Key Insights

The Brazilian luxury goods market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a burgeoning affluent consumer class, increasing disposable incomes, and a rising appreciation for high-end brands among younger demographics. This expanding market is fueled by strong demand across various segments, including clothing and apparel, jewelry, watches, and bags. The prominent presence of both international luxury houses (like LVMH, Kering, and Richemont) and local high-end brands contributes to a diverse yet competitive landscape. Online sales channels are expected to show significant growth, leveraging the increasing penetration of e-commerce and digital marketing strategies. However, the market's growth trajectory is subject to macroeconomic conditions, currency fluctuations, and consumer sentiment. The ongoing expansion of luxury retail spaces, including both single-brand boutiques and multi-brand department stores, further underscores the market's potential.

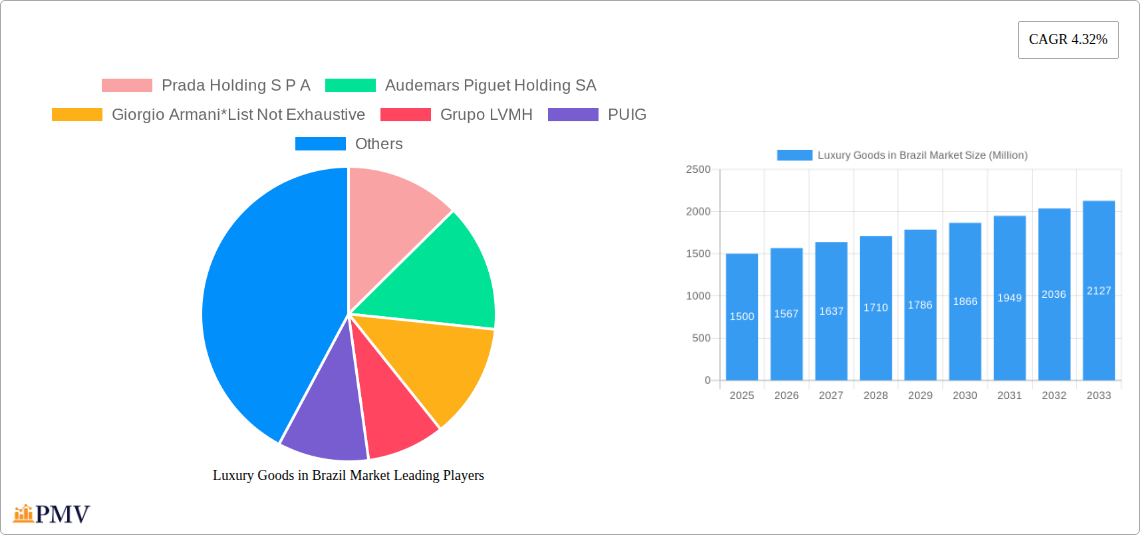

Luxury Goods in Brazil Market Market Size (In Billion)

While a precise market size for 2025 isn't provided, considering the 4.32% CAGR and a hypothetical 2019 market size (this figure would need to be supplied for accurate projection), a reasonable estimation can be made using compound annual growth calculations. This projected growth is underpinned by Brazil's expanding middle class, increasing tourism, and the allure of exclusive brands. However, challenges remain, including economic volatility and potential inflationary pressures that could impact consumer spending on luxury goods. Strategic marketing initiatives focusing on digital engagement and personalized experiences are crucial for brands to capitalize on the opportunities within this dynamic market. A continued focus on responsible sourcing and sustainable practices will also become increasingly important for maintaining consumer trust and brand loyalty.

Luxury Goods in Brazil Market Company Market Share

Luxury Goods in Brazil Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning luxury goods market in Brazil, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth trajectories. Expect detailed segmentation by distribution channel (single-brand stores, multi-brand stores, online stores, other channels) and product type (clothing & apparel, footwear, jewelry, watches, bags, other types). The report utilizes a robust methodology, incorporating historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033) to provide a clear and actionable picture of this dynamic market. Key players such as Prada Holding S P A, Audemars Piguet Holding SA, Giorgio Armani, Grupo LVMH, PUIG, Chanel limited, Rolex SA, Kering Group, Patek Philippe, and Hermès International S A are analyzed in detail.

Luxury Goods in Brazil Market Market Structure & Competitive Dynamics

The Brazilian luxury goods market exhibits a moderately concentrated structure, with a few key players holding significant market share. The market is characterized by a dynamic interplay of established international brands and emerging local players. Innovation ecosystems are nascent but growing, driven by increased investments in digital technologies and sustainable practices. The regulatory framework, while generally supportive of foreign investment, presents certain complexities related to taxation and import duties. Product substitutes, particularly in the apparel and accessory segments, exert pressure on pricing and market share. End-user trends showcase a growing preference for personalized experiences and digitally-driven engagement. M&A activity has been relatively modest in recent years, with deal values averaging around xx Million in the period 2019-2024. Key players such as Grupo LVMH and Kering Group have strategically acquired smaller brands to expand their market reach and product portfolios.

- Market Concentration: High concentration at the top, with xx% of market share held by the top 5 players in 2024.

- Innovation Ecosystems: Emerging, with focus on digital marketing, personalized experiences, and sustainable luxury.

- Regulatory Frameworks: Generally supportive but complex concerning taxation and import/export.

- M&A Activity (2019-2024): Average deal value: xx Million; number of deals: xx.

Luxury Goods in Brazil Market Industry Trends & Insights

The Brazilian luxury goods market is projected to experience robust growth, driven by increasing disposable incomes among the affluent population, a growing middle class aspiring to luxury goods, and a rising preference for premium brands. Technological disruption is transforming consumer experiences through e-commerce platforms and personalized marketing campaigns. The market exhibits a preference for international luxury brands, alongside a growing interest in local designers and sustainable luxury options. Competitive dynamics are characterized by both price competition and brand differentiation, with leading brands focusing on building brand equity and customer loyalty. The Compound Annual Growth Rate (CAGR) for the luxury goods market in Brazil is estimated to be xx% during the forecast period (2025-2033). Market penetration is expected to increase from xx% in 2024 to xx% by 2033.

Dominant Markets & Segments in Luxury Goods in Brazil Market

The most dominant segment within the Brazilian luxury goods market is the single-brand store distribution channel, capturing the majority of sales due to its ability to provide a fully immersive brand experience. The watches and jewelry segments are experiencing the strongest growth, driven by high demand for luxury timepieces and precious metals.

- By Distribution Channel: Single-brand stores maintain dominance due to brand control and premium experience.

- By Type: Watches and jewelry show highest growth due to gifting trends and aspirational purchases.

- Key Drivers for Watches and Jewelry:

- Rising disposable income among high-net-worth individuals.

- Increased demand for luxury goods as status symbols.

- Strong domestic tourism and gifting culture.

- Key Drivers for Watches and Jewelry:

Luxury Goods in Brazil Market Product Innovations

Recent product innovations have focused on integrating technology to enhance customer engagement and experiences, such as personalized online shopping platforms and augmented reality applications for product visualization. The focus on sustainable luxury and ethical sourcing has driven the development of eco-friendly materials and production processes. These initiatives align with evolving consumer preferences and address growing environmental concerns.

Report Segmentation & Scope

This report segments the Brazilian luxury goods market across two key dimensions: distribution channel and product type.

- By Distribution Channel: Single-brand stores, Multi-brand stores, Online Stores, and Other Distribution Channels, each segment exhibiting distinct growth rates and competitive dynamics. The online segment displays the highest growth rate, driven by the rapid adoption of e-commerce among luxury consumers.

- By Type: Clothing and Apparel, Footwear, Jewelry, Watches, Bags, and Other Types – each characterized by unique pricing strategies, brand positioning, and consumer preferences. The jewelry and watches segments demonstrate the highest growth potential, boosted by heightened gifting trends and the perception of luxury as an investment.

Key Drivers of Luxury Goods in Brazil Market Growth

The Brazilian luxury goods market's growth is primarily driven by a burgeoning affluent population, an expanding middle class with aspirations for luxury goods, and rising tourism. Favorable economic policies fostering foreign investment and a robust retail infrastructure also contribute to market expansion. Increased digital adoption and targeted online marketing campaigns are crucial growth enablers.

Challenges in the Luxury Goods in Brazil Market Sector

The sector faces challenges such as economic volatility impacting consumer spending, fluctuating currency exchange rates affecting import costs, and intense competition from both established and emerging brands. Counterfeit products also pose a considerable threat, undermining brand authenticity and market integrity. These factors may negatively influence the overall market growth, potentially reducing the projected CAGR by xx%.

Leading Players in the Luxury Goods in Brazil Market Market

Key Developments in Luxury Goods in Brazil Market Sector

- October 2021: Grupo Axo and thredUP invest in Vopero, expanding into sustainable fashion resale.

- April 2021: Balenciaga opens its first South American store in São Paulo.

- July 2020: Prada launches a revamped online store with new features.

- October 2019: Osklen launches its Black Edition Collection with sustainable technology.

Strategic Luxury Goods in Brazil Market Market Outlook

The Brazilian luxury goods market presents a promising outlook for continued growth, driven by a rising affluent population, increasing digital adoption, and the growing popularity of sustainable luxury. Strategic opportunities lie in capitalizing on the expanding online market, leveraging technology to enhance customer experiences, and focusing on product differentiation and brand storytelling to build stronger customer loyalty. The long-term potential of the market remains strong, with projected expansion exceeding xx Million by 2033.

Luxury Goods in Brazil Market Segmentation

-

1. Product Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Jewelry

- 1.4. Watches

- 1.5. Bags

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. Single-brand stores

- 2.2. Multi-brand stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Luxury Goods in Brazil Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Goods in Brazil Market Regional Market Share

Geographic Coverage of Luxury Goods in Brazil Market

Luxury Goods in Brazil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Prevalence of Obesity Among Consumers; Demand for Online and Hybrid Models with Customization and Personalization

- 3.3. Market Restrains

- 3.3.1. High Operational Costs and Competitive Pricing of Memberships

- 3.4. Market Trends

- 3.4.1. Expansion of Online Retailing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Jewelry

- 5.1.4. Watches

- 5.1.5. Bags

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-brand stores

- 5.2.2. Multi-brand stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Jewelry

- 6.1.4. Watches

- 6.1.5. Bags

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single-brand stores

- 6.2.2. Multi-brand stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Jewelry

- 7.1.4. Watches

- 7.1.5. Bags

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single-brand stores

- 7.2.2. Multi-brand stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Jewelry

- 8.1.4. Watches

- 8.1.5. Bags

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single-brand stores

- 8.2.2. Multi-brand stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Jewelry

- 9.1.4. Watches

- 9.1.5. Bags

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single-brand stores

- 9.2.2. Multi-brand stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Luxury Goods in Brazil Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Jewelry

- 10.1.4. Watches

- 10.1.5. Bags

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single-brand stores

- 10.2.2. Multi-brand stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Prada Holding S P A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Audemars Piguet Holding SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Giorgio Armani*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Grupo LVMH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PUIG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chanel limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rolex SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kering Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Patek Philippe

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hermès International S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Prada Holding S P A

List of Figures

- Figure 1: Global Luxury Goods in Brazil Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Luxury Goods in Brazil Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Luxury Goods in Brazil Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Luxury Goods in Brazil Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Luxury Goods in Brazil Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Luxury Goods in Brazil Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Luxury Goods in Brazil Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Luxury Goods in Brazil Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: South America Luxury Goods in Brazil Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Luxury Goods in Brazil Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: South America Luxury Goods in Brazil Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Luxury Goods in Brazil Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Luxury Goods in Brazil Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Luxury Goods in Brazil Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Luxury Goods in Brazil Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Luxury Goods in Brazil Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Europe Luxury Goods in Brazil Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Luxury Goods in Brazil Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Luxury Goods in Brazil Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Luxury Goods in Brazil Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa Luxury Goods in Brazil Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa Luxury Goods in Brazil Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Luxury Goods in Brazil Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Luxury Goods in Brazil Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Luxury Goods in Brazil Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Luxury Goods in Brazil Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Luxury Goods in Brazil Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Luxury Goods in Brazil Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Luxury Goods in Brazil Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Luxury Goods in Brazil Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Luxury Goods in Brazil Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 38: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Luxury Goods in Brazil Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Luxury Goods in Brazil Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Goods in Brazil Market?

The projected CAGR is approximately 5.23%.

2. Which companies are prominent players in the Luxury Goods in Brazil Market?

Key companies in the market include Prada Holding S P A, Audemars Piguet Holding SA, Giorgio Armani*List Not Exhaustive, Grupo LVMH, PUIG, Chanel limited, Rolex SA, Kering Group, Patek Philippe, Hermès International S A.

3. What are the main segments of the Luxury Goods in Brazil Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Prevalence of Obesity Among Consumers; Demand for Online and Hybrid Models with Customization and Personalization.

6. What are the notable trends driving market growth?

Expansion of Online Retailing.

7. Are there any restraints impacting market growth?

High Operational Costs and Competitive Pricing of Memberships.

8. Can you provide examples of recent developments in the market?

In October 2021, Grupo Axo and thredUP announced Strategic Investment in Vopero to capture emerging opportunities in Latin America's Sustainable Fashion Resale Marketplace. The collaboration is expanding to Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Goods in Brazil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Goods in Brazil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Goods in Brazil Market?

To stay informed about further developments, trends, and reports in the Luxury Goods in Brazil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence