ship

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 10. North America Marine Propulsion Engine Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Marine Propulsion Engine Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Spain

- 11.1.5 Rest of Europe

- 12. Asia Pacific Marine Propulsion Engine Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Marine Propulsion Engine Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Rolls-Royce PLC

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 MAN SE (Man Diesel & Turbo)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Hyundai Heavy Industries Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Yanmar Co Lt

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Scania

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cummins Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Daihatsu Diesel Mfg Co Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Wartsila

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Caterpillar

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Mitsubishi Heavy Industries Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Rolls-Royce PLC

List of Figures

- Figure 1: Global Marine Propulsion Engine Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Marine Propulsion Engine Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Marine Propulsion Engine Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Marine Propulsion Engine Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Marine Propulsion Engine Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Marine Propulsion Engine Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Marine Propulsion Engine Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Marine Propulsion Engine Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Marine Propulsion Engine Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Marine Propulsion Engine Market Revenue (Million), by Engine Type 2024 & 2032

- Figure 11: North America Marine Propulsion Engine Market Revenue Share (%), by Engine Type 2024 & 2032

- Figure 12: North America Marine Propulsion Engine Market Revenue (Million), by Application Type 2024 & 2032

- Figure 13: North America Marine Propulsion Engine Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 14: North America Marine Propulsion Engine Market Revenue (Million), by Ship Type 2024 & 2032

- Figure 15: North America Marine Propulsion Engine Market Revenue Share (%), by Ship Type 2024 & 2032

- Figure 16: North America Marine Propulsion Engine Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Marine Propulsion Engine Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Marine Propulsion Engine Market Revenue (Million), by Engine Type 2024 & 2032

- Figure 19: Europe Marine Propulsion Engine Market Revenue Share (%), by Engine Type 2024 & 2032

- Figure 20: Europe Marine Propulsion Engine Market Revenue (Million), by Application Type 2024 & 2032

- Figure 21: Europe Marine Propulsion Engine Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 22: Europe Marine Propulsion Engine Market Revenue (Million), by Ship Type 2024 & 2032

- Figure 23: Europe Marine Propulsion Engine Market Revenue Share (%), by Ship Type 2024 & 2032

- Figure 24: Europe Marine Propulsion Engine Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Marine Propulsion Engine Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Marine Propulsion Engine Market Revenue (Million), by Engine Type 2024 & 2032

- Figure 27: Asia Pacific Marine Propulsion Engine Market Revenue Share (%), by Engine Type 2024 & 2032

- Figure 28: Asia Pacific Marine Propulsion Engine Market Revenue (Million), by Application Type 2024 & 2032

- Figure 29: Asia Pacific Marine Propulsion Engine Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 30: Asia Pacific Marine Propulsion Engine Market Revenue (Million), by Ship Type 2024 & 2032

- Figure 31: Asia Pacific Marine Propulsion Engine Market Revenue Share (%), by Ship Type 2024 & 2032

- Figure 32: Asia Pacific Marine Propulsion Engine Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Marine Propulsion Engine Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Marine Propulsion Engine Market Revenue (Million), by Engine Type 2024 & 2032

- Figure 35: Rest of the World Marine Propulsion Engine Market Revenue Share (%), by Engine Type 2024 & 2032

- Figure 36: Rest of the World Marine Propulsion Engine Market Revenue (Million), by Application Type 2024 & 2032

- Figure 37: Rest of the World Marine Propulsion Engine Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 38: Rest of the World Marine Propulsion Engine Market Revenue (Million), by Ship Type 2024 & 2032

- Figure 39: Rest of the World Marine Propulsion Engine Market Revenue Share (%), by Ship Type 2024 & 2032

- Figure 40: Rest of the World Marine Propulsion Engine Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Marine Propulsion Engine Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Marine Propulsion Engine Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Marine Propulsion Engine Market Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 3: Global Marine Propulsion Engine Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 4: Global Marine Propulsion Engine Market Revenue Million Forecast, by Ship Type 2019 & 2032

- Table 5: Global Marine Propulsion Engine Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Marine Propulsion Engine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Marine Propulsion Engine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Marine Propulsion Engine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Marine Propulsion Engine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Other Countries Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Marine Propulsion Engine Market Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 26: Global Marine Propulsion Engine Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 27: Global Marine Propulsion Engine Market Revenue Million Forecast, by Ship Type 2019 & 2032

- Table 28: Global Marine Propulsion Engine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Marine Propulsion Engine Market Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 33: Global Marine Propulsion Engine Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 34: Global Marine Propulsion Engine Market Revenue Million Forecast, by Ship Type 2019 & 2032

- Table 35: Global Marine Propulsion Engine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Spain Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Marine Propulsion Engine Market Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 42: Global Marine Propulsion Engine Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 43: Global Marine Propulsion Engine Market Revenue Million Forecast, by Ship Type 2019 & 2032

- Table 44: Global Marine Propulsion Engine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Marine Propulsion Engine Market Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 51: Global Marine Propulsion Engine Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 52: Global Marine Propulsion Engine Market Revenue Million Forecast, by Ship Type 2019 & 2032

- Table 53: Global Marine Propulsion Engine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Brazil Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Other Countries Marine Propulsion Engine Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Marine Propulsion Engine Market?

The projected CAGR is approximately 2.63%.

2. Which companies are prominent players in the Marine Propulsion Engine Market?

Key companies in the market include Rolls-Royce PLC, MAN SE (Man Diesel & Turbo), Hyundai Heavy Industries Co Ltd, Yanmar Co Lt, Scania, Cummins Inc, Daihatsu Diesel Mfg Co Ltd, Wartsila, Caterpillar, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Marine Propulsion Engine Market?

The market segments include Engine Type, Application Type, Ship Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

Marine Propulsion Engine Market is Expected to Grow at a Steady Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

November 2022: Volvo Penta received an order for two D16-650 IMO III engines from the Swedish maritime administration, Sjöfartsverket, for their replacement patrol vessels. These engines are certified to comply with IMO (International Marine Organisation) Tier III emissions regulations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Marine Propulsion Engine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Marine Propulsion Engine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Marine Propulsion Engine Market?

To stay informed about further developments, trends, and reports in the Marine Propulsion Engine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence